- Home

- »

- Food Additives & Nutricosmetics

- »

-

Emulsifiers In Personal Care Market, Industry Report, 2033GVR Report cover

![Emulsifiers In Personal Care Market Size, Share & Trends Report]()

Emulsifiers In Personal Care Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Green, Non-green/ Synthetic, Green), By Region (North America, Asia Pacific, Europe, Middle East & Africa, Latin America), And Segment Forecasts

- Report ID: GVR-4-68040-699-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Emulsifiers In Personal Care Market Summary

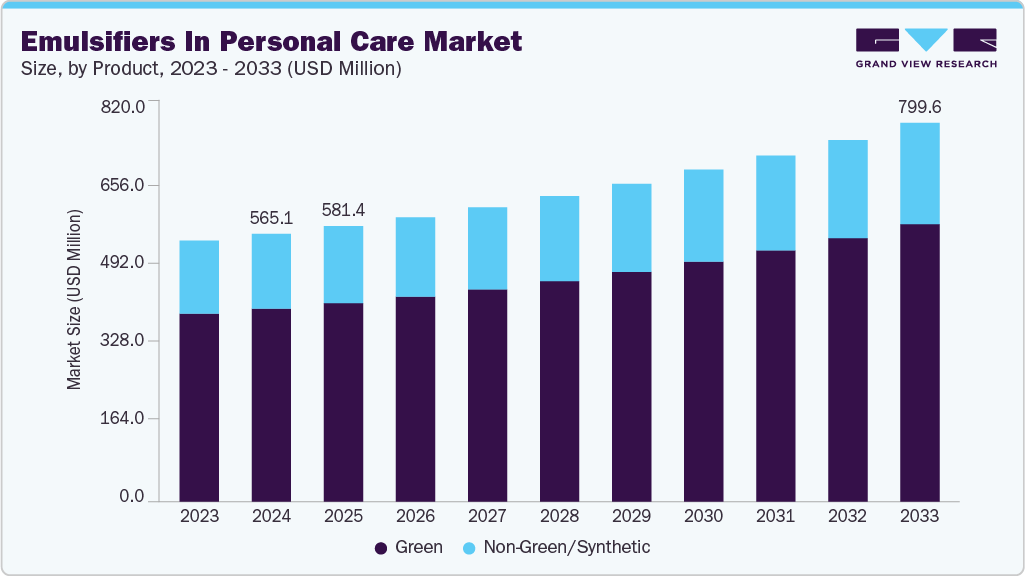

The global emulsifiers in personal care market size was estimated at USD 565.1 million in 2024 and is projected to reach USD 799.6 million by 2033, growing at a CAGR of 4.1% from 2025 to 2033. The market is primarily driven by the growing demand for multifunctional personal care products with enhanced sensory appeal, stability, and extended shelf life.

Key Market Trends & Insights

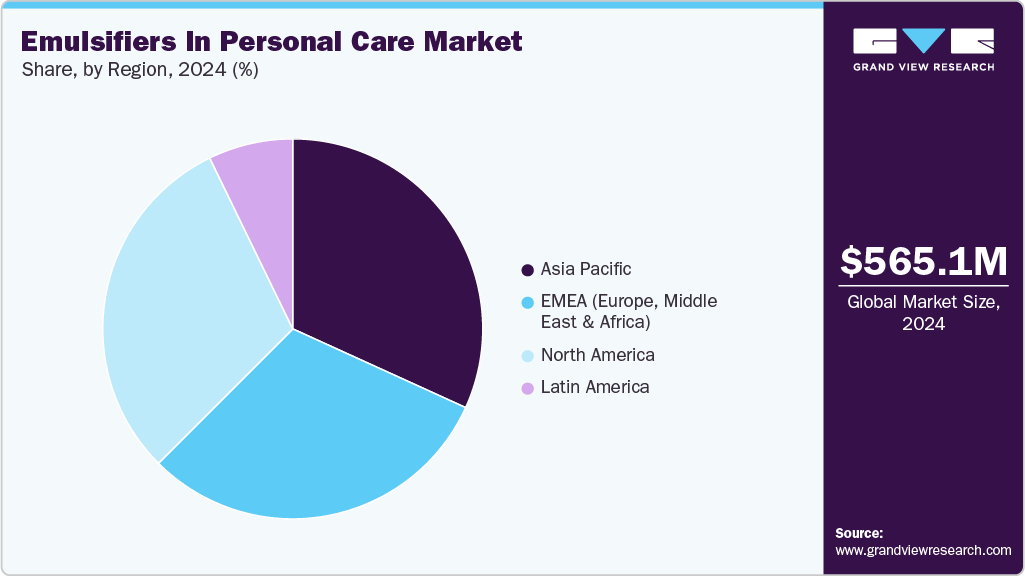

- Asia Pacific dominated the emulsifiers in personal care market with the largest revenue share of 31.8% in 2024.

- The market in China is expected to grow at a significant CAGR of 3.8% from 2025 to 2033 in terms of revenue.

- By product, the green segment held the largest revenue share of 72.0% in 2024 in terms of value.

- By product, the non-green/ synthetic segment is expected to grow at a significant CAGR of 3.5% in terms of volume.

Market Size & Forecast

- 2024 Market Size: USD 565.1 Million

- 2033 Projected Market Size: USD 799.6 Million

- CAGR (2025-2033): 4.1%

- Asia Pacific: Largest market in 2024

Rising consumer preference for clean-label and sustainable formulations is accelerating the shift toward naturally derived emulsifiers, particularly polyglyceryl-based and amino acid-based variants. The increased awareness of skin compatibility and sensitivity is prompting formulators to replace harsh synthetic emulsifiers with mild, green alternatives, further propelling the market’s growth.Emerging markets in Asia Pacific and Latin America offer significant growth potential due to rising disposable incomes, expanding middle-class populations, and increasing adoption of skincare and haircare routines. Moreover, the rising penetration of e-commerce and D2C brands has created a platform for niche, organic, and green personal care products, driving demand for innovative emulsifier systems. Advancements in green chemistry and biotechnology are also enabling the development of high-performance natural emulsifiers, presenting opportunities for premium product differentiation and brand positioning.

Despite strong growth prospects, the market faces challenges related to the high cost and limited scalability of green emulsifiers compared to their synthetic counterparts. Regulatory complexities across regions and the need for extensive safety and efficacy testing for novel emulsifier systems can delay product commercialization. In addition, formulating with natural emulsifiers often presents performance trade-offs, such as reduced stability or compatibility issues with certain actives, posing technical hurdles for manufacturers.

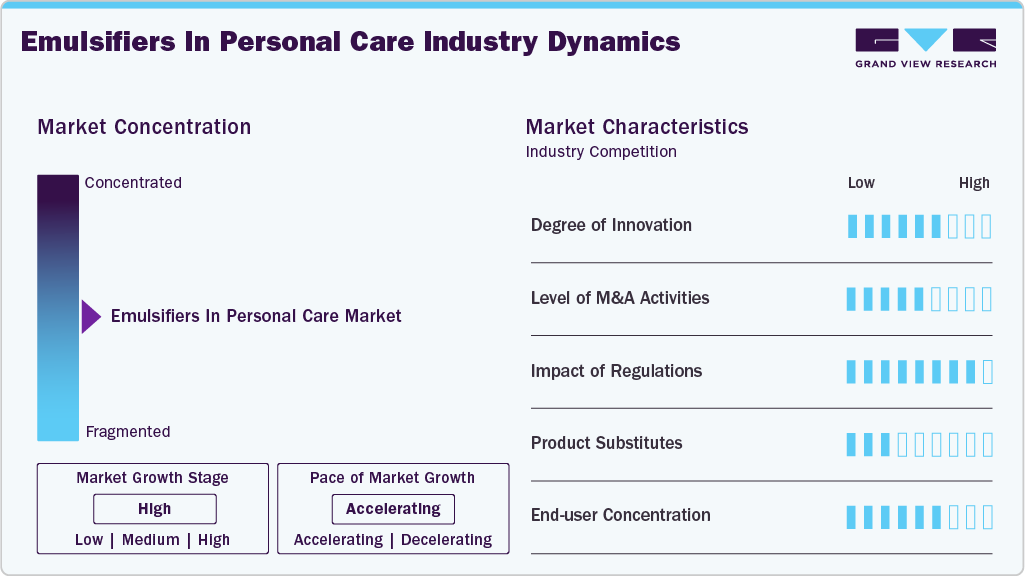

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as ADM, BASF SE, dsm-firmenich, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the industry are focusing on a mix of portfolio diversification, strategic partnerships, and sustainability-led innovation to strengthen their market position. Companies are expanding their range of green and naturally derived emulsifiers to align with clean beauty trends and evolving consumer preferences. Investments in R&D and green chemistry are enabling the development of high-performance, biodegradable emulsifier systems with improved sensory profiles. Major players are pursuing strategic acquisitions and collaborations with biotech firms and natural ingredient suppliers to enhance supply chain capabilities and accelerate product development. To deepen market penetration, they are also leveraging digital marketing and e-commerce platforms, particularly in high-growth regions such as Asia Pacific and Latin America.

Product Insights

The green segment held the largest revenue share of 72.0% in 2024, driven by rising consumer demand for clean-label, sustainable, and skin-friendly personal care products. Growing awareness of ingredient safety, coupled with the clean beauty movement, has encouraged manufacturers to adopt naturally derived emulsifiers such as glyceryl esters, polyglyceryl-based compounds, and amino acid-based emulsifiers. These ingredients offer excellent skin compatibility, are often biodegradable, and align well with global regulations favoring natural formulations, especially in Europe and North America. The expansion of premium skincare and baby care segments, where formulation safety and sustainability are top priorities, has further reinforced the dominance of green emulsifiers in the market.

The non-green/synthetic segment, which includes ethoxylated/propoxylated emulsifiers, silicone-based emulsifiers, and others such as mono- and diglycerides, continues to play a significant role in mainstream and mass-market personal care formulations due to their high performance, cost efficiency, and proven formulation stability. These emulsifiers are particularly valued in products that need a long shelf life, stability at high temperatures, and effective emulsification. However, increasing regulatory scrutiny and consumer concerns regarding petrochemical derivatives and potential skin irritation are gradually pushing formulators to seek alternative green solutions. Despite this shift, synthetic emulsifiers remain relevant in markets where performance, scalability, and cost control are prioritized.

Regional Insights

North Americaemulsifiers in personal care market accounted for a 30.3% share of the global market in 2024, fueled by a strong preference for premium personal care products, a mature cosmetics industry, and high consumer awareness of product ingredients. The region has seen rapid growth in clean beauty brands that prioritize the use of naturally derived emulsifiers and minimize synthetic additives. Regulatory guidance from bodies such as the FDA and increasing scrutiny over ethoxylated and silicone-based emulsifiers have prompted formulators to shift toward plant-based, biodegradable alternatives. The demand for multi-functional, sensorially appealing emulsifiers is especially strong in anti-aging, sun care, and baby care categories.

U.S. Emulsifiers in Personal Care Market Trends

The U.S. continued to be the largest market within North America, supported by a high concentration of global personal care brands, strong innovation pipelines, and a consumer base that actively seeks sustainable, ethically sourced products. The clean beauty trend has gained mainstream momentum, with green emulsifiers witnessing widespread adoption across indie and established brands alike. Moreover, the presence of advanced R&D infrastructure and favorable investments in green chemistry innovations have positioned the U.S. as a key hub for developing and commercializing next-generation emulsifier technologies.

Asia Pacific Emulsifiers in Personal Care Market Trends

Asia Pacific emulsifiers in personal care market dominated the global market with a 31.8% share in 2024, primarily driven by the growing consumption of personal care products in countries such as China, Japan, South Korea, and India. Rising disposable incomes, rapid urbanization, and an expanding middle-class population have significantly increased demand for skincare, haircare, and cosmetics. The region also benefits from a strong manufacturing base and cost-effective production, making it a hub for both local and global personal care brands. Furthermore, the increasing penetration of clean beauty trends and plant-based ingredients is accelerating the adoption of green emulsifiers in premium and mass-market formulations.

Emulsifiers in personal care market in China remained the largest contributor within Asia Pacific, supported by its booming beauty and personal care industry, a well-established e-commerce ecosystem, and a rising inclination toward natural and functional ingredients. Domestic brands are increasingly adopting green emulsifiers to differentiate their offerings and meet evolving consumer expectations around sustainability and safety. Regulatory encouragement for natural and non-toxic cosmetic ingredients, alongside rising interest in traditional Chinese medicine-inspired formulations, is also strengthening demand for naturally derived emulsifiers.

EMEA (Europe, Middle East & Africa) Emulsifiers in Personal Care Market Trends

EMEA held a 30.7% market share in 2024, with Europe accounting for the largest contribution due to stringent regulatory frameworks such as REACH and the EU Cosmetics Regulation that prioritize safe, eco-friendly ingredients. Consumer awareness around ingredient transparency and sustainability is high, leading to greater demand for green emulsifiers, particularly in natural and organic personal care formulations. The Middle East and Africa are witnessing gradual growth, driven by increasing beauty consciousness and rising demand for premium and halal-certified products, opening new avenues for bio-based emulsifiers in the region.

Emulsifiers in personal care market in Germany played a key role in driving emulsifier demand within the European personal care industry, backed by its strong positioning in the natural cosmetics segment. The country has a well-developed market for certified organic and biodynamic personal care products, which has led to a consistent demand for sustainable, non-toxic emulsifiers. Local manufacturers are heavily investing in R&D to develop high-purity, plant-based emulsifier systems, while German consumers are increasingly inclined toward clean-label and dermatologically tested formulations, supporting further market expansion.

Latin America Emulsifiers in Personal Care Market Trends

Latin America is emerging as a promising market for emulsifiers in personal care, driven by increasing urbanization, growing awareness of personal grooming, and rising disposable incomes across countries such as Brazil, Mexico, and Chile. While synthetic emulsifiers continue to dominate due to their affordability, the region is witnessing a growing shift toward green emulsifiers, particularly in the premium and natural product segments. Local and international brands are expanding their presence through retail and e-commerce channels, while consumer interest in botanical and regionally sourced ingredients is creating opportunities for innovation in emulsifier blends tailored to regional preferences.

Key Emulsifiers In Personal Care Company Insights

Key players, such as ADM, BASF SE, dsm-firmenich, and The Lubrizol Corporation, are dominating the market.

-

ADM (Archer Daniels Midland Company) is a Chicago headquartered global agribusiness and nutrition leader, founded in 1902 to process linseed and today operating over 270 plants in more than 50 countries. ADM connects farmers to consumers by processing key agricultural commodities, particularly oilseeds and grains, into food and beverage ingredients, human and animal nutrition products, bio-based chemicals, and industrial emulsifiers. Its diversified operations are structured into three core segments: Ag Services & Oilseeds (trading and processing), Carbohydrate Solutions (sweeteners and starches), and Nutrition (specialty ingredients). The company is recognized as a leading bulk supplier of plant‑based lecithin emulsifiers, serving food, beverage, industrial, and personal care markets with plant‑sourced, non‑GM, halal‑certified, clean‑label emulsifier formulations backed by more than 85 years of expertise.

Key Emulsifiers In Personal Care Companies:

The following are the leading companies in the emulsifiers in personal care market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- BASF SE

- dsm-firmenich

- Evonik Industries AG

- Kerry Group Plc

- Palsgaard A/S

- Puratos Group

- Spartan Chemical Company Inc.

- Stepan Company

- The Dow Chemical Company

- The Lubrizol Corporation

Recent Developments

-

In February 2025, LBB Specialties announced a strategic partnership with Kerry Group to distribute Kerry’s new line of emollients, emulsifiers, and fermentation-derived actives across the U.S. and Canada. This collaboration strengthens LBBS’s personal care portfolio and supports the growing demand for innovative, sustainable ingredients in skincare, cosmetics, and broader personal care applications.

-

In October 2024, BASF expanded its natural-based emulsifier portfolio with the launch of Emulgade Verde 10 OL (Polyglyceryl-10 Oleate) and Emulgade Verde 10 MS (Polyglyceryl-10 Stearate). These multifunctional, cold-processable emulsifiers support energy-efficient manufacturing and meet the growing demand for green, sprayable formulations, including sun care. Part of the Emulgade Verde line, the new products were showcased at the SEPAWA Congress 2024 in Berlin.

-

In September 2024, Evonik inaugurated a new cosmetic emollients production facility in Steinau, Germany, significantly expanding its manufacturing capacity. The double-digit million-euro plant utilizes enzymatic processing technology to produce sustainable esters, aligning with the growing demand for eco-friendly cosmetic ingredients. This investment supports Evonik’s strategy to lower its climate footprint while enabling customers to formulate more sustainable personal care products.

Emulsifiers In Personal Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 581.4 million

Revenue forecast in 2033

USD 799.6 million

Growth rate

CAGR of 4.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Asia Pacific; EMEA (Europe, Middle East & Africa); Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Saudi Arabia; UAE; Brazil; Argentina

Key companies profiled

ADM; BASF SE; dsm-firmenich; Evonik Industries AG; Kerry Group Plc; Palsgaard A/S; Puratos Group; Spartan Chemical Company Inc.; Stepan Company; The Dow Chemical Company; The Lubrizol Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Emulsifiers In Personal Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global emulsifiers in personal care market report based on product, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Non-green/ Synthetic

-

Ethoxylated/ Propoxylated Emulsifiers

-

Silicone Based

-

Others

-

-

Green

-

Glyceryl Esters

-

Sucrose Esters

-

Sorbitan Esters

-

Alkyl Polyglycosides

-

Polyglyceryl-Based

-

Polyglyceryl-6 Stearate

-

Polyglyceryl-3 Methylglucose Distearate

-

Polyglyceryl-4 Laurate

-

Others

-

-

Amino Acid-based

-

Stearoyl Glutamate

-

Cocoyl Glutamate

-

Lauryl Glutamate

-

N-Lauroyl Glutamate

-

Others

-

-

Lecithin

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

EMEA (Europe, Middle East & Africa)

-

Germany

-

UK

-

France

-

Italy

-

Saudi Arabia

-

UAE

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global emulsifiers in personal care market size was estimated at USD 565.1 million in 2024 and is expected to reach USD 581.4 million in 2025.

b. The global emulsifiers in personal care market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033 to reach USD 799.6 million by 2033.

b. The green segment held the largest revenue share in 2024 due to rising consumer demand for sustainable, skin-friendly ingredients and regulatory support for natural, non-toxic formulations. Manufacturers increasingly adopted plant-based emulsifiers to align with clean beauty trends and meet eco-conscious consumer expectations.

b. Some of the key players operating in the market include ADM, BASF SE, dsm-firmenich, Evonik Industries AG, Kerry Group Plc, Palsgaard A/S, Puratos Group, Spartan Chemical Company Inc., Stepan Company, The Dow Chemical Company, and The Lubrizol Corporation.

b. The market is driven by the growing demand for clean-label, multifunctional personal care products and the rising adoption of natural and sustainable emulsifiers. Advancements in green chemistry and increasing consumer awareness around ingredient safety further accelerate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.