- Home

- »

- Next Generation Technologies

- »

-

Engineering Software Market Size, Industry Report, 2030GVR Report cover

![Engineering Software Market Size, Share & Trends Report]()

Engineering Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud, On-Premises), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-122-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Engineering Software Market Summary

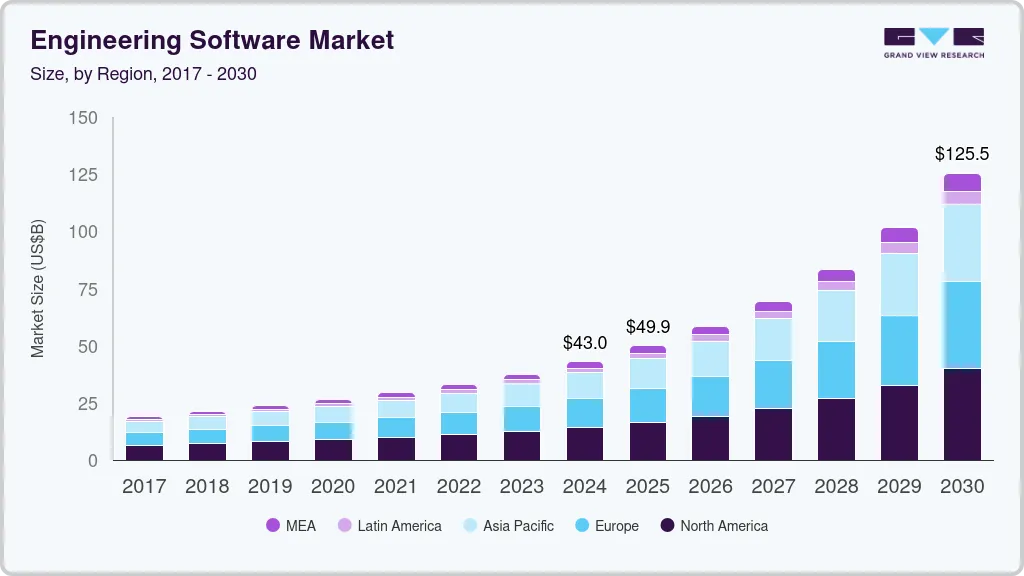

The global engineering software market size was estimated at USD 43.03 billion in 2024 and is projected to reach USD 125.45 billion by 2030, growing at a CAGR of 20.3% from 2025 to 2030. The increasing adoption of digital twin technology across industries drives the engineering software industry growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, the U.S. engineering software market demand is experiencing significant growth.

- Based on components, the software segment dominated the market with a revenue share of 70.6% in 2024.

- Based on deployment, the on-premise segment dominated the market with a revenue share of 53.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 43.03 Billion

- 2030 Projected Market Size: USD 125.45 Billion

- CAGR (2024-2030): 20.3%

- North America: Largest market in 2024

Digital twins, virtual replicas of physical systems or processes, rely heavily on engineering software for modeling, simulation, and analysis. This technology enables businesses to monitor real-time performance, predict maintenance needs, and optimize operations. Manufacturing, healthcare, and automotive industries are integrating digital twins into their operations, driving demand for robust and advanced engineering software solutions.

In addition, the shift toward cloud-based solutions is another crucial factor propelling the market growth. Cloud-based engineering software offers several advantages: remote accessibility, scalability, and cost efficiency. Engineers and designers can collaborate across geographical locations in real time, which makes managing complex projects easier. Cloud platforms also provide seamless updates, ensuring users can always access the latest features and improvements. This trend particularly appeals to small and medium-sized enterprises (SMEs) that may need more resources to invest in expensive on-premise solutions.

Moreover, the growth of 3D printing and additive manufacturing technologies is also contributing to the expansion of the engineering software industry. These technologies rely heavily on engineering software for creating detailed models, optimizing designs, and simulating performance under various conditions. Engineering software tailored for additive manufacturing, such as generative design tools, enables users to create complex geometries that are lightweight and structurally efficient. Adopting 3D printing across sectors like aerospace, healthcare, and consumer goods has increased demand for advanced engineering software solutions. According to the 2024 edition of Protolabs Network's annual survey, 70% of respondents reported producing more parts using 3D printers in 2023 compared to 2022. Meanwhile, 21% printed the same number of parts as in 2022, and only 9% printed fewer than the previous year.

Furthermore, infrastructure modernization initiatives drive demand for AEC (architecture, engineering, and construction) software, particularly in developing and developed economies. Governments and private organizations are investing in smart cities, renewable energy projects, and sustainable construction, all of which require sophisticated engineering tools for planning, design, and project management. AEC software allows for accurate modeling, efficient resource utilization, and enhanced collaboration among stakeholders, making it an essential component of modern infrastructure projects.

Component Insights

Based on components, the market is segmented into software and services. The software segment dominated the market with a revenue share of 70.6% in 2024. The construction industry is a major contributor to the growth of the software segment in the engineering software industry, driven by the increasing use of BIM solutions. BIM software provides detailed 3D models and real-time data for planning, designing, and managing construction projects. Governments in various countries, including the U.S. and the UK, are mandating the use of BIM for public infrastructure projects, further boosting demand for these tools. BIM enables stakeholders to improve project efficiency, reduce waste, and minimize costs, making it an essential tool in modern construction.

The services segment is anticipated to grow significantly over the forecast period. As engineering projects become more specialized, businesses require consulting services tailored to their industry’s needs. For instance, the construction sector often seeks expertise in deploying BIM software, while manufacturers may require guidance on integrating PLM tools into their production processes. Service providers offering industry-specific knowledge and solutions are gaining traction, driving the consulting services segment of the market.

Deployment Insights

Based on deployment, the market is segmented into cloud and on-premises. The on-premise segment dominated the market with a revenue share of 53.3% in 2024. Performance optimization for resource-intensive tasks is another driver of on-premise adoption. Engineering applications often require significant computational resources, particularly in simulation, CAD, and 3D modeling industries. On-premise solutions allow companies to dedicate their high-performance hardware to these tasks, ensuring that the software runs at optimal speed without being dependent on cloud servers' bandwidth or computational limitations. This level of performance is particularly important in industries where real-time simulations and high-quality renderings are critical, such as automotive or aerospace engineering.

The cloud segment is expected to register a significant growth from 2025 to 2030. The growing adoption of edge computing and cloud hybrid models in the engineering sector drives market growth. While cloud solutions provide a centralized platform for large-scale data processing, edge computing allows for localized, near-real-time data analysis at the source. The combination of cloud and edge computing enhances the ability of engineering firms to manage decentralized projects efficiently, especially in fields like IoT-enabled smart infrastructure and autonomous systems. This hybrid approach ensures better performance, lower latency, and enhanced data security, making cloud solutions suitable for engineering professionals.

Application Insights

Based on application, the application segment is divided into design automation, product design & testing, plant design, drafting & 3D modeling, and others. The product design & testing segment dominated the market in terms of the largest revenue share of 31.4% in 2024. The rise of digital twins in product design and testing is a transformative trend. Digital twins are virtual replicas of physical products or systems that allow engineers to simulate, monitor, and analyze product performance in real-time. They enable continuous testing throughout the product lifecycle, from design to deployment, and help optimize performance even after the product launches. This technology is particularly relevant in the aerospace, automotive, and manufacturing industries, where continuous monitoring and iterative testing are essential for maintaining product quality and performance.

The drafting & 3D modeling segment is expected to emerge as the fastest-growing segment over the forecast period. Advancements in 3D visualization and rendering technologies drive the segment growth in the engineering software industry. The ability to create realistic, interactive 3D models has revolutionized the design process. With the integration of advanced rendering tools, engineers and designers can visualize how a product will look and behave under real-world conditions before it is physically produced. This is particularly useful in industries like architecture and automotive, where visualizing the final product is crucial for decision-making and customer approval. 3D visualization helps stakeholders better understand design concepts, leading to improved collaboration and fewer revisions. Virtual reality (VR) and augmented reality (AR) technologies, when integrated into 3D modeling software, further enhance this capability, allowing users to interact with and manipulate designs in a highly immersive environment.

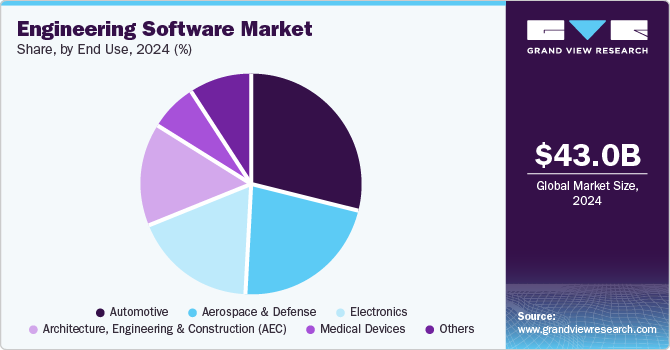

End Use Insights

Based on end use, the segment is divided into automotive, aerospace & defense, electronics, medical devices, architecture, engineering and construction (AEC), and others. The automotive segment dominated the market in terms of revenue share of 28.8% in 2024. Autonomous driving technologies drive the automotive engineering software industry growth. As self-driving cars become a reality, automotive manufacturers invest heavily in developing autonomous systems that rely on advanced software algorithms, sensors, machine learning, and real-time data processing. Engineering software designs and simulates complex systems, including sensor fusion, vehicle control, and autonomous decision-making algorithms. Simulation tools help test and validate the behavior of autonomous vehicles in a wide range of real-world scenarios, reducing the need for extensive physical testing. This is critical for ensuring the safety and reliability of autonomous vehicles. In addition, software tools for virtual testing and simulation of communication between autonomous vehicles (V2V communication) and their environments (V2X) are becoming increasingly important.

The aerospace & defense segment is expected to register the fastest CAGR over the forecast period. The increased focus on modular aerospace and defense systems design drives the engineering software industry's growth. As systems become more complex and the demand for customization grows, manufacturers increasingly adopt modular designs that allow for easier upgrades, maintenance, and integration of new technologies. Engineering software helps design modular components that can be easily swapped or modified without impacting the overall system. This approach reduces development time and costs and improves the scalability of products, such as aircraft, satellites, and defense systems. Software tools enable engineers to simulate and model various configurations of modular designs, optimizing their functionality, performance, and cost-efficiency. The ability to design systems modularly is particularly valuable in defense, where the need for adaptable and customizable systems is ever-growing.

Regional Insights

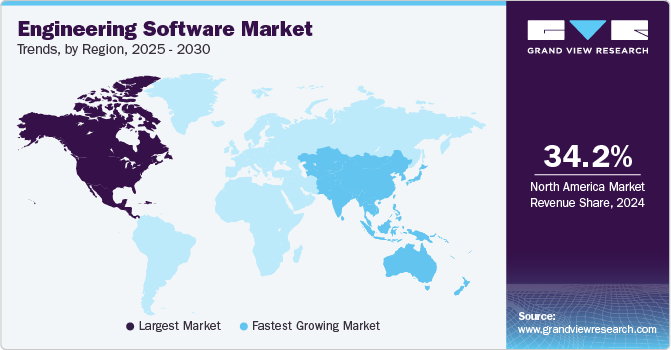

North America engineering software market held a significant share of around 34.2% in 2024. North America has prominent market players such as Altair Engineering, Inc., ANSYS, Inc., Autodesk, Inc., and Bentley Systems, Incorporated. The region is home to a robust and mature industrial landscape, including aerospace, automotive, and electronics sectors, which heavily rely on advanced engineering solutions for design, simulation, and analysis. Secondly, strong research and development activities and a culture of innovation drive the demand for cutting-edge solutions in engineering processes. For instance, in August 2022, RoboDK and BobCAD-CAM collaborated to launch a plugin that enabled machinists to program robots rapidly and easily for machining applications. With the help of this new tool, robot machining became more practical for machinists, ushering in a flexible machining era for various businesses. In addition, North America's emphasis on technological advancements and its early adoption of Industry 4.0 principles have led to a higher adoption rate of CAD, CAM, and CAE solutions among companies seeking to enhance productivity and stay competitive.

U.S. Engineering Software Market Trends

The U.S. engineering software market demand is experiencing significant growth owing to the growing demand for enhanced cybersecurity in engineering designs. With the rise of smart manufacturing, IoT-enabled devices, and connected products, ensuring the security of digital engineering data and intellectual property is crucial. Cybersecurity threats can compromise product integrity, lead to intellectual property theft, or cause operational disruptions. As a result, engineering software providers focus more on integrating robust cybersecurity features, such as encryption, multi-factor authentication, and data access control, into their products. Industries such as aerospace, defense, and automotive, which handle sensitive designs and information, are particularly focused on these security enhancements to prevent breaches and ensure the confidentiality of their intellectual property.

Asia Pacific Engineering Software Market Trends

Asia Pacific's engineering software market is expected to register the fastest growth during the forecast period. The automotive and aerospace industries in Asia Pacific drive the growth of the engineering software industry. The region has some of the world’s largest automotive manufacturers, including Toyota, Hyundai, and Tata Motors, and a rapidly expanding aerospace sector, with companies like Mitsubishi Heavy Industries and Hindustan Aeronautics Limited (HAL). These industries rely heavily on engineering software for product design, simulation, testing, and manufacturing optimization. The need for advanced tools to manage increasingly complex vehicle designs, reduce time-to-market, and improve safety and fuel efficiency is driving the demand for engineering software. Furthermore, the growing interest in electric vehicles (EVs) and autonomous driving technologies also fuels the need for specialized software solutions to handle new and innovative automotive design challenges.

Key Engineering Software Company Insights

Some of the key players operating in the market are ANSYS, Inc., Autodesk, Inc., Bentley Systems, Incorporated, among others.

-

Autodesk Inc. is a global software solutions company for the engineering, architecture, construction, and manufacturing industries. Autodesk offers a comprehensive suite of software tools for 2D and 3D design, simulation, and analysis, including specialized solutions for product design, civil engineering, and infrastructure. Its products, such as Revit, Fusion 360, and Civil 3D, are widely used to streamline workflows, improve collaboration, and optimize project outcomes across multiple industries. Autodesk is also heavily involved in cloud-based solutions, aiming to enable seamless access to tools and data across teams and geographies.

Hexagon AB and ZWSOFT CO., LTD. are some of the emerging market participants in the target market.

-

ZWSOFT Co., Ltd. is a prominent provider of Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), and Computer-Aided Engineering (CAE) solutions. The company offers tools tailored for design, simulation, and manufacturing across various sectors, including mechanical, shipbuilding, automotive, defense, and rail transportation. ZWSOFT specializes in ZWCAD, ZW3D, and ZWSim, catering to 2D and 3D CAD applications. ZWCAD is particularly notable for its user-friendly interface and high performance in architectural and engineering designs, while ZW3D integrates CAD and CAM for product design and manufacturing. Additionally, the company provides simulation software like ZWSim-EM and ZWSim Structural, which focus on electromagnetic and structural analysis, essential for industries that require precision in their design processes.

Key Engineering Software Companies:

The following are the leading companies in the engineering software market. These companies collectively hold the largest market share and dictate industry trends.

- ANSYS, Inc

- Autodesk Inc.

- Bentley Systems, Incorporated

- Dassault Systèmes

- ESI Group

- Siemens

- 3D Systems Inc.

- PTC

- Mastercam

- Hexagon AB

- ZWSOFT CO., LTD.

Recent Developments

-

In October 2024, Siemens acquired Altair Engineering Inc., a software solutions provider in the industrial simulation and analysis sector. This strategic move aligns with Altair's goal of accelerating customers' digital and sustainability transformations by bridging the physical and digital worlds. The partnership will form the most extensive AI-driven design and simulation portfolio by integrating Altair's expertise in simulation, high-performance computing, data science, and artificial intelligence with Siemens' Xcelerator platform. The merger of these two industry leaders in engineering software brings together Altair's comprehensive simulation, data science, and high-performance computing (HPC) expertise with Siemens' strengths in mechanical and electronic design automation (EDA).

-

In September 2024, Bentley Systems, Incorporated acquired Cesium, a 3D geospatial company. Cesium Ion, the company's SaaS platform, delivers 3D geospatial experiences to over 1 million active devices monthly. Bentley's iTwin Platform enables engineering and construction firms and asset owners to design, build, and operate the world's infrastructure using digital twin solutions. The integration of Cesium with iTwin allows developers to effortlessly combine 3D geospatial data with engineering, subsurface, IoT, and enterprise data, creating digital twins that offer exceptional user experiences.

Engineering Software Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 49.89 billion

Revenue Forecast in 2030

USD 125.45 billion

Growth Rate

CAGR of 20.3% from 2025 to 2030

Actual Data

2017 - 2023

Forecast Period

2025 - 2030

Report updated

December 2024

Quantitative Units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, deployment, application, end use, region

Regional Scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

ANSYS, Inc., Autodesk Inc., Bentley Systems, Incorporated, Dassault Systèmes, ESI Group, Siemens, 3D Systems Inc., PTC, Mastercam, Hexagon AB, ZWSOFT CO., LTD.

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Engineering Software Market Report Segmentation

This report forecasts revenue growth at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global engineering software market report based on component, deployment, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Computer-Aided Design (CAD) Software

-

Computer-Aided Manufacturing (CAM) Software

-

Computer-Aided Engineering (CAE) Software

-

Others

-

-

Services

-

Development Service

-

Training, Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Design Automation

-

Product Design & Testing

-

Plant Design

-

Drafting & 3D Modeling

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace & Defense

-

Electronics

-

Medical Devices

-

Architecture, Engineering, and Construction (AEC)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global engineering software market size was estimated at USD 43.03 billion in 2024 and is expected to reach USD 49.89 billion in 2025.

b. The global engineering software market is expected to witness a compound annual growth rate of 20.3% from 2025 to 2030 to reach USD 125.45 billion by 2030.

b. North America dominated the overall market in 2024, with a market share of 34.2%. The region's early adoption of Industry 4.0 principles and technological advancements drives a high adoption rate of CAD, CAM, and CAE solutions for enhanced productivity and competitiveness.

b. Some key players operating in the engineering software market include Altair Engineering, Inc.; ANSYS, Inc.; Autodesk, Inc.; Bentley Systems, Inc.; Dassault Systemes, Inc.; ESI Group; Siemens; 3D Systems Inc.; PTC; Mastercam; Hexagon AB; and ZWSOFT CO., LTD., among others.

b. The growth of engineering software is driven by increasing demand for advanced tools to enhance productivity, automation, and digitization across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.