- Home

- »

- Next Generation Technologies

- »

-

Enterprise Collaboration Market Size, Industry Report, 2030GVR Report cover

![Enterprise Collaboration Market Size, Share & Trends Report]()

Enterprise Collaboration Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Solution, Services), By Organization Size, By Deployment Mode (On-premises, Cloud-based), By End-use (BFSI, Healthcare, Education), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-610-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Collaboration Market Summary

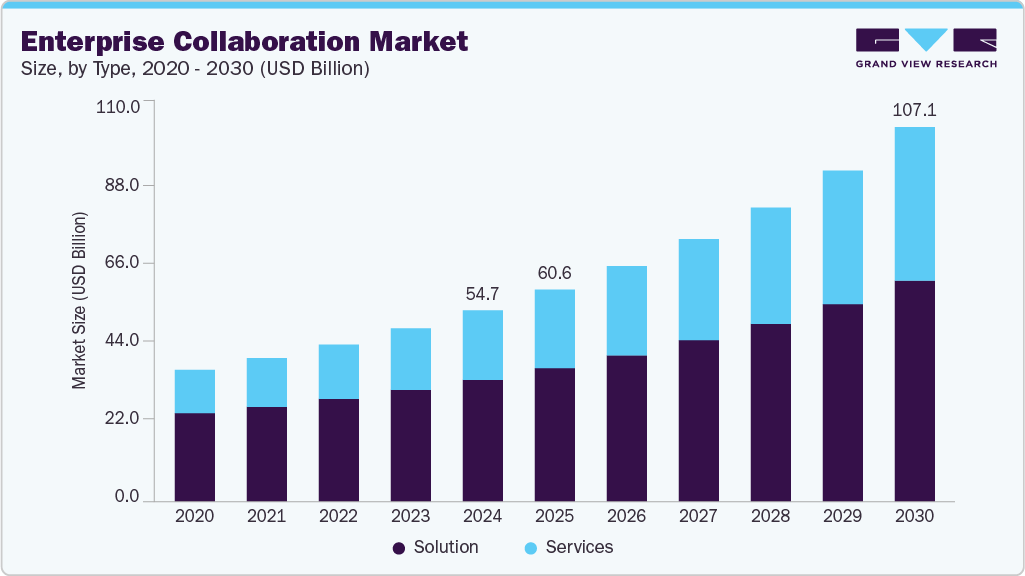

The global enterprise collaboration market size was estimated at USD 54.67 billion in 2024 and is projected to reach USD 107.03 billion by 2030, growing at a CAGR of 12.1% from 2025 to 2030. The market is growing due to remote and hybrid work adoption, increasing demand for real-time communication, cloud-based collaboration, centralized project management, artificial intelligence (AI) and machine learning (ML) integration in platforms.

Key Market Trends & Insights

- Asia Pacific enterprise collaboration market accounted for the largest market share of over 34% in 2024.

- The U.S. enterprise collaboration market accounted for the largest market share of over 81% in 2024.

- By type, the solution segment dominated the market with a market share of over 63% in 2024.

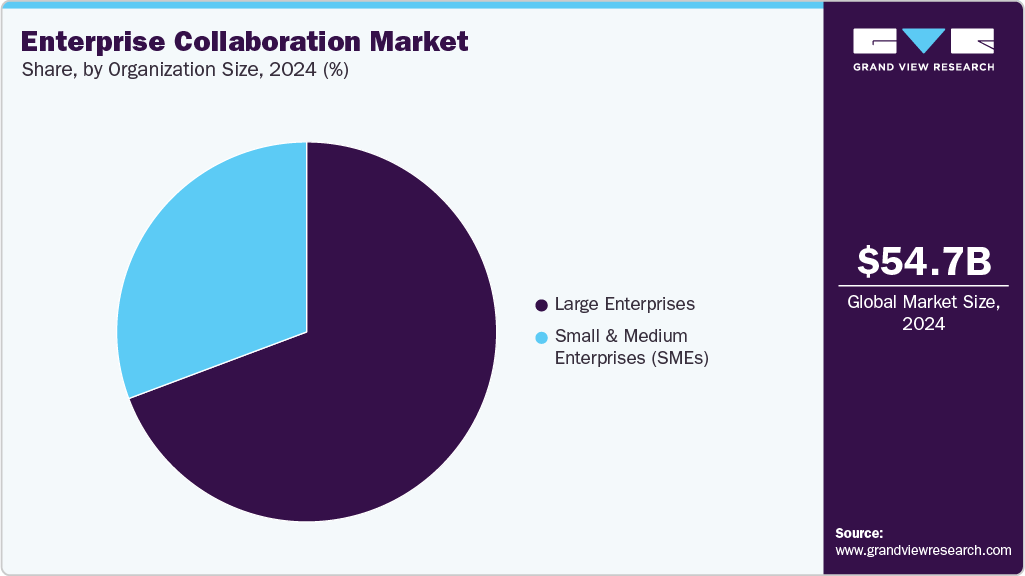

- By organization size, the large enterprises segment accounted for the largest market share in 2024.

- By deployment mode, the cloud-based segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Revenue: USD 54.67 Billion

- 2030 Projected Market Size: USD 107.03 Billion

- CAGR (2025-2030): 12.1%

- Asia-Pacific: Largest market in 2024

Enterprise collaboration tools enable seamless connectivity across geographically dispersed teams. The shift toward digital transformation initiatives across industries and the emphasis on improving workforce engagement are significantly contributing to the expansion of the enterprise collaboration market. The increasing adoption of remote and hybrid work models is significantly driving the growth of the enterprise collaboration industry. Organizations that adapt to distributed workforces need seamless communication and real-time collaboration tools. Solutions such as video conferencing, instant messaging, shared workspaces, and project management platforms enable teams to remain productive regardless of location. This trend is prompting businesses to invest heavily in collaborative technologies that support flexibility and operational continuity.In addition, the growing focus on digital transformation initiatives across industries is fueling the demand for enterprise collaboration solutions. Companies are actively replacing legacy systems with modern, cloud-based platforms to streamline workflows, enhance productivity, and foster innovation. These tools facilitate cross-functional communication and integrate with other enterprise applications, creating unified digital ecosystems that improve efficiency and agility in dynamic business environments.

Furthermore, the rise of artificial intelligence and machine learning is enhancing the capabilities of enterprise collaboration tools. AI-powered features such as smart scheduling, automated meeting transcription, real-time language translation, and predictive analytics are transforming how teams interact and make decisions. These intelligent capabilities reduce manual workload, improve decision-making speed, and increase user engagement, making collaboration platforms more valuable to organizations.

Moreover, the integration of enterprise collaboration tools into mobile apps and browsers is revolutionizing how teams communicate and operate in real-time. Professionals increasingly rely on mobile devices for work-related tasks, and collaboration platforms that offer mobile accessibility are becoming essential. This growing dependence on mobile-enabled collaboration is expected to remain a critical driver of enterprise collaboration industry growth in the coming years.

Type Insights

The solution segment dominated the market with a market share of over 63% in 2024, driven by the growing demand for integrated communication platforms that streamline workflows, enhance productivity, and support hybrid work environments. Enterprises are prioritizing platforms that support real-time collaboration and remote team coordination, leading to a surge in demand for comprehensive software solutions. This trend is further reinforced by the rising reliance on cloud infrastructure and AI-powered tools, solidifying the dominance of the solution segment in the market.

The services segment is expected to witness the highest CAGR of over 14% from 2025 to 2030. This growth is attributed to the increasing reliance of organizations on managed services, consulting, and support. Enterprises accelerate their digital transformation journeys, the demand for services that ensure seamless deployment, customization, and maintenance of collaboration platforms is growing. The integration of AI, automation, and cloud technologies into collaboration ecosystems is driving organizations to seek expert services to effectively implement and manage these innovations, thereby contributing to the robust growth of the services segment.

Organization Size Insights

The large enterprises segment accounted for the largest market share in 2024, owing to the substantial investments these organizations make in advanced collaboration tools, unified communication platforms, and digital transformation initiatives. Large enterprises often operate across multiple geographies and require robust, secure, and scalable collaboration solutions to manage distributed teams, complex workflows, and interdepartmental communication. These factors contribute to the dominance of the large enterprises segment in the enterprise collaboration industry.

The small & medium enterprise segment is expected to witness the highest CAGR from 2025 to 2030, driven by the increasing need for cost-effective, scalable, and user-friendly collaboration tools. SMEs are rapidly adopting cloud-based enterprise collaboration platforms to enhance productivity, streamline communication, and support remote work environments. This growing reliance on digital tools to remain competitive and connect globally is a key factor propelling the rapid growth of the SME segment in the enterprise collaboration market.

Deployment Mode Insights

The cloud-based segment accounted for the largest market share in 2024, as organizations increasingly prioritize flexibility, scalability, and remote accessibility in their collaboration tools. The integration of advanced technologies such as AI, machine learning, and analytics into cloud-based tools enhances decision-making and workflow automation. These drivers, coupled with the increasing demand for cross-functional collaboration and secure data access, propel the rapid adoption of cloud-based solutions in the enterprise collaboration industry.

The on-premises segment is expected to witness a significant CAGR from 2025 to 2030, owing to growing concerns over data security, regulatory compliance, and the need for greater control over collaboration environments. On-premises deployment allows organizations to maintain full ownership of their infrastructure, enabling tighter integration with internal IT systems and adherence to stringent data protection laws. These factors are collectively driving the growth of this deployment mode in the enterprise collaboration market.

End-use Insights

The IT & telecom segment accounted for the largest market share in 2024, driven by the accelerating digital transformation initiatives and the increasing demand for seamless communication tools. Global telecom operators and IT service providers embrace hybrid and remote work models, there is a heightened need for integrated collaboration platforms that support real-time communication and file sharing. The growing reliance on cloud-based solutions reinforces the sector's leadership in adopting enterprise collaboration technologies across the global market.

The healthcare segment is expected to witness the highest CAGR from 2025 to 2030, driven by the industry's growing focus on digital transformation and patient-centric care. Healthcare providers are adopting enterprise collaboration industry to enhance communication. The increasing use of remote diagnostics, and virtual health consultations is further propelling the market. Technological advancements, combined with stringent regulatory compliance requirements, are pushing healthcare organizations to invest in robust collaboration solutions, thereby emerging as the fastest-growing segment in the enterprise collaboration industry.

Regional Insights

North America accounted for a significant market share of over 26% in 2024, primarily driven by the region’s widespread adoption of hybrid work models and the increasing digital transformation initiatives across industries. In the U.S., enterprises are rapidly investing in cloud-based collaboration platforms to enhance remote team productivity and streamline communication workflows. The presence of major technology vendors and a robust IT infrastructure in North America continues to accelerate enterprise collaboration industry advancements across the region.

U.S. Enterprise Collaboration Market Trends

The U.S. enterprise collaboration market accounted for the largest market share of over 81% in 2024, driven by the state's position as a global hub for technology and innovation. The high concentration of tech companies in Silicon Valley, coupled with a strong startup ecosystem, fuels the demand for advanced collaboration tools that support remote and hybrid work environments. Digital infrastructure and investment in smart workplace solutions by both public and private sector organizations are accelerating the adoption of the enterprise collaboration industry.

Europe Enterprise Collaboration Market Trends

The Europe enterprise collaboration market is expected to grow at a CAGR of over 11% from 2025 to 2030, driven by the region’s robust industrial landscape and increasing digital maturity. A major driver across the region is the intensifying focus on sustainability and compliance with strict environmental regulations. These regulations, along with EU-wide climate policies, are compelling organizations to adopt collaborative tools that facilitate real-time communication and monitoring of environmental performance.

The UK enterprise collaboration market is expected to grow due to the country's progressive remote and hybrid work culture. The UK's emphasis on workplace flexibility has led to increased demand for cloud-based collaboration platforms, video conferencing tools, and integrated communication solutions. The push toward digital government services and public sector modernization also fuels enterprise collaboration adoption, as agencies seek efficient interdepartmental communication and workflow automation.

The Germany enterprise collaboration market is fueled by the country's growing trend toward remote and hybrid work models, particularly among its highly skilled workforce in sectors like IT, finance, and consulting. Germany’s strict data protection laws, such as the GDPR, compel enterprises to invest in compliant and secure collaboration platforms, further boosting demand for localized enterprise collaboration industry.

Asia Pacific Enterprise Collaboration Market Trends

Asia Pacific enterprise collaboration market accounted for the largest market share of over 34% in 2024 and is expected to grow at the highest CAGR of over 13% from 2025 to 2030, driven by increasing digitalization among small and medium enterprises, rising adoption of 5G networks, and the rapid expansion of cloud-based infrastructures. Accelerated deployment of AI-powered tools and automation within enterprise ecosystems is enhancing productivity and streamlining workflows, fueling the need for enterprise collaboration solutions.

The Japan enterprise collaboration market is gaining traction, fueled by the country’s strong emphasis on digital transformation and seamless integration of advanced technologies. The government’s initiatives promoting Industry 4.0 and work-style reforms encourage organizations to adopt enterprise collaboration tools to improve productivity and address workforce challenges. The cultural focus on harmony within Japanese companies also supports the preference for enterprise collaboration technologies.

The China enterprise collaboration market is rapidly expanding. China's strong emphasis on building a smart and connected workforce to support its vast manufacturing and service sectors is a key driver of enterprise collaboration solutions adoption. The government's strategic policies, including the Digital China initiative and significant investments in 5G infrastructure, are enhancing connectivity and enabling seamless collaboration across geographically dispersed teams.

Key Enterprise Collaboration Company Insights

Some of the key players operating in the market include Microsoft and Salesforce, Inc., among others.

-

Microsoft is a global technology leader known for its comprehensive software products and cloud services. Microsoft Teams, its flagship enterprise collaboration platform, integrates chat, video conferencing, file sharing, and workflow automation within the Microsoft 365 ecosystem. The company’s continuous innovation in AI, cloud computing (Azure), and security drives digital transformation for organizations worldwide. Microsoft’s vast global presence and strong enterprise relationships make it a dominant force in the enterprise collaboration market.

-

Salesforce, Inc. offers a popular real-time messaging and collaboration platform designed to streamline communication across organizations. Salesforce integrates with hundreds of third-party applications, enabling seamless workflow management, file sharing, and team collaboration. With Salesforce’s backing, Slack is expanding its capabilities around CRM integration, AI-powered insights, and cross-platform collaboration, solidifying its position as a top player in the enterprise collaboration industry.

Igloo Software Limited and Zoho Corporation Pvt. Ltd. are some of the emerging market participants in the enterprise collaboration market.

-

Igloo Software specializes in modern digital workplace solutions that enable organizations to create engaging intranets, extranets, and collaboration hubs. The company focuses on improving knowledge sharing, communication, and team productivity by leveraging cloud-based platforms that integrate with popular enterprise tools. Igloo’s user-centric design and flexibility make it an attractive choice for mid-sized businesses and enterprises looking to enhance internal collaboration and culture. Its growing adoption in North America and Europe positions it as an emerging player in the enterprise collaboration market.

-

Zoho Corporation Pvt. Ltd. offers a comprehensive suite of cloud-based business applications, including collaboration tools such as Zoho Cliq (messaging), Zoho Projects (project management), and Zoho Connect (team collaboration). The company emphasizes affordability, integration, and ease of use, targeting SMEs and growing enterprises. Zoho’s continuous innovation in AI and automation, along with its global reach, is driving its emergence as a competitive player in the enterprise collaboration space.

Key Enterprise Collaboration Companies:

The following are the leading companies in the enterprise collaboration market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Cisco Systems, Inc.

- Zoom Communications, Inc.

- Google LLC

- Salesforce, Inc.

- SAP SE

- Cloud Software Group, Inc.

- Atlassian

- Igloo Software

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In May 2025, at Zoholics USA, Zoho Corporation Pvt. Ltd. launched Vani, a new visual collaboration platform designed specifically to address the evolving needs of the enterprise collaboration market. Featuring an infinite canvas, smart templates, and built-in video conferencing, Vani aims to enhance collaborative workflows and foster creativity within teams. This launch reflects Zoho’s strategic focus on providing integrated, user-friendly solutions that support remote and hybrid work environments, helping enterprises improve productivity and streamline communication across diverse industries.

-

In April 2025, Atlassian made its enterprise AI solution, Rovo, available to all customers. This launch aims to address the growing demand in the enterprise collaboration market for AI-powered tools that enhance team productivity. Rovo offers advanced AI-driven search, chat, and agent capabilities designed to improve knowledge sharing and streamline communication across teams. Atlassian’s move reflects its commitment to integrating intelligent automation and collaboration features that support digital transformation in enterprises globally.

-

In April 2025, Microsoft introduced the nearby feature in Microsoft Teams to enhance real-time team interactions within physical workspaces. This innovation allows users to identify and connect with nearby colleagues from their 1:1 or group chats, facilitating spontaneous in-person meetings and brainstorming sessions. The launch underscores Microsoft’s commitment to strengthening hybrid work models and boosting productivity through seamless enterprise collaboration, positioning Teams as a critical tool in the evolving enterprise collaboration market.

Enterprise Collaboration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 60.57 billion

Revenue forecast in 2030

USD 107.03 billion

Growth rate

CAGR of 12.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, organization size, deployment mode, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Microsoft; Cisco Systems, Inc.; Zoom Communications, Inc.; Google LLC; Salesforce, Inc.; SAP SE; Cloud Software Group, Inc.; Atlassian; Igloo Software; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Enterprise Collaboration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the enterprise collaboration market report based on type, organization size, deployment mode, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Healthcare

-

Retail & Consumer Goods

-

Manufacturing

-

Education

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise collaboration market size was estimated at USD 54.67 billion in 2024 and is expected to reach USD 60.57 billion in 2025.

b. The global enterprise collaboration market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2030 to reach USD 107.03 billion by 2030.

b. Asia Pacific enterprise collaboration market accounted for the largest market share of over 34% in 2024 and is expected to grow at the highest CAGR of over 13% from 2025 to 2030, driven by increasing digitalization among small and medium enterprises, rising adoption of 5G networks, and the rapid expansion of cloud-based infrastructures.

b. Some key players operating in the enterprise collaboration market include Microsoft, Cisco Systems, Inc., Zoom Communications, Inc., Google LLC, Salesforce, Inc., SAP SE, Cloud Software Group, Inc., Atlassian, Igloo Software, Zoho Corporation Pvt. Ltd.

b. The key factors driving the enterprise collaboration market include the rising adoption of remote and hybrid work models, increasing need for real-time communication and information sharing, growing use of cloud-based collaboration tools, demand for centralized project management solutions, and the integration of artificial intelligence (AI) and machine learning (ML) in collaborative platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.