- Home

- »

- Advanced Interior Materials

- »

-

Europe Automotive Webbing Market Size, Share Report 2030GVR Report cover

![Europe Automotive Webbing Market Size, Share & Trends Report]()

Europe Automotive Webbing Market Size, Share & Trends Analysis Report By Region (Germany, France, U.K., Spain, Italy, Russia), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-057-0

- Number of Report Pages: 55

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

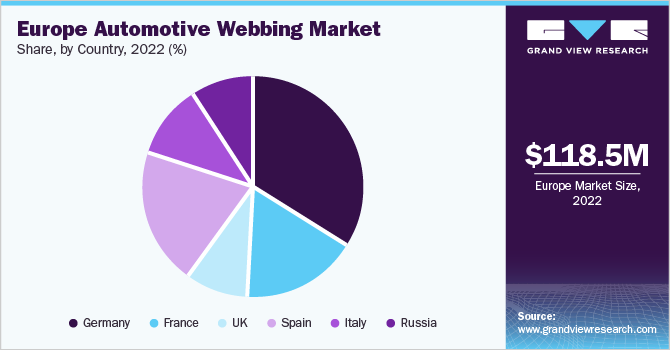

The Europe automotive webbing market size was estimated at USD 118.5 million in 2022 and is expected to grow at a compound annual growth (CAGR) of 6.6% from 2023 to 2030. The growth is expected to be driven by rising product demand from the automotive industry. Growing product demand for various automotive applications, including seatbelts, battery die-down straps, push & pull straps, and boot lining assemblies is likely to further drive the industry’s growth. Properties such as high durability and strength are the factors further influencing product demand. Polyester and nylon webbing are considered to be strong and suitable for use in automotive applications. Moreover, polypropylene is water-repellent and the webbing strips made from it are used to hold car batteries, as it can withstand battery acid.

Rising demand for electric vehicles is expected to be one of the major factors driving the growth of the market. The product is used in electric vehicles in the form of retaining straps, battery tie-down straps, elastic holders, safety seatbelts, and child restraint safety belts. Increasing concerns about greenhouse emissions by the transport sector, which is the largest contributor to greenhouse gas emissions in the EU region, are driving the demand for electric vehicles in a bid to achieve emission reduction and climate change mitigation targets.

Raw materials used for manufacturing webbing, include polyesters, cotton, nylon, polypropylene, carbon fiber, ultra-high molecular weight polyethylene (UHMWP), Dyneema (DSM), and Kevlar (DuPont). Latest advancements in technology such as extra-strength cotton obtained by reinforcing cotton with nylon and other materials help the manufacturers cut down on bulk raw material costs, which also reduces the cost of raw material handling and processing, thus, directly increasing the profitability of the supplier.

The market is technologically driven and companies are required to exhibit high product standards in terms of safety and quality. A major focus is on the weaving, dyeing, cutting, and labeling processes for different brands. This increases the capital and operating expenses of the company, which creates a restraint for new entrants in the market, thus lowering the threat of new entrants.

Stringent regulations and government guidelines in the region regarding passenger safety have triggered the utilization of seat belts and child safety gadgets in passenger cars, buses, light commercial vehicles, and other utility vehicles. Moreover, the UN regulations for child seat safety, R129 covering toddler & baby seats attached with seatbelts is likely to increase the installation of webbing materials in passenger cars and other passenger vehicles.

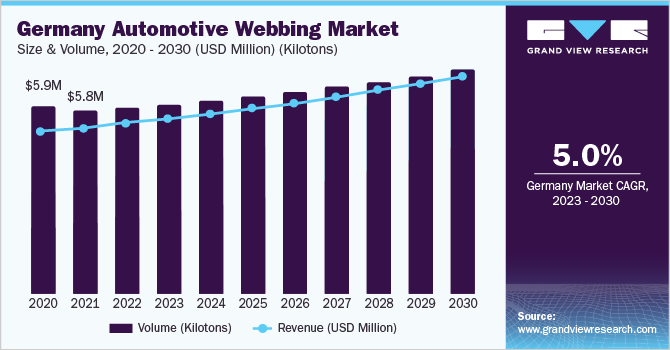

The automobile industry in Germany is heavily dependent on exports to Europe and other economies across the globe. It exports around 80% of its production mainly to European economies. The industry is likely to upscale production in the coming years, which will further increase the exports of German vehicles to other European countries. This will boost the automotive demand, thereby positively impacting the automotive webbing market in the country.

The increasing adoption of high-performance materials such as carbon fibers, aramid fibers, ultra-high molecular weight polyethylene (UHMWPE), and others to manufacture automotive webbing is also gaining traction with the increasing number of high-performance fabric manufacturers in the region. An increase in the number of high-performance fiber manufacturing plants is likely to reduce material prices in the near future. This creates an opportunity for automotive webbing manufacturers to adopt these materials to manufacture products such as safety belt slings, airbag tethers, boot lining straps, and various others.

The major focus of the automotive webbing industry in Europe is to offer advanced webbing products with characteristics such as high breaking strength, lightness, and durability. Companies such as E. Oppermann GmbH, Elastic-Berger GmbH & Co. KG, Marling Leek, and Fantex are the major players operating in the European automotive webbing industry. Safety seatbelts in commercial vehicles and racing cars are the most common example of webbing used in the market.

Key players in the industry such as H Seal & Co Limited and JTTI - Janisset SAS are working on integration across their value chains. These players supply their products to end users through their distribution channel, which helps them eliminate the distribution margin, thereby providing the product at a comparatively lesser cost. Companies are also exporting their products to other countries to expand their customer base. For instance, over 75% of the annual turnover of JTTI is generated through exports.

Region Insights

Germany dominated the Europe automotive webbing market with a revenue of USD 29.2 million in 2022. Increasing demand for high-end, luxury cars from domestic consumers in the country is anticipated to be a key factor driving the demand for webbing products in Germany. The production of automotive parts including handle straps, holders, and other straps for exhaust pipe hangers is likely to witness an upward trend on account of increasing webbing product demand for automotive production.

Moreover, increasing investments by prominent vehicle manufacturers in the country are anticipated to create a wide scope for the webbing products market. Prominent vehicle manufacturers operating in the economy are Bayerische Motoren Werke AG (BMW), Mercedes Benz, Porsche, Audi, Volkswagen Group, and others.

France is anticipated to grow at the fastest CAGR of over 6.0% in terms of volume over the forecast period. The country was valued at a revenue of USD 14.3 million in 2022 owing to the significant growth of the automobile industry in the country. The automobile industry in France is a significant contributor to the overall European automobile industry with a share of around 10% in overall production in the region.

Spain accounted for a volume of 3.7 kilotons in 2022. Automobile production in the country witnessed a growth of more than 15% from 2014 to 2019 due to the high demand from end-user segments and international markets. This was supported by fair investments from prominent automobile manufacturers in the country and favorable regulations by the government. These factors resulted in the growth of the automotive webbing market in the country.

Key Companies & Market Share Insights

The key players includeE. Oppermann GmbH; Bowmer Bond Narrow Fabrics Limited; Elastic-Berger GmbH & Co. KG; H Seal & Co Limited; JTTI - Janisset SAS; Wisla Narrow Fabrics Limited; and FANTEX INDUSTRIE.These players focus on the development of new technologies and mergers with established players to settle in the market.

The companies focus on R&D of new types of automotive webbing with high mechanical strength, tensile strength, high abrasion resistance, and long lives to gain a competitive edge over one another. Additionally, strategies adopted by the key market players usually include product portfolio expansion, technology innovation, and geographical expansion of business. Some prominent players in the Europe automotive webbing market include:

-

E. Oppermann GmbH

-

Helmut Pfeiffer GmbH & Co. KG

-

Bowmer Bond Narrow Fabrics Limited

-

Elastic-Berger GmbH & Co. KG

-

Marling Leek

-

Ribbons Ltd

-

H Seal & Co Limited

-

Wisla Narrow Fabrics Limited

-

JTTI - Janisset SAS

-

FANTEX INDUSTRIE

Europe Automotive Webbing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 125.8 million

Revenue forecast in 2030

USD 197.2 million

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Region

Regional scope

Europe

Country scope

Germany; U.K.; France; Spain; Italy; Russia

Key companies profiled

E. Oppermann GmbH; Helmut Pfeiffer GmbH & Co. KG; Bowmer Bond Narrow Fabrics Limited; Elastic-Berger GmbH & Co. KG; Marling Leek; Ribbons Ltd; H Seal & Co Limited; Wisla Narrow Fabrics Limited; JTTI - Janisset SAS; FANTEX INDUSTRIE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Automotive Webbing Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the Europe automotive webbing market report based on region:

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Frequently Asked Questions About This Report

b. The Europe automotive webbing market size was estimated at USD 118.5 million in 2022 and is expected to reach USD 125.8 million in 2023.

b. The Europe automotive webbing market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 197.2 million by 2030.

b. Germany accounted for the largest volume share of 29.0% in Europe automotive webbing market in 2022 on account of increasing production capacity of automobiles in the country owing to rising demand for high-end, luxury cars from domestic consumers.

b. Some of the key players operating in the Europe automotive webbing market include E. Oppermann GmbH, Helmut Pfeiffer GmbH & Co. KG, Bowmer Bond Narrow Fabrics Limited, Elastic-Berger GmbH & Co. KG, Marling Leek, Ribbons Ltd, H Seal & Co Limited, Wisla Narrow Fabrics Limited, and JTTI - Janisset SAS.

b. The key factors that are driving the Europe automotive webbing is the presence of large number of automobile manufacturers in the region which accounts to the rising demand for webbing for manufacturing safety seatbelts, child restraint safety belts, battery die-down straps, and push & pull straps.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."