- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Europe Composites Market Size, Share, Growth Report 2030GVR Report cover

![Europe Composites Market Size, Share & Trends Report]()

Europe Composites Market (2023 - 2030) Size, Share & Trends Analysis Report By Manufacturing Process, By Product (Carbon Fiber, Glass Fiber), By Application (Automotive & Transportation, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-994-4

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Composites Market Size & Trends

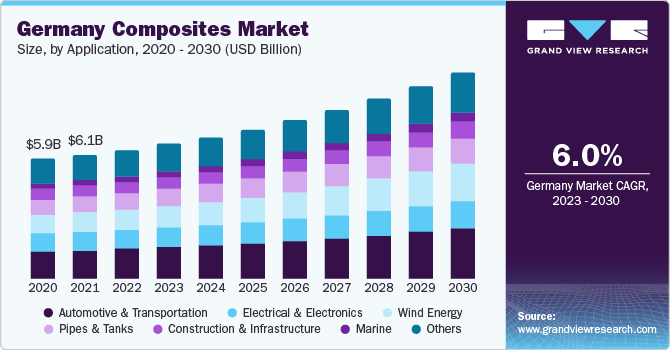

The Europe composites market size was valued at USD 19.35 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This can be attributed to the increasing demand for lightweight materials across diverse industries, including wind energy, automotive, transportation, aerospace, and defense. Additionally, the surge in demand for wind energy and the high product demand within the automotive industry are projected to provide substantial impetus to the market throughout the forecast period.

Composite products play an essential role in the manufacturing of automotive and aircraft parts. Technological innovations to minimize manufacturing cycle time are expected to propel the demand for composites in the automotive sector. Increasing requirements for high-quality composite materials in the automotive sector are expected to steer investments in developing new manufacturing technologies. Companies such as Toray, Hexcel Corporation, Teijin Limited, and SGL Group utilize their patented technologies to manufacture composites. SGL Group has collaborated with various research centers and academic institutes to develop and test CFRP materials.

Increasing demand for composites in the automotive industry is anticipated to boost the Europe composites market over the forecast period. Rising fuel prices have triggered the need for fuel-efficient vehicles. Composites are most widely utilized as a replacement for aluminum, wood, and steel on account of their higher strength-to-weight ratio. Stringent environmental regulations in Europe have forced automotive manufacturers to include composites in automotive production. Globally, especially in Europe, regulations are forcing OEMs to significantly reduce carbon dioxide (CO2) emissions caused by vehicles. Proposed regulations in countries are further expected to fuel product demand from this sector.

Product Insights

The glass fiber segment accounted for the largest revenue share of around 55.6% in 2022. Glass fiber is made from fine fibers of glass and is also known as fiberglass. Fiberglass is lightweight, robust, and strong material; however, it has lower stiffness compared to carbon fiber. The weight properties and bulk strength of glass fibers are extremely advantageous as compared to those of metals. The growth of the automotive and wind energy industries in Germany is expected to drive the overall market.

The carbon fiber segment is expected to register the fastest CAGR of 8.6% over the forecast period. Carbon fiber mostly consists of carbon atoms that are bonded together in crystals aligned parallel to the fiber. Carbon fiber is combined with other materials to form composites. It is molded with plastic resin to form a carbon fiber-reinforced polymer. The properties of these fibers, such as high temperature, high stiffness, low thermal expansion, low weight, and high chemical resistance, make them very popular for utilization in industrial and other applications.

Application Insights

The automotive & transportation segment held the largest revenue share of 22.2% in 2022. Composites offer several advantages, such as fuel-saving, to the transportation sector. Their durability and lightweight are beneficial properties for design and manufacturing efficiencies across this sector. Manufacturers in bus and light rail markets use composites to increase fuel efficiency and enhance the visual appeal of interiors.

The wind energy segment is expected to grow at the fastest CAGR of 8.0% over the forecast period. Composite materials find application due to their advantageous attributes, encompassing elevated dependability, low weight, safety, aerodynamic proficiency, and the ability to function effectively under diverse weather conditions. The expansion of renewable energy resources, paired with an increasing requirement for wind turbines that excel in both lightweight construction and exceptional quality, is projected to serve as a driving force behind the surge in demand for these products within the region.

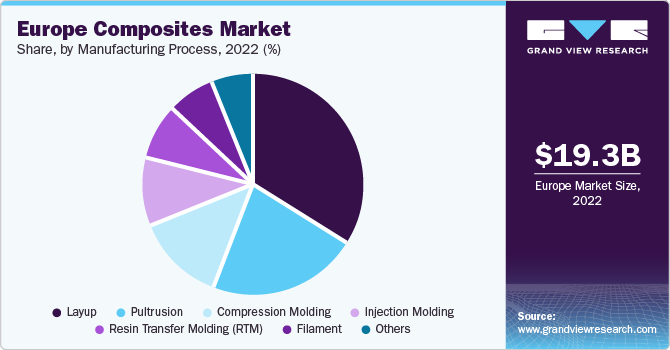

Manufacturing Process Insights

The layup segment accounted for the largest revenue share of 34.2% in 2022 and is expected to grow at the fastest CAGR of 8.1% during the forecast period. Layup is the most basic method for composite production. The anticipated rise in wind turbine blade, boat, and architectural molding production is poised to drive the growth of the layup process segment throughout the forecast period.

The pultrusion process involves the drawing of fiberglass through a liquid resin that saturates glass reinforcement. The pultrusion process of manufacturing fiber composites with polymer matrix is an efficient and resource-saving technique. Injection molding is a high-volume, fast, low-pressure, closed process. It allows the molding of complex structures and enables a wide range of materials with almost exact properties required from the article.

Regional Insights

Germany dominated the market and accounted for the largest revenue share of 32.8% in 2022. The country is one of the largest producers of composites in the region, driven by rising demand from the aerospace and automotive industries. The development of Future Combat Air System projects is expected to propel demand in aerospace applications.

UK is expected to grow at the fastest CAGR of 7.0% during the forecast period. Product demand is expected to be particularly propelled by offshore electrical and electronics installations in the country. Moreover, the steady growth of the UK marine industry is anticipated to propel demand in the coming years.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. The following are some of the major participants in the Europe composites market:

Key Europe composites Companies:

- Toray Industries, Inc.

- Owens Corning

- Nippon Electric Glass Co., Ltd.

- Huntsman International LLC

- SGL

- Hexcel Corporation

- DowDuPont Inc

- Compagnie de Saint-Gobain S.A.

- Weyerhaeuser Company

- Momentive Performance Materials, Inc.

- Solvay

- China Jushi Co., Ltd.

Recent Developments

-

In April 2023, Teijin Limited qualified its polyether ether ketone (PEEK) and carbon fiber-based materials, which are referred to as ThermoPlastic Woven Fabric and ThermoPlastic Consolidated Laminate, under the unified brand name of Tenax. This qualification was achieved in collaboration with the National Center for Advanced Materials Performance (NCAMO).

-

In June 2023, Huntsman International LLC and V-Carbon combined their expertise to develop End-of-life recycling solutions for carbon fiber composites. The pursuit of enhanced fuel and energy efficiency in domains like transportation and aviation demands the incorporation of robust yet lightweight composites. Despite the widespread integration of these composites, advancements in bolstering product sustainability have shown gradual progress, particularly in the aspect of recyclability. This collaborative initiative stands poised to introduce a pioneering resolution aimed at significantly reducing the prevalent carbon footprint in the composites market.

Europe Composites Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.27 billion

Revenue forecast in 2030

USD 31.54 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in Kilo Tons, Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Manufacturing process, product, application, region

Country scope

UK; Germany; France; Italy; Spain.

Key companies profiled

Teijin Limited; Toray Industries, Inc.; Owens Corning; Nippon Electric Glass Co., Ltd.; Huntsman International LLC; SGL; Hexcel Corporation; DowDuPont Inc; Compagnie de Saint-Gobain S.A.; Weyerhaeuser Company; Momentive Performance Materials, Inc.; Solvay; China Jushi Co.; Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Composites Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe composites marketreport based on manufacturing process, product, application, and region:

-

Manufacturing Process Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Layup

-

Filament

-

Injection Molding

-

Pultrusion

-

Compression Molding

-

Resin Transfer Molding (RTM)

-

Others

-

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Carbon Fiber

-

Glass Fiber

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Wind Energy

-

Construction & Infrastructure

-

Pipes & Tanks

-

Marine

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The Europe composites market size was estimated at USD 19.35 billion in 2022 and is expected to reach USD 20.27 billion in 2023.

b. The Europe composites market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 31.54 billion by 2030.

b. Glass fiber accounted for the largest revenue share 55.6% in 2022 of Europe composites market on account of its properties such bulk strength, robust, and lightweight which makes it more popular than carbon fiber.

b. Some of the key players operating in the Europe composites market include Teijin Limited, Hexcel Corporation, Toray Industries, Owens Corning, and Solvay.

b. The key factors that are driving the Europe composites market include the growing demand for lightweight materials in industries including transportation, automotive, aerospace, and wind energy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.