- Home

- »

- Consumer F&B

- »

-

Europe Dairy Alternatives Market Size, Industry Report, 2030GVR Report cover

![Europe Dairy Alternatives Market Size, Share & Trends Report]()

Europe Dairy Alternatives Market Size, Share & Trends Analysis Report By Source (Soy, Almond, Coconut, Rice, Oats), By Product (Milk, Yogurt, Cheese, Ice-cream, Creamers), By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-214-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Dairy Alternatives Market Trends

The Europe dairy alternatives market size was estimated at USD 5.52 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.4% from 2024 to 2030. The market is expected to increase owing to the rising demand for healthy foods & beverages in the region. Dairy alternative-based beverages are often consumed as alternatives to dairy beverages. Manufacturers are focusing on new product development, which includes soya juice mixes and fresh soya drinks.

The European market accounted for a revenue share of 18.9% of the global dairy alternatives market in 2023. In the upcoming years, almond milk is predicted to expand at the fastest rate. This is because the region's dairy substitute goods are expected to see a rise in market value due to the organic claims made by major firms like Earth's Own Food Company and Blue Diamond Growers. In an effort to draw customers, a number of producers in the industry are developing a variety of flavors, such as vanilla, chocolate, and honey, for dairy substitute beverages like soymilk and almond milk.

Over the course of the forecast period, it is anticipated that rising use of dairy substitutes in food applications such cheese, desserts, and snacks will positively affect market growth. The region's market is anticipated to develop due to the strong demand for non-dairy ice creams including coconut and almond ice cream. Growing consumer demand for yogurt drinks without lactose will probably fuel industry expansion. Dairy alternatives registered a high demand from cheese slices & blocks, shreds, butter, and creamer manufacturers, which is expected to have a positive impact on market growth over the forecast period.

Over the anticipated period, increased consumer awareness of the need of eating a healthy diet and the demand for foods with lower fat and cholesterol levels are predicted to create new opportunities for market competitors. Worldwide, lactose intolerance is a highly prevalent condition, and over 60% of people have some form of milk allergy, according to the World Health Organization.

Market Concentration & Characteristics

In order to keep up with the changing expectations of consumers, manufacturers are driven to innovate, enhance, and diversify their product offerings in response to the quickly shifting tastes and wants of consumers.

In the dairy substitute market, new product introductions are critical, especially for goods with high ingredient content and health benefits. To stay competitive and satisfy changing consumer needs for natural and healthy ingredients, food companies in this industry rely on new product offers.

Acquiring certifications for components is crucial in the dairy substitute business since it demonstrates the dedication to fulfilling stringent quality, sustainability, and environmental requirements. These certificates vouch for the product's honesty and dependability and give consumers peace of mind regarding its origin, manufacturing method, and commitment to environmentally sustainable standards.The dairy alternatives industry places a high value on corporate social responsibility (CSR), which emphasizes the adoption of sustainable and moral business practices. By taking part in projects that improve the local community and the environment, businesses can develop a favorable brand image and long-lasting relationships with partners and customers.

Distribution Channel Insights

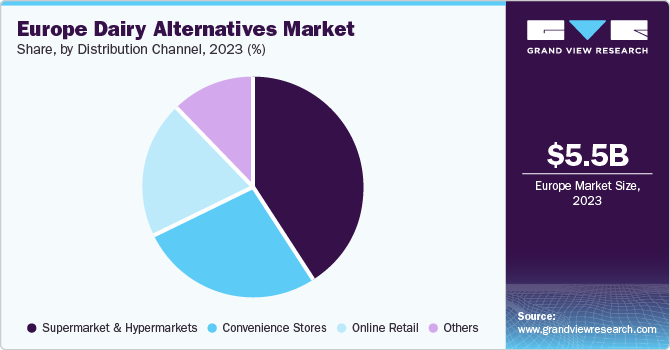

Supermarkets & hypermarkets dominated the European market, having accounted for a revenue share of over 41% in 2023. The penetration of supermarkets and hypermarkets in Europe is observed to be higher than that in the developing regions. Besides, the presence of a large variety of this product in one place and ease of buying contributed to the dominance of supermarkets and hypermarkets in the market.

The online sales of dairy alternatives in Europe are projected to grow at a CAGR of 12.5% from 2024 to 2030. The growing penetration of Internet, smartphones, and online delivery infrastructure in the region are contributing to the growth of this sales channel segment.

Source Insights

The soy-based dairy alternatives market accounted for a revenue share of over 35% in 2023. The key factors driving this segment’s growth include increasing incidences of milk allergies and lactose intolerance among consumers in the region.

The demand for almond-based dairy alternatives is anticipated to grow at a CAGR of 12.4% from 2024 to 2030. Rich in vitamin B, it helps increase the body's basal metabolic rate, making it more effective at burning calories and fat. Almond milk's demand is anticipated to rise as a result of these nutritional advantages. Important minerals included in almond milk, including iron, magnesium, phosphorus, zinc, and copper, support healthy blood pressure regulation, enhance blood oxygenation, and shield the body from illness. A higher potency beverage for enhancing skin quality and preventing cancer is almond milk, which also contains high levels of manganese and vitamin E.

Product Insights

The market for non-dairy milk dominated the European market in 2023, having accounted for a revenue share of over 66%. In Europe, individuals are choosing alternatives based on milk because the country's elderly population is growing. But rising health worries about soy milk, particularly for those who have survived breast cancer, are probably going to slow market expansion.

A wide range of flavored beverages that include dairy substitutes are available as a result of customers' growing need for a diversity of beverage options. Lactose intolerant customers seeking diversity in milk-based dairy substitute drinks are also drawn to the flavored beverages.

The demand for non-dairy ice cream is expected to grow at a CAGR of 12.9% from 2024 to 2030. The region has, in recent years, witness a surge in demand for non-dairy ice creams, such as almond-based and coconut-based.

Country Insights

Germany Dairy Alternatives Market Trends

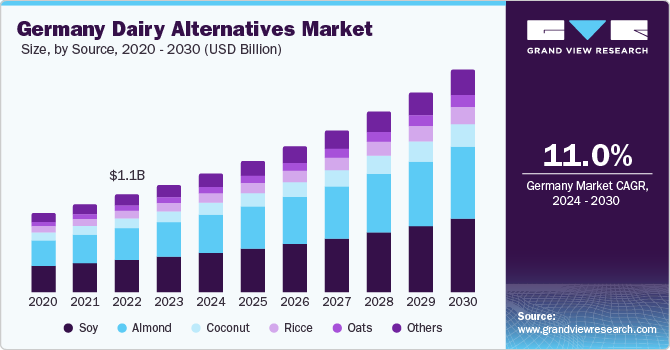

The Germany dairy alternatives market accounted for a revenue share of 21.6% of the European market in 2023. Consumer preferences in the region are shifting toward lactose-free, low-fat, and plain soy-based goods as a result of growing health concerns. In Germany, soymilk has been a significant product category in the dairy substitutes market. The market for dairy substitute beverages in Germany has grown to become the biggest in Europe, surpassing that of the UK.

Growing health consciousness among consumers will probably force producers to choose lactose-free, low-calorie frozen goods in the dairy substitute sector. In the area, cheese has been a significant food product category in the dairy substitutes industry. Over the course of the forecast period, it is predicted that the low fat and high nutritional value associated with dairy replacement goods, such as desserts and snacks produced from almond, rice, and coconut, will positively impact market growth.

UK Dairy Alternatives Market Trends

The UK dairy alternatives market is projected to grow at a CAGR Of 11.5% from 2024 to 2030. The country is one of the largest markets for chilled soymilk and is anticipated to witness a significant growth owing to rising popularity of chilled soymilk as a fresh alternative for dairy milk. Growing demand for non-dairy products and the growing acceptance of plant-based milk, which is seen as healthful, are expected to propel market expansion over the projected period.

France Dairy Alternatives Market Trends

The dairy alternatives market in France accounted for a revenue share of around 6% in 2023. Plant-based milks are widely accessible in France, with options ranging from supermarket own-brands, discount stores, and local grocery stores to popular brands like Bjorg, Sojasun, and Alpro. The need for dairy substitutes has skyrocketed in the last several years due to new product developments, shifting consumer preferences, and growing environmental consciousness. However, it is anticipated that the French government's ban on the use of terms such as "milk" and "meat" on vegan food labels may limit the market growth for dairy substitutes in the upcoming years.

Key Europe Dairy Alternatives Company Insights

The European dairy alternatives market is characterized by the presence of internationally known brands. Companies have been extensively focusing on new product launches to gain a competitive advantage over others in the market. For instance, in November 2021, Oatly, launched Oat Drink Vanilla Flavor made with rapeseed and fortified with B12 and D2 to cater to the growing demand for dairy alternatives in the U.K. market.

Key Europe Dairy Alternatives Companies:

- Blue Diamond Growers

- Danone S.A.

- Melt Organic

- Ecomil

- Ecotone

- First Grade International Limited

- Oatly Group AB

- The Hain Celestial Group Inc.

- Upfield Holdings BV.

- Unilever PLC

Recent Developments

-

In February 2023, Blue Diamond declared that it is launching three campaigns for three products-Snack Almonds, Almond Breeze almond milk, and Almond Flour-in an effort to capitalize on the rising demand for plant-based diets. This indicates a greater effort to present the advantages of almonds in novel ways. The Snack Almonds campaign uses catchy jingles and a range of packaging sizes to promote the variety of snacking options. The taste and adaptability of almond milk are highlighted by the Almond Breeze promotion. These commercials will appear online, on social media, and on linear TV.

-

In June 2023, Oatly Group AB introduced cream cheese in vegan option, which is available across U.S. This cream cheese is produced into two interesting flavors such as Plain and Chive & Onion.

Europe Dairy Alternatives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.13 billion

Revenue forecast in 2030

USD 11.71 billion

Growth rate

CAGR of 11.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, distribution channel, country

Regional scope

Europe

Country scope

Germany; UK; Spain; Italy; France

Key companies profiled

Blue Diamond Growers; Danone S.A.; Melt Organic; Ecomil; Ecotone; First Grade International Limited; Oatly Group AB; The Hain Celestial Group Inc.; Upfield Holdings BV.; Unilever PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Dairy Alternatives Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe dairy alternatives market report on the basis of source, product, distribution channel, and country:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Almond

-

Coconut

-

Rice

-

Oats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Milk

-

Yogurt

-

Cheese

-

Ice Cream

-

Creamer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket & Hypermarkets

-

Convenience Stores

-

Online Retail

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe dairy alternatives market size was estimated at USD 5.52 billion in 2023 and is expected to reach USD 6.13 billion in 2024.

b. The Europe dairy alternatives market is expected to grow at a compound annual growth rate of 11.4% from 2024 to 2030 to reach USD 11.71 billion by 2030.

b. Germany dominated the Europe dairy alternatives market with a share of 21.6% in 2023. This is attributable to the shifting consumer preferences towards soymilk and the growing demand for plant-based beverages.

b. Some key players operating in the Europe dairy alternatives market include Blue Diamond Growers, Danone S.A., Melt Organic, Ecomil, Ecotone, First Grade International Limited, Oatly Group AB, The Hain Celestial Group Inc., Upfield Holdings BV., and Unilever PLC.

b. Key factors that are driving the market growth include the rising demand for healthy foods & beverages, along with the growing consumer preferences towards non-dairy or plant-based beverages.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."