- Home

- »

- Healthcare IT

- »

-

Europe Digital Health Market Size, Industry Repot, 2030GVR Report cover

![Europe Digital Health Market Size, Share & Trends Report]()

Europe Digital Health Market Size, Share & Trends Analysis Report By Technology (Tele-healthcare, mHealth), By Component (Software, Hardware), By Application, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-941-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Digital Health Market Size & Trends

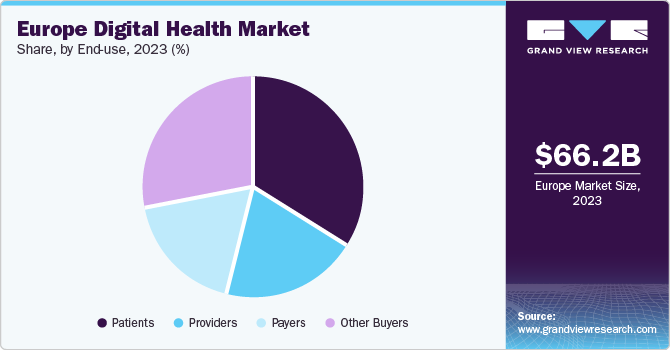

The Europe digital health market size was anticipated at USD 66.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 22.3% from 2024 to 2030. The increasing prevalence of chronic diseases, shortage of medical professionals, and growing aging population in Europe are some factors anticipated to drive market growth.In addition, the advancement of digital technologies, improved internet connectivity, and increasing demand for virtual healthcare services are also contributing to the market growth.

Rising demand for remote patient monitoring and growing smartphone penetration are expected to boost the adoption of digital health platforms. For instance, according to The Mobile Economy Europe, the number of unique mobile subscribers in Europe amounted to 496 million in 2022 and is projected to increase to 507 million by 2030. This signifies a penetration rate of 92% across the European region. Furthermore, it is anticipated that by 2030, a substantial 87% of mobile connections in Europe will be powered by 5G technology. This rise in connectivity is closely connected to the increasing prevalence of internet usage and the widespread adoption of smartphones throughout the continent. This acceptance of advanced mobile technology has subsequently contributed to a heightened dependence on medical, health, and fitness applications. As a result, the expanding digital landscape in Europe is playing a significant role in supporting the market's growth.

Furthermore, the number of patients suffering from chronic diseases such as cancer, diabetes, Alzheimer's, and cardiovascular diseases is increasing rapidly. As a result, there is a growing demand for long-term patient monitoring services, which is driving the growth of the digital health market. For instance, according to the European Commission's estimates published in the European Cancer Information System (ECIS), the number of new cancer cases has increased by 2.3% compared to 2020, reaching 2.74 million in 2022. Similarly, cancer-related deaths have increased by 2.4% compared to 2020. Moreover, a shortage of medical professionals and an increasing trend towards remote patient monitoring is further fueling the demand for telehealth services, thus fostering market growth.

In addition, telehealth services have become increasingly popular as they provide a platform for patients to engage with healthcare providers remotely. This service offers several benefits including convenience, reduced costs, and eliminates the need for in-person consultations. By facilitating remote consultations, telehealth services can help bridge the gap between patients and healthcare providers, making it easier for individuals to schedule appointments and receive care. These benefits are expected to drive the market growth in the forecast period.

Case Study: European firms have created digital technologies that can scale up to offer solutions for clinical settings, remote care, health insurance, and patient-centered eHealth services.

According to Digital Europe’s published article, “Digital health decade in action: case studies,” early detection, efficient workflows, and accurate diagnosis are essential for better patient care.

Digital health solutions have undergone extensive R&D and require authorization & post market surveillance. Furthermore, they receive ongoing optimization support after delivery to their users.

Electronic Health Data Systems (EHDS) can also facilitate health data access. They can be used on a large scale by companies of all sizes, fostering inclusive collaborations across Europe between academia, hospitals, health companies, & technologies.

“Smart Solutions for Treating Complex Arrhythmias in Clinical Settings”

-

Enhancing Healthcare: The collaboration of physicians, electrophysiology lab administrators, and electrophysiologists through multicenter studies and AI-based data analysis can improve procedure efficiency, lab efficiency, and patient outcomes in treating complex arrhythmias.

-

How does CARTONET work?

CARTONET is a digital platform that stores all CARTO 3 System cases and applies AI-based algorithms to analyze them, storing the analysis on the cloud. Physicians can review the analysis of each case and easily modify the algorithm analysis. The system can also generate statistics based on analysis data from hundreds of cases, which can be aggregated for cases identified in multicenter studies, providing global statistics for research in treatment analysis.

-

Partnership: Biosense Webster, a medical device company under Johnson & Johnson, developed this solution in collaboration with Siemens Healthineers' teamplay platform and Microsoft Azure cloud technology.

-

Main technologies: WEB PACS, database management, and deep learning AI.

-

Member: Johnson & Johnson

Moreover, increasing government initiatives to promote digital health solutions and the growing adoption of advanced technology for remote health management are also anticipated to accelerate the market growth in Europe. For instance , in June 2023, the World Health Organization (WHO) and European Commission announced a digital health partnership. This initiative aims to streamline international travel and safeguard individuals globally against existing and potential health threats, such as pandemics. Similarly, in September 2022, Health ministers and representatives from the 53 Member States of WHO/Europe adopted an extensive digital health action plan. The plan aims to use digital transformation to improve the health and well-being of people in Europe and central Asia.

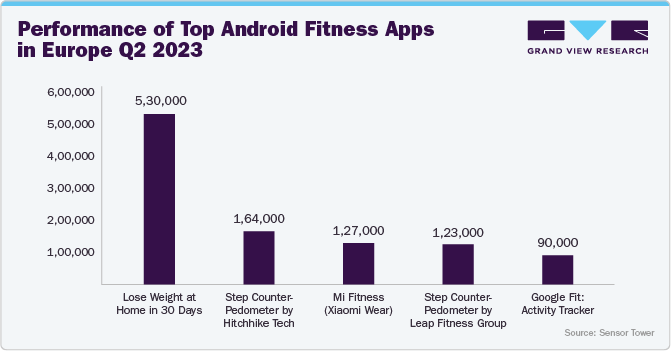

The current rise in health awareness has prompted an increasing number of individuals to give priority to physical fitness, resulting in an increased uptake of fitness applications. This shift towards emphasizing personal well-being is expected to play a significant role in the expansion of the market. As individuals increasingly look for convenient and personalized ways to maintain their fitness, there is anticipated to be a noticeable increase in the demand for fitness apps.

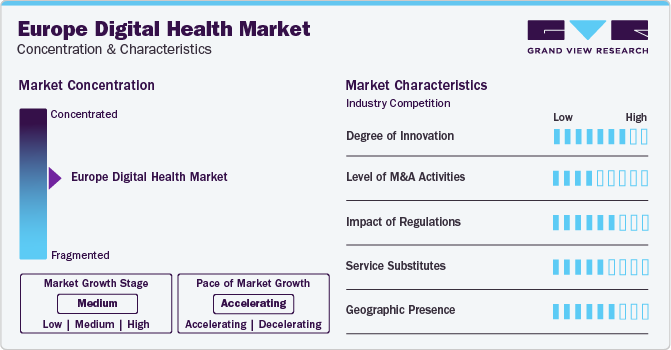

Market Concentration & Characteristics

The region's strong emphasis on research and development, supported by robust public and private investments in healthcare innovation is one of the key drivers of innovation in the digital health market. In 2022, European digital health startups raised USD 5.2 billion, including USD 1.8 billion in France, nearly three times the amount invested in 2021. Furthermore, integration of data analytics and artificial intelligence (AI) in healthcare to enhance clinical decision-making, personalize treatment plans, and optimize healthcare operations is accelerating the degree of innovation.

Various growth strategies are implemented by market players to strengthen their business revenues, further facilitating market growth. For instance, in December 2023, 7NXT acquired the wellbeing application 7Mind to establish itself as the foremost platform for both physical and mental fitness. Such mergers and acquisition are further driving the market growth.

Regulatory frameworks are essential in ensuring patient safety, data privacy, interoperability, and quality of care. In addition, regulations that govern the reimbursement and financing of digital health products and services can affect market adoption and growth. As per theRemap Consulting report, in 2023, Germany reimbursed 47 digital health applications across 20 disease areas. Moreover, in March 2023, France has introduced a fast-track reimbursement route, named Prise en Charge Anticipée scheme, for digital health solutions, which includes digital health applications.

One common service substitute in the European digital health market is traditional in-person healthcare consultations. While telemedicine and virtual consultations have gained popularity, particularly during the COVID-19 pandemic, many patients still prefer face-to-face interactions with healthcare providers for certain types of appointments or medical issues.

Several market players are expanding their business by expanding into new countries in the region to strengthen their market position and expand their product portfolio. For instance, in June 2023, Future4care has initiated its operations in Germany with the objective of establishing itself as the largest ecosystem of digital healthcare players in Europe.

Technology Insights

Based on technology, the tele-healthcare segment led the market with a largest revenue share of 43.2% in 2023, owing to the growing adoption of telecare and telehealth platforms for remote patient monitoring and treatment. The use of tele-healthcare technology is becoming increasingly beneficial, particularly in situations where face-to-face interaction between patients and healthcare providers is unnecessary. This is expected to drive the tele-healthcare segment growth. Medical professionals and patients are also showing a growing preference for tele-healthcare services, as they improve access to care in remote areas and reduce the risk of transmitting infectious diseases. These factors are expected to support market growth. For instance, as of 2022, over fifty percent of the countries within the European region of the World Health Organization (WHO) have reported the implementation of teleradiology services.

The mHealth segment held the second highest revenue share in 2023. This can be attributed to the increase in the number of mHealth apps for medical, health, and wellness purposes, as well as the growing number of smartphone users. Furthermore, the constant improvements in mobile app functionality by manufacturers are driving growth. The increasing adoption of mobile healthcare applications for disease management, medication management, patient tracking, women's health, fitness & wellness, and personal health record management, among other things, is also expected to drive segment growth. For instance , according to a survey by Civey on behalf of eco - Association of the Internet Industry, almost one-third of Germans (31.6%) use health apps.

Component Insights

Based on component, the services segment led the market with the largest revenue share of 37.8% in 2023. The dominance of this segment is due to the growing demand for training, staffing, maintenance, resource allocation, and optimization services of tele healthcare components. Market players are increasingly focusing on offering these services to maintain their strong position in the market, which is expected to drive the segment’s growth. Furthermore, the increasing demand for better services and the advancement of electronic health platforms is expected to boost the market share of this segment.

The software segment is expected to register the fastest CAGR throughout the forecast period. This growth is attributable to the rapid adoption of software among healthcare institutions, patients, and insurance payers. Moreover, the availability of various software for health management in the market is also anticipated to drive the segment growth. In addition, the integration of artificial intelligence (AI), machine learning (ML), and data analytics technologies into healthcare software has improved clinical decision-making, predictive analytics, and population health management.

Application Insights

Based on application, the diabetes segment led the market with the largest revenue share of 24.3% in 2023. Increasing prevalence of diabetes coupled with the growing recognition of the need for more accessible and effective tools to support diabetes management is driving the market growth. As per the InsuJet article, there were 5 million people suffering from diabetes in 2023, which accounts for more than 9.7% of the UK population. In addition, according to a report by Public Health England, the number of diabetes cases in the UK is expected to rise to 4.9 million by 2035. Digital health technologies offer real-time feedback, convenience, and insights that enable users to better understand their health status and take proactive measures to manage their diabetes effectively.

The obesity is the second fastest growing segment in the Europe market. Poor diet and lack of physical activity are the primary contributors to obesity. According to the German Health Update (GEDA 2019/2020-EHIS), over half of the population (53.5%) was classified as overweight, with men (60.5%) being more affected than women (46.6%). In addition, 19.0% of adults were found to be obese. Thus, the rising prevalence of obesity coupled with the increasing demand for personalized healthcare solutions are supplementing the market growth.

End-use Insights

Based on end-use, the patients segment led the market with a largest revenue share of 34.1% in 2023. Increasing launch of healthcare apps is anticipated to boost market growth. In June 2022, PINK gegen Brustkrebs GmbH launched PINK Coach health app in Germany, a digital platform designed to enhance health-related quality of life and health literacy, while also addressing the psychological, psychosomatic, and somatic consequences associated with breast cancer. Digital health technologies, such as wearable devices and health apps, enable patients to track their health metrics and receive recommendations tailored to their unique needs and preferences, thereby fostering market growth.

The providers segment held a significant share in the market and is expected to maintain their market share over the forecast period. Electronic Health Records (EHRs), telemedicine platforms, and remote monitoring devices help healthcare providers streamline their administrative tasks, enhance communication between healthcare teams, and enable providers to deliver care more seamlessly across different settings. This increased efficiency leads to better patient outcomes and allows providers to see more patients, allocate resources more effectively, and generate more revenue, thereby fostering market growth.

Country Insights

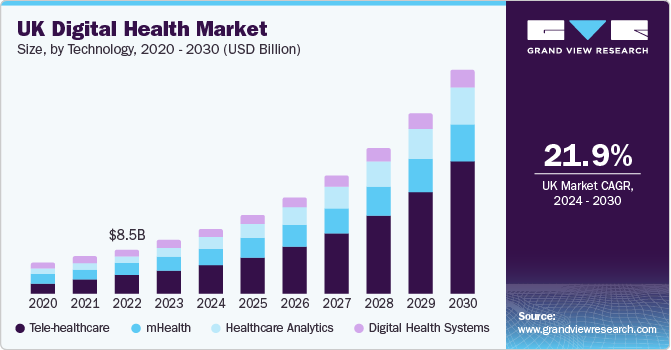

UK Digital Health Market Trends

The UK digital health market is anticipated to grow at a significant CAGR over the forecast period,owing to the growing penetration of internet users and an increasing number of consumers using remote digital health services. For instance , as per the Kepios analysis, in January 2023, there were 66.11 million internet users in the UK. In addition, the growing geriatric population, changing lifestyles and increasing number of chronic disease cases are among the major factors driving the adoption of digital health solutions in the UK.

Italy Digital Health Market Trends

The Italy dominated the market with a revenue share in 2023. The increase in the number of digital health startups in Italy and the strong government initiatives to promote remote health care services are some of the major factors driving the regional market growth. For instance, as per the HEALTHTECH APLHA, Italy's network of 70 Digital Health ventures has grown at a rate of 3.1% CAGR from 2019 to January 2024.

Spain Digital Health Market Trends

The digital health market in Spain is anticipated to grow at a significant CAGR over the forecast period. Increasing government investment in digital health services will foster market growth. For instance, in October 2022, the Spanish Council of Ministers has approved an allocation of USD 247.2 million to develop the Digital Health Strategy as one of the proposals of the current Government aims to promote the digital transformation of health services.

France Digital Health Market Trends

The France digital health market is anticipated to grow at a significant CAGR of 24.1% over the forecast period. Increasing consumer demand for convenient and accessible healthcare services is driving the market growth. Moreover, government initiatives and policies aimed at promoting digital health innovation are fueling France digital health market growth.

Key Europe Digital Health Company Insights

Key participants in the Europe market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions. Moreover, favorable support from government organizations is anticipated to boost the involvement & overall performance of digital health companies in Europe. For instance, in June 2023, WHO and the European Commission entered into a digital health partnership which would focus on facilitating mobility and improve protection of citizens from current and future health threats. Some of the key players operating in the market include Oracle, Allscripts, Apple Inc, Telefonica S.A., McKesson Corporation, Epic Systems Corporation, AT&T, Vodafone Group, and Google, Inc.

Key Europe Digital Health Companies:

- Oracle

- Veradigm LLC

- Apple Inc

- Telefonica S.A.

- McKesson Corporation

- Epic Systems Corporation

- QSI Management, LLC

- AT&T

- Vodafone Group

- Airstrip Technologies

- Google, Inc

- Samsung Electronics Co. Ltd

- HiMS

- Orange

- Qualcomm Technologies, Inc

- Softserve

- Computer Programs and Systems, Inc

- IBM Corporation

- CISCO Systems, Inc

Recent Developments

-

In November 2023, Bertelsmann Investments (BI) invested USD 5.4 million in Doccla, Europe’s top provider of virtual hospital platforms for tele-monitoring

-

In June 2023, Apple announced the launch of new health features in iOS 17, watchOS 10, and iPadOS 17. These features are intended to provide innovative tools to users, empowering them to take better care of their health. Two new features were introduced: one for mental health and the other for vision health. These tools enable users to access data that can help them better understand their health

-

In June 2023, Berlin-based healthtech Nelly has raised USD 16.1 million to enable a fully digital patient journey across Europe

-

In July 2022, Smith+Nephew launched an application called the WOUND COMPASS Clinical Support App. The app is designed to aid healthcare professionals in wound assessment and decision-making

Europe Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 79.7 billion

Revenue forecast in 2030

USD 267.2 billion

Growth rate

CAGR of 22.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end-use, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Oracle; Veradigm LLC; Apple Inc; Telefonica S.A.; McKesson Corporation; Epic Systems Corporation; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd; HiMS; Orange; Qualcomm Technologies, Inc; Softserve; Computer Programs and Systems, Inc; IBM Corporation; CISCO Systems, Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Digital Health Market Report Segmentation

This report forecasts revenue growth and provides at regional and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Europe digital health market report based on technology, component, application, end-use, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables & Connected Medical Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep Trackers.

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal And Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

mHealth Apps

-

Medical Apps

-

Women's Health

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Menopause

-

Disease Management

-

Others

-

-

Chronic Disease Management Apps

-

Diabetes Management Apps

-

Blood Pressure and ECG Monitoring Apps

-

Mental Health Management Apps

-

Cancer Management Apps

-

Obesity Management Apps

-

Other Chronic Disease Management Apps

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

-

Fitness Apps

-

Exercise & Fitness

-

Diet & Nutrition

-

Lifestyle & Stress

-

-

-

Services

-

mHealth Service, By Type

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-Acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

-

Digital Health Systems

-

EHR

-

E-prescribing Systems

-

-

Healthcare Analytics

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Diabetes

-

Cardiovascular

-

Respiratory Diseases

-

Neurology

-

Others

-

-

End-use Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Other

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. Based on technology, the tele-healthcare segment dominated the market with a revenue share of 43.2% in 2023 owing to the growing adoption of telecare and telehealth platforms for remote patient monitoring and treatment.

b. Some key players operating in the Europe digital health market include Cerner Corporation; Veradigm LLC; Apple Inc; Telefonica S.A.; McKesson Corporation; Epic Systems Corporation; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd; HiMS; Orange; Qualcomm Technologies, Inc; Softserve; Computer Programs and Systems, Inc; IBM Corporation; CISCO Systems, Inc

b. Key factors that are driving the Europe digital health market growth include the advancement of digital technologies, improved internet connectivity, and growing demand for virtual healthcare services.

b. The Europe digital health market size was estimated at USD 66.2 billion in 2023 and is expected to reach USD 79.7 billion in 2024.

b. The Europe digital health market is expected to grow at a compound annual growth rate of 22.3% from 2024 to 2030 to reach USD 267.2 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."