Europe Hydrocarbon Solvents Market Trends

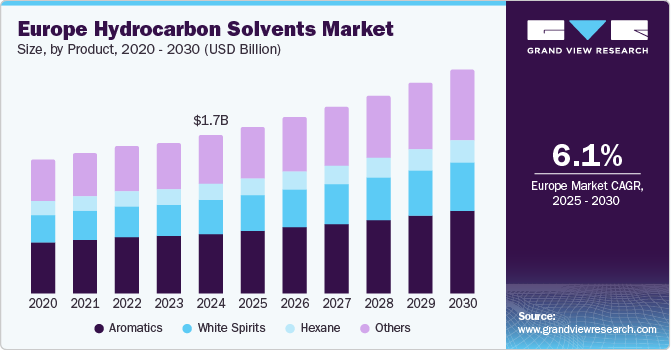

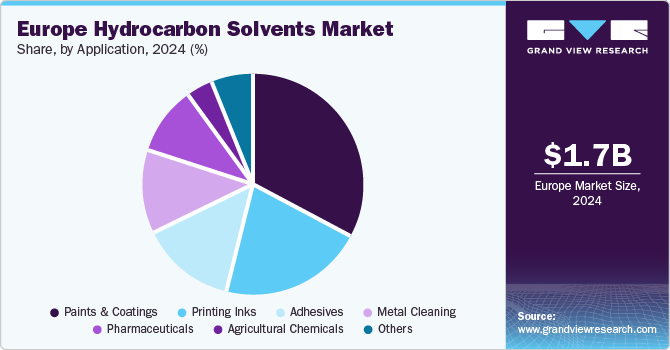

The Europe hydrocarbon solvents market was estimated at USD 1.68 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030, driven by their widespread use in various industrial applications. The paints and coatings sector heavily relies on these solvents, particularly for construction, automotive, and aerospace products. In addition, the chemical manufacturing industry, which produces adhesives, sealants, and pharmaceuticals, depends on hydrocarbon solvents. The growing need for industrial cleaning and degreasing also contributes to the demand, as these solvents are essential for maintaining machinery and surfaces in many manufacturing operations. These factors collectively drive the growth of the Europe hydrocarbon solvents industry.

The increasing growth in key industries such as automotive and aerospace significantly boosts the demand for hydrocarbon solvents in Europe. As these sectors recover and expand, the need for paint, coating, and cleaning solvents rises. The construction industry also plays a major role, particularly in the residential and commercial sectors, where hydrocarbon solvents are essential for coatings, adhesives, and sealants. These industries growth creates sustained demand for high-quality solvents across various applications. Therefore, the continued expansion of these industries contributes to the overall development of the Europe hydrocarbon solvents industry.

The increasing focus on technological advancements drives significant improvements in the hydrocarbon solvents market. Continuous research and development lead to the creation of high-performance solvents that meet the demanding requirements of modern manufacturing processes. These advanced solvents feature improved solvency power, faster evaporation rates, and enhanced safety profiles. Moreover, there is a noticeable shift toward bio-based or renewable hydrocarbon solvents, responding to consumer demand for eco-friendly products and the need to comply with sustainability regulations. These innovations are shaping the future of the Europe hydrocarbon solvents industry.

Product Insights

The aromatics segment dominated the market and accounted for the largest revenue share of 38.0% in 2024, driven by the extensive use of aromatic solvents in industries such as paints and coatings, where their effectiveness and performance characteristics are highly valued. Aromatic solvents, such as toluene and xylene, are recognized for dissolving many substances, making them essential for producing high-quality coatings and inks. Their versatility in various formulations further enhances their attractiveness to manufacturers, aiming to optimize product performance. The continued reliance on these solvents highlights their critical role in the Europe hydrocarbon solvents industry.

The white spirits segment is projected to grow at the highest CAGR of 6.6% over the forecast period due to increasing demand for white spirits in cleaning products and as solvents in paints and coatings. Their relatively lower cost than other solvent options makes them more appealing to consumers and manufacturers. In addition, the trend toward using less Volatile Organic Compounds (VOCs) aligns with consumer preferences for safer and more environmentally friendly products. These factors collectively enhance the market potential for white spirits within the Europe hydrocarbon solvents industry.

Application Insights

The paints & coatings segment dominated the market and anticipated the largest revenue share in 2024, which can be attributed to the robust demand for high-performance coatings in construction, automotive, and industrial applications. As infrastructure development continues across Europe, the need for durable and aesthetically pleasing coatings drives significant consumption of hydrocarbon solvents. Moreover, innovations in paint formulations that leverage hydrocarbon solvents enhance product performance, further solidifying this segment's leading position.

The printing inks segment is expected to grow significantly over the forecast period, fueled by increasing demand from the packaging and publishing industries. E-commerce has spurred demand for printed materials, including labels and packaging solutions that utilize hydrocarbon-based inks. Moreover, advancements in ink technology that improve drying times and print quality are attracting manufacturers' interest, leading to greater adoption of hydrocarbon solvents in this application area. As digital printing continues to evolve, it will likely enhance the market dynamics within this segment.

Key Europe Hydrocarbon Solvents Company Insights

Key companies in the Europe hydrocarbon solvents market include Exxon Mobil Corporation; Exxon Mobil Corporation; Leading Solvent Supplies Limited, Huntsman International LLC, and TotalEnergies. These players adopt numerous strategies to improve their competitive edge. Strategic partnerships are formed to leverage complementary strengths, improve product offerings, and expand distribution networks. In addition, mergers and acquisitions enable companies to consolidate resources, enter new markets, and diversify their product lines. Furthermore, new product launches focus on innovation and meeting evolving consumer preferences, allowing companies to capture market share and respond effectively to pet nutrition and health trends.

-

Eastman Chemical Company offers various hydrocarbon solvents for applications such as coatings, inks, and cleaning products. Its products include Eastman EB solvent for enhancing gloss in lacquers, Eastman Isobutanol for organic synthesis and coatings, and Eastman EEH solvent for specialty coatings. In addition, the company provides methyl acetate for fast evaporation in polyurethane coatings and DP solvent, which is low-odor and water-miscible and ideal for printing inks and aqueous cleaners.

-

Exxon Mobil Corporation offers a wide range of hydrocarbon solvents under its Exxsol, Isopar, and Solvesso brands. Exxsol products, such as D40, D60, D80, and D95, replace traditional solvents with low odor and high solvency, while Isopar fluids provide high-purity synthetic isoparaffins for industrial and consumer applications. The company offers heavy aromatic solvents and methyl ethyl ketone, ensuring reliable performance and safety and health regulations compliance.

Key Europe Hydrocarbon Solvents Companies:

- Eastman Chemical Company

- Exxon Mobil Corporation

- Leading Solvent Supplies Limited

- Huntsman International LLC

- TotalEnergies

- Ashland

- DuPont

- Honeywell International Inc.

- Banner Chemicals Limited

- Kandla Energy & Chemicals Ltd.

Recent Developments

-

In November 2024, Eastman Chemical Company announced an investment to expand and upgrade its extrusion capabilities at its Belgium facility to meet the growing demand for Saflex Polyvinyl Butyral (PVB) products, particularly in the automotive sector. This investment aims to support both automotive and architectural markets, driving innovation and enhancing customer service. The project is set for completion by 2026.

-

In January 2023, TotalEnergies Fluids and Clariter produced the world’s first sustainable ultra-pure solvents from plastic waste after 18 months of joint research and development. Using Clariter's upcycling technology and TotalEnergies' Hydro-De-Aromatization (HDA) technology, they created high-quality solvents that meet strict industry standards for pharmaceuticals and cosmetics.

Europe Hydrocarbon Solvents Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.77 billion

|

|

Revenue forecast in 2030

|

USD 2.38 billion

|

|

Growth Rate

|

CAGR of 6.1% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, country

|

|

Region scope

|

Europe

|

|

Country scope

|

Germany, Italy, France, Poland, Czech Republic, Austria, Ukraine, Romania, Bulgaria.

|

|

Key companies profiled

|

Eastman Chemical Company; Exxon Mobil Corporation; Leading Solvent Supplies Limited; Huntsman International LLC; TotalEnergies; Ashland; DuPont; Honeywell International Inc.; Banner Chemicals Limited; Kandla Energy & Chemicals Ltd.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Europe Hydrocarbon Solvents Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Europe hydrocarbon solvents market report based on product, application, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

White Spirits

-

Hexane

-

Aromatics

-

Others

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Printing Inks

-

Agricultural Chemicals

-

Pharmaceuticals

-

Adhesives

-

Metal Cleaning

-

Others

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

Italy

-

France

-

Poland

-

Czech Republic

-

Austria

-

Ukraine

-

Romania

-

Bulgaria