- Home

- »

- Homecare & Decor

- »

-

Europe Outdoor Furniture Market Size, Industry Report 2030GVR Report cover

![Europe Outdoor Furniture Market Size, Share & Trends Report]()

Europe Outdoor Furniture Market Size, Share & Trends Analysis Report By Product (Seating Sets, Loungers, Dining Sets, Chairs, Tables, Others), By Material Type (Wooden, Plastic, Metal), By End-use (Commercial, Residential), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-237-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Outdoor Furniture Market Trends

The Europe outdoor furniture market size was estimated at USD 13.84 billion in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030. Consumers are increasingly spending on traveling, thereby increasing the usage of hotels, resorts, open spaces, and public gardens. These trends are mainly observed in seaside areas, hill stations, scenic beauty places, and historical monuments. Thus, the increasing number of hotels and restaurants may drive the outdoor furniture market during the forecast period.

Europe outdoor furniture market accounted for 28.60% share of the global outdoor furniture market revenue in 2023. Millennials are among the fastest-growing outdoor furniture shoppers, and they are expected to be more interested in high-end premium outdoor collections. Furthermore, millennials use the Internet for a detailed analysis before investing in furniture. This trend is also increasingly being observed among other age groups.

According to Consumer Buying Trends Survey, Casual Living reported that there is an increase in outdoor furniture buying activity and millennials tend to purchase more than others. Millennial households accounted for 37 percent of purchases. Baby boomers followed close behind with 34 percent of sales, while generation X-ers accounted for 23 percent. Industry experts expect millennials’ buying power to continue in this sector, as Americans aged 19-35 years old begin to build careers, families, and homes.

A combination of different materials is typically preferred in outdoor furniture. The majority of buyers do not tend to favor outdoor furniture that is totally constructed of wood. Therefore, during the production of outdoor furniture products, a large number of market participants combine two or more components. For instance, Talenti Outdoor Living, an outdoor furniture company based in Italy, released its new CleoSoft collection that combines materials in an effort to create a line that adapts to any outdoor style and space. The collection features unusual combinations of materials, such as the lightness of aluminum, the modernity of surfaces in Vitter or stone, and the vitality of wood. The furniture products include a sofa, a rocking chair, a coffee table, a sun bed, and a dining table.

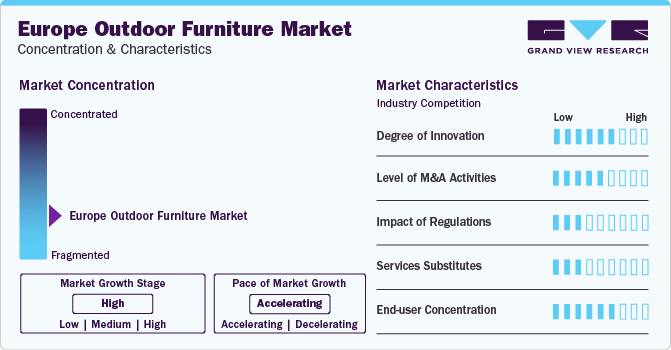

Market Concentration & Characteristics

The Europe outdoor furniture market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Key players in the region are making significant investments in R&D. Product differentiation is crucial to gain a comparative advantage and prosper in competitive markets. The introduction of innovative furniture products as per consumer demands and requirements will contribute to market growth. For instance, in January 2022, Piet Boon, a design studio based in the Netherlands, announced the launch of its outdoor furniture collections-TIMME and BENTE. These utilize less bulky designs for greater flexibility and include a teak dining table in various sizes, a dining chair (with and without armrests), a coffee table, and benches.

Companies are increasingly adopting strategies such as brand launches to expand their geographical reach. Product development based on the application area, price competition, and competent distribution channels are among the key entry strategies for a competitive advantage. Apart from product innovation, many manufacturers also focus on partnerships as such market strategies to significantly help target the right audience and boost brand visibility.

The end-user concentration is a significant factor in the Europe outdoor furniture market. An increasing number of people have shown the desire for a relaxing and comfortable outdoor seating experience, which is driving the demand for premium furniture for open spaces in residential as well as commercial settings. Lloyd Flanders, Inc.-a Michigan-based premium outdoor furniture company-provides distinctive, woven outdoor furniture that has been featured in music, movies, and television. Its vinyl furniture has welded, all-aluminum frames that are incredibly strong and resistant to corrosion.

Product Insights

The outdoor seating seat furniture accounted for a revenue share of 27.2% in 2023. With the surge in commercial constructions such as hotels, restaurants, and cafes, outdoor dining sets created a huge demand for seating seat. Commercial establishments focus on achieving a sophisticated and elegant look. There is often an emphasis on including luxurious seating seat to improve the appearance of the space.

The demand for the outdoor tables is projected to grow at a CAGR of 6.9% from 2024 to 2030. Consumers increasingly spent on home renovation by making their balconies or outdoor spaces more usable, thereby contributing to the increased demand for multipurpose and high quality tables. Tables are the important product in outdoor furniture it helps to create aesthetic look and takes less space.

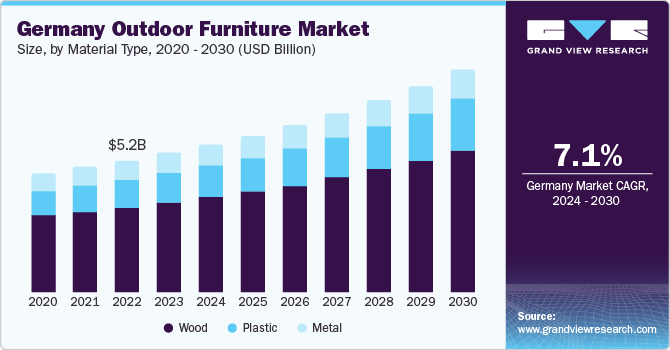

Material Type Insights

The wooden outdoor furniture products accounted for a revenue share of 62.65% in 2023. Increasing focus on quality furniture to create the right ambiance in outdoor spaces is increasing the market scope for wood-based outdoor furniture products. Wood is a highly popular material as it is environment-friendly and adds to the aesthetics of any setting. The majority of the wooden furniture is imported from countries like China and India. Teak wood outdoor furniture is preferred in Germany as the wood is resistant to the weather conditions in the country. For example, Souren Furniture offers a variety of range of outdoor furniture that can combat all the weather conditions of Germany. It offers a variety of products, such as teak wood chairs, garden benches, dining tables, and bar tables.

The Europe metal outdoor furniture market is projected to grow at a CAGR of 7.2% over the forecast period. Numerous players offer a wide range of stainless-steel outdoor that help simplify the fitting needs for residential and commercial outdoor sitting. These products are available in various lengths, designs, finishes, diameters, quality, and price ranges. Stainless steel is a low-maintenance material made from carbon, iron, and other metal alloys. The key reason for its strength is chromium, which protects against rust and corrosion due to a thin oxide layer on the surface. Many players in the furniture industry are also offering products that are made from a combination of two materials

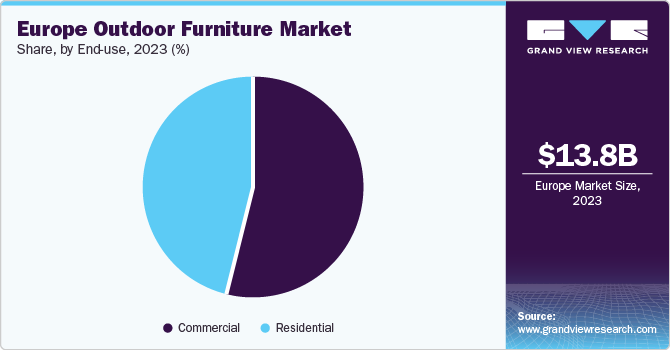

End-use Insights

The residential outdoor furniture accounted for a revenue share of 53.76% in 2023. The growth in demand for the same is attributed to the rise in working population and increasing disposable incomes in the region. In 2020, the growth rate of the disposable income was 0.6%, following the impact of the COVID-19 pandemic. This increase in disposable income enables consumers to spend more on furniture and home decor, which is expected to drive market growth. Furthermore, the increasing number of construction and home remodeling projects has augmented the demand for quality outdoor furniture such as coffee tables, chairs, tables, dining tables, rocking chairs, and swings.

The commercial outdoor furniture market is projected to grow at a CAGR of 6.6% over the forecast period of 2024-2030. Hotels, restaurants, resorts, offices, and showrooms fall under the commercial category. The architecture of these places reflects the brand that these places have attempted to create and aids in attracting consumers as well as creating a strong corporate atmosphere.

Country Insights

The Europe outdoor furniture market is projected to grow at a CAGR of 6.7% from 2024 to 2030. With the growing tourist activity, the sales of outdoor furniture are rising in the region, helping in increasing the market share commercial segment of the outdoor furniture market in the region.

UK Outdoor Furniture MarketTrends

The outdoor furniture market in UK is expected to grow at a CAGR of 5.9% from 2024 to 2030. This is mainly due to growing demand for the eco-friendly outdoor furniture based on bamboo and rattan. The disappearing boundary between the home and garden, which makes outdoor spaces an extension of the home in purpose and style, is driving market growth. For instance, in March 2021, British furniture brand Very Good & Proper launched the Latte Chair and a new outdoor version of its classic Canteen Table. This furniture collection features the world’s first furniture made with bio-composite technology, by combining recycled plastic and hemp fibers to drastically lower the CO2 impact of production and make the furniture most sustainable.

Germany Outdoor Furniture Market Trends

The outdoor furniture market in Germany held 39% revenue share in 2023. Several international brands are launching their products worldwide after adapting them to the requirements of regional consumers. This helps the product reach overseas and create a market on a country basis. For instance, in July 2022, Andreu World, a furniture manufacturer based in UK, opened its new showroom in Germany. The furniture pieces displayed were produced under the advice of internationally-reputed designers such as Patricia Urquiola, Philippe Starck, Alfredo Häberli, Jasper Morrison, and Benjamin Hubert. The new showroom is located in the urban center of Hanau, Hessen.

Key Europe Outdoor Furniture Company Insights

Some of the key players operating in the market include Inter IKEA Systems B.V.,Keter, and Brown Jordan Inc.

-

Inter IKEA Systems B.V. is a privately held company incorporated in 1983 and headquartered in Delft, Netherlands. The Inter IKEA Holding Company owns IKEA Systems B.V. and therefore controls the property of IKEA and also is in charge of manufacturing, designing, and supply of IKEA products. IKEA manufactures and retails affordable furniture for the kitchen, bedroom, storage, bathroom, outdoors, and offices. Moreover, the brand also provides electronics, home improvement, pet products, food & beverage, lighting, decoration, and textile products. Outdoor furniture is available under the outdoor products category.

-

Keter is a privately-held company incorporated in 1948 and headquartered in Herzliya, Israel. The company is engaged in the manufacturing, designing, and operation of home and garden spaces. Keter provides a wide range of products in the categories of outdoor furniture, outdoor entertainment, sheds, outdoor storage, spaces, and garden beds. The company’s products are made of plastic; however, most of the plastic used is recycled.

Barbeques Galore, Ashley Furniture Industries, Inc., and Fermob are some of the other participants in the Europe outdoor furniture market,

-

Ashley Furniture Industries, Inc. is a privately held firm founded in 1945 and is headquartered in Wisconsin, UK It is a manufacturer and retailer of home furniture and accessories. The company sells its products through independent furniture dealers, as well as 945+ Ashley Furniture Homestores.

-

Barbeques Galore is privately-held company established in 1980 and headquartered in California, UK The company designs, manufactures, and retails BBQ grills and outdoor furniture products. Barbeques Galore has a wide variety of products in gas, charcoal, and electric grills, outdoor heaters, gas fireplace logs, and patio furniture and also provide customized BBQ. In outdoor furniture, the brand offers products such as chairs, sofa sets, bar stools, dining sets, tables, outdoor privacy screens, pergolas, and umbrellas. The company sells its products through various collections such as Weber, Big Green Egg, Twin Eagles, EVO, DCS, Alfresco, Firemagic, Heston, Blaze, and Green Mountain Grills.

Key Europe Outdoor Furniture Companies:

- Inter IKEA Systems B.V.

- Keter

- Brown Jordan Inc.

- Barbeques Galore

- Ashley Furniture Industries, Inc.

- Fermob

- Hartman

- Kettal

- Gloster

- Royal Botania

Europe Outdoor Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.62 billion

Revenue forecast in 2030

USD 21.61 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material type, end-use, country

Regional scope

Europe

Country scope

UK, Germany, France, Italy, Spain

Key companies profiled

Inter IKEA Systems B.V.; Keter; Brown Jordan Inc.; Barbeques Galore; Ashley Furniture Industries, Inc.; Fermob; Hartman; Kettal; Gloster; Royal Botania

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Outdoor Furniture Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe outdoor furniture market report based on product, material type, end-use and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Seating Sets

-

Loungers

-

Dining Sets

-

Chairs

-

Table

-

Others

-

-

Material Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Plastic

-

Metal

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe outdoor furniture market was estimated at USD 13.84 billion in 2023 and is expected to reach USD 14.62 billion in 2024.

b. The Europe outdoor furniture market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 21.61 billion by 2030.

b. UK dominated the Europe outdoor furniture market with a share of around 43% in 2023. This is mainly due to the growing demand for eco-friendly outdoor furniture based on bamboo and rattan. The disappearing boundary between the home and garden, which makes outdoor spaces an extension of the home in purpose and style, is driving market growth.

b. Some of the key players operating in the Europe outdoor furniture market include Inter IKEA Systems B.V.; Keter; Brown Jordan Inc.; Barbeques Galore; Ashley Furniture Industries, Inc.; Fermob; Hartman; Kettal; Gloster; Royal Botania

b. Consumers are increasingly spending on traveling, thereby increasing the usage of hotels, resorts, open spaces, and public gardens

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."