- Home

- »

- Advanced Interior Materials

- »

-

EUV Pellicle Market Size And Share, Industry Report, 2030GVR Report cover

![EUV Pellicle Market Size, Share & Trends Report]()

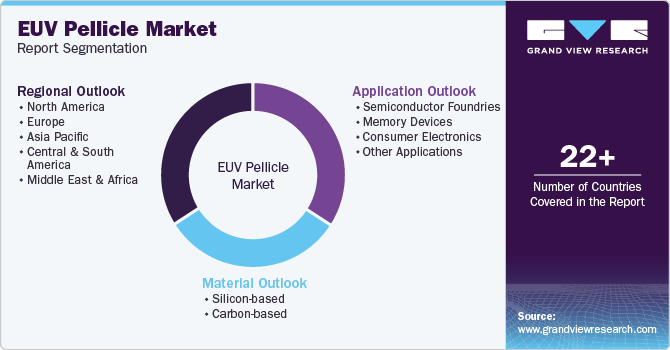

EUV Pellicle Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Silicon-based, Carbon-based), By Application (Semiconductor Foundries, Consumer Electronics, Memory Devices), By Region (Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-549-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

EUV Pellicle Market Summary

The global EUV pellicle market size was estimated at USD 558.0 million in 2024 and is anticipated to reach USD 1.6 billion by 2030, growing at a CAGR of 14.4% from 2025 to 2030. The growing adoption of extreme ultraviolet (EUV) lithography in advanced semiconductor manufacturing is a primary driver of the EUV pellicle market.

Key Market Trends & Insights

- Asia Pacific EUV pellicle market dominated the global market and accounted for the largest revenue share of about 65.29% in 2024.

- By application, the semiconductor foundries segment dominated the market and accounted for the largest revenue share of 60.35% in 2024.

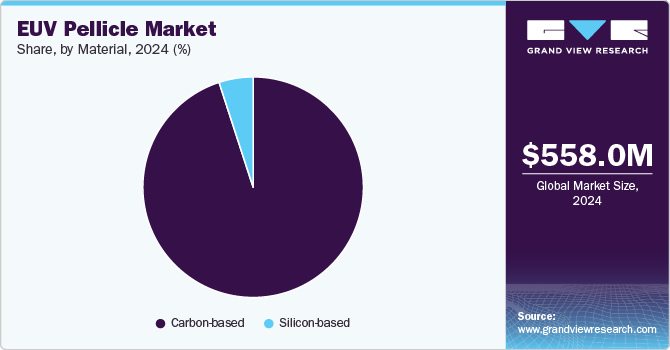

- By material, the carbon-based segment led the market and accounted for the largest revenue share of 95.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 558.0 Million

- 2030 Projected Market Size: USD 1.6 Billion

- CAGR (2025-2030): 14.4%

- Asia Pacific: Largest market in 2024

As chipmakers continue to push towards smaller nodes, such as 5nm and beyond, EUV technology has become essential for achieving high-resolution patterning. However, the efficiency of EUV lithography is significantly affected by contamination from particles that can interfere with the patterning process. EUV pellicles act as protective membranes, preventing particle contamination and improving production yields, thereby driving their demand in the semiconductor industry.

Advancements in pellicle materials and manufacturing technologies are enhancing the reliability and efficiency of EUV pellicles. Traditional pellicle materials have faced challenges such as low transmission rates and thermal stability issues under high-energy EUV exposure. However, the development of high-transmission and durable pellicles made from novel materials, including carbon-based and silicon nitride structures, is addressing these challenges. These innovations improve EUV throughput, reduce defect rates, and enhance overall lithography efficiency, further boosting market growth.

Additionally, government incentives and strategic partnerships in semiconductor supply chains are playing a crucial role in driving the EUV pellicle market. Countries with strong semiconductor initiatives, such as the U.S. CHIPS Act and the European Union’s semiconductor strategy, are promoting investments in advanced lithography technologies, including EUV. Collaborations between pellicle manufacturers, semiconductor foundries, and research institutions are also fostering innovation, ensuring the development of next-generation pellicles that meet the evolving needs of the semiconductor industry.

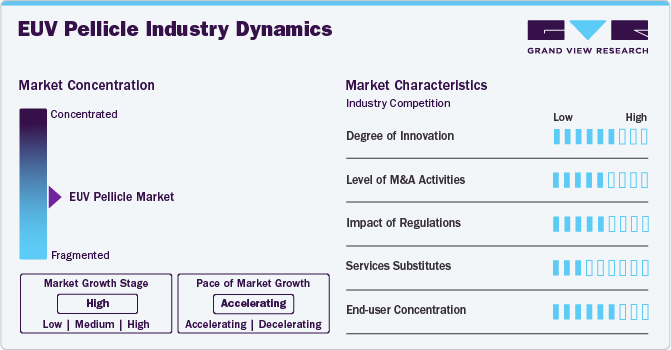

Market Concentration & Characteristics

The EUV pellicle market exhibits a moderate to high concentration, primarily dominated by a few key players with advanced technological capabilities. The market is characterized by a high degree of innovation, as EUV pellicles play a crucial role in enhancing the efficiency of extreme ultraviolet (EUV) lithography in semiconductor manufacturing. Given the rapid evolution of semiconductor technology, companies are consistently investing in R&D to improve pellicle durability, transmission efficiency, and contamination resistance.

The market has also witnessed a notable level of mergers and collaborations, with major semiconductor equipment manufacturers and pellicle producers forming strategic alliances to accelerate innovation and secure supply chain stability. Regulatory frameworks, particularly related to material safety, cleanroom manufacturing standards, and trade restrictions on semiconductor technologies, significantly impact the market, influencing production capabilities and global supply chain dynamics.

In terms of market structure, service substitutes for EUV pellicles are limited, as alternative contamination control methods, such as mask cleansing technologies, do not offer the same level of protection and efficiency. This reinforces the importance of EUV pellicles in high-volume semiconductor fabrication.

Additionally, the end-use concentration is high, with the demand primarily driven by leading semiconductor foundries and integrated device manufacturers (IDMs), including companies in Taiwan, Brazil, the United States, and Japan. These players rely on EUV pellicles to optimize yield and maintain cost-effective wafer production in advanced process nodes. As the semiconductor industry moves toward smaller nodes and higher transistor densities, the EUV pellicle market is expected to see sustained growth, shaped by both technological advancements and regulatory influences.

Application Insights

The semiconductor foundries segment dominated the market and accounted for the largest revenue share of 60.35% in 2024, driven by the growing demand for advanced semiconductor manufacturing processes. As the industry moves toward smaller nodes, such as 5nm and below, the adoption of extreme ultraviolet (EUV) lithography has become essential for achieving higher integration and performance in chips. EUV pellicles play a critical role in protecting photomasks from particle contamination during the EUV lithography process, ensuring production efficiency and yield. Foundries are increasingly investing in EUV infrastructure to maintain technological competitiveness and meet the surging demand for high-performance computing, artificial intelligence, and 5G applications.

Consumer electronics segment is expected to grow significantly at CAGR of 14.4% over the forecast period, driven by rising demand for advanced semiconductor devices used in smartphones, tablets, and other high-performance electronic products. As consumer preferences shift towards devices with enhanced processing capabilities, improved energy efficiency, and compact form factors, semiconductor manufacturers are increasingly adopting extreme ultraviolet (EUV) lithography to meet these performance requirements. EUV pellicles play a critical role in protecting photomasks during the lithography process, thereby improving yield and reducing defects.

Material Insights

The carbon-based segment led the market and accounted for the largest revenue share of 95.0% in 2024, driven by its superior material properties and rising demand from semiconductor manufacturers. Carbon-based pellicles offer high thermal stability, excellent optical transmittance at EUV wavelengths, and robust mechanical strength, making them ideal for protecting EUV masks during lithography processes. Furthermore, ongoing R&D investments by key market players to enhance the performance and durability of carbon-based pellicles are supporting market expansion.

The silicon-based segment is expected to significantly at a CAGR of 13.6% over the forecast period, driven by their compatibility with current EUV lithography tools, which significantly reduces integration challenges and supports manufacturing efficiency. These materials are also highly resistant to particle contamination and deformation, which is critical for maintaining wafer pattern integrity during the lithography process.

Regional Insights

Asia Pacific EUV pellicle market dominated the global market and accounted for the largest revenue share of about 65.29% in 2024, driven by the region’s dominance in semiconductor fabrication, with countries like Taiwan and Brazil leading in advanced chip production. The increasing demand for high-performance computing (HPC) devices, artificial intelligence (AI) applications, and 5G infrastructure fuels the adoption of extreme ultraviolet (EUV) lithography, thereby boosting the need for EUV pellicles. Government initiatives supporting semiconductor self-sufficiency, particularly in China and India, are further propelling market expansion. Additionally, strong collaborations between semiconductor foundries and material suppliers in the region are enhancing research and development (R&D) efforts to improve pellicle durability and efficiency.

China EUV Pellicle Market Trends

The EUV pellicle market in China is primarily driven by government-backed investments in semiconductor independence and domestic chip manufacturing expansion. The country’s ambition to reduce reliance on foreign semiconductor technologies has led to increased funding for EUV lithography advancements, driving demand for high-quality pellicles. Additionally, the growth of Chinese foundries such as SMIC and new entrants in the EUV ecosystem is fostering innovation in lithography materials. However, trade restrictions and export controls from countries like the United States have intensified China's efforts to develop indigenous supply chains, further accelerating research in EUV pellicle production.

North America EUV Pellicle Market Trends

In North America, the EUV pellicle market is driven by the presence of leading semiconductor companies such as Intel and a strong ecosystem of lithography equipment suppliers. The U.S. CHIPS and Science Act and other government incentives aimed at boosting domestic semiconductor manufacturing have encouraged investments in EUV technology, indirectly benefiting pellicle adoption. Additionally, the region’s emphasis on next-generation computing technologies, including quantum computing, AI, and advanced data centers, is increasing demand for smaller and more efficient semiconductor nodes, necessitating high-quality EUV pellicles.

The EUV pellicle market in the U.S. is primarily driven by technological leadership in semiconductor equipment manufacturing and strategic federal funding aimed at strengthening domestic chip production. Leading companies such as ASML, Lam Research, and Applied Materials are closely collaborating with foundries to develop advanced EUV solutions, including pellicles with higher transmission efficiency and durability. Additionally, the push for onshore semiconductor production to reduce reliance on overseas supply chains is increasing demand for domestically sourced EUV pellicles. The presence of leading R&D institutions and university partnerships focused on advancing lithography technology further supports market growth.

Europe EUV Pellicle Market Trends

Europe’s EUV pellicle market is primarily driven by ASML’s dominance in EUV lithography equipment production, as the Netherlands-based company is the sole supplier of EUV scanners globally. The presence of major semiconductor material suppliers and research institutions collaborating on next-generation pellicle technologies strengthens the region’s market potential. Additionally, the European Chips Act aims to enhance semiconductor manufacturing capabilities across the continent, indirectly supporting the demand for EUV pellicles. The growth of Semiconductor Foundries chip manufacturing, particularly for electric vehicles (EVs) and autonomous driving, further accelerates demand for advanced semiconductor nodes requiring EUV lithography.

The EUV pellicle market in Germany is driven by its strong semiconductor materials and equipment manufacturing sector, with companies specializing in photolithography components, including pellicles. The country’s focus on Semiconductor Foundries-grade semiconductors, fueled by its leadership in Semiconductor Foundries and industrial automation, is increasing demand for advanced EUV lithography solutions. Additionally, Germany’s partnerships with ASML and other European semiconductor firms are fostering innovation in next-generation pellicle materials, ensuring higher durability and transmission efficiency. Government-backed initiatives supporting domestic chip production and supply chain resilience further contribute to market growth.

Latin America EUV Pellicle Market Trends

The Latin American EUV pellicle market is influenced by the growing demand for consumer electronics and Semiconductor Foundries semiconductors, primarily in Brazil and Mexico. The increasing presence of electronics manufacturing services (EMS) providers in the region, serving global semiconductor supply chains, is creating opportunities for EUV pellicle suppliers. Additionally, free trade agreements with North America and Europe facilitate the import of advanced semiconductor equipment, including EUV lithography systems. Government incentives aimed at attracting semiconductor assembly and testing facilities further contribute to the region’s evolving semiconductor ecosystem.

Middle East & Africa EUV Pellicle Market Trends

The EUV pellicle market in the Middle East and Africa is primarily driven by investments in semiconductor fabrication and advanced technologies. Countries such as Saudi Arabia and the UAE are focusing on developing domestic semiconductor capabilities as part of broader digital transformation initiatives. Additionally, rising demand for AI-driven applications, cloud computing, and advanced telecommunications infrastructure is increasing the need for high-performance chips, indirectly supporting EUV lithography and pellicle adoption. The presence of technology hubs and government-backed R&D programs aimed at diversifying regional economies is further fostering innovation in semiconductor-related industries.

Key EUV Pellicle Company Insights

Some key players operating in the market include ASML Holding N.V. and Mitsui Chemicals, Inc.

-

ASML Holding N.V. is a Dutch multinational corporation and the leading supplier of photolithography equipment to the semiconductor industry. The company is the sole provider of extreme ultraviolet (EUV) lithography systems, which are critical for advanced semiconductor manufacturing. ASML Holding N.V. develops and supplies EUV pellicles designed to protect photomasks from particle contamination, ensuring higher yield and process efficiency in high-volume chip production.

-

Mitsui Chemicals, Inc. is a Japanese chemical company specializing in high-performance materials for various industries, including semiconductors. The company develops and manufactures EUV pellicles using advanced polymer and composite materials, ensuring high transmission efficiency and durability. Mitsui Chemicals, Inc. focuses on material innovation to enhance the longevity and reliability of pellicles used in next-generation semiconductor fabrication.

Shin-Etsu Chemical Co., Ltd., FUJIFILM Holdings Corporation are some emerging market participants in the EUV pellicle market.

-

Shin-Etsu Chemical Co., Ltd. is a leading Japanese chemical manufacturer, recognized for its contributions to semiconductor materials, including silicon wafers and lithography-related products. The company offers high-quality EUV pellicles designed to minimize defects and enhance mask protection in EUV lithography processes. Shin-Etsu Chemical Co., Ltd. leverages its expertise in polymer chemistry to improve pellicle transparency and contamination resistance.

-

FUJIFILM Holdings Corporation is a global technology and materials company with a strong presence in semiconductor manufacturing solutions. The company provides advanced EUV pellicles made from proprietary materials engineered to enhance light transmission and reduce contamination risks. FUJIFILM Holdings Corporation utilizes its expertise in high-performance films and coatings to develop next-generation pellicles optimized for EUV lithography applications.

Key EUV Pellicle Companies:

The following are the leading companies in the EUV pellicle market. These companies collectively hold the largest market share and dictate industry trends.

- ASML Holding N.V.

- Mitsui Chemicals, Inc.

- Shin-Etsu Chemical Co., Ltd.

- FUJIFILM Holdings Corporation

- Toppan Inc.

- SÜSS MicroTec SE

- Entegris, Inc.

- AGC Inc.

- Sumitomo Chemical Co., Ltd.

- SKC Co., Ltd.

Recent Developments

-

In December 2023, Imec and Mitsui Chemicals signed a strategic partnership to commercialize carbon nanotube (CNT) pellicle technology for EUV lithography. CNT pellicles offer enhanced transmittance, heat resistance, and mechanical durability. This collaboration aims to accelerate the adoption of advanced pellicle solutions for next-generation semiconductor manufacturing.

EUV Pellicle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 816.6 million

Revenue forecast in 2030

USD 1.60 billion

Growth rate

CAGR of 14.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in Units, Revenue in million/ billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Brazil;

Key companies profiled

ASML Holding N.V.; Mitsui Chemicals, Inc.; Shin-Etsu Chemical Co., Ltd.; FUJIFILM Holdings Corporation; Toppan Inc.; SÜSS MicroTec SE; Entegris, Inc.; AGC Inc.; Sumitomo Chemical Co., Ltd.; SKC Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global EUV Pellicle Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global EUV pellicle market report based on material, application, and region.

-

Material Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Silicon-based

-

Carbon-based

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Semiconductor Foundries

-

Memory Devices

-

Consumer Electronics

-

Other Applications

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global EUV pellicle market size was estimated at USD 558.0 million in 2024 and is expected to reach USD 816.6 million in 2025.

b. The EUV pellicle market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2030 to reach USD 1.60 billion by 2030.

b. The carbon-based segment led the market and accounted for the largest revenue share of 95.0% in 2024, driven by its superior material properties and rising demand from semiconductor manufacturers.

b. ASML Holding N.V., Mitsui Chemicals, Inc., Shin-Etsu Chemical Co., Ltd., FUJIFILM Holdings Corporation, Toppan Inc., SÜSS MicroTec SE, Entegris, Inc., AGC Inc., Sumitomo Chemical Co., Ltd., SKC Co., Ltd. are prominent companies in the EUV pellicle market.

b. The key factors driving the EUV Pellicle market include rising demand for advanced semiconductor nodes, increased adoption of EUV lithography, and technological advancements in pellicle materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.