- Home

- »

- Animal Health

- »

-

Exotic Pets Market Size And Share, Industry Report, 2033GVR Report cover

![Exotic Pets Market Size, Share & Trends Report]()

Exotic Pets Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Pharmaceuticals, Nutritional Supplements), By Animal Type (Birds, Reptiles), By Route of Administration, By Indication, By Distribution Channel, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-575-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Exotic Pets Market Summary

The global exotic pets market size was estimated at USD 1.75 billion in 2025 and is projected to reach USD 3.21 billion by 2033, growing at a CAGR of 8.1% from 2026 to 2033. The market is advancing due to expansion of specialized veterinary and pet care services, increasing exotic pet ownership and expenditure, rising adoption of exotic pet insurance and expansion of products availability.

Key Market Trends & Insights

- North America exotic pets market held the largest revenue share of 50.02% in 2025.

- U.S. dominated the North America region with the largest revenue share in 2025.

- By product, pharmaceuticals segment held the largest share of 69.51% of the market in 2025.

- By animal, small mammals segment held the largest market share in 2025.

- By route of administration, oral segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.75 Billion

- 2033 Projected Market Size: USD 3.21 Billion

- CAGR (2026-2033): 8.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing in market

Growing availability of specialized pet care services drives the expansion of the market. As clinics hire veterinarians trained in reptile, avian, amphibian, and small mammal medicine, owners gain confidence in accessing reliable treatment for species that were considered difficult to care. This increased access to diagnostic tools, emergency services, and species-specific nutrition and wellness programs reduces perceived risk and encourages prospective owners to adopt exotic pets. Thus, this greater demand fuels further investment in specialty hospitals, mobile exotic vet services, and tele-veterinary care services.In addition, growing exotic pet ownership directly increases overall market expenditure, reinforcing market expansion. According to a report of May 2025, approximately 9% of U.S. households own exotic pets, and among these owners, around 28% choose birds as their exotic species. Besides this, as consumers adopt reptiles, birds, amphibians, and small mammals their spending naturally increases on habitat setups, high-quality feed, supplements, enrichment, and medical care. This rising expenditure incentivizes manufacturers to introduce premium, species-specific products, further enhancing pet wellbeing and improving ownership experiences. Besides this, higher spending also highlights emotional value placed on these pets, encouraging owners to invest in advanced care solutions.

Furthermore, rising adoption of exotic pet insurance is accelerating market growth by reducing the financial risks associated with caring for exotic pets. As veterinary care for species such as parrots, reptiles, and ferrets can be specialized and expensive, insurance makes ownership more accessible. Besides this, companies such as Nationwide and Petcover are expanding coverage to meet rising demand. For instance, nationwide offers insurance for birds, rabbits, and reptiles, with bird plans covering a wide range of medical services from any licensed veterinarian and premiums starting below USD 21 per month. Similarly, Petcover provides insurance for reptiles, turtles, birds, and small mammals. These specialized, affordable plans boost owner confidence, support exotic bird care.

Moreover, product expansion is one of the key driver of the market, as growing availability of specialized supplies supports the unique needs of exotic animals. Some of the manufacturers and retailers are expanding their portfolios with species-specific nutrition, habitat enrichment tools, heating and lighting systems, grooming products, and health-related solutions such as supplements and medical care kits. This wider range of high-quality products across online and offline channels lowers barriers for new owners and improves long-term care. For instance, in March 2025, REMY expanded into exotic pet snacks with affordable, human-grade, vet-developed products for rodents, launching across Thailand and preparing for international markets. This expansion increased product accessibility, strengthened brand visibility and boosted demand for exotic pet care, influencing market growth through wider distribution and increasing consumer interest. Besides this, larger product variety also drives innovation, leading to more species-specific, welfare-focused solutions that enhance animal health and longevity. Thus, this expansion of accessible, high-quality supplies encourages more households to adopt exotic pets, directly expanding sustained market growth.

Estimated Number of U.S. Households Owning a Pet (2024)

Species

Millions of U.S. households owning

Percent of U.S. households owning

Fish

3.9

2.9

Reptiles

2.3

1.8

Birds

2.1

1.6

Small Mammals (gerbils, hamsters, etc.)

1.3

1.0

Rabbits

0.9

0.7

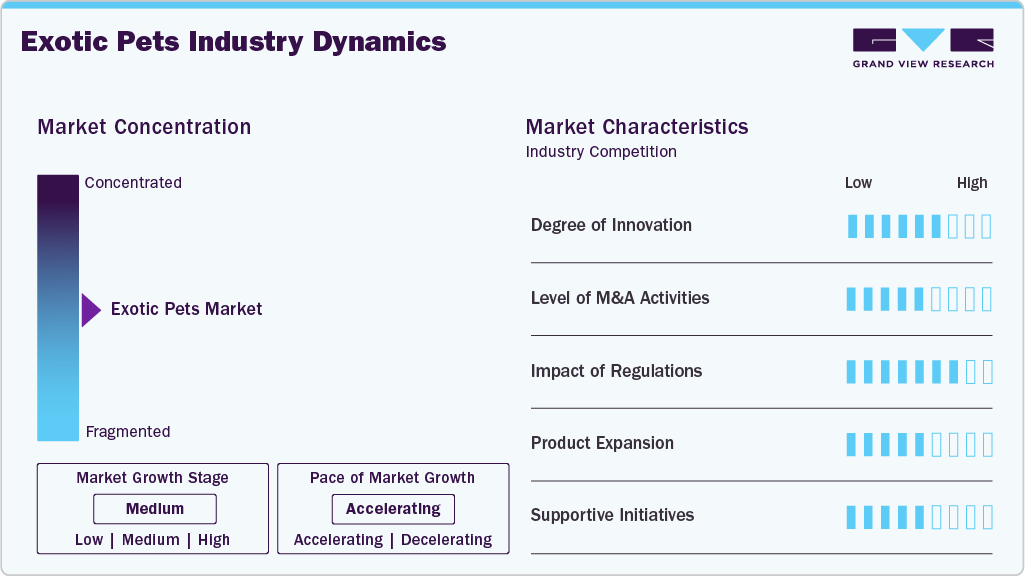

Market Concentration & Characteristics

The market is moderately concentrated and pace is accelerating, with a mix of niche specialty brands and a few expanding multinational players. In the market, no single company holds a dominant position; however, rising investments in specialized nutrition, habitat solutions, and healthcare products are enabling select innovators to capture increasing market share.

The exotic pet market demonstrates moderate innovation, especially in nutrition, habitat design, and veterinary care. Companies invest in specialized diets, smart enclosures, and species-specific medical solutions to meet diverse animal needs. Innovation is driven by consumer demand for better health and enrichment products for exotic species. Startups and niche brands often lead in introducing novel offerings, while larger firms follow with scalable solutions. However, limited research funding and species complexity slightly restrain the pace of breakthroughs.

Mergers and acquisitions in the exotic pet market remain relatively low compared to mainstream pet sectors. Most small- to mid-sized businesses focus on specific animal categories or regional markets. Larger pet care firms occasionally acquire niche players to diversify their portfolios or enter new segments. M&A activity tends to increase during heightened consumer interest or regulatory clarity periods. Overall, the market remains fragmented with limited consolidation.

Regulations strongly impact the exotic pet market, influencing species trade, breeding practices, and ownership laws. Many countries enforce strict import controls and welfare standards that directly affect product availability and market growth. Shifting legal frameworks can disrupt supply chains or limit the types of animals kept as pets. Businesses must stay agile and compliant with local and international wildlife protection laws. Regulatory complexity often acts as a barrier to entry for new players

Substitution risk is moderate, with some consumers opting for traditional pets such as dogs or cats over exotic animals. However, exotic species' unique appeal and personality sustain a loyal niche customer base. In some cases, interactive robotic pets or advanced simulations also serve as partial substitutes. Depending on cost, maintenance, or ethical concerns, educational institutions and hobbyists may shift preferences. Despite this, emotional attachment and novelty keep demand steady in key segments.

Supportive initiatives come from private and non-profit sectors, focusing on responsible ownership, breeding, and conservation. Educational campaigns help raise awareness about exotic pet care and legal responsibilities. Trade associations promote industry best practices and offer ethical breeders and sellers certifications. Collaborations with veterinarians enhance species-specific healthcare and welfare standards. Such initiatives strengthen consumer trust and encourage sustainable market development.

Product Insights

Pharmaceuticals segment dominated the market with largest revenue share of 69.51% in 2025. The segment is comprised of anti-inflammatories, parasiticides, antibiotics, non-steroidal anti-inflammatory drugs (NSAIDs) and other drugs. The segment is driven by the rising ownership of these non-traditional pets and a growing awareness of their unique healthcare needs. Pharmaceuticals play a central role in managing a range of conditions in these species, including respiratory infections in birds and small mammals, parasitic infestations in reptiles, metabolic bone disease in lizards and tortoises, and dermatological issues in rodents and sugar gliders. These health challenges often require species-specific treatments, and the growing availability of tailored medications such as antibiotics, antiparasitics, anti-inflammatories, and supplements has improved treatment outcomes and quality of care.

The nutritional supplements segment is expected to grow at the fastest CAGR over the forecast period. The health of exotic companion animals is heavily influenced by their nutritional intake, with deficiencies commonly arising from poor diets and insufficient species-specific knowledge. Guinea pigs are prone to scurvy due to their inability to produce vitamin C, making supplementation essential to prevent symptoms such as lethargy and joint pain. Chinchillas need high dietary fiber and proper minerals to avoid digestive and dental problems. Parrots and cockatiels often experience vitamin A deficiency from seed-only diets, leading to respiratory issues and poor feather condition. Reptiles such as iguanas and tortoises are at risk of metabolic bone disease caused by calcium, phosphorus, and vitamin D3 imbalances. Ensuring balanced nutrition, proper supplementation, and routine veterinary care is vital for preventing nutritional disorders in these species

Animal Insights

Small mammals segment dominated with largest revenue share in 2025, driven by urbanization, changing lifestyles, and a growing preference for compact and low-maintenance pets. As urban populations increase, particularly in North America, Europe, and urban centers across Asia-Pacific, living spaces have become more confined, making larger pets such as dogs and cats less practical. In contrast, small mammals provide an ideal solution for apartment living due to their manageable care requirements and suitability for limited spaces. According to a report of May 2025, about 70% of exotic pet owners care for multiple exotic animals, reflecting strong enthusiasm and deeper engagement with their pets. In addition, around 56% state that exotic pets significantly enhance their mental well-being. These pets also appeal to young professionals, families with children, and elderly individuals, offering companionship without the demanding upkeep associated with larger animals.

The birds segment is expected to be the fastest-growing segment over the forecast period. Between March 2023 and February 2024, global exotic bird shipments reached approximately 90,561, marking a 19% annual growth and signaling rising demand. U.S. dominated imports with 86,632 shipments, trailed by India and Russia with 34,394 and 27,944 shipments, respectively. Despite recording only 15 shipments between February 2023 and January 2024, a 56% year-on-year decline, India remains a notable market due to its strategic ties with European exporters. Major exporters include Turkey, China, and Belgium, accounting for 71% of global shipments during the period. Turkey led with a 43% share, while China and Belgium followed with 20% and 7%. This evolving trade landscape presents both growth prospects and regulatory hurdles for players in the exotic pet sector.

Route of Administration Insights

Oral segment held the largest revenue share in 2025, owing to its ease of use and efficiency, particularly for exotic pets such as reptiles, birds, and small mammals. Pet owners highly favor oral medications due to their simplicity, especially for animals that may be difficult to handle with injection-based treatments. For instance, in December 2024, the U.S. Food and Drug Administration (FDA) opened a new application period for grants to support the development of animal drugs for uncommon diseases in major species or minor species (MUMS drugs). These grants offer up to USD 250,000 per year for routine studies and up to USD 750,000 for toxicology studies. The program is specifically designed for veterinary drugs administered via various routes, including oral, topical, and injectable, for minor species such as rabbits, guinea pigs, ferrets, reptiles (snakes, lizards, turtles), and birds (parrots, cockatiels).

The topical segment is expected to be the fastest-growing segment over the forecast period, driving demand for creams, ointments, sprays, and spot-on therapies, these options provide a less stressful and more convenient method for managing skin conditions, parasites, and minor wounds in species such as reptiles and small mammals. Spot-on treatments are commonly used for tick and mite control, while antifungal creams address various infections in mammals. In addition, advancements in veterinary pharmaceuticals have improved the safety and effectiveness of these products.

Indication Insights

Bacterial infection segment dominated the market in 2025. Bacterial infections in exotic companion animals are commonly caused by poor husbandry, stress, or exposure to infected animals, leading to respiratory, gastrointestinal, skin, and systemic diseases. Diagnostic advancements such as bacterial cultures and PCR have improved early detection and targeted treatments. Salmonella enterica is widespread in reptiles and is often asymptomatic, but it poses zoonotic and antimicrobial resistance risks. Birds, especially parrots and cockatiels, are prone to Chlamydia psittaci, which can be transmitted to humans and requires vigilant hygiene and testing. Small mammals like guinea pigs and hedgehogs may carry Salmonella and develop fungal infections such as dermatophytosis due to stress or immunosuppression. Exotic mammals, including chinchillas and sugar gliders, can harbor Leptospira spp., complicating diagnosis and increasing zoonotic risk without vaccines

The others segment that comprises of nutritional deficiencies, trauma, dental problems, dermatological issues, and respiratory infections in animals is emerging as the fastest growing segment in the market. The factors driving demand for targeted diagnostics, supplements, and veterinary interventions include rising ownership of reptiles, birds and small mammals that has increased awareness of species-specific health vulnerabilities. As pet owners become more informed and seek specialized care, companies are rapidly expanding treatment options, making this segment a major contributor to market growth.

Distribution Channel Insights

Hospitals and clinics constituted the largest revenue segment in 2025 due to more pet owners are taking their animals to hospitals for cure. Veterinary hospitals frequently use IV fluid therapy as a fundamental component of patient care. Veterinary hospitals are qualified to handle emergencies and provide immediate and intensive care to animals in critical conditions. In North America, especially in the U.S. and Canada, the ownership of exotic pets has steadily increased, driving a surge in demand for veterinary services equipped to handle these unique animals. These clinical settings frequently treat common conditions such as dental issues in rabbits and guinea pigs, respiratory diseases in birds, and metabolic bone disorders in reptiles. Veterinary hospitals in the region are equipped with advanced diagnostic capabilities, including specialized imaging, microbial cultures, and laboratory testing specifically adapted to small exotic species. Routine wellness exams, dietary consultations, and emergency care have become standard offerings.

The e-commerce segment is expected to grow at fastest rate during the forecast period. The growing adoption of digital platforms is driving the expansion of the exotic pet care market. In addition, rising ownership of non-traditional pet’s influence owners to online sources for specialized healthcare and husbandry products. Besides this, e-commerce enables convenient access to species-specific pharmaceuticals, diets, habitat gear, and grooming tools, especially in regions with limited physical retail options. It helps overcome geographical barriers, making tailored products available to owners in rural and underserved areas. Furthermore, online platforms also facilitate the distribution of veterinary drugs such as enrofloxacin and doxycycline, supported by educational resources and expert advice. As digital engagement continues to rise, the E-commerce segment is expected to play an increasingly vital role in meeting the diverse needs of exotic pet owners globally.

Regional Insights

North America exotic pets marketdominated with largest revenue share of 50.02% in 2025. The market is driven by urban lifestyles and increased exposure to exotic species through social media increasing pet ownership preferences. In the U.S., regulatory support for certain exotic animals creates niche markets for breeders and specialty retailers. Customized veterinary care and species-specific nutrition are gaining momentum among exotic pet owners. High pet care spending in the region, particularly in the U.S., is fueling demand for advanced habitats and expert veterinary services. Educational resources and breeder networks further drive market growth in urban and suburban areas.

U.S. Exotic Pets Market Trends

The exotic pets market in the U.S. accounted for the largest market share in the North America market, owing to the increasing popularity of non-traditional companion animals like fish, reptiles, birds, and small mammals, with 8% of households owning fish and 4% owning reptiles. These pets are often preferred in urban settings due to space constraints and lifestyle fit, as they are perceived to require less daily care than traditional pets. Besides this, retail expansion and specialized products, such as species-specific diets, habitat accessories, and wellness supplements, further support market growth. Veterinary medicines specialized for exotic pets, including those for reptiles and small mammals, are in high demand. For instance, in April 2025, FDA approved Faunamor as the first treatment for Ich, a deadly disease in ornamental fish, improving care options. With increased awareness, there is a growing focus on preventive care, ethical sourcing, and proper pet husbandry. This trend presents opportunities for veterinarians, retailers, and suppliers to expand educational efforts and engage more with exotic pet owners.

Canada exotic pets marketis expected to grow at a significant CAGR during the forecast periodpropelled by rising ownership of reptiles, birds, and small mammals, expanding availability of specialized nutrition, and increasing veterinary expertise in exotic species. Some of the key players include PetSmart, Petland, Hagen Group, Oxbow Animal Health, and local specialty breeders advance market growth by their innovative products. The competitive scenario is moderately fragmented, with major pet retailers expanding exotic product lines whereas niche brands and boutique stores compete through species-specific diets, enrichment products, and expert customer guidance.

Europe Exotic Pets Market Trends

The exotic pets market in Europe is expected to drive market growth due to rising pet ownership and increased acceptance of exotic animals. In Europe there are around 340 million pets, including 53 million ornamental birds, 29 million small mammals, and 22 million aquatic species, exotic species represent a significant portion of the pet population. In addition, urbanization, shifting lifestyle preferences, and interest in unique pets are boosting demand, particularly in Germany, France, and Italy. The market benefits from improved species-specific nutrition, veterinary care, and habitat products for exotic animals. Besides this, social media and online communities foster responsible ownership by enhancing visibility and knowledge-sharing. Furthermore, EU regulations, such as animal welfare laws, ensure ethical trade and maintenance standards for exotic species.

The exotic pets market in UK is expected to grow significantly over the forecast period. The market is characterized by rising awareness of animal welfare & responsible ownership, expansion of exotic veterinary services and increasing online access to expert care products. Key players include Pets at Home, Johnston & Jeff, Peregrine Livefoods, Monkfield Nutrition, and Arcadia Reptile are expanding their product reach.

The Germany exotic pets market held largest share in 2025 in Europe. The country’s growth is influenced by an increasing number of households adopting exotic animals, with 44% of homes owning pets. The country's diverse pet population includes millions of small mammals, pet birds, and reptiles, which are fueling demand for specialized care. Veterinary services, including tailored treatments and fluid therapy, are becoming essential for managing the health of these exotic pets. Specialized pet food manufacturers, such as Sera GmbH, Kessler GmbH, and Tierfutterpro, are responding by offering products tailored to the nutritional needs of exotic animals. Sera GmbH provides specialized food for reptiles, while Kessler GmbH focuses on natural ingredients for various pet species. This growing market for exotic pet care products, alongside veterinary advancements, is expected to drive further growth in Germany's exotic pet sector.

Asia Pacific Exotic Pets Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's growth can be attributed to the increasing urbanization, rising disposable incomes, and a rising interest in unique animals. As the middle class grows, more people treat exotic pets as family members, with demand rising for animals such as reptiles, birds, and small mammals. Besides this, countries such as China, Japan, and South Korea are seeing a growing interest in these pets and specialized products and services for their care. In addition, animal welfare awareness is also rising, although regulations vary greatly across the region. Some countries, such as Australia, have strict rules to protect ecosystems and prevent invasive species, while others have more lenient policies. Despite regulatory challenges, the market is expanding with increased demand for veterinary care, pet supplies, and services, likely leading to more regulation for sustainability and responsible ownership

The exotic pets market in China held the largest revenue shareandis witnessing new growth opportunities due its expanding e-commerce and social commerce ecosystem, growing veterinary specialization for exotic species and increased availability of imported species & premium supplies. In addition, strategic collaborations, such as, in July 2025, Top Wealth Group Holding Limited (TWG) signed MoU with Jilin Xiuzheng Agriculture and Animal Husbandry Technology Co., Ltd. strengthening its market capabilities and accelerate innovation across exotic pet health and nutrition.

India exotic pets market is witnessing notable growth due to new regulations introduced by the Ministry of Environment, Forest and Climate Change (MoEFCC) in February 2024. The Living Animal Species (Reporting and Registration) Rules require individuals owning exotic animals listed under the Wildlife Protection Act to register them on the PARIVESH 2.0 portal. Owners must complete registration within six months or 30 days of acquiring the animal and report any changes, such as births or deaths, to the State Chief Wildlife Warden. Despite these new rules, the commercial sector supporting exotic pets remains active, with pet expos and trade fairs continuing to promote various products and services. besides this, events like the India International Pet Trade Fair showcase specialized items for exotic animals, including custom enclosures and veterinary care products. In addition, the new regulations may impact business operations, they are expected to foster responsible pet ownership and compliance, balancing business growth with conservation efforts.

Latin America Exotic Pets Market Trends

The exotic pets market in Latin America is driven by regulatory frameworks that protect biodiversity and promote ethical animal ownership. Countries such as Brazil and Argentina have strict regulations, such as licensing and monitoring programs, to control the ownership and trade of exotic pets. These regulations require permits and compliance with housing and care standards, aiming to minimize ecological risks and prevent illegal trade. Despite these controls, the market for exotic pets continues to grow, supported by events, online platforms, and specialty stores. Besides this, consumer interest in urban areas sustains the demand for exotic pet products, and breeders and community forums contribute to market growth. In addition, awareness of proper care and species-specific needs continues to rise, ensuring the region's steady demand for related goods and services.

Brazil exotic pets market is gaining momentum due to its rich biodiversity and a regulatory framework governed by the Brazilian Institute of Environment and Renewable Natural Resources (IBAMA), which restricts the importation and trade of exotic species. Importing reptiles for pets is prohibited, and wildlife capture and breeding without IBAMA approval is illegal, aiming to protect ecosystems and curb unlawful wildlife trafficking. Despite these regulations, interest in exotic pets remains strong, particularly in urban areas where birds, small mammals, and reptiles are popular.

Middle East & Africa Exotic Pets Market Trends

Exotic pets market in MEA is anticipated to grow at a lucrative rate, due to cultural preferences, regulatory frameworks, and enforcement challenges. In Gulf countries such as the UAE and Saudi Arabia, exotic pet ownership is linked to social status, driving demand for rare animals. However, strict laws have been enacted to address animal welfare concerns. The UAE has banned private ownership of dangerous exotic animals, while legal trade continues for permitted species. In Africa, nations like South Africa and Kenya have seen growing interest in exotic pets, fueled by a burgeoning middle class and rich biodiversity. South Africa has a thriving trade in reptiles, birds, and mammals, but faces challenges such as illegal wildlife trade and insufficient veterinary care. Despite these obstacles, the market is evolving with increased public awareness of animal welfare and responsible pet ownership.

South Africa exotic pets market is growing slowly due to a dynamic commercial ecosystem and increasing consumer interest. Events such as the SOS Reptile Expo in Johannesburg showcase trends in exotic pet care and provide a platform for breeders, retailers, and enthusiasts. Non-native species, especially reptiles, comprise a significant portion of the pet population, with snakes being a popular choice. Regulatory oversight varies by province, with the Western Cape requiring a Wild Animal Captivity Permit for exotic pet ownership. Legal frameworks aim to balance consumer interest with ecological and ethical concerns. Organizations such as the NSPCA promote awareness about responsible ownership, animal welfare, and compliance with environmental laws.

UAE exotic pets market is experiencing significant growth due to rising investment in veterinary infrastructure, tourism-driven demand for unique animal experiences and growing awareness of responsible exotic pet care. Some of the players such as Petzone, Dubai Pet Food, Pet Corner, and specialty exotic breeders and clinics are strengthening the market by strategic initiatives. The competitive landscape remains moderately fragmented, with retailers, online platforms, and niche breeders competing through premium products, specialized care services, and curated exotic species.

Key Exotic Pets Company Insights

The global exotic pet market is expanding due to rising interest in unique companion animals, increased urbanization, and greater access to specialized care products. Key players such as Mazuri, Vetafarm, Versele Laga, Zoetis, Merck, AdvaCare Pharma, and VETARK are driving innovation in nutrition, health, and habitat enrichment. Growing online retail, education, and awareness of ethical sourcing are boosting demand for high-quality, species-specific products. With improving veterinary expertise and regional market expansion, the sector is poised for steady growth globally.

Key Exotic Pets Companies:

The following are the leading companies in the exotic pets market. These companies collectively hold the largest market share and dictate industry trends.

- AdvaCare Pharma

- VETARK (Candioli Srl)

- Vetafarm

- Mazuri

- Versele Laga

- CROCdoc (a sister company of The Birdcare Company)

- Zoetis Inc.

- Merck & Co., Inc

- Vetnil

- Pet King Brands

Recent Developments

-

In July 2025, Corbion gained regulatory approval in China to introduce its algae-based omega-3 DHA solutions, enabling expansion into animal nutrition markets and strengthening sustainable feed ingredient offerings in the region.

-

In April 2025, The FDA has approved Faunamor, a new treatment for Ichthyophthirius multifiliis (Ich or white spot disease) in ornamental fish, including tropical fish, goldfish, and koi. This drug, containing methylthionine chloride, malachite green oxalate, and acriflavine chloride, is now legally available for treating Ich in home aquariums and outdoor ponds, marking it as the first FDA-approved treatment for this common parasitic infection.

-

In March 2025, Refit Animal Care launched FEATHER GROW, an innovative bird supplement enhancing plumage, immunity, and vitality, underscoring the company’s commitment to affordable, research-driven avian nutrition and customer-focused veterinary product development.

-

In January 2025, Revelation Pharma launched Revelation Animal Health, a nationwide division offering custom-compounded medications for companion animals, exotics, and zoo species, expanding veterinary support through multi-state pharmacy hubs and specialized animal health expertise.

Exotic Pets Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.86 billion

Revenue forecast in 2033

USD 3.21 billion

Growth rate

CAGR of 8.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, route of administration, indication, distribution channel and regional

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

AdvaCare Pharma; VETARK (Candioli Srl); Vetafarm; Mazuri; Versele Laga; CROCdoc (a sister company of The Birdcare Company); Zoetis Inc.; Merck & Co., Inc.; Vetnil; Pet King Brands.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Exotic Pets Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the exotic pets market report based on product, animal, route of administration, indication, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceuticals

-

Parasiticides

-

Antibiotics

-

Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

-

Others

-

-

Nutritional Supplements

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Mammals

-

Birds

-

Reptiles

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Injectable

-

Topical

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Bacterial infection

-

Parasitic infection

-

Orthopedic diseases

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Retail

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global exotic pets market size was estimated at USD 1.75 billion in 2025 and is expected to reach USD 1.86 billion in 2026.

b. The global exotic pets market is expected to grow at a compound annual growth rate of 8.07% from 2026 to 2033 to reach USD 3.21 billion by 2033

b. North America dominated the exotic pets market with a share of 50.02% in 2025. This is attributable to the increasing popularity of non-traditional companion animals like fish, reptiles, birds, and small mammals. These pets are often preferred in urban settings due to space constraints and lifestyle fit, as they are perceived to require less daily care than traditional pets.

b. Some key players operating in the exotic pets market include AdvaCare Pharma, VETARK (Candioli Srl), Vetafarm, Mazuri, Versele Laga, CROCdoc (a sister company of The Birdcare Company), Zoetis Inc., Merck & Co., Inc., Vetnil, Pet King Brands.

b. Key factors that are driving the market growth include increased awareness of species-specific health issues and the demand for specialized care, including veterinary services, diagnostics, and insurance. Additionally, the growth of product offerings, like personalized nutrition and wellness products, and the rise in responsible pet ownership further support market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.