- Home

- »

- Next Generation Technologies

- »

-

Extended Reality Market Size, Share & Growth Report, 2030GVR Report cover

![Extended Reality Market Size, Share & Trends Report]()

Extended Reality Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application, By Industry Vertical, By Enterprise Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-260-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extended Reality Market Summary

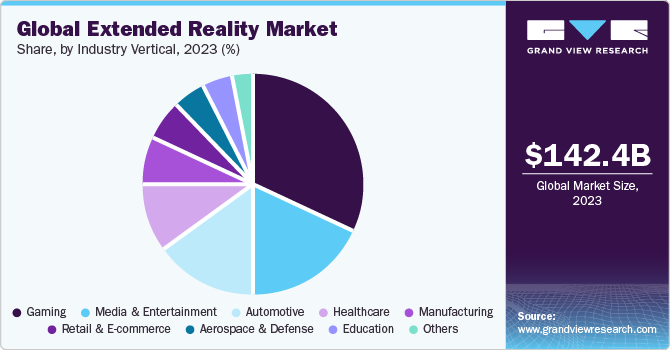

The global extended reality market size was estimated at USD 142.39 billion in 2023 and is projected to reach USD 1,069.27 billion by 2030, growing at a CAGR of 32.9% from 2024 to 2030. The market for augmented and virtual reality technologies is growing due to increased spending, rising government support, and high demand for improved visual information and shorter distances.

Key Market Trends & Insights

- North America dominated the extended reality market with a revenue share of 41.1% in 2023.

- The extended reality market in U.S. accounted for a revenue share of 37% in 2023.

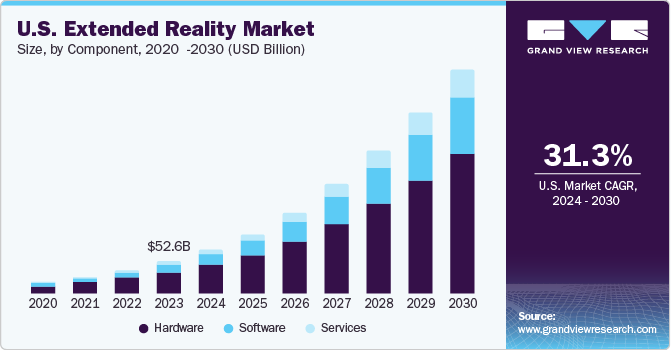

- Based on components, the hardware segment led the market with the largest revenue share of 65.3% in 2023.

- Based on application, the virtual reality segment led the market with the largest revenue share of 55.7% in 2023.

- Based on industry vertical, the gaming segment held the market with the largest revenue share of 32.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 142.39 Billion

- 2030 Projected Market Size: USD 1,069.27 Billion

- CAGR (2024-2030): 32.9%

- North America: Largest market in 2023

- Middle East & Africa: Fastest growing market

In addition, the availability of affordable VR devices and increased demand in the entertainment and gaming industry are contributing to the market growth. Investors such as venture capital firms, private equity investors, and corporate entities provide more funds to XR startups and technology companies. This financial support helps research and development efforts, speeds up product commercialization, and promotes ecosystem growth, resulting in increased innovation and expansion within the market. For instance, in June 2023, Meta announced a new mixed reality (MR) program in India, which includes a grant of USD 250 thousand for Indian startups and developers to build apps and experiences. The fund encourages innovation and creates an ecosystem of extended reality (XR) technologies in the country.

The increase in 5G networks has boosted the extended reality (XR) market by enabling high-speed, low-latency communication, essential for delivering seamless and immersive XR experiences. 5G's capability to support massive data transfer and real-time interactions offers new opportunities for XR applications, particularly in remote collaboration, live events, and cloud-based gaming. This collaboration between XR and 5G is expected to further growth and innovation. According to the GSM Association, 5G connections are expected to double by 2025. It is being accelerated by innovations and new 5G network deployments in over 30 countries in 2023. The organizations are expected to benefit from the commercial availability of 5G Advanced in 2025, which is expected to improve speed, coverage, mobility, and power efficiency.

The COVID-19 pandemic positively impacted the XR market, accelerating the adoption of virtual and augmented reality solutions across various sectors such as education, media & entertainment, and gaming, among others. Due to restrictions on physical gatherings, organizations increasingly adopted XR technologies to maintain business continuity, deliver virtual events, and provide remote training and education. This change expanded the XR user base and established the value and usefulness of these technologies in addressing challenges.

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse applications, and a supportive ecosystem. One prominent feature is the increasing adoption of extended reality across various industries, including healthcare, finance, entertainment, gaming, and more.

Government initiatives play an essential role in fostering the growth of the XR market through various funding programs, awareness projects, and partnerships with industry stakeholders. These initiatives aim to accelerate the deployment of XR solutions and strengthen the competitiveness of domestic XR companies on the global stage. For instance, in October 2023, The UK government launched Museums in the Metaverse project, allocating USD 6.08 million to create an extended reality platform to help visitors access cultural sites throughout Scotland. The University of Glasgow leads the initiative, using advanced XR technology to allow visitors to virtually engage with a wider range of museum collections.

The degree of innovation in extended reality is propelled by the convergence of XR with other emerging technologies, such as artificial intelligence (AI), 5G connectivity, and the Internet of Things (IoT), which drives innovation by unlocking new possibilities and capabilities. AI algorithms enhance XR experiences by enabling more realistic simulations, intelligent interactions, and personalized content recommendations. 5G connectivity facilitates low-latency, high-bandwidth communication, enabling seamless streaming of XR content and real-time collaboration in virtual environments.

Component Insights

Based on components, the market is further bifurcated into hardware, software, and services. The hardware segment led the market with the largest revenue share of 65.3% in 2023. The growth of the hardware segment can be attributed to technological innovations in hardware components, such as displays, sensors, processors, and optics, which have led to the development of lightweight and affordable XR headsets and accessories.

The services segment is anticipated to witness at the fastest CAGR during the forecast period. Cloud-based XR platforms drive the demand for XR services by providing scalable infrastructure, collaborative tools, and access to advanced development frameworks. Service providers use these platforms to accelerate development cycles, reduce costs, and offer subscription-based XR services. The increasing demand for customized XR solutions has led to the growth of service providers specializing in XR development and integration. For instance, in February 2023, Google launched Immersive Stream for XR. It is a cloud-based graphics rendering service that enables developers to create various immersive experiences without needing powerful hardware or special applications. Users can experience 3D or AR worlds by scanning a QR code or clicking a link, eliminating the need for specific devices or software.

Application Insights

Based on application, the market is segmented into augmented reality (AR), virtual reality (VR), and mixed reality (MR). The virtual reality segment led the market with the largest revenue share of 55.7% in 2023. Industries such as healthcare, education, retail, manufacturing, and automotive are using VR for training simulations, product design and visualization, virtual tours, remote collaboration, and marketing experiences. The versatility of VR technology is driving adoption across diverse sectors, fueling market growth. For instance, in January 2024, U.S.-based Alo Yoga, a digital styling, beauty, and wellness service provider, launched the Alo Sanctuary app for Apple Vision Pro, created with Obsess and Ave Advisory. The app offers immersive environments, audio for meditation, and 3D shopping for Alo Yoga's collection. Shoppers can view products up close and differentiate between fabric types.

The augmented reality (AR) segment is expected to grow at the fastest CAGR during the forecast period. Augmented reality is driving innovation and immersive experiences in the gaming and entertainment industries, with the popularity of AR-enabled mobile games, location-based AR experiences, and AR-enhanced storytelling platforms. The proliferation of smartphones, coupled with the development of AR development platforms and software development kits (SDKs), is democratizing AR content creation and distribution, fueling the market growth.

Industry Vertical Insights

Based on industry vertical, the market is segmented into aerospace & defense, manufacturing, automotive, education, media & entertainment, gaming, healthcare, retail & E-commerce, and others. The gaming segment held the market with the largest revenue share of 32.1% in 2023, due to increasing demand for immersive and interactive gaming experiences and continuous innovation in XR hardware, particularly VR headsets and accessories. Advancements in display technology, motion tracking, and haptic feedback systems contribute to developing more immersive and comfortable XR gaming devices.

In addition, growing investment in research and development (R&D) of XR games drives the gaming segment growth. For instance, in July 2023, Sony announced an investment of USD 2.16 billion in the advancement of live service games and extended reality through research and development. Sony's game R&D expenditure focuses on live service titles and extended reality. Leveraging the resources of the nine game studios acquired or invested in outside Japan over the past two years, Sony seeks to enhance its efforts in extended reality development. With a target to allocate 55% of PS5 game development funds to live service games in 2023, this proportion is set to increase to 60% by 2024.

The healthcare segment is expected to grow at the fastest CAGR during the forecast period. Healthcare professionals increasingly use extended reality for medical training, therapy, and surgical planning. This technology also provides significant opportunities for remote surgery and access to healthcare from remote areas without requiring emergency transportation. For instance, in October 2023, Tan Tock Seng Hospital in Singapore launched a virtual reality learning platform for healthcare professionals. Through virtual reality technology, this platform enables staff to gain hands-on experience from anywhere, anytime.

Enterprise Size

Based on enterprise size, the market is segmented into large enterprises and small & medium enterprises. The large enterprise segment led the market with the largest revenue share of 64.8% in 2023. Integrating extended reality (XR) into customer service and support functions is driving its adoption among large enterprises. Augmented reality-powered customer support applications enable service technicians to visualize equipment schematics, access troubleshooting guides, and overlay digital annotations onto physical objects, expediting problem resolution and improving customer satisfaction. By leveraging XR technologies in customer service and support, large enterprises can enhance service delivery, build stronger customer relationships, and differentiate themselves in competitive markets.

The small & medium enterprises segment is expected to grow at the fastest CAGR during the forecast period. Rising demand for immersive training and skill development solutions is driving the segment growth. XR technologies offer a cost-effective and scalable solution for delivering immersive training experiences that simulate real-world scenarios and environments. By investing in XR-based training programs, small and medium enterprises can ensure that their workforce remains skilled, adaptable, and capable of meeting evolving job requirements.

Regional Insights

North America dominated the extended reality market with a revenue share of 41.1% in 2023, owing to industrialization and the growing emphasis on industrial safety consciousness. The increasing focus on industrial safety consciousness drives demand for XR solutions that optimize operational processes, positioning XR technology as a critical tool for promoting safer and more efficient industrial operations in North America.

U.S. Extended Reality Market Trends

The extended reality market in U.S. accounted for a revenue share of 37% in 2023, as the region maintains an advanced infrastructure for XR development and adoption, with major technology companies investing heavily in XR hardware and software and a booming startup ecosystem driving the market growth. In addition, the COVID-19 pandemic accelerated the adoption of XR technologies for remote collaboration, virtual events, and immersive experiences, further increasing market growth.

Asia Pacific Extended Reality Market Trends

The extended reality market in Asia Pacific is expected to grow at a significant CAGR during the forecast period. Many countries in the region are undergoing rapid urbanization and industrialization, driving demand for XR solutions in various industries. Emerging economies such as China, India, and Southeast Asia are witnessing significant infrastructure development, manufacturing, and construction investments. XR technologies are increasingly utilized for architectural visualization, urban planning, and industrial training, catering to rapidly growing urban populations and expanding industries.

The China extended reality market is expected to grow at the fastest CAGR over the forecast period, as it is one of the major manufacturers in hardware manufacturing, with a strong ecosystem of electronics suppliers, component manufacturers, and assembly factories. This strong manufacturing base enables Chinese companies to produce XR hardware at scale and competitive prices. Domestic XR hardware manufacturers use China's manufacturing capabilities to produce high-quality VR headsets and accessories for domestic and international markets, driving adoption and market growth. For instance, in September 2023, Qualcomm China and Baidu signed a strategic cooperation MoU. The two companies are set to collaborate to develop extended reality (XR) technology and its application in various sectors, including tourism and education.

The extended reality market in India is expected to grow at the fastest CAGR over the forecast period. The growing ecosystem of XR content creators, developers, and startups in India contributes to the XR market's expansion. With a growing community of creative professionals and tech enthusiasts, India is witnessing a surge in XR content production, ranging from immersive games and interactive experiences to enterprise applications and creative artworks. This vibrant ecosystem of XR innovation fosters collaboration, knowledge sharing, and cross-disciplinary creativity, driving the development of new XR solutions and driving the market's growth.

Middle East & Africa Extended Reality Market Trends

The extended reality market in the Middle East & Africa is expected to grow at the fastest CAGR over the forecast period, due to rapid digitization and modernization efforts across various regional industries. XR technologies in the process by offering innovative solutions for training, simulation, visualization, and remote collaboration. Industries such as oil and gas, construction, healthcare, and education are embracing XR to improve operational processes, optimize resource utilization, and deliver immersive experiences to employees and customers.

Key Extended Reality Company Insights

Some of the key players operating in the market include Apple Inc., Google, and Microsoft:

-

Apple Inc. is a technology company that offers consumer electronics, software, and services. With its ARKit and ongoing development in augmented reality (AR) and virtual reality (VR), Apple aims to revolutionize immersive experiences across its ecosystem of devices

-

Google is a technology company that develops and promotes XR technologies through its subsidiaries, such as Google ARCore and Google Cardboard. Google ARCore is a platform that allows developers to build AR experiences for Android and iOS devices, while Google Cardboard is a low-cost, do-it-yourself VR viewer

-

Microsoft offers a range of software, hardware, and cloud services. Through its HoloLens and Mixed Reality platform, Microsoft is driving innovation in augmented reality (AR) and virtual reality (VR) technologies for enterprise and consumer applications

Key Extended Reality Companies:

The following are the leading companies in the extended reality market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Apple Inc.

- HTC Corporation

- Meta Platforms, Inc.

- Microsoft

- Northern Digital Inc.

- PTC Inc.

- Qualcomm Technologies Inc.

- Samsung Electronics Co., Ltd.

- Seiko Epson Corporation

- SoftServe Inc.

- Sony Group Corporation

- SphereGen Technologies LLC

Recent Developments

-

In January 2024, Qualcomm launched the Snapdragon XR2+ Gen 2 Platform, a new chipset that enhances XR displays and visuals. The improved chipset is expected to support AR smart glasses with integrated AI features. The XR2+ Gen 2 chipset is part of the Snapdragon platform, which serves as the foundation for AR/VR/MR application development. Qualcomm aims to make it an affordable option for vendors, lowering entry barriers for workplace AR/VR/MR

-

In June 2023, Apple Inc. launched its mixed-reality headset, the Vision Pro. This new device is equipped with multiple cameras and sensors and resembles a futuristic pair of ski goggles. The headset is capable of immersing the user in virtual reality while incorporating real-world elements through augmented reality

-

In February 2023, HTC Vive, a company that provides virtual reality (VR) products and platforms, announced the launch of its new solution 'VIVERSE for Business' at the Mobile World Congress (MWC) in Barcelona. The solution is designed to help businesses make the most of immersive technology. VIVERSE for Business provides an easy and intuitive way for organizations to create virtual spaces for collaboration

Extended Reality Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 193.98 billion

Revenue forecast in 2030

USD 1,069.27 billion

Growth rate

CAGR of 32.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, industry vertical, enterprise size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture; Apple Inc.; Google; HTC Corporation; Meta Platforms, Inc.; Microsoft; Northern Digital Inc.; PTC Inc.; Qualcomm Technologies Inc.; Samsung Electronics Co., Ltd.; Seiko Epson Corporation; SoftServe Inc.; Sony Group Corporation; SphereGen Technologies LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extended Reality Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global extended realitymarketreport based on, component, application, industry vertical, enterprise size, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Augmented Reality (AR)

-

Virtual Reality (VR)

-

Mixed Reality (MR)

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Manufacturing

-

Automotive

-

Education

-

Media & Entertainment

-

Gaming

-

Healthcare

-

Retail & E-commerce

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global extended reality market size was estimated at USD 142.39 billion in 2023 and is expected to reach USD 193.98 billion in 2024.

b. The global extended reality market is expected to grow at a compound annual growth rate of 32.9% from 2024 to 2030 to reach USD 1,069.27 billion by 2030.

b. North America dominated the industry with a share of 41.1% in 2023, owing to industrialization and the growing emphasis on industrial safety consciousness.

b. Some key players operating in the extended reality market include Accenture Plc, Apple Inc., Google LLC, HTC Corporation, Meta Platforms, Inc., Microsoft, Northern Digital Inc., PTC Inc., Qualcomm Technologies Inc., Samsung Electronics Co., Ltd., Seiko Epson Corporation, SoftServe Inc., Sony Group Corporation, SphereGen Technologies LLC

b. Key factors that are driving the market growth include increased spending, rising government support, and high demand for improved visual information and shorter distances. Additionally, the availability of affordable VR devices and increased demand in the entertainment and gaming industry are contributing to the growth of the extended reality market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.