- Home

- »

- Semiconductors

- »

-

Fiber Optic Preform Market Size And Share Report, 2030GVR Report cover

![Fiber Optic Preform Market Size, Share & Trends Report]()

Fiber Optic Preform Market (2023 - 2030) Size, Share & Trends Analysis Report By Process (OVD, VAD, PCVD, MCVD), By Product Type (Single-Mode, Multi-Mode, Plastic Optical Fiber), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-817-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiber Optic Preform Market Size & Trends

The global fiber optic preform market size was valued at USD 4.88 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 22.6% from 2023 to 2030. The growth can be attributed to the growing popularity of high-bandwidth internet connections, healthcare industry opportunities, and telecommunication infrastructure investments, among other factors. According to the Organization for Economic Co-operation and Development (OECD), the number of fiber broadband subscriptions increased across all OECD nations by 12.3% between June 2021 and June 2022.

The fiber optic preforms make optical fibers, potentially transmitting data quickly. Optical fibers are flexible transparent fiber cables of high-quality glass, plastic, and silica that operate on total internal light reflection principles. Fiber optics are mostly used for light transmission, illumination, laser delivery systems, and flexible bundling. Intensive research and development into fiber optic technology have led to several innovations and enabled many applications for optical fibers in oil and gas, medical, utilities, and defense industries.

Telecommunication and information technology are among the major industries that rely significantly on optical fiber network infrastructure. The demand for fiber optic cables has increased with the evolving fiber-rich network infrastructure. The growing demand for high bandwidth communication is one of the prominent drivers in the fiber optic preform market.

While the myriad of innovations in the telecommunication industry have paved the way for bandwidth-intensive communication based on fiber optic networks, optical fibers are also finding applications in other industries, including oil and gas, aerospace, defense, railway, and healthcare. For instance, in August 2021, SLB launched Optiq, a Schlumberger optic solution. The product features multidomain distributed sensing capabilities for various applications and settings across the energy industry. Combined with Schlumberger's extensive digital portfolio, Optiq solutions enable continuous and immediate measurements that yield actionable insights to improve operational performance, efficiency, and environmental impact. As the technology continues to advance, researchers have launched the fifth generation of fiber optics, based on the Dense Wave Division Multiplexing (DWDM) conceptual optical solutions.

The rise in data traffic in line with the continued proliferation of tablets, smart devices, laptops, and other portable devices is anticipated to further trigger the demand for optical fiber. The market is evolving continuously, as it is a vital element of the supply chain associated with the broader optical fiber and cable industry.

The market is highly concentrated, with a few well-established and multinational players. It is equally competitive owing to the strategic initiatives these players undertake to offer advanced and innovative products. As a result, the companies often engage in mergers & acquisitions and backward integration to expand their product portfolio, widen their geographic presence, and gain a competitive advantage over their competitors. Hence, the market is witnessing high internal rivalry and competition among market incumbents.

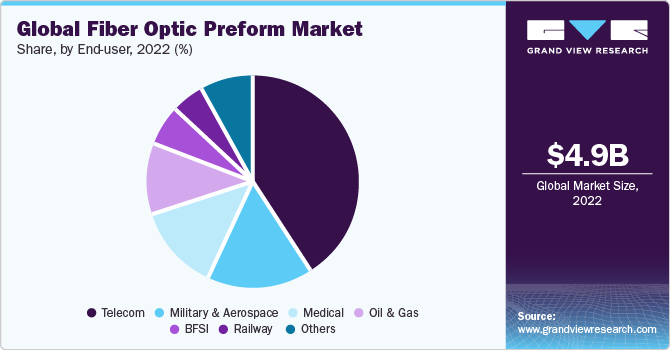

End-user Insights

Based on end user, the market is segmented into telecom, oil & gas, military & aerospace, BFSI, medical, railway, and others. The telecom segment held the largest market share of 41.0% in 2022. This is attributed to the increasing demand for high-speed internet and data transmission. The proliferation of smartphones, expanding internet connectivity, and growing adoption of cloud services have fueled the segment growth.

The others segment is expected to expand at the fastest CAGR of 25.0% over the forecast period. This is attributed to the increase in investments and initiatives by the government and public sector organizations to provide better connectivity across untapped and rural areas. For instance, in March 2023, CommScope announced the expansion of the production of fiber-optic cable to connect additional communities and underserved areas and increase broadband rollout across the U.S. In addition, it launched the new HeliARC fiber optic cable, primarily designed to cater to the deployment needs of rural areas.

Type Insights

Based on type, the market is segmented into single-mode, multi-mode, and plastic optical fiber. The multi-mode segment accounted for the largest market share of 51.9% in 2022. Multi-mode uses a much wider core than single-mode and customarily uses a longer wavelength of light. Consequently, optical fibers used in multi-mode possess a higher competence to gather light from the laser source. Manufacturers are undertaking strategic initiatives to integrate vertically and optimize the tasks associated with assembling and testing.

The plastic optical fiber segment is expected to expand at the fastest CAGR of 25.6% over the forecast period. Its advantages include lower packaging and production costs, greater bending capacity, immunity to noise, ruggedness, and flexibility that offers easy installation.

Regional Insights

Asia Pacific dominated the market and held the largest revenue share of 69.9% in 2022. The increasing internet usage, expanding telecom industry, and strong presence of end-use industries are the major drivers for the region’s growth. According to Tridens d.o.o. 2023 telecommunication stats, the largest mobile market in the world is China, which has about 1.7 billion mobile subscribers. China also led the market for 5G deployment and 5G device production.

Asia Pacific has witnessed a surge in telecommunication infrastructure development driven by increased demand for broadband connectivity, expansion of 4G & 5G networks, and rising smartphone adoption. It has surged the demand for fiber optical preforms used in these devices. On the other hand, the Middle East & Africa region is expected to expand at the fastest CAGR of 24.5% over the forecast year, owing to the digital transformation and strong growth of telecom and other end-user industries.

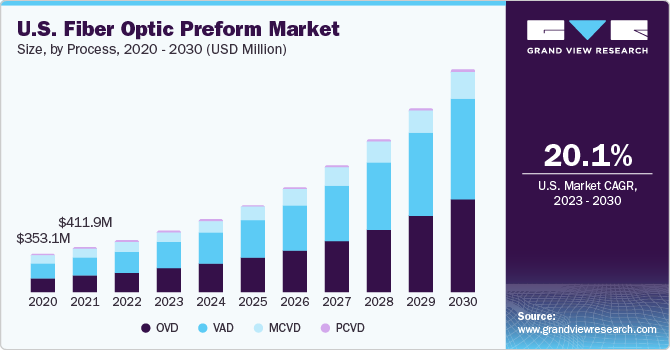

Process Insights

Based on process, the global market is segmented into OVD, VAD, PCVD, and MCVD. The VAD segment accounted for the largest revenue share of 39.5% in 2022 and is expected to witness the fastest growth over the forecast period. This is attributed to its ability to produce high-quality preforms with low attenuation and excellent transmission characteristics. The VAP is the primary method used for manufacturing the fiber preforms. It involves disposing of various materials, such as silica, on a rotating rod, which is later drawn in the final optical fiber. VAD is an exceptional method for manufacturing large glass in large quantities and has paved the way for the mass production of optical fiber.

The OVD segment is expected to expand at a significant CAGR of 23.8% over the forecast period. This is attributed to the wide range of features offered by OVD such as high scalability, lower signal loss during data transmission, uniform deposition, and flexibility & efficiency.

Key Companies & Market Share Insights

The key players are involved in new product developments, agreements, product launches, mergers & acquisitions, and expansion strategies to improve their market penetration. These key players emphasize improving their processes to deliver quality preform to their customers and expand their geographic presence. For instance, in April 2023, Finolex Cables Ltd. planned to set up a plant in Pune, India, to produce preforms. The company initiated an investment of INR 290 crores for the plant setup.

Key Optic Preform Companies:

- Corning Incorporated

- Optical Cable Corporation

- Sterlite Technologies Limited

- OFS Fitel, LLC

- Prysmian Group

- AFL

- Furukawa Electric Co., Ltd.

- Sumitomo Electric Industries, Ltd

- Yangtze Optical Fibre and Cable Joint Stock Limited Company

- HENGTONG GROUP CO., LTD

- Fujikura Ltd.

- Shin-Etsu Chemical Co., Ltd

- Jiangsu Zhongtian Technology Co., Ltd.

Recent Developments

-

In June 2023, Finolex Cables Limited, an Indian manufacturing company specializing in telecommunication and electrical cables, disclosed plans for a significant investment at its Urse facility in Pune. The company planned to allocate Rs. 390 crore for this venture. A substantial portion of Rs. 290 crores was planned to be dedicated to establishing a new fiber preform plant, while approximately Rs. 100 crores were planned to be utilized in the expansion of their solar cables' manufacturing capacity. This investment highlights Finolex Cables' commitment to enhancing its production capabilities and further strengthening its position in the market.

-

In January 2023, Light Brigade announced enhancing its capacity for fiber skills training by establishing two new academies on the East Coast. As the Fiber Optic Industry experiences rapid growth and heightened demand, Light Brigade is dedicated to expanding its training courses and locations. The strategic placement of an academy on the East Coast enables Light Brigade to provide the industry with a centralized hub for a wide range of classes.

-

In August 2022, Light Brigade announced enhancing its capacity for fiber skills training by establishing two new academies on the East Coast. As the fiber optic industry experiences rapid growth and heightened demand, Light Brigade is dedicated to expanding its training courses and locations. The strategic placement of an academy on the East Coast enables Light Brigade to provide the industry with a centralized hub for a wide range of classes. It is essential for both emerging and experienced technicians to ensure they have access to the necessary training and skills critical for their profession.

-

In April 2022, ROSENDAHL NEXTROM, a part of the Knill Gruppe, specializing in manufacturing solutions for optical preforms, fibers, and fiber optic cables, recognized the importance of advancing its research and development capabilities to stay ahead. In line with this vision, the company made a substantial investment to propel itself into the future. This dedicated effort ensures that it continues to offer its customers and partners state-of-the-art technology, enabling them to remain at the forefront of preform, fiber, and fiber optic cable production technology.

-

In November 2022, the Telangana Government implemented the T-Fiber program to provide broadband connectivity to households in the state. STL was handed a work order worth approximately Rs. 1100 crore for Phase 1 of the project, with the total project value estimated at around Rs. 1800 crore. The project involves designing, building, and managing a rural broadband network across 11 districts and 3000 gram panchayats in Telangana. STL was also entrusted to handle the network's maintenance and operations for the next seven years, thereby planning to generate a significant revenue stream.

Fiber Optic Preform Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.86 billion

Revenue forecast in 2030

USD 24.44 billion

Growth rate

CAGR of 22.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

Corning Incorporated; Optical Cable Corporation; Sterlite Technologies Limited; OFS Fitel, LLC; Prysmian Group; AFL; Furukawa Electric Co., Ltd.; Sumitomo Electric Industries, Ltd; Yangtze Optical Fibre and Cable Joint Stock Limited Company; HENGTONG GROUP CO., LTD; Fujikura Ltd.; Shin-Etsu Chemical Co., Ltd; Jiangsu Zhongtian Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Optic Preform Market Report Segmentation

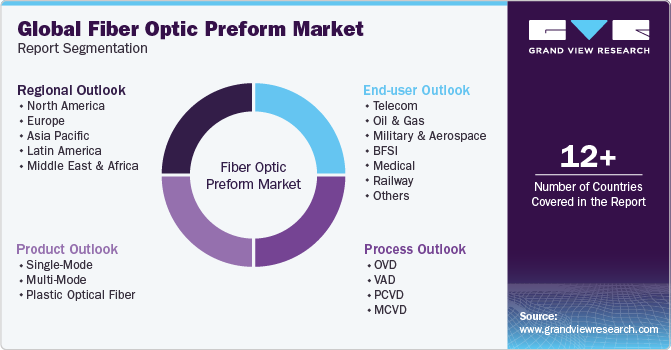

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fiber optic preform market report based on process, type, end-user, and region:

-

Process Outlook (Revenue in USD Million, 2017 - 2030)

-

OVD

-

VAD

-

PCVD

-

MCVD

-

-

Product Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Single-Mode

-

Multi-Mode

-

Plastic Optical Fiber

-

-

End-user Outlook (Revenue in USD Million, 2017 - 2030)

-

Telecom

-

Oil & Gas

-

Military & Aerospace

-

BFSI

-

Medical

-

Railway

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiber optic preform market size was estimated at USD 4.88 billion in 2022 and is expected to reach USD 5.87 billion in 2023.

b. The global fiber optic preform market is expected to grow at a compound annual growth rate of 22.6% from 2023 to 2030 to reach USD 24.44 billion by 2030.

b. Asia Pacific dominated the fiber optic preform market with a share of 69.9% in 2022. This is attributable to the rising demand for fiber optics across the globe.

b. Some key players operating in the fiber optic preform market include Yangtze Optical Fibre and Cable Joint Stock Limited Company, Corning Incorporated, Sumitomo Electric Industries, Ltd., HENGTONG GROUP CO., LTD., and Shin-Etsu Chemical Co., Ltd.

b. Key factors that are driving the market growth include growing demand for high bandwidth communication, growth opportunities in the healthcare sector, and growing government funding in infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.