- Home

- »

- Animal Feed and Feed Additives

- »

-

Fishmeal Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Fishmeal Market Size, Share & Trends Report]()

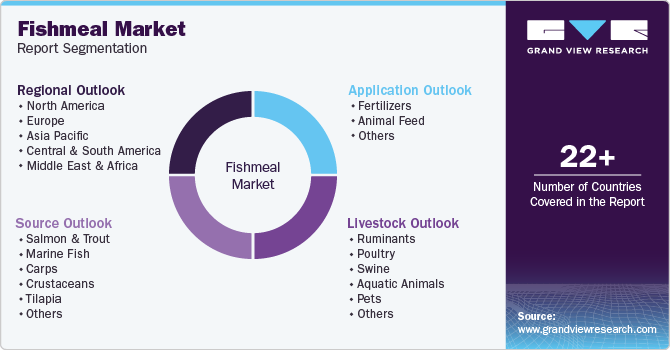

Fishmeal Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Salmon & Trout, Marine Fish, Tilapia), By Livestock (Poultry, Swine), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-418-6

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fishmeal Market Summary

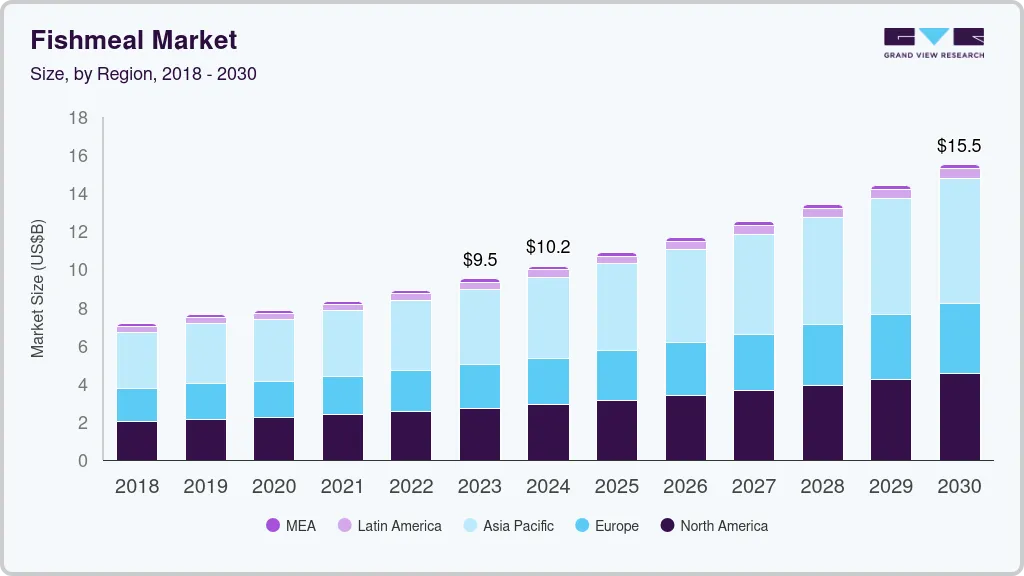

The global fishmeal market size was estimated at USD 9,499.3 million in 2023 and is projected to reach USD 15,506.3 million by 2030, growing at a CAGR of 7.3% from 2024 to 2030. The growth of the market is fueled by the rising demand for fishmeal in the livestock and aquaculture feed industries.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of source, the marine fish segment was valued at USD 6,883.5 million in 2023.

- The crustaceans segment is expected to witness growth at a 7.8% CAGR over the forecast years.

Market Size & Forecast

- 2023 Market Size: USD 9,499.3 Million

- 2030 Projected Market Size: USD 15,506.3 Million

- CAGR (2024-2030): 7.3%

- Asia Pacific: Largest market in 2022

The consumption of fishmeal has seen an uptick in sectors such as pig farms, poultry, and aquaculture.

Fishmeal's significance as a source of omega-3 fatty acids EPA and DHA has driven demand for products. According to the International Fishmeal and Fish Oil Organization (IFFO), typical fishmeal contains 64-67% crude protein and up to 12% fat, while specialized variants offer higher protein content. Additionally, the Food and Agriculture Organization (FAO) highlights the use of crustacean-derived bioactive compounds in the pharmaceutical industry. These factors, alongside ongoing scientific innovation, are expected to augment the demand for fishmeal in the coming years.

Drivers, Opportunities & Restraints

The inclusion of fishmeal in aquaculture feeds has significantly enhanced fish population growth and development for farmers, marking a notable contribution to aquaculture's productivity and sustainability. By supplying essential nutrients, the product facilitates the optimal growth and potential of fish populations, underscoring its vital role in the development of feeds that bolster the sustainable intensification of global aquaculture practices. As the aquaculture sector expands in response to growing demands for high-quality seafood, the importance of nutritious feed components like fishmeal, known for its nutritional content, becomes ever more pronounced.

Environmental concerns further buoy the preference for fishmeal, advocating for it as a natural alternative to synthetic feed additives. This shift is motivated by a heightened consciousness of the ecological impacts of such additives, fostering a trend towards options that promise sustainability and environmental compatibility. Moreover, the presence of heavy metals in conventionally cultured seafood, implicating potential health risks, emphasizes the value of fishmeal as a safer choice for feed production.

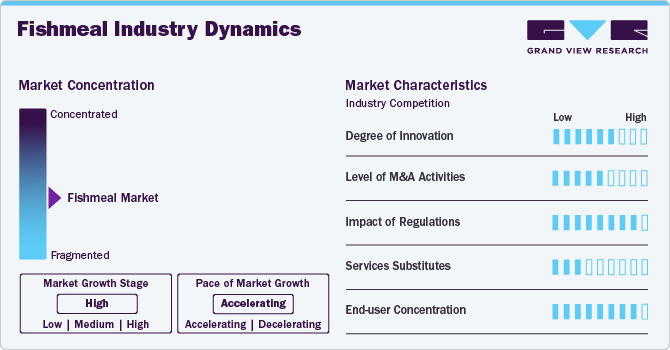

Market Concentration & Characteristics

The fishmeal market is moderately fragmented with strong competition among the tier-1 and tier-2 players.

The global market exhibits a moderate level of fragmentation, characterized by a considerable presence of domestic and international companies focusing on regional markets. Industry participants have embraced strategies such as product launch expansion in emerging markets for future growth.

Market players are recognizing the increased demand for premium feed additives like fishmeal, driven by the industrialization of meat and dairy production. They are also creating new products with tailored functionalities to meet diverse customer needs. Additionally, they are focusing on sustainable fishing practices and obtaining certifications to enhance brand reputation and trust.

Source Insights

“Crustaceans segment is expected to witness growth at 7.8% CAGR”

The marine fish segment of the market was valued at USD 6,883.5 million in 2023 and is projected to reach USD 11,370.69 million by 2030. The most commonly used marine fishes in production of fish meal include mackerel, capelin, pilchard, herring, and anchoveta. Increasing catches of small pelagic fish coupled with rising product demand from aquaculture are likely to boost the segment growth. These fishes have high protein content, rich omega-3 fatty acids, as well as well-balanced amino acid profile, making it an ideal source of fishmeal.

There is increasing popularity for crustaceans such as shrimp, crab, and krill owing to their high protein content, rich astaxanthin, and omega-3 fatty acids. It further enables to improve flavor and palatability in animal feed, resulting in improved feed efficiency, better nutrient digestibility, and enhanced overall health and growth rates in farmed fishes, thereby boosting the segment growth.

Livestock Insights

"Swine segment is expected to witness the fastest growth at 7.9% CAGR”

The aquatic animals segment accounted for the largest revenue share of 85.1% of the market in 2023. The segment growth is driven by rising popularity of the product as a premium protein source, known for its high nutritional value and bioavailability. Fish meal is highly favored in aquaculture feeds due to its high protein content and excellent balance of amino acids for aquatic animals. From 1990 to 2020, global aquaculture production increased by 609%, with an average annual growth rate of 6.7%, thereby offering ample growth opportunities for the market players to widen their product offerings for aquatic animals.

Fishmeal for pigs is high in protein, with 100g/ton improving the protein content of a barley-based ration from 11% to 16%. It has low antigenicity and high digestibility, which reduces stress in young pigs and helps maintain a healthy gut. It is the only commonly used feed ingredient that is high in health-promoting omega-3 PUFA. Approximately 38,000 tons of fishmeal are used in UK pig rations each year, representing around 14% of the 270,000 tons of fishmeal consumed annually in the UK.

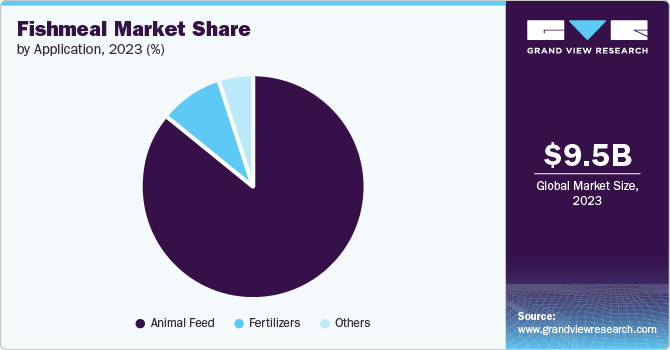

Application Insights

“Fertilizer segment is expected to witness the fastest growth at 7.6% CAGR”

The animal feed segment accounted for the largest revenue share of 38.8% of the market in 2023. Fish meal is a highly valuable and nutrient-rich feed ingredient that is widely utilized in animal diets across various sectors. It is regarded as an essential protein source in fish feed due to its high protein content, excellent essential amino acid profile, and superior nutrient digestibility. Additionally, fishmeal has been acknowledged for its positive impact on the health and performance of livestock when used as a component in cattle feeding.

Fish meal in fertilizer is an excellent source of nitrogen and phosphorus, recommended for vegetable gardens, flower beds, and outdoor plants, providing essential nutrients for plant growth. Roses particularly benefit from fish fertilizer, producing larger, longer-lasting flowers. Additionally, fish meal aids in the establishment of young plants by boosting nitrogen levels, thereby proliferating the product consumption in fertilizers.

Regional Insights

“North America is expected to witness a market growth of CAGR 7.7%”

The regional market growth is driven by increased poultry farming, fish production, surging pork consumption, pig farming, and rising pet food demand due to the growing trend of having pets. Aquaculture production is projected to continue growing globally, with variations in species and products across regions.

Asia Pacific Fishmeal Market Trends

Asia Pacific accounted for the largest revenue share of 41.8% in 2023. This growth is attributed to the rapid expansion of the aquaculture sector in China, Indonesia, Vietnam, and Thailand, where there is a growing demand for high-quality fishmeal from shrimp and marine fishes. Also, surging swine production is further expected to propel the demand for fish meal in animal feed, thereby bolstering the regional market growth.

China fishmeal market witnessing product demand due to increasing annual growth in feed production. Global fishmeal production is approximately 6 million tons per year, with about 4 million tons being traded. China imports around 1 million tons of product annually, which accounts for a quarter of the total global production and trading volume.

Europe Fishmeal Market Trends

The consumption of fishmeal in the EU decreased by around 40% from 2009 to 2020, reaching approximately 450,000 tons. Each year, the European Union produces 370,000-520,000+ tons of fishmeal. In the region, Denmark is the leading producer, accounting for 40-50% of the total regional production.

Key Fishmeal Company Insights

Some of the key players operating in the market include FF Skagen, The Scoular Company, Omega Protein Corporation among others.

-

FF Skagen is a leading global producer of fishmeal and fish oil, providing essential protein and omega-3 supplements for animals and fish in aquaculture, agriculture, and the pet food industry. With 130 employees, the company processes about 500,000 tons of fresh fish into 170,000 tons of fishmeal and fish oil annually. The FF Skagen Group has an annual turnover of USD 270 million and exports to over 60 countries. FF Skagen A/S is owned by the FF Skagen Foundation, with a strong representation from the fishing industry and fishermen.

-

Established in 1892, The Scoular Company consistently sources fishmeal and oil of various qualities throughout the year through its global network of suppliers. Our fishmeal solutions are highly digestible, containing high levels of essential amino acids and proteins ranging from 50% to 80%. We provide a range of antioxidants, including natural, organic, and BHT/BHA stabilized fishmeal, to fulfill your requirements for quality, nutrition, and cost. Our fishmeal is responsibly sourced, with many products holding the highest sustainability certifications such as MSC and MarinTrust.

Key Fishmeal Companies:

The following are the leading companies in the fishmeal market. These companies collectively hold the largest market share and dictate industry trends.

- FF Skagen

- The Scoular Company

- Omega Protein Corporation

- Oceana Group Limited

- Pelagia

- Pesquera Diamante SA

- Pesquera Exalmar S.A.A

- Austral Group S.A.A

- Copeinca

- Triplenine Group A/S

Recent Developments

-

In August 2023, Pelagin launched ProAllo, a novel fishmeal aimed at optimizing fish conditions to support allostasis, essentially aiding fish in managing stress from environmental changes and handling. Pro-Allo has been shown in Pelagin's seabass trials to significantly reduce vulnerability—by up to 86% compared to traditional fishmeal—and enhance growth rates and feed efficiency by 19% and 30%, respectively.

-

In May 2023, Scoular acquired Northwest Farm Food Cooperative’s frozen fish processing facility in Burlington. The facility processes fish trimmings into frozen fish ingredients for pet food manufacturers. This acquisition complements Scoular’s new joint venture fishmeal processing facility in Warrenton, Oregon, strengthening its ability to provide pet food customers with sustainable, high-quality fish ingredients year-round.

Fishmeal Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.16 billion

Revenue forecast in 2030

USD 15.51 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, livestock, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Thailand; Brazil; Argentina; South Africa

Key companies profiled

FF Skagen; The Scoular Company; Omega Protein Corporation; Oceana Group Limited; Pelagia; Pesquera Diamante SA; Pesquera Exalmar S.A.A; Austral Group S.A.A; Copeinca; Triplenine Group A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fishmeal Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fishmeal market report based on source, livestock, application, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Salmon & Trout

-

Marine Fish

-

Carps

-

Crustaceans

-

Tilapia

-

Others

-

-

Livestock Outlook(Revenue, USD Million, 2018 - 2030)

-

Ruminants

-

Poultry

-

Swine

-

Aquatic Animals

-

Pets

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertilizers

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global fishmeal market size was estimated at USD9.50 billion in 2023 and is expected to reach USD 10.16 billion in 2024.

b. The global fishmeal market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 15.51 billion by 2030.

b. Asia Pacific dominated the fishmeal market with a share of 41.8% in 2023. This is attributable to rapid expansion of aquaculture sector in the emerging countries, where there is surging demand for high-quality fishmeal from shrimp and marine fishes.

b. Some key players operating in the fishmeal market include FF Skagen, The Scoular Company, Omega Protein Corporation, Oceana Group Limited, Pelagia, Pesquera Diamante SA, Pesquera Exalmar S.A.A, Austral Group S.A.A, Copeinca, and Triplenine Group A/S

b. Key factors that are driving the market growth include rising demand for fishmeal in the livestock and aquaculture feed industries. The consumption of fishmeal has seen an uptick in sectors such as pig farms, poultry, and aquaculture.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.