- Home

- »

- Consumer F&B

- »

-

Flavored Syrup Market Size, Share & Trends Report, 2030GVR Report cover

![Flavored Syrup Market Size, Share & Trends Report]()

Flavored Syrup Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Fruit, Chocolate, Vanilla, Coffee, Others), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-282-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flavored Syrup Market Summary

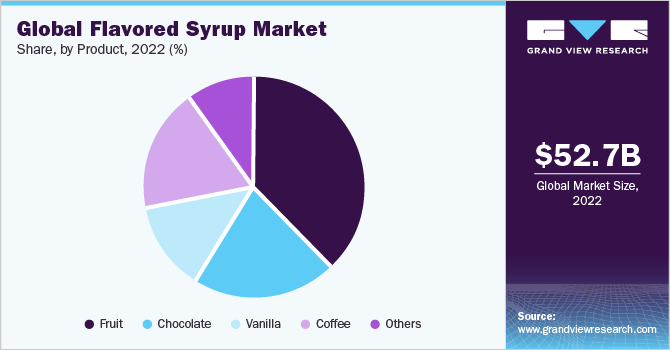

The global flavored syrup market size was worth USD 52.68 billion in 2022 and is projected to reach USD 70.16 billion by 2030, growing at a CAGR of 3.6% from 2023 to 2030. This growth of the market is attributable to the rise in the demand for customized flavors in the food and beverage sector.

Key Market Trends & Insights

- North America emerged as the largest regional market for flavored syrups around 33.8% in 2022.

- The point of care ultrasound systems market in the U.S. is expected to grow rapidly in the coming years.

- Based on product, The fruit segment accounted for the largest market share of around 37.6% in 2022 and is expected to grow with a CAGR of 3.2% from 2023 to 2030.

- Based on product, The chocolate segment is expected to witness the fastest growth rate of 4.5% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 52.68 Billion

- 2030 Projected Market Size: USD 70.16 Billion

- CAGR (2023-2030): 3.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Another factor driving the market growth is rising consumer preference for ready-to-eat and convenience foods. COVID-19 has had a moderate impact on the demand for flavored syrup. The hotel and restaurant sector's sales of flavored syrup witnessed a decline due to restrictions on consumer movement and outdoor eating. However, the demand for household consumption remained relatively stable in 2020, as the work-from-home culture urged consumers to make various food dishes at home and acquire new ingredients, such as flavored syrup. This factor fueled the growth of the market during the pandemic. The global market is expected to return to pre-lockdown levels as lockdowns ease and people return to hotels and restaurants, boosting demand in the sector during the forecast period.Fruit-flavored syrups have been dominating the global market due to their widespread application in beverage products such as cocktails, cold drinks, soft drinks, and soda. Moreover, the rising consumer inclination towards syrups with high fruit content has been a most important factor accelerating the manufacturers to introduce a wide range of syrups infused with natural ingredients is expected to accelerate the market growth. For instance, the two most preferred fruit flavors include raspberry and orange. Moreover, consumers’ willingness to try out different and unique fruit flavors is inspiring the manufacturers to produce duo-fruit syrups such as Lime-Mint, Raspberry-Mint, and Lime-Ginger, which provides a blend of sweet, sour, and bitter taste is expected to propel the market growth.

Moreover, the manufacturers are developing and innovating various flavors in order to provide to the frequently changing taste preferences of the consumers, thereby contributing to the global market growth. For instance, the Ági fruit syrups range introduced a new product category of containing honey in these products with unique flavors like baked apples with honey, elder-lime with honey, and raspberry-lemon balm with honey is accelerating the market growth.

Moreover, the increasing popularity of flavored syrups in western countries such as the U.S., Germany, U.K., France, and Canada. In addition to this, rising production and consumption of these products in the above-mentioned countries have been contributing to global market growth. These syrups are majorly consumed as a topping ingredient in desserts, pancakes, various breakfast foods, waffles, ready-to-eat products, and ice cream. Furthermore, the increasing demand and consumption of chocolate-flavored syrups for various bakery, cold beverages, and confectionery products is expected to accelerate the market growth over the forecast period.

Product Insights

The fruit segment accounted for the largest market share of around 37.6% in 2022 and is expected to grow with a CAGR of 3.2% from 2023 to 2030. The increasing demand for fruit-infused flavored syrups along with unique tastes is a major factor accelerating the market growth. Moreover, producers have been focusing on developing combined fruit syrups and launching innovative flavors to hold their position in the global industry. Based on consumer inclinations toward pure, natural, and organic products, companies are also introducing syrups infused with fruit content. For instance, common sea-buckthorn, apple, 100% natural sour cherry, and beetroot juice are some of the unique flavors mixed with high-fruit ingredients.

The chocolate segment is expected to witness the fastest growth rate of 4.5% from 2023 to 2030. The rising popularity of chocolate syrup in the food and beverage industry is driving market growth. The segment is driven by the significant application in cold and hot beverages such as hot and cold coffee, milkshakes, smoothies, and baking and confectionery products such as pastries, cakes, waffles, and pancakes. Developing economies like India and China have a high preference for chocolate-based products and are expected to be one of the target markets for chocolate syrup manufacturers.

Distribution Channel Insights

The B2B distribution channel segment contributed to the largest market share of around 82.9% in 2022 and is expected to grow with a CAGR of 3.5% from 2023 to 2030. The segment includes various industries like bakery & confectionery, beverages, dairy & frozen desserts sectors is expected to accelerate the market growth. Beverages, particularly cocktails, hot and cold beverages, and soft drinks are some of the common products that contain flavored syrups as a taste and sweetness enhancer ingredient. For instance, Starbucks uses a wide range of naturally flavored syrups such as caramel, hazelnut, and vanilla in their coffee.

The B2C segment will register the fastest CAGR of 4.3% from 2023 to 2030. This can be attributed to the rising popularity and demand for flavored syrups across the globe. Moreover, the increase in sales of flavored syrups sets mostly through company-owned websites and other e-commerce platforms are further expected to accelerate the growth of this segment over the forecast period. The introduction of novel flavors, along with the increasing indulgence factors among consumers in the APAC countries, is expected to drive the demand for the global market in the next few years.

Regional Insights

North America emerged as the largest regional market for flavored syrups around 33.8% in 2022 owing to the high acceptance of fruits contain syrups in the U.S., and Canada, and rising consumers’ preference for flavored syrups in daily meals such as snacks, cereals, beverages, and desserts. The bakery industry is expected to witness significant growth in this region due to the ample availability of high-quality ingredients such as toppings, chocolates, flavors, and fillings. This, in turn, is encouraging the use of flavored syrups across the food and beverage industry.

Asia Pacific is expected to expand at the highest CAGR of 4.5% from 2023 to 2030. Bakery products and beverages are considered a product of mass consumption due to their low prices. Furthermore, consumers’ inclination to consume sweet foods has led producers to introduce innovative products infused with various flavored syrups like fruits, chocolate, and many others. Many foreign companies have penetrated the Asian market and were successful to make quick inroads in this industry.

Key Companies & Market Share Insights

Key players in this industry include The Hershey Company, The Kraft Heinz Company, Kerry Group, Tate & Lyle, Toschi Vignola s.r.l., and many others. Both large and small players are introducing innovative products and expanding their portfolios in order to appeal to consumers. For instance, Starbucks has a wide range of flavored syrups such as toffee nuts, peppermint mocha, cinnamon dolce, and peach. Companies are also focusing on offering sugar-free syrups to cater to the health-conscious segment. For instance, Monin offers sugar-free syrups in various fruit flavors such as raspberry, pomegranate, and peach. Irish cream, almond, and hazelnut are some of the other sugar-free syrups offered by this company. Some of the prominent players in the global flavored syrup market include:

-

The Hershey Company

-

The Kraft Heinz Company

-

Kerry Group

-

Tate & Lyle

-

Toschi Vignola s.r.l.

-

Monin Inc.

-

Fuerst Day Lawson

-

Torani

-

The J.M. Smucker Company

-

Panos Brands

-

Amoretti

-

Skinny Mixes.

-

Nature's Flavors, Inc.

-

Sonoma Syrup Co

Flavored Syrup Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 54.27 billion

Revenue forecast in 2030

USD 70.16 billion

Growth rate

CAGR of 3.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy Spain; China; India, Japan; South Korea; Indonesia; South Africa; Brazil

Key companies profiled

The Hershey Company; The Kraft Heinz Company;

Kerry Group; Tate & Lyle; Toschi Vignola s.r.l.; Monin Inc.; Fuerst Day Lawson; Torani; The J.M. Smucker Company; Panos Brands; Amoretti; Skinny Mixes; Nature's Flavors, Inc.; Sonoma Syrup Co

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

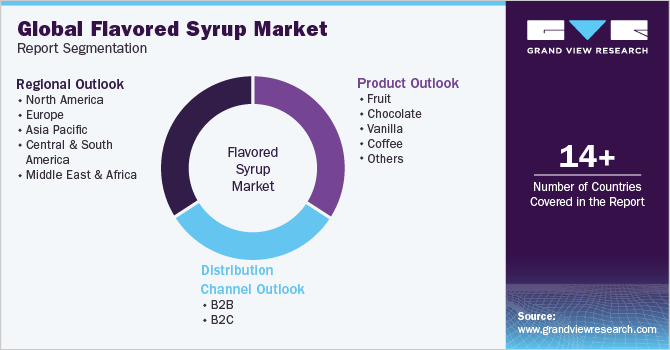

Global Flavored Syrup Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global flavored syrup market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fruit

-

Chocolate

-

Vanilla

-

Coffee

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

B2B

-

B2C

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flavored syrup market size was estimated at USD 52.68 billion in 2022 and is expected to reach USD 54.27 billion in 2023.

b. The global flavored syrup market is expected to grow at a compounded growth rate of 3.6% from 2023 to 2030 to reach USD 70.16 billion by 2030.

b. The fruit segment dominated the global flavored syrup market with a share of 37.6% in 2022. This is attributed to the increasing demand for fruit-infused flavored syrups along with unique tastes.

b. Some key players operating in the flavored syrups market include The Hershey Company; Kerry Group; Tate & Lyle; Monin Inc.; Fuerst Day Lawson; Torani; Archer Daniels Midland Company; Starbucks Coffee Company; Smucker’s; Walden Farms (Panos Brands) and Fox Syrups.

b. Key factors that are driving the market growth include increasing demand for personalized flavors in the food & beverage industry and growing consumer preferences for syrups with high fruit content.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.