- Home

- »

- Advanced Interior Materials

- »

-

Flax Fiber Market Size, Share, Trends, Industry Report, 2033GVR Report cover

![Flax Fiber Market Size, Share & Trends Report]()

Flax Fiber Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Fashion & Textile, Sportswear, Workwear, Smart Textiles & Sensors), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-640-7

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flax Fiber Market Summery

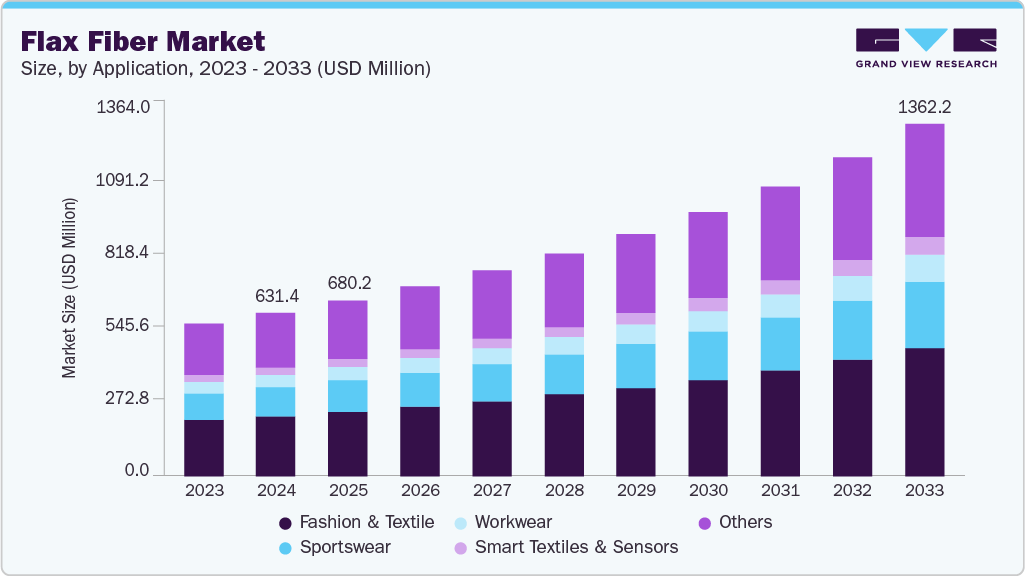

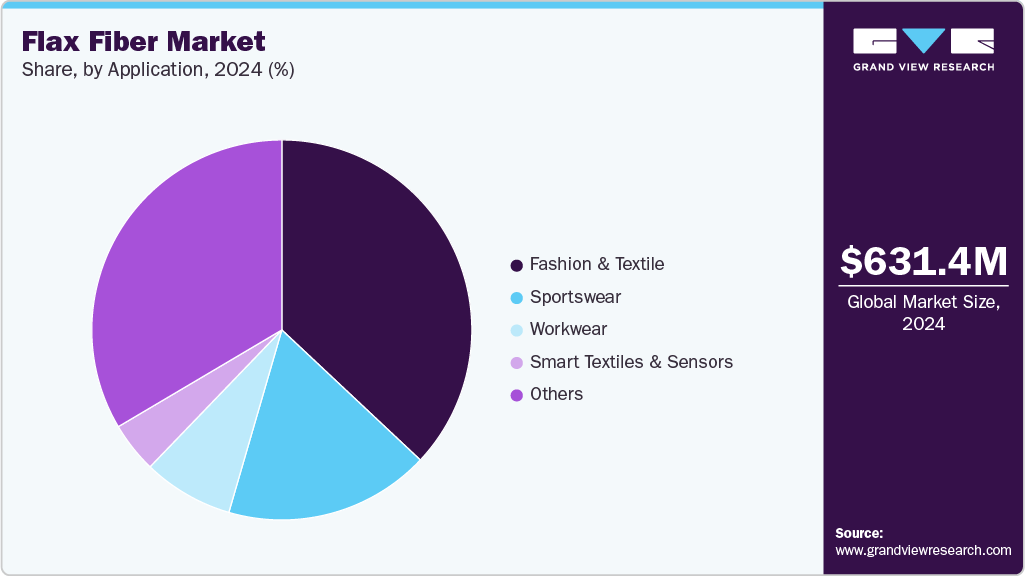

The global flax fiber market size was estimated at USD 631.4 million in 2024 and is projected to reach USD 1,362.2 million by 2033, growing at a CAGR of 9.1% from 2025 to 2033. The demand for flax fiber is rising due to growing global awareness of environmental sustainability and the harmful impacts of synthetic fibers.

Key Market Trends & Insights

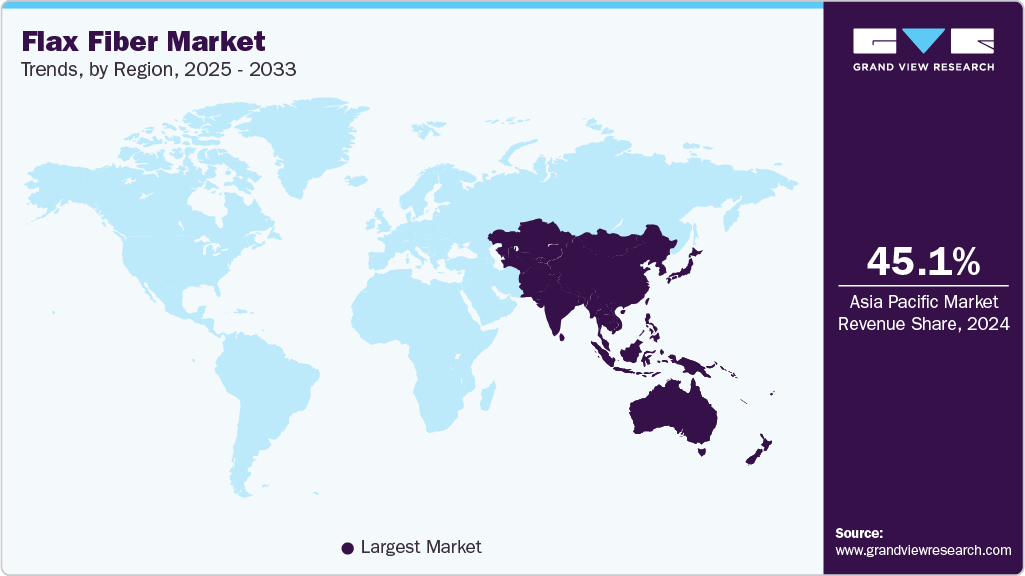

- Asia Pacific dominated the flax fiber market with the largest revenue share of 45.1% in 2024.

- The U.S. flax fibers market is driven by the rise in automotive manufacturing.

- By application, the smart textiles and sensors segment is expected to grow at fastest CAGR of 37.0% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 631.4 Million

- 2033 Projected Market Size: USD 1,362.2 Million

- CAGR (2025-2033): 9.1%

- Asia Pacific: Largest market in 2024

Consumers and industries alike are shifting toward biodegradable, renewable, and low-impact alternatives, and flax being a naturally grown, low-water, and pesticide-free crop perfectly aligns with these priorities. Its strength, breathability, and moisture resistance make it an attractive material for textiles, home furnishings, and industrial applications. As climate concerns and eco-conscious consumption patterns accelerate, flax fiber is emerging as a preferred sustainable material across various sectors.Key drivers fueling the flax fiber market include the booming sustainable fashion industry, increasing use of natural fibers in automotive composites, and growing applications in biodegradable packaging. In addition, flax’s mechanical properties such as lightweight strength and durability are attracting demand in construction and sports equipment. The rise in consumer preference for natural and skin-friendly fabrics is pushing brands and manufacturers to incorporate flax in apparel and home textiles. Moreover, industries are adopting flax composites as eco-friendly alternatives to fiberglass and carbon fiber in non-load-bearing applications, enhancing the fiber’s commercial value.

Innovation is reshaping the flax fiber market through advancements in fiber processing, composite technology, and smart textile applications. Blending flax with other fibers to enhance softness, durability, or electrical conductivity is becoming common, particularly in high-performance and fashion textiles. The development of flax-based biocomposites for automotive interiors and eco-construction materials is also gaining traction. In addition, flax fibers are being explored in smart textiles and e-textile sensors, where their lightweight, breathable, and flexible nature makes them suitable for wearable electronics. These trends are widening flax’s potential far beyond conventional textile use.

Government support is playing a pivotal role in driving the flax fiber market through subsidies for sustainable agriculture, incentives for bio-based product development, and regulations aimed at reducing plastic and synthetic fiber use. The European Union’s Green Deal and Common Agricultural Policy (CAP) promote the cultivation of low-input crops such as flax, while other regions are pushing for eco-labeling, organic certifications, and bans on harmful textiles. Policies supporting circular economy practices and sustainable supply chains are encouraging industries to invest in natural fibers like flax, further boosting market growth and adoption globally.

Market Concentration & Characteristics

The flax fiber market is moderately fragmented, with a mix of established European producers and emerging players from Asia and North America. Key companies such as Terre de Lin, Safilin, and Depestele dominate the European market, particularly in France and Belgium, which are recognized for high-quality flax production. Meanwhile, Asia Pacific is witnessing the entry of new players leveraging cost-effective processing and large-scale cultivation. Strategic collaborations, vertical integration, and investments in sustainable processing technologies are becoming common as players seek to strengthen their position and cater to the rising global demand for eco-friendly fibers.

Flax fiber faces competition from a range of natural and synthetic substitutes such as cotton, hemp, jute, bamboo, and polyester. While synthetic fibers offer consistency, low cost, and mass availability, their environmental impact is prompting industries to reconsider. Cotton, though widely used, consumes more water and pesticides compared to flax. Hemp and jute offer similar strength and sustainability but differ in texture and processing requirements. The growing focus on biodegradable and renewable resources gives flax an edge in applications demanding environmental certifications, yet innovation and cost competitiveness among substitutes remain a critical challenge for broader market penetration.

Application Insights

Fashion & Textile end-use segment held highest revenue market share of 37.0% in 2024, driven by increasing consumer demand for sustainable, breathable, and biodegradable fabrics. Flax fibers, known for their strength and moisture-wicking properties, are widely used in linen garments, home furnishings, and lifestyle textiles. Growing environmental awareness, combined with the rise of ethical fashion and circular economy practices, has propelled brands and manufacturers to shift toward natural fiber alternatives like flax, especially in Europe and Asia Pacific.

Smart Textiles and Sensors segment is expected to grow significantly at CAGR of 11.1% over the forecast period, due to the increasing integration of natural fibers with electronic functionalities. Flax fibers are gaining attention in research and innovation for use in flexible, wearable electronics and health-monitoring garments, offering eco-friendly alternatives to synthetic substrates. Their mechanical stability, low weight, and compatibility with conductive materials make them ideal for sustainable e-textile solutions, especially as demand rises for green, high-performance materials in healthcare, sportswear, and military applications.

Regional Insights

The North American flax fibers market is witnessing significant growth owing to increasing consumer awareness of sustainable products and a strong push from industries such as automotive and construction. The region’s preference for biodegradable and lightweight materials, coupled with innovations in composite applications, is fostering demand. U.S.-based brands promoting organic and eco-conscious fashion are also contributing to market expansion.

U.S. Flax Fiber Market Trends

In the U.S., the flax fibers market is driven by the rise in sustainable fashion, green building practices, and the use of natural fiber composites in automotive manufacturing. The growing popularity of organic home furnishings and consumer awareness about carbon footprint reduction have created a favorable market environment. In addition, partnerships between agriculture and textile companies are strengthening the domestic supply chain.

Asia Pacific Flax Fiber Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of about 45.1% in 2024, due to robust textile production, expanding industrial applications, and growing demand for sustainable materials. Countries such as India and China are investing heavily in eco-friendly raw materials amid rising environmental concerns. The region benefits from abundant raw material availability, cost-effective labor, and increasing adoption of natural fibers in home textiles, fashion, and automotive interiors.

China is a major hub for flax fiber production and consumption, driven by its massive textile industry and export-oriented manufacturing. Government emphasis on sustainable development and circular economy practices has further encouraged the use of natural fibers like flax. Additionally, rising consumer preference for eco-friendly clothing and growing investments in bio-based materials are accelerating market growth.

Europe Flax Fiber Market Trends

Europe represents a mature and innovation-driven market for flax fibers, supported by stringent environmental regulations, strong consumer demand for sustainable products, and a well-established textile industry. Countries such as France, Belgium, and the Netherlands are key producers, while demand is being boosted by the circular fashion movement, green construction materials, and EU sustainability policies.

Germany stands out in Europe for its strong industrial base and technological expertise in developing flax-based composites for automotive and engineering applications. The country is also a leading player in the sustainable textile segment, with growing demand from eco-conscious consumers and retailers. Research and development initiatives focusing on bio-based alternatives are further fueling flax fiber adoption.

Central & South America Flax Fiber Market Trends

The Central & South America flax fibers market is gradually emerging, with Brazil and Argentina seeing increased agricultural production and textile innovation. Growing awareness of environmental sustainability, coupled with rising demand for natural fibers in fashion and home decor, is driving regional interest. However, limited infrastructure and lack of awareness may slow rapid growth without international collaboration and investment.

Middle East & Africa Flax Fiber Market Trends

The Middle East & Africa region presents a nascent but promising market for flax fibers, especially as governments push for diversification and sustainability. The construction sector’s interest in eco-friendly insulation and composite materials is creating new opportunities. While production remains limited, increasing import and distribution channels, along with rising demand for green textiles, are expected to boost growth.

Key Flax Fiber Company Insights

The flax fiber market includes prominent players such as Terre de Lin, Safilin, DEPESTELE Group, Van de Bilt Zaden en Vlas, CELC, Kingdom Holdings Limited, Eastern Europe Flax Fiber LLC, Lineo SAS, Swicofil AG, and HempFlax Group. These companies are actively pursuing strategies such as vertical integration, capacity expansion, and application-specific innovation to strengthen market presence. With rising demand for eco-friendly materials, leading firms are focusing on advanced retting and scutching technologies, the development of technical textiles, and enhancing performance attributes for industrial applications. Emphasis on traceability, certifications, and alignment with circular economy principles also remains critical for market leadership.

Moreover, top players are accelerating growth through partnerships, joint ventures, and technology-driven collaborations. For instance, in February 2024, Safilin announced a strategic alliance with a Scandinavian textile brand to launch a premium flax-linen apparel collection using European-grown fibers. This initiative supports both regional sourcing goals and sustainable fashion trends. Similarly, investments in biocomposites and construction-grade flax solutions are broadening market scope beyond traditional textiles, reinforcing flax fiber’s position as a durable, multifunctional, and future-focused material.

Key Flax Fiber Companies:

The following are the leading companies in the flax fiber market. These companies collectively hold the largest market share and dictate industry trends.

- Terre de Lin

- Safilin

- DEPESTELE Group

- Van de Bilt Zaden en Vlas

- CELC

- Kingdom Holdings Limited

- Eastern Europe Flax Fiber LLC

- Lineo SAS

- Swicofil AG

- HempFlax Group

Flax Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 680.1 million

Revenue forecast in 2033

USD 1,362.2 million

Growth rate

CAGR of 9.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; South Korea; Brazil; UAE

Key companies profiled

Terre de Lin; Safilin; DEPESTELE Group; Van de Bilt Zaden en Vlas; CELC; Kingdom Holdings Limited; Eastern Europe Flax Fiber LLC; Lineo SAS; Swicofil AG; HempFlax Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flax Fiber Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global flax fiber market report on the basis of application, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Fashion & Textile

-

Sportswear

-

Workwear

-

Smart Textiles and Sensors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global flax fiber market size was estimated at USD 631.4 million in 2024 and is expected to reach USD 680.1 million in 2025.

b. The global flax fiber market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2030 to reach USD 1.36 billion by 2033.

b. The fashion & textile segment of the market accounted for the largest revenue share of 37.0% in 2024, driven by the rising demand for sustainable and biodegradable materials.

b. Some of the key players operating in the flax fiber market include Terre de Lin, Safilin, DEPESTELE Group, Van de Bilt Zaden en Vlas, CELC, Kingdom Holdings Limited, Eastern Europe Flax Fiber LLC, Lineo SAS, Swicofil AG, HempFlax Group.

b. The key factors driving the flax fiber market include rising demand for sustainable textiles, growth in eco-friendly composites, supportive government policies, and increased adoption in automotive and construction industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.