- Home

- »

- Plastics, Polymers & Resins

- »

-

Flexible Plastic Packaging Market Size & Share Report, 2030GVR Report cover

![Flexible Plastic Packaging Market Size, Share & Trends Report]()

Flexible Plastic Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PE, PP, PVC, PA, PS), By Product (Pouches, Films & Wraps, Rollstock, Bags), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-583-0

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible Plastic Packaging Market Summary

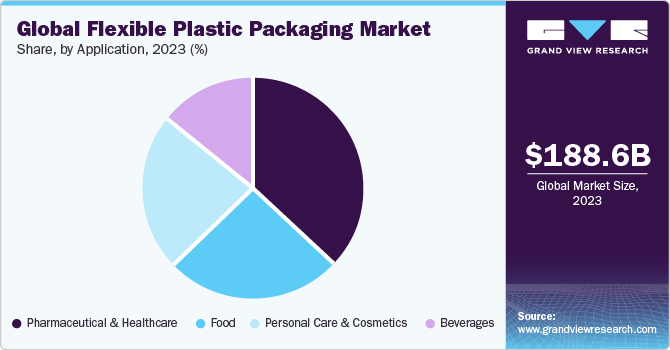

The global flexible plastic packaging market size was estimated at USD 188.63 billion in 2023 and is projected to reach USD 253.76 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030. Rapidly increasing demand for flexible plastic in pharmaceutical packaging owing to increasing health awareness among consumers and popularity of convenient packaging has driven the industry’s expansion and is expected to offer healthy growth prospects over the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the flexible plastic packaging market, accounting for the largest revenue share of around 43.0% in 2023.

- Germany flexible plastic packaging market held over 25% share of Europe in 2023.

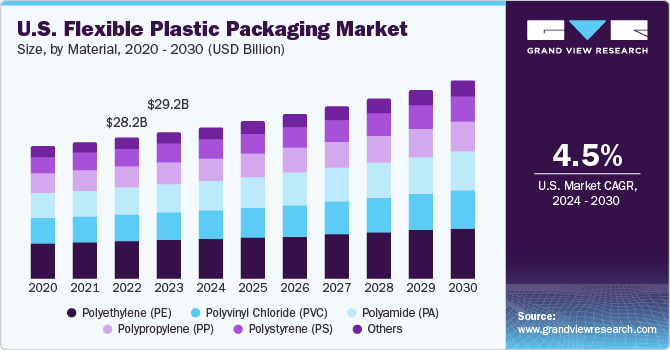

- By material, Polyethylene (PE) dominated the market with a revenue share of 26.3% in 2023.

- By product, the films & wraps segment is anticipated to grow at the fastest CAGR of 5.2% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 188.63 billion

- 2030 Projected Market Size: USD 253.76 billion

- CAGR (2024-2030): 4.4%

- Asia Pacific: Largest market in 2023

The flexible plastic packaging market’s growth is fueled by the increasing demand products such as stand-up pouches and flat pouches. Manufacturers of food and beverage products prefer stand-up pouches to differentiate their brands and gain a competitive advantage in market. Stand up pouches have flexibility of being tailored to offer unique designs, styles, and sizes.

Flexible packaging products have garnered widespread popularity in healthcare applications. Flexible plastic packaging saves space on retail shelves or displays. This attractive and see-through packaging is easy to recycle, lightweight, and cost-effective. These bags and pouches help reduce food waste and extend product shelf life. They are also resistant to dents, damage, and breakage.

Regulatory organizations such as the Environmental Protection Agency (EPA) have implemented various guidelines to govern the market. This regulatory body has promulgated Organic Chemicals, Plastics and Synthetic Fibers (OCPSF) concerning the discharge of plastic products. Several product usage restrictions have forced the market players to conform to regulatory guidelines set up by various bodies. Considering these restrictions, key players are adopting sustainability as the fourth pillar of their long-term business strategy.

Recognizing the environmental challenges associated with packaging waste, manufacturers are striving to work with partners across value chain to help support a circular economy for packaging waste. For instance, In August 2023, Amcor and Mondelēz International, Inc. decided to jointly invest in Licella to fund the construction of first soft plastic advanced recycling facilities in Australia. New facility in Melbourne, Australia will use its innovative Catalytic Hydrothermal Reactor (Cat-HTR) technology to recycle end-of-life plastic back into a crude oil substitute suitable to produce new food-grade plastic packaging. It will be managed by Advanced Recycling Victoria (ARV), is scheduled for completion in 2025 and will initially process around 20,000 tons per annum of end-of-life plastic, with plans to scale up to 120,000 tons per annum.

Market Concentration & Characteristics

The global flexible plastic packaging market is characterized by a considerable number of small and medium-sized market players, thereby leading to a fragmented market environment, especially in the downstream segment. Major players use product differentiation as a key strategy to increase demand for their products. Strategies including economies of scale, pricing, enhanced quality of products, and extension of product portfolios have given major market players a competitive edge over small and medium-sized regional players operating in different regions.

Companies are increasingly focusing on introducing sustainable packaging material in flexible plastic packaging space. For instance, On February 5, 2024, Amcor signed a deal with Cadbury to source 1,000 tons of post-consumer recycled plastic to wrap its core Cadbury chocolate range, accelerating Cadbury’s ambitions to reduce its virgin plastic needs. Cadbury aims to use 50% recycled plastic for its wrappers across its chocolate blocks, bars, and pieces range produced in Australia.

In November 2023, Amcor signed a Memorandum of Understanding (MOU) with NOVA Chemicals Corporation regarding the procurement of mechanically recycled polyethylene resin (rPE) for use in flexible packaging films. The supply agreement enables the company to purchase SYNDIGO rPE resin, manufactured at mechanical recycling facility in Connersville, Indiana, U.S.

Material Insights

The polyethylene (PE) material segment dominated with a revenue share of 26.3% in 2023. Abundant availability of raw materials encouraged demand in this material segment. Pliability of PE makes it an ideal material in packaging solutions. It also demonstrates high chemical resistance and is inexpensive.

The polyamide (PA) material segment is anticipated to grow at a rapid CAGR of 5.0%, from 2024 to 2020, owing to the unique properties of this material such as mechanical strength, high flexibility, and excellent oxygen barrier. Polypropylene (PP) is increasingly being used in the food & beverage industry and is in huge demand in countries such as the U.S., China, and India. The segment’s growth can be attributed to the increasing popularity of plastic recycling in these countries.

The key manufacturers are investing in recycled materials to accompany the regulations governed by regulating authorities. For instance, In October 2023, Amcor signed a Memorandum of Understanding (MOU) with SK Geo Centric (SK), a leading petrochemical company based in South Korea, to source advanced recycled material primarily in Asia Pacific beginning in 2025. MOU with SK will enable the company to provide access to packaging solutions using recycled content for food and healthcare customers in key markets in Asia Pacific, as well as globally. These partnerships will help the company take toward achieving its target of 30% recycled content across its portfolio by 2030.

Product Insights

The pouches segment accounted for the largest market share of 60.3% in 2023. This product has gained widespread popularity owing to its convenience of storage. The manufacturers of packaged beverages such as mineral water, milk, and non-carbonated soft drinks increasingly prefer these products, which is anticipated to bode well for product demand.

The films & wraps segment is anticipated to grow at the fastest CAGR of 5.2% over the forecast period. From a manufacturer’s standpoint, films & wraps cater to the packaging requirements of samples in various industries, thereby offering them an opportunity to increase their scale of production. The availability of plastic films & wraps in required colors also helps companies with an opportunity for greater brand exposure by including company information on these pouches.

Application Insights

The key applications of flexible packaging products include food & beverages, pharmaceutical & healthcare, and personal care & cosmetics among others. In 2023, the pharmaceutical & healthcare segment dominated the industry with a revenue share of around 33.4%. It is expected to retain its prominent position over the forecast period. Application of flexible packaging in healthcare caters to basic requirements of offering protection to drugs. Other desired benefits concerning flexible packaging in healthcare applications include promoting product differentiation and enhancing the appeal of overall package.

The packaging industry has also witnessed significant innovations in the food & beverages segment. Recent developments in packaging of food & beverage products include employment of nano-coated technology. The use of this technology aided manufacturers to construct packaging with multi-layer barrier films that are clear. Such developments in packaging offer better protection to food & beverage products from contaminants.

In April 2023, Sealed Air and Koenig & Bauer AG signed an agreement to expand their strategic partnership for digital printing machines. The partnership aims to significantly improve packaging design capabilities by developing state-of-the art digital printing technology, equipment, and services. Solutions developed by SEE and Koenig & Bauer will scale and deliver digitally printed materials dramatically faster, enabling brand owners to promote products by connecting with consumers through a digitally enhanced package.

Regional Insights

The key players operating in North America market are expanding their production capacities, owing to the increasing demand from end-users. For instance, On January 31, 2024, Amcor expand its state-of-the art manufacturing facility in Oshkosh, Wisconsin, U.S. for increasing demand from customers in medical, pharmaceutical, and consumer health sectors. Expansion also allow to source thermoforms and companion die-cut lids from a single location, helping streamline product manufacturing and distribution.

U.S. Flexible Plastic Packaging Market Trends

TheU.S. flexible plastic packaging market holds majority share of North America. This can be attributed to the increasing rate of adoption of advanced packaging technologies. Various benefits offered by flexible plastic packaging solutions including reduced energy consumption and low cost of packaging, warehouse, and transportation.

Asia Pacific Flexible Plastic Packaging Market Trends

Asia Pacific dominated the flexible plastic packaging market and accounted for largest revenue share of around 43.0% in 2023. Asia Pacific has witnessed a significant increase in disposable income among consumers, thereby enabling them to buy products from a sizable number of retail locations. The key manufacturers in APAC have started investing in improving production process to protect product integrity. For instance, In September 2023, Sealed Air collaborated with Sparck Technologies's for automated packaging systems to improve its packaging products operations. It is a provider of 3D automated packaging solutions, in Australia, New Zealand, Japan, and South Korea.

The China flexible packaging market has registered substantial growth, in terms of both production and consumption. This growth is stimulated by the healthy growth of Chinese economy, thereby leading to an increase in production of products such as healthcare and food & beverage, exports and imports, and consumer consumption.

The flexible plastic packaging market in India is anticipated to grow at a CAGR of over 6.5% during the forecast period. Rapidly changing food habits in country coupled with increasing demand for convenience packaging has fueled demand for consumption of flexible packaging products such as stand-up pouches and flat pouches.

Europe Flexible Plastic Packaging Market Trends

The flexible packaging market in Europe is expected to witness increasing product demand, owing to a high growth of the food & beverage sector. In the food category, the industry has benefited from a substantial sale of ready-to-eat food products along with fruit compotes. Packaging requirements is driven by increasing replacement of substitutes for flexible plastic packaging such as glass and metal packaging.

The Germany flexible plastic packaging market held over 25% share of Europe in 2023. Germany is the largest food producer in Europe and has encouraged the manufacturers of flexible plastic packaging to target the consumers in the county. This has contributed to the growth of the Germany market.

The flexible plastic packaging market in the UK is s anticipated to grow at a CAGR of over 2.8% during the forecast period. The market is strengthened by healthy growth of healthcare personal care industries. The rising popularity of cost-effective and attractive designs in packaging for various products has favored market growth in the country.

Central & South America Flexible Plastic Packaging Market Trends

The growth of the flexible plastic packaging market in Central & South America is driven by the high growth of end-use industries in key economies including Brazil and Argentina. Growing personal care, consumer goods, and other industries have contributed significantly to the regional demand for flexible plastic packaging products.

The Brazil flexible plastic packaging market is expected to grow at the fastest CAGR during the forecast period, due to the increasing consumer demand for greater transparency from the key brands concerning packaged food ingredients has led to emergence of novel packaging technologies in the country.

Middle East & Africa Flexible Plastic Packaging Market Trends

Middle East & Africa is expected to witness increased demand for flexible plastic packaging products from personal care and household care industries. This is backed by the substantial increase in the sales of detergents, cleaners, shampoos, liquid soaps, and other products.

The Saudi Arabia flexible plastic packaging market is driving by changing eating habits and lifestyles of consumers. Country is witnessing high growth of retail grocery market, thereby necessitating the application of flexible plastic packaging products.

Key Flexible Plastic Packaging Company Insights

The market is highly fragmented with the presence of a sizable number of small and medium-sized companies. Key players mainly cater to food and beverage, pharmaceuticals, and cosmetics industries. The flexible plastic packaging industry has been witnessing a significant rise in mergers & acquisitions and new product launches over the past few years.

-

In February 2023, Sealed Air acquired Liquibox for a purchase price of USD 1.15 billion on a cash and debt-free basis. Liquibox is a pioneer, innovator, and manufacturer of Bag-in-Box sustainable fluids & liquids packaging and dispensing solutions for fresh food, beverage, consumer goods, and industrial end-markets.

-

In August 2023, Amcor acquired Phoenix Flexibles, expanding its capacity in the Indian market. Phoenix Flexibles is situated in Gujarat, India, and generates revenue of approximately USD 20 Mn per year from the sale of flexible packaging for food, home care, and personal care applications. The acquisition also adds advanced film technology, enabling local production of a broader range of more sustainable packaging solutions, and brings capabilities allowing Amcor to expand its product offering in attractive high-value segments.

Key Flexible Plastic Packaging Companies:

The following are the leading companies in the flexible plastic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Sonoco Products Company

- Sealed Air Corporation

- Amcor Plc.

- Constantia Flexibles Group GmbH

- Berry Global Group Inc.

- Huhtamaki Oyj

- Bemis Company, Inc.

- AR Packaging Group AB

- Mondi Group

- DS Smith Plc.

- CCL Industries Inc.

- Westrock Company

- Transcontinental Inc.

- Uflex Limited

- Novolex (Carlyle Group)

- Bischof + Klein SE & Co. KG

- Silafrica

- ProAmpac

- PPC Flexible Packaging LLC

- Printpack Inc.

- Cosmo Films Limited

- Wihuri Group

- C-P Flexible Packaging

- Gualapack S.p.A.

Flexible Plastic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 195.51 billion

Revenue forecast in 2030

USD 253.76 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Sonoco Products Company; Sealed Air Corporation; Amcor Plc.; Constantia Flexibles Group GmbH; Berry Global Group Inc.; Huhtamaki Oyj; Bemis Company, Inc.; AR Packaging Group AB; Mondi Group; DS Smith Plc.; CCL Industries Inc.; Westrock Company; Transcontinental Inc.; Uflex Limited; Novolex (Carlyle Group); Bischof + Klein SE & Co. KG; Silafrica; ProAmpac; PPC Flexible Packaging LLC; Printpack Inc.; Cosmo Films Limited; Wihuri Group; C-P Flexible Packaging; Gualapack S.p.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexible Plastic Packaging Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the flexible plastic packaging market report based on material, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pouches

-

Rollstock

-

Films & Wraps

-

Bags

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverages

-

Pharmaceutical & Healthcare

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flexible plastic packaging market size was estimated at USD 188.63 billion in 2023 and is expected to reach USD 195.51 billion in 2024.

b. The global flexible plastic packaging market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 and reach USD 253.76 billion by 2030.

b. Asia Pacific dominated the flexible plastic packaging market with a share of 43.5% in 2023. This is attributable to the burgeoning demand for flexible packaging solutions owing to the emergence of robust e-commerce infrastructure.

b. Some key players operating in the flexible plastic packaging market include Sonoco Products Company, Sealed Air, Sonoco Products Company, Amcor Plc., Constantia Flexible Group GmBH, Berry Global Group Inc., Huhtamaki Oyj, Sonoco Products Company, Bemis Company, Inc., AR Packaging Group AB, Mondi Group, DS Smith Plc., CCL Industries Inc., and Westrock Company.

b. Key factors that are driving the market growth include surging demand for flexible plastics in pharmaceutical packaging, owing to increasing health awareness among consumers and the burgeoning popularity of convenient packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.