- Home

- »

- Plastics, Polymers & Resins

- »

-

Flexitank Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Flexitank Market Size, Share & Trends Report]()

Flexitank Market Size, Share & Trends Analysis Report By Product (Single Trip, Multi-trip), By Application (Foodstuffs, Chemicals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-745-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Flexitank Market Size & Trends

The global flexitank market size was estimated at USD 1.12 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 22.8% from 2024 to 2030. Increasing global trade activities, along with competitive flexitank benefits over their conventional substitutes such as ISO containers, drums, barrels, and IBCs, is expected to drive market growth. Flexitanks have capacities ranging from 12,000 liters to 26,000 liters. They are generally deployed for shipping a wide range of liquid products, such as wines, concentrates, fruit juices, edible oils, mineral water, malt extracts, lubricants, tallow, non-hazardous chemicals, fertilizers, and pharmaceuticals.

The U.S. consists of some of the world’s largest pharmaceutical companies, including Pfizer, Johnson & Johnson, Eli Lilly and Company, and Abbott Laboratories. These companies prefer single-trip flexitanks for transportation of temperature-sensitive liquids, thus resulting in significant growth prospects for the industry in the U.S. Flexitanks are considerably more inexpensive than ISO containers and drums and carry approximately 15% more payload than IBCs and 44% more than drums, which makes them economically favored bulk packaging solutions. Moreover, they are mainly designed for single use, which reduces contamination risks.

A growing need to reduce the weight of bulk packaging to increase the cost-effectiveness of freight is projected to support market growth. In addition, low labor and logistic costs associated with flexitanks handling, zero cleaning cost owing to one-time use, and eco-friendliness are a few factors that are likely to fuel product demand over the forecast years. However, factors such as leakage or breakage of contents in these tanks result in total loss of shipper, which may reduce product usage for transportation of hazardous liquids, thereby limiting market growth. Moreover, fluctuating prices of plastic resins, raw materials for manufacturing flexitanks, are expected to pose challenges to manufacturers.

Market Dynamics

Increasing commodity trade and the cost-effectiveness of these tanks over their counterparts are preponderance for the market. An uneven production and consumption rate over different geographical areas creates a need for commodity trade. The huge growth of international trade over the past several decades has been a major cause of globalization. Therefore, consumers globally enjoy a wider choice of products than they would if they only had access to locally produced products on account of increasing international trade. In response to the ever-expanding flow of services, goods, and capital, a whole group of government organizations and international institutions have been formed to help cope with these rapidly developing trends.

Flexitanks are more economical packaging solution than ISO tanks and drums and have become key alternative packaging solutions for companies looking to cut costs on transportation of liquids including wines, soft drinks, juice concentrates, liquid latex, agricultural oils, non-hazardous chemicals, biofuels, and glycerin. They offer low labor and loading costs with no repositioning costs, which is the best option for transporting bulk liquids to remote destinations.

Product Insights

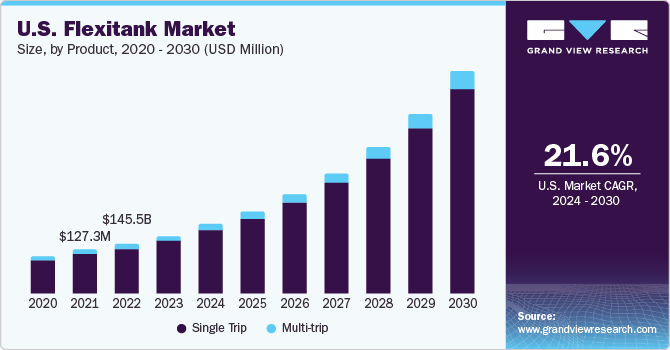

Single-trip product segment led the market in 2023 with a revenue share of over 93.0%. The segment is estimated to retain its leading position throughout the forecast period due to low cost and wide availability of single-trip products. Furthermore, a low risk of product contamination associated with single-trip flexitanks will augment their demand in the coming years.

Usually, 1mm thick PE is incorporated as the inner material in these products to enhance the package's barrier properties. Single-trip products are ideal for transporting polymers, lubricating & transformer oils, surfactants, liquid malt, cement & construction additives, edible oils, and specialty chemicals. However, the segment is expected to lose its share of the multi-trip product segment, owing to rising demand for multi-trip flexitanks, as a result of the high sustainability offered by these products.

In terms of volume, the multi-trip product segment is projected to expand at a considerable CAGR over the forecast period. These flexitanks rank high on the sustainability front as they can be reused numerous times, thereby optimizing Total Cost of Ownership (TCO). Thus, these bulk packages are comparatively more efficient throughout the logistical circuit.

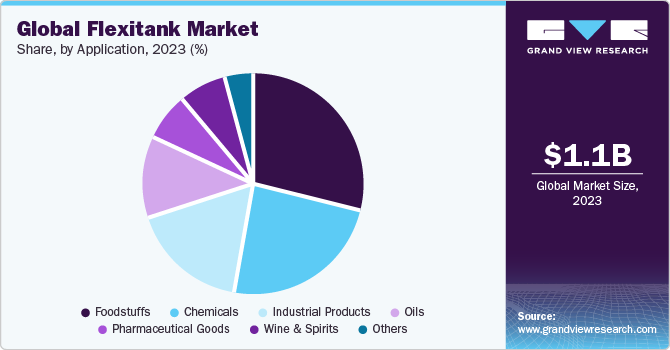

Application Insights

The foodstuffs application segment led the market in 2023 with a global revenue share of 28.0% owing to high demand from end-use applications, such as fruit juices, sauces, concentrates, edible oils, and bakery and confectionery products. The rapid expansion of retail chains and rising food requirements due to the growing population in emerging economies are anticipated to boost product demand in this segment in the coming years.

Wine products are usually at risk of spoilage when packaged using ordinary shipping boxes. Polyethylene-based flexitanks help combat this issue and are being increasingly used by wine producers globally to replace insulated pouches or insulated shipping containers. Double- and multi-layered PE is among the most widely used materials for the packaging of wine.

An increasing number of chemical companies are adopting flexitanks over traditional corrugated packaging due to their low cost and high durability. In addition, flexitanks for applications in the chemical industry can be manufactured from recycled plastic resins, which eliminates the need for 100% virgin polymers. This further lowers product prices and supports sustainability.

In oil transportation, flexitanks are commonly utilized for the transportation of base oils, lubricants, and transformer oils. Overall drive-in innovation and production have led to demand for industrial lubricants, such as metalworking fluids, greases, and process oils, which are required for smooth machinery functioning. Growing demand for lubricants owing to the global manufacturing sector's steady growth is expected to benefit the oil segment in the market.

Regional Insights

Asia Pacific dominated the market in 2023 with the largest revenue share of over 45.0%, owing to the presence of the two largest agricultural-producing and consuming countries, namely China and India. In addition, high production, coupled with the export of palm oil from Indonesia and Malaysia, contributes to regional market growth.

Furthermore, several key companies in Europe and North America have been outsourcing production activities to India and China owing to lower production costs in these countries. Thus, a visibly strong growth in the food as well as pharmaceutical sectors is anticipated to increase demand for such tanks in the Asia Pacific region over the forecast period.

The European market is projected to advance at a substantial rate during the projection period. This growth is expected to be aided by the increasing rate of production and export of temperature-sensitive pharmaceuticals, especially in economies such as France, Germany, Belgium, Switzerland, and the Netherlands.

North America is poised to expand at a strong CAGR during the forecast period, on account of the U.S. manufacturing industry's steady growth. Moreover, the presence of favorable trade agreements such as NAFTA, which permit free trade within the U.S., Canada, and Mexico, is projected to favor market growth.

Key Companies & Market Share Insights

The global market is highly fragmented with the presence of a significant number of companies. Competitive prices and advancements in technologies, coupled with innovative packaging solutions, are followed by market players to gain a competitive advantage. The presence of small-scale manufacturers that serve regional as well as international markets is likely to boost competition for key industry participants.

Major companies have implemented numerous organic and inorganic growth strategies to bolster their market position. In addition, new product launches and regional expansions are among the key business strategies adopted by these players to enhance their product portfolio and cater to rising product demand.

-

In November 2023, ASF, Inc., a logistics service provider, announced the expansion of its flexitank portfolio providing highly efficient and environmentally friendly forms of shipping for non-hazardous bulk liquid cargo.

Key Flexitank Companies:

- Qingdao BLT Packing Industrial Co., Ltd. (BLT)

- Braid Logistics UK Ltd.

- Bulk Liquid Solutions Pvt. Ltd.

- Büscherhoff Packaging Solutions GmbH

- Environmental Packaging Technologies, Inc.

- Full-Pak

- HOYER GmbH

- K Tank Supply Ltd.

- Mak & Williams Flexitank Supply Ltd.

- MY FlexiTank (MYF)

- KriCon Group BV

- Qingdao LAF Packaging Co., Ltd.

- SIA FLEXITANKS

- Yunjet Plastics Packaging

- Trans Ocean Bulk Logistics Ltd.

- TRUST Flexitanks

- FLUIDTAINER FLEXITANK Sdn Bhd

- Hinrich Industries

- One Flexitank Industries Sdn Bhd

- ORCAFLEXI SDN BHD

- Infinity Bulk Logistics Sdn Bhd

- Rishi FIBC Solutions Pvt Ltd. (India)

Flexitank Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.36 billion

Revenue forecast in 2030

USD 4.75 billion

Growth rate

CAGR of 22.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in units, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Belgium; The Netherlands; China; India; Japan; Australia; Singapore; Malaysia; Argentina; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Braid Logistics UK Ltd.; Bulk Liquid Solutions Pvt. Ltd; Qingdao BLT Packing Industrial Co., Ltd. (BLT); Full-Pak; Environmental Packaging Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexitank Market Report Segmentation

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flexitank market report based on product, application, and region:

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Single trip

-

Multi-trip

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Foodstuffs

-

Wine & Spirits

-

Chemicals

-

Oils

-

Industrial Products

-

Pharmaceutical Goods

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Belgium

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flexitank market was estimated at USD 1.12 billion in the year 2023 and is expected to reach USD 1.36 billion in 2024.

b. The global flexitank market is expected to grow at a compound annual growth rate of 22.8% from 2024 to 2030 to reach USD 4.75 billion by 2030.

b. Single-trip dominated the flexitank market with a share of 93.20% in 2023, owing to its low cost, wide availability, and its ability to transport liquid products without contamination.

b. Qingdao BLT Packing Industrial Co., Ltd. (BLT); Braid Logistics UK Ltd.; Bulk Liquid Solutions Pvt. Ltd.; Büscherhoff Packaging Solutions GmbH; Environmental Packaging Technologies, Inc.; Full- Pak; K Tank Supply Ltd.; MY Flexitank; Kricon Group BV; Qingdao LAF Packaging Co., Ltd.; SIA FLEXITANKS; Yunjet Plastics Packaging; Trans Ocean Bulk Logistics Ltd.

b. The key factors that are driving the flexitank market include increasing trade across the countries and the competitive benefits of flexitanks over its traditional substitutes such as ISO containers, drums, barrels, and IBC’s.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."