- Home

- »

- Plastics, Polymers & Resins

- »

-

Folding Carton Packaging Market Size, Industry Report, 2030GVR Report cover

![Folding Carton Packaging Market Size, Share & Trends Report]()

Folding Carton Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By End-use (Food & Beverage, Household, Healthcare, Personal Care & Cosmetic, Electrical & Electronics, Tobacco), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-846-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Folding Carton Packaging Market Summary

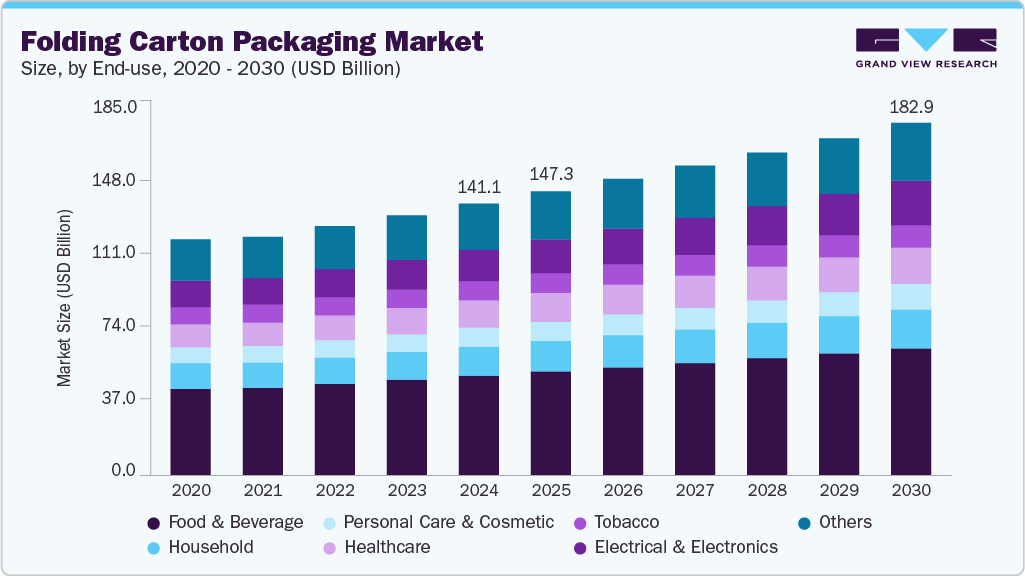

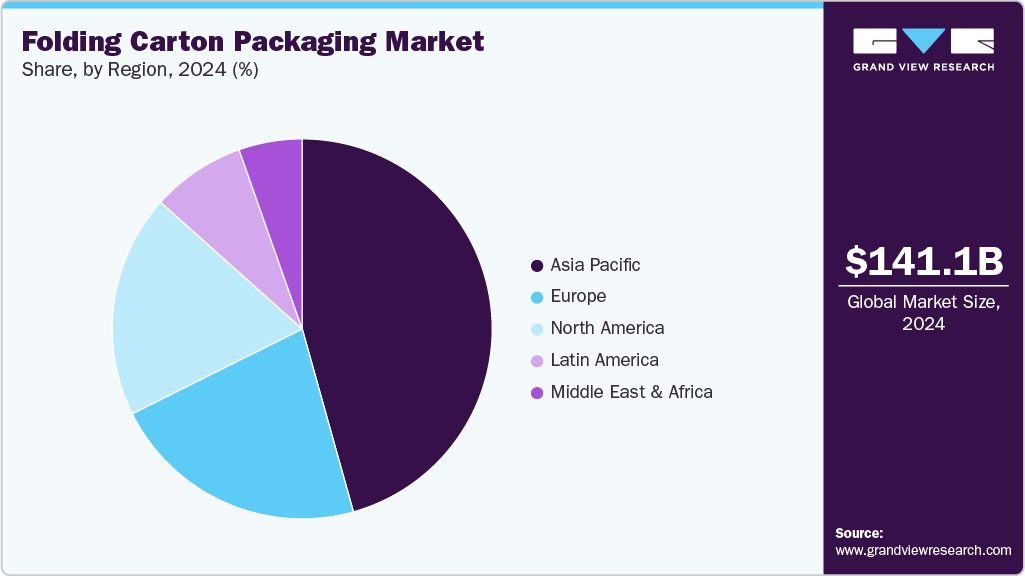

The global folding carton packaging market size was estimated at USD 141.1 billion in 2024 and is projected to reach USD 182.9 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The growing preference for biodegradable packaging over plastic is expected to boost the demand for folding cartons.

Key Market Trends & Insights

- Asia Pacific folding carton packaging dominated the global market, with a revenue share of 45.7% in 2024.

- China's folding carton packaging market dominated the Asia Pacific market with the largest revenue share in 2024.

- By end-use, the food and beverage industry segment dominated the folding carton packaging market with a revenue share of 36.7% in 2024.

Market Size & Forecast

- 2024 Revenue: USD 141.1 Billion

- 2030 Projected Market Size: USD 182.9 Billion

- CAGR (2025-2030):4.4%

- Asia-Pacific: Largest market in 2024

Folding cartons are made of paperboard, and the wide availability and sustainability of paperboard at a lower cost make folding cartons a popular packaging choice among end-use industries.Additionally, folding cartons can be produced in varied sizes per end-use application compared to bulkier packaging solutions, further attracting end-user industries. Folding cartons provide several advantages, such as excellent printability, rigidity, and flexibility. As a result, they are widely used for packaging small and medium-sized food and beverage products and consumer goods. The growing global ban on single-use plastics and increasing consumer awareness of sustainability are driving industries to adopt eco-friendly, non-plastic packaging solutions.

Folding cartons are widely used across cosmetics, pharmaceuticals, consumer electronics, toys, apparel, e-commerce, and retail industries. Their versatility offers benefits such as protection, easy handling, and branding customization. They help maintain product integrity, provide sustainable packaging solutions, and support marketing efforts with eye-catching designs. Modern folding and forming equipment, including automated folding and gluing machines, has boosted production efficiency with faster, precise operations. These advancements enable enhanced surface finishes such as embossing, foiling, and varnishing, improving both the aesthetics and functionality of paperboard packaging.

Anti-counterfeit technologies such as RFID, embedded barcode, and others can be easily incorporated on the folding cart due to its excellent printability and rigidity. Increasing incorporation of anti-counterfeit measures into product packaging owing to rising counterfeiting is further expected to drive the market. However, fluctuation in wood pulp prices owing to the demand-supply gap is expected to negatively impact the market growth as it leads to a substantial reduction in the profit margin of the folding carton manufacturers.

End-use Insights

The food and beverage industry dominated the folding carton packaging market with a revenue share of 36.7% in 2024. A busy lifestyle and an increasing working women population have led to the rise in the consumption of ready-to-eat food products. The online food delivery market is expanding due to convenience, technological advancements, and changing consumer preferences. The COVID-19 pandemic accelerated this shift, while various food options and promotional offers further boosted demand. This growth drives the need for folding carton packaging, which provides durability, sustainability, and customization. Its lightweight, stackable design ensures safe, secure food transport, making it a preferred packaging choice for food delivery services.

The electrical and electronics segment of the folding carton packaging market is expected to grow at the fastest CAGR of 5.7% over the forecast period. The folding carton packaging market in the electrical and electronics segment is growing due to robust protection for sensitive products, customizable designs, cost-effectiveness, sustainability, and efficient storage. With rising technological advancements and the development of compact-sized electronic products, folding cartons offer an ideal packaging solution. Their ability to protect, customize, and cater to eco-conscious consumers contributes to their increasing demand in the electronics industry, presenting opportunities for manufacturers.

Folding cartons find significant application in tobacco packaging owing to its convenience and printability. The global tobacco industry has been witnessing considerable traction despite the severe taxation and bans, mainly due to increasing demand from the millennial population. Increasing stress levels among the younger population have also been fueling the demand for tobacco products such as cigarettes. Therefore, the growing tobacco industry is also anticipated to generate considerable demand for folding cartons in the coming years.

The personal care and cosmetic industry have experienced considerable growth over the past few years due to increasing demand for organic beauty products. Furthermore, the rising aging population has resulted in augmented demand for skincare products. Therefore, expanding the personal care and cosmetics market is anticipated to fuel the demand for folding cartons in the coming years.

Regional Insights

Asia Pacific folding carton packaging dominated the global market, with a revenue share of 45.7% in 2024. Asia Pacific, home to emerging economies such as China, India, and Indonesia, is witnessing increased demand for packaging solutions due to higher disposable incomes, changing consumer lifestyles, and a growing appetite for packaged foods such as ready-to-eat meals. The rise of organized retail chains and e-commerce penetration further fuels this demand.

Folding cartons, favored for their durability and sustainability, are widely used by e-commerce companies for product delivery, which is expected to drive market growth in the region.

China Folding Carton Packaging Market Trends

China's folding carton packaging market dominated the Asia Pacific market with the largest revenue share in 2024. The folding carton packaging market in China is growing due to key factors such as rapid urbanization, which increases demand for packaged goods, including food and consumer products. E-commerce has fueled the need for eco-friendly, durable packaging for online deliveries. As sustainability awareness grows, businesses and consumers favor recyclable and biodegradable packaging solutions. Increasing disposable incomes have increased demand for packaged products, especially ready-to-eat meals.

Middle East & Africa Folding Carton Packaging Market Trends

The Middle East and Africa folding carton packaging industry is expected to grow significantly at a CAGR of 4.9% over the forecast period. Changing consumer lifestyles and rising government emphasis on environmentally friendly packaging are anticipated to boost regional market growth.

The folding carton packaging market in Saudi Arabia led the Middle East and Africa market with the largest revenue share in 2024. Saudi Arabia’s robust economic development, driven by diversification efforts under Vision 2030, has increased demand for packaged goods across various sectors, including food, beverages, and consumer products. Government initiatives promoting sustainability and the reduction of plastic waste are encouraging the adoption of recyclable packaging materials, including folding cartons.

North America Folding Carton Packaging Market Trends

North America folding carton packaging market held a substantial market share in 2024. The surge in online shopping has significantly increased the demand for folding cartons. These cartons protect products during transit and offer cost-effective shipping solutions. Innovations in packaging technologies, such as integrating smart packaging features such as QR codes and NFC tags, enhance product traceability and consumer engagement.

The U.S. dominated the North American folding carton packaging market, with a revenue share of 76.7% in 2024. The demand for folding cartons has increased with the growth of the food and beverage industry. They are tailored to various shapes and sizes, accommodating various products from dry goods to frozen foods and beverages. The rising consumer demand for electronics, including smartphones, laptops, and home appliances, necessitates protective and visually appealing packaging.

Key Folding Carton Packaging Company Insights

Key companies in the folding carton packaging market include Smurfit Kappa, WestRock, Graphic Packaging International, LLC, and Mayr-Melnhof Karton AG

-

Smurfit Kappa operates in 22 European countries, 13 in the Americas, and one in Africa. The company offers diverse products, including corrugated packaging, solid board, folding cartons, Bag-in-Box, and various paper grades. It works in multiple industries, such as Food and Beverage, Retail and Consumer Goods, Pharmaceuticals and Healthcare, and Agriculture and Horticulture.

-

WestRock offers a variety of products, including containerboard and paperboard (folding cartons, bleached paperboard, coated recycled paperboard, retail displays), kraft paper and pulp, and corrugated containers for diverse packaging needs.

Key Folding Carton Packaging Companies:

The following are the leading companies in the folding carton packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Smurfit Kappa

- WestRock

- Graphic Packaging International, LLC

- Seaboard Folding Box Company, Inc.

- Quad

- Huhtamaki

- Amcor plc

- KapStone Paper and Packaging Corporation

- Mayr-Melnhof Karton AG

- Georgia-Pacific

Recent Developments

-

In January 2025, Huhtamäki appointed Ralf K. Wunderlich as its new CEO and President. Wunderlich, a member of Huhtamäki’s Board of Directors since 2018, succeeds Charles Héaulmé, who will remain available until July 2025 to ensure a smooth transition.

-

In January 2024, Hood Container Corp. announced the acquisition of Sumter Packaging Corp. Sumter offers graphic packaging, high-graphic corrugated displays, and corrugated packaging, and it services various end markets, including industrial products, paper and packaging, healthcare, home improvement, furniture, F&B, automotive, and consumer products.

Folding Carton Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 147.3 billion

Revenue forecast in 2030

USD 182.9 billion

Growth Rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD mlion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; France; UK; China; Japan; India; Brazil; Saudi Arabia

Key companies profiled

Smurfit Kappa; WestRock; Graphic Packaging International, LLC; Mayr-Melnhof Karton AG; Seaboard Folding Box Company, Inc.; Quad; Huhtamaki; Amcor plc; KapStone Paper and Packaging Corporation; and Georgia-Pacific

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Folding Carton Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global folding carton packaging market report based on end-use and region:

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Food & Beverage

-

Household

-

Personal Care & Cosmetic

-

Healthcare

-

Tobacco

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.