- Home

- »

- Plastics, Polymers & Resins

- »

-

Fresh Food Packaging Market Size, Industry Report, 2033GVR Report cover

![Fresh Food Packaging Market Size, Share & Trends Report]()

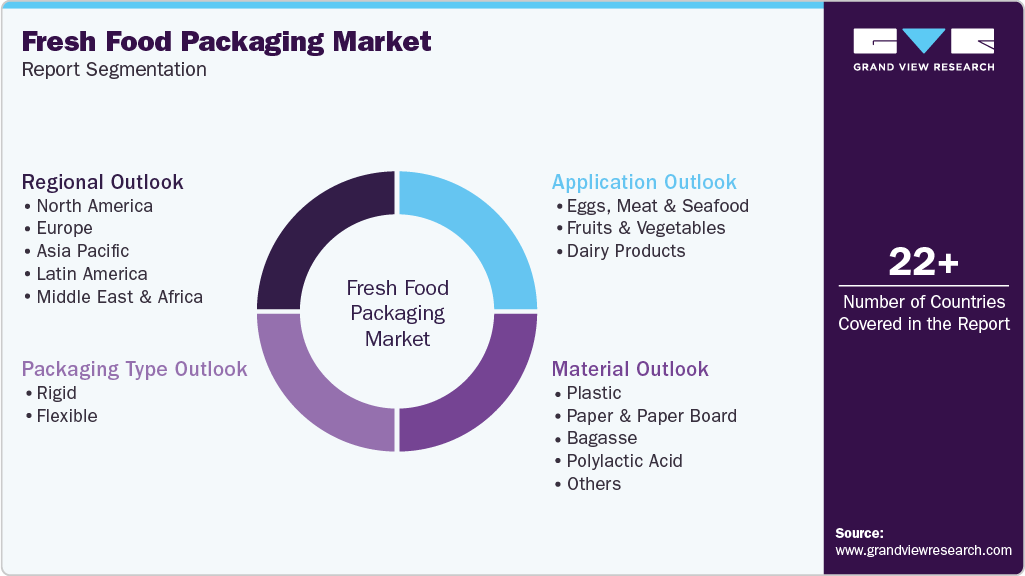

Fresh Food Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Packaging Type (Rigid, Flexible), By Material (Plastic, Paper & Paper Board, Bagasse, Polylactic), By Application (Fruits & Vegetables, Dairy Products), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-437-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fresh Food Packaging Market Summary

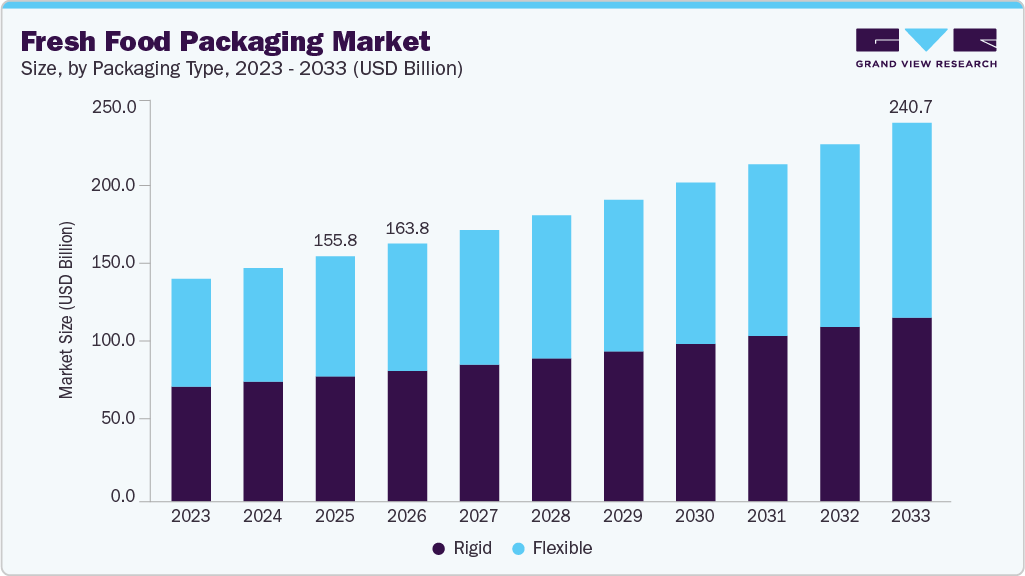

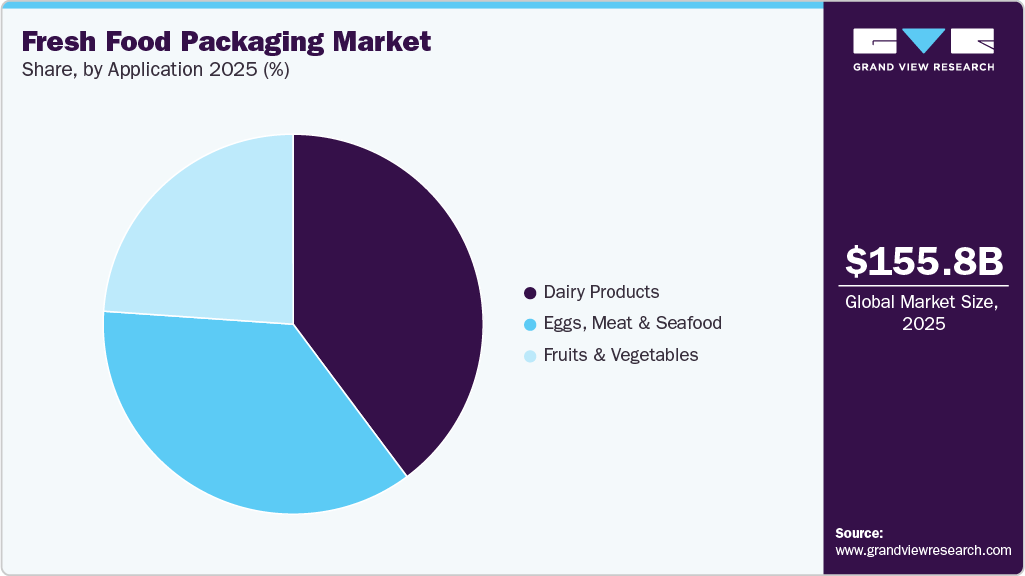

The global fresh food packaging market size was estimated at USD 155.83 billion in 2025 and is projected to reach USD 240.68 billion by 2033, growing at a CAGR of 5.6% from 2026 to 2033. Increasing demand for organic fresh food products like fruits, vegetables, and dairy from diet and health-conscious consumers is expected to have a positive impact on the market over the forecast period.

Key Market Trends & Insights

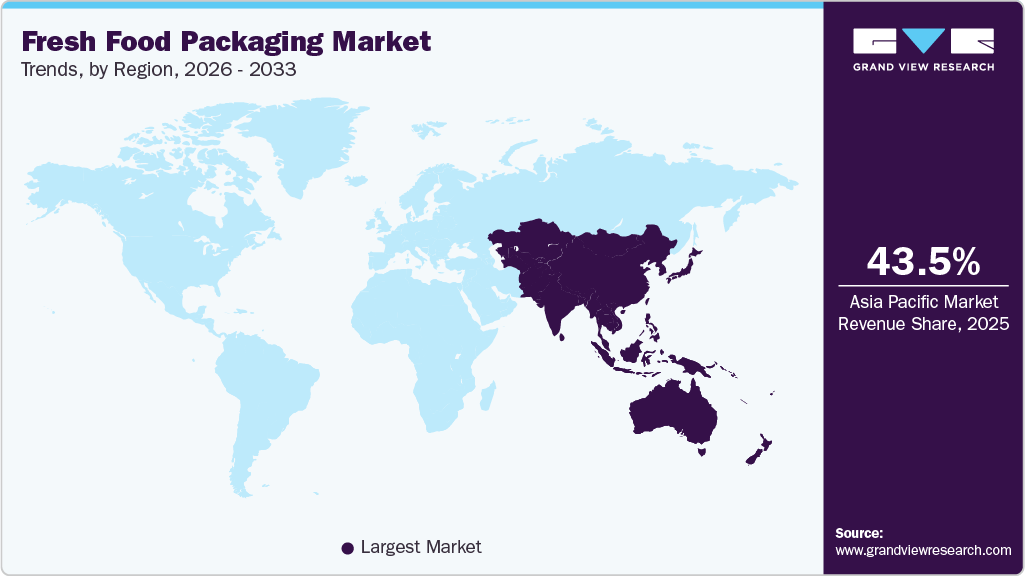

- Asia Pacific dominated the market with a revenue share of 43.52% in 2025.

- China’s fresh food packaging demand is rising rapidly due to structural shifts in food distribution and consumption patterns.

- Based on packaging type, the rigid fresh food packaging segment led the market and accounted for a 50.9% share of the global revenue in 2025.

- Based on material, the plastic segment dominated the global market, accounting for more than 36.8% of revenue in 2025.

- Based on application, the dairy products segment accounted for the highest revenue share of over 39.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 155.83 Billion

- 2033 Projected Market Size: USD 240.68 Billion

- CAGR (2026-2033): 5.6%

- Asia Pacific: Largest market in 2025

Furthermore, ever-increasing foodservice operators and retail chains in North American and European economies are projected to switch from plastic packaging to a sustainable solution to attract an environment-conscious consumer base in the region. Thus, the aforementioned factors are expected to drive the demand for eco-friendly fresh food packaging.The global industry is experiencing steady growth driven primarily by rising demand for fresh and minimally processed food products. Consumers across both developed and emerging economies are increasingly prioritizing fresh fruits, vegetables, meat, seafood, and dairy due to growing health awareness and a preference for natural, preservative-free foods. This shift has significantly increased the need for packaging solutions that preserve freshness, prevent contamination, and extend shelf life while maintaining product quality throughout storage and distribution.

Another major growth driver is the rapid expansion of modern retail formats and organized food distribution networks worldwide. Supermarkets, hypermarkets, and convenience stores rely heavily on effective packaging to maintain product hygiene, improve shelf appeal, and reduce food waste. Furthermore, the growth of e-commerce and online grocery platforms has intensified demand for durable, lightweight, and protective packaging that can withstand longer and more complex supply chains while ensuring food safety during transportation.

Additionally, sustainability considerations are also shaping the growth of the fresh food packaging market. Governments, retailers, and consumers are increasingly pushing for recyclable, reusable, and bio-based packaging materials to reduce environmental impact. This has encouraged manufacturers to develop eco-friendly alternatives such as recyclable mono-material plastics, paper-based trays, and compostable films, supporting market expansion while aligning with evolving regulatory frameworks.

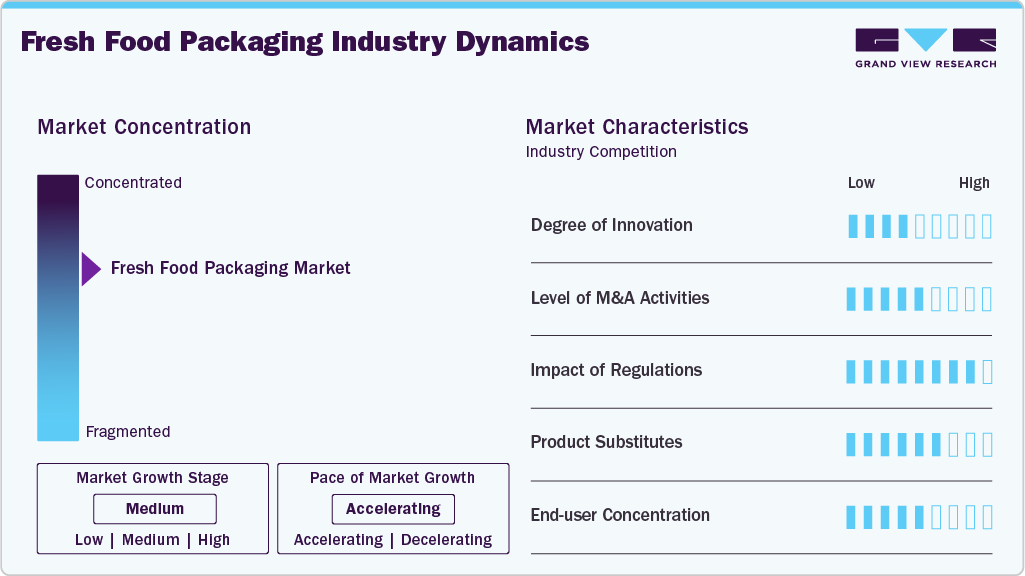

Market Concentration & Characteristics

The industry is characterized by a high volume demand, strong reliance on food safety standards, and continuous innovation in materials and formats. Packaging solutions must preserve freshness, prevent contamination, and extend shelf life while maintaining product visibility and appeal. As fresh foods are highly perishable, the industry places strong emphasis on barrier properties, temperature resistance, and compatibility with cold-chain logistics, making performance and reliability critical competitive factors.

The industry is moderately fragmented, with a mix of large multinational packaging companies and numerous regional and local players serving specific food categories or geographies. Leading companies benefit from scale, advanced manufacturing capabilities, and long-term relationships with food producers and retailers, while smaller players compete through cost efficiency, customization, and proximity to end users. Product differentiation is driven by material innovation, lightweighting, sustainable designs, and value-added features such as resealability and modified atmosphere compatibility.

Regulatory compliance and sustainability are defining structural characteristics of the fresh food packaging industry. Packaging materials must meet strict food-contact regulations and increasingly align with environmental policies aimed at reducing plastic waste and improving recyclability. As a result, manufacturers are investing in recyclable, bio-based, and mono-material solutions while balancing cost, performance, and regulatory requirements. This regulatory and sustainability-driven environment continues to shape investment decisions, innovation pipelines, and long-term industry competitiveness.

Packaging Type Insights

The rigid fresh food packaging segment emerged as the largest type segment in 2025 and accounted for the largest revenue share of 50.9%. Rigid solutions provide stronger support to the goods that are packed with firm bases and barrier walls. Products packed in a rigid type of packaging are easy to ship from one place to another without damaging the contents, owing to the sturdy structure of the packaging.

These packs are easy to store due to their higher degree of stack ability in warehouses, during transit, and displayed on shelves in retail stores. It can protect the food from damage or external impact during handling and transportation, leading to higher demand from the eggs, fruits, and vegetable manufacturers.

The flexible fresh food packaging segment is expected to witness a CAGR of 6.3% over the forecast period. Flexible packages, including films such as shrink film, stretch film, and pouches, offer greater convenience in handling as they are lightweight and easy to carry. Pouches and bags are compact and thereby occupy less space in warehouses and retail stores, leading to high growth of the market for fresh food packaging.

In comparison to rigid formats, flexible packaging requires less material, reduces transportation and storage costs, and offers greater design flexibility, making it well-suited for high-volume fresh produce, meat, seafood, and dairy products. Advanced flexible formats such as films, pouches, and bags also support technologies like modified atmosphere packaging (MAP) and high-barrier structures, which help extend shelf life and reduce food waste. In addition, the growing availability of recyclable and mono-material flexible solutions aligns with sustainability goals, further accelerating adoption over traditional rigid packaging formats.

Material Insights

The plastic segment led the global market, accounting for more than 36.8% of revenue in 2025. This is attributed to its low cost, durability, and abundant availability. Packaging with plastic provides an efficient moisture barrier to the contents. Similarly, clear and transparent containers or films are in demand as they enable end-users to easily identify the content as well as to check the product quality, leading to a high market share.

The paper and paperboard material segment accounted for the second-largest market share in the global fresh food packaging market due to its strong alignment with sustainability goals, regulatory acceptance, and consumer preferences. As concerns over plastic waste intensify, retailers, brand owners, and governments are increasingly favoring renewable, recyclable, and biodegradable materials. Paper-based packaging is widely perceived as environmentally friendly, as it is derived from renewable resources and has well-established recycling streams across most regions. This positive sustainability profile has made paper and paperboard a preferred choice for fresh produce trays, cartons, wraps, and secondary packaging, especially in markets with strict environmental regulations such as Europe and North America.

Bagasse is another sustainable raw material, produced during the process of manufacturing sugar from sugarcane. It is the potential fiber source formed by high heat and high-pressure processes, consuming relatively lower energy as compared to paper pulping. Therefore, companies are taking efforts to develop and supply plant-based options to customers.

Application Insights

The dairy products segment held the largest share of the global market, accounting for more than 39.8% of revenue in 2025. Dairy products are a major driver of growth in the fresh food packaging market due to their high perishability, strict hygiene requirements, and consistently strong global consumption. Products such as milk, yogurt, cheese, butter, and cream are highly sensitive to temperature, light, oxygen, and microbial contamination, making effective packaging essential to preserve freshness, ensure food safety, and extend shelf life. As dairy consumption continues to rise, particularly in emerging economies and urban markets, the demand for reliable, protective, and high-performance packaging solutions has increased accordingly.

Furthermore, dairy products have an ongoing diversification and premiumization of dairy products. The market has expanded beyond traditional liquid milk to include flavored milk, probiotic yogurts, specialty cheeses, and value-added dairy desserts, all of which require specialized packaging formats. This has driven demand for advanced packaging solutions such as high-barrier films, aseptic cartons, rigid containers, and flexible pouches that offer superior protection, portion control, convenience, and shelf appeal. Packaging also plays a critical role in product differentiation, branding, and compliance with labeling regulations, further increasing its importance in the dairy segment.

The fruits and vegetables application segment is expected to witness a CAGR of 5.5% in terms of revenue over the forecast period. Major contents in a vegetarian diet are fruits and vegetables. The shift in the consumer preference toward a vegan diet and plant-based nutrients is likely to expand the market size of the fruits and vegetables segment.

Regional Insights

The market for fresh food packaging in Asia Pacific accounted for the largest revenue share of 43.52% in 2025. The region is expected to dominate the market over the forecast period. The rapid urbanization and rising disposable incomes are the primary drivers of fresh food packaging growth. As more consumers shift from traditional wet markets to organized retail and packaged food formats, demand for hygienic and visually appealing packaging has increased. The region hosts several fast-growing economies, including India, China, South Korea, Japan, and Indonesia. A large consumer base in countries like India and China is responsible for the high demand for fresh food products, which, in turn, is augmenting the demand for fresh food packaging over the forecast period.

China Fresh Food Packaging Market Trends

China’s fresh food packaging demand is rising rapidly due to structural shifts in food distribution and consumption patterns. The expansion of cold-chain infrastructure, supported by government investment, has enabled wider distribution of fresh meat, seafood, dairy, and produce beyond Tier-1 cities into lower-tier urban and semi-urban areas. In addition, the explosive growth of online grocery platforms and instant-delivery models has increased the need for protective, leak-resistant, and temperature-compatible packaging to ensure food quality during last-mile delivery. These supply-chain transformations are making packaging a critical enabler of China’s fresh food ecosystem.

North America Fresh Food Packaging Market Trends

Across North America, fresh food packaging demand is growing due to the region’s highly developed export-oriented food supply chain. The U.S., Canada, and Mexico are major exporters of fresh produce, meat, and dairy, requiring packaging solutions that can support long-distance transportation while preserving freshness and minimizing spoilage. Packaging that offers durability, stackability, and shelf-life extension has become essential to maintain product quality across cross-border logistics. This export-driven food trade significantly contributes to sustained demand for fresh food packaging across the region.

The fresh food packaging market in the U.S. is driven by heightened food safety expectations and stringent regulatory oversight. Fresh food producers and retailers increasingly rely on advanced packaging solutions to comply with FDA regulations, traceability requirements, and retailer quality standards. At the same time, labor shortages in food handling and retail have increased reliance on pre-packed fresh foods, which reduces in-store handling and contamination risks. This shift toward packaged fresh foods has directly increased demand for reliable, standardized, and high-performance packaging formats.

Europe Fresh Food Packaging Market Trends

The fresh food packaging market in Europe is strongly influenced by regulatory and sustainability-led transformation. Strict EU food safety laws, combined with aggressive packaging waste reduction targets, have encouraged the adoption of innovative fresh food packaging that balances protection with recyclability. Retailers are increasingly replacing loose or plastic-heavy packaging with paper-based, recyclable, or lightweight alternatives for fresh produce and proteins. This regulatory-driven innovation environment continues to stimulate demand for compliant, sustainable fresh food packaging solutions across Europe.

Germany fresh food packaging market is growing due to the country’s strong emphasis on quality assurance, product labeling, and organized retail efficiency. German consumers place a high value on freshness, origin transparency, and standardized packaging, particularly for meat, dairy, and fresh produce. This has increased reliance on well-designed packaging that supports traceability, shelf organization, and quality communication. Additionally, Germany’s advanced recycling systems encourage the use of structured, recyclable packaging formats, reinforcing steady demand for fresh food packaging across the country.

Key Fresh Food Packaging Company Insights

The fresh food packaging market is highly competitive and characterized by the presence of large multinational packaging companies alongside numerous regional and local manufacturers. Global players leverage economies of scale, advanced material science capabilities, and long-term partnerships with major food producers and retailers to maintain strong market positions. Some of the major players operating in the market include Amcor plc; DS Smith Plc; Mondi; Coveris; FLAIR Flexible Packaging Corporation; PPC Flexible Packaging LLC; Flex-Pack; Transcontinental Inc; FFP Packaging Ltd; Sealed Air; GRUPO LANTERO; INFIA srl; Sonoco Products Company; Huhtamaki, CLONDALKIN GROUP, Clifton Packaging Group Limited; ProAmpac; Genpak, LLC; Pro-Pac Packaging Limited; and WINPAK LTD.

These companies compete through continuous innovation in high-barrier materials, shelf-life extension technologies, and sustainable packaging solutions that meet evolving regulatory and retailer requirements. Strategic investments in capacity expansion, automation, and R&D enable leading players to offer consistent quality, cost efficiency, and customized solutions across multiple fresh food categories.

At the same time, regional and smaller players remain competitive by focusing on cost competitiveness, localized production, and application-specific expertise. Many specialize in particular food segments such as fresh produce, meat, or dairy, allowing them to offer tailored formats, shorter lead times, and flexible order volumes. Competitive intensity is further heightened by increasing customer emphasis on sustainability, prompting companies to accelerate the development of recyclable, paper-based, and mono-material packaging solutions. As a result, differentiation in the fresh food packaging market increasingly depends on innovation speed, sustainability credentials, supply reliability, and the ability to balance performance with cost.

Key Fresh Food Packaging Companies:

The following are the leading companies in the fresh food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- DS Smith Plc

- Mondi

- Coveris

- FLAIR Flexible Packaging Corporation

- PPC Flexible Packaging LLC

- Flex-Pack

- Transcontinental Inc.

- FFP Packaging Ltd.

- Sealed Air

- GRUPO LANTERO

- INFIA srl

- Sonoco Products Company

- Huhtamaki

- CLONDALKIN GROUP

- Clifton Packaging Group Limited

- ProAmpac

- Genpak, LLC

- Pro-Pac Packaging Limited

- WINPAK LTD

Recent Developments

-

In April 2025, Hartmann Packaging A/S introduced FiberWise™, a sustainable, fiber-based tray designed for fresh food packaging. Developed to address growing retailer demand for plastic alternatives, FiberWise™ consists of a recycled paper tray combined with a minimal fossil-based barrier layer and a peelable liner. The solution is compatible with existing production lines, enabling food producers to transition seamlessly while meeting increasingly stringent environmental regulations.

-

In February 2025, Kaliroy Fresh LLC, a company based in Texas, revealed the launched of the newly patented peel-back shaker snacking tomato clamshell at Southeast Produce Council’s Southern Exposure event held in Orlando, Florida, U.S.

Fresh Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 163.83 billion

Revenue forecast in 2033

USD 240.68 billion

Growth rate

CAGR of 5.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, packaging type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; Russia; Poland; Netherlands; Portugal; India; China; Japan; Brazil; Mexico; South Africa

Key companies profiled

Amcor plc; DS Smith Plc; Mondi; Coveris; FLAIR Flexible Packaging Corporation; PPC Flexible Packaging LLC; Flex-Pack; Transcontinental Inc; FFP Packaging Ltd; Sealed Air; GRUPO LANTERO; INFIA srl; Sonoco Products Company; Huhtamaki, CLONDALKIN GROUP, Clifton Packaging Group Limited; ProAmpac; Genpak, LLC; Pro-Pac Packaging Limited; WINPAK LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Fresh Food Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fresh food packaging market report on the basis of material, packaging type, application, and region:

-

Packaging Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Rigid

-

Clamshells

-

Trays & Boxes

-

Others

-

-

Flexible

-

Pouches & Bags

-

Wraps & Films

-

-

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Plastic

-

Polypropylene

-

Polyethylene

-

Polystyrene

-

Polyvinyl Chloride

-

Polyethylene Terephthalate

-

-

Paper & Paper Board

-

Bagasse

-

Polylactic Acid

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Eggs, Meat & Seafood

-

Fruits & Vegetables

-

Dairy Products

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Russia

-

Poland

-

Netherlands

-

Portugal

-

-

Asia Pacific

-

India

-

China

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The rigid fresh food packaging segment emerged as the largest type segment in the year 2025 and accounted for the largest revenue share of 50.9% in the market.

b. The key player in the fresh food packaging market includes Amcor plc; DS Smith Plc; Mondi; Coveris; FLAIR Flexible Packaging Corporation; PPC Flexible Packaging LLC; Flex-Pack; Transcontinental Inc; FFP Packaging Ltd; Sealed Air; GRUPO LANTERO; INFIA srl; Sonoco Products Company; Huhtamaki, CLONDALKIN GROUP, Clifton Packaging Group Limited; ProAmpac; Genpak, LLC; Pro-Pac Packaging Limited; WINPAK LTD.

b. Increasing demand for organic fresh food products like fruits, vegetables, and dairy from diet and health-conscious consumers is expected to have a positive impact on the fresh food packaging market over the forecast period.

b. The global fresh food packaging market was estimated at USD 155.83 billion in 2025 and is expected to reach USD 163.83 billion in 2026.

b. The global fresh food packaging market is expected to grow at a compound annual growth rate of 5.6% from 2026 to 2033 to reach USD 240.68 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.