- Home

- »

- Plastics, Polymers & Resins

- »

-

Fresh Meat Packaging Market Size & Share Report, 2030GVR Report cover

![Fresh Meat Packaging Market Size, Share & Trends Report]()

Fresh Meat Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Flexible, Rigid), By Material (Plastic, Paper & Paperboard, Bagasse, Polylactic Acid, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-607-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fresh Meat Packaging Market Summary

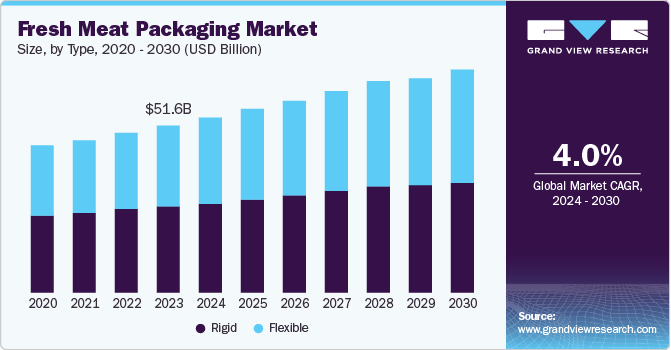

The global fresh meat packaging market size was valued at USD 51.64 billion in 2023 and is projected to reach USD 68.43 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030. Increasing consumer demand for convenience while purchasing meat and ensuring its freshness, rising awareness about hygiene among meat sellers, and innovative packaging solutions being introduced by manufacturers have led to a surge in demand for advanced meat packaging products.

Key Market Trends & Insights

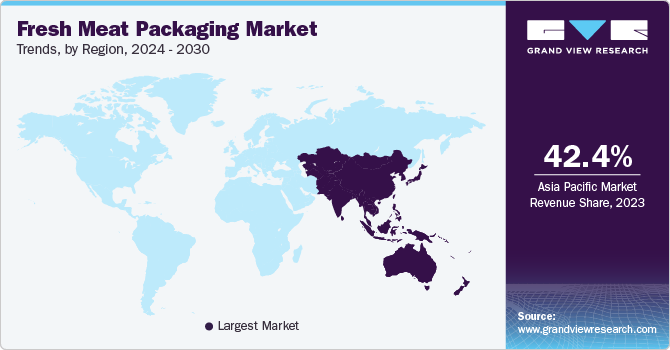

- Asia Pacific led the market with a revenue share of 42.4% in 2023.

- India accounted for a significant share of the regional fresh meat packaging market in 2023.

- By type, rigid packaging accounted for a larger revenue share of 51.5% in the market in 2023.

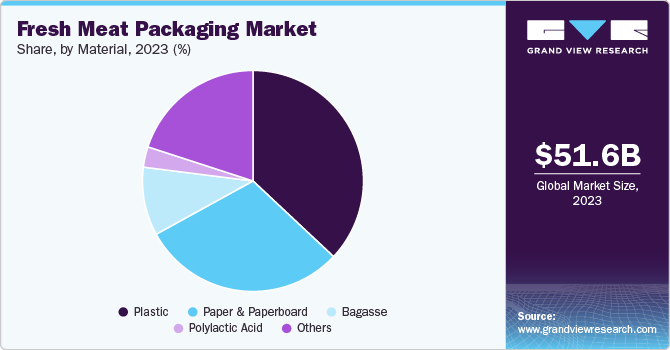

- By material, plastic materials held the highest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 51.64 Billion

- 2030 Projected Market Size: USD 68.43 Billion

- CAGR (2024-2030): 4.0%

- Asia Pacific: Largest market in 2023

Moreover, consumers and businesses are increasingly becoming concerned about the environmental impact of food packaging. Packaging solutions prioritizing recyclability, reduced material usage, and lower carbon footprints are thus gaining significant traction. For instance, in May 2024, Mondi partnered with Scan Sverige to create a recyclable polypropylene-based mono-material food packaging. Such developments are expected to drive the demand for sustainable food packaging solutions in the coming years.

Innovations in packaging materials, such as the emergence of barrier films, modified atmosphere packaging (MAP), and vacuum packaging, have helped improve product preservation and extend their shelf life, thereby driving market expansion. For instance, in March 2024, Berry Global Group partnered with Mitsubishi Gas Chemical Company to develop a recyclable barrier solution. This innovative product, incorporating MXD6, a high-quality barrier resin produced by Mitsubishi Gas Chemical, is suited for plastic tubes, jars, thermoformed items, and bottles. It eliminates the requirement for Ethylene Vinyl Alcohol (EVOH), which presents various performance and compatibility limitations, thus effectively safeguarding food products and extending their shelf life while maintaining recyclability.

The proliferation of supermarkets, hypermarkets, and online grocery platforms across the globe has increased the demand for attractive and functional packaging to enhance product visibility and appeal. For instance, in November 2023, Coveris introduced the recyclable and visually appealing MonoFlex Thermoform packaging solution. The product can be made using polypropylene or polyethylene and is fully nylon-free, providing extended shelf life to fish, meat, poultry, dairy products, and baked goods. Growing awareness regarding food safety and hygiene among manufacturers and consumers has led to a surge in demand for secure and hygienic packaging solutions for fresh meat products.

Type Insights

Rigid packaging accounted for a larger revenue share of 51.5% in the market in 2023. This is attributed to the superior protection and preservation features offered by rigid packaging solutions, which effectively prevent moisture and oxygen from compromising the quality and safety of fresh meat products. Using rigid materials, such as plastic trays and containers, provides excellent structural integrity and barrier properties, ensuring that fresh meat products remain in their required condition and contamination-free throughout the supply chain. Furthermore, rigid packaging facilitates efficient stacking, transportation, and storage, streamlining logistics and reducing costs for meat processors and retailers. These characteristics of rigid packaging solutions have led to segment dominance in this market.

Meanwhile, flexible packaging is expected to advance at the fastest CAGR over the forecast period. This is owing to its versatility, convenience, and sustainability benefits. The increasing demand for portable, easy-to-handle, and cost-effective packaging solutions has driven the adoption of flexible packaging formats, such as pouches, bags, and wraps, which offer strong flexibility and barrier properties. Additionally, their ability to provide excellent seal integrity, prevent leakage, and maintain product freshness has resonated with meat processors and consumers alike. The rapidly growing trend of e-commerce and online grocery shopping has further accelerated the demand for flexible packaging, facilitating efficient and damage-free transportation of fresh meat products.

Material Insights

Plastic materials held the highest market revenue share in 2023. Plastic packaging solutions, such as films, trays, and containers, offer excellent moisture and oxygen barrier properties, preventing contamination and spoilage of food materials. Additionally, they can be easily molded, extruded, or thermoformed to create customized packaging solutions that cater to specific meat products and processing requirements. The widespread adoption of plastic packaging in the fresh meat industry is also driven by its cost-effectiveness, lightweight nature, and ease of transportation and storage. Manufacturers worldwide are frequently collaborating to offer sustainable solutions. For instance, Sealed Air (SEE), in July 2023, partnered with ExxonMobil to offer recyclable food-grade plastic packaging solutions. This initiative is expected to contribute to Sealed Air’s efforts to create a sustainable and circular economy.

The polylactic acid (PLA) segment is expected to register the fastest growth from 2024 to 2030. This is owing to its exceptional sustainability profile, biodegradability, and renewable resource-based composition. As the fresh meat industry increasingly prioritizes eco-friendly packaging solutions, PLA's ability to replace traditional plastics while maintaining their performance and functionality has driven its rapid adoption. PLA's compostable nature, non-toxicity, and minimal environmental impact have addressed the concerns of environmentally conscious consumers and regulators, leading to increased demand for PLA-based packaging solutions. Moreover, advancements in PLA production technology have improved its cost competitiveness, scalability, and barrier properties, making it an attractive alternative to conventional plastics.

Regional Insights

North America held a substantial share of the global market in 2023. This is due to high per capita meat consumption in economies such as the U.S. and Canada. In addition, anticipating the potential of the packaging market, prominent companies are acquiring existing raw material businesses to offer environment-friendly packaging solutions at attractive prices. For instance, in February 2024, Mondi completed the acquisition of Hilton Pulp Mill from West Fraser Timber Co. Ltd., located in Alberta, Canada, to produce sustainable paper-based packaging solutions in North America.

U.S. Fresh Meat Packaging Market Trends

The U.S. accounted for a significant share of the regional market in 2023. According to the meat consumption data from the Organisation for Economic Co-operation and Development (OECD), the U.S. was among the leading economies consuming the highest amount of meat per capita in 2023, highlighting a strong potential for steady market growth. Furthermore, a well-established packaging manufacturing sector in the economy with a strong presence of multinational companies and innovative small and medium-sized enterprises has enabled the development of cutting-edge packaging technologies and formats.

Asia Pacific Fresh Meat Packaging Market Trends

Asia Pacific led the market with a revenue share of 42.4% in 2023. This is attributed to the region's growing population, increasing urbanization, and rising disposable income levels, which have driven the demand for convenient, safe, high-quality fresh meat products. The region's rapidly expanding middle-income population has led to a noticeable increase in meat consumption, with countries such as China, India, and Indonesia experiencing significant growth in fresh meat demand. Furthermore, the region's well-established food processing industry and a strong presence of local and international packaging manufacturers have enabled the widespread adoption of innovative and specialized fresh meat packaging solutions.

India fresh meat packaging market accounted for a significant share of the regional fresh meat packaging market in 2023. The economy's favorable business environment, government support for the food processing industry, and growing e-commerce sector have also contributed to its prominent position in this industry, making it an attractive hub for packaging manufacturers and fresh meat producers. Additionally, multinational companies are expanding their business in the economy. For instance, in August 2023, Amcor announced the acquisition of Gujarat-based Phoenix Flexibles, a flexible packaging provider for food, personal care, and home care applications.

Europe Fresh Meat Packaging Market Trends

Europe held a notable share of the global market in 2023. This is attributed to Europe's highly developed food processing industry, stringent food safety regulations, and strong consumer demand for sustainably packaged fresh meat products. For instance, the European Union has established stringent rules regarding packaging material and packaging waste, requiring companies to reduce and reuse plastic and other packaging waste. To abide by these regulations, Coveris, in June 2024, introduced a paper-based flexible packaging product range, the MonoFlex Fibre, which can be fully recycled. Europe's large and affluent consumer base and high per capita meat consumption have driven the adoption of such advanced packaging solutions.

The UK fresh meat packaging market held a substantial share of the regional market in 2023. It can be attributed to the increasing adoption of hygienic and premium-quality meat packaging products by butcher shops in the country. Furthermore, the UK's emphasis on sustainability and environmental concerns has led to a growing demand for eco-friendly and biodegradable packaging solutions, contributing to the country's high share in the European fresh meat packaging business.

Key Fresh Meat Packaging Company Insights

Some key companies involved in the fresh meat packaging market include Mondi, Amcor plc, and Coveris, among others.

-

Mondi is a UK-based multinational packaging company with over 100 production sites in more than 30 countries across North America, Europe, and Africa. Mondi offers diverse packaging products, including containerboard, corrugated solutions, flexible packaging, industrial paper bags, specialty kraft paper, and uncoated printing paper. The company’s notable solutions for the food sector include FunctionalBarrier papers, Monomaterial barrier packaging, and Monomaterial barrier pouches.

-

Amcor plc is a Switzerland-based multinational packaging product manufacturer. The company offers packaging for food, beverage, pet care, medical, pharmaceutical, and home & personal care products. Amcor has around 218 production sites in 41 countries worldwide. The company offers a wide range of fresh meat packaging solutions, such as Form-Tite and Flow-Tite Shrink Rollstock, ICE coextruded thermoforming films, and FreshCase vacuum packaging technology for extended shelf life. Additionally, Amcor offers OvenRite Ovenable packaging, High-barrier paperboard trays, and vacuum seal packaging (VSP) for fresh meat products.

Key Fresh Meat Packaging Companies:

The following are the leading companies in the fresh meat packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Mondi

- Amcor plc

- Berry Global Inc.

- Coveris

- WINPAK LTD.

- Bolloré Group

- Cascades Inc.

- Sealed Air

- Crown

- Reynolds Consumer Products

- Sealpac International bv

Recent Developments

-

In August 2024, Winpak Ltd. and SK Geo Centric entered a worldwide strategic partnership to supply packaging made from recycled plastics. This move is expected to support Winpak's efforts to source materials sustainably for the packaging of food items, medical products, and beverages.

-

In April 2024, Coveris announced the expansion of its packaging product portfolio through a substantial investment in a vacuum skin packaging (VSP) facility at the company’s site in Winsford, UK. The company would leverage its co-extrusion capabilities and expertise in producing nine-layer EVOH barrier films that provide extra shelf life for fish, meat, and dairy items.

Fresh Meat Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 54.02 billion

Revenue Forecast in 2030

USD 68.43 billion

Growth Rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, material, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Southeast Asia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Mondi; Amcor plc; Berry Global Inc.; Coveris; WINPAK LTD.; Bolloré Group; Cascades Inc.; Sealed Air; Crown; Reynolds Consumer Products; Sealpac International BV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fresh Meat Packaging Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fresh meat packaging market report based on type, material, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Flexible

-

Pouches & Bags

-

Wraps & Films

-

-

Rigid

-

Clamshells

-

Trays & Boxes

-

Others

-

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Polystyrene (PS)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Paper & Paperboard

-

Bagasse

-

Polylactic Acid

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.