- Home

- »

- Plastics, Polymers & Resins

- »

-

Frozen Food Packaging Market Size, Industry Report, 2030GVR Report cover

![Frozen Food Packaging Market Size, Share & Trends Report]()

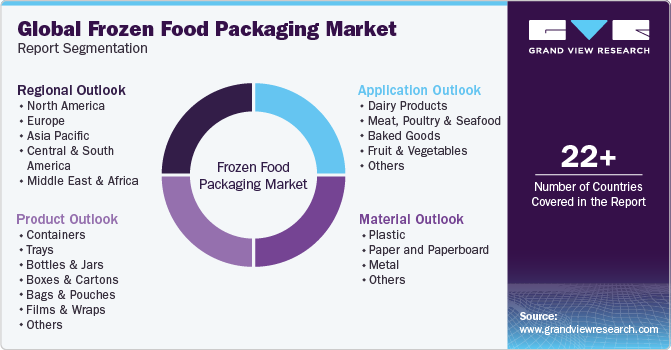

Frozen Food Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper and Paperboard, Metal), By Product, By Application (Meat, Poultry & Seafood, Fruit & Vegetables), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-233-5

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Frozen Food Packaging Market Summary

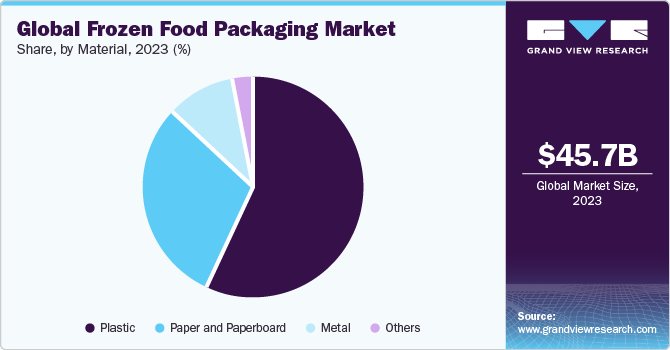

The global frozen food packaging market size was estimated at USD 45.69 billion in 2023 and is expected to reach USD 67.48 billion by 2030, growing at a CAGR of 5.8% from 2024 to 2030. Growing demand for frozen food products owing to several advantages such as longer shelf life coupled with easy availability is expected to benefit market growth.

Key Market Trends & Insights

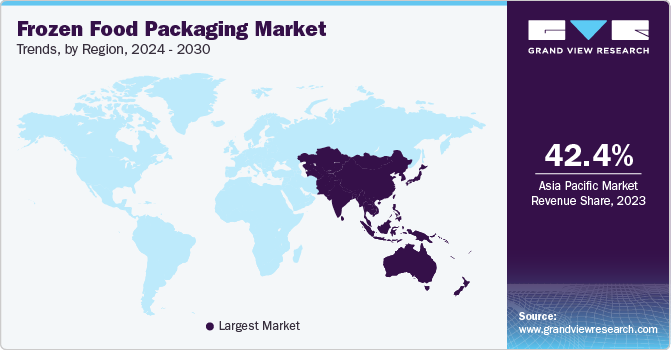

- Asia Pacific dominated the market and accounted for the largest revenue share of over 42.4% in 2023.

- India is expected to witness significant growth over the forecast period.

- By product, the bags & pouches segment dominated the market and accounted for the largest revenue share of over 34.0% in 2023.

- By application, the meat, poultry & seafood application segment accounted for the largest revenue share of over 36.0% in 2023.

- By material, the plastic segment dominated the market with a share of over 59.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 45.69 Billion

- 2030 Projected Market Size: USD 67.48 Billion

- CAGR (2024-2030): 5.8%

- Asia Pacific: Largest market in 2023

According to the United States Department of Agriculture (USDA), U.S. dairy consumption has increased, with per capita consumption reaching a record high of 667 pounds in 2021, up from 539 pounds in 1975. This growth can be attributed to the strong performance of certain dairy products, such as cheese, butter, and yogurt, which have seen significant increases in per capita consumption.

Moreover, in 2022, per capita consumption of fluid milk products in the U.S. was about 130 pounds per person, as reported by the USDA. Hence, increasing dairy consumption is generating greater demand for frozen food packaging, which is necessary for transport and storage. Items, such as frozen yogurt, ice cream, and cheese, rely heavily on plastic bags, cardboard cartons, and foil wraps to prevent spoilage and maintain quality before consumer purchase. Advancements in freezing technologies and cold chain infrastructure have enabled longer shelf lives and higher-quality frozen foods. Improved freezing techniques help better preserve nutrients, taste, and texture.

This increases consumer confidence in frozen options, further driving packaging needs. In addition, expanded cold chain facilities allow frozen items to be transported over longer distances and be exposed to fewer temperature variances. Moreover, rising health consciousness has spurred demand for frozen fruits, vegetables, meals, and snacks marketed as healthier alternatives to shelf-stable options. Packaging plays a crucial role in communicating nutritious frozen food product benefits to increasingly health-focused shoppers. Transparent pouches, information labels, and seal guarantees indicating no added preservatives satisfy the demand for clean-label frozen items.

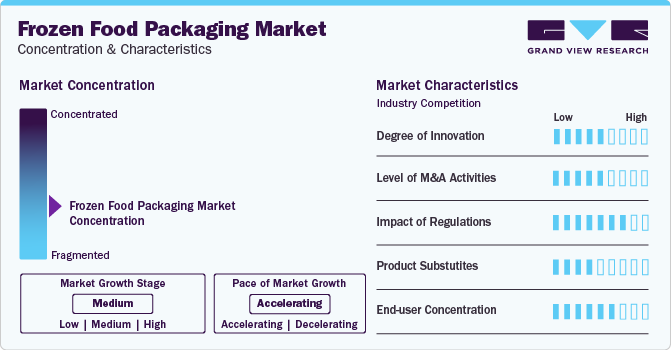

Market Concentration & Characteristics

Prominent frozen food packaging solutions companies operating in market include Sonoco Products Company, Sealed Air, Berry Global Inc., ProAmpac, Cascades Inc., Printpack, SÜDPACK, Amcor Plc., WestRock Company, Huhtamaki Oyj, Sabert Corporation, Smurfit Kappa, Tetra Pak, Transcontinental Inc., Toyo Seikan Group Holdings, Ltd., Jupiter Laminators Pvt. Ltd., Omprakash Packaging, and ROVEMA GmbH.

Companies are increasingly focusing on the introduction of sustainable packaging practices in the market. For instance, in October 2023, UPM Specialty Papers, in collaboration with Lantmännen Unibake and Adara, introduced a fiber-based barrier paper called Asendo to replace plastic bags as the primary packaging material for frozen baked goods. This new packaging solution is designed to minimize the use of fossil-based materials within the sector. Asendo is compostable, recyclable, and safe for direct food contact due to its high grease and moisture resistance. It is suitable for frozen foods, dry, and chilled, as well as for bread bags and non-food wrapping applications.

In August 2023, Ahlstrom, a prominent company in sustainable specialty materials, collaborated with Paper People LLC to develop a fully fiber-based, recyclability-certified packaging solution for frozen food applications. This new line of packaging is designed to replace traditional fossil-based plastic and films, offering an eco-friendly alternative for frozen food packaging. The packaging is compatible with existing packaging equipment, including vertical form-fill-seal systems, stand-up pouches, and SOS-style systems, as well as bundle wrap and flow wrap applications. The Paper People's Paperlock G technology, an FDA-approved direct food contact heat-seal material and grease barrier, is combined with Ahlstrom's proprietary FluoroFree barrier papers, which provide significant grease resistance.

Product Insights

Based on the product, the market is segmented into containers, trays, bottles & jars, boxes & cartons, bags & pouches, films & wraps, and others. The bags & pouches segment dominated the market and accounted for the largest revenue share of over 34.0% in 2023. Bags and pouches can be easily formed to fit the contours of frozen food. This reduces excess air pockets and minimizes space the package takes up during packaging. Moreover, it allows for more efficient packing and stacking in freezers.

Films and wraps are extensively used for frozen food packaging as they provide an effective barrier against oxygen, moisture, and aromas while remaining lightweight and flexible. Plastic films, such as PP and PE or plastic wraps, including PVC and PVDC cling wrap seal in freshness of frozen foods exceptionally well inside the packaging.

Application Insights

Based on application, the market is segmented into dairy products, meat, poultry & seafood, baked goods, fruits & vegetables, and others. The meat, poultry & seafood application segment dominated the market and accounted for the largest revenue share of over 36.0% in 2023. The segment is likely to retain its leading position throughout the forecast period due to the increasing consumption of meat and poultry products across the globe owing to their nutritional benefits, which has led to a rise in demand for reliable packaging solutions, thus benefitting the market.

The dairy products application segment is projected to progress at the fastest CAGR of 6.2% from 2024 to 2030 owing to the versatility and convenience offered by dairy packaging materials. For instance, Ziploc bags are commonly used for storing dairy products, such as milk and cheese, in the freezer, as they are ideal for short-term usage and space-saving. In addition, re-sealable closures and easy-to-pour spouts have made dairy packaging more user-friendly, which is preferred by consumers.

Material Insights

On the basis of materials, the global market has been segmented into plastic, paper & paperboard, metal, and others. The plastic segment dominated the market with a share of over 59.0% in 2023 Plastic is the most widely used material for frozen food packaging owing to several beneficial properties including heat resistance, heat sealing, and good barrier properties among others. In addition, plastic also offers several choices in terms of color and transparency. Commonly used plastics for frozen food packaging include polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and high-impact polystyrene among others.

Various grades of polyethylene including low-density polyethylene (LDPE) and high-density polyethylene (HDPE) are commonly used for manufacturing frozen food packaging products. The paper & paperboard material segment is expected to witness robust growth at a CAGR of 6.3% from 2024 to 2030. This material is used in the manufacturing of frozen food packaging products that are commonly used for packaging products, such as ice creams, frozen pizzas, frozen vegetables & fruits, and frozen dessert cones, among others. This material is widely used as it is relatively inexpensive and abundantly available compared to plastics and metals.

Regional Insights

The North America regional market is characterized by extensive R&D for developing innovative technologies and processes for manufacturing food packaging solutions. Food packaging manufacturers are trying to develop technologically advanced manufacturing processes, which can aid in saving time and effort of production, while simultaneously increasing their overall production efficiency to maximize profit. For instance, Knurls is a U.S.-based startup in the packaging industry that uses a 3D printing process for developing packaging solutions. The printing process is based on its proprietary Knurlpack technology and uses materials, such as ceramics, plastics, and metals, to print packaging around products, either partially or completely. Furthermore, increasing efforts undertaken by manufacturers in North America to develop edible packaging and micro-packaging solutions are expected to provide growth opportunities within the food packaging industry.

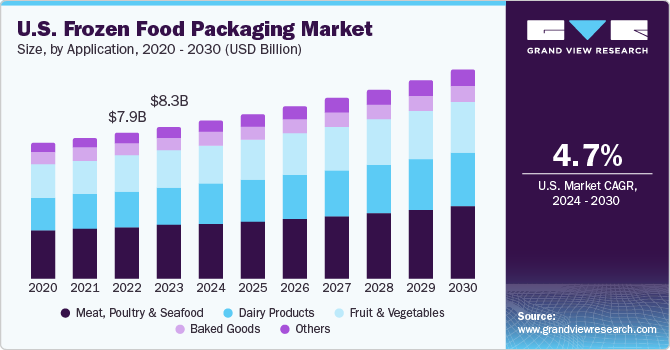

U.S. Frozen Food Packaging Market Trends

The U.S. frozen food packaging market is one of the largest packaged food industries in the world owing to the presence of a large population with high disposable income. Moreover, busy lifestyles in the country further lead to a surged demand for packaged food products. The U.S. has one of the largest markets for fresh fruits & vegetables, including exotic fruits & mushrooms. Moreover, the extensive penetration of quick-service restaurants, which are the main consumers of frozen food products, is also contributing to the market growth.

The frozen food packaging market in Canada held a significant revenue share in 2023 due to its pursuit of a circular economy with zero zero-plastic waste agenda. The willingness of Canadians to pay premiums for sustainable food packaging showcases the awareness among consumers and the changing market dynamic.

Asia Pacific Frozen Food Packaging Market Trends

Asia Pacific frozen food packaging market dominated the market and accounted for the largest revenue share of over 42.4% in 2023. The region is likely to dominate the industry over the forecast period. E-commerce companies in Asia Pacific, especially in China, largely prefer this product for the delivery of fresh produce and processed food. Due to continuously increasing demand for ready-to-eat foods and on-the-go snacks, many food packaging companies are expanding their geographic presence in different countries of Asia Pacific, including the developing countries of Southeast Asia, such as Malaysia, Indonesia, and Thailand, Vietnam, among others. For instance, in May 2022, Lamipak, a provider of aseptic packaging solutions, began construction of its second packaging facility in Indonesia. This newly constructed facility is the first of its kind in Indonesia. This facility has a total production capacity of 18 billion packs per annum.

The frozen food packaging market in India is expected to witness significant growth over the forecast period due to changing lifestyles, shifting consumption patterns of population, increasing working hours, resulting in a lack of time to cook food at home, and rising purchasing power of consumers. According to Plastic Waste Management Rules, 2016, the use of recycled plastic was prohibited in all food packaging applications owing to a lack of recycling infrastructure and an attempt to eliminate the use of plastics in food contact applications. However, in March 2022, the Food Safety & Standards Authority of India (FSSAI) established stringent regulations to permit the use of recycled plastic for food packaging applications to create a circular economy. Such a favorable regulatory scenario is expected to increase demand for sustainable food packaging solutions in India over the forecast period.

Europe Frozen Food Packaging Market Trends

The Europe frozen food packaging market held a major revenue share in 2023 owing to the continuous innovations for promoting sustainable packaging. Dutch Pack International provides mono-material packaging for better recycling characteristics. Furthermore, in August 2023, Ahlstrom collaborated with The Paper People to co-develop and launch fiber-based frozen food packaging. This new line of recyclability-certified and fiber-based packaging is specially designed to replace conventional fossil-based plastic and disrupt the market.

The frozen food packaging market in Germany is primarily driven by the increasing efforts made by the Government of Germany and manufacturers of food packaging products to reduce plastic pollution, backed by partnerships among various players in food packaging to eliminate the usage of multi-layered plastics in food packaging products. For instance, BioLutions, a German cleantech startup, partnered with Pulpac in May 2022 to replace single-use plastics with dry molded fibers in its entire product portfolio. Companies operating in Germany are planning to use this technology for manufacturing various single-use disposable packaging products for packaging different frozen food products, such as fruits and vegetables.

Central & South America Frozen Food Packaging Market Trends

The Central & South America frozen food packaging market is projected to expand at a significant CAGR from 2024 to 2030 due to the rise in the middle-income population, with factors, such as high food quality expectations, rapid urbanization, and a gradual shift toward eco-friendly packaging solutions. In South America, changing lifestyles have driven the adoption of ready-to-eat convenient foods, thus, pivoting the market growth.

The frozen food packaging market in Brazil is expected to register a considerable CAGR from 2024 to 2030, primarily owing to rising consumer demand for dairy products. Growing awareness regarding the importance of consuming protein-rich food is likely to raise demand for dairy products, in turn, fostering market growth. Given the rising demand for flexible food packaging in Brazil, in April 2022, Sonoco acquired the remaining one-third shares and interest in its joint venture company, Sonoco do Brasil Participacoes in Brazil. This joint venture offers foil-based flexible packaging solutions with advanced lamination and rotogravure printing features to different food processing companies, such as dairy and confectionery. This acquisition is expected to help Sonoco strengthen its presence in the Brazilian food packaging market.

Middle East & Africa Frozen Food Packaging Market Trends

The MEA frozen food packaging market dynamics are influenced by evolving consumer preferences like demand for products with longer shelf life, government regulations on sustainable packaging, and a competitive landscape. Al Kabeer Group and Sunbulah Group are among the top players operating in the region.

The frozen food packaging market in Saudi Arabia will grow exponentially owing to an increasing population of working individuals with a lack of time to cook food at home. The region also boasts of having one of the highest per capita incomes or GDP, making consumers able to have more disposable income to spend on e-commerce, luxury retail, and retail from stores. The Middle Eastern markets are also known to be innovators in upcoming technologies with high adaptability rates for new products and technologies. Increasing adoption of innovative design concepts and technologies for manufacturing flexible frozen food packaging products by food packaging companies in the region is likely to promote market growth. In March 2021, South African company, EasyPack Packaging, acquired a V-Shapes ALPHA vertically integrated machine for producing single-dose sachets that can be opened using a single hand with one gesture only. EasyPack would be using this sustainable single-use packaging for packaging various types of liquid and semi-liquid food products, such as grappa, honey, peanut butter, and olive oils, among others.

Key Frozen Food Packaging Company Insights

The market is highly fragmented with the presence of a significant number of medium-sized companies. The frozen food packaging industry has been witnessing a significant number of new product launches and expansions over the past few years. This can be attributed to the growing urbanization, demand for easy-to-cook meals, and busy schedules of the working population across the globe.

-

In July 2023, Huhtamaki Oyj, a prominent global provider of sustainable packaging solutions, made a substantial investment in its facility located in Paris, Texas, U.S. This investment involves expanding manufacturing capacity and consolidating an external warehouse. The company planned to invest approximately USD 30.0 million in production assets while leasing a warehouse and manufacturing facility.

-

In February 2023, C-P Flexible Packaging partnered with Northwest Frozen, LLC to launch an advanced packaging solution, namely C-P Affirm Film that enhances the shelf life of refrigerated meals. This collaboration aims to improve the performance and durability of packaging, ensuring extended freshness for products.

Key Frozen Food Packaging Companies:

The following are the leading companies in the frozen food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Sonoco Products Company

- Sealed Air

- Berry Global Inc.

- ProAmpac

- Cascades Inc.

- Printpack

- SÜDPACK

- Amcor Plc

- WestRock Company

- Huhtamaki Oyj

- Sabert Corporation

- Smurfit Kappa

- Tetra Pak

- Transcontinental Inc.

- Toyo Seikan Group Holdings, Ltd.

- Jupiter Laminators Pvt. Ltd.

- Omprakash Packaging

- ROVEMA GmbH

Frozen Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 48.03 billion

Revenue forecast in 2030

USD 67.48 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Sonoco Products Company; Sealed Air; Berry Global Inc.; ProAmpac; Cascades Inc.; Printpack; SÜDPACK; Amcor plc; WestRock Company; Huhtamaki Oyj; Sabert Corporation; Smurfit Kappa; Tetra Pak; Transcontinental Inc.; Toyo Seikan Group Holdings, Ltd.; Jupiter Laminators Pvt. Ltd.; Omprakash Packaging; ROVEMA GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Frozen Food Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global frozen food packaging market report on the basis of material, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Paper and Paperboard

-

Metal

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Containers

-

Trays

-

Bottles & Jars

-

Boxes & Cartons

-

Bags & Pouches

-

Films & Wraps

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dairy Products

-

Meat, Poultry & Seafood

-

Baked Goods

-

Fruit & Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global frozen food packaging market was estimated at around USD 45.69 billion in the year 2023 and is expected to reach around USD 48.03 billion in 2024.

b. The global frozen food packaging market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 and reach around USD 67.48 billion by 2030.

b. Meat, poultry, and seafood emerged as a dominating application segment with a value share of around 36.0% in the year 2023 owing to the rising consumption of meat and poultry products all around the world owing to its nutritional benefits, which has led to the increase in demand for the reliable and efficient packaging solutions, thus positively influencing the frozen food packaging market.

b. The key market players in the frozen food packaging market include Sonoco Products Company, Sealed Air; Berry Global Inc.; ProAmpac, Cascades Inc., Printpack, SÜDPACK, Amcor plc; WestRock Company, Huhtamaki Oyj, Sabert Corporation; Smurfit Kappa; Tetra Pak; Transcontinental Inc.; Toyo Seikan Group Holdings, Ltd.; Jupiter Laminators Pvt. Ltd.; Omprakash Packaging; ROVEMA GmbH.

b. The frozen food packaging market is experiencing rapid growth due to the increasing consumption of convenient frozen food products driven by hectic modern lifestyles. Busy work schedules and a rising number of working individuals have led to greater demand for quick, easy-to-prepare frozen foods like ice cream, whole grain waffles, brown rice, quinoa, wild shrimp, sweet potato fries, and more.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.