- Home

- »

- Food Additives & Nutricosmetics

- »

-

Fructooligosaccharides (FOS) Market Size Report, 2030GVR Report cover

![Fructooligosaccharides (FOS) Market Size, Share & Trends Report]()

Fructooligosaccharides (FOS) Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Sucrose, Chicory), By Form (Liquid, Powder), By Application (Infant Formulation, Food & Beverages), By Region, And Segment Forecasts

- Report ID: 978-1-68038-957-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fructooligosaccharides (FOS) Market Summary

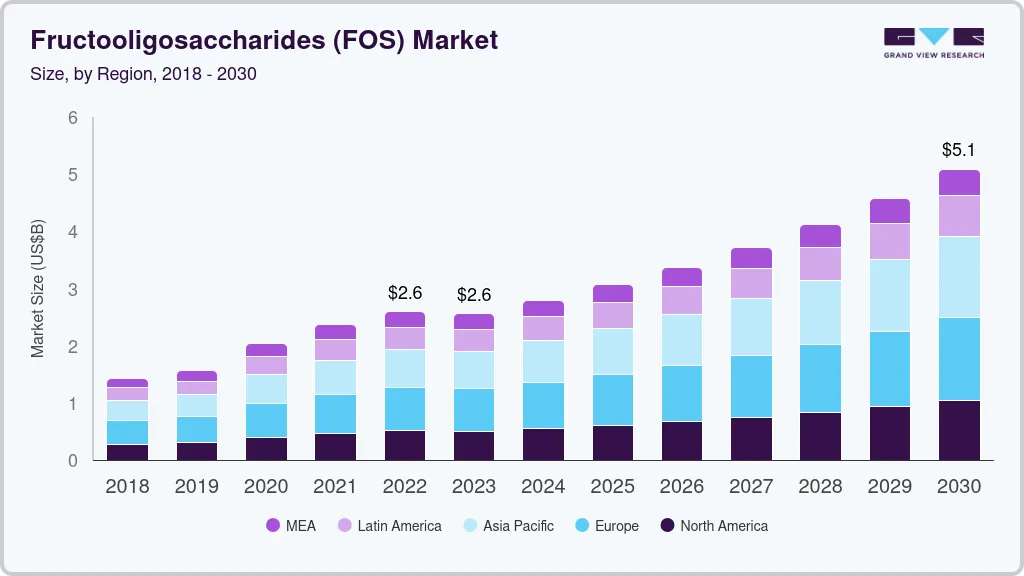

The global fructooligosaccharides (fos) market size was estimated at USD 2,595.6 million in 2022 and is projected to reach USD 5,086.6 million by 2030, growing at a CAGR of 8.8% from 2023 to 2030. The product is being increasingly used in food & beverages, dietary supplements, animal feed, and pharmaceuticals.

Key Market Trends & Insights

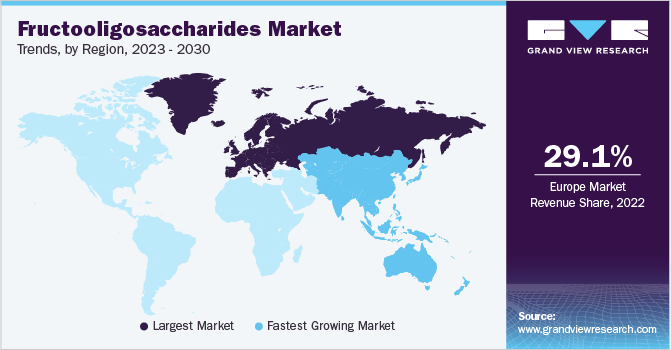

- In terms of region, Europe was the largest revenue generating market in 2022.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, chicory accounted for a revenue of USD 1,838.4 million in 2022.

- Sucrose is the most lucrative source segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 2,595.6 Million

- 2030 Projected Market Size: USD 5,086.6 Million

- CAGR (2023-2030): 8.8%

- Europe: Largest market in 2022

It stimulates the growth of bifidobacteria and lactobacilli in the human gut and produces short chain fatty acids. These acids further stimulate the growth of colorectal mucosal cells, slow down the atrophy of the mucosa, and reduce the risk of harmful changes to the colon. This is expected to have a positive impact on the market over the forecast period.

The low calorific value of the product helps in reducing levels of phospholipids, triglycerides, and cholesterol and aids the absorption of calcium and magnesium in the body, thus augmenting demand over the next eight years.

With increasing knowledge related to the product among consumers and a better understanding of its functions, the demand for fructo-oligosaccharides is expected to increase rapidly over the forecast period. Moreover, changing lifestyle coupled with rising concerns regarding health is expected to augment market growth. Such factors are responsible for the rapid growth of fructooligosaccharides in the global market over the forecasted period.

Increased prebiotic demand coupled with rising government support is expected to augment growth over the forecast period. Rising concern regarding gut health and increased demand for low-calorie sweeteners is expected to fuel product growth over the next eight years.

Market players are increasingly investing in the introduction of cost-effective production routes to increase product yield. In addition, FOS yields a lower carbon footprint as opposed to other prebiotics and hence is widely used. However, regulations governing fructooligosaccharides quantity in food products and infant formula coupled with high price is expected to restrain growth.

Source Insights

Chicory as a source of FOS dominated the market with a revenue share of 70.8% in 2022, as chicory is easy to extract, has high inulin content, low-calorie content, and is safe & efficient to use in versatile applications

Chicory root is a well-known source of fructo-oligosaccharides. Chicory root contains inulin, a type of soluble fiber that is not digested in the small intestine but instead is fermented by beneficial bacteria in the large intestine, producing FOS as a byproduct. In fact, chicory root is one of the richest dietary sources of inulin, with concentrations ranging from 15-20% by weight.

Some other sources of fructooligosaccharides are bananas, wheat, leeks, barley, onions, blue agave, garlic, and asparagus. In addition, Sucrose can be used as a starting material to produce FOS through a process called enzymatic hydrolysis. In this process, the sucrose is broken down into its component monosaccharides, glucose and fructose, by the action of enzymes. The resulting mixture of glucose and fructose can then be used as a substrate for the production of FOS.

Form Insights

Liquid form dominated the market with a revenue share of 54.2% in 2022. Liquid fructooligosaccharides (FOS) are commonly used because they are easy to incorporate into a wide range of food and beverage products. Their syrupy texture makes them easily dissolvable in water and other liquids, which allows for a homogeneous mixture.

In addition to their ease of use, liquid FOS has several other benefits that make them attractive to food manufacturers. For example, they are a natural, plant-based ingredient that can be used to replace traditional sweeteners, such as sugar and high fructose corn syrup. They also have a lower glycemic index than sugar, which means they do not cause a sharp spike in blood sugar levels.

Powder fructooligosaccharides are a form of FOS that is typically derived from natural sources such as chicory root, Jerusalem artichoke, or agave. The powder form is created by extracting FOS from these sources, purifying and concentrating them, and then drying the resulting liquid into a fine powder.

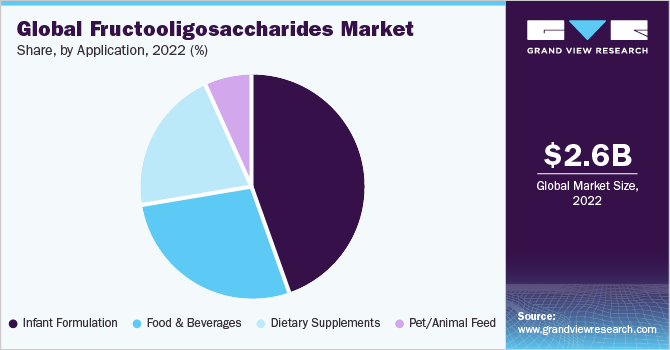

Application Insights

Infant Formulation application dominated the substrate segment with a revenue share of 44.6% in 2022, because FOS are natural prebiotic ingredients that can help support the growth and activity of beneficial bacteria in the infant's gut. This is important because the gut microbiota plays a critical role in the development of the infant's immune system, digestive health, and overall well-being.

Furthermore, Fructooligosaccharides (FOS) are used in food and beverages for a variety of reasons, including as a natural sweetener, a prebiotic ingredient, and a source of dietary fiber. As a natural sweetener, FOS can be used to replace traditional sweeteners like sugar or high fructose corn syrup. It has a sweet taste but is lower in calories and has a lower glycemic index than sugar, which can help manage blood sugar levels.

FOS are used in dietary supplements for their prebiotic properties and potential health benefits. As a prebiotic ingredient, FOS serves as food for beneficial bacteria in the gut. This can help promote the growth and activity of these bacteria, which can have a range of positive effects on digestive health, immune function, and overall well-being. FOS has been shown to increase the population of Bifidobacteria in the gut, which is associated with various health benefits.

Regional Insights

Europe region dominated the market with a revenue share of more than 29.09% in 2022. This is due to several factors, including the growing consumer demand for natural, healthier food and beverage products, as well as the increasing awareness of the potential health benefits of FOS. In addition, the regulatory environment in Europe is supportive of the use of FOS in food and dietary supplements. The European Food Safety Authority (EFSA) has evaluated the safety and efficacy of FOS and has approved its use as a food ingredient and as a source of dietary fiber.

Dairy products especially beverages account for the major market in the U.S. functional food & beverage industry. Rising concern regarding aging, heart health, weight management, gut health, and immune function is likely to augment product demand in the U.S. over the next eight years.

The U.S., China, Japan, and Germany dominated the market over the past few years owing to increased demand for dietary supplement applications. In East Asia, Europe, and North America, the product is primarily employed as a dietary fiber and nutritional supplement.

Key Companies & Market Share Insights

FOS substitutes numerous sweeteners in the food sector such as xylitol, aspartame, and sucralose in light of cost-effectiveness and superior properties. In addition, the product is less harmful when added to products as compared to their counterparts. The School of Food Science and Technology in China has been conducting extensive R&D to introduce cost-effective production routes, which are expected to open new market avenues for the product over the forecast period. In addition, in June 2022, Tate & Lyle, a food ingredient supplier, acquired Quantum Hi-Tech, a key prebiotic dietary fiber business which is located in China. The latter company is engaged in the research, development, production, and sale of the product.

One of the key players in the global Fructooligosaccharides (FOS) market is Meiji Seika Kaisha Ltd. which is largely engaged in product manufacturing under the brand Meioligo. The company joint ventured with a France-based player Beghin-Meiji Industries to produce FOS under the brand name Actilight. Some prominent players in the global fructooligosaccharides (FOS) market include:

-

Beneo

-

Biosynth

-

Cargill, Incorporated

-

Galam

-

Ingredion

-

Meiji Holdings Co., Ltd.

-

Tata Chemicals

-

Tereos Group

Fructooligosaccharides (FOS) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.55 billion

Revenue forecast in 2030

USD 5.09 billion

Growth Rate

CAGR of 8.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, application, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Chile; Mexico; Saudi Arabia; South Africa

Key Companies Profiled

Beneo, Biosynth, Cargill, Incorporated, Galam, Ingredion, Meiji Holdings Co., Ltd., Tata Chemicals Ltd., Tereos Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fructooligosaccharides (FOS) Market Report Segmentation

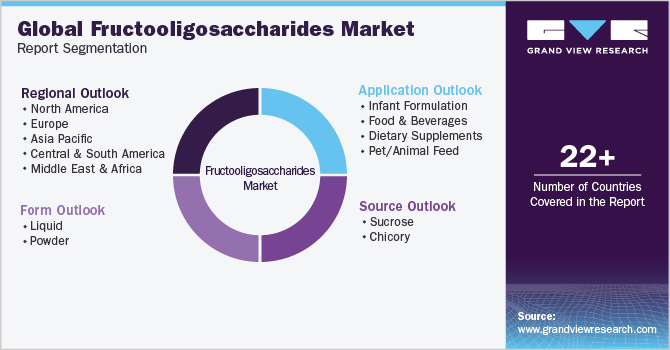

This report forecasts revenue growth at regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fructooligosaccharide (FSO) market report based on source, form, application, and region:

-

Source Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Sucrose

-

Chicory

-

-

Form Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Infant Formulation

-

Food & Beverages

-

Dietary Supplements

-

Pet/Animal Feed

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Itay

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Mexico

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fructooligosaccharides (FOS) market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 to reach USD 5.09 billion by 2030.

b. Europe dominated the fructooligosaccharides (FOS) market with a share of 29.1% in 2022. This is attributable to rising demand for baby food coupled with the presence of numerous infant formula manufacturers in the region.

b. Some key players operating in the fructooligosaccharides market include BBeneo, Biosynth, Cargill Incorporated, Galam,Ingredion, Meiji Holdings Co., Ltd., Tata Chemicals Ltd., Tereos Group

b. Key factors that are driving the market growth include growing consumer awareness regarding the benefits of the product coupled with changing lifestyles and rising concerns regarding health.

b. The global fructooligosaccharides market size was estimated at USD 2.59 billion in 2022 and is expected to reach USD 2.55 billion in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.