- Home

- »

- Advanced Interior Materials

- »

-

Fused Deposition Modeling 3D Printing Market Report, 2030GVR Report cover

![Fused Deposition Modeling 3D Printing Market Size, Share & Trends Report]()

Fused Deposition Modeling 3D Printing Market (2024 - 2030) Size, Share & Trends Analysis Report By Printer Type (Desktop, Industrial), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-270-8

- Number of Report Pages: 124

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fused Deposition Modeling 3D Printing Market Summary

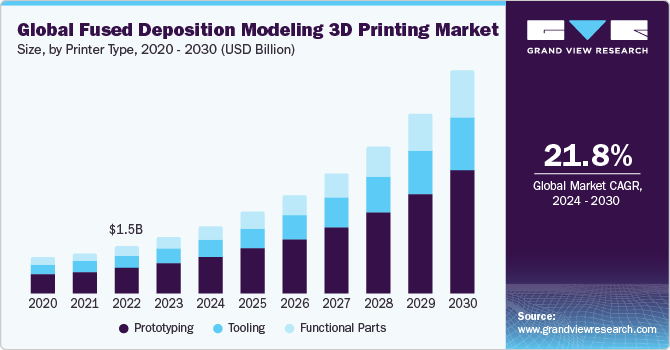

The global fused deposition modeling 3D printing market size was valued at USD 1.7 billion in 2023 and is projected to reach USD 6.9 billion by 2030, growing at a CAGR of 21.8% from 2024 to 2030. The FDM 3D printing market is experiencing robust growth driven by factors such as cost-effectiveness, technological advancements, expanding applications, and sustainability concerns.

Key Market Trends & Insights

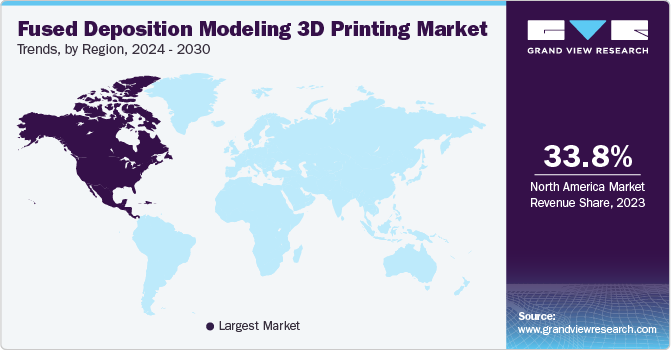

- The North America region led the market and accounted for 33.8% of the global revenue share in 2023.

- Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period.

- By printer type, the industrial segment led the market, accounting for 75.8% of the market share in 2023.

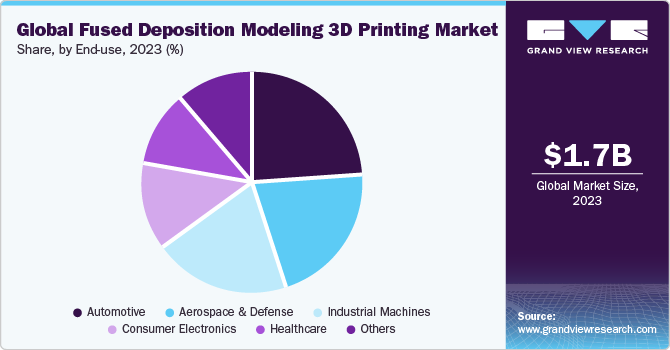

- By end-use, the automotive segment accounted for the largest market share in 2023.

- By application, the prototyping segment led the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.7 Billion

- 2030 Projected Market Size: USD 6.9 Billion

- CAGR (2024-2030): 21.8%

- North America: Largest market in 2023

The increasing availability and development of a diverse range of thermoplastic materials compatible with FDM printers have played a significant role in driving market growth. Manufacturers now have access to a wide selection of materials with different properties, including strength, flexibility, heat resistance, and biodegradability. This enables them to choose the most suitable materials for their specific applications.

Fused Deposition Modeling (FDM) has emerged as one of the most prominent 3D printing technologies, leveraging its ability to create functional prototypes, customized parts, and end-use products with relative ease. One of the key drivers behind the market growth of FDM 3D printing is its cost-effectiveness compared to traditional manufacturing methods. This affordability makes FDM accessible to a wide range of businesses, from small startups to large enterprises, fostering its widespread adoption across industries.

Rising demand for customized and on-demand manufacturing solutions is projected to contribute to the growth of the FDM 3D printing market. FDM technology allows for the rapid and cost-effective production of highly customized parts and products, enabling companies to respond quickly to changing market demands and offer personalized solutions to their customers.

Furthermore, the growing awareness of environmental sustainability and the adoption of eco-friendly manufacturing practices have led to increased interest in FDM 3D printing. Many FDM printers are capable of using recyclable or biodegradable materials, reducing waste and minimizing the environmental impact of manufacturing processes.

The increasing emphasis on sustainability and environmental responsibility is influencing the market. Manufacturers are seeking eco-friendly alternatives to traditional manufacturing processes, and FDM's capability to use recyclable and biodegradable materials aligns with this trend. As environmental regulations become stricter and consumer preferences shift towards sustainable products, FDM 3D printing is expected to gain traction in the market.

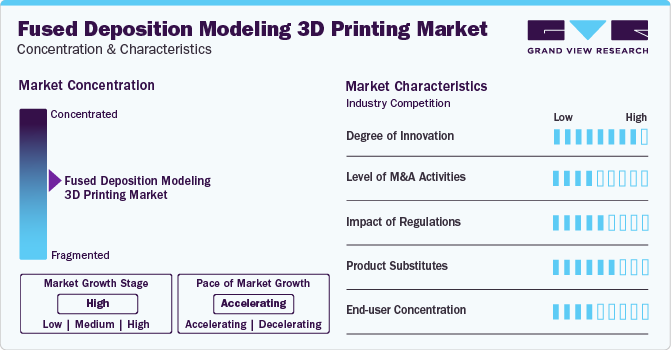

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating. The Fused Deposition Modeling (FDM) 3D printing market is characterized by a high degree of innovation on account of the rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as geographical expansions, product launches, and mergers & acquisitions, to strengthen their position in the global market.

The FDM market is highly competitive, with numerous manufacturers offering a variety of desktop and industrial-grade printers, as well as aftermarket accessories and services. This competition drives innovation and continuous improvement in printer hardware, software, and materials, leading to enhancements in performance, reliability, and user experience.

Technological developments in the FDM 3D printing market have been instrumental in driving the growth and adoption of this additive manufacturing technology. One significant area of advancement is in printer hardware, where manufacturers have continually improved the speed, precision, and reliability of FDM machines. These advancements have led to faster print speeds, finer layer resolutions, and enhanced mechanical properties of printed parts, making FDM printers more capable and versatile.

Regulations play a significant role in shaping the Fused Deposition Modeling (FDM) 3D printing market, particularly concerning safety, intellectual property rights, and environmental considerations. As the adoption of FDM technology expands across industries, regulatory bodies are increasingly scrutinizing its implications and implementing standards to ensure compliance and mitigate risks.

Printer Type Insights

The industrial printer type segment led the market and accounted for a revenue share of 75.8% in 2023. Industrial 3D printers are engineered for high-performance, and high-volume production across industries such as aerospace, automotive, healthcare, and consumer electronics. Their robust construction, advanced features, and large build volumes characterize these printers, enabling them to produce complex, high-precision parts with superior mechanical properties and surface finishes.

Desktop 3D printers are designed for personal, educational, and small-scale professional use, offering affordability, ease of use, and compact form factors. These printers are popular among students, educators, and small businesses seeking to explore 3D printing technology without significant upfront investment or specialized expertise. Desktop 3D printers often feature open-source software, user-friendly interfaces, and a variety of material options, enabling users to create prototypes, models, and functional parts for various applications such as product design, engineering, and art. The choice between desktop and industrial 3D printers depends on factors such as budget, application requirements, production volume, and desired level of automation.

Application Insights

The prototyping application segment led the market in 2023. Prototyping allows designers, engineers, and manufacturers to rapidly iterate on product designs and concepts. FDM printers excel at producing functional prototypes with quick turnaround times and low costs compared to traditional prototyping methods. By using FDM technology for prototyping, companies can accelerate the product development cycle, validate design concepts, and identify potential design flaws early in the process, leading to faster time-to-market and reduced development costs.

Tooling is another critical application area for FDM 3D printing, leveraging its ability to produce custom, durable tools, jigs, fixtures, and molds for manufacturing processes. FDM-printed tooling offers advantages such as design flexibility, lightweight construction, and cost-effectiveness compared to traditional tooling methods. Functional parts production is also a significant application segment for FDM 3D printing, encompassing a wide range of end-use components and products across industries. FDM printers are capable of producing robust, functional parts with excellent mechanical properties, making them suitable for various applications such as automotive components, medical devices, consumer goods, and aerospace parts.

End-use Insights

The automotive end-use segment led the market in 2023. In the automotive sector, FDM 3D printing is employed for manufacturing end-use parts such as interior components, dashboard elements, brackets, and prototype models. Automotive manufacturers leverage FDM technology to produce lightweight, durable parts that meet performance requirements while reducing production costs and lead times. FDM-printed parts contribute to vehicle design innovation, weight reduction, and improved fuel efficiency, enhancing the overall performance and appeal of automobiles.

In the healthcare sector, FDM 3D printing is utilized for manufacturing patient-specific medical devices, prosthetics and orthotics, surgical tools, and anatomical models. FDM technology enbles healthcare providers to customize treatment solutions, improve patient outcomes, and reduce healthcare costs. FDM-printed medical devices offer advantages such as biocompatibility, sterilizability, and rapid prototyping capabilities, facilitating innovation and personalized healthcare delivery.

Regional Insights

North America led the market and accounted for 33.8% of the global revenue share in 2023. North America Fused Deposition Modeling (FDM) 3D Printing is driven by a combination of technological innovation, robust manufacturing industries, and a supportive regulatory environment. Moreover, the region benefits from a thriving ecosystem of research institutions, universities, and technology hubs focused on advancing additive manufacturing techniques and materials.

U.S. Fused Deposition Modeling 3D Printing Market Trends

The U.S. Fused Deposition Modeling (FDM) 3D printing market is projected to grow at a CAGR of 19.7% from 2024 to 2030. The growth of the market is attributed to a strong presence of aerospace, automotive, and healthcare industries leveraging the technology for prototyping, tooling, and end-use parts production.

Europe Fused Deposition Modeling 3D Printing Market Trends

Europe is a significant market for FDM 3D printing, characterized by a diverse industrial base, strong engineering heritage, and a culture of innovation. Countries such as Germany, the UK, and France are driving adoption in industries such as automotive, aerospace, and healthcare, where FDM technology is used for prototyping, tooling, and customized part production. Moreover, initiatives such as the European Union's Horizon Europe funding program and the adoption of Industry 4.0 principles are driving investments in FDM technology and facilitating its integration into existing manufacturing processes.

The Germany Fused Deposition Modeling 3D printing market held a revenue share of over 35.3% of Europe in 2023. The market growth is attributed to highly skilled workforce, advanced research and development capabilities, and a strong industrial base.

The Fused Deposition Modeling 3D Printing market in France is experiencing growth propelled by robust research and development. Initiatives such as "French Fab," which promote collaboration between industry, academia, and government, are playing a key role in this growth.

Asia Pacific Fused Deposition Modeling 3D Printing Market Trends

The Asia Pacific region, including countries such as China, Japan, South Korea, and India, represents a rapidly growing market for FDM 3D printing, fueled by industrialization, urbanization, and technological advancement. In addition, the region benefits from a growing ecosystem of FDM printer manufacturers, material suppliers, and 3D printing service providers, catering to diverse industry verticals and applications.

The China Fused Deposition Modeling 3D printing market held a revenue share of over 44.4% within Asia Pacific in 2023. The Chinese government's "Made in China 2025" initiative and investments in research and development are driving advancements in additive manufacturing technologies such as FDM.

The growth of the Fused Deposition Modeling 3D printing market in India is driven by the country's growing industrialization, technological advancement, and government initiatives to promote additive manufacturing.

Central & South America Fused Deposition Modeling 3D Printing Market Trends

Central and South America, comprising countries such as Brazil, Colombia, and Argentina, exhibit increasing interest and adoption of FDM 3D printing technology, although at a slower pace compared to other regions. Economic growth, industrial development, and investments in technology infrastructure contribute to the expansion of the FDM market in the region.

The Brazil Fused Deposition Modeling 3D printing market held a revenue share of over 46% within the Central & South America region in 2023. The country's diverse manufacturing sector, including automotive, aerospace, healthcare, and consumer goods industries, is embracing FDM technology for prototyping, tooling, and end-use part production.

Middle East & Africa Fused Deposition Modeling 3D Printing Market Trends

The Middle East and Africa region are also witnessing growing interest and investment in FDM 3D printing technology, driven by a combination of economic diversification efforts, infrastructure development, and technological innovation. Countries such as the UAE, Saudi Arabia, and South Africa are leading the adoption of FDM technology in the region, particularly in industries such as aerospace, healthcare, and automotive.

The UAE Fused Deposition Modeling 3D printing market’s growthis driven by the country's ambition to become a global hub for innovation, technology, and advanced manufacturing. Technology. The UAE government's initiatives, including the Dubai 3D Printing Strategy and investments in research and development, support the adoption and growth of FDM technology across various industries.

Key Fused Deposition Modeling 3D Printing Company Insights

The competitive landscape of the Fused Deposition Modeling (FDM) 3D printing market is characterized by a mix of established players, innovative startups, and emerging competitors, driving continuous innovation, technological advancement, and market expansion. This dynamic environment presents opportunities for collaboration, partnership, and strategic differentiation as companies seek to capitalize on the growing demand for additive manufacturing solutions across industries.

Key Fused Deposition Modeling 3D Printing Companies:

The following are the leading companies in the fused deposition modeling 3D printing market. These companies collectively hold the largest market share and dictate industry trends.

- Stratasys

- Markforged

- Bambu Lab

- Shenzhen Creality 3D Technology Co., Ltd.

- ELEGOO

- MakerBot

- UltiMaker

- INTAMSYS TECHNOLOGY CO., LTD.

- Prusa Research a.s.

- Flashforge

Recent Developments

-

In March 2024, Stratasys Ltd. acquired Arevo’s technology portfolio, including its Intellectual Property (IP) estate. This acquisition grants Stratasys access to key patents in carbon fiber printing, Z-strength improvement techniques, and AI-powered build monitoring. By integrating this technology into their FDM 3D printing systems, Stratasys aims to broaden the range of manufacturing applications they can provide to customers.

-

In January 2024, Nexa3D acquired Essentium, a manufacturer of high-speed extrusion 3D printers and materials. This acquisition broadens Nexa3D's capabilities with faster printing technology and deepens their knowledge in super polymers. Additionally, it allows them to better serve a wider range of customers in industrial, healthcare, and government sectors.

-

In November 2023, Stratasys Ltd. launched F3300 Fused Deposition Modeling (FDM) 3D printer. This printer offers reduced labor cost, maximized uptime, and increased part quality and yield.

Fused Deposition Modeling 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.1 billion

Revenue forecast in 2030

USD 6.9 billion

Growth rate

CAGR of 21.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Printer type, application, end-use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; South Korea; Australia; Colombia; Brazil; Saudi Arabia; UAE

Key companies profiled

Stratasys; Markforged; Bambu Lab; Shenzhen Creality 3D Technology Co., Ltd.; ELEGOO; MakerBot; UltiMaker; INTAMSYS TECHNOLOGY CO., LTD.; Prusa Research a.s.; Flashforge

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fused Deposition Modeling 3D Printing Market Report Segmentation

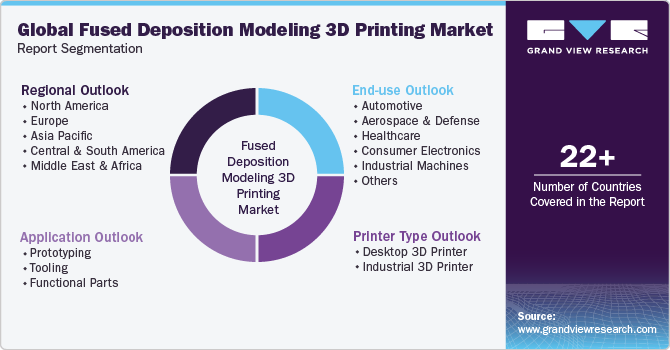

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Fused Deposition Modeling 3D printing market report based on printer type, application, end-use, and region:

-

Printer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Desktop 3D Printer

-

Industrial 3D Printer

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Prototyping

-

Tooling

-

Functional Parts

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Consumer Electronics

-

Industrial Machines

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fused deposition modeling market size was estimated at USD 1.7 billion in 2023 and is expected to be USD 2.1 billion in 2024.

b. The global fused deposition modeling 3D printing market, in terms of revenue, is expected to grow at a compound annual growth rate of 21.8% from 2024 to 2030 to reach USD 6.9 billion by 2030.

b. North America led the market and accounted for 33.3% of the global revenue share in 2023. North America FDM 3D printing market is driven by a combination of technological innovation, robust manufacturing industries, and a supportive regulatory environment.

b. Some of the key players operating in the FDM 3D printing market include Stratasys, Markforged, Bambu Lab, Shenzhen Creality 3D Technology Co., Ltd., ELEGOO, MakerBot, UltiMaker, INTAMSYS TECHNOLOGY CO., LTD., Prusa Research a.s., Flashforge, Raise 3D Technologies, Inc., Zortrax, BigRep, Mosaic Manufacturing, Nexa3D

b. The market is driven by continuous advancements in FDM technology; increasing adoption in manufacturing, and FDM technology offers compatibility with a vast array of materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.