- Home

- »

- Next Generation Technologies

- »

-

Game Engines Market Size & Share, Industry Report, 2030GVR Report cover

![Game Engines Market Size, Share & Trends Report]()

Game Engines Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Type (2D Game Engines, 3D Game Engines), By Platform (Mobile, Console, Computer), By Genre (Action & Adventure, Sandbox), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-991-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Game Engines Market Summary

The global game engines market size was estimated at USD 3,072.6 million in 2024 and is projected to reach USD 8,345.2 million by 2030, growing at a CAGR of 18.4% from 2025 to 2030. The surge in mobile gaming popularity is a significant market growth driver.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, solution accounted for a revenue of USD 2,480.9 million in 2024.

- Services is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,072.6 Million

- 2030 Projected Market Size: USD 8,345.2 Million

- CAGR (2025-2030): 18.4%

- Asia Pacific: Largest market in 2024

With the widespread use of smartphones and tablets, developers are increasingly seeking efficient tools to create high-quality mobile games. Game engines like Unity and Unreal Engine are capitalizing on this trend by providing robust features tailored for mobile platforms, enabling rapid game development and deployment. This trend is expected to continue, as mobile gaming accounts for a substantial share of overall gaming revenue, fostering further innovation in game engine technology. As a result, the demand for versatile and user-friendly game engines is likely to rise.

The booming eSports industry is significantly influencing the game engines market. Game engines are essential for developing competitive titles that require real-time physics simulation and network optimization to ensure smooth gameplay experiences. Platforms like Unity have introduced specialized tools to cater to eSports, enhancing features such as match management and player profiles. This trend underscores the importance of high-performance game engines that can support complex multiplayer mechanics, driving further investment and development in this area. Consequently, the eSports segment is expected to continue expanding rapidly.

The increasing adoption of VR and AR technologies is transforming the game engines industry by redefining the requirements for development platforms. Developers now seek advanced game engines capable of crafting immersive experiences that fully leverage these cutting-edge technologies. Platforms incorporating robust VR and AR functionalities are becoming indispensable for creating next-generation games that captivate players on a deeper level. This shift is fueling demand for sophisticated 3D game engines that can render intricate environments in real-time, thereby expanding the horizons of traditional gaming. As consumer enthusiasm for immersive technologies continues to grow, the game engines industry is poised for significant expansion.

The market is also seeing the introduction of innovative game engines designed to enhance development capabilities. Next-generation platforms such as Unreal Engine 5 and Amazon Lumberyard are setting new benchmarks in graphics quality and user experience. These advanced solutions empower developers with powerful tools for producing visually impressive games while streamlining the creation process through enhanced accessibility. This evolution underscores a shift in the game engines industry towards more sophisticated development environments that appeal to both experienced professionals and newcomers. The continuous refinement of these platforms is expected to drive sustained growth in the game engines industry.

Beyond gaming, the versatility of the game engines industry is evident in its growing use across non-gaming sectors such as education, healthcare, and advertising. These platforms are increasingly valued for their ability to power interactive simulations and training environments. As industries discover new applications for game engines, demand is set to rise sharply. This diversification not only broadens the industry’s market potential but also fosters innovation as developers adapt game engine technologies for novel use cases. This trend will play a pivotal role in driving the game engines industry’s overall growth trajectory.

Component Insights

The solution segment has a significant market share in 2024, accounting for over 69% of the global revenue. The demand for cross-platform gaming experiences is propelling advancements in game engine technology. Developers are increasingly looking for solutions that allow seamless gameplay across multiple devices, including mobile, PC, and consoles. Game engines that facilitate cross-platform compatibility are becoming essential as they enable developers to reach broader audiences without compromising on quality or performance. This trend is driving innovation within game engines, leading to improved functionalities that support diverse platforms and enhance user engagement. As cross-platform gaming continues to gain momentum, this aspect will be a key focus area for future developments in the market.

The services segment is predicted to foresee the highest growth in the coming years. There is a growing trend towards custom development services within the game engines industry, as developers seek unique solutions tailored to their specific needs. Many companies are recognizing that off-the-shelf solutions may not fully meet the diverse requirements of their projects, prompting them to invest in custom engine modifications and integrations. This trend enables developers to create highly specialized gaming experiences that stand out in a competitive market. As a result, service providers are increasingly offering bespoke development options, which enhances their value proposition and strengthens client relationships. This shift towards customization reflects a broader demand for personalized solutions in the gaming industry.

Type Insights

The 3D game engines segment accounted for the largest market revenue share in 2024. The availability of open-source 3D game engines is becoming a notable trend in the market. These engines offer developers access to powerful tools without the associated costs of proprietary software, fostering innovation and creativity. Open-source platforms allow for greater customization and flexibility, enabling developers to tailor their projects according to specific needs. This trend is particularly appealing to indie developers and smaller studios, who can leverage these resources to create high-quality games on limited budgets. The rise of open-source solutions is expected to democratize game development further, leading to a broader range of creative projects in the industry.

The 2D game engines segment is predicted to foresee significant growth in the coming years. The mobile gaming sector is significantly boosting the demand for 2D game engines, as many successful mobile titles utilize 2D graphics for their gameplay. With billions of global users engaging in mobile gaming, there is a growing need for engines that can efficiently support the development of 2D games tailored for smartphones and tablets. This trend has prompted major game engine platforms to enhance their features specifically for mobile development, making it easier for developers to create engaging and visually appealing games. As mobile gaming continues to thrive, the demand for versatile 2D engines is expected to rise accordingly. This shift underscores the importance of 2D engines in catering to the expanding mobile gaming audience.

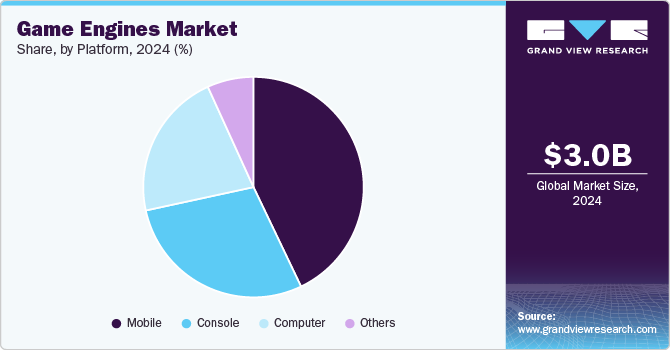

Platform Insights

The mobile segment accounted for the largest revenue share in 2024. The integration of cloud-based game engines is becoming increasingly popular among developers for real-time collaboration and efficient workflows. These platforms allow teams to work together seamlessly, regardless of their physical location, thus improving productivity and reducing development time. Cloud-based solutions also enable developers to leverage powerful computing resources without the need for extensive local infrastructure. This trend aligns with the growing need for agile development processes in the fast-paced gaming industry. As more developers adopt cloud technologies, the demand for mobile game engines that offer these capabilities will likely increase significantly.

The console segment is predicted to foresee significant growth in the coming years. There is a growing demand for game engines that support advanced features such as multiplayer gaming, virtual reality (VR), and streaming capabilities on consoles. Developers are looking for engines that can handle complex game mechanics while providing smooth and responsive gameplay experiences. The need for high-quality graphics and real-time physics simulations is driving the evolution of console game engines, prompting providers to enhance their offerings continuously. This trend reflects the industry's shift towards creating more immersive and interactive gaming experiences that resonate with players. As a result, game engines equipped with cutting-edge features will be crucial for developers aiming to excel in the competitive console market.

Genre Insights

The action & adventure segment accounted for the largest revenue share of the game engines industry in 2024. The action and adventure genre are experiencing a surge in indie game development, as independent creators leverage accessible game engines to bring their unique visions to life. Affordable platforms like Unity and Godot provide indie developers with powerful tools to create high-quality games without requiring extensive resources or funding. This trend has led to a diverse range of innovative titles within the action and adventure space, enriching the gaming landscape. As indie games gain popularity among players, the demand for user-friendly game engines that cater specifically to this genre will continue to rise. This evolution underscores the importance of supporting independent developers in fostering creativity within the market.

The multiplayer online battle arena (MOBA) segment is expected to exhibit the highest CAGR over the forecast period. The demand for cross-platform compatibility within MOBA games is becoming increasingly important as players seek flexibility in how they engage with games. Game engines that facilitate cross-platform play allow developers to reach a broader audience by enabling gameplay across various devices, including PCs, consoles, and mobile platforms. This trend reflects the desire for inclusivity within the gaming community, allowing friends to play together regardless of their preferred platform. As cross-platform capabilities become a standard expectation among gamers, the adoption of versatile game engines that support this functionality will likely accelerate. This shift highlights the importance of adaptability in meeting player preferences within the MOBA segment.

Regional Insights

North America game engines market has a significant revenue share of over 29% in 2024. The North America game engines market is the largest globally, driven by the presence of major developers like Epic Games and Unity Technologies. This region is characterized by a strong demand for advanced game engines that support high-quality graphics and complex gameplay mechanics, particularly in the eSports sector. The U.S. remains a key player, with a significant share of the market attributed to its robust gaming ecosystem and continuous innovation in game development technologies.

U.S. Game Engines Market Trends

The U.S. game engines industry is expected to grow at a CAGR from 2025 to 2030. The U.S. game engine market is witnessing a significant shift towards the adoption of AR and VR technologies, which are transforming gaming experiences. Developers are increasingly looking for engines that support these advanced features, enabling them to create more interactive and immersive games that integrate seamlessly with the real world. As technology progresses, the demand for game engines with enhanced capabilities to deliver lifelike effects and experiences is expected to rise.

Europe Game Engines Market Trends

The game engines industry in the Europe region is expected to witness significant growth over the forecast period. Europe is the second-largest market for game engines, with countries such as the UK, Germany, and France leading in development activities. The region benefits from a strong presence of established game studios and a growing indie game community that favors engines like Unity and Unreal Engine for their versatility. The increasing interest in immersive gaming experiences and advanced graphics capabilities is driving demand for sophisticated game engines across various genres.

Asia Pacific Game Engines Market Trends

The Asia Pacific game engines industry is expected to register the highest CAGR over the forecast period, driven by a rapidly growing gaming population in countries like China, Japan, and South Korea. This region is characterized by significant investments in mobile game development, with popular engines such as Unity and Unreal Engine being favored for their ability to deliver high-quality graphics and cross-platform functionality. The increasing smartphone penetration and high-speed internet access further fuel demand for innovative mobile games, positioning Asia Pacific as a critical growth area for game engine providers.

Key Game Engines Company Insights

Leading companies in the game engines industry, such as Unity Software Inc.; Epic Games (Unreal Engine); Crytek GmbH (CryEngine); YoYo Games Ltd. (GameMaker Studio 2); Scirra Ltd. (Construct 3); and Cocos, are actively working to expand their customer base and strengthen their competitive positioning. To achieve these objectives, they are implementing strategic measures including partnerships, mergers and acquisitions, collaborations, and the development of innovative products and technologies. These initiatives enable them to enhance their market footprint while aligning with the evolving preferences of consumers. By prioritizing innovation and adaptability, these companies aim to address the dynamic requirements of the gaming industry effectively.

-

Unity Software Inc. is a leading name in the game engines market, providing a versatile platform for creating real-time 3D (RT3D) content across various industries, including gaming, automotive, architecture, and film. Known for its user-friendly interface, Unity supports cross-platform development, enabling developers to deploy games on multiple platforms seamlessly. The company excels in offering robust features such as physics engines, asset management, and scripting capabilities, making it a top choice for indie developers and large studios alike. Unity’s dominance stems from its large developer community, extensive marketplace of assets, and continuous innovation, such as support for VR and AR technologies.

-

Unreal Engine, developed by Epic Games, is renowned for its high-performance capabilities, particularly in creating photorealistic visuals and immersive experiences. The engine offers a comprehensive suite of tools, including advanced rendering, visual scripting via Blueprints, and a dynamic asset marketplace. Unreal Engine is a preferred choice for AAA game studios and industries requiring cinematic-quality visuals, such as film production and architectural visualization. Its flexible licensing model and free access to core features empower developers of all scales, while Epic’s consistent focus on innovation ensures the platform remains at the forefront of technology trends.

Key Game Engines Companies:

The following are the leading companies in the game engines market. These companies collectively hold the largest market share and dictate industry trends.

- Buildbox

- Clickteam

- Cocos

- Crytek GmbH

- GameSalad

- Marmalade Technologies Ltd.

- Phaser (Photon Storm Ltd.)

- RPG Maker

- Scirra Ltd. (Construct 3)

- Stencyl LLC

- Stride

- The Game Creators Ltd. (AppGameKit)

- Unity Software Inc.

- Unreal Engine (Epic Games)

- YoYo Games Ltd. (GameMaker Studio 2)

Recent Developments

-

In October 2024, Unity Technologies released Unity 6 during its annual Unite Developer Conference. This new version is designed to enhance performance and stability, addressing previous developer concerns regarding the company's pricing model. Unity has committed to a more transparent approach to pricing, ensuring that any future adjustments will be communicated clearly in advance. The release aims to strengthen the Unity’s relationship with developers by providing improved tools and resources tailored to their needs.

-

In August 2024, NVIDIA launched NVIDIA ACE, a suite designed to enhance digital human interactions through generative AI. The first game to utilize this technology is Mecha BREAK, which highlights AI-powered characters capable of more intuitive player interactions. Additionally, NVIDIA celebrated reaching a milestone of 600 RTX games and applications, announcing 20 new titles, including Indiana Jones and the Great Circle and Dragon Age: The Veilguard. Furthermore, NVIDIA's collaboration with MediaTek aims to make G-SYNC display technologies more accessible, introducing G-SYNC Pulsar for improved motion clarity and variable refresh rates in upcoming monitors.

Game Engines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.58 billion

Revenue forecast in 2030

USD 8.35 billion

Growth rate

CAGR of 18.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, platform, genre, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy, Spain China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Buildbox; Clickteam; Cocos; Crytek GmbH; GameSalad; Marmalade Technologies Ltd.; Phaser (Photon Storm Ltd.); RPG Maker; Scirra Ltd. (Construct 3); Stencyl LLC; Stride; The Game Creators Ltd. (AppGameKit); Unity Software Inc.; Unreal Engine (Epic Games); YoYo Games Ltd. (GameMaker Studio 2)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Game Engines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global game engines market report based on component, type, platform, genre, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Game Engines

-

3D Game Engines

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile

-

Console

-

Computer

-

Others

-

-

Genre Outlook (Revenue, USD Million, 2018 - 2030)

-

Action & Adventure

-

Multiplayer online battle arena (MOBA)

-

Real-time strategy (RTS)

-

Role-playing games (RPG, ARPG, CRPG, MMORPG, TRPG, etc.)

-

Sandbox

-

Shooter (FPS & TPS)

-

Simulation and Sports

-

Others (Puzzlers, Gamers, Survival & Horror Games, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global game engines market size was estimated at USD 3.07 billion in 2024 and is expected to reach USD 3.58 billion in 2025.

b. The global game engines market is expected to grow at a compound annual growth rate of 18.4% from 2025 to 2030 to reach USD 8.35 billion by 2030.

b. Asia Pacific dominated the game engines market with a share of 36.71% in 2024. This is attributable to the strong trend of playing & creating video games and the high penetration of mobile platforms in the region.

b. Some key players operating in the game engines market include Unity Software, Inc.; PixiJS; Godot; RPG Maker; Crytek GmbH; GDevelop Ltd. and Open 3D Engine.

b. Key factors that are driving the game engines market growth include increasing demand for gaming on various devices along with the increasing trends towards gaming among the population worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.