- Home

- »

- Electronic & Electrical

- »

-

Gaming Accessories Market Size And Share Report, 2030GVR Report cover

![Gaming Accessories Market Size, Share & Trends Report]()

Gaming Accessories Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Gaming Chairs, Controllers, Headsets and Audio Equipment), By Platform, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-180-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gaming Accessories Market Summary

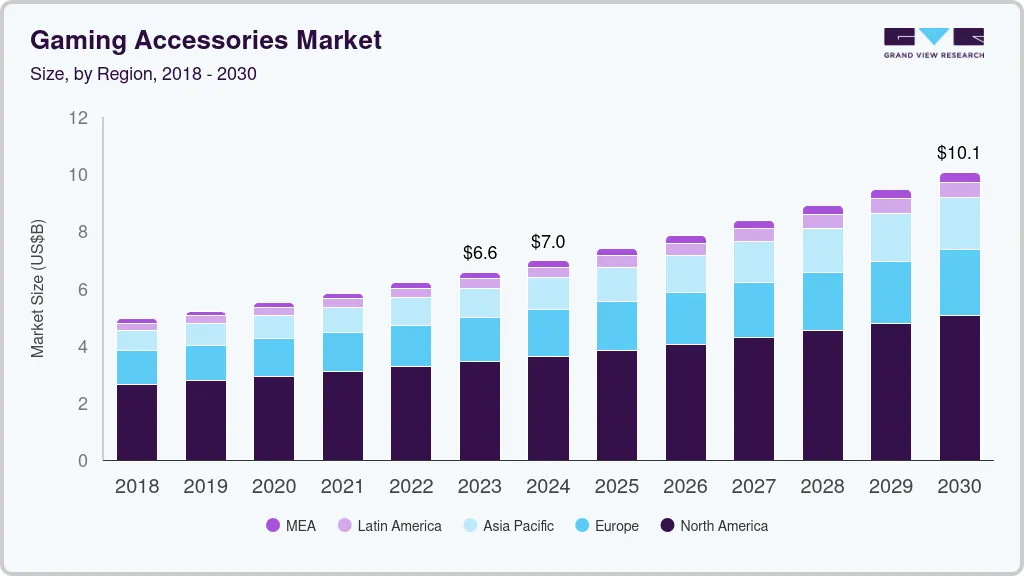

The global gaming accessories market size was estimated at USD 6,570.5 million in 2023 and is projected to reach USD 10,072.2 Million by 2030, growing at a CAGR of 6.3% from 2024 to 2030.Mobile gaming has become a dominant force in the industry with the widespread use of smartphones and tablets.

Key Market Trends & Insights

- North America dominated the market with a share of over 52.3% in 2023.

- In terms of product, controllers dominated the global market with the largest market share of 32.9% of the total revenue in 2023.

- By platform, PC gaming held 38.9% of the total market in 2023.

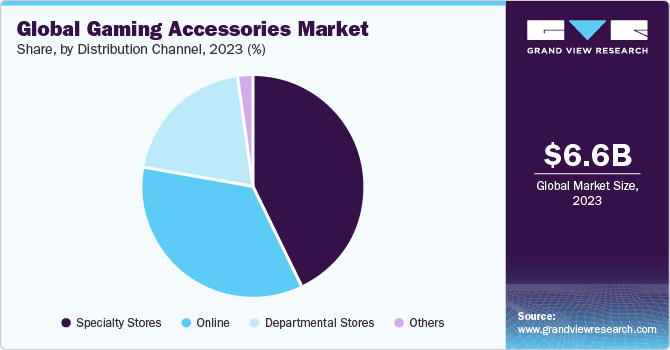

- By distribution channel, specialty stores are expected to hold a market share of 42.7% of the total market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6,570.5 Million

- 2030 Projected Market Size: USD 10,072.2 Million

- CAGR (2024-2030): 6.3%

- North America: Largest market in 2023

This shift has led to a surge in demand for portable gaming accessories, including controllers and headphones specifically designed for mobile devices, boosting the market. Technological advancements within the gaming industry have been instrumental in shaping the trajectory of the market. Modern gaming consoles, powerful graphics cards, and immersive gaming experiences have set new standards for quality and performance. Accessory manufacturers have developed products that complement these advancements, such as mechanical keyboards with customizable RGB lighting, high-precision gaming mice, and audio peripherals that deliver an immersive sound experience. The symbiotic relationship between gaming technology and accessories has created a cycle of innovation, driving the market forward.

Cross-platform compatibility has emerged as a pivotal and influential concept within the market, significantly shaping consumer preferences and contributing to industry growth. In the contemporary gaming landscape, where players often own and engage with multiple gaming platforms such as consoles, PCs, and even mobile devices, the demand for accessories seamlessly transcending these boundaries has intensified. This demand is fueled by the desire for flexibility and convenience, allowing gamers to use their preferred accessories across various platforms without encountering compatibility issues.

Market Concentration & Characteristics

The gaming accessories market is characterized by a high degree of innovation, with companies consistently striving to introduce cutting-edge technologies and features in their products. Range of innovations has advanced sensor technologies in gaming mice, immersive haptic feedback in controllers, and high-quality audio enhancements in headsets. The competitive landscape drives continuous improvements as manufacturers compete to offer unique and superior functionalities.

Merger and acquisition (M&A) activities have been notable in the gaming accessories industry, with companies seeking strategic partnerships and acquisitions to strengthen their market positions. Established gaming accessory manufacturers often acquire emerging companies specializing in niche technologies or innovative designs. These activities aim to broaden product portfolios, tap into new consumer segments, and leverage complementary expertise.

The market is driven by technological advancements as there is a relatively low impact of stringent regulations. Regulatory frameworks typically focus on product safety standards rather than restricting innovation. Manufacturers must comply with industry-specific safety regulations to ensure consumer protection, especially concerning products like controllers, VR headsets, and electronic components.

The market faces limited direct substitutes due to the specialized and unique functionalities of gaming peripherals. While there are alternative brands and models within specific product categories, such as different gaming mice or keyboards, valid substitutes are rare. However, indirect substitutes exist as cross-compatible accessories and peripherals designed for general computer use.

Product Insights

In terms of product, controllers dominated the global market with the largest market share of 32.9% of the total revenue in 2023. Controllers have a broad appeal across different gaming platforms. Whether used with gaming consoles, PCs, or even mobile devices, they provide a familiar and standardized means of interaction for gamers. This universality contributes to their widespread adoption and ensures they cater to a diverse audience, encompassing casual gamers, enthusiasts, and professional players.

Platform Insights

PC gaming held 38.9% of the total market in 2023. Unlike consoles, PCs allow users to build and upgrade their gaming setups according to their preferences and requirements. This flexibility extends to gaming accessories such as keyboards, mice, headsets, and monitors, allowing gamers to create a personalized gaming environment. As a result, the demand for different accessories tailored to PC gaming has significantly contributed to the platform's market share.

Distribution Channel Insights

Specialty stores are expected to hold a market share of 42.7% of the total market in 2023. A focused and curated selection of gaming accessories in specialty stores is responsible for its prominence in the market. These stores specialize exclusively in gaming-related products, creating an environment where consumers can find various accessories tailored specifically for gaming purposes. This specialization allows for a more in-depth and knowledgeable approach to product offerings, catering to the unique requirements of gamers in terms of performance, design, and compatibility.

Specialty stores also excel in creating an immersive and engaging shopping experience for gamers. The ambiance of these stores is designed to resonate with gaming culture, fostering a sense of community and excitement. This environment attracts gaming enthusiasts and enhances the shopping experience, making it more enjoyable and memorable for consumers.

Regional Insights

North America dominated the market with a share of over 52.3% in 2023. The region boasts a large and diverse community of gamers, from casual players to professional esports enthusiasts. The widespread popularity of gaming as a form of entertainment has created a substantial market for high-quality accessories, including controllers, keyboards, headsets, and virtual reality peripherals.

Technological advancements in the gaming industry further solidify North America's leading position in the market. The region is home to leading gaming console manufacturers like Microsoft, Sony, and influential gaming accessory brands. The continuous innovation in gaming technology, including the development of advanced graphics, immersive audio, and cutting-edge peripherals, contributes to a high demand for top-tier accessories that complement these technological advancements.

Key Companies & Market Share Insights

The competitive landscape in the gaming accessories market is characterized by intense rivalry among key players, innovative product offerings, strategic partnerships, and a constant focus on meeting the evolving demands of the diverse and growing gaming community. Several factors contribute to the dynamic nature of the competitive environment within this market.

Major players in the market include well-established brands with a global presence. Companies like Logitech, Razer, Corsair, SteelSeries, and HyperX are among the leaders, offering a wide range of gaming peripherals such as mice, keyboards, headsets, and controllers. These brands leverage their strong brand recognition, extensive distribution networks, and research and development capabilities to maintain a competitive edge.

-

In December 2023, Logitech G, a branch of Logitech specializing in gaming technologies and equipment, unveiled the Logitech G ASTRO A50 X LIGHTSPEED Wireless Gaming Headset and Base Station.

-

In November 2023, Razer launched an upgrade of an 8000 Hz mouse with 30k optical sensors. This gaming mouse is accompanied by ultra-low latency of Razer hyperpolling wireless technology, giving it smoother curser moments and better accuracy.

-

In October 2023, Corsair launched a K70 core gaming keyboard. The product has OPX optical and MGX magnetic switches, Corsair reds, and mechanical switches to ensure smooth gameplay and operation.

Key Gaming Accessories Companies:

- Logitech G

- Razer Inc.

- Corsair

- SteelSeries

- HyperX

- Thrustmaster

- Turtle Beach

- ASUS

- Xbox

- Micro-Star INT'L CO., LTD

Gaming Accessories Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.97 billion

Revenue forecast in 2030

USD 10.07 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, platform, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; Brazil; South Africa

Key companies profiled

Logitech G; Razer Inc.; Corsair; SteelSeries; HyperX; Thrustmaster; Turtle Beach; ASUS; Xbox; Micro-Star INT'L CO., LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Gaming Accessories Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gaming accessories market report based on product, platform, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gaming Chairs

-

Controllers

-

Headsets and Audio Equipment

-

Keyboards and Mouse

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile

-

Console

-

PC Gaming

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialty Stores

-

Online

-

Departmental Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gaming accessories market size was estimated at USD 6.57 billion in 2023 and is expected to reach USD 6.97 billion in 2024.

b. The global gaming accessories market is expected to grow at a compounded growth rate of 6.3% from 2024 to 2030 to reach USD 10.07 billion by 2030.

b. North America dominated the global gaming accessories market with a share 52.3% in 2023. The region boasts a large and diverse community of gamers, ranging from casual players to professional esports enthusiasts. The widespread popularity of gaming as a form of entertainment has created a substantial market for high-quality accessories, including controllers, keyboards, headsets, and virtual reality peripherals.

b. Some key players operating in gaming accessories market include Logitech G, Razer Inc., Corsair, SteelSeries, HyperX, Thrustmaster, Turtle Beach, ASUS, Xbox, Micro-Star INT'L CO., LTD

b. With the widespread use of smartphones and tablets, mobile gaming has become a dominant force in the industry. This shift has led to a surge in demand for portable gaming accessories, including controllers and headphones specifically designed for mobile devices and this is boosting the gaming accessories market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.