- Home

- »

- Electronic Devices

- »

-

Gaming PC Market Size And Trends, Industry Report, 2030GVR Report cover

![Gaming PC Market Size, Share & Trends Report]()

Gaming PC Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Category (Desktop, Laptop, Peripherals), By Price Range, By End-user (Professional Gamers, Casual Gamers), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-086-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gaming PC Market Summary

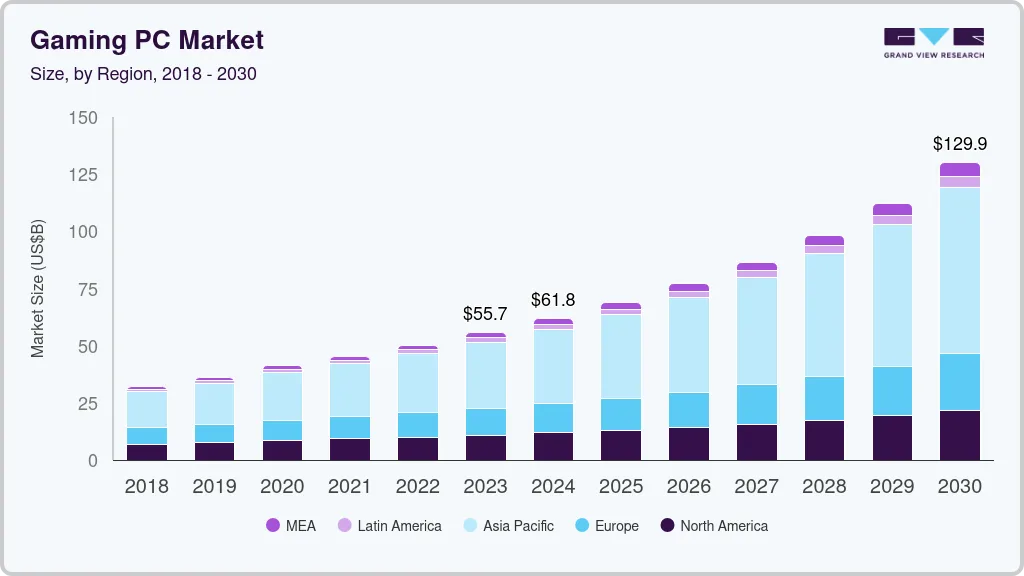

The global gaming PC market size was estimated at USD 61.84 billion in 2024 and is projected to reach USD 129.93 billion by 2030, growing at a CAGR of 13.5% from 2025 to 2030. The market growth is primarily driven by increasing global demand for high-performance computing systems supporting next-generation video games.

Key Market Trends & Insights

- Asia Pacific gaming PC market dominated the global industry with a revenue share of over 52.04% in 2024.

- The gaming PC market in China is rapidly expanding, fueled by the booming gaming culture and expansive digital infrastructure.

- By product category, the desktop segment held the largest share of over 54.0% in 2024.

- By end-use, the professional gamers segment accounted for the largest revenue share in 2024.

- By distribution channel, the offline segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 61.84 Billion

- 2030 Projected Market Size: USD 129.93 Billion

- CAGR (2025-2030): 13.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

The surge in popularity of esports and online multiplayer games is fueling consumer investment in advanced gaming setups. The growing trend of game streaming and content creation on platforms like Twitch and YouTube is encouraging gamers to upgrade their PCs with high-end graphics cards, processors, and peripherals. Technological advancements such as ray tracing, real-time rendering, and higher frame rates are also pushing gamers to adopt newer systems. Increasing disposable income among millennials and Gen Z consumers, along with rising awareness of customizable and upgradeable PC builds, is driving sustained interest in the gaming PC market.

The increasing popularity of eSports and competitive gaming is a powerful driver for the gaming PC industry. Professional and amateur players demand high-performance hardware to compete at optimal levels. Gaming PCs with advanced graphics cards, high refresh rate monitors, and superior cooling systems offer the edge needed in competitive environments. The proliferation of global eSports tournaments and sponsorships has further fueled consumer interest, encouraging gamers to invest in high-end systems that mirror those used by professional players, thereby enhancing the gaming PC industry.

Additionally, the rise of content creation and game streaming has become a significant influence on gaming PC sales. Platforms such as Twitch, YouTube Gaming, and Kick have created a new segment of users who play games and produce engaging content. These streamers require powerful PCs capable of running games smoothly while handling live broadcasting and video editing simultaneously. Individuals seek to build personal brands through gaming content, and the demand for high-specification gaming PCs continues to grow.

Furthermore, the expanding ecosystem of gaming accessories and peripherals is contributing to the market’s growth. Products such as mechanical keyboards, programmable gaming mice, RGB lighting systems, and immersive headsets enhance the overall gaming experience. This encourages users to build complete gaming setups around their PCs, driving sales across the broader gaming hardware segment. Innovations in haptic feedback and wireless technologies emerge, and these complementary devices further solidify the demand for the gaming PC industry.

Moreover, there is a technological advancement in graphics processing units (GPUs) and central processing units (CPUs). Companies regularly release cutting-edge components that drastically enhance gaming experiences through better frame rates, realism, and multitasking capabilities. The desire among gamers to keep up with the latest hardware upgrades fosters a culture of continual replacement and customization, which directly benefits the gaming PC market.

Product Category Insights

The desktop segment dominated the market with a revenue share of over 54% in 2024. Desktops are more powerful than laptops due to their powerful components and larger size. Furthermore, they are more affordable compared to other available alternatives. They can be easily upgraded and customized to meet gamers’ specific needs. Market players are focused on collaborations to maximize efficiency and deliver a quality product, thereby solidifying the dominance of this segment.

The laptop segment is expected to witness a significant CAGR of over 14% from 2025 to 2030. The increasing consumer demand for portable yet high-performance gaming solutions drives this growth. Modern gaming laptops are now equipped with advanced GPUs, high-refresh-rate displays, and efficient thermal management systems, offering desktop-like performance in a compact form. Technological advancements in battery life, cooling technologies, and power-efficient chipsets enhance gaming laptops' appeal, making them an attractive choice for casual and competitive gamers.

End-user Insights

The professional gamers segment accounted for the largest revenue share in 2024, owing to the increasing complexity of modern games, combined with the need for seamless streaming, multi-tasking, and real-time analytics, which has further accelerated the demand for customized, high-end PC configurations among professionals. Sponsorship deals, tournament participation, and career monetization opportunities have incentivized professional gamers to upgrade their systems to stay ahead continually. The segment's growth is also supported by the emergence of training academies, gaming houses, and brand endorsements, which rely heavily on state-of-the-art gaming hardware, reinforcing the dominance of the professional gamers segment in the gaming PC industry.

The casual gamers segment is expected to witness the highest CAGR from 2025 to 2030. The growing popularity of accessible and less hardware-intensive games, such as eSports titles and multiplayer online games, has driven demand for mid-range yet powerful gaming PCs. Casual gamers prioritize affordability, plug-and-play functionality, and versatility, prompting manufacturers to develop systems with optimized performance and user-friendly features. Additionally, the influence of social media, streaming platforms, and influencer-driven content has made gaming more mainstream, attracting a wider audience. These trends contribute to the rapid growth of the casual gamer segment in the gaming PC market.

Distribution Channel Insights

The offline segment accounted for the largest revenue share in 2024, driven by its tactile and experiential advantages. Many consumers prefer visiting physical stores to interact with systems firsthand, testing performance, building quality, and peripheral compatibility before making a purchase. This hands-on experience is particularly important for gamers investing significantly in high-performance hardware. These benefits make the offline segment a critical force in sustaining gaming PC sales, particularly among first-time buyers.

The online segment expected to witness the highest CAGR from 2025 to 2030, driven by unmatched convenience, broader product selection, and competitive pricing. Accessibility has become especially important for tech-savvy gamers who prefer detailed specifications and customization options before making a purchase. The rise of flash sales, exclusive online discounts, and flexible payment options further incentivizes buyers to choose online retailers over traditional stores. The ability to access global inventories and limited-edition models also enhances the appeal of the online segment, making it a key contributor to sustained gaming PC market growth.

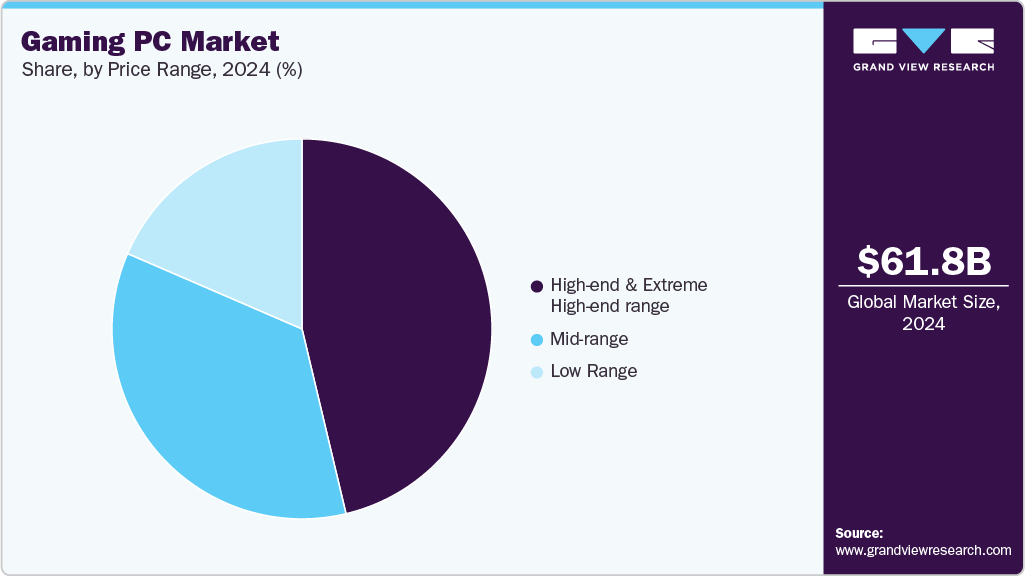

Price Range Insights

The high-end and extreme high-end range segment accounted for the largest revenue share in 2024, driven by the increasing demand for premium gaming experiences and the growing sophistication of modern games. The emergence of 4K and 8K gaming, real-time ray tracing, and AI-enhanced graphics is pushing enthusiasts toward high-performance systems. This convergence of technological innovation, content demands, and consumer expectations positions the high-end and extreme high-end segments as a key growth area within the gaming PC market.

The mid-range segment is expected to witness the highest CAGR from 2025 to 2030, owing to its ability to strike the perfect balance between cost and capability. Consumers are increasingly seeking systems that offer solid performance without the premium price tag of high-end rigs. Improvements in thermal management and SSD storage in mid-tier models have significantly enhanced system responsiveness and longevity. These systems appeal especially to casual and semi-serious gamers who want quality gaming experiences without overspending, making this segment a consistent driver of market growth.

Regional Insights

North America gaming PC market accounted for the revenue share of over 19% in 2024, primarily driven by the region’s high concentration of gaming enthusiasts and tech-savvy consumers. The strong presence of leading gaming hardware manufacturers, coupled with widespread broadband access and advanced IT infrastructure, has created a robust environment for the gaming PC industry. The increasing integration of gaming into mainstream entertainment and education, along with rising disposable income and consumer willingness to invest in premium technology, continues to make North America a dominant force in the global gaming PC market.

U.S. Gaming PC Market Trends

The U.S. gaming PC market is expected to grow at a CAGR of over 10% from 2025 to 2030, fueled by a highly developed digital infrastructure and a tech-savvy consumer base. The widespread availability of high-speed internet and the rapid expansion of 5G networks enhance online gaming experiences, prompting users to upgrade to high-performance gaming PCs. Increasing investments by leading tech companies and hardware manufacturers in product innovation and retail presence continue to bolster market growth across the country.

Europe Gaming PC Market Trends

The Europe gaming PC market is expected to grow at a CAGR of over 12% from 2025 to 2030. In Europe, a well-established retail network, both online and offline, ensures widespread accessibility to premium and mid-range gaming systems. The rise of gaming-focused education programs and vocational training in game development and design is also driving demand for high-performance PCs among students and professionals. Broadband speeds improve, and 5G connectivity expands across the continent, more users are turning to gaming PCs for immersive multiplayer experiences, reinforcing the region’s pivotal role in the global gaming PC market.

The UK gaming PC market is expected to grow at a significant rate in the coming years. The country has a vibrant gaming community supported by a robust ecosystem of local game developers, eSports organizations, and tech retailers. The growing popularity of game streaming and content creation in the UK is prompting users to invest in powerful PCs capable of handling both gameplay and broadcasting tasks. Tech-savvy population and widespread broadband access, the UK offers a fertile environment for sustained gaming PC market expansion.

The Germany gaming PC market is experiencing robust growth driven by the country’s strong consumer purchasing power. German gamers tend to favor high-performance systems with reliable build quality, fueling demand for premium gaming PCs equipped with advanced GPUs, fast processors, and durable components. Germany's well-developed digital infrastructure and growing interest in eSports and online multiplayer gaming further stimulate demand, positioning the country as a key player in the broader European gaming PC landscape.

Asia Pacific Gaming PC Market Trends

Asia Pacific gaming PC market is expected to grow at a CAGR of over 14% from 2025 to 2030, fueled by a youthful population and rising disposable incomes. The cultural shift is pushing demand for high-performance PCs capable of delivering immersive gaming experiences. The proliferation of internet cafés and gaming lounges in densely populated areas, the region presents a fertile environment for gaming PC adoption. These dynamics, supported by local and international hardware vendors, position Asia Pacific as a major global growth engine for the gaming PC industry.

The Japan gaming PC market is gaining traction, fueled by the country’s deep-rooted gaming culture and strong consumer preference for high-quality electronics. Japan’s legacy as a pioneer in gaming home to global giants like Nintendo, Sony, and Sega, has cultivated a tech-savvy and loyal gaming community that values immersive and graphically advanced experiences. This has driven consistent demand for high-performance gaming PCs capable of supporting cutting-edge titles and VR applications. These factors, combined with a rising interest in eSports and PC-based competitive gaming, are propelling the growth of the gaming PC market across the country.

China gaming PC market is rapidly expanding, fueled by the country's booming gaming culture and expansive digital infrastructure. China presents a fertile environment for high-performance gaming PCs, especially as demand surges for immersive titles and eSports participation. The rise of local PC hardware brands and component manufacturers is making premium technology more accessible and competitively priced, encouraging widespread adoption. Coupled with a growing middle class eager to spend on leisure and entertainment, these factors are propelling the gaming PC market.

Middle East & Africa Gaming PC Market Trends

The Middle East & Africa gaming PC market is expected to grow at the highest CAGR of over 15% from 2025 to 2030, driven by increasing adoption of high-performance gaming systems and rising internet penetration. The growing popularity of eSports and online multiplayer games is fueling demand for powerful gaming PCs with advanced graphics and processing capabilities. Government initiatives to promote digital entertainment further boost market growth in the region.

Key Gaming PC Company Insights

Some key players operating in the market include Dell Inc. and ASUSTeK Computer Inc., among others

-

Dell Inc. is a global technology company widely recognized for its Alienware brand, a leader in the gaming PC market. Alienware is known for delivering premium performance, innovative designs, and tailored solutions that cater to gamers’ needs. With a strong presence in eSports and gaming communities worldwide, Dell leverages its global distribution and marketing strength to maintain a top position in the competitive gaming PC industry.

-

ASUSTeK Computer Inc. is a leading manufacturer in the gaming PC sector, operating through its Republic of Gamers (ROG) brand. ASUS offers a comprehensive portfolio of gaming laptops and desktops renowned for advanced cooling technologies, high-performance components, and extensive customization options. With a loyal global customer base across Asia, Europe, and North America, ASUS continues to drive innovation and maintain a competitive edge in the gaming PC market.

CyberPowerPC and Razer Inc. are some emerging market participants in the gaming PC market.

-

CyberPowerPC is a rapidly growing custom gaming PC manufacturer known for its affordability and extensive customization options. The company targets younger gamers and streamers by offering high-performance, tailored gaming rigs that balance cost and capability. CyberPowerPC’s focus on delivering personalized gaming solutions has helped it gain strong traction in the competitive gaming PC market.

-

Razer Inc. specializes in premium gaming laptops and desktops, renowned for their sleek design and cutting-edge technology. With its flagship Razer Blade series, the company targets high-end users and content creators seeking powerful, stylish, and portable gaming systems. Razer continues to expand its presence in the gaming PC industry by combining performance with aesthetics and innovation.

Key Gaming PC Companies:

The following are the leading companies in the gaming PC market. These companies collectively hold the largest market share and dictate industry trends.

- Dell Inc.

- HP Inc.

- ASUSTeK Computer Inc.

- Micro-Star INT'L CO., LTD.

- Acer Inc.

- Lenovo.

- CyberPowerPC

- Razer Inc.

- Digital Storm.

- CORSAIR.

Recent Developments

-

In April 2025, HP Inc. launched its flagship OMEN gaming PC lineup for 2025, featuring the OMEN 45L and 35L models designed to deliver extreme performance and revolutionary cooling technologies. These systems are engineered to meet the demands of elite gamers and content creators by offering future-proof capabilities and lightning-fast response times. The 2025 OMEN series aims to provide an immersive gaming experience with cutting-edge hardware optimized for esports competitors, multitasking professionals, and tech enthusiasts alike.

-

In April 2025, ASUS announced the launch of the TUF Gaming T500, a compact desktop designed to deliver high-performance gaming experiences for both AAA and esports titles. The T500 is powered by up to an Intel Core i7-13620H processor and an NVIDIA GeForce RTX 5060 Ti GPU, complemented by up to 64GB of DDR5 RAM and 2TB of PCIe 4.0 storage. Priced starting at $999.99, the T500 features a compact chassis with classic TUF Gaming aesthetics, making it an ideal choice for LAN labs, bedrooms, and dorm rooms. ASUS emphasizes the system’s efficient cooling solution with 90mm fans, providing a balance of performance, lower power consumption, and reduced noise levels to enhance overall gaming and desktop usage.

-

In April 2025, MSI unveiled a new lineup of AI gaming desktops powered by NVIDIA GeForce RTX 50 Series graphics cards, including the RTX 5090, RTX 5060 Ti, and RTX 5060 models. The new systems are designed to significantly enhance gaming performance and AI task efficiency, offering higher frame rates in demanding titles and faster rendering for content creators, reinforcing the company’s commitment to advancing gaming and AI capabilities in its desktop offerings.

Gaming PC Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 68.88 billion

Revenue forecast in 2030

USD 129.93 billion

Growth rate

CAGR of 13.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product category, price range, end-user, distribution channel, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Dell Inc., HP Inc.; ASUSTeK Computer Inc.; Micro-Star INT'L CO., LTD.; Acer Inc.; Lenovo.; CyberPowerPC; Razer Inc.; Digital Storm.; CORSAIR

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Gaming PC Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gaming PC market report based on product category, price range, end-user, distribution channel, and region:

-

Product Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Desktop

-

Laptop

-

Peripherals

-

-

Price Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low range (Less than USD 500)

-

Mid-range (USD 600 to USD 1000)

-

High-end and Extreme High-end range (More than USD 1000)

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Gamers

-

Casual Gamers

-

Others (Game Testers, Game Troubleshooters, Etc.)

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gaming PC market size was estimated at USD 61.84 billion in 2024 and is expected to reach USD 68.88 billion in 2025.

b. The global gaming PC market is expected to grow at a compound annual growth rate of 13.5% from 2023 to 2030 to reach USD 129.93 billion by 2030.

b. Asia Pacific dominated the market in 2024 with a share of more than 52.57%. The segment growth is fueled by a youthful population and rising disposable incomes. The cultural shift is pushing demand for high-performance PCs capable of delivering immersive gaming experiences.

b. The key players in this industry are Acer, Advanced Micro Devices, Inc., Alienware (Dell Inc.), CORSAIR, NVIDIA, CyberPowerPC, Lenovo Group Limited, Razer Inc., Digital Storm, and Micro-Star International (MSI) among others.

b. Key factors that are driving the gaming PC market growth include the growing popularity of esports gaming, the increasing interest of gamers in virtual entertainment, and the availability of high graphics PCs among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.