- Home

- »

- Sensors & Controls

- »

-

Gas Detection Equipment Market Size & Share Report, 2030GVR Report cover

![Gas Detection Equipment Market Size, Share & Trends Report]()

Gas Detection Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Fixed Gas Detector, Portable Gas Detector), By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-335-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gas Detection Equipment Market Summary

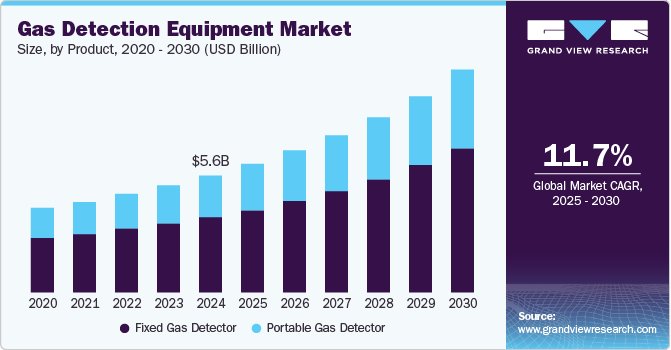

The global gas detection equipment market size was estimated at USD 5.60 billion in 2024 and is projected to reach USD 10.66 billion by 2030, growing at a CAGR of 11.7% from 2025 to 2030. The market growth is anticipated to increase due to employees' increasing worries about their safety worldwide.

Key Market Trends & Insights

- The Asia Pacific gas detection equipment market held largest share in 2024 and accounted for 33.40% of the overall global market.

- The Japan gas detection equipment market is expected to grow rapidly in the coming years due to the technological advancements in the gas detection equipment market.

- By product, fixed gas detector segment accounted for the largest share of 65.0% in 2024.

- By technology, infrared segment held the largest market share in 2024.

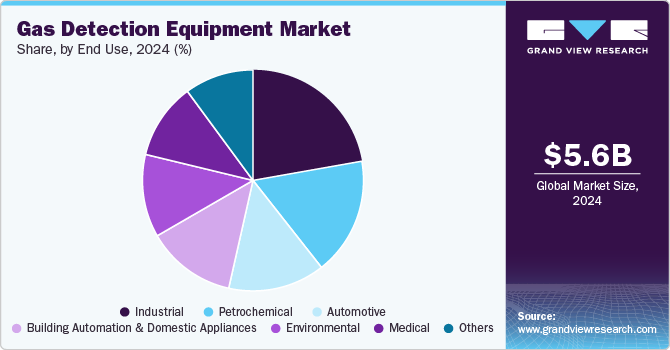

- By end use, the industrial segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.60 Billion

- 2030 Projected Market Size: USD 10.66 Billion

- CAGR (2025-2030): 11.7%

- Asia Pacific: Largest market in 2024

Public safety agencies such as the Occupational Safety and Health Administration (OSHA) and the Health and Safety Executive have developed stringent rules for the use of gas detection equipment, which is a key driver fueling market expansion. In addition, advancements in technology, such as the integration of Internet-of-Things (IoT) and cloud computing in gas detection systems are expected to drive the market growth in the coming years.

There is a rising need for gas detection technology as a result of efforts made by governments throughout the world to limit methane emissions from oil and gas. Methane detection with infrared gas detection sensors is common since these detectors are essential for evaluating effectiveness and safety in a variety of applications. Methane leaks during transportation, natural gas extraction, and power generation may be significantly reduced due to gas detecting devices.

Due to its capacity to detect the presence of flammable gases that are not visible to the naked eye, IR camera-based gas detectors have seen a considerable increase in demand in recent years. The camera used in infrared technology clicks the picture of the scanned region canned and displays the leaks as smoke on the screen. The camera can detect a variety of invisible gases from several meters away, including hydrocarbon-based gases such as methane, ethane, propane, and butane. It can also detect gas leaks in moving automobiles. The key advantage of adopting IR camera-based detection technology is its ability to monitor gas leaks remotely. Furthermore, using infrared imaging technology to identify gas leaks in pipelines can improve process efficiency.

Industries such as oil and gas, utilities, and manufacturing produce enormous amounts of poisonous gases such as hydrogen sulfide, ammonia, and sulfur dioxide, exposing employees to respiratory ailments. Hydrogen sulfide is a hazardous gas that is commonly found in oil and gas deposits. The gas causes discomfort to the eyes, nose, throat, and lungs and might prove fatal. As a result, for occupational safety in industries such as oil and gas, mining, chemicals, and manufacturing, the concentration of these gases must be regularly monitored.

Many countries are focusing on expanding the oil and gas pipeline networks as it is considered the safest and most cost-effective mode of transportation. Pipelines enable safe oil and gas transportation through urban areas with minimal obstructions. Multiple cross-country oil and gas pipelines are being planned for the faster transportation of hydrocarbons and are expected to propel the growth of the gas detection equipment market. Moreover, leaks can occur due to high temperature and pressure, and corrosion conditions. Corrosion can be internal as well as external. Internal corrosion is caused due to constituents in natural gas and crude oil, whereas external corrosion mainly occurs due to temperature change and rainfall, among other natural factors. Hence, companies are focusing on improving their maintenance and safety processes to reduce and eliminate emission risks.

Product Insights

Fixed gas detector segment accounted for the largest share of 65.0% in 2024. The need for safe and healthy working environments is a major driving force behind the increased use of fixed gas detectors, as employers are becoming more aware of the risks associated with hazardous gases in the workplace. The adoption of wireless technology is also driving the growth of the fixed gas detector market, as it allows for more efficient monitoring and data analysis. The rise in use of fixed gas detectors in the global market is also ascribed to the benefits given by these systems, such as the low sample amount required for gas analysis and real-time monitoring capacity. The expanding tendency to connect these systems with municipal infrastructures such as traffic lights and advertising boards is also fueling their popularity among end-users.

The portable gas detector segment is expected to grow at a significant CAGR during the forecast period. The growing focus on worker safety and health drives the demand for portable gas detectors, as they provide personnel with a reliable and convenient way to monitor the concentration of hazardous gases in their immediate environment. Portable gas detectors, also referred to as personal gas detectors, are frequently used in private automobiles. Elements such as the simplicity of use, portability, affordability, and small size are also driving the need for portable gas detectors. Environmental authorities are using these detectors more often to check the emissions of public transportation vehicles and to check for the presence of flammable gases in restricted places.

Technology Insights

Infrared segment held the largest market share in 2024. Infrared light is utilized in infrared gas detection technologies to identify flammable gases such as hydrocarbon gases. Infrared gas detectors are almost maintenance-free, which contributes significantly to the growth of the infrared gas detection technology segment. Cameras, for example, use passive infrared detectors to analyze spectral changes at each pixel in a picture and seek specific spectral signatures indicating target gases' presence. Furthermore, because infrared-based gas detectors are impervious to contamination and poisoning, they are utilized to detect gases like carbon dioxide and methane, as well as volatile organic chemicals such as benzene, butane, and acetylene.

The semiconductor segment is expected to register the fastest CAGR during the forecast period. Semiconductor-based gas detectors are cost-efficient and detect combustible gases. They are widely used by industries such as petrochemical, automotive, and medical, owing to benefits such as resistance to corrosion and longer life. Various semiconductor technology providers are entering into partnerships with gas detection equipment providers, which is creating new opportunities for segment growth. For instance, in July 2021, Semtech Corporation, a supplier of mixed-signal semiconductors, announced its partnership with eLichens, a developer of avolta-CH4, a gas leak detector running on LORaWAN standard. Avolta-CH4 can detect natural gas leaks and is based on the patented gas-sensing technology of eLiches.

End-use Insights

The industrial segment dominated the market in 2024. Due to several rules relevant to employee safety, gas detectors are widely employed in the industrial sector. The quantity of oxygen and carbon dioxide in mines is measured using gas detectors in the mining industry. The increasing incidence of mine deaths caused by a lack of oxygen is anticipated to increase demand for gas detectors in the industrial end use market. The implementation of strict requirements for worker safety is also anticipated to accelerate the growth of the industrial end-use segment.

The petrochemical segment is projected to grow at the fastest CAGR over the forecast period. The increased demand for natural gas and petroleum has resulted in possible dangers during production, such as exposure to poisonous and flammable gases during extraction and gas leaks. Also, there has been a considerable increase in shale gas exploration operations, which is projected to be a major driver driving segment growth throughout the projection period. Gas detectors are also required in restricted places to maintain appropriate levels of oxygen in the presence of hazardous gases and VOCs.

Regional Insights

The North America gas detection equipment market held a significant share of the overall market in 2024. The market in North America is expected to witness significant growth owing to the presence of a large oil and gas pipeline network and oil and gas refineries in countries such as the U.S. and Canada. The increasing need for the safety and security of workers who are constantly exposed to toxic gases is also driving the regional market growth.

U.S. Gas Detection Equipment Market Trends

The U.S. gas detection equipment market held a dominant position in 2024 due to a significant rise in demand for gas detection equipment from the country’s oil & gas industry, particularly due to the increasing shale gas exploration activities. According to the U.S. Energy Information Administration, the U.S. emerged as the largest producer and consumer of crude oil, petroleum liquids, and biofuels in 2022. The country accounted for 21% of the global oil production in 2022 and 20% of the global oil consumption in 2021. This has opened opportunities for the deployment of smart oil fields and refining technologies, facilitating real-time process monitoring and control. All these factors are contributing to the growth of the U.S. market.

Europe Gas Detection Equipment Market Trends

The Europe gas detection equipment market was identified as a lucrative region in 2024. According to the BP Statistical Review of World Energy 2022, the European Union is the world's second-largest producer of petroleum products. In 2021, it had a crude oil refining capacity of about 13 million barrels per day, which represented 16% of the total global capacity. This reflects the vast opportunity for the adoption of gas detection equipment.

The UK gas detection equipment market is expected to grow rapidly in the coming years due to the increasing emphasis on workplace safety, and regulatory compliance has driven the demand for advanced gas detection technologies. Stringent regulations and standards pertaining to occupational safety have prompted industries to invest in cutting-edge gas detection equipment to mitigate potential risks. In the UK, the Oil & Gas Authority has drafted regulations, climate change policies, business strategies, and a technology adoption roadmap with a strong emphasis on the recovery of the UK’s oil and gas industry.

The Germany gas detection equipment market held a substantial market share in 2024. Germany is home to numerous manufacturing, automotive, and chemical companies, all of which require stringent monitoring of potential gas hazards. With the continuous expansion of these industries, there is an increasing demand for reliable gas detection equipment that can detect leaks and hazardous gases in real-time.

Asia Pacific Gas Detection Equipment Market Trends

The Asia Pacific gas detection equipment market held largest share in 2024 and accounted for 33.40% of the overall global market. Increasing industrialization, urbanization, and rural electrification, along with the growing automobile sales across the region, are responsible for the rising demand for crude oil across the Asia Pacific region. In 2022, Asia Pacific emerged as the fastest-growing market, accounting for almost 57% of global crude oil trade. Moreover, in 2022, as per the insights of Geopolitical Intelligence Services AG, the region held the position of the world's largest oil market, having consumed 35.3 million barrels per day (b/d). It constituted over 36 % of the global oil consumption during that year. This has created significant growth in the oil & gas industry and is expected to drive the demand for gas detection equipment market in the APAC region.

The Japan gas detection equipment market is expected to grow rapidly in the coming years due to the technological advancements in the gas detection equipment market. Innovations such as wireless connectivity, real-time data analysis, and IoT-enabled devices have transformed traditional gas detection systems into smart monitoring solutions. Japanese companies are increasingly investing in connected gas detection systems that offer continuous monitoring and instant alerts.

The gas detection equipment market in China held a substantial market share in 2024 owing to a surge in the adoption of innovative and interconnected gas detectors, facilitating real-time monitoring and data analysis to enhance safety protocols.

Key Gas Detection Equipment Company Insights

Some of the key companies in the gas detection equipment market include ABB Ltd., General Electric Company, Honeywell International Inc., Siemens, and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

ABB Ltd. is a global technology company that operates in four business segments namely electrification, motion, process automation, and robotics & discrete automation. The company offers its products and services to industrial users, transport & infrastructure businesses, and utility companies.

-

Honeywell International Inc. is a multinational conglomerate and electrical and electronic devices manufacturing company, which operates in four business segments namely Aerospace, Honeywell Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions. The company serves industry verticals such as aerospace, banking, education, commercial, finance, gaming, government, healthcare, life sciences, retail, residential, and power & utilities.

Key Gas Detection Equipment Companies:

The following are the leading companies in the gas detection equipment market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- AirTest Technologies Inc.

- TELEDYNE TECHNOLOGIES INCORPORATED

- Fluke Corporation

- General Electric Company

- Honeywell International Inc.

- Lynred

- Opgal Optronic Industries Ltd.

- THERMO FISHER SCIENTIFIC INC.

- Siemens

Recent Developments

-

In January 2024, Teledyne FLIR, a separate subsidiary of Teledyne Technologies Incorporated, announced the launch of the Neutrino LC OGI, a camera module designed especially for UAV-based gas leak detection. This Mid-Wave Infrared (MWIR) imaging module can seamlessly integrate with Unmanned Aerial Vehicles (UAVs) and other devices to identify, quantify, and visualize methane and other hydrocarbon gas emissions. The Neutrino LC OGI is tailored to the requirements of developers working on optical gas imaging cameras and offers a compact, lightweight, and low-power solution specifically optimized for the challenges associated with detecting gas leaks from aerial platforms.

-

In March 2024, Honeywell International Inc. announced its participation as the inaugural gas detector manufacturer in the 'Made in Saudi' initiative, underscoring the company's dedication to promoting localization and economic diversification within Saudi Arabia. At its Dammam site, the company would undertake the assembly and calibration of three distinct gas detection solutions. This includes the Honeywell BW Max XT II, a portable multi-gas detector used by workers in hazardous areas to identify gases such as hydrogen sulfide and carbon monoxide, which will be locally produced.

Gas Detection Equipment Market Report Scope

Report Attribute

Details

Marketsize value in 2025

USD 6.14 billion

Revenue forecast in 2030

USD 10.66 billion

Growth rate

CAGR of 11.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-use, region

Regional scope

North America, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

ABB Ltd.; AirTest Technologies Inc.; TELEDYNE TECHNOLOGIES INCORPORATED; Fluke Corporation; General Electric Company; Honeywell International Inc.; Lynred; Opgal Optronic Industries Ltd.; THERMO FISHER SCIENTIFIC INC.; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

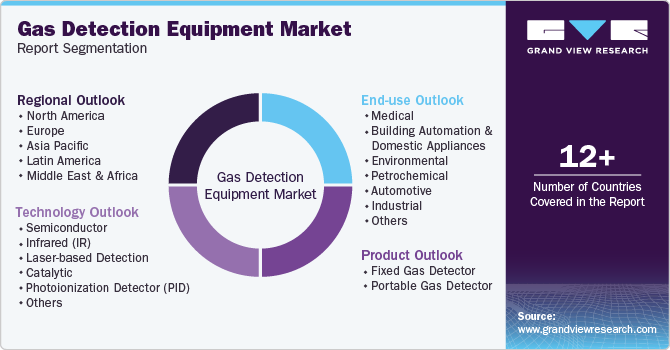

Global Gas Detection Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gas detection equipment market report based on product, technology, end-use, and region.

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Fixed Gas Detector

-

Portable Gas Detector

-

-

Technology Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Semiconductor

-

Infrared (IR)

-

Laser-based Detection

-

Catalytic

-

Photoionization Detector (PID)

-

Others

-

-

End-use Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Medical

-

Building Automation & Domestic Appliances

-

Environmental

-

Petrochemical

-

Automotive

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gas detection equipment market size was estimated at USD 5.60 billion in 2024 and is expected to reach USD 6.14 billion in 2025.

b. The global gas detection equipment market is expected to grow at a compound annual growth rate of 11.7% from 2025 to 2030 to reach USD 10.66 billion by 2030.

b. Asia Pacific dominated the gas detection equipment market with a share of 33.40% in 2024. Increasing industrialization, urbanization, and rural electrification, along with the growing automobile sales across the region, are responsible for the rising regional market growth.

b. Some key players operating in the gas detection equipment market include ABB; Airtest Technologies, Inc; Teledyne Technologies Incorporated; Fluke Corporation; General Electric Company; Honeywell International Inc.; Lynred; Opgal; Siemens; and Thermo Fisher Scientific, Inc.

b. Key factors that are driving the gas detection equipment market growth include stringent regulations for workplace safety, increasing demand for infrared (IR) camera-based gas detectors, and increasing oil and gas pipeline infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.