- Home

- »

- Sensors & Controls

- »

-

Gas Detection Equipment Market Size & Growth Report, 2030GVR Report cover

![Gas Detection Equipment Market Size, Share & Trends Report]()

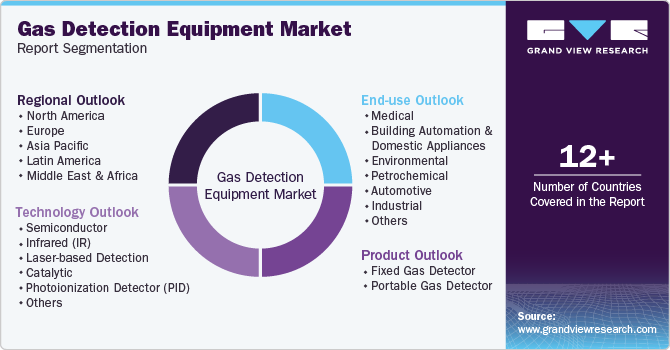

Gas Detection Equipment Market Size, Share & Trends Analysis Report By Product (Fixed Gas Detector, Portable Gas Detector), By Technology (Semiconductor, Catalytic) By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-335-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

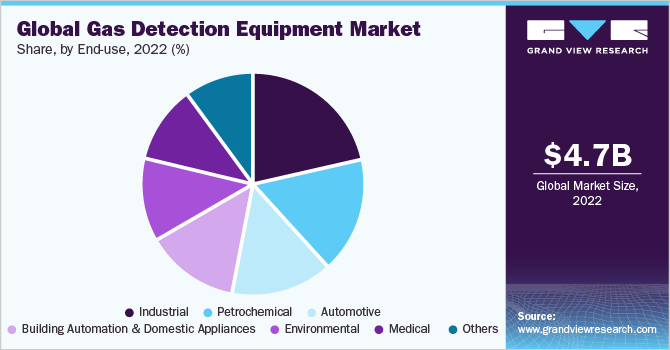

The global gas detection equipment market size was valued at USD 4.73 billion in 2022 and is expected to register compound annual growth rate (CAGR) of 11.0% from 2023 to 2030. The market growth is anticipated to increase due to employees' increasing worries about their safety worldwide. Public safety agencies like the Occupational Safety and Health Administration (OSHA) and the Health and Safety Executive have developed stringent rules for the use of gas detection equipment, which is a key driver fueling market expansion. Additionally, advancements in technology, such as the integration of Internet-of-Things (IoT) and cloud computing in gas detection systems are expected to drive the market growth in the coming years.

There is a rising need for gas detection technology as a result of efforts made by governments throughout the world to limit methane emissions from oil and gas. Methane detection with infrared gas detection sensors is common since these detectors are essential for evaluating effectiveness and safety in a variety of applications. Methane leaks during transportation, natural gas extraction, and power generation may be significantly reduced due to gas detecting devices. Moreover, the Canadian government pledged in January 2020 to reduce oil and gas methane emissions by 40% to 45% below 2012 levels by 2025.

Due to its capacity to detect the presence of flammable gases that are not visible to the naked eye, IR camera-based gas detectors have seen a considerable increase in demand in recent years. The camera used in infrared technology clicks the picture of the scanned region canned and displays the leaks as smoke on the screen. The camera can detect a variety of invisible gases from several meters away, including hydrocarbon-based gases like methane, ethane, propane, and butane. It can also detect gas leaks in moving automobiles. The key advantage of adopting IR camera-based detection technology is its ability to monitor gas leaks remotely. Furthermore, using infrared imaging technology to identify gas leaks in pipelines can improve process efficiency.

Industries such as oil and gas, utilities, and manufacturing produce enormous amounts of poisonous gases such as hydrogen sulfide, ammonia, and sulfur dioxide, exposing employees to respiratory ailments. Hydrogen sulfide is a hazardous gas that is commonly found in oil and gas deposits. The gas causes discomfort to the eyes, nose, throat, and lungs and might prove fatal. According to the United Nations' 2018 report to the Human Rights Council, hazardous gas exposure affects around 2.8 million employees annually. As a result, for occupational safety in industries such as oil and gas, mining, chemicals, and manufacturing, the concentration of these gases must be regularly monitored.

Many countries are focusing on expanding the oil and gas pipeline networks as it is considered the safest and most cost-effective mode of transportation. Pipelines enable safe oil and gas transportation through urban areas with minimal obstructions. Multiple cross-country oil and gas pipelines are being planned for the faster transportation of hydrocarbons and are expected to propel the growth of the gas detection equipment market. Moreover, leaks can occur due to high temperature and pressure, and corrosion conditions. Corrosion can be internal as well as external. Internal corrosion is caused due to constituents in natural gas and crude oil, whereas external corrosion mainly occurs due to temperature change and rainfall, among other natural factors. Hence, companies are focusing on improving their maintenance and safety processes to reduce and eliminate emission risks.

COVID-19 Impact Analysis

The COVID-19 pandemic has positively influenced the demand for gas detection equipment. According to an April 2021 study by the U.S. Energy Information Administration, commercial and residential gas consumption reduced by 2.1 Bcf/d from 2019 to 2020 due to the pandemic and the warmer weather observed in the country. Warmer conditions reduced the demand for natural gas for space heating. Reduced consumption increase the percentage of natural gas storage facilities across the U.S., thus driving the demand for gas detectors among natural gas producers in the U.S.

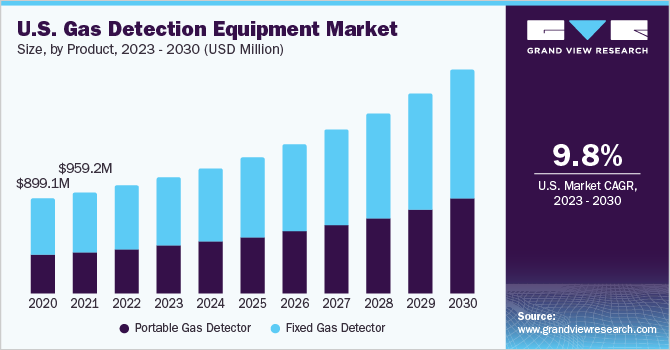

Product Insights

The fixed gas detectors segment dominated the market in 2022 and accounted for over 65.0% share of the global revenue. The need for safe and healthy working environments is a major driving force behind the increased use of fixed gas detectors, as employers are becoming more aware of the risks associated with hazardous gases in the workplace. The adoption of wireless technology is also driving the growth of the fixed gas detector market, as it allows for more efficient monitoring and data analysis. The rise in use of fixed gas detectors in the global market is also ascribed to the benefits given by these systems, such as the low sample amount required for gas analysis and real-time monitoring capacity. The expanding tendency to connect these systems with municipal infrastructures such as traffic lights and advertising boards is also fueling their popularity among end-users.

The portable gas detectors segment is anticipated to register the fastest growth in the forecast period. The growing focus on worker safety and health drives the demand for portable gas detectors, as they provide personnel with a reliable and convenient way to monitor the concentration of hazardous gases in their immediate environment. Portable gas detectors, also referred to as personal gas detectors, are frequently used in private automobiles. Elements like the simplicity of use, portability, affordability, and small size are also driving the need for portable gas detectors. Environmental authorities are using these detectors more often to check the emissions of public transportation vehicles and to check for the presence of flammable gases in restricted places.

Technology Insights

The infrared gas detection technology segment dominated the market in 2022 and accounted for over 26.9% share of the global revenue. Infrared light is utilized in infrared gas detection technologies to identify flammable gases such as hydrocarbon gases. Infrared gas detectors are almost maintenance-free, which contributes significantly to the growth of the infrared gas detection technology segment. Cameras, for example, use passive infrared detectors to analyze spectral changes at each pixel in a picture and seek specific spectral signatures indicating target gases' presence. Furthermore, because infrared-based gas detectors are impervious to contamination and poisoning, they are utilized to detect gases like carbon dioxide and methane, as well as volatile organic chemicals like benzene, butane, and acetylene.

The semiconductor segment is expected to register the fastest growth over the forecast period. Semiconductor-based gas detectors are cost-efficient and detect combustible gases. They are widely used by industries such as petrochemical, automotive, and medical, owing to benefits such as resistance to corrosion and longer life. Various semiconductor technology providers are entering into partnerships with gas detection equipment providers,which is creating new opportunities for segment growth. For instance, in July 2021, Semtech Corporation, a supplier of mixed-signal semiconductors, announced its partnership with eLichens, a developer of avolta-CH4, a gas leak detector running on LORaWAN standard. Avolta-CH4 can detect natural gas leaks and is based on the patented gas-sensing technology of eLiches.

End-use Insights

The industrial segment dominated the market in 2022 and accounted for over 21.9% share of the global revenue. Due to several rules relevant to employee safety, gas detectors are widely employed in the industrial sector. The quantity of oxygen and carbon dioxide in mines is measured using gas detectors in the mining industry. The increasing incidence of mine deaths caused by a lack of oxygen is anticipated to increase demand for gas detectors in the industrial end-use market. The implementation of strict requirements for worker safety is also anticipated to accelerate the growth of the industrial end-use segment.

The petrochemical segment is anticipated to register the fastest growth over the forecast period. The increased demand for natural gas and petroleum has resulted in possible dangers during production, such as exposure to poisonous and flammable gases during extraction and gas leaks. Also, there has been a considerable increase in shale gas exploration operations, which is projected to be a major driver driving segment growth throughout the projection period. Gas detectors are also required in restricted places to maintain appropriate levels of oxygen in the presence of hazardous gases and VOCs.

Regional Insights

Asia Pacific dominated the gas detection equipment market in 2022 and accounted for over 32.5% share of the global revenue. Portable gas detectors are becoming increasingly popular in the Asia Pacific due to their ease of use and flexibility. These detectors can be easily installed and moved around as needed, making them ideal for use in large industrial facilities. Advances in sensor technology are also driving the development of more accurate and reliable gas detectors. At the same time, the demand for the market in the region is also being boosted by the development of activities by several oil corporations, including the National Offshore Oil Corporation of China and the Oil & Natural Gas Corporation of India.

North America is expected to witness a significant growth in the forecast period. The presence of a significant oil and gas pipeline network as well as oil and gas refineries in nations such as the U.S. and Canada, bodes well for market expansion. Furthermore, the growing requirement for the safety and security of employees who are regularly exposed to harmful gases is boosting regional market expansion. The increased requirement for minimizing accidents caused by gas leakages is also one of the primary factors fueling the market development.

Key Companies & Market Share Insights

The competitive landscape is highly fragmented in nature. Market players are focused on partnerships, product innovation, geographical expansion, and research & development to strengthen their market positions. For instance, in April 2021, ABB Ltd. announced the launch of the HoverGuard, a drone-based gas leak detection system. HoverGuard maps, detect,andquantifies leaks up to 100 meters from natural gas distribution and storage facilities, gathering lines, transmission pipelines, and other potential sources quickly, safely, and reliably. Through this launch, the company has expanded its product portfolio.

Additionally, the market players are focused on improving their product offerings to meet the changing needs of users. For instance, in October 2021, Fluke Corporation announced the launch of SV600 Fixed Acoustic Imager, its first fixed acoustic imaging solution. The product enables users to detect gas leaks or changes in sound to detect problems before they become too costly to resolve. Some of the prominent players in the global gas detection equipment market are:

-

ABB

-

Airtest Technologies, Inc.

-

Teledyne Technologies Incorporated

-

Fluke Corporation

-

General Electric Company

-

Honeywell International Inc.

-

Lynred

-

Opgal Optronics Industries Limited

-

Thermo Fisher Scientific, Inc.

-

Siemens

Gas Detection Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.14 billion

Revenue forecast in 2030

USD 10.66 billion

Growth rate

CAGR of 11.0% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast ,company market share, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

ABB; Airtest Technologies, Inc.; Teledyne Technologies Incorporated; Fluke Corporation; General Electric Company; Honeywell International Inc.; Lynred ; Opgal Optronics Industries Limited; Thermo Fisher Scientific, Inc.; Siemens

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Detection Equipment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global gas detection equipment market report based on product, technology, end-use, and region.

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units, 2017 - 2030)

-

Fixed Gas Detector

-

Portable Gas Detector

-

-

Technology Outlook (Revenue, USD Million; Volume, Thousand Units, 2017 - 2030)

-

Semiconductor

-

Infrared (IR)

-

Laser-basedDetection

-

Catalytic

-

PhotoionizationDetector (PID)

-

Others

-

-

End-use Outlook (Revenue, USD Million; Volume, Thousand Units, 2017 - 2030)

-

Medical

-

Building Automation & Domestic Appliances

-

Environmental

-

Petrochemical

-

Automotive

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Units, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global gas detection equipment market size was estimated at USD 4.73 billion in 2022 and is expected to reach USD 5.14 billion in 2023.

b. The global gas detection equipment market is expected to grow at a compound annual growth rate of 11.0% from 2023 to 2030 to reach USD 10.66 billion by 2030.

b. North America dominated the gas detection equipment market with a share of 26.73% in 2022. This is attributable to the region’s large oil and gas pipeline network and is home to oil and gas refining companies.

b. Some key players operating in the gas detection equipment market include ABB; Airtest Technologies, Inc; Teledyne Technologies Incorporated; Fluke Corporation; General Electric Company; Honeywell International Inc.; Lynred; Opgal; Siemens; and Thermo Fisher Scientific, Inc.

b. Key factors that are driving the gas detection equipment market growth include stringent regulations for workplace safety, increasing demand for infrared (IR) camera-based gas detectors, and increasing oil and gas pipeline infrastructure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."