- Home

- »

- Animal Health

- »

-

GCC Veterinary Hospitals Market Size, Industry Report, 2033GVR Report cover

![GCC Veterinary Hospitals Market Size, Share & Trends Report]()

GCC Veterinary Hospitals Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal (Farm Animals, Companion Animals), By Type (Surgery, Medicine, Consultation), By Sector (Public, Private), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-725-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

GCC Veterinary Hospitals Market Summary

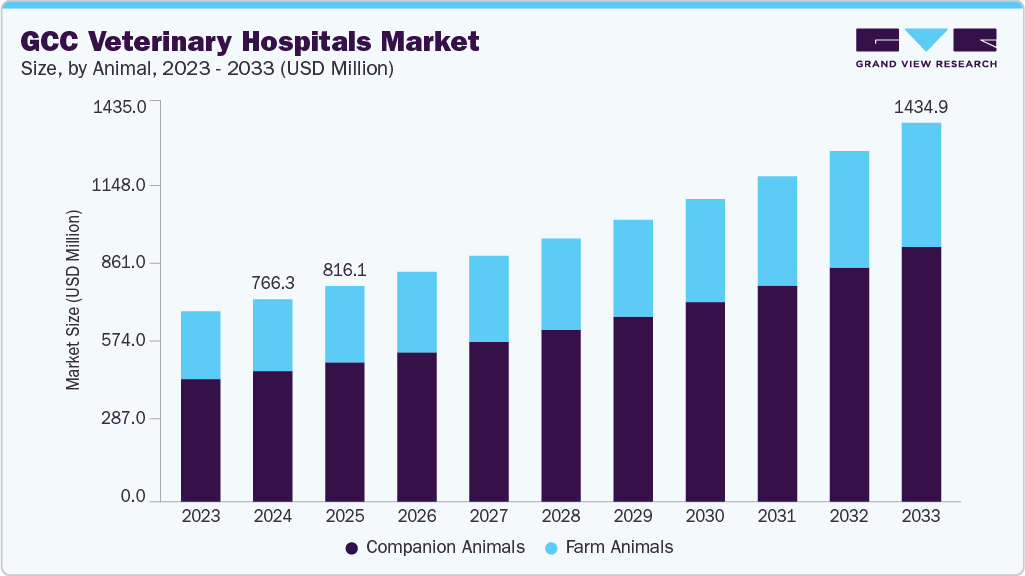

The GCC veterinary hospitals market size was estimated at USD 766.35 million in 2024 and is projected to reach USD 1,434.91 million by 2033, growing at a CAGR of 7.31% from 2025 to 2033. The market is advancing, driven by rising pet ownership & humanization of pets, government initiatives, livestock focus & food security, and technological advancements & in-house diagnostics.

Key Market Trends & Insights

- Saudi Arabia held the largest revenue share of 41.27% of the GCC veterinary hospitals market in 2024.

- By animal, the companion animal segment held the highest market share of 64.53% in 2024.

- Based on type, the medicine segment held the highest market share of 47.28% in 2024.

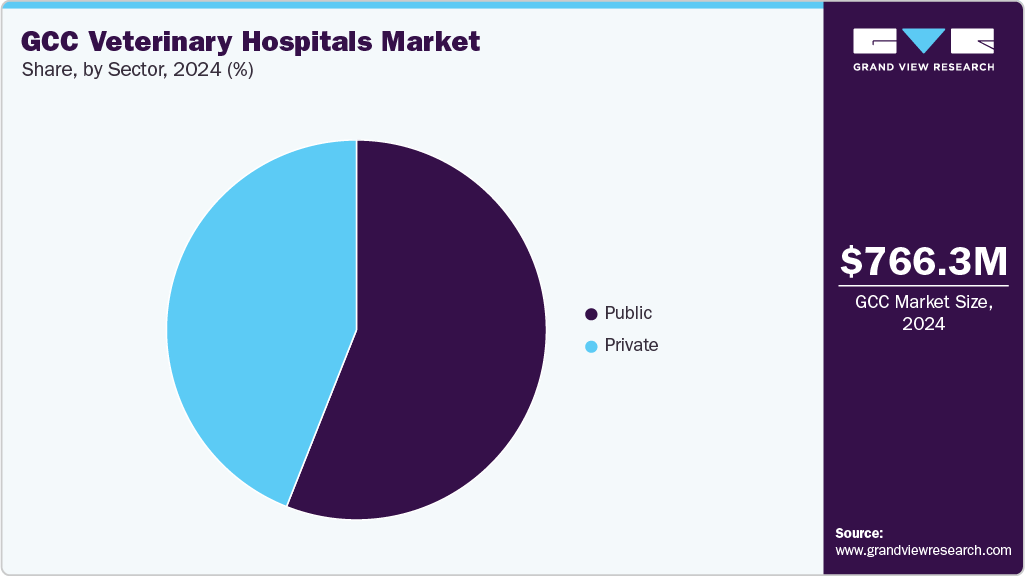

- By sector, the private segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 766.35 Million

- 2033 Projected Market Size: USD 1,434.91 Million

- CAGR (2025-2033): 7.31%

- Saudi Arabia: Largest market in 2024

Rapid growth in affluence across the GCC has spurred a cultural shift toward pet ownership, with dogs, cats, and exotic animals increasingly regarded as family members. In 2024, KSA pet ownership rose from 0.8 million to 2.4 million. The cats remain dominant, dog ownership is increasing, fueled by cultural shifts, urbanization, and supportive policies driving growth in pet-related sales.This trend has led to a higher demand for veterinary services, including diagnostics, preventive care, surgeries, and wellness programs. As more urban residents adopt pets, investments in pet-friendly infrastructure such as grooming centers, pet food stores, and day-care facilities have increased, creating additional demand for veterinary support. According to industry analysis, this surge in companion animal adoption is driving growth in veterinary laboratories and clinics across the region.

In addition, GCC governments are actively reinforcing veterinary infrastructure to safeguard food security and public health. Emphasis on livestock productivity, widespread vaccination programs, and biosecurity protocols align with regional goals of agricultural self-sufficiency and zoonotic disease control. Veterinary hospitals and clinics play a critical role in administering in-house diagnostics, vaccines, and treatment services-especially important given their multi-functional setups that streamline service delivery. For instance, in November 2023, Thumbay Group’s Gulf Medical University signed an MoU with the UK’s Royal Veterinary College to advance ‘One Health’ in the Middle East, planning UAE veterinary clinics, hospitals, and collaborative research initiatives by 2024. In addition, in July 2024, Saudi Arabia allocated USD 46.66 million to build a high-biosafety regional veterinary laboratory in Riyadh, focusing on disease diagnosis, local vaccine development, and research to protect and enhance animal health across the Middle East. These efforts, further backed by public-private partnerships and international health collaborations, are key drivers in expanding the veterinary care network.

The veterinary health sector in the GCC is witnessing accelerated adoption of cutting-edge technologies. Hospital and clinic pharmacies increasingly offer advanced diagnostics, in-house laboratories, point-of-care testing, and imaging services to deliver rapid and accurate animal healthcare solutions. Point-of-care testing-such as assays for CRP, hemoglobin, and lactate has experienced the fastest growth due to its convenience and efficiency. Simultaneously, investment in molecular diagnostics, immunology, and imaging technologies is enhancing disease detection and treatment across both companion and production animals. For instance, in August 2025, Oman’s Ministry of Agriculture, Fisheries, and Water Resources will begin the trial operation of Al Bashayer Vet Hospital in Adam, the nation’s first integrated livestock-focused facility. With a USD 2.60 million investment, it offers advanced diagnostics, treatment, surgery, and specialized camel care, aiming to boost veterinary infrastructure, biosecurity, and sustainable livestock production.

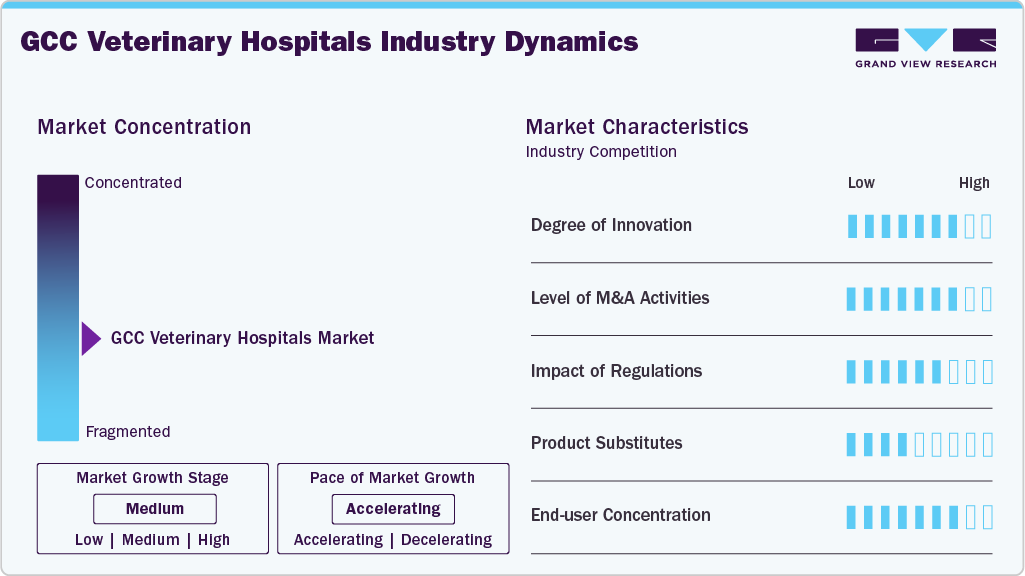

Market Concentration & Characteristics

The GCC veterinary hospitals industry is advancing and experiencing accelerated growth. The key players benefit from strong brand recognition, regulatory expertise, and the ability to launch innovative vaccines and therapeutics at scale. Their dominance is strengthened by frequent mergers, acquisitions, and partnerships aimed at expanding geographical reach and technological capabilities. The emerging regional players are gaining ground in specific markets, barriers like high R&D costs, complex regulatory approvals, and cold-chain requirements make it challenging to disrupt the established hierarchy.

The GCC veterinary hospitals industry is witnessing rising innovation, with facilities adopting advanced diagnostic imaging, telemedicine platforms, and specialized surgical procedures. Hospitals are integrating AI-based disease detection, electronic medical records, and modern rehabilitation therapies. In June 2024, Abu Dhabi’s British Veterinary Centre made MENA history by performing the region’s first canine mitral valve repairs, led by global experts, revolutionizing heart care and offering dogs renewed, medication-free lives.

Mergers and acquisitions in the market are gaining momentum as regional chains, private equity investors, and international veterinary groups expand their presence. Cross-border partnerships are also emerging, enabling knowledge exchange and market penetration, particularly in high-growth hubs such as the UAE, Saudi Arabia, and Qatar.

Government regulations in the GCC significantly influence veterinary hospital operations, covering licensing, animal welfare standards, and pharmaceutical use. Authorities are implementing stricter disease control protocols and quality assurance frameworks to align with global veterinary norms. Supportive initiatives, including subsidies and public-private partnerships, are fostering infrastructure development while ensuring hospitals meet biosecurity, safety, and professional training requirements.

Substitutes for veterinary hospital services include mobile veterinary clinics, tele-veterinary consultations, and home-based pet care services, which appeal to cost-sensitive or convenience-driven pet owners. In addition, community-run animal welfare centers and basic veterinary kiosks provide limited alternatives. However, complex diagnostics, surgeries, and specialized treatments still require fully equipped hospitals, limiting the threat of complete substitution in the GCC.

End-user concentration in the GCC market varies between urban pet owners and rural livestock farmers. Urban centers such as Dubai, Riyadh, and Doha see higher demand from companion animal owners seeking premium care, while agricultural regions prioritize livestock health. This dual customer base drives diversified service portfolios, balancing pet-focused wellness with advanced livestock disease management.

Animal Insights

The companion animals represented the largest segment with a revenue share of 64.53% in 2024 and are among the fastest growing segments over the forecast period, driven by rising pet ownership, urban lifestyles, and growing awareness of animal welfare. Cats dominate due to cultural preferences, but dog ownership is increasing, supported by shifting social attitudes and regulatory openness. Higher disposable incomes and the humanization of pets have led to greater demand for advanced veterinary services, including preventive care, diagnostics, and surgeries. Hospitals are expanding specialized departments for cardiology, orthopedics, and dermatology to cater to companion animals. For instance, in June 2025, Al Falah Veterinary Clinic announced a major expansion, introducing advanced medical technology, expanded services, and enhanced rescue operations to strengthen its commitment to comprehensive animal care across the region.

The farm animals’ segment is emerging as a rapidly growing area in the GCC market, driven by increasing investments in livestock health, food security initiatives, and sustainable farming practices. Governments across the region are prioritizing disease prevention, biosecurity, and productivity enhancement in cattle, sheep, goats, and poultry. Veterinary hospitals are expanding their services to include advanced diagnostics, reproductive health, and specialized treatments for large animals, supported by modern equipment and skilled veterinarians. In August 2022, ADAFSA’s 14th annual livestock vaccination campaign targeted PPR, FMD, and crystalline inflammation through three stages, aiming to boost animal immunity, strengthen biosecurity, and eradicate epidemic livestock diseases in Abu Dhabi. Rising demand for high-quality meat, dairy, and poultry products, coupled with export ambitions, is further fuelling growth, making farm animal healthcare a strategic priority for the GCC.

Type Insights

The medicine segment held the largest share of 47.28% in the market in 2024, driven by rising demand for advanced pharmaceuticals, preventive care, and treatment of both companion and farm animals. Veterinary hospitals across the region are expanding their medicine offerings, including antibiotics, antiparasitic, vaccines, and specialized drugs for chronic conditions. Increasing pet ownership, government-led livestock health programs, and growing awareness about disease prevention further fuel this demand. The segment benefits from ongoing innovation in veterinary pharmaceuticals and a strong regulatory push for high-quality, safe products. As a result, medicine remains central to veterinary hospital services, supporting better animal health outcomes across the GCC.

The surgery is emerging as the fastest-growing segment, driven by advancements in veterinary surgical techniques, increasing pet ownership, and rising demand for specialized care. Hospitals are investing in state-of-the-art surgical theatres, minimally invasive procedures, and advanced anesthesia technologies to enhance treatment outcomes. The surge includes orthopedic, soft tissue, and cardiac surgeries for companion animals, as well as reproductive and emergency procedures for livestock. Growing awareness of surgical options, higher disposable incomes, and pet humanization trends are encouraging owners to opt for complex treatments. This rapid growth positions surgery as a key revenue and innovation driver in GCC veterinary care.

Sector Insights

The private sector is both the largest and fastest-growing segment in the market with a revenue share of 56.48% in 2024, fueled by rising pet ownership, premium service demand, and expanding investment in advanced medical technologies. Private veterinary hospitals and clinics cater to companion animals and high-value livestock, offering specialized diagnostics, surgeries, grooming, rehabilitation, and preventive care. Growing awareness of pet wellness, coupled with higher disposable incomes, is driving clients toward personalized, high-quality veterinary services. Many private providers are adopting international standards, expanding chains, and integrating digital platforms for telemedicine and appointment management. This rapid modernization and customer-focused approach are propelling the private sector’s dominance and growth.

The public sector is emerging as a growing segment in the market, driven by strong government involvement in animal health, disease control, and livestock management. National ministries and municipal bodies operate extensive veterinary networks, offering subsidized or free services, particularly for livestock owners and farmers. These facilities focus on preventive care, vaccination programs, disease surveillance, and emergency response, ensuring the protection of both animal health and food security. In addition, public veterinary hospitals often collaborate with research institutions to develop localized treatments and vaccines. For example, in October 2024, Saudi Arabia’s Ministry of Health (MOH) and Boehringer Ingelheim renewed their partnership to expand telestroke services via Seha Virtual Hospital, advancing nationwide stroke care.

Country Insights

The GCC veterinary hospitals industry is expanding rapidly, driven by rising pet ownership, livestock health needs, and government-led animal welfare initiatives. Technological advancements like digital diagnostics and telemedicine enhance service quality. Key players include British Veterinary Centre, Al Falah Veterinary Clinic, and Modern Veterinary Clinic, with private investments and public partnerships accelerating market growth and innovation.

UAE Veterinary Hospitals Market Trends

The UAE veterinary hospitals industry is fueled by the increasing demand for advanced pet care, livestock health programs, and government-backed animal welfare policies. Innovations such as cardiac surgery and digital diagnostics boost the capabilities of the industry. For instance, in August 2023, The Veterinary Group (TVG) extended partnership with Troy Animal Healthcare, for delivering high-quality, affordable animal healthcare pharmaceuticals across the GCC, strengthening both brands’ presence and commitment to the region’s veterinary sector.

Saudi Arabia Veterinary Hospitals Market Trends

Saudi Arabia’s veterinary hospitals industry is dominating the market with a revenue share of 41.27% in 2024, driven by rising pet ownership, government livestock health programs, and advanced treatment adoption. Some of the players include Al Hayat Veterinary Clinic and British Veterinary Centre. Technological advancements, modern surgical facilities, and increasing private sector investments are enhancing service quality, aligning with Vision 2030’s focus on improved animal health and biosecurity standards.

Kuwait Veterinary Hospitals Market Trends

Kuwait’s veterinary hospitals industry is growing, fueled by rising demand for companion animal care, government livestock health initiatives, and modern diagnostic technologies. Some of the players include Kuwait Animal Hospital and Royal Animal Care. Advancements in surgical procedures, imaging, and preventive healthcare services, alongside increased private sector participation, are enhancing veterinary standards and accessibility across the country, supporting both pet owners and livestock farmers.

Qatar Veterinary Hospitals Market Trends

Qatar’s veterinary hospitals industry is expanding, driven by growing pet ownership, livestock health programs, and government-backed animal welfare initiatives. Advancements in digital diagnostics, surgical capabilities, and preventive medicine are elevating care standards. Increasing private investment and specialized services are strengthening the market, catering to both companion animals and livestock sectors effectively. Qatar’s Ministry of Municipality and Environment has opened a new veterinary centre in Abu Nakhla, enhancing livestock healthcare, boosting meat and milk self-sufficiency, and supporting disease prevention initiatives post-blockade.

Oman Veterinary Hospitals Market Trends

Oman’s GCC veterinary hospitals industry is expanding, driven by rising livestock health needs, growing pet ownership, and government investments in veterinary infrastructure. Advancements in diagnostic imaging, surgical capabilities, and academic-veterinary collaborations are enhancing service quality, positioning Oman as an emerging hub for comprehensive animal healthcare in the GCC. In March 2020, Oman’s tender board approved a USD 3.6m contract for constructing a new hospital in Dhofar Governorate, marking a significant investment in expanding the region’s healthcare infrastructure and service capacity.

Bahrain Veterinary Hospitals Market Trends

Bahrain’s veterinary hospitals industry is driven by rising pet ownership, advanced veterinary care demand, and government support for high-potential sectors. Key players include Barri’s Vet Hospital and private clinics, with advancements in specialized treatments, training programs, and modern diagnostic facilities enhancing service quality and positioning Bahrain as a niche leader in regional animal healthcare. In June 2022, Tamkeen supported Bahrain’s first specialized veterinary hospital, Barri’s Vet Hospital, to boost innovation, train local talent, and set new service standards, positioning Bahrain as a regional leader in advanced animal healthcare.

Key GCC Veterinary Hospitals Company Insights

The GCC market for veterinary hospitals features leading players such as Barri’s Vet Hospital, Al Ain Animal Care, and Dubai Kennels & Cattery. These companies leverage advanced medical technologies, specialized expertise, and expanding service portfolios to capture significant market share, driven by rising pet ownership, livestock health needs, and veterinary service modernization.

Key GCC Veterinary Hospitals Companies:

- Zabeel Veterinary Hospital

- Gulf Vetcare

- Bahrain Veterinary Clinic

- Advanced Veterinary Center

- All Care Veterinary Clinic W.L.L

- Elite Veterinary Clinic

- International Veterinary Hospital

- Companion Veterinary Clinic

- Capital Veterinary Center

- Petcare Veterinary Centre

- Blue Cross Veterinary Clinic

- SINA Vet Clinic

- Sama Capital Healthtech

- The Veterinary Hospital

Recent Developments

-

In August 2025, Oman began trial operations of Al Bashayer Vet Hospital in Adam, its first specialized livestock veterinary facility, offering advanced diagnostics, surgery, and camel medicine services, with an investment exceeding USD 2.60 million.

-

In June 2024, the British Veterinary Centre in Abu Dhabi performed the MENA region’s first canine mitral valve repair surgery, pioneering advanced cardiac care for dogs and eliminating the need for lifelong medication.

-

In March 2024, Abu Dhabi Fund for Development inaugurated Jordan’s first veterinary educational hospital at JUST, a 7,000-square-meter, USD 7 million facility, enhancing veterinary education, treatment capabilities, and public awareness in the region.

GCC Veterinary Hospitals Market Report Scope

Report Attribute

Details

Market size in 2025

USD 816.15 million

Revenue forecast in 2033

USD 1,434.91 million

Growth rate

CAGR of 7.31% from 2025 to 2033

Historical Period

2021 - 2023

Base year

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, type, sector, country

Countries covered

Saudi Arabia; UAE; Kuwait; Qatar; Bahrain; Oman

Key hospitals profiled

Zabeel Veterinary Hospital; Gulf Vetcare; Bahrain Veterinary Clinic; Advanced Veterinary Center; All Care Veterinary Clinic W.L.L; Elite Veterinary Clinic; International Veterinary Hospital; Companion Veterinary Clinic; Capital Veterinary Center; Petcare Veterinary Center; Blue Cross Veterinary Clinic; SINA Vet Clinic; Sama Capital Healthtech; The Veterinary Hospital

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

GCC Veterinary Hospitals Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the GCC veterinary hospitals market report based on animal, type, sector, and country.

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Farm Animals

-

Companion Animals

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Surgery

-

Medicine

-

Consultation

-

-

Sector Outlook (Revenue, USD Million, 2021 - 2033)

-

Private

-

Public

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

Bahrain

-

Frequently Asked Questions About This Report

b. The GCC veterinary hospitals market size was estimated at USD 766.35 million in 2024 and is expected to reach USD 816.15 million in 2025.

b. The GCC veterinary hospitals market is expected to grow at a compound annual growth rate of 7.31% from 2025 to 2033 to reach USD 1,434.91 million by 2033

b. Saudi Arabia’s veterinary hospitals market is dominating the market with a revenue share of 41.27% in 2024, driven by rising pet ownership, government livestock health programs, and advanced treatment adoption. Some of the players include Al Hayat Veterinary Clinic and British Veterinary Centre. Technological advancements, modern surgical facilities, and increasing private sector investments are enhancing service quality, aligning with Vision 2030’s focus on improved animal health and biosecurity standards.

b. Some key players operating in the GCC veterinary hospitals market include Zabeel Veterinary Hospital, Gulf Vetcare, Bahrain Veterinary Clinic, Advanced Veterinary Center, All Care Veterinary Clinic W.L.L, Elite Veterinary Clinic, International Veterinary Hospital, Companion Veterinary Clinic, Capital Veterinary Center, Petcare Veterinary Centre, Blue Cross Veterinary Clinic, SINA Vet Clinic, Sama Capital Healthtech, The Veterinary Hospital

b. Key factors that are driving the market growth include rising pet ownership & humanization of pets, government initiatives, livestock focus & food security and technological advancements & in-house diagnostics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.