- Home

- »

- Next Generation Technologies

- »

-

Generative AI Chipset Market Size, Industry Report, 2033GVR Report cover

![Generative AI Chipset Market Size, Share & Trends Report]()

Generative AI Chipset Market (2026 - 2033) Size, Share & Trends Analysis Report By Chipset Type (CPU, GPU, FPGA), By Application (Machine Learning, Deep Learning, Reinforcement Learning, Generative Adversarial Networks), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-431-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Generative AI Chipset Market Summary

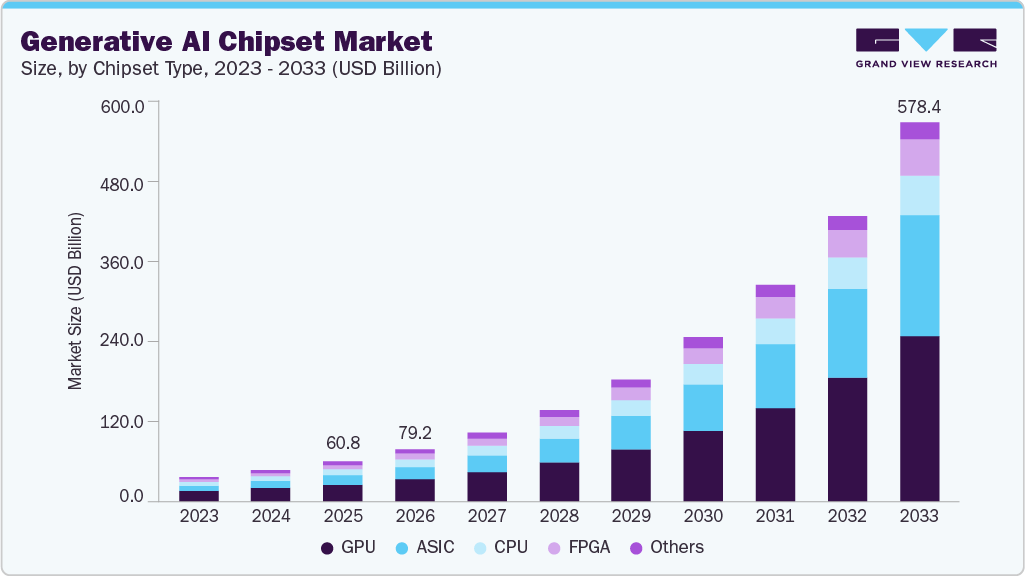

The global generative AI chipset market size was estimated at USD 60.79 billion in 2025 and is projected to reach USD 578.35 billion by 2033, growing at a CAGR of 32.8% from 2026 to 2033. The market is primarily driven by the increasing demand for AI-powered applications across industries, linked with the need for faster and more efficient AI processing capabilities.

Key Market Trends & Insights

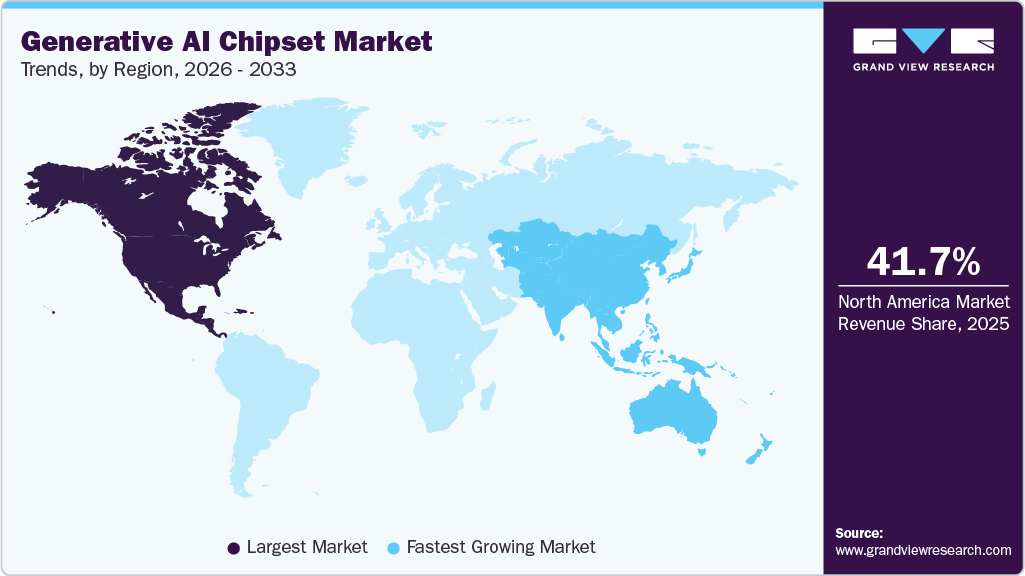

- North America dominated the global generative AI chipset market with the largest revenue share of 41.7% in 2025.

- The generative AI chipset market in the U.S. led the North America market and held the largest revenue share in 2025.

- By chipset type, GPU segment led the market and held the largest revenue share of 42.2% in 2025.

- By application, deep learning segment held the dominant position in the market and accounted for the leading revenue share of 40.5% in 2025.

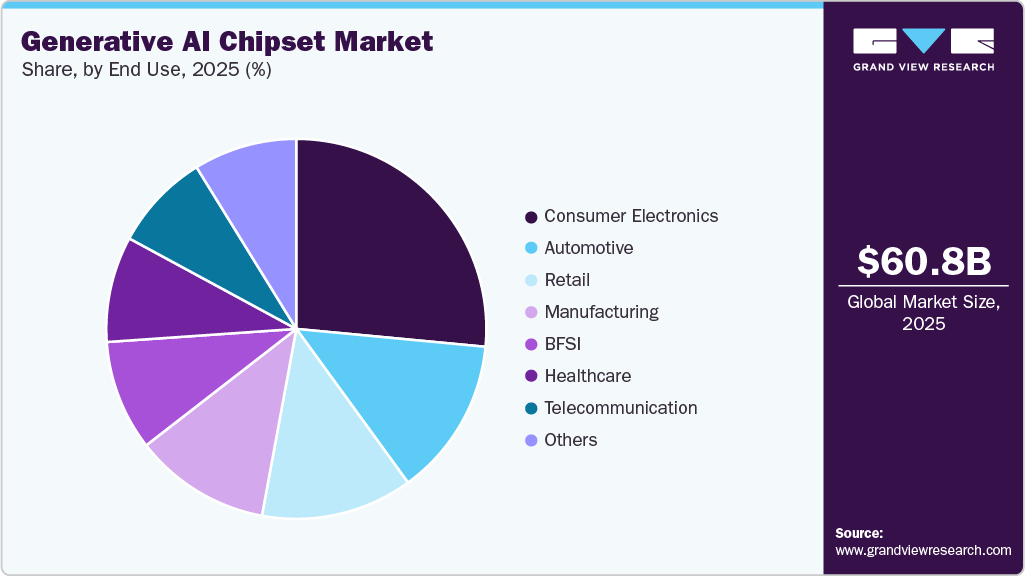

- By end use, automotive segment is expected to grow at the fastest CAGR of 39.1% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 60.78 Billion

- 2033 Projected Market Size: USD 578.35 Billion

- CAGR (2026-2033): 32.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The growth of cloud and edge computing is fueling the requirement for AI acceleration in both data centers and edge devices. Advancements in AI algorithms, which are becoming increasingly complex, necessitate more powerful hardware. The need for real-time processing in applications such as autonomous vehicles and robotics, along with a focus on energy efficiency, further accelerates the demand for specialized AI chipsets designed to meet these evolving requirements.The market is witnessing a shift towards specialized AI architectures, with companies developing custom chip designs optimized for specific AI workloads, including generative AI tasks. There's a growing focus on energy efficiency, as developers strive to create chips that can perform AI tasks with lower power consumption.

Advanced manufacturing processes are being leveraged to improve chip performance, while there's an increased emphasis on building security and privacy features directly into AI chipsets. The rise of domain-specific accelerators, designed for particular AI applications such as natural language processing or computer vision, is becoming more prevalent. These trends collectively reflect the market's response to the growing superiority and diversification of AI applications, particularly in the range of chips.

Another notable trend is the use of AI in designing and optimizing chipsets, leading to more efficient hardware. The market is also seeing increased collaboration among chipset manufacturers, software developers, and AI researchers, fostering innovation and compatibility with modern AI frameworks. Regulatory and ethical considerations are influencing the development of secure and privacy-focused chipsets, while significant investments in R&D continue to drive innovation in next-generation AI chipsets.

Chipset Type Insights

The GPU segment led the market and accounted for 42.2% of the global revenue in 2025. GPU deliver parallel computing capabilities essential for training large-scale generative AI models through matrix multiplications and tensor operations. Their programmable architecture supports diverse neural network architectures, enabling rapid iteration in model development. For instance, in January 2024, NVIDIA announced GeForce RTX 40 SUPER Series GPUs featuring Tensor Cores that deliver up to 836 trillion operations per second for generative AI tasks, including 1.5x faster AI video and 1.7x faster image generation compared to RTX 3080 Ti.

The ASIC segment is predicted to foresee significant growth over the forecast period. ASIC provide computational efficiency for recurrent generative AI tasks, minimizing energy consumption per operation. Custom designs integrate domain-specific accelerators directly into silicon, reducing latency for sequential inference pipelines. For instance, in September 2025, OpenAI's partnered with Broadcom to produce its first artificial intelligence chip in 2026, internally termed "XPU." This chip features application-specific design elements optimized for OpenAI's generative AI workloads, aligning directly with ASIC characteristics through silicon for efficiency in inference and training tasks.

Application Insights

The deep learning segment accounted for the largest market revenue share in 2025. Deep learning's dominance is driven by its widespread adoption across various industries, including healthcare, finance, and autonomous systems, where it powers complex tasks such as image and speech recognition, natural language processing, and predictive analytics. The computational intensity of deep learning models necessitates the use of high-performance chipsets, contributing to this segment's significant market share.

The generative adversarial networks (GANs) segment is predicted to foresee significant growth during the forecast period, driven by the requirements for real-time image synthesis in design prototyping which accelerates the generator-discriminator training cycles essential for high-fidelity outputs in visual content creation. These networks necessitate dedicated accelerators to process vast parameter sets during iterative convergence. Chipset advancements enable efficient deployment of GANs in production environments for scalable media generation.

End Use Insights

The consumer electronics segment holds the largest revenue share of the global market in 2025. This is primarily driven by the widespread adoption of AI in devices such as smartphones, smart home systems, and wearables. These devices increasingly rely on AI for features such as voice assistants, image processing, and personalized recommendations, which necessitate advanced AI chipsets. The growing consumer demand for smarter and more intuitive electronics continues to reinforce the dominance of this segment in the market.

The automotive segment is predicted to foresee significant growth during the forecast period. The automotive industry's increasing focus on autonomous driving, advanced driver assistance systems (ADAS), and in-vehicle infotainment systems is driving the demand for high-performance AI chipsets. As automakers invest heavily in AI to enhance vehicle safety, efficiency, and user experience, the adoption of generative AI chipsets in this sector is expected to surge, making it the fastest-growing end use segment.

Regional Insights

North America generative AI chipset marketdominated the market by 41.7% revenue share in 2025. The growth is driven by strong investments in AI research and development, particularly in the technology and automotive sectors. The region's established tech ecosystem, with major companies such as NVIDIA, Intel, and AMD leading innovations, is fueling demand for advanced AI chipsets. In addition, North America benefits from early adoption across industries such as healthcare, finance, and retail, where AI is being used to enhance decision-making, customer experience, and operational efficiency. The growing focus on edge computing and AI-driven automation further boosts the market in this region.

U.S. Generative AI Chipset Market Trends

The U.S. stands at the front of the generative AI chipset market, being home to several leading AI chipset manufacturers and a hub for unique AI research. The country’s dominance is strengthened by substantial government and private sector investments in AI and semiconductor technologies. The U.S. market is characterized by rapid adoption in sectors such as defense, healthcare, and automotive, where AI applications are critical for innovation. The presence of tech giants such as Google, Microsoft, and Tesla also drives the demand for specialized AI chipsets, especially as these companies push the boundaries of AI capabilities.

Europe Generative AI Chipset Market Trends

Generative AI chipset market in Europe is witnessing a steady growth, supported by strong regulatory frameworks and government initiatives that promote AI innovation and digital transformation. Countries such as Germany, the UK, and France are leading the adoption, particularly in the automotive, manufacturing, and financial services sectors. Europe’s focus on ethical AI and data privacy also influences the development and deployment of AI chipsets, with a growing emphasis on energy-efficient and secure AI solutions. Collaborative efforts among academia, industry, and government are further driving advancements in AI chipset technologies across the region.

Asia Pacific Generative AI Chipset Market Trends

Asia Pacific is expected to witness the fastest CAGR over the forecast period, driven by rapid industrialization, a growing consumer electronics market, and significant investments in AI by countries such as China, Japan, and South Korea. The region’s strong manufacturing base, coupled with increasing demand for AI in applications like smart cities, autonomous vehicles, and consumer devices, is propelling the growth of the AI chipset market. Moreover, the rise of local tech giants and startups focused on AI innovation is contributing to the region’s expanding market share.

Key Generative AI Chipset Market Company Insights

Some key companies in the generative AI chipset industry are Apple Inc., Intel Corporation,NVIDIA, Broadcom Inc.

-

Intel develops processors and tools for AI applications across client computing, data centers, edge devices, and high-performance computing. Core Ultra processors support AI workloads in PCs, robotics, smart cities, automation, and healthcare through integrated neural processing units. Intel provides developer resources for AI solution preparation, building, deployment, and scaling, alongside open-source contributions and ecosystem expansion with partners.

-

NVIDIA advances AI technologies for social impact through news, blogs, talks, podcasts, and videos that showcase real-world applications. The company focuses on solving global challenges via AI infrastructure and personal computing products developed in collaboration with Intel. NVIDIA emphasizes AI innovation in events and expert insights for broader technology deployment.

Key Generative AI Chipset Market Companies:

The following key companies have been profiled for this study on the generative AI chipset market.

- Advanced Micro Devices, Inc.

- Apple Inc.

- Arm Holdings plc

- Broadcom Inc.

- Cerebras Systems

- Google Inc.

- Graphcore

- Intel Corporation

- Micron Technology, Inc.

- Mythic AI

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Xilinx Inc.

Recent Developments

-

In October 2025, Qualcomm Technologies unveiled the AI200 and AI250 accelerator cards and rack-scale solutions designed for data center AI inference. The AI200 targets large language model workloads, while the AI250 introduces near-memory computing architecture that delivers over 10x effective memory bandwidth efficiency.

-

In June 2025, Micron Technology shipped samples of its HBM4 36GB 12-high memory to select customers for use in next-generation AI platforms. The technology powers generative AI inference for large language models and chain-of-thought reasoning in data centers. This development addresses growing needs for high-bandwidth memory in AI workloads.

-

In May 2025, NVIDIA introduced the DGX Spark and DGX Station as personal AI supercomputers powered by the Grace Blackwell platform. These systems target developers and researchers working on generative AI tasks. Collaborations with Acer, GIGABYTE, MSI, Dell, and additional partners broaden access to the systems. They replicate data center software environments, incorporating NVIDIA NIM microservices.

Generative AI Chipset Market Report Scope

Report Attribute

Details

Market size in 2026

USD 79.21 billion

Revenue forecast in 2033

USD 578.35 billion

Growth rate

CAGR of 32.8% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Chipset type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Advanced Micro Devices, Inc.; Apple Inc.; Arm Holdings plc; Broadcom Inc.; Cerebras Systems; Google Inc.; Graphcore; Intel Corporation; Micron Technology, Inc.; Mythic AI; NVIDIA Corporation; Qualcomm Technologies, Inc.; Xilinx Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

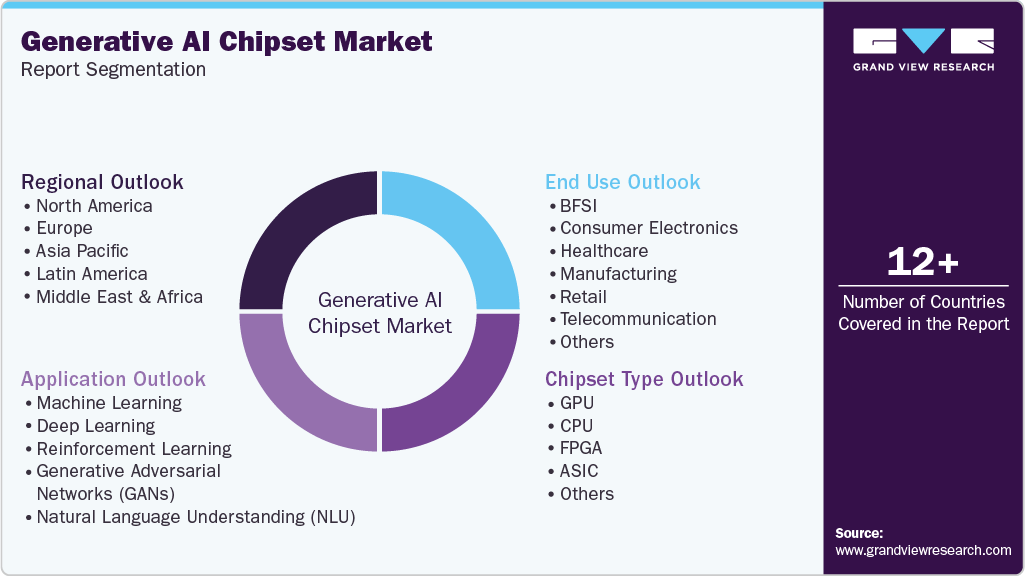

Global Generative AI Chipset Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global generative AI chipset market report based on chipset type, application, end use, and region:

-

Chipset Type Outlook (Revenue, USD Million, 2021 - 2033)

-

GPU

-

CPU

-

FPGA

-

ASIC

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning

-

Deep Learning

-

Reinforcement Learning

-

Generative Adversarial Networks (GANs)

-

Natural Language Understanding (NLU)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Consumer Electronics

-

Healthcare

-

Manufacturing

-

Retail

-

Telecommunication

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazila

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the generative AI chipset market include Advanced Micro Devices, Inc.; Apple Inc.; Arm Holdings plc; Broadcom Inc.; Cerebras Systems; Google Inc.; Graphcore; Intel Corporation; Micron Technology, Inc.; Mythic AI; NVIDIA Corporation; Qualcomm Technologies, Inc.; Xilinx Inc.

b. Key factors that are driving the market growth include the increasing demand for AI-powered applications across industries, growth of cloud and edge computing, and the need for real-time processing in applications like autonomous vehicles and robotics

b. The global generative AI chipset market size was estimated at USD 60.79 billion in 2025 and is expected to reach USD 79.21 billion in 2026.

b. The global generative AI chipset market is expected to grow at a compound annual growth rate of 32.8% from 2026 to 2033 to reach USD 578.35 billion by 2033.

b. North America dominated the generative AI chipset market with a share of 41.7% in 2025. This is attributable to strong investments in AI research and development, particularly in the technology and automotive sectors and region's established tech ecosystem, with major companies such as NVIDIA, Intel, and AMD leading innovations

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.