- Home

- »

- Next Generation Technologies

- »

-

Geospatial Solutions Market Size And Share Report, 2030GVR Report cover

![Geospatial Solutions Market Size, Share & Trends Report]()

Geospatial Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Remote Sensing, GPS), By Component (Hardware, Software), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-433-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geospatial Solutions Market Summary

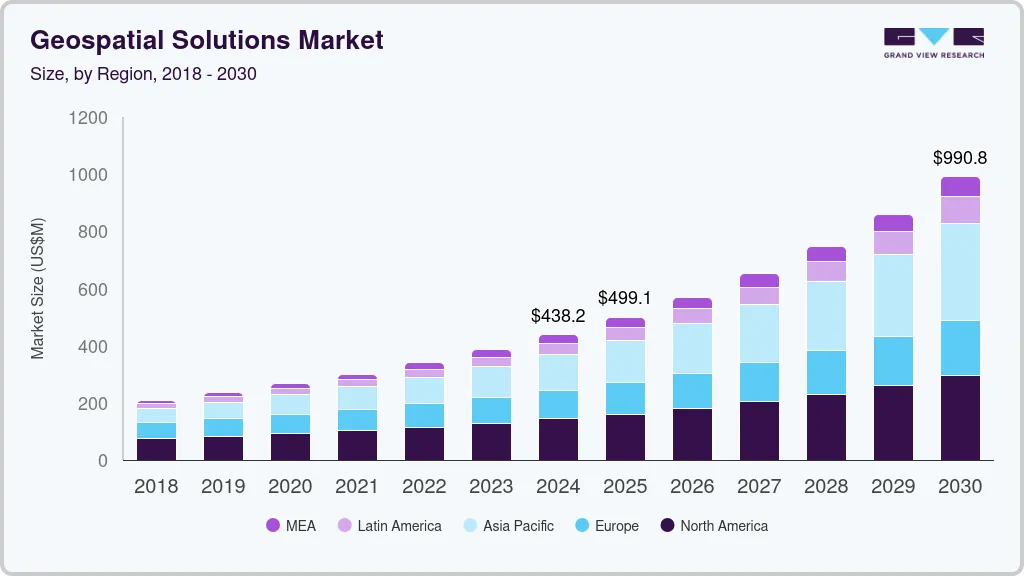

The global geospatial solutions market size was estimated at USD 385.49 billion in 2023 and is projected to reach USD 990.79 billion by 2030, growing at a CAGR of 14.6% from 2024 to 2030. The market is growing due to rapid advancements in technologies such as artificial intelligence (AI), machine learning, and cloud computing.

Key Market Trends & Insights

- North America accounted for the highest market revenue share of 33.29% in 2023.

- The geospatial solutions market in the U.S. is expected to have a notable CAGR of 11.8% from 2024 to 2030.

- Based on technology, the GIS/spatial analytics accounted for the largest market revenue share in 2023.

- Based on component, the software segment accounted for the largest market revenue share in 2023.

- Based on application, the Surveying & mapping accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 385.49 Billion

- 2030 Projected Market Size: USD 990.79 Billion

- CAGR (2024-2030): 14.6%

- North America: Largest market in 2023

These technologies significantly enhance market capabilities by enabling more accurate and efficient data analysis, real-time processing, and predictive modeling. AI and machine learning are particularly driving the evolution of geospatial analytics by automating data processing and improving pattern recognition. Cloud computing facilitates scalable and flexible geospatial data management, allowing organizations to access and process large datasets without extensive infrastructure. As these technologies evolve, they are expected to further expand their applications and effectiveness across various industries.

The increasing global focus on smart city initiatives is a major driver of growth in the market. Smart cities rely heavily on geospatial technologies for urban planning, infrastructure management, and efficient resource allocation. These solutions provide critical insights into traffic patterns, energy consumption, environmental monitoring, and public safety, enabling city planners to make data-driven decisions for sustainable urban development. Integrating geospatial data with IoT (Internet of Things) devices is crucial in creating interconnected and intelligent urban environments.

The growing dependence on the defense and intelligence sectors is another key driver of market growth. Geospatial technologies are essential for military operations, surveillance, reconnaissance, and intelligence gathering, providing accurate and timely information for decision-making. Analyzing terrain, monitoring borders, tracking movements, and assessing threats in real-time are critical for national security. Furthermore, advancements in satellite imagery, UAV (Unmanned Aerial Vehicle) technology, and remote sensing are enhancing the precision and effectiveness of geospatial solutions in defense applications.

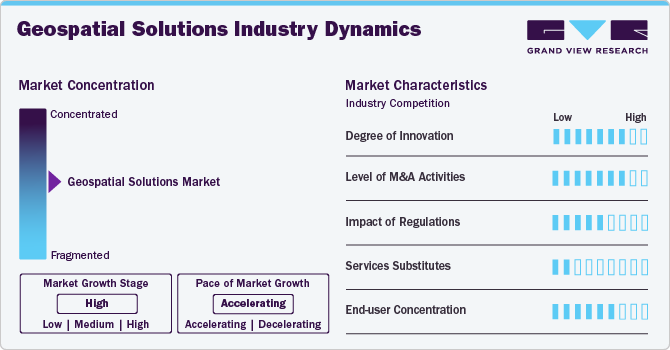

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by the integration of cutting-edge technologies such as AI, machine learning, and big data analytics. This innovation enhances geospatial solutions' accuracy, efficiency, and applicability across industries. Cloud computing and IoT further boost real-time data processing and connectivity, making geospatial tools indispensable for smart city development, environmental monitoring, and defense. Continuous technological advancements are expanding the capabilities and driving the growth of the geospatial market.

The market is seeing increasing merger and acquisition (M&A) activitiesas companies seek to bolster their technological capabilities and market presence. Firms increasingly acquire or merge with other entities to access advanced technologies like AI, machine learning, and cloud-based solutions and enhance their geographic reach. These strategic M&As enable companies to offer more comprehensive and integrated geospatial solutions, driving competitive advantage and fueling market growth in an increasingly technology-driven landscape.

The market is also subject to moderate regulatory scrutiny primarily due to concerns over data privacy, security, and satellite and drone imagery use. Governments and regulatory bodies are imposing guidelines to ensure that geospatial data collection, storage, and usage comply with national security and privacy standards. These regulations can impact the deployment of geospatial technologies, particularly in sensitive areas such as defense and urban planning. While these regulations aim to protect public interests, they pose challenges for companies navigating the evolving compliance landscape.

Geospatial solutions face minimal competition from product substitutes due to their unique capabilities and advantagesin spatial data analysis, real-time monitoring, and decision-making. Unlike other technologies, geospatial tools provide precise location-based insights, which are crucial for applications such as urban planning, environmental monitoring, and defense operations. Integrating advanced technologies like AI, machine learning, and remote sensing further enhances their effectiveness, making them indispensable across various sectors. This uniqueness reduces the threat of substitutes, allowing geospatial solutions to maintain a strong market position.

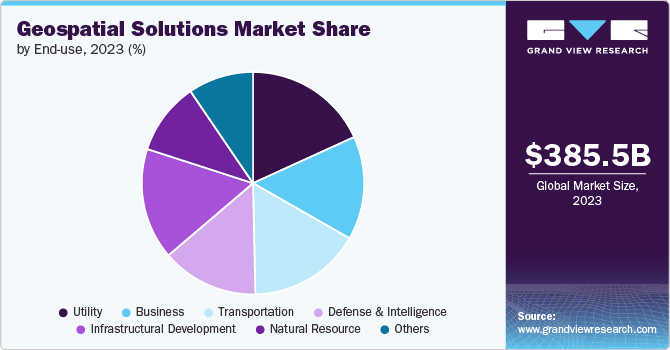

End-user concentration is a moderate factor in the market, with a diverse range of industries, such as utilities, transportation, defense, and urban planning, relying heavily on these technologies. While certain sectors like defense and utilities may represent significant portions of the market, the wide applicability of geospatial solutions across various industries mitigates the risks associated with high concentration. This diversity in end-users ensures a stable demand base, though companies must continually adapt their offerings to meet the specific needs of each sector to maintain competitiveness.

Technology Insights

GIS/Spatial analytics accounted for the largest market revenue share in 2023. The market is driven by the increasing demand for data-driven decision-making across industries. GIS solutions become essential as businesses and governments prioritize efficient resource management, urban planning, and disaster response. Integrating AI and machine learning further enhances spatial analytics, providing deeper insights and predictive capabilities. Moreover, the rise of smart cities and IoT applications requires sophisticated spatial data analysis, making GIS indispensable for monitoring and optimizing urban environments, ultimately driving the market forward.

3D scanning is expected to register the fastest CAGR from 2024 to 2030. The market is growing due to its expanding construction, manufacturing, and heritage preservation applications. The demand for precise and detailed spatial data for modeling and simulation is fueling the adoption of 3D scanning in these sectors. In construction, 3D scanning enhances project planning and monitoring accuracy, reducing errors and costs. In addition, the technology's ability to capture complex geometries and environments drives its use in cultural heritage documentation and restoration, contributing to its market expansion.

Component Insights

Software accounted for the largest market revenue share in 2023. The increasing need for sophisticated tools to manage and analyze large volumes of spatial data drives the market. The transition to cloud-based platforms and integration of AI and machine learning into geospatial software enhance functionality and accessibility. Industries such as urban planning, agriculture, and environmental monitoring rely heavily on geospatial software for real-time data analysis and decision-making. Continuous innovation and the growing demand for user-friendly interfaces further propel the growth of this segment.

Services are expected to register the fastest CAGR from 2024 to 2030. The market is growing rapidly due to the increasing reliance on specialized expertise for data collection, analysis, and integration. As organizations adopt geospatial technologies, there is a rising demand for consulting, implementation, and maintenance services to ensure the effective use of these tools. The complexity of geospatial data and the need for customized solutions drive the growth of professional services, including training, support, and managed services. This segment is further bolstered by the trend toward outsourcing geospatial operations to specialized providers.

Application Insights

Surveying & mapping accounted for the largest market revenue share in 2023. The market is driven by their critical role in infrastructure development, land management, and urban planning. The ongoing expansion of construction projects, both residential and commercial, requires accurate and detailed maps, fueling demand for these services. Furthermore, advancements in technology, such as drones and LiDAR, enhance the precision and efficiency of surveying and mapping activities. The need for updated geographic data for environmental monitoring and disaster management also contributes to the sustained growth of this segment.

Land management is expected to register the fastest CAGR from 2024 to 2030. An increasing need for efficient land use planning, property management, and sustainable development drives the market. Governments and private organizations are adopting geospatial technologies to monitor land use, assess property boundaries, and manage natural resources more effectively. Integrating GIS and remote sensing in land management provides accurate data for decision-making, helping balance development with environmental conservation. The rising focus on sustainable agriculture and urban expansion also fuels the demand for advanced land management solutions.

End Use Insights

Utility segment accounted for the largest market revenue share of over 18% in 2023. The market is growing as these technologies are essential for efficient infrastructure management, asset tracking, and service delivery. Geospatial tools enable utilities to optimize network operations, monitor assets in real-time, and respond quickly to outages or maintenance needs. Integrating GIS with smart grid technologies enhances the management of electricity, water, and gas distribution networks. As utilities face increasing pressure to improve service reliability and sustainability, the demand for geospatial solutions continues to rise.

The defense & intelligence segment is expected to grow at a CAGR of over 15% from 2024 to 2030. The market is driven by increasing reliance on these technologies for surveillance, reconnaissance, and mission planning. Geospatial solutions provide critical insights into terrain, troop movements, and potential threats, enabling more informed decision-making in military operations. Integrating satellite imagery, UAVs, and real-time data analytics enhances the precision and effectiveness of defense strategies. As global security challenges evolve, the demand for advanced geospatial tools in defense and intelligence continues to grow, driving market expansion.

Regional Insights

North America accounted for the highest market revenue share of 33.29% in 2023. The market is driven by advanced technological adoption and strong demand from key sectors like defense, transportation, and urban planning. The region's robust infrastructure and government initiatives, such as smart city projects and environmental monitoring programs, fuel market growth. Moreover, the presence of leading geospatial technology companies and a high level of R&D investment further bolster innovation and market expansion. The increasing use of geospatial analytics in business intelligence and disaster management also contributes to the region's growth.

U.S. Geospatial Solutions Market Trends

The geospatial solutions market in the U.S. is expected to have a notable CAGR of 11.8% from 2024 to 2030. The market is growing due to significant investments in defense, smart cities, and infrastructure development. The federal government’s focus on enhancing national security and emergency response systems drives demand for advanced geospatial technologies. In addition, the U.S. leads in technological innovation, with widespread adoption of AI, machine learning, and big data analytics in geospatial applications. The country’s dynamic real estate, energy, and transportation sectors also contribute to the growth, as they increasingly rely on geospatial data for efficient planning, resource management, and decision-making.

Asia Pacific Geospatial Solutions Market Trends

The geospatial solutions market in Asia Pacific accounted for a significant revenue share of over 27% in 2023. Large-scale infrastructure projects, urbanization, and smart city initiatives in countries like China and India drive the market. The region’s growing economies are investing heavily in transportation, utilities, and environmental monitoring, increasing the demand for geospatial technologies. Furthermore, government policies promoting digital transformation and integrating advanced technologies like AI and IoT in geospatial applications further fuel market growth. The region's diverse topography and climate challenges also drive the adoption of geospatial solutions for disaster management and agriculture.

Japan geospatial solutions market is estimated to grow significantly from 2024 to 2030. The country's focus on disaster management, urban planning, and technological innovation drives the market. Japan's vulnerability to natural disasters like earthquakes and tsunamis necessitates advanced geospatial tools for risk assessment, early warning systems, and recovery planning. The government's smart city initiatives and infrastructure modernization contribute to market growth. Moreover, Japan's leadership in robotics, AI, and precision mapping technology and its strong research and development capabilities foster continuous innovation in geospatial solutions.

The geospatial solutions market in India is estimated to record a notable CAGR from 2024 to 2030. The market is growing due to the government’s focus on digital transformation, smart cities, and infrastructure development. Initiatives like Digital India and the Smart Cities Mission drive the adoption of geospatial technologies for urban planning, utility management, and disaster preparedness. The country’s vast and diverse geography and rapid urbanization necessitate efficient land use and resource management, further boosting demand. Furthermore, the rising agricultural sector increasingly utilizes geospatial tools for precision farming, contributing to the market's expansion in India.

China geospatial solutions market had the largest revenue share in 2023. The country’s massive infrastructure projects, urbanization, and government-led initiatives like the Belt and Road Initiative drive the market. The government's emphasis on smart cities and environmental monitoring is increasing the adoption of geospatial technologies. In addition, China's significant investments in satellite technology, remote sensing, and AI integration are enhancing the capabilities of geospatial solutions. The growing demand for advanced mapping, land management, disaster response tools, and China's industrial and agricultural sectors further fuels market growth.

Europe Geospatial Solutions Market Trends

The geospatial solutions market in Europe is anticipated to grow at a moderate CAGR of 11.9% from 2024 to 2030. The market is driven by strong demand from environmental monitoring, transportation, and urban planning sectors. The region’s commitment to sustainability and climate action initiatives, including the European Green Deal, accelerates the adoption of geospatial technologies for monitoring and managing natural resources. Furthermore, Europe’s advanced technological infrastructure and government support for smart city projects and digital transformation foster market growth. The presence of leading geospatial companies and collaborative research initiatives across the EU further enhance innovation and market expansion.

France geospatial solutions market accounted for a significant revenue share in 2023. The country’s emphasis on environmental sustainability, urban planning, and infrastructure modernization fuels the market. The French government’s commitment to climate action and renewable energy projects drives the adoption of geospatial technologies for monitoring and managing natural resources. Moreover, France’s robust transportation and agriculture sectors rely on geospatial data for efficient planning and operations. The country’s active participation in European Union geospatial initiatives and collaborative research programs also contributes to innovation and growth in the market.

The geospatial solutions market in the UK is estimated to grow at the highest CAGR from 2024 to 2030. The market is driven by strong demand in sectors like transportation, urban planning, and environmental monitoring. The UK government’s focus on smart city development and infrastructure projects, such as the High-Speed Rail (HS2) initiative, is increasing the use of geospatial technologies. In addition, the UK’s advanced research capabilities and the integration of AI and big data analytics into geospatial applications are fostering innovation. The country's commitment to sustainability and climate change mitigation also drives demand for geospatial solutions in environmental management.

Germany geospatial solutions market is estimated to grow at a moderate CAGR from 2024 to 2030. The market is growing due to the country’s strong industrial base, infrastructure development, and commitment to sustainability. The German government’s focus on smart manufacturing (Industry 4.0) and urban planning drives the adoption of geospatial technologies for optimizing production processes and managing urban growth. Furthermore, Germany’s leadership in the automotive and transportation sectors increases demand for geospatial data in logistics, navigation, and infrastructure management. The country’s emphasis on environmental protection and renewable energy also contributes to the market’s expansion, as geospatial tools are essential for monitoring and managing these initiatives.

Middle East & Africa (MEA) Geospatial Solutions Market Trends

The geospatial solutions market in the Middle East and Africa (MEA) region is estimated to grow a significant CAGR of 14% from 2024 to 2030. The market is expanding due to the region’s focus on infrastructure development, urbanization, and resource management. Countries in the Gulf Cooperation Council (GCC) are investing heavily in smart city projects, driving the adoption of geospatial technologies for urban planning and utility management. Moreover, the region’s vast natural resources, including oil and gas, necessitate advanced geospatial tools for exploration, monitoring, and sustainable management. The growing need for efficient land use and environmental monitoring in the face of climate challenges further fuels market growth in the MEA.

Saudi Arabia geospatial solutions market accounted for a considerable revenue share in 2023. The market is driven by the country’s ambitious Vision 2030 initiative, which aims to diversify the economy and develop infrastructure. The government’s focus on smart city projects, such as NEOM, and large-scale infrastructure development is increasing the demand for geospatial technologies. In addition, Saudi Arabia’s oil and gas sector relies heavily on geospatial solutions for exploration, production, and environmental management. Integrating advanced technologies like AI and IoT into geospatial applications further enhances the country’s capabilities in land management and resource optimization.

Key Geospatial Solutions Company Insights

Some key players operating in the market include Microsoft Corporation, Oracle Corporation, and Google LLC.

-

Microsoft Corporation's strategic growth in the market focuses on leveraging its cloud platform, Azure, to integrate geospatial analytics with AI and machine learning. Through partnerships with geospatial technology leaders, Microsoft enhances its mapping and location-based services, offering scalable solutions for industries like defense, urban planning, and environmental monitoring. By embedding geospatial data into Azure services, Microsoft enables advanced spatial analytics, driving innovation in smart cities, logistics, and IoT, reinforcing its position as a key player in geospatial solutions.

-

Google LLC's strategic growth in the market is driven by its dominance in mapping and location services through Google Maps and Google Earth. The company leverages its cloud platform, Google Cloud, to offer geospatial analytics and location-based services integrated with AI and big data capabilities. Google's investments in AI-driven geospatial data processing, partnerships with industry leaders, and continuous innovation in 3D mapping, AR, and VR technologies enhance its retail, transportation, and urban planning offerings, solidifying its geospatial market leadership.

Living Map, Mappedin Inc., and TomTom International BV are some of the emerging market participants.

-

Living Map's strategic growth in the market focuses on providing real-time, location-based mapping solutions tailored to smart cities, transportation hubs, and large venues. The company leverages advanced geospatial data analytics to deliver dynamic, interactive maps that enhance user experiences and operational efficiency. Through partnerships with tech giants and transportation authorities, Living Map integrates its solutions with IoT and mobile platforms, enabling seamless indoor-outdoor navigation. This approach positions Living Map as a key player in delivering innovative, customized geospatial solutions for urban environments and complex infrastructures.

-

TomTom International BV's strategic growth in the market is centered around its expertise in mapping, navigation, and location-based services. The company focuses on developing highly accurate maps and advanced geospatial data platforms, crucial for autonomous driving, smart mobility, and logistics. TomTom strengthens its position through strategic partnerships with automotive, tech, and logistics companies, integrating real-time traffic data, AI, and machine learning to enhance its geospatial offerings. TomTom remains a significant player in the geospatial market by continuously innovating in areas like HD mapping and location-based APIs.

Key Geospatial Solutions Companies:

The following are the leading companies in the geospatial solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Pix4D

- Microsoft Corporation

- Uber Technologies Inc.

- L3Harris Geospatial Solutions Inc.

- TomTom International BV

- Living Map

- Google LLC

- Mappedin Inc.

- Bentley Systems Inc.

- SAP SE

- Apple Inc.

- GIS Cloud Ltd.

- General Electric Company

- Oracle Corporation

- Telenav Inc.

- Trimble Inc.

- Pitney Bowes Inc.

- Hexagon AB

Recent Developments

-

In July 2024, Esri collaborated with Microsoft Corporation to integrate its spatial analytics technology with Fabric, Microsoft's unified analytics SaaS platform. Data experts, including analysts, data scientists, engineers, and executives, could seamlessly use Esri's advanced spatial analytics tools and visualizations within Microsoft Fabric through this integration. This collaboration enabled powerful spatial analytics to be easily shared across organizational tools such as Microsoft Fabric, Power BI, and Esri's ArcGIS environment.

-

In February 2024, GE Vernova announced the release of Proficy for Sustainability Insights, a new AI-based software solution aimed at helping manufacturers achieve sustainability goals while maximizing productivity and profitability. The software integrates operational and sustainability data, enabling industrial companies to use resources more efficiently and manage climate metrics required for regulatory compliance across plants or enterprises.

Geospatial Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 438.15 billion

Revenue Forecast in 2030

USD 990.79 billion

Growth rate

CAGR of 14.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Pix4D; Microsoft Corporation; Uber Technologies Inc.; L3Harris Geospatial Solutions Inc.; TomTom International BV; Living Map; Google LLC; Mappedin Inc.; Bentley Systems Inc.; SAP SE; Apple Inc.; GIS Cloud Ltd.; General Electric Company; Oracle Corporation; Telenav Inc.; Trimble Inc.; Pitney Bowes Inc.; Hexagon AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geospatial Solutions Marker Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global geospatial solutions market report based on technology, component, application, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

GIS/Geospatial Analytics

-

Remote Sensing

-

GPS

-

3D Scanning

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surveying & Mapping

-

Geovisualization

-

Planning & Analysis

-

Land Management

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Utility

-

Business

-

Transportation

-

Defense & Intelligence

-

Infrastructure Development

-

Natural Resources

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the geospatial solutions market growth include the rapid advancements in technologies such as artificial intelligence (AI), machine learning, and cloud computing.

b. The global geospatial solutions market size was estimated at USD 385.49 billion in 2023 and is expected to reach USD 438.15 billion in 2024.

b. The global geospatial solutions market is expected to grow at a compound annual growth rate of 14.6% from 2024 to 2030 to reach USD 990.79 billion by 2030.

b. The North America region accounted for the largest share of over 33% in the geospatial solutions market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the geospatial solutions market include Pix4D, Microsoft Corporation, Uber Technologies Inc., L3Harris Geospatial Solutions Inc., TomTom International BV, Living Map, Google LLC, Mappedin Inc., Bentley Systems Inc., SAP SE, Apple Inc., GIS Cloud Ltd., General Electric Company, Oracle Corporation, Telenav Inc., Trimble Inc., Pitney Bowes Inc., Hexagon AB.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.