Germany Milk Protein Market Summary

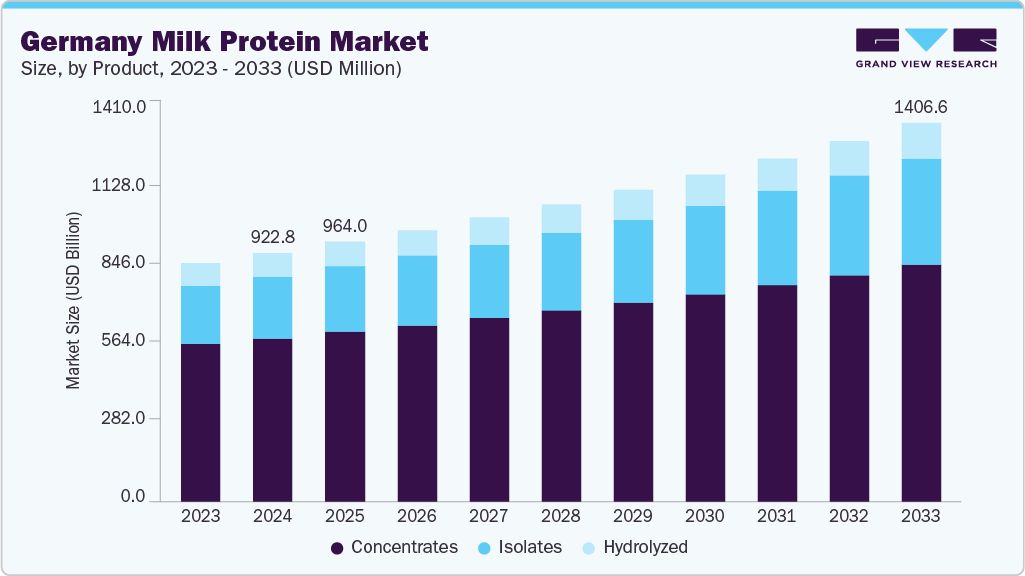

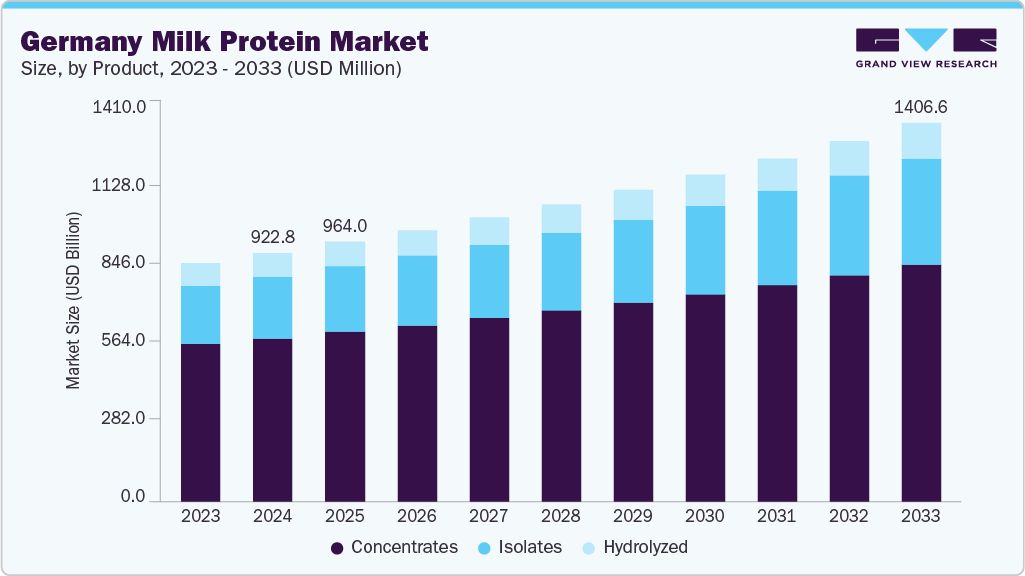

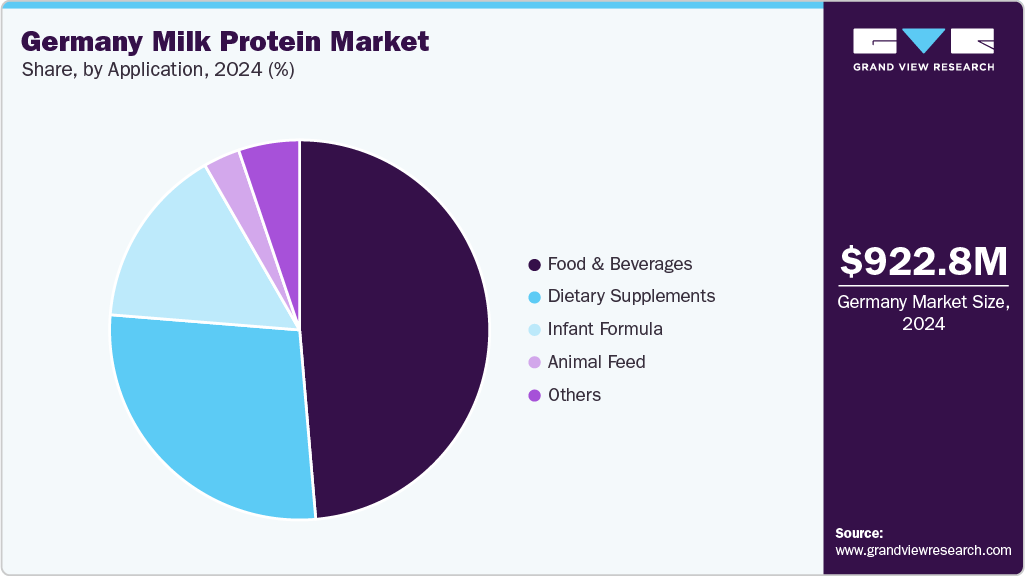

The Germany milk protein market size was estimated at USD 922.8 million in 2024 and is projected to reach USD 1,406.6 million by 2033, growing at a CAGR of 4.8% from 2025 to 2033. Germany holds a leading position in the European milk protein market due to its advanced dairy infrastructure, strong processing capabilities, and consistent innovation across the supply chain.

Key Market Trends & Insights

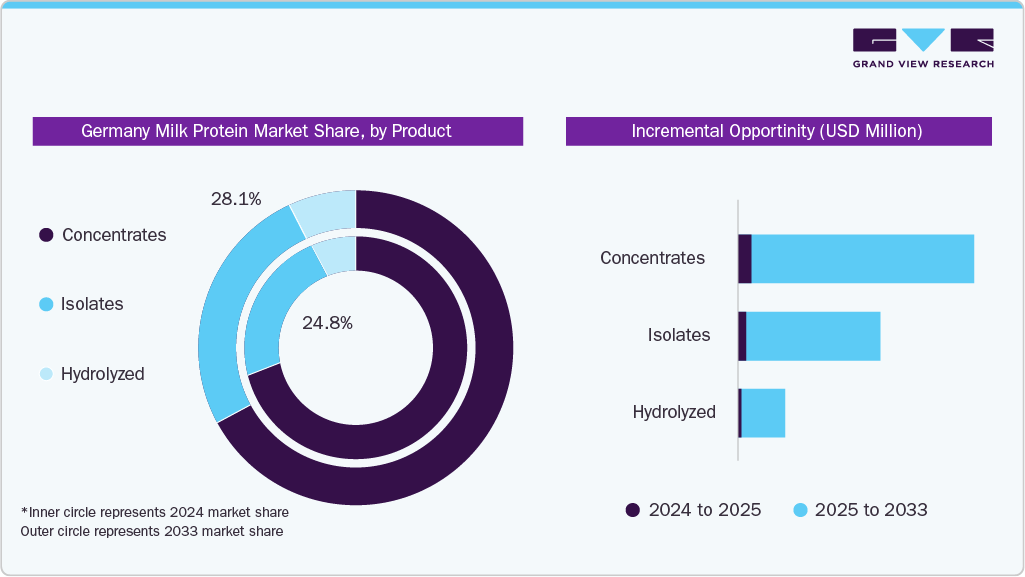

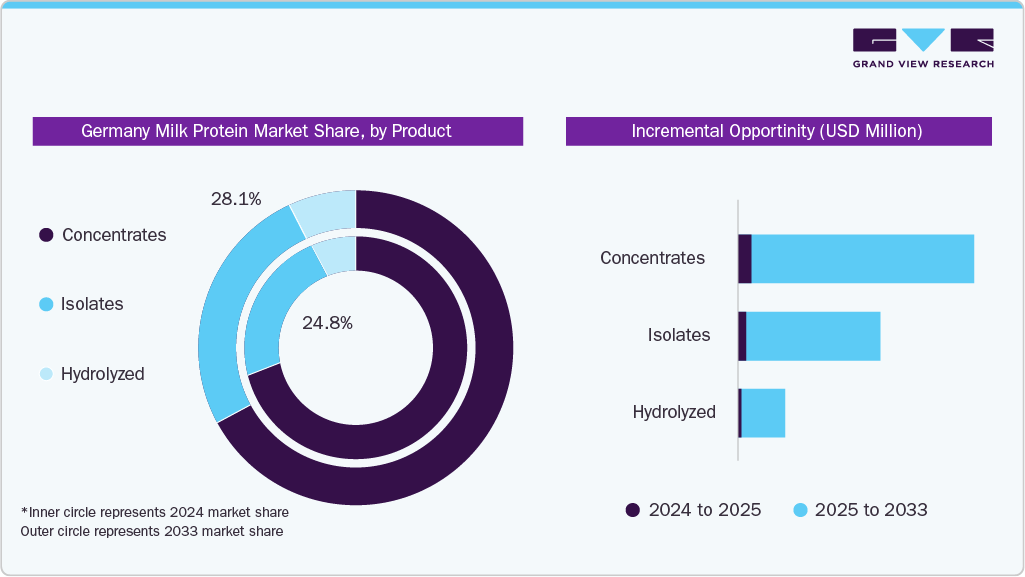

- By product, the concentrates segment held the highest revenue share of 65.7% in 2024.

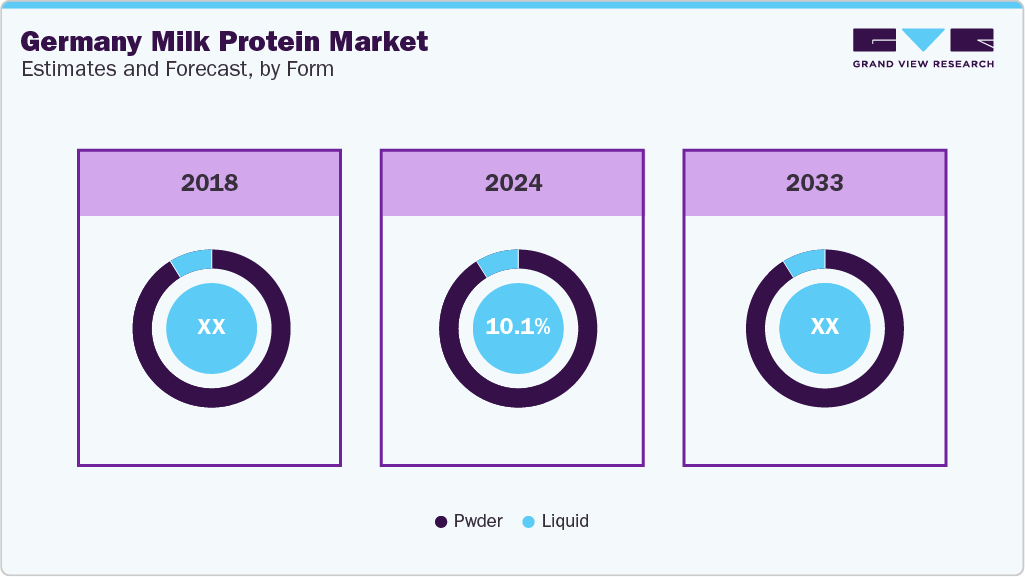

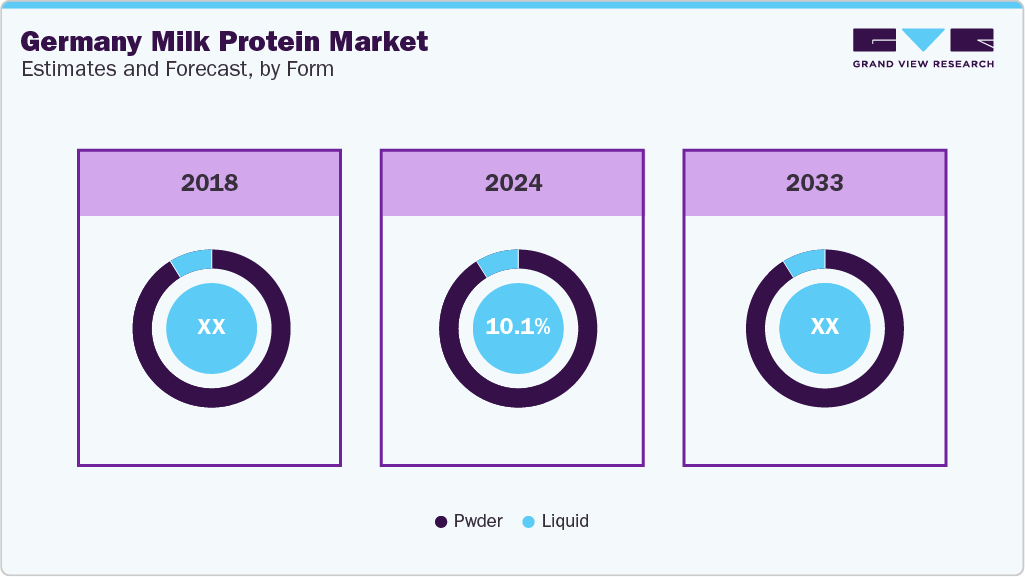

- Based on form, the powder segment held the largest revenue share of 89.9% in 2024.

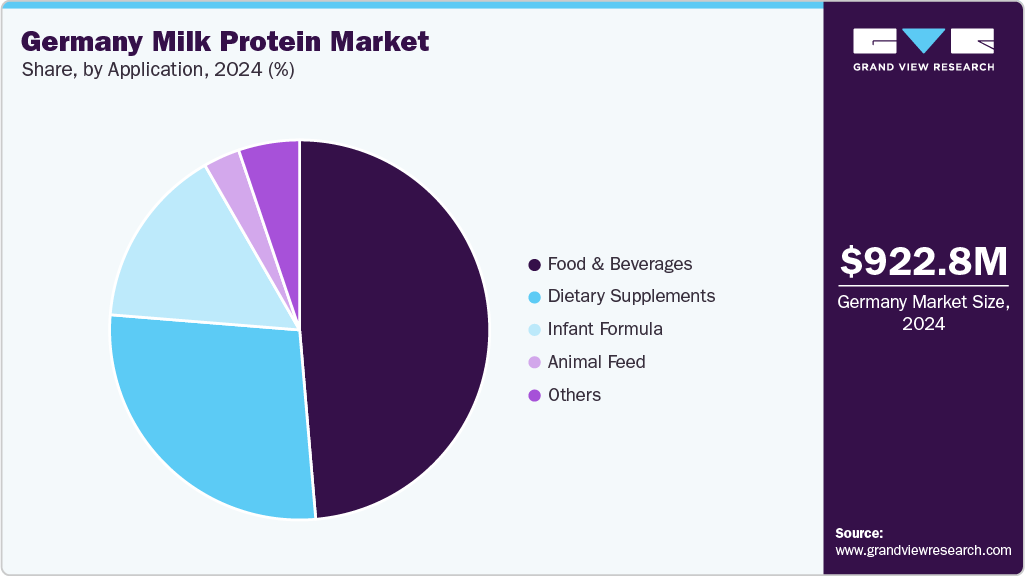

- By application, the food & beverages segment held the highest revenue share of 48.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 922.8 Million

- 2033 Projected Market Size: USD 1,406.6 Million

- CAGR (2025-2033): 4.8%

The country produces a wide range of milk-derived proteins used in sports nutrition, infant formula, and functional food applications. While traditional milk consumption is declining due to changing lifestyles and rising interest in plant-based alternatives, Germany continues to prioritize sustainability, efficiency, and premium product development in the milk protein sector. The country’s milk protein market is undergoing a transformation shaped by evolving consumer preferences, nutritional trends, and structural adjustments within the dairy industry.

According to the Federal Agency for Agriculture and Nutrition (BLE), around 32.4 million tons of cow milk production was recorded in 2023, reflecting a 1.5% rise, an increase of approximately 476,700 tons compared to 2022.

Key drivers of the German milk protein industry include the increasing demand for high-protein functional foods, growing use of milk proteins in sports and medical nutrition, and a strong emphasis on sustainability and premium product development. The market is also influenced by innovation in processing technologies and the adoption of clean-label, organic, and lactose-free offerings, positioning Germany as a leader in the evolving European protein landscape.

Product Insights

The concentrates segment dominated the Germany milk protein market and accounted for a revenue share of 65.7% in 2024, owing to their broad functionality, cost-effectiveness, and compatibility with a wide range of food and beverage formulations. Their high protein content and beneficial emulsifying, water-binding, and foaming properties make them ideal for use in bakery products, dairy drinks, protein bars, and clinical nutrition.

The isolates segment is expected to grow at the fastest CAGR of 6.3% over the forecast period. In Germany, the development of milk protein isolates is driven by advanced food technology infrastructure, a long-standing tradition of biotechnology, and rising demand for high-purity protein ingredients in clinical, sports, and functional nutrition. The country offers a highly innovative ecosystem, characterized by strong collaboration between research institutes, specialized processing companies, and public funding initiatives. Furthermore, Germany’s emphasis on quality standards, sustainable production methods, and export-oriented manufacturing makes it an attractive hub for dairy-based ingredient innovation.

Form Insights

The powder segment accounted for the highest revenue share in 2024, driven by the long shelf life, ease of transport, and versatility of powder format across various applications, including sports nutrition, clinical foods, and functional beverages. Germany’s advanced processing infrastructure, such as spray drying and ultrafiltration, supports the production of high-quality, biofunctional protein powder. The growing consumer focus on high-protein and low-sugar diets further boosts the use of milk protein powders in snacks, bakery items, and ready-to-mix drinks.

The liquid segment is expected to record the fastest CAGR over the forecast period. Germany's strong dairy infrastructure and advanced processing capabilities support the development of ready-to-drink milk protein products. Rising consumer demand for convenient, high-protein beverages, especially among health-conscious, fitness-oriented, and aging population, is expected to accelerate market growth. In addition, the growing interest in functional nutrition, such as muscle maintenance, recovery, and satiety, is expected to fuel demand for liquid formats. The shift toward clean-label, low-sugar formulations, as well as innovations in sustainable packaging and on-the-go consumption, further support the expansion of this segment. Collaboration between established dairy brands and consumer goods companies is also driving product innovation and is expected to enhance market penetration over the coming years.

Application Insights

The food and beverages segment accounted for the largest revenue share in 2024, driven by increasing demand for gut-health-focused products, convenient on-the-go formats, clean-label and protein-enriched formulations, and sustainable production methods. The rising popularity of functional beverages, consumer interest in digestive wellness, and innovation in dairy-based nutraceutical ingredients are also supporting the segment's growth.

The dietary supplements segment is expected to experience the fastest CAGR over the forecast period. A strong fitness and wellness culture is creating demand for high-quality protein supplements for muscle recovery, weight management, and general health. Dietary supplements are available in various formats such as shakes, capsules, ready-to-mix blends, and powdered supplements.

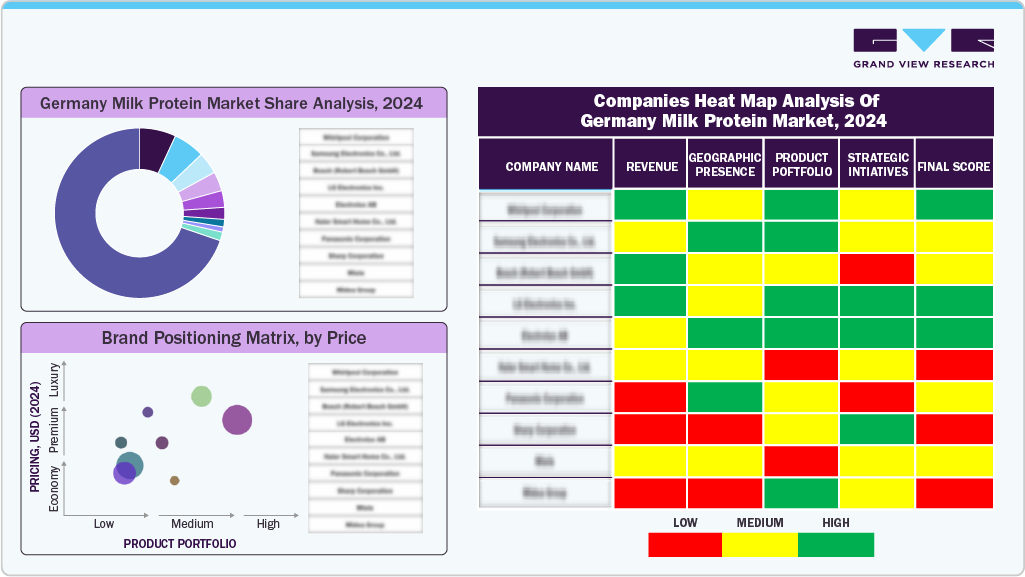

Key Germany Milk Protein Company Insights

- Some key players in the German milk protein industry are Arla Foods and Fonterra Co-Operative Group Limited.

Key Germany Milk Protein Companies:

- Arla Foods amba

- Agrial

- FrieslandCampina

- MORINAGA MILK INDUSTRY CO., LTD.

Recent Developments

- In April 2025, Arla Foods and DMK GROUP announced their plan to merge, forming Europe’s largest dairy cooperative with over 12,000 farmers and a combined pro forma revenue of USD 22.26 billion.

Germany Milk Protein Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 964.0 million

|

|

Revenue forecast in 2033

|

USD 1,406.6 million

|

|

Growth rate

|

CAGR of 4.8% from 2025 to 2033

|

|

Historical Period

|

2021 - 2023

|

|

Base Year

|

2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, form, application

|

|

Key companies profiled

|

Arla Foods amba; Agrial; FrieslandCampina; MORINAGA MILK INDUSTRY CO., LTD.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Germany Milk Protein Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Germany milk protein market report based on product, form, and application.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Concentrates

-

Isolates

-

Hydrolyzed

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Dairy Products

-

Bakery & Confectionery

-

Functional Foods

-

Beverages

-

Others

-

Infant Formula

-

Dietary Supplements

-

Animal Feed

-

Others