- Home

- »

- Foods, Beverages & Food Ingredients

- »

-

Milk Protein Market Size And Share, Industry Report, 2033GVR Report cover

![Milk Protein Market Size, Share & Trends Report]()

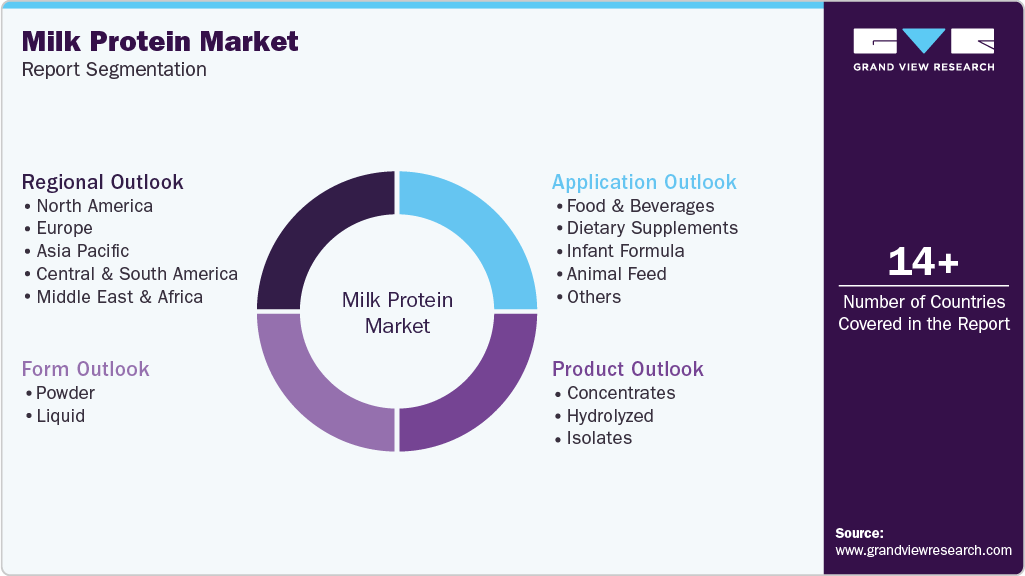

Milk Protein Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Concentrates, Hydrolyzed, Isolates), By Form (Powder, Liquid), By Application (Dietary Supplements, Food & Beverages, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-462-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Milk Protein Market Summary

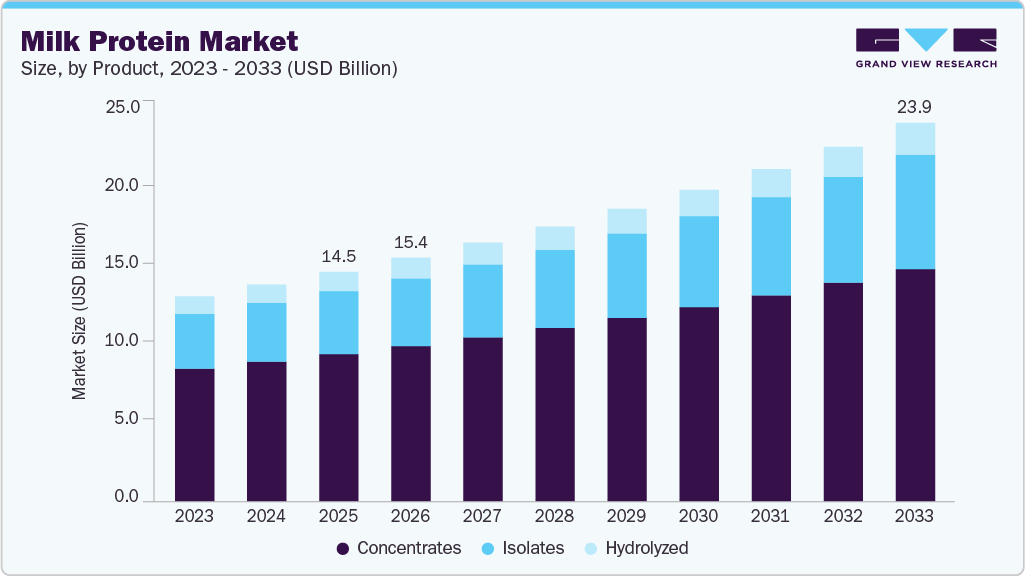

The global milk protein market size was estimated at USD 14.50 billion in 2025 and is projected to reach USD 23.90 billion by 2033, growing at a CAGR of 6.5% from 2026 to 2033. One of the primary growth drivers is the increasing health consciousness among consumers.

Key Market Trends & Insights

- North America dominated the milk protein market in 2025 with a share of 39.81%.

- The Asia Pacific milk protein market is experiencing significant growth, projecting a CAGR of 7.6%.

- Based on product, milk protein concentrate accounted for a share of 64.11% in 2025.

- The milk protein isolates market is expected to witness a CAGR of 7.8% from 2026 to 2033.

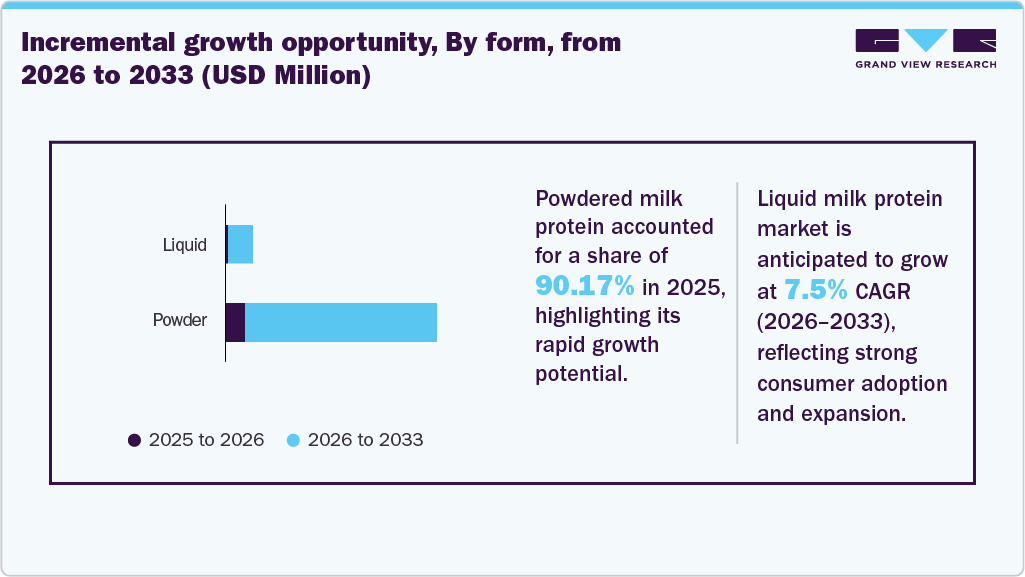

- By form, powdered milk protein accounted for a share of 90.17% in 2025.

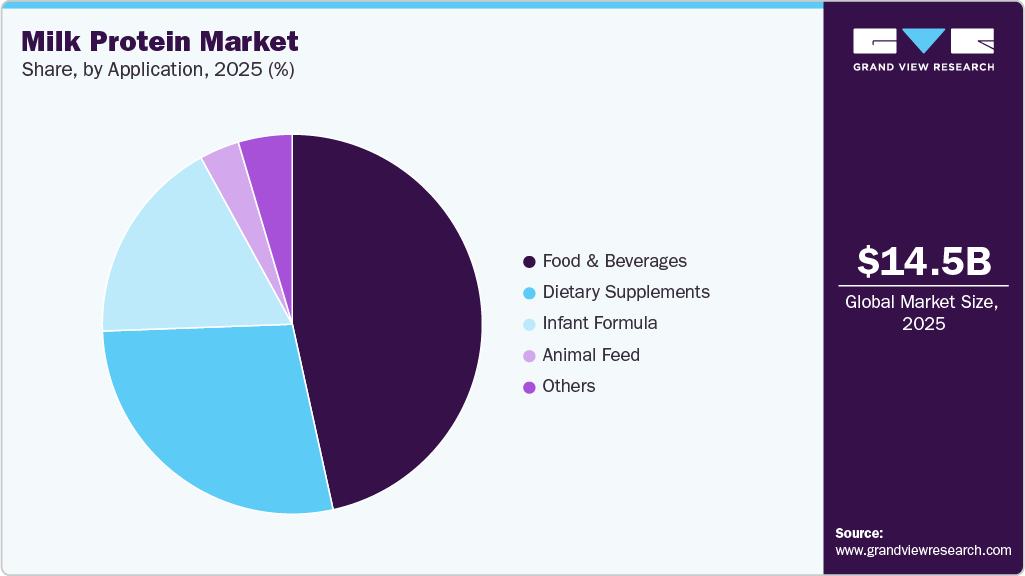

- By application, the food & beverages segment accounted for a share of 46.60% in 2025.

- The dietary supplements application segment is expected to witness a CAGR of 7.7% from 2026 to 2033.

Key Market Trends & Insights

- 2025 Market Size: USD 14.50 Billion

- 2033 Projected Market Size: USD 23.90 Billion

- CAGR (2026-2033): 6.5%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

There is a widespread awareness of the importance of protein in maintaining overall health, leading to a rise in the consumption of protein-rich products. Milk proteins, which include casein, whey protein, and milk protein concentrates, are recognized for their high nutritional value, complete amino acid profile, and digestibility, making them ideal for various dietary applications.Functional foods and beverages, which provide health benefits beyond basic nutrition, are gaining significant traction globally. Milk proteins play a crucial role in this segment due to their multifunctional properties, including emulsification, foaming, and gelation. The ability of milk proteins to enhance texture, stability, and nutritional content makes them ideal ingredients in a variety of functional food applications, including fortified dairy products, meal replacements, and protein-enriched snacks. Manufacturers are increasingly focusing on innovation to meet the rising demand for functional foods. For instance, Arla Foods Ingredients Group offers a range of milk protein-based ingredients designed for protein bars that maintain their texture and softness over time, a common issue with high-protein snacks. This move addresses the growing demand for convenient, on-the-go products that offer both taste and health benefits.

Technological advancements in the processing and extraction of milk proteins have significantly contributed to the market's growth. Traditional methods of extracting milk proteins were often inefficient, resulting in lower yields and higher costs. However, innovations in filtration, ultrafiltration, and microfiltration technologies have improved the purity and functionality of milk proteins, making them more suitable for a wider range of applications. For instance, advanced membrane filtration technologies have enabled manufacturers to produce highly concentrated whey protein isolates and caseinates with minimal denaturation, preserving their nutritional integrity. These innovations have also enabled the development of lactose-free and fat-free milk protein products, catering to consumers with specific dietary requirements. As a result, manufacturers can offer more diverse product portfolios that meet the specific needs of different consumer groups, from athletes to individuals with lactose intolerance.

Product Insights

Milk protein concentrates (MPCs) held a revenue share of 64.11% in 2025 due to their versatility and broad applicability across different industries. MPCs contain a higher concentration of protein along with other essential nutrients such as calcium, phosphorus, and magnesium. Their well-rounded nutritional profile makes them a popular choice in various sectors like food and beverages, sports nutrition, infant formula, and even animal feed. Milk protein concentrates are cost-effective compared to hydrolyzed and isolate proteins; they are relatively more affordable to produce, making them an attractive option for manufacturers looking to incorporate high-protein ingredients without significantly increasing production costs.

Milk protein isolates are expected to grow at a CAGR of 7.8% from 2026 to 2033 due to rising demand for high-protein and functional nutrition products across sports nutrition, clinical nutrition, and functional food applications. Increasing consumer focus on muscle health, weight management, and active lifestyles is driving the incorporation of milk protein isolates into protein powders, ready-to-drink beverages, bars, and dairy alternatives. Their high protein concentration, excellent amino acid profile, and low lactose content make them attractive for both performance and digestive health benefits. Growth is further supported by expanding use in medical nutrition and elderly nutrition products, where easily digestible, high-quality proteins are essential. Additionally, innovation in clean-label formulations and improved processing technologies is enhancing product quality, solubility, and application versatility, supporting sustained market growth.

Form Insights

Powdered milk proteins accounted for a revenue share of 90.17% in 2025 due to their long shelf life, ease of transportation, and versatile application across industries. The stability of powdered milk protein makes it a preferred choice for manufacturers in sectors such as food and beverages, nutraceuticals, and dietary supplements. In powdered form, milk protein can be easily mixed into products such as baked goods, beverages, protein bars, and meal replacements. Another key factor driving the dominance of powdered milk proteins is their cost-effectiveness in storage and distribution. Compared to liquid forms, which require refrigeration and have a shorter shelf life, powdered forms can be stored for extended periods without refrigeration, reducing logistics and storage costs. This makes powdered milk proteins a highly attractive option for both manufacturers and retailers, especially in regions with limited cold chain infrastructure.

The liquid milk proteins segment is expected to grow at a CAGR of 7.5% from 2026 to 2033 due to the increasing demand for ready-to-drink (RTD) protein beverages and fortified dairy products. Liquid milk proteins are particularly popular in the sports nutrition and functional beverages markets, where consumers seek convenient, on-the-go nutrition solutions. The rising demand for high-protein beverages, such as protein shakes, smoothies, and fortified milk drinks, is driving the growth of liquid milk protein. Companies are increasingly developing RTD protein beverages that offer high-quality protein in a convenient liquid format. These products cater to consumers with active lifestyles who prioritize convenience without compromising on nutrition.

Application Insights

The food and beverages application held a share of 46.60% of the milk protein market in 2025, driven by the growing demand for protein-enriched products in both developed and emerging markets. Milk proteins are widely used in various food products, including dairy products, snacks, bakery items, and beverages, due to their functional properties such as emulsification, texture enhancement, and nutritional value. In the dairy sector, milk proteins are crucial for producing products such as cheese, yogurt, and ice cream. The increasing consumer demand for high-protein dairy products, particularly in developed markets such as North America and Europe, has further boosted the use of milk protein in the food and beverage industry.

The milk protein for dietary supplements application is expected to grow at a CAGR of 7.7% from 2026 to 2033. The nutraceuticals and dietary supplements market is experiencing rapid growth, and milk proteins play a crucial role in this sector. The rising awareness of preventive healthcare, coupled with the increasing popularity of protein supplements for fitness and wellness, is driving the demand for milk protein-based nutraceutical products. Whey protein isolates and concentrates are among the most widely used ingredients in protein powders, shakes, and bars, which are popular among athletes, fitness enthusiasts, and individuals looking to increase their protein intake for muscle building, weight management, or overall health.

Regional Insights

The North America milk protein industry accounted for a revenue share of 39.81% in 2025, supported by strong demand for protein-enriched foods, sports nutrition products, and dietary supplements. High consumer awareness of health, fitness, and active lifestyles has driven widespread use of milk proteins in protein powders, ready-to-drink beverages, bars, and functional dairy products. The presence of major dairy processors, advanced processing technologies, and well-established distribution networks further strengthens the regional market. Additionally, rising consumption of clinical and elderly nutrition products, along with growing interest in clean-label and high-quality protein sources, continues to reinforce North America’s leading position in the global landscape.

U.S. Milk Protein Market Trends

The U.S. milk protein industry is expected to grow at a CAGR of 6.0% from 2026 to 2033, driven by increasing demand for high-protein and functional food products. Growth is supported by rising participation in fitness and sports activities, as well as increased consumption of protein powders, bars, and ready-to-drink beverages formulated with milk proteins. The expanding use of milk proteins in clinical nutrition, elderly nutrition, and weight-management products further contributes to market expansion. In addition, ongoing product innovation, clean-label trends, and consumer preference for natural, high-quality protein sources are encouraging food and beverage manufacturers to incorporate milk proteins across a wide range of applications, sustaining steady growth in the U.S. market.

Europe Milk Protein Market Trends

The milk protein industry in Europe accounted for a market share of 27.16% in 2025, supported by strong consumption of dairy products, well-established food processing industries, and increasing demand for protein-enriched foods across the region. Countries such as Germany, France, the Netherlands, and the UK play a significant role due to advanced dairy infrastructure and continuous product innovation. Rising interest in sports nutrition, functional foods, and medical nutrition is driving the use of milk proteins in supplements, beverages, and specialized dietary products. In addition, growing focus on clean-label formulations, sustainable dairy sourcing, and high-quality nutrition standards continues to support steady demand for milk proteins across Europe.

The UK milk protein industry is expected to grow at a CAGR of 6.2% from 2026 to 2033, driven by rising demand for high-protein and functional food products among health-conscious consumers. The increasing popularity of sports and active nutrition, along with growing consumption of protein-fortified dairy, bakery, and ready-to-drink beverages, is supporting market growth. The market is also benefiting from expanding applications in clinical and elderly nutrition, where milk proteins are valued for their high digestibility and complete amino acid profile. In addition, clean-label preferences, innovation in dairy processing, and rising adoption of convenient, on-the-go protein formats are expected to further sustain growth in the UK market.

Asia Pacific Milk Protein Market Trends

The milk protein industry in the Asia Pacific is expected to grow with a CAGR of 7.6% from 2026 to 2033, driven by rapid urbanization, increasing disposable incomes, and changing dietary patterns in emerging economies such as China and India. The rising demand for high-protein foods, driven by increasing health consciousness and the adoption of Western dietary habits, is a key factor contributing to the market's growth in the region. The expansion of the sports nutrition and functional food markets in the Asia Pacific is also contributing to the growing demand for milk proteins. As more consumers in the region become aware of the benefits of protein for muscle building, weight management, and overall health, they are increasingly turning to protein-enriched products, including milk protein-based supplements and beverages.

The China milk protein industry accounted for 32.01% of the Asia Pacific market share in 2025, supported by rapid growth in the dairy and nutrition industries and rising consumer awareness of protein-rich diets. Increasing demand for infant formula, sports nutrition, and functional dairy products has significantly driven milk protein consumption. Urbanization, higher disposable incomes, and growing health consciousness among middle-class consumers are encouraging the adoption of premium nutrition products formulated with milk proteins. In addition, government support for domestic dairy production, investments in modern processing facilities, and strong demand for clinical and elderly nutrition products are further strengthening China’s leading position in the region.

Middle East & Africa Milk Protein Market Trends

The milk protein industry in the Middle East & Africa is expected to grow at a CAGR of 6.7% from 2026 to 2033, driven by increasing demand for nutritious and protein-enriched food products across the region. Rising urbanization, improving disposable incomes, and growing awareness of the health benefits of protein consumption are supporting market growth. Demand is particularly strong in infant nutrition, sports nutrition, and functional dairy products. In addition, the expansion of the food and beverage manufacturing sector, increasing imports of dairy ingredients, and the growing adoption of Western dietary habits are contributing to a higher use of milk proteins in beverages, bakery products, and convenience foods across the Middle East and Africa.

Central & South America Milk Protein Market Trends

The milk protein industry in Central & South America is expected to grow at a CAGR of 7.1% from 2026 to 2033, driven by rising consumption of protein-rich foods and growing awareness of nutrition and wellness. The expansion of middle-class populations, increased participation in sports and fitness activities, and higher demand for functional and fortified food products are all supporting market growth. The region is witnessing increased use of milk proteins in dairy beverages, nutritional supplements, and bakery applications. In addition, the development of the local dairy processing industry, improved distribution networks, and growing adoption of convenient, on-the-go nutrition formats are expected to further boost demand for milk proteins across Central and South America.

Key Milk Protein Company Insights

The global market is characterized by the presence of numerous well-established players such as Saputo, Inc., Glanbia, Plc., Cargill, Inc., Nestlé S.A., Kerry Group plc, and Arla Foods Ingredients, among others. The market players face intense competition from each other as some of them are among the top cereal manufacturers with diverse product portfolios for milk proteins. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional and international consumers.

Key Milk Protein Companies:

The following are the leading companies in the milk protein market. These companies collectively hold the largest market share and dictate industry trends.

- Saputo, Inc.

- Glanbia, Plc.

- Cargill, Inc.

- Nestlé S.A.

- Kerry Group plc

- Arla Foods Ingredients

- Fonterra Co-Operative Group Limited

- FRIESLANDCAMPINA N.V.

- Idaho Milk

- Groupe Lactalis

Recent Developments

-

In November 2025, Arla Foods Ingredients unveiled several new high-protein dairy concepts, including a high-protein drinking yoghurt with hydrolyzed whey protein and a protein-rich carbonated dairy drink, at Fi Europe 2025.

-

In March 2025, at Natural Products Expo West 2025, Dutch start-up Vivici launched its precision-fermented dairy protein ingredient, Vivitein BLG, designed to enable innovative high-protein consumer products with superior functional and sensory properties.

Milk Protein Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.38 billion

Revenue forecast in 2033

USD 23.90 billion

Growth rate (Revenue)

CAGR of 6.5% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilo Tons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; the Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Saputo, Inc.; Glanbia, Plc.; Cargill, Inc.; Nestlé S.A.; Kerry Group plc; Arla Foods Ingredients; Fonterra Co-Operative Group Limited; Idaho Milk; Groupe Lactalis; FRIESLANDCAMPINA N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Milk Protein Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global milk protein market report on the basis of product, form, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Concentrates

-

Hydrolyzed

-

Isolates

-

-

Form Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Powder

-

Liquid

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Dairy Products

-

Bakery & Confectionery

-

Functional Foods

-

Beverages

-

Others

-

-

Dietary Supplements

-

Infant Formula

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global milk protein market size was estimated at USD 14.50 billion in 2025 and is expected to reach USD 15.38 billion in 2026.

b. The global milk protein market is expected to grow at a compounded growth rate of 6.5% from 2026 to 2033, reaching USD 23.90 billion by 2033.

b. The North America milk protein market accounted for a share of 39.81% in 2025 due to the expanding sports nutrition and fitness industry plays a significant role, with milk proteins being integral to protein supplements and performance nutrition products

b. Some key players operating in the milk protein market include Saputo Inc., Actus Nutrition, Agropur, Idaho Milk Products, Vitalis Nutrition, Glanbia PLC, Kerry Group plc, and others

b. One of the primary drivers of the milk protein market is the increasing health consciousness among consumers. There is a widespread awareness of the importance of protein in maintaining overall health, leading to a rise in the consumption of protein-rich products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.