- Home

- »

- Pharmaceuticals

- »

-

Germany Nutritional Supplements Market Size Report, 2030GVR Report cover

![Germany Nutritional Supplements Market Size, Share & Trends Report]()

Germany Nutritional Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sports Nutrition, Dietary Supplements, Fat Burner), By Consumer Group, By Formulation, By Sales Channel, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-304-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

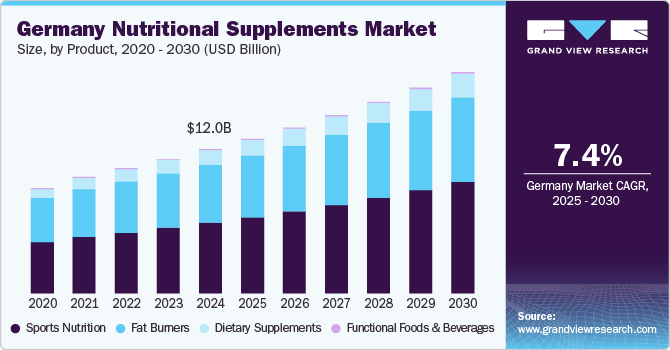

The Germany nutritional supplements market size was estimated at USD 12.0 billion in 2024 and is expected to grow at a CAGR of 7.4% from 2025 to 2030. The growth of this market is primarily fueled by rising awareness of health and wellness and increasing engagement in sports activities. The growing availability of various supplements and the rising obesity rates are expected to contribute significantly to the expansion of the nutritional supplements market in Germany during the forecast period.

Moreover, the rising number of health initiatives related to nutritional supplements is expected to boost market growth. In addition, government policies and national programs in Germany aimed at fostering healthy lifestyles among youth and encouraging young adults to participate in sports are anticipated to further enhance market expansion. The National Action Plan IN FORM established by Germany's Federal Government aims to improve children's and young adults' dietary habits and nutrition by incorporating healthy meal plans for school students. Furthermore, it advocates fitness and physical activities across all age groups to mitigate obesity-related health issues.

In addition, the availability of multiple online and retail channels has enhanced access to dietary supplements. A significant factor propelling the Germany nutritional supplements industry is product accessibility. The increased visibility of these products and their capacity to reach more people across various age groups and socioeconomic backgrounds via e-commerce platforms, as well as retail outlets, is also boosting market demand. According to the International Trade Administration (ITA), Germany's online population is likely to reach 68.4 million in 2025, up from 62.4 million in 2020. During the COVID-19 pandemic, German consumers notably increased the use of e-commerce platforms due to the benefits of home delivery, 24/7 availability, and enhanced convenience.

Medical research and technological advancements are driving a shift in the Germany nutritional supplements industry. The trend toward novel formulations, personalized nutrition solutions, and the use of bioactive ingredients is gaining traction. Companies are increasingly investing in research and development to produce products that fulfill essential nutritional requirements while providing added health benefits. This emphasis on innovation is fostering competition and is resulting in a steady stream of new products and treatments tailored to various patient demographics.

A surge in research and development within dietary supplements is transforming the nutritional supplements sector. The growing preference for plant-based nutritional and dietary supplements is driving recent discoveries in food, cosmetics, and pharmaceuticals. For example, in November 2023, a Berlin-based startup, CISCAREX, introduced its MINA5 product, a plant-extract-based vitamin A5 dietary supplement designed to meet balanced diet needs. The Germany nutritional supplements industry is notably fragmented due to the presence of both global and local brands across retail stores and online platforms. Furthermore, key players in the Germany nutritional supplements industry have implemented several strategic initiatives to maintain their competitive edge.

Product Insights

The functional foods and beverages segment accounted for the largest share of around 49% of the total revenue in 2024. This growth is attributable to the rising demand for omega-3 fatty acids, which enhance the heart, brain, eye, skin, and overall mental and physical health, as well as the increasing consumption of probiotics as dietary supplements. The growing prevalence of illnesses in society drives the need for probiotics, which are essential components of the human diet. Probiotics support immune function and help alleviate various health conditions.

Germany sports nutrition segment is expected to grow at the highest CAGR of 8.7% over the forecast period. This growth can be attributed to the country's active engagement in sports; support from athletes, sports professionals, and enthusiasts of sports nutrition; and a growing demand for plant-based sports nutrition products. In addition, the increasing number of health clubs, fitness centers, and gyms in Germany is encouraging more individuals to pursue fitness activities, further propelling the demand for sports nutrition. The trend toward personalized nutrition solutions is also gaining traction as consumers seek products tailored to their specific fitness goals and dietary needs. Furthermore, the rising awareness of the importance of nutrition in enhancing athletic performance is motivating consumers to invest in high-quality sports supplements.

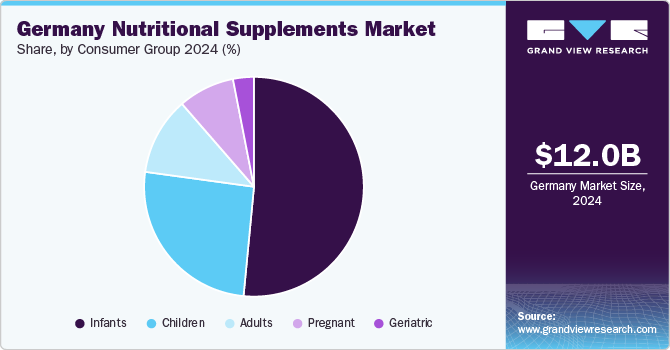

Consumer Group Insights

The adults segment is expected to grow at the fastest rate, with a CAGR of 8.1% during the forecast period. This segment is further categorized into age groups: 21-30, 31-40, 41-50, and 51-65. According to 2022 data from Germany’s Federal Statistical Office, 24.5% of the population in the country is between the ages of 20 and 40, while 27.3% is between 40 and 60 years old. A study published in the Nature Journal highlights that cancer, cardiovascular diseases, and diabetes accounted for 44% of total disability-adjusted life years in 2019, accounting for 19.5%, 18.8%, and 5.8%, respectively.

The high prevalence of chronic diseases underscores the increasing demand for nutritional supplements tailored to adults as they look to improve their health and better manage these conditions. Moreover, the increasing involvement of both children and adults in sports, the growing preference for healthier food, a significant proportion of adults in Germany's population, and the rising prevalence of diseases among the elderly highlight the need for supplements. These supplements play an essential role in disease prevention and are often prescribed as part of treatment plans, further driving market growth.

Sales Channel Insights

Thebrick-and-mortar segment accounted for the largest share of 63.5% in terms of revenue in 2024. The strong presence of supermarket chains nationwide contributes to market growth. The supermarkets provide various products from well-known brands such as Edeka, Lidl & Kaufland, REWE, and Aldi, which drives the market.

The e-commerce segment is projected to exhibit the fastest CAGR of 9.1% over the forecast period. Germany's e-commerce consumer base, internet penetration rate, and annual average expenditure are all higher than the average for Europe. Post-COVID-19, Germany witnessed a rise in online purchases, and in 2022, it had the third-highest rate of e-commerce penetration in the world, with 80% of the market share.

Formulation Insights

The powder segment dominated the market in 2024, with the largest revenue share of 38.2%. Powder formulations are a convenient way to incorporate essential nutrients, such as proteins, minerals, amino acids, and other beneficial diet compounds, into food products. Powders are more readily absorbed by the body compared to traditional pill forms. Hence, the increasing demand for food additives, protein powders, vitamins, and minerals is further expected to drive the growth of the German nutritional supplements industry.

The capsule segment is projected to grow at the fastest CAGR of 9.7%. The increase in the bioavailability of active ingredients can be attributed to the quantity of products offered in various encapsulations. The availability of multimembrane encapsulations or multilayered, extended-release capsules for vitamins, minerals, and omega-3 fatty acids has fueled the market growth.

Application Insights

The weight management segment dominated the Germany nutritional supplements market in 2024, capturing the largest revenue share of around 23.9%. This segment's growth is driven by the increasing awareness of maintaining a healthy weight and the rising prevalence of obesity-related health concerns. Nutritional supplements designed for weight management often include ingredients that help boost metabolism, support fat burning, and improve overall energy levels, making them a popular choice among consumers.

The sports and athletics segment is projected to grow at the fastest CAGR of 12.6% during the forecast period. This rapid growth can be attributed to the rising participation in sports and fitness activities, coupled with an increasing focus on muscle recovery, endurance, and performance enhancement. Products such as protein powders, amino acids, and energy supplements tailored to athletes and fitness enthusiasts have significantly contributed to the segment expansion.

Key Germany nutritional supplements Company Insights

The Germany nutritional supplements market is witnessing significant growth driven by increasing health awareness, growing demand for dietary supplements, and advancements in product innovation. Some key players in the German market are Glanbia PLC,; Abbott; Nestlé Health Science and Amway Europe. These companies are actively focused on expanding their customer base and strengthening their competitive position through strategic initiatives. By prioritizing collaborations, introducing innovative products, and expanding their portfolios, they aim to meet evolving consumer demands and address emerging market needs.

-

Abbott specializes in science-based nutritional products that support overall health and wellness. Its portfolio includes a variety of supplements catering to different age groups and health needs, ranging from essential vitamins and minerals to advanced medical nutrition for managing specific conditions.

-

Nestlé Health Science focuses on advancing personalized nutrition through science-backed solutions. Its offerings include nutritional supplements for weight management, sports nutrition, and addressing specific health challenges such as aging and chronic diseases.

Key Germany Nutritional Supplements Companies:

- Glanbia PLC

- Abbott

- Nestlé Health Science

- Herbalife International Deutschland GmbH

- Amway Europe

- PepsiCo

- Mondelez International group

- Science in Sport PLC

- THG PLC

- Hawlik BioImport GmbH

- Rocka Nutrition

Recent Developments

-

In November 2023, The German Federal Government announced around USD 41 million funding in budget 2024 for research on plant-based foods and cultivated meat.

-

In April 2024, Glanbia PLC announced the acquisition of Flavor Producers, a U.S.-based flavoring business, for USD 300 million. This strategic move aimed to enhance Glanbia's flavor solutions within its nutritional division.

Germany Nutritional Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.9 billion

Revenue forecast in 2030

USD 18.5 billion

Growth Rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, sales channel, consumer group, application

Country scope

Germany

Key companies profiled

Glanbia PLC; Abbott; Nestlé Health Science; Herbalife International Deutschland GmbH; Amway Europe; PepsiCo; Mondelez International group; Science in Sport PLC; THG PLC; Hawlik BioImport GmbH; Rocka Nutrition.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Nutritional Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Germany nutritional supplements market report based on product, formulation, sales channel, consumer group and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Sport Supplements

-

Protein Supplements

-

Egg Protein

-

Soy Protein

-

Pea Protein

-

Lentil Protein

-

Hemp Protein

-

Casein

-

Quinoa Protein

-

Whey Protein

-

Whey Protein Isolate

-

Whey Protein Concentrate

-

-

-

Vitamins

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

-

Amino Acids

-

BCAA

-

Arginine

-

Aspartate

-

Glutamine

-

Beta Alanine

-

Creatine

-

L-carnitine

-

-

Probiotics

-

Omega -3 Fatty Acids

-

Carbohydrates

-

Maltodextrin

-

Dextrose

-

Waxy Maize

-

Karbolyn

-

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Foods

-

Protein Bars

-

Energy Bars

-

Protein Gel

-

-

Meal Replacement Products

-

Weight Loss Products

-

-

Fat Burner

-

Green Tea

-

Fiber

-

Protein

-

Green Coffee

-

Others (Turmeric, Ginseng, Cranberry, Garcinia cambogia)

-

-

Dietary Supplements

-

Vitamins

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

-

Minerals

-

Enzymes

-

Amino Acids

-

Conjugated Linoleic Acids

-

Others

-

-

Functional Foods and Beverages

-

Probiotics

-

Omega -3

-

Others

-

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Brick & Mortar

-

Direct Selling

-

Chemist/Pharmacies

-

Health Food Shops

-

Hyper Markets

-

Super Markets

-

-

E-commerce

-

-

Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Infants

-

Children

-

Adults

-

Age group 21 to 30

-

Age group 31 to 40

-

Age group 41 to 50

-

Age group 51 to 65

-

-

Pregnant

-

Geriatric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports & Athletics

-

General Health

-

Bone & Joint Health

-

Brain Health

-

Gastrointestinal Health

-

Immune Health

-

Cardiovascular Health

-

Skin/Hair/Nails

-

Sexual Health

-

Women’s Health

-

Anti-aging

-

Weight Management

-

Others

-

Frequently Asked Questions About This Report

b. The Germany nutritional supplements market size was estimated at USD 12.05 billion in 2024 and is expected to reach USD 12.9 billion in 2025.

b. The Germany nutritional supplements market is expected to grow at a compound annual growth rate (CAGR) of 7.44% from 2025 to 2030 to reach USD 18.5 billion by 2030.

b. The functional foods and beverages segment accounted for the largest share of 48.96% of the total revenue in 2024, owing to the increased demand for omega-3 fatty acids, which improve heart, brain, eye, skin, and overall mental and physical health, and the consumption of probiotics as dietary supplements.

b. Some of the key players operating in the market include Glanbia PLC; Abbott GmbH; Nestlé Health Science; Herbalife International Deutschland GmbH; and Science in Sport plc.

b. The key factors driving the German nutritional supplements market are an increase in health consciousness and active participation in sports, increasing accessibility of supplements, and the increasing prevalence of obesity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.