- Home

- »

- Clinical Diagnostics

- »

-

C-Reactive Protein Testing Market, Industry Report, 2033GVR Report cover

![C-Reactive Protein Testing Market Size, Share & Trends Report]()

C-Reactive Protein Testing Market (2026 - 2033) Size, Share & Trends Analysis Report By Assay Type (ELISA, Chemiluminescence Immunoassay), By Detection Range (hs-CRP, Conventional CRP), By Disease Area (Cancer, Lupus), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-129-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

C-Reactive Protein Testing Market Summary

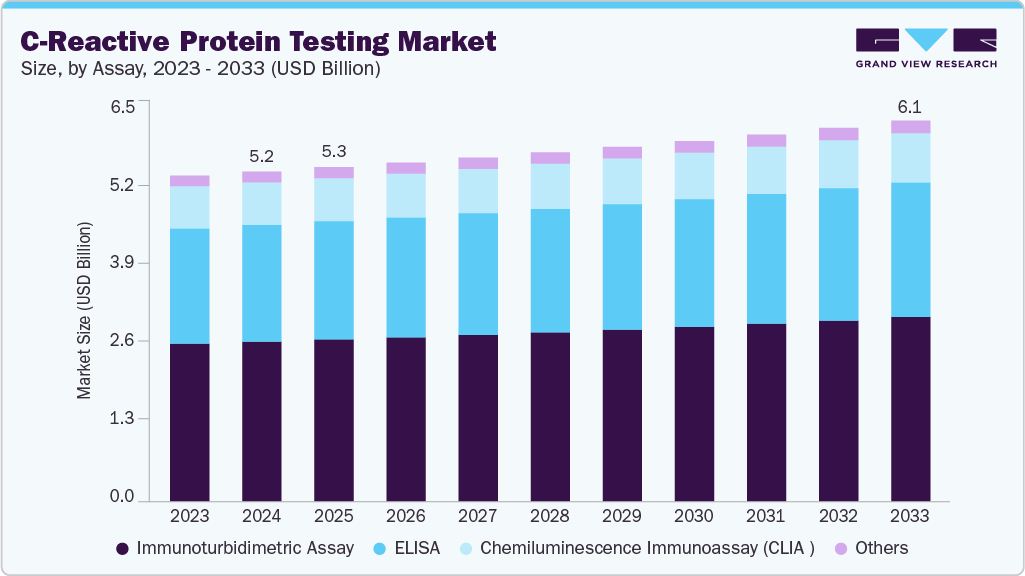

The global C-reactive protein testing market size was estimated at USD 5.34 billion in 2025 and is projected to reach USD 6.08 billion by 2033, growing at a CAGR of 1.68% from 2026 to 2033, due to the increasing demand for precision medicine. C-reactive protein is an acute-phase reactant whose levels rise during the early stage of a disease condition, leading to inflammation in the body.

Key Market Trends & Insights

- North America c-reactive protein testing market dominated the global market and accounted for the largest revenue share of 40.86% in 2025.

- The U.S. led the North American market and held the largest revenue share in 2025.

- Based on assay type, the immunoturbidimetric assay segment dominated the global market and accounted for the largest revenue share of 48.46% in 2025.

- Based on detection area, the hs-CRP segment held the largest revenue share of 62.02% in 2025.

- Based on disease type, the rheumatoid arthritis segment held the largest revenue share of 25.78% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.34 Billion

- 2033 Projected Market Size: USD 6.08 Billion

- CAGR (2025-2033): 1.68%

- North America: Largest Market in 2025

- Asia Pacific: Fastest growing market

The increasing burden of chronic diseases such as cardiovascular disorders, diabetes, and autoimmune conditions is a major market driver. In addition, technological advancements in CRP testing, such as innovations in diagnostic techniques, accuracy of the tests, and ease of accessibility, contribute to the major drivers for this market.The development of point-of-care (POC) CRP testing has transformed disease diagnosis by allowing for quick, on-site testing in clinics, pharmacies, and even home-care environments. These advancements have improved the efficiency of healthcare delivery by shortening result turnaround times and facilitating quicker clinical decision-making. As the demand for personalized medicine increases, technological advancements in CRP testing are anticipated to further propel market growth by enhancing patient outcomes and streamlining diagnostic procedures. According to a report in July 2024, Cornell University proposed an electrochemical impedance spectroscopy (EIS)-based sensor for real-time, fast, and sensitive detection of C-reactive Protein in interstitial fluid (ISF) using minimally invasive microneedle arrays. This sensor, which could be integrated into a wearable device similar to continuous glucose monitoring, offers a non-invasive, affordable, and simple method for CRP detection.

CRP testing serves as an essential tool for early diagnosis of infections, cardiovascular conditions, and inflammatory disorders, allowing for timely medical intervention. Governments and healthcare organizations around the globe are actively encouraging regular screening programs to detect individuals at risk before serious complications develop. In addition, growing health awareness among individuals has resulted in a higher demand for preventive diagnostic tests, such as CRP testing, as part of regular health check-ups. The shift towards preventive healthcare and early disease detection has been a key factor driving market growth. As healthcare systems prioritize lowering long-term treatment expenses and enhancing patient outcomes, the early detection of inflammation-related diseases has become increasingly crucial. The increasing focus on proactive health management will further accelerate the adoption of CRP testing in various healthcare settings.

One of the key drivers for expansion in the market of C-reactive protein testing is the increasing adoption of these tests and the expansion oftheir application in emerging markets. As chronic diseases become more prevalent in these regions due to lifestyle changes, urbanization, and aging populations, the demand for affordable and accessible diagnostic solutions is growing. CRP testing is becoming a standard component of primary healthcare screenings, especially in regions with high rates of infectious diseases and inflammatory disorders. The expansion of diagnostic laboratory services, along with the growing availability of point-of-care testing in rural and underserved areas, is expected to drive the market in these regions further. As healthcare systems in emerging markets continue to advance, the demand for CRP testing will continue to rise, fueling global market growth.

Beyond technological advancements, C-reactive protein testing continues to be integral in clinical research applications. For example, in August 2024, a study presented at the European Society of Cardiology Companies utilized hsCRP (high-sensitivity) measurements to assess cardiovascular risks in women. The findings suggest that evaluating hsCRP levels starting in a woman's 30s can better predict future cardiovascular events, highlighting the importance of early intervention and personalized healthcare strategies. These developments underscore the dynamic nature of CRP testing, reflecting its expanding role in both market growth and clinical practice.

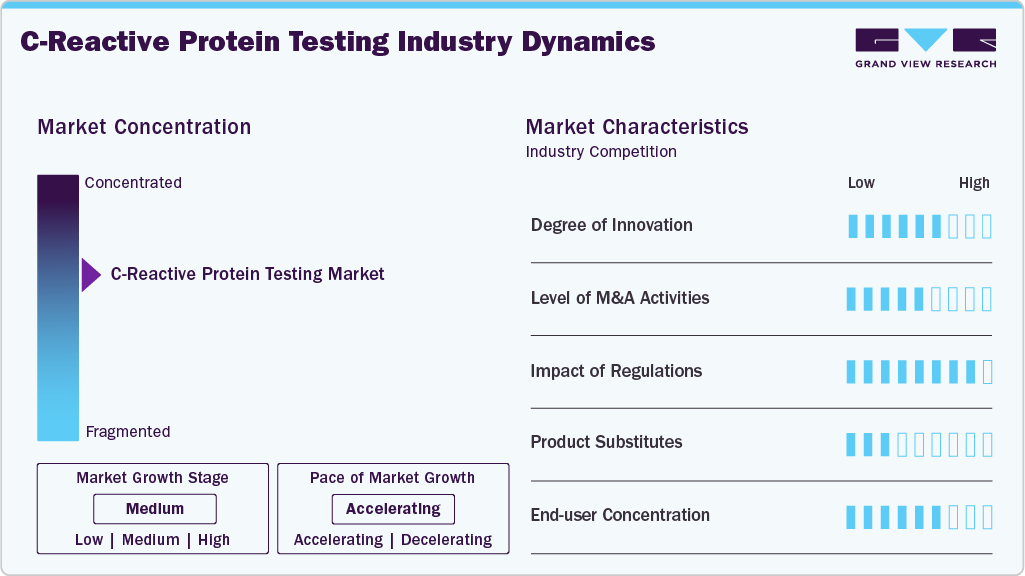

Market Concentration & Characteristics

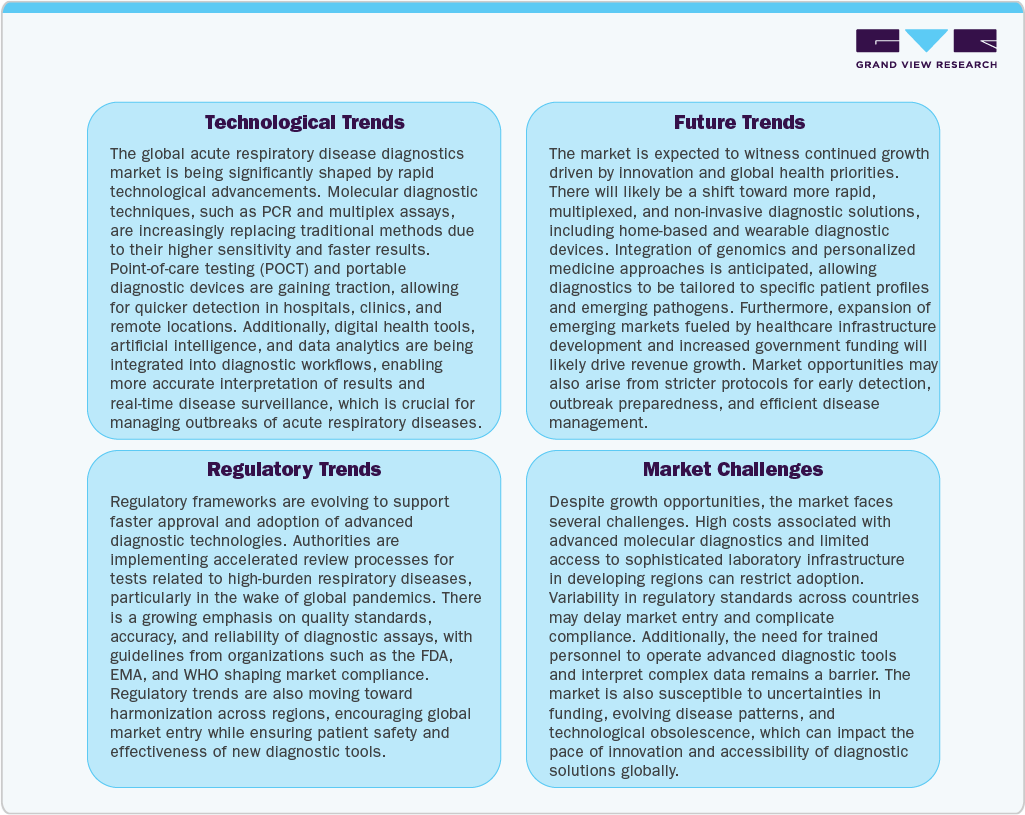

The C-reactive protein sector is experiencing swift technological advancements, with significant progress in areas such as non-invasive methods, such as point-of-care testing and wearable devices. The development of electrochemical sensors and microfluidic technologies for CRP detection allows for real-time monitoring, enhancing early detection and management of inflammation-related diseases. Furthermore, incorporating CRP testing into personalized medicine, by using biomarkers to evaluate individual health risks, represents another significant innovation. Advances such as CRP testing in interstitial fluid via microneedle arrays enhance convenience and broaden accessibility, providing a more efficient and less invasive method for monitoring health, especially in managing cardiovascular risk. In August 2024, Researchers from the Institute of Physical Chemistry, Polish Academy of Sciences, developed a point-of-care device for real-time monitoring of C-reactive Protein, a key inflammation biomarker. Using electrochemical biosensors and nanobody-modified electrodes, the device provides higher sensitivity and stability compared to traditional methods. It connects to Android smartphones for immediate results, potentially replacing time-consuming ELISA tests. This innovation could enhance diagnostic speed and accessibility in healthcare.

M&As are also used to form strategic partnerships between C-reactive protein companies and companies involved in pharmaceutical development,clinical trials, andbiotech innovations. Major players in the market include Abbott Laboratories, Beckman Coulter (a subsidiary of Danaher Corporation), F. Hoffmann-La Roche AG, and Laboratory Corporation of America Holdings. These companies are consistently investing in research and development to improve their diagnostic products.

The USFDA (Food and Drug Administration) ensures that C-reactive protein products meet high standards of safety, performance, and quality. These tests are categorized as Class II, requiring them to meet specific performance standards to prove their safety and effectiveness. Manufacturers must submit a 510(k) premarket notification to the FDA, offering proof that their test systems comply with these standards. This pre-market evaluation ensures only reliable and effective assays are available in the market, shaping product development strategies and ensuring high standards in precision medicine.

As personalized medicine continues to grow, C-reactive protein companies are focusing on creating customized tests that cater to individual patient needs. According to the global report published in December 2024, C-reactive Protein testing can quickly assess whether respiratory infections are self-limiting, reducing unnecessary antibiotic use. Point-of-care testing in primary care supports the WHO's strategy to combat antimicrobial resistance (AMR) and aligns with Sustainable Development Goal to improve access to quality healthcare. Advancements in immunoturbidimetric assays have led to the development of latex-enhanced assays, which offer improved sensitivity and automation. For example, nanoparticle-enhanced ITA has been introduced, enhancing sensitivity and enabling high-throughput analysis suitable for large-scale clinical settings.

The global adoption of C-reactive protein is increasing, with emerging markets such as North America, Asia-Pacific, Latin America,the Middle East and Africa witnessing rapid growth. High-income countries have implemented CRP testing to limit unnecessary prescriptions, and similar efforts are expanding in Europe. The adoption of CRP testing with low-cost devices is also feasible and justifiable in low- and middle-income countries (LMICs). Trials in both public and private healthcare settings, which are often the first point of contact for patients in many LMICs, have demonstrated the benefits and cost-effectiveness of this approach.

Assay Type Insights

Immunoturbidimetric assays held the largest market share of 48.46% in 2025. Immunoturbidimetric assays are widely used in C-reactive Protein testing due to their rapid processing time, high throughput, and cost-effectiveness. These assays work by measuring the turbidity generated when CRP in a patient's sample reacts with specific antibodies, allowing for accurate quantification of CRP levels. Technological advancements in immunoturbidimetric assays further fuel the growth. In July 2023, ALPCO introduced the Calprotectin Immunoturbidimetric Assay at the American Association for Clinical Chemistry annual meeting. This assay, approved for in vitro diagnostic use, helps diagnose inflammatory bowel disease (IBD), including Crohn's disease (CD) and ulcerative colitis (UC), and aids in distinguishing IBD from irritable bowel syndrome (IBS) when used in conjunction with other clinical and laboratory data.

ELISA held the second-largest market share in 2025. This is fueled by ELISA, which offers high sensitivity and specificity for detecting CRP levels in human serum and plasma. Recent advancements have enhanced ELISA's accuracy, versatility, and ease of automation, making it a preferred choice for both clinical diagnostics and research applications. The increasing prevalence of inflammatory conditions, such as cardiovascular diseases and autoimmune disorders, has driven the demand for CRP ELISA kits, which are instrumental in diagnosing and monitoring these diseases. In addition, the development of high-sensitivity CRP (hs-CRP) ELISA kits enables the detection of low-grade inflammation, aiding in early disease risk assessment.

Detection Range Insights

The hs-CRP segment dominated the market with a revenue share of 62.02% in 2025. The hs-CRP segment led the global market due to its enhanced sensitivity, enabling the detection of minute CRP quantities. This sensitivity is crucial for evaluating cardiovascular disease risk. The hs-CRP test is used to detect inflammation and can accurately measure lower levels of CRP than the standard CRP test. With a measurement range of 0.3 to 10 mg/L, it provides greater accuracy than traditional CRP assays and has a lower detection threshold than conventional methods. The American Heart Association (AHA) and the Centers for Disease Control and Prevention (CDC) recognize hsCRP as an independent marker that helps assess cardiovascular conditions, including myocardial infarction. In addition, studies on inflammatory markers have shown a link between elevated hsCRP levels and disease activity in rheumatoid arthritis. The market in 2024 is marked by diverse product innovations and expanding services that cater to both clinical diagnostics and non-healthcare applications. As regulations change, especially regarding in-vitro diagnostic regulations (IVDR) of FDA guidelines in the U.S., firms are offering regulatory consulting services to assist manufacturers in managing the intricate approval procedures. CRP levels above 10 ml/dL are markedly elevated and may indicate severe infection or trauma. C-reactive protein levels between 1.0 and 10.0 ml/dL are moderately elevated and signal systemic inflammation in the body, such as rheumatoid arthritis.

The conventional CRP segment is expected to grow at a substantial rate over the forecast period. Conventional C-reactive Protein tests are designed to detect higher levels of CRP, typically ranging from 10 mg/L to 1,000 mg/L. These tests are particularly useful for identifying significant inflammation resulting from infections, injuries, or chronic inflammatory conditions. Immunoassays and laser nephelometry are methods used to measure CRP levels, offering an affordable, accurate, and quick approach.

Disease Area Insights

The rheumatoid arthritis (RA) application segment held the largest market share of 25.78% in 2025. Clinical utility in disease monitoring, rising prevalence and awareness of RA, integration with broader diagnostic panels, technological advancements, and a shift toward preventive care and personalized treatment are factors responsible for high market growth. Improved precision and faster turnaround support more frequent monitoring. CRP testing is increasingly used alongside serological tests (e.g., RF, anti-CCP) and imaging to track disease progression and treatment efficacy, which broadens CRP’s value proposition in RA management.

Cardiovascular diseases are projected to grow significantly during the forecast period. High CRP levels have been associated with a higher risk of cardiovascular diseases (CVD), including heart attacks and strokes. Adding high-sensitivity CRP (hs-CRP) testing to traditional lipid panels can improve the accuracy of cardiovascular risk prediction. Recent studies have shown that measuring hs-CRP, along with low-density lipoprotein (LDL) cholesterol and lipoprotein(a) levels, can effectively assess a woman's risk of cardiovascular events up to 30 years ahead.

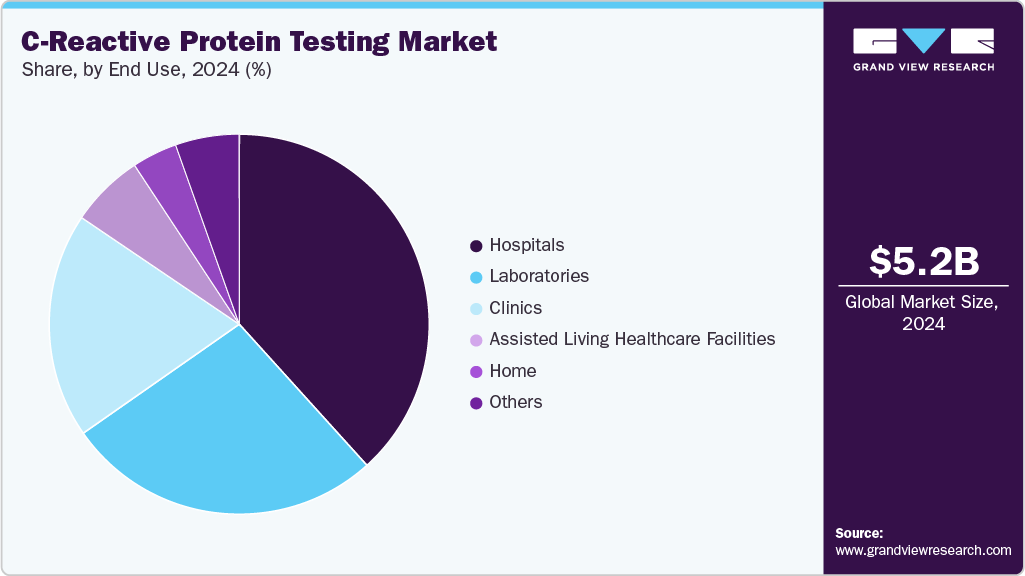

End-use Insights

The hospitals dominated the market with a revenue share of 38.17% in 2025. Hospitals play a crucial role in the market, as they are the primary healthcare settings where CRP tests are conducted for diagnosing and monitoring inflammatory conditions. The rising prevalence of infectious diseases, cardiovascular disorders, and autoimmune conditions has significantly increased CRP testing demand in hospitals. Many hospitals are integrating automated immunoturbidimetric and ELISA-based CRP testing methods into their laboratories to ensure quick and accurate results. In addition, the growing emphasis on point-of-care testing in emergency departments has led to the adoption of high-sensitivity CRP (hs-CRP) assays for rapid assessment of conditions such as sepsis and cardiovascular risk.

Laboratories is expected to grow at a substantial rate over the forecast period, they frequently utilize CRP testing to monitor patients with infections, inflammatory diseases, and postoperative conditions. The diagnostic laboratories segment led the market in 2024, driven by factors such as enhanced diagnostic accuracy, ease of accessibility, and improved patient outcomes. With the expansion of C-reactive proteins, diagnostic laboratories are quickly embracing cutting-edge technologies to improve early cancer detection and tailor treatment approaches to individual patients. With ongoing advancements in technology, especially in high-throughput systems and digital diagnostics, diagnostic laboratories are increasingly moving away from traditional C-reactive proteins in favor of more advanced, automated, and high-precision methods.

Regional Insights

North America dominated the C-reactive protein testing market and accounted for a 40.86% share in 2025. This dominance is attributed to the high prevalence of cardiovascular diseases, continuous product innovations, and the presence of advanced healthcare facilities. In addition, technological advancements, including the development of high-sensitivity CRP (hs-CRP) assays and automated immunoturbidimetric systems, have further strengthened North America's market position. The presence of key market players, ongoing research initiatives, and favorable reimbursement policies in countries like the U.S. and Canada continue to support market expansion. With increasing demand for personalized medicine and preventive healthcare strategies, North America's leadership in the market is expected to grow over the forecast period.

U.S. C-Reactive Protein Testing Market Trends

The C-reactive protein testing market in the U.S. is driven by growing risk for cardiovascular events. A study published in the New England Journal of Medicine highlighted the predictive value of high-sensitivity CRP (hs-CRP) testing in assessing women's risk for cardiovascular events up to 30 years in advance. This underscores the growing emphasis on early detection and preventive healthcare strategies in the U.S. In addition, the U.S. market has seen substantial investments in research and development, leading to technological advancements in CRP testing methods. These innovations aim to enhance the accuracy, efficiency, and accessibility of CRP tests, further solidifying the country's leadership in the market.

Europe C-Reactive Protein Testing Market Trends

The C-reactive protein testing market in Europe represents a significant market, led by nations such as Germany, France, and the UK. The European region, for instance, witnesses over 1.9 million deaths and 3.7 million new cancer cases annually, emphasizing the need for widespread adoption of point-of-care (POC) testing solutions to aid in cancer management in both developed and developing countries worldwide. While hs-CRP assays are gaining traction for cardiovascular risk assessment, conventional CRP tests remain prevalent in many European countries. The market is also influenced by the rising prevalence of cardiovascular diseases and a stronger focus on preventive healthcare. Rising prevalence of cardiovascular diseases, technological advancements in testing methods, expansion of Point-of-Care testing, and supportive reimbursement policies.

Germany C-reactive Protein testing market has seen notable developments recently. Technological advancements, such as the development of high-sensitivity CRP assays and point-of-care testing devices, have enhanced the accuracy and convenience of CRP testing, making it more accessible for diagnosing and monitoring inflammatory conditions. In addition, German researchers have developed an innovative therapy option based on CRP, further highlighting its importance in medical advancements. These innovations, coupled with Germany's robust healthcare infrastructure and the increasing prevalence of chronic diseases, are expected to sustain the demand for CRP testing in the country.

Asia Pacific C-Reactive Protein Testing Market Trends

The C-reactive protein testing market in the Asia Pacific represents a significant market share. The Asia Pacific region is anticipated to witness substantial growth during the forecast period, primarily driven by factors such as the continuously growing population and a rising geriatric population, particularly in countries like Japan and China. In addition, the robust adoption of CRP testing in hospitals, coupled with the increasing prevalence of cardiovascular diseases and malaria, is expected to drive market growth for CRP testing in the region in the forecast period.

China C-reactive Protein testing market is experiencing significant growth, driven by the increasing prevalence of diseases and advancements in diagnostic technologies. The rising burden of chronic diseases such as cardiovascular disorders, rheumatoid arthritis, and infections has increased the demand for CRP testing as a crucial biomarker for inflammation and disease progression. The country’s healthcare sector is witnessing a surge in research and development efforts focused on improving the accuracy and efficiency of CRP assays, with a particular emphasis on high-sensitivity testing methods.

Latin America C-Reactive Protein Testing Market Trends

The C-reactive protein testing market in Latin America presents profitable prospects in the sector. The region's susceptibility to infectious diseases has led to a greater need for CRP testing to detect and monitor infections, thereby driving market growth. Innovations in CRP testing technologies, such as the development of point-of-care assays, have improved the speed and accessibility of testing, contributing to market expansion. The growing use of point-of-care diagnostic devices in Latin America facilitates rapid CRP testing, enhancing disease management and fueling market growth.

Brazil C-reactive Protein testing market is poised for growth, driven by several key factors. The increasing prevalence of chronic diseases, such as cardiovascular conditions and inflammatory disorders, has heightened the demand for CRP testing as a vital diagnostic tool. Advancements in diagnostic technologies, particularly the adoption of immunoturbidimetric assays, have enhanced the accuracy and efficiency of CRP measurements, making them more accessible in clinical settings. In addition, Brazil's expanding healthcare infrastructure and the government's focus on improving healthcare services have facilitated greater integration of advanced diagnostic tests, including CRP, across hospitals and laboratories. These developments collectively contribute to the anticipated market expansion in Brazil.

Middle East and Africa C-Reactive Protein Testing Market Trends

The C-reactive protein testing market in the Middle East and Africa is expected to grow at a substantial rate over the forecast period. Innovations in assay technologies, such as immunoturbidimetric assays and CLIA, have enhanced the speed and accuracy of CRP testing, contributing to market growth. The expanding healthcare infrastructure in the MEA region supports the adoption of advanced diagnostic tests, including various CRP assays. The high incidence of cardiovascular diseases and other inflammatory conditions in the MEA region drives the demand for sensitive and accurate CRP testing methods.

Key C-Reactive Protein Testing Company Insights

Leading players in the market, such as Randox Laboratories Limited, Merck KGaA (MilliporeSigma), Abbott Laboratories, Thermo Fisher Scientific, Inc., Zoetis Inc. (Abaxis Inc.), are actively developing innovative products. Companies are undertaking strategic initiatives such as product collaborations, geographic expansion, and strategic agreements for product portfolio expansion to maximize their market share. To sustain their presence in the market, industry players are further concentrating on collaborations, acquisitions, mergers, and product approval.

Key C-Reactive Protein Testing Companies:

The following are the leading companies in the C-reactive protein testing market. These companies collectively hold the largest Market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Danaher

- Quest Diagnostics

- Siemens Healthineers AG

- Abbott

- Merck KGaA

- Zoetis

- Ortho Clinical Diagnostics

- Getein Biotech, Inc.

- HORIBA, Ltd

- Randox Laboratories Ltd.

- Boditech Med, Inc.

- Aidian

Recent Developments

-

In September 2025, HORIBA announced a strategic partnership with GeodAIsics to develop an AI-powered solution for early sepsis detection, integrating hematology analyzers (including HORIBA’s CRP-capable systems) to flag infection/inflammation patterns.

-

In August 2025, Quest completed the acquisition of certain clinical testing assets from Fresenius Medical Care’s Spectra Laboratories, enhancing its chronic kidney disease testing capabilities.

-

In July 2025, Siemens Healthineers earned the “My Green Lab ACT Ecolabel” certification for more than 150 immunoassay and clinical chemistry reagents (including its Atellica portfolio). This reflects improved reagent manufacturing and sustainability.

-

In November 2023, Siemens Healthcare Diagnostics Products GmbH received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its CardioPhase high-sensitivity C-reactive protein (hs-CRP) prognostic test. This clearance allows Siemens to market the test in the United States, providing healthcare professionals with a tool to assess cardiovascular risk.

“CardioPhase hsCRP is an in-vitro diagnostic reagent for the quantitative determination of C-reactive Protein in human serum, and heparin and EDTA plasma by means of particle-enhanced immunonephelometry using the BN II and BN ProSpec® System. In the acute phase response, increased levels of a number of plasma proteins, including C-reactive protein, are observed.”

-Ying Mao, Ph.D. Branch Chief, Division of Immunology and Hematology Devices

-

In March 2023, Quest Diagnostics introduced post-COVID-19 panels on QuestHealth.com, offering consumers tests to assess potential long-term health impacts after COVID-19 infection. The Post-COVID-19 basic panel collects data for the C-reactive Protein Test to measure the amount of CRP in your blood, a protein produced by the liver that is a marker of inflammation. These panels include biomarkers for inflammation, heart health, and immune response, aiming to provide insights into post-viral complications. The initiative reflects the growing demand for accessible post-COVID diagnostics.:

”These two post-COVID-19 panels will empower consumers with the data they need to find the best recovery path and ease long COVID-19 symptoms. Further, they will help ignite conversations among researchers and healthcare providers to understand COVID-19 side effects better,"

-Yuri Fesko, MD, Vice President for Medical Affairs, Quest.

- In January 2023, Qlife Holding AB announced the soft launch of its Egoo CRP Capsule in Sweden, marking the first product in its Egoo portfolio aimed at the home market. This initial release is intended for non-professional use without medical claims, with plans to apply CE marking to broaden its clinical applicability. The Egoo Health platform aims to provide precise biomarker testing for health-conscious individuals and professionals.

“We are very excited to have reached this milestone. Our most important goal has always been to make Egoo Health available for non-professionals and for people in their homes. The company is now taking this first step for general health empowerment to the people.”

-Thomas Warthoe, CEO of Qlife

C-Reactive Protein Testing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.42 billion

Revenue forecast in 2033

USD 6.08 billion

Growth rate

CAGR of 1.68% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Assay type, detection range, disease area, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific; F. Hoffmann-La Roche; Danaher; Quest Diagnostics; Siemens Healthineers; Abbott; Merck KGaA; Zoetis; Ortho Clinical Diagnostics; Getein Biotech; HORIBA; Randox Laboratories; Boditech Med; Aidian

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global C-Reactive Protein Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global C-reactive protein testing market report based on assay type, detection range, disease area, end-use, and region:

-

Assay Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Immunoturbidimetric Assay

-

ELISA

-

Clinical

-

Nonclinical

-

-

Chemiluminescence Immunoassay

-

Others

-

-

Detection Range Outlook (Revenue, USD Million, 2021 - 2033)

-

hs-CRP

-

Conventional CRP

-

cCRP

-

Disease Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular Diseases

-

Cancer

-

Rheumatoid Arthritis

-

Inflammatory Bowel Disease

-

Endometriosis

-

Lupus

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinics

-

By Entity

-

Physician Offices

-

Small Clinics

-

Others

-

-

By Settings

-

Urban Setting

-

Rural Setting

-

-

-

Hospitals

-

Urban Setting

-

Rural Setting

-

-

Laboratories

-

Urban Setting

-

Rural Setting

-

-

Assisted Living Healthcare Facilities

-

Urban Setting

-

Rural Setting

-

-

Home

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global C-reactive protein testing market size was estimated at USD 5.34 billion in 2025 and is expected to reach USD 5.42 billion in 2026.

b. The global C-reactive protein testing market is expected to grow at a compound annual growth rate of 1.68% from 2026 to 2033 to reach USD 6.08 billion by 2033.

b. The immunoturbidimetric assay dominated the CRP testing market with a share of 48.46% in 2025. As immunoturbidimetric assays are widely used in C-Reactive Protein (CRP) testing due to their rapid processing time, high throughput, and cost-effectiveness. These assays work by measuring the turbidity generated when CRP in a patient's sample reacts with specific antibodies, allowing for accurate quantification of CRP levels

b. Some key players operating in the CRP testing market include Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd.; Danaher; Quest Diagnostics Incorporated; Siemens; Abbott Laboratories; Laboratory Corporation of America Holdings; Merck KGaA; Abaxis, Inc.; Ortho Clinical Diagnostics; Getein Biotech, Inc.; HORIBA, Ltd.; Randox Laboratories Ltd.; BODITECH MED INC.; and Aidian.

b. Key factors that are driving the C-reactive protein testing market growth include increasing R&D in the field of C-reactive protein testing and the rising incidence of chronic disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.