- Home

- »

- Food Additives & Nutricosmetics

- »

-

Glucosamine Market Size, Share And Growth Report, 2030GVR Report cover

![Glucosamine Market Size, Share & Trends Report]()

Glucosamine Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Glucosamine Sulfate, Glucosamine Hydrochloride, N-acetyl Glucosamine, Others), By Application (Supplement, Food & Beverages), By Region, And Segment Forecasts

- Report ID: 978-1-68038-091-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glucosamine Market Summary

The global glucosamine market was valued at USD 871.5 million in 2022 and is projected to reach USD 1,309.8 million by 2030, growing at a CAGR of 5.2% from 2023 to 2030. An increasing number of arthritis cases globally coupled with the rising obese population is expected to propel product demand over the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 47.9% in 2022.

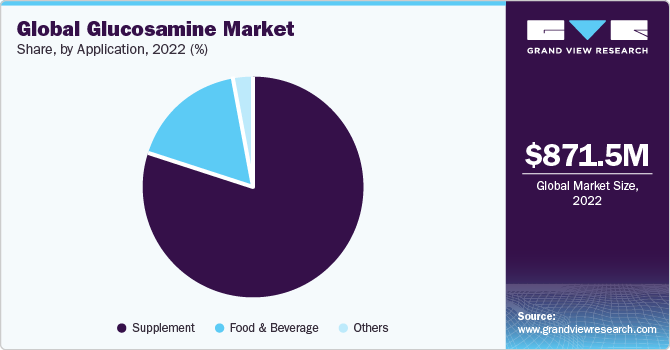

- By application, the supplement segment held the largest revenue share of 79.9% in 2022.

- By product, the glucosamine sulfate segment accounted for the largest revenue share of 61.1% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 871.5 Million

- 2030 Projected Market Size: USD 1,309.8 Million

- CAGR (2023-2030): 5.2%

- Asia Pacific: Largest Market in 2022

The product helps in relieving joint pain which is anticipated to propel its utilization among the geriatric population over the next seven years. Moreover, the pet food industry is experiencing a notable increase in the demand for glucosamine as a food ingredient. Glucosamine is recognized for its potential benefits in promoting joint health and mobility in pets, making it a sought-after ingredient for pet food manufacturers. In May 2023, CULT Food Science introduced an innovative product line named Noochies Sprinkles, with the intention of entering the expanding market for pet performance supplements. CULT Food Science has set itself apart by crafting the supplement using a fermented plant-based source of glucosamine, departing from the conventional practice of using ocean wildlife sources.

Pets are increasingly being regarded as integral members of families, leading to an uptick in human-like care and treatment. Pet owners are now more willing to invest in premium pet food products that provide supplementary health advantages, including glucosamine, to enrich their pets' quality of life. Pet owners are also growing more informed about their pets' nutritional requirements, actively searching for pet food items that incorporate ingredients with targeted health benefits. Given its recognition as a well-established joint-supporting component, glucosamine resonates with this consumer inclination toward functional pet food.

The product has been increasingly used in the manufacturing of dietary supplements. Rising focus on the production of vegetarian glucosamine, as these are considered safe for consumption in food & beverages, is expected to propel industry growth over the next seven years. The products are also being used in therapeutic goods in Australia.

As the global population continues to age, there has been a surge in age-related joint problems, such as osteoarthritis. Glucosamine is frequently utilized as a supplement to alleviate joint pain and promote joint health, which has resulted in an increased demand. Individuals are becoming more health-conscious and proactively seeking natural remedies for diverse health issues. Glucosamine, being a naturally occurring substance in the body, is perceived as a more natural alternative to traditional medications for joint health. Glucosamine supplements are readily accessible in various forms, including capsules, tablets, and powders, and are available at pharmacies, health food stores, and online retailers. The convenience of access and availability of diverse formulations has significantly contributed to the growth of the market.

The popularity of sports and fitness activities has grown, with more people engaging in physical exercise. This has resulted in a higher incidence of joint injuries and subsequent demand for supplements like glucosamine to support recovery and joint health.

Application Insights

The supplement segment held the largest revenue share of 79.9% in 2022. These supplements are mainly manufactured from crustaceans including shrimp and crabs, however, increasing instances of allergy and a rising number of vegans, particularly in the U.S., have led manufacturers to develop the product from fungi and other plant sources.

The food and beverages segment is expected to grow at the second-fastest CAGR of 4.4% over the forecast period. There has been an increasing interest in functional foods and beverages that offer health benefits beyond basic nutrition. As a result, glucosamine has gained attention as an ingredient in food and beverages targeting joint health.

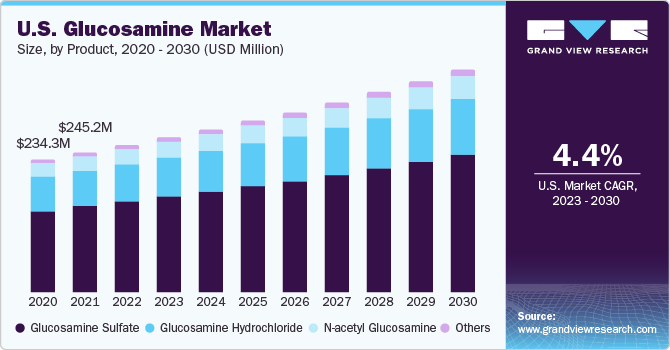

Product Insights

The glucosamine sulfate segment accounted for the largest revenue share of 61.1% in 2022. Glucosamine sulfate has been one of the most widely used forms of glucosamine in dietary supplements and pharmaceuticals. Glucosamine is commonly taken as a supplement to support joint health and manage symptoms of osteoarthritis. Glucosamine sulfate, in particular, has been extensively studied and is considered one of the more effective forms of glucosamine for relieving joint pain.

The glucosamine hydrochloride segment is expected to grow at the second-fastest CAGR of 5.2% over the forecast period. Glucosamine hydrochloride is a compound commonly used as a dietary supplement to support joint health. It is a naturally occurring substance found in the fluid around joints. Glucosamine is involved in the formation and repair of cartilage, the flexible tissue that cushions the joints. Many people take glucosamine hydrochloride supplements to manage symptoms of osteoarthritis, a degenerative joint disease characterized by the breakdown of cartilage. The increasing prevalence of osteoarthritis is expected to drive the segment growth over the forecast period.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 47.9% in 2022. The Asia Pacific region, encompassing countries like China, Japan, India, and Australia, boasts a substantial and expanding population, with a simultaneous surge in health and wellness awareness across the area. These factors collectively underpin the expansion of the dietary supplements market, including the heightened demand for glucosamine.

North America accounted for the second-largest market share in 2022. This is attributed to increasing awareness about joint health, the rising prevalence of osteoarthritis and other joint disorders, and the aging population in the region. Glucosamine, a popular dietary supplement, is often used to alleviate symptoms associated with joint pain and improve joint health.

Europe is expected to grow at the second fastest CAGR of 5.4% over the forecast period. Approval of glucosamine as a food ingredient as well as a prescription drug in European economies is expected to propel demand over the forecast period. Government support and high R&D investments related to the product are expected to play a major role in industry growth over the next seven years. The product has been widely accepted for the treatment of osteoarthritis in Europe which will positively impact industry growth over the forecast period.

Key Companies & Market Share Insights

The glucosamine market is fragmented with numerous small-scale manufacturers and distributors catering to various domestic markets. Numerous market players have been trying to develop glucosamine based on consumer preference which is expected to propel growth. The key market players also adopt various strategic initiatives including collaborations, mergers and acquisitions, new product launches, and others.

Key Glucosamine Companies:

- Koyo Chemical Industry Co., Ltd

- Laboratoires Expanscience

- Nutramax Laboratories Consumer Care, Inc.

- Amway

- CELLMARK AB.

- Alfa Chemical Group

- Cargill, Incorporated

- Golden-Shell Pharmaceutical

- SimplySupplements

Recent Developments

-

In July 2021, Nestlé China launched a series of health foods specially designed for seniors, marking their initial foray into the 'blue hat' certified category. The product range encompasses a glucosamine-infused milk powder, designed to improve bone density and cater to the mobility requirements of older adults. By addressing the distinct health considerations of seniors, Nestlé China endeavors to penetrate this expanding market sector and offer precise solutions to promote the well-being of the aging population.

-

In August 2020, Jadran-galenski laboratorij d.d. (JGL) introduced a new food supplement named Onaceron Forte, with the aim of meeting the increasing demand for joint health products. This strategic initiative leverages the advantages of key ingredients, including glucosamine, chondroitin, vitamin C, and the proprietary component Mobilee. Mobilee, a patented ingredient recognized for its content of hyaluronic acid, collagen, and polysaccharides, contributes to joint health. This strategic launch aligns the company's offerings with evolving market trends and reinforces its dedication to furnishing innovative and efficacious solutions for maintaining healthy joints.

-

In December 2020, Companion Sciences announced significant progress in exploring the potential of CBD to enhance the bioavailability of various nutrients and compounds. The company successfully concluded a trial focused on assessing the tolerability and palatability of their innovative CBD + Glucosamine chew for dogs. This strategic move allows Companion Sciences to gather valuable insights and refine its product offering, ensuring that it meets the needs and preferences of both pets and their owners.

Glucosamine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 915.5 million

Revenue forecast in 2030

USD 1,309.8 million

Growth Rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Brazil; Saudi Arabia; South Africa

Key companies profiled

Koyo Chemical Industry Co., Ltd; Laboratoires Expanscience; Nutramax Laboratories Consumer Care, Inc.; Amway; CELLMARK AB.; Alfa Chemical Group; Cargill Incorporated; Golden-Shell Pharmaceutical; SimplySupplements

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glucosamine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glucosamine market based on product, application, and region:

-

Product Outlook (Volume, Tons, Revenue, USD Million, 2018 - 2030)

-

Glucosamine Sulfate

-

Glucosamine Hydrochloride

-

N-acetyl glucosamine

-

Others

-

-

Application Outlook (Volume, Tons, Revenue, USD Million, 2018 - 2030)

-

Supplement

-

Food and Beverage

-

Others

-

-

Regional Outlook (Volume, Tons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global glucosamine market size was estimated at USD 871.50 million in 2022 and is expected to reach USD 915.50 million in 2023.

b. The global glucosamine market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 1,309.8 million by 2030.

b. Asia Pacific dominated the glucosamine market with a share of 47.86% in 2022. There is a growing awareness of health and wellness in the Asia Pacific region. As people become more health conscious, they are more likely to seek out dietary supplements like glucosamine to proactively address joint health and prevent joint-related problems.

b. Some key players operating in the glucosamine market include Koyo Chemical Company Limited, Nutramax Laboratories, Nutrilite, CellMark, Alfa Chem, Cargill Inc., Triarco Industries Inc., Golden-Shell Pharmaceutical Co. Ltd., and Simply Supplements.

b. Key factors that are driving the market growth include an increasing number of arthritis cases globally coupled with rising obese population. Furthermore, the product helps in relieving joint pain which is anticipated to propel its utilization among the geriatric population over the projected period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.