- Home

- »

- Renewable Chemicals

- »

-

Green Chemicals Market Size & Share, Industry Report 2033GVR Report cover

![Green Chemicals Market Size, Share & Trends Report]()

Green Chemicals Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Bio-alcohols, Bio-organic Acids, Biopolymers), By Application (Construction, Packaging, Automotive, Textile), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-700-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Green Chemicals Market Summary

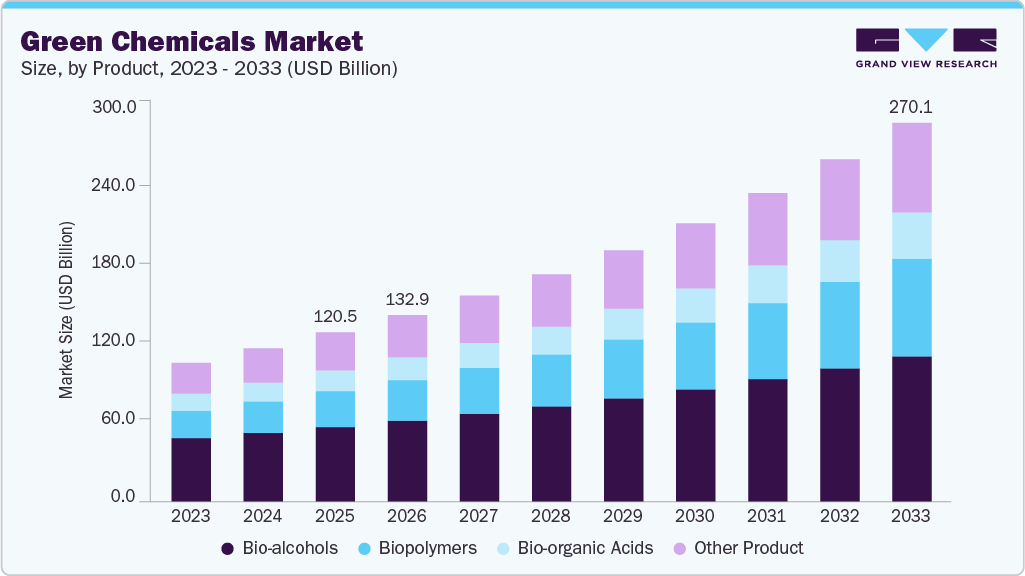

The global green chemicals market size was estimated at USD 120.51 billion in 2025 and is projected to reach USD 270.13 billion by 2033, growing at a CAGR of 10.7% from 2026 to 2033. An increasing global focus on sustainability and the adoption of circular economy practices is driving market growth.

Key Market Trends & Insights

- Asia Pacific dominated the green chemicals market with the largest revenue share of 30.8% in 2025.

- The green chemicals market in China held a substantial share of 41.6% in the Asia Pacific market in 2025.

- By product, bio-alcohols green chemicals, dominated the market with a revenue share of 44.0% in 2025.

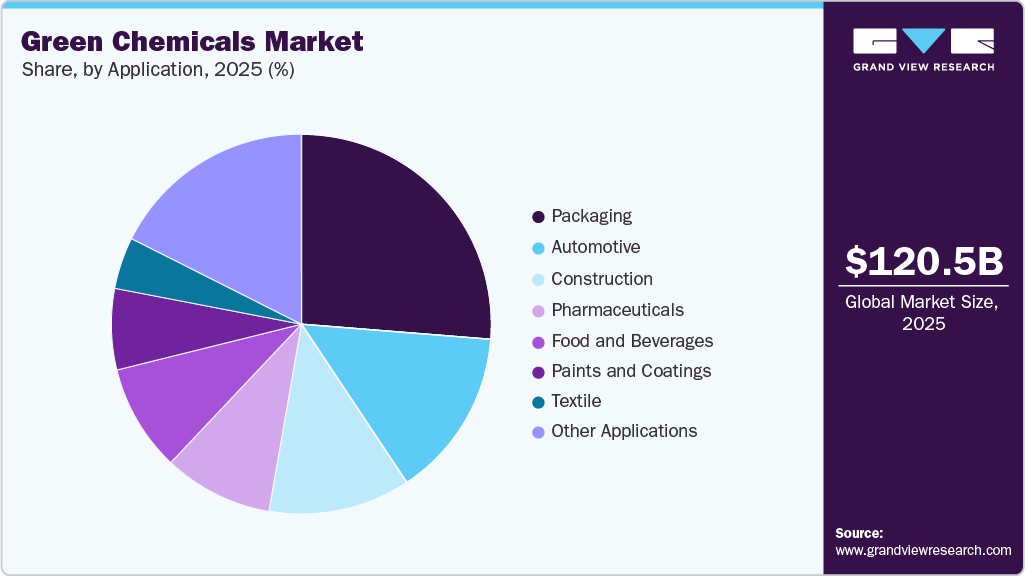

- By application, packaging dominated the green chemicals market with a revenue share of 26.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 120.51 Billion

- 2033 Projected Market Size: USD 270.13 Billion

- CAGR (2026-2033): 10.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Governments, industries, and consumers are collectively pushing for the reduction of hazardous chemicals, carbon emissions, and dependence on fossil-based raw materials. This transition is further reinforced by stringent environmental regulations, corporate ESG (Environmental, Social, and Governance) initiatives, and rising demand for safer, biodegradable, and renewable alternatives across various sectors.A key application driving the market growth is packaging. With increasing pressure to reduce plastic waste, particularly single-use plastics, industries are rapidly adopting bio-based polymers and biodegradable materials derived from green chemicals for packaging solutions. Companies are leveraging materials such as polylactic acid (PLA), starch blends, and bio-polyethylene (Bio-PE) to produce compostable films, containers, and flexible packaging. Leading food and beverage brands are partnering with green chemical producers to support circular economy goals and comply with regulations like the EU Single-Use Plastics Directive and extended producer responsibility frameworks in countries such as India, Japan, and Canada. Consequently, packaging continues to be one of the most dynamic and commercially impactful applications in the market.

In the textile industry, bio-organic acids, particularly polycarboxylic acids, are increasingly used as sustainable alternatives to conventional harmful chemicals. They play vital roles in cross-linking fibers, enhancing dimensional stability, dye fixation, antimicrobial finishing, and improving fabric lightfastness. Their eco-friendly, biodegradable, and non-toxic properties make them ideal for environmentally responsible textile processing. In addition, these acids support waste paint and coatings recycling and contribute to circular manufacturing practices, helping textile industries achieve sustainability targets.

The fuel sector is also witnessing growth driven by technologies that convert non-edible bio feedstocks and waste into sustainable fuels and chemicals. These innovations aim to reduce greenhouse gas emissions, enhance process efficiency, and replace petroleum-based products with renewable alternatives. Advanced pretreatment and supercritical processing techniques enable the use of low-quality oils and fats, minimizing impurities and environmental impact. Furthermore, upcycling industrial byproducts into valuable fuel inputs supports circular economy goals and promotes cleaner, more sustainable energy solutions. These developments align with global efforts to lower carbon intensity and advance eco-friendly fuel production.

Market Concentration & Characteristics

The green chemicals industry is moderately fragmented, with market leadership concentrated among several large, vertically integrated chemical manufacturers. These key players leverage economies of scale, internal sourcing of bio-based raw materials, including natural oils, sugars, and bio-based acids, and extensive global distribution networks to maintain a competitive advantage. Their integration across the green chemical value chain, from feedstock processing to the production of bio-alcohols, biopolymers, and bio-based solvents, enables enhanced cost efficiency, consistent product quality, and reliable supply. This strategic positioning allows them to effectively cater to a wide range of end-use industries, including agriculture, automotive, packaging, textiles, and construction, reinforcing their market influence and supporting sustainable industry adoption.

At the same time, emerging players in the Asia-Pacific and Middle East are steadily expanding their presence in the green chemicals industry by leveraging abundant renewable feedstocks, cost-efficient energy infrastructure, and growing domestic demand for sustainable alternatives. These regional producers are supported by targeted investments in biopolymer, bio-organic acid, and bio-alcohol manufacturing hubs strategically located within economic and industrial corridors. Their focus is on delivering cost-effective, scalable solutions across high-demand segments such as construction materials, textiles, and textile ingredients. This evolving landscape, characterized by global consolidation among established multinationals alongside regional cost-driven expansion, continues to reshape the competitive dynamics of the green chemicals industry.

However, the market also faces key challenges, including increasing environmental and regulatory scrutiny of specific bio-based chemical classes, such as amine derivatives and certain organic acids. Regulatory authorities in North America and Europe have raised concerns regarding the ecotoxicity, persistence, and potential health impacts of some green chemical ingredients, even if they are derived from renewable sources. These considerations underscore the importance of compliance, innovation, and transparent risk management in sustaining market growth.

Product Insights

Bio-alcohols remain the dominant market segment, accounting for the largest revenue share of 44.0% in 2025, primarily due to their widespread use as biofuels. These alcohol-based fuels, including methanol, ethanol, propanol, and butanol, are produced through microbial fermentation, where pretreated lignocellulosic materials are converted into soluble sugars and then fermented using specialized microbes. Among them, ethanol and methanol are the most commercially viable for internal combustion engines, thanks to their favorable combustion properties and high-octane ratings. Ethanol, in particular, is widely employed as a gasoline additive to reduce carbon emissions and decrease reliance on fossil fuels. Recent advancements, such as nanoparticle-assisted fermentation, have further enhanced bio-alcohol yields while minimizing the formation of harmful by-products, improving both efficiency and environmental performance.

The biopolymers segment is projected to grow at the fastest rate in terms of revenue, with a CAGR of 13.4% from 2026 to 2033, driven by its broad applications across multiple industries. Biopolymers, derived from renewable sources like biomass, corn, sugarcane, and molasses, are valued for their biodegradability, sustainability, and low environmental impact. These materials naturally decompose under suitable environmental conditions, such as moisture, oxygen, and temperature, without leaving toxic residues, making them a compelling alternative to conventional synthetic plastics. When reinforced with natural fillers or additives, biopolymers demonstrate enhanced physical and mechanical properties, making them suitable for diverse commercial applications. Within the market, biopolymers are transforming industries such as automotive, pharmaceuticals, packaging, agriculture, electronics, and construction. Materials like polylactic acid (PLA), polyhydroxyalkanoates (PHAs), and other bio-based polyesters are increasingly used to create composites that can replace traditional thermoset resins. Their production often involves environmentally friendly processes, such as microbial fermentation or ring-opening polymerization, reducing dependency on petroleum-based feedstocks and lowering greenhouse gas emissions.

Application Insights

The packaging industry dominated the market, accounting for 26.3% of the total market value share in 2025, driven by growing regulatory pressure and rising demand for sustainable packaging solutions. Manufacturers are increasingly replacing conventional plastics with bio-based polymers, biodegradable films, and compostable materials derived from green chemicals to reduce environmental impact. Materials such as polylactic acid (PLA), bio-polyethylene (Bio-PE), and starch-based blends are widely used in rigid and flexible packaging applications. Beyond packaging, green chemicals are witnessing strong adoption across automotive, construction, pharmaceuticals, food and beverages, paints and coatings, and textile industries, where they are used to improve sustainability profiles and comply with environmental standards. In the food and beverage and pharmaceutical sectors, green chemicals support safer packaging and processing solutions, while automotive and construction industries benefit from bio-based resins and additives. In addition, paints and coatings and textile applications are increasingly utilizing green formulations to reduce VOC emissions. Collectively, these other applications continue to reinforce packaging as the leading end-use segment within the global market.

The automotive industry represents the second-largest application segment in the global market, driven by the sector’s increasing focus on light-weighting, emission reduction, and sustainable manufacturing. Automakers are increasingly adopting bio-based polymers, bio-alcohols, green solvents, and bio-organic acids to reduce dependence on petroleum-derived materials and meet stringent environmental regulations. Green chemicals are widely used in interior components, exterior parts, adhesives, lubricants, coatings, and fuel additives, offering improved environmental performance without compromising durability or safety. Bio-based plastics and composites help lower vehicle weight, improving fuel efficiency and reducing carbon emissions, while green coatings and solvents support low-VOC manufacturing processes. In addition, the use of bio-alcohols in fuel blending and advanced powertrain applications supports global decarbonization initiatives. Beyond passenger vehicles, adoption is expanding across commercial vehicles and electric vehicles, where sustainable materials align with lifecycle sustainability goals. As regulatory mandates and OEM sustainability commitments strengthen, the automotive sector continues to play a pivotal role in advancing the global market.

Regional Insights

The Asia Pacific region dominated the global green chemicals market, accounting for a 30.8% value share in 2025, driven largely by the expanding application of green chemicals within the pharmaceutical industry. This growth aligns closely with the principles of green chemistry, which emphasize minimizing environmental impact while improving process efficiency and safety. The holistic integration of green chemistry across the entire life cycle of active pharmaceutical ingredients (APIs) from raw material selection and intermediate synthesis to final product development supports resource-efficient, low-emission, and environmentally responsible manufacturing. In addition, regulatory reforms, government support, and strong innovation ecosystems across major Asia Pacific economies are accelerating adoption. For example, Takeda Pharmaceutical Company Limited has implemented green chemistry principles in the development of a sustainable manufacturing process for TAK-954, an investigational serotonin (5-HT4) receptor agonist. The company’s second-generation process replaced organic solvents with water as the reaction and isolation medium, achieving 78% waste reduction, 93% lower organic solvent use, and a 46% decrease in water consumption, highlighting the region’s leadership in sustainable pharmaceutical manufacturing.

China Green Chemicals Market Trends

The green chemicals market in China held a substantial share of 41.6% in the Asia Pacific market in 2025, driven by the country’s strong presence in the automotive industry, particularly in vehicle wash, detailing, and valet service applications. Green chemicals are increasingly used in automotive cleaning solutions due to their environmental and health advantages, offering effective removal of dirt, rust, paint residues, and contaminants while remaining gentle on vehicle surfaces such as metal, plastic, and painted components. Unlike conventional chemical cleaners, these formulations are non-toxic, biodegradable, and derived from renewable resources, significantly reducing air, water, and soil pollution. Products such as Eco-Rust O Kleener, Eco-Cop Shiner, and Eco-Green PSS demonstrate how green chemistry is replacing harsh solvents with safer, high-performance alternatives. Their adoption supports regulatory compliance, enhances worker safety, and strengthens sustainable brand positioning.

North America Green Chemicals Market Trends

The green chemicals market in North America is witnessing robust growth with a significant market value share of 28.5% in 2025, supported by stringent environmental regulations, rising corporate sustainability initiatives, and increasing adoption of eco-friendly materials across industries. Regulatory oversight from agencies such as the U.S. Environmental Protection Agency (EPA) and Environment and Climate Change Canada is encouraging the shift toward bio-based, biodegradable, and low-toxicity chemical alternatives. Green chemicals are widely used in automotive, packaging, construction, pharmaceuticals, food and beverages, and paints and coatings, where they support emission reduction and safer manufacturing practices. The automotive and packaging sectors remain key contributors, driven by sustainable materials adoption and fuel-blending mandates. In addition, strong investments in R&D, green manufacturing technologies, and circular economy initiatives are accelerating commercialization. Growing consumer preference for sustainable products and transparent supply chains further reinforces North America’s position as a major market for green chemicals.

The U.S. green chemicals market has witnessed notable growth, supported by stringent environmental regulations, increasing consumer awareness, and the automotive industry’s transition toward sustainable practices. Eco-friendly cleaning agents are gaining widespread adoption in vehicle wash, detailing, and fleet maintenance services due to their high performance, safety, and environmental benefits. Products such as Simple Green Pro HD and ECO Touch Car Care provide biodegradable and non-toxic alternatives to conventional solvent-based cleaners, enabling businesses to comply with EPA and OSHA standards while reducing worker exposure to hazardous substances. In addition, the expansion of electric vehicles (EVs) and green fleet programs is further accelerating demand for sustainable automotive maintenance solutions. As sustainability becomes a core purchasing criterion for both consumers and enterprises, green chemicals are playing a critical role in regulatory compliance, brand differentiation, and the reduction of environmental impact across the U.S. automotive services ecosystem.

Europe Green Chemicals Market Trends

The green chemicals market in Europe is experiencing steady growth with a revenue share of 28.1%, driven by stringent environmental regulations, strong sustainability commitments, and widespread adoption of green chemistry across industries. Regulatory frameworks such as REACH, the EU Green Deal, and the Circular Economy Action Plan are encouraging manufacturers to replace conventional chemicals with bio-based, biodegradable, and low-toxicity alternatives. Green chemicals are widely used across automotive, packaging, pharmaceuticals, construction, and paints and coatings, supporting reduced emissions and safer production processes. The automotive and packaging sectors, in particular, are adopting green solvents, bio-based polymers, and eco-friendly coatings to meet carbon reduction targets. In addition, rising consumer demand for sustainable products and transparent supply chains is accelerating market adoption. With strong R&D capabilities, supportive policy frameworks, and active collaboration between industry and research institutions, Europe continues to play a leading role in advancing the global market.

Germany green chemicals market is witnessing steady growth, driven by stringent environmental regulations, strong industrial sustainability commitments, and the automotive sector’s transition toward low-emission and resource-efficient practices. Germany’s robust automotive and manufacturing base is increasingly adopting bio-based solvents, green cleaning agents, and low-toxicity chemical formulations across vehicle production, maintenance, and surface treatment applications. Eco-friendly chemical solutions are gaining traction in automotive cleaning, coatings, and component processing, offering high performance while complying with regulatory frameworks such as REACH and the EU Green Deal. In addition, Germany’s emphasis on electric mobility, circular manufacturing, and green supply chains is accelerating the adoption of sustainable chemical inputs across industrial operations. As environmental responsibility becomes a core criterion for both manufacturers and consumers, green chemicals are playing a critical role in regulatory compliance, operational efficiency, and sustainable innovation within Germany’s industrial and automotive ecosystems.

Middle East & Africa Green Chemicals Market Trends

The green chemicals market in the Middle East and Africa is gradually gaining momentum, driven by diversification initiatives, sustainability goals, and increasing regulatory attention to environmental protection. Governments across the region are promoting the adoption of bio-based and environmentally friendly chemicals to reduce reliance on conventional petrochemicals and support long-term economic resilience. Green chemicals are finding growing application in construction, packaging, agriculture, water treatment, and paints and coatings, particularly in countries investing heavily in infrastructure and urban development. In the Middle East, access to cost-competitive energy and industrial feedstocks supports scalable production, while in Africa, rising demand for sustainable agricultural inputs and consumer goods is driving market uptake. Increasing foreign investment, technology partnerships, and awareness of circular economy practices are expected to further accelerate green chemical adoption across the MEA region.

Latin America Green Chemicals Market Trends

The green chemicals market in Latin America is experiencing steady growth, supported by abundant renewable feedstocks, expanding sustainability initiatives, and increasing regulatory focus on environmental protection. The region benefits from strong availability of biomass, sugarcane, and agricultural residues, which support the production of bio-based chemicals such as bio-alcohols, biopolymers, and green solvents. Green chemicals are increasingly adopted across agriculture, packaging, food and beverages, automotive, and construction industries to reduce environmental impact and comply with evolving sustainability standards. Countries such as Brazil and Mexico are leading adoption, driven by biofuel programs, industrial decarbonization efforts, and export-oriented manufacturing. Growing investment in bio-refineries, rising consumer awareness, and partnerships between local producers and global chemical companies are expected to strengthen further Latin America’s role in the global market.

Key Green Chemicals Company Insights

Some of the key players operating in the market include Dow and Evonik.

-

Evonik, headquartered in Essen, Germany, is a dominant and mature player in the global market, leveraging its longstanding expertise in amines and surface chemistry. The company offers a comprehensive portfolio of green chemical solutions, specifically designed for diverse industrial and specialty applications. These green chemicals provide critical functionalities such as emulsification, hydrophobic modification, anti-static properties, surface activity, and corrosion inhibition, serving a broad spectrum of end-use industries like agriculture as adjuvants, personal and home care as conditioning agents, oil & gas as corrosion inhibitors, textiles, and Paints and Coatings. Evonik’s vertically integrated production network and global manufacturing footprint enable it to deliver high-quality, reliable, scalable green solutions with strong regional adaptability. Its state-of-the-art R&D facilities in Germany, the U.S., and Asia focus intensively on green chemistry innovation, driving the development of sustainable synthesis methods, biogenic formulations, and low-VOC fatty amine technologies.

Solugen and Syensqoare areemerging market participants in the Market.

-

Syensqo, a technology-driven spin-off from Solvay, is an emerging and innovative player in the global market, rapidly gaining momentum across key industries such as mobility, electronics, healthcare, energy storage, and specialty chemicals. With a strong foundation in advanced materials and specialty formulations, Syensqo is strategically channeling its R&D capabilities toward the development of bio-based, recyclable, and low-carbon chemical solutions to meet the growing global demand for sustainability. Syensqo, through its Renewable Materials & Biotechnology platform, offers bio-based and recycled-content chemicals like Rhovanil Natural, Naternal guar polymers, Amodel Bios, and Omnix HPPA. These sustainable solutions are derived from renewable feedstocks and support circularity in specialty applications. Syensqo’s green innovations are used in applications ranging from electric vehicles and batteries to pharmaceuticals, Construction, and clean technologies.

Key Green Chemicals Companies:

The following are the leading companies in the green chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- ADM

- BASF

- Cargill, Incorporated

- Corbion

- Merck KGaA

- Syensqo

- Solugen

- Evonik

- DUDECHEM GmbH

- Mitsubishi Chemical Group Corporation.

- DuPont

Recent Developments

-

In June 2025, Syensqo launched Miracare Biopacify, a biodegradable and microplastic-free opacifier for liquid laundry detergents, aligning with upcoming European microplastics regulations. With a Renewable Carbon Index (RCI) over 90%, the product offers a sustainable alternative to styrene acrylates without compromising performance. This innovation strengthens Syensqo's green chemical portfolio, addressing the rising demand for eco-friendly home care solutions.

-

In April 2024, Merck introduced Cyrene, a bio-derived, greener alternative to traditional dipolar aprotic solvents like Dimethylformamide (DMF) and N-Methyl-2-pyrrolidone (NMP), both of which face increasing regulatory restrictions under the EU REACH framework due to their toxicity. Cyrene is made in a two-step process from renewable cellulose and aligns with the 12 Principles of Green Chemistry, making it safer for users and less harmful to the environment. Cyrene showed superior performance in applications such as graphene production, Sonogashira cross-couplings, and amide bond formation. It has earned recognition as the Bio-Based Chemical Innovation of the Year (2017) and is now commercially available worldwide.

Green Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 132.96 billion

Revenue forecast in 2033

USD 270.13 billion

Growth rate

CAGR of 10.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; MEA; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Dow Chemical; ADM; BASF SE; Cargill, Inc.; Corbion; Merck KGaA; Syensqo; Solugen; Evonik; DUDECHEM GmbH; Mitsubishi Chemical; DuPont

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global Green Chemicals Market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Bio-alcohols

-

Bio-organic Acids

-

Biopolymers

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Construction

-

Pharmaceuticals

-

Packaging

-

Food and Beverages

-

Paints and Coatings

-

Automotive

-

Textile

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green chemicals market size was estimated at USD 120.51 billion in 2025 and is expected to reach USD 132.96 billion in 2026.

b. The global green chemicals market is expected to grow at a compound annual growth rate of 10.7% from 2026 to 2033 to reach USD 270.13 billion by 2033.

b. The bio-alcohols segment dominated the global green chemicals market by product in 2025, accounting for a significant share of 44.0% of overall consumption, driven by their versatility, renewable nature, and wide applicability across industrial and consumer applications. Bio-alcohols are extensively used in solvents, fuels, personal care products, and chemical intermediates due to their eco-friendly profile, high biodegradability, and compatibility with sustainable production practices. Key advantages such as renewability, broad industrial utility, and alignment with green and clean-label trends continue to reinforce the market position of bio-alcohols globally.

b. Some of the key players operating in the market include Dow Chemical, ADM, BASF SE, Cargill, Inc., Corbion, Merck KGaA, Syensqo, Solugen, Evonik, DUDECHEM GmbH, Mitsubishi Chemical, DuPont.

b. The global green chemicals market is primarily driven by rising demand from the biofuels, personal care, pharmaceuticals, and industrial chemicals sectors, supported by increasing focus on sustainability, renewable feedstocks, and environmentally friendly production. Growing adoption of bio-based solutions, continuous product innovation, and expanding use of bio-alcohols in solvents, fuels, coatings, and chemical intermediates are accelerating market growth. The integration of bio-alcohols into industrial processes and consumer products, driven by demand for renewable, biodegradable, and low-carbon alternatives, continues to support steady global market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.