- Home

- »

- Next Generation Technologies

- »

-

Hardware In The Loop Market Size & Share Report, 2030GVR Report cover

![Hardware In The Loop Market Size, Share & Trends Report]()

Hardware In The Loop Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Open Loop, Closed Loop), By Application (Automotive, Aerospace & Defense, Electronics And Semiconductor), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-268-5

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hardware In The Loop Market Summary

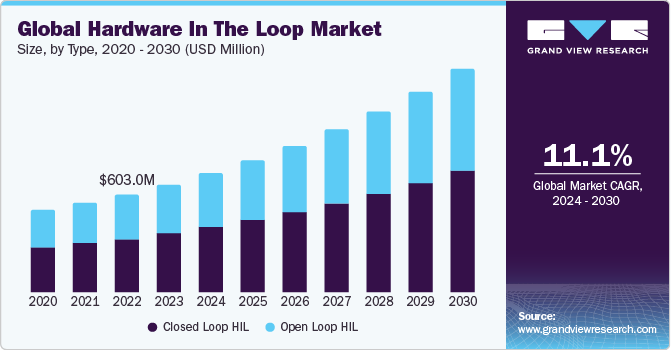

The global hardware in the loop market size was estimated at USD 665.4 million in 2023 and is projected to reach USD 1.38 billion by 2030, growing at a CAGR of 11.1% from 2024 to 2030. The Hardware-in-the-Loop (HIL) market encompasses a crucial aspect of modern engineering and technology development, offering a sophisticated simulation environment for testing and validating complex systems.

Key Market Trends & Insights

- The hardware in the loop market in North America asserted its dominance in 2023, capturing the largest revenue share at 33.6%.

- The hardware in the loop market in the U.S. held the largest revenue share of 87.2% in 2023.

- By type, the closed loop HIL segment dominated the market with the largest revenue share of 55.4% in 2023.

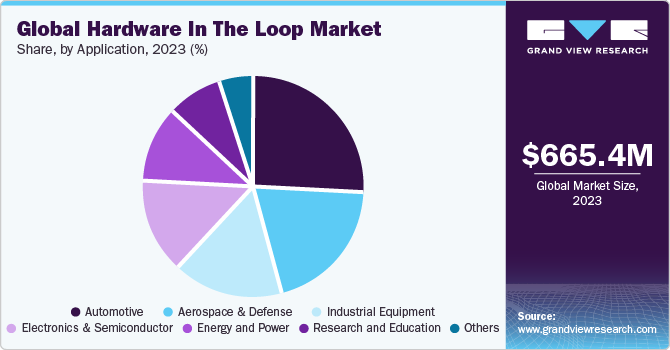

- By application, the automotive segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 665.4 Million

- 2030 Projected Market Size: USD 1.38 Billion

- CAGR (2024-2030): 11.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

HIL simulation involves integrating physical components, such as sensors and actuators, with virtual models in a controlled environment to mimic real-world scenarios accurately. This approach enables engineers to evaluate the performance and functionality of systems in a safe and controlled manner before deployment, thereby reducing risks and enhancing reliability.

Furthermore, factors such as increasing demand for realistic testing environments, growing adoption of electric vehicles, advancements in simulation technology, cost and time savings realized by the implementation of HIL technology, and the increasing adoption of automation are driving the demand for Hardware in the Loop technology.

In response to the demand for realistic testing environments, the market has witnessed a surge in the development of sophisticated simulation platforms. These platforms integrate physical components with virtual models, enabling engineers to replicate complex real-world scenarios accurately. Companies across industries such as automotive, aerospace, and defense are increasingly investing in HIL technology to ensure the safety, reliability, and performance of their products. These solutions offer a controlled yet dynamic environment for testing various systems and subsystems, allowing for thorough validation before deployment. The HIL market continues to innovate with advanced features such as high-fidelity sensor simulation, real-time feedback loops, and multi-domain integration to meet the evolving demands for realism in testing environments.

The rising adoption of automation across industries such as manufacturing, transportation, and energy is fueling the demand for advanced Hardware in the Loop technology. Automation systems rely on HIL testing to validate complex control algorithms, communication protocols, and interactions with physical components in real time. HIL platforms provide a realistic and controlled environment for testing automation systems, enabling engineers to assess performance, reliability, and safety before deployment. As industries increasingly embrace autonomous systems, the need for HIL technology capable of simulating complex and interconnected systems becomes more pronounced.

The integration of HIL testing into the development workflow of automation projects helps mitigate risks, optimize performance, and ensure compliance with industry standards and regulations. Moreover, the demand for HIL solutions tailored to specific automation applications, such as robotics, autonomous vehicles, and industrial control systems, continues to drive innovation in the market. Overall, the increasing adoption of automation highlights the critical role of HIL technology in enabling the development and deployment of reliable and efficient automated systems.

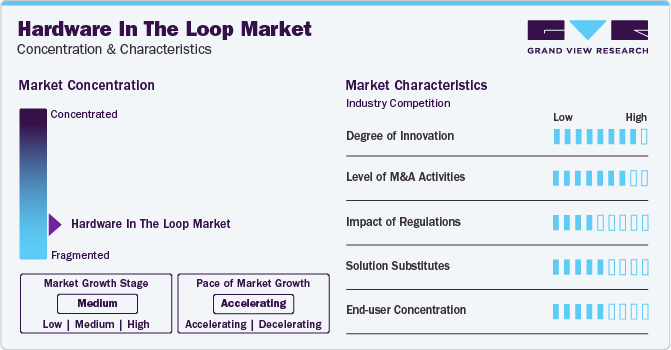

Market Concentration & Characteristics

The degree of innovation in the market can be classified as high. HIL technology continuously evolves to meet the demands of complex systems integration and testing across various industries such as automotive, aerospace, and robotics. With advancements in simulation software, hardware components, and real-time computing capabilities, HIL systems offer increasingly sophisticated solutions for validating and verifying complex control systems.

Moreover, the integration of artificial intelligence and machine learning techniques into HIL platforms further enhances their capabilities, allowing for more efficient testing and analysis of dynamic systems. Additionally, the emergence of new HIL applications in fields like renewable energy, robotics, and autonomous vehicles underscores the market's innovative trajectory. For instance, in March 2024, NVIDIA Corporation announced major enhancements to its Isaac robotics platform, introducing generative AI foundation models, simulation tools, and infrastructure for AI workflows. These advancements, including the new Jetson Thor computer, are aimed at bolstering humanoid robots' capabilities, leveraging hardware-in-the-loop techniques to streamline development and training processes.

The market exhibits a significant level of partnership and collaboration among industry players. Companies often collaborate with HIL solution providers to integrate their hardware and software offerings seamlessly. Additionally, partnerships between HIL developers and end-users facilitate the customization of solutions to meet specific testing requirements. Academic institutions also play a crucial role in collaborating with industry partners to conduct research and develop cutting-edge HIL technologies.

Furthermore, cross-industry collaborations enable the transfer of knowledge and best practices, driving innovation and advancing the capabilities of HIL systems across various sectors. For instance, in April 2024, VI-grade and MdynamiX partnered to enhance their presence in the hardware-in-the-loop sector, with VI-grade becoming an official reseller of MdynamiX's HIL solutions. This collaboration enables customers to access HIL rigs in VI-grade SimCenters for testing, offering advanced solutions for steering and brake system evaluation in the early development stages.

The impact of regulation in the market can be classified as moderate. While regulatory frameworks regarding safety standards and compliance drive some aspects of HIL development, they do not exert as significant an influence as in highly regulated industries such as automotive or aerospace. However, as HIL systems are increasingly utilized in safety-critical applications, such as autonomous vehicles and medical devices, regulatory scrutiny is intensifying. Compliance with standards like ISO 26262 for automotive safety or FDA regulations for medical device testing shapes the design and implementation of HIL solutions. Additionally, evolving regulations related to data privacy and cybersecurity also impact HIL testing protocols, particularly in sectors dealing with sensitive information or critical infrastructure. Overall, while not as dominant as in some industries, regulation plays a moderate yet growing role in shaping the trajectory of the HIL market.

The market faces a low impact from solution substitutes as there are limited alternatives that offer the same level of real-time simulation, scalability, efficiency, and cost-effectiveness as HIL systems. HIL systems offer unique capabilities for real-time simulation and testing of complex control systems, with few direct substitutes that can replicate their functionalities. While traditional testing methods such as physical prototyping and manual testing exist as alternatives, they need more scalability, efficiency, and cost-effectiveness of HIL solutions.

Additionally, advancements in HIL technology, such as integration with artificial intelligence and machine learning, further differentiate these systems from potential substitutes. Moreover, the increasing complexity of systems in industries like automotive and aerospace necessitates specialized solutions like HIL, reducing the feasibility of substitutes. Overall, the low impact of solution substitutes highlights the unique and indispensable role that HIL systems play in modern engineering and development workflows.

The market exhibits a moderate level of end-user concentration, characterized by various industries leveraging this technology. While prominent players such as Ford, GM, and Toyota in automotive, as well as Boeing and Airbus in aerospace, heavily rely on HIL systems for testing ADAS, autonomous vehicles, and avionics, the market is not monopolized by a few leading players. Furthermore, HIL finds applications in sectors like robotics, renewable energy, and industrial automation, further diversifying its user base. This diversity mitigates the risk associated with dependence on any single sector, contributing to the moderate level of end-user concentration observed in the HIL market.

Type Insights

The closed loop HIL segment dominated the market with the largest revenue share of 55.4% in 2023. Closed-loop systems offer a higher level of accuracy and fidelity by incorporating real-time feedback loops between the physical and virtual components, enabling more realistic simulations. This enhanced realism is particularly valuable in industries such as automotive and aerospace, where precise testing of control algorithms and system interactions is essential.

Additionally, closed-loop HIL systems provide better validation of complex control strategies and fault scenarios, making them indispensable for critical applications where safety and reliability are paramount. Furthermore, the closed-loop approach allows for comprehensive testing of dynamic systems under various operating conditions, ensuring robust performance across a wide range of scenarios. The versatility and scalability of closed-loop HIL solutions make them suitable for a diverse range of applications, from automotive powertrain testing to renewable energy system validation. Moreover, advancements in closed-loop simulation technology, such as improved real-time processing capabilities and advanced modeling techniques, have further boosted the adoption of these systems.

The open loop HIL segment is expected to register the highest CAGR of 11.4% over the forecast period. The open-loop systems offer a more cost-effective and accessible solution compared to closed-loop alternatives, making them attractive to a broader range of industries and applications. This affordability has spurred adoption across sectors such as consumer electronics, renewable energy, and industrial automation, driving significant market growth.

Additionally, open-loop HIL setups are simpler to configure and operate, requiring less specialized expertise and resources, thus reducing implementation barriers for smaller companies and research institutions. Furthermore, the flexibility of open-loop HIL configurations allows for easy integration with existing testing setups and workflows, facilitating seamless adoption across diverse industries. Moreover, the scalability of open-loop solutions enables companies to tailor their testing environments to specific requirements and gradually expand their capabilities as needed.

Application Insights

The automotive segment dominated the market with the largest revenue share in 2023. The automotive industry relies heavily on HIL testing for the development and validation of advanced driver assistance systems (ADAS), autonomous driving technologies, and vehicle control systems. These systems require rigorous testing in realistic simulated environments to ensure safety, reliability, and compliance with regulatory standards. Additionally, the increasing complexity of automotive electronics and software necessitates the use of HIL technology to validate integrated systems and subsystems comprehensively.

Moreover, HIL testing enables automotive manufacturers to accelerate product development cycles, reduce costs associated with physical prototyping, and minimize time-to-market for new vehicle models. For instance, in January 2022, LeddarTech and dSpace collaborated to develop LeddarEcho, a lidar simulation software aimed at Tier 1 sensor and perception system developers. By leveraging dSpace's sensor-realistic Aurelion simulator, LeddarEcho enables efficient simulation, validation, and optimization of lidar sensor designs, supporting software-in-the-loop (SIL) and hardware in the-loop testing environments.

Furthermore, advancements in HIL simulation software and hardware have enhanced the accuracy and fidelity of testing, further driving adoption within the automotive sector. Thus, the automotive industry's ongoing emphasis on innovation, safety, and efficiency has positioned it as the leading adopter of HIL technology, contributing to its largest market share in the HIL market.

The aerospace & defense segment is expected to grow at the fastest CAGR over the forecast period. The aerospace and defense industry demands rigorous testing and validation of complex systems, including aircraft avionics, weapon systems, and unmanned aerial vehicles (UAVs), necessitating the use of advanced HIL technology. The critical nature of these applications requires high-fidelity simulation environments to ensure the safety, reliability, and performance of mission-critical systems.

Moreover, ongoing technological advancements in aircraft design, sensor technology, and autonomous systems drive the need for sophisticated HIL solutions capable of simulating increasingly complex scenarios. Additionally, government investments in defense modernization programs and the expansion of commercial aerospace activities contribute to the growth of the aerospace and defense segment in the HIL market. Furthermore, stringent regulatory requirements and certification processes mandate thorough testing and validation procedures, further fueling the demand for HIL technology in these industries. The versatility of these systems allows aerospace and defense companies to conduct comprehensive testing of integrated systems, subsystems, and individual components in a controlled environment, reducing development cycles and costs.

Regional Insights

The hardware in the loop market in North America asserted its dominance in 2023, capturing the largest revenue share at 33.6%. The North America region has a robust automotive industry, which heavily relies on HIL testing for vehicle development and validation. Additionally, North America is home to numerous aerospace and defense companies, such as Boeing and Lockheed Martin. HIL simulation is crucial for testing complex systems and ensuring safety and reliability. Furthermore, the region hosts several leading HIL solution providers and research institutions, fostering innovation and driving market growth. Moreover, the presence of a skilled workforce and advanced technological infrastructure also contributes to the dominance of North America in the HIL market. Lastly, a strong focus on technological advancements and the continuous evolution of industries like automotive, aerospace, and defense continue to sustain the demand for HIL solutions, consolidating North America's position as the market leader.

U.S. Hardware In The Loop Market Trends

The hardware in the loop market in the U.S. held the largest revenue share of 87.2% in 2023 and is experiencing substantial growth. This dominance can be attributed to the presence of a robust automotive industry, where HIL testing is extensively utilized for vehicle development and validation. Additionally, the U.S. boasts numerous aerospace and defense companies that rely on HIL simulation for testing complex systems and ensuring safety and reliability.

Moreover, the increasing product launches in the U.S. highlight the nation's commitment to technological innovation and market leadership across diverse industries. For instance, in January 2024, Bloomy Controls, Inc. introduced the Desktop BMS HIL Test System to enhance the efficiency of battery engineering teams by bringing hardware-in-the-loop testing capabilities directly to their desktops, reducing time-to-market for projects like EVs and drones. This system simulates the functions of battery cells, temperature sensors, and digital communications, allowing engineers to thoroughly test battery management systems in a controlled environment using both manual and automated test scenarios.

Asia Pacific Hardware In The Loop Market Trends

Asia Pacific is expected to record the fastest CAGR of 11.6% over the forecast period. The rapid industrialization and infrastructure development across countries such as China, India, and Japan have driven increased demand for HIL solutions in the automotive, aerospace, and electronics industries. The rapidly growing automotive sector in the region, coupled with the adoption of advanced driver assistance systems (ADAS) and electric vehicles (EVs), has fueled the need for robust testing and validation technologies, including HIL. Additionally, several companies are expanding Hardware-in-the-Loop technology in India to drive innovation and efficiency in automotive and mobility solutions. For instance, in January 2024, Valeo expanded its Group Technical Centre in Chennai, emphasizing technology and innovation with infrastructure accommodating over 1,000 workstations, including Software-in-the-Loop (SIL) and Hardware in the Loop farms and a cybersecurity test lab. This expansion consolidates Valeo's Software and Systems workforce in Chennai, fostering collaboration, creativity, and excellence while attracting top talent to drive advancements in mobility technology.

China hardware in the loop market is experiencing significant growth, driven by increasing demand for advanced testing and validation solutions, particularly within the automotive sector. This expansion is fueled by the rising adoption of electric vehicles and autonomous driving technologies across the country, supported by government incentives and environmental concerns. For instance, in 2022, China saw an 82% surge in new electric vehicle (EV) sales, capturing nearly 60% of the global market share for EV purchases. China's robust manufacturing infrastructure and skilled workforce contribute to its prominence in the global HIL market, enabling the development and deployment of cutting-edge solutions. With a growing emphasis on innovation and technological advancement, Chinese companies are heavily investing in HIL technology to meet evolving industry needs.

Europe Hardware In The Loop Market Trends

The hardware in the loop market in Europe is driven by increasing demand for advanced testing and validation solutions, particularly within the automotive and aerospace sectors. This expansion is fueled by the region's focus on innovation, stringent safety regulations, and the need to develop cutting-edge technologies to maintain competitiveness in global markets. Additionally, Europe's strong manufacturing base and skilled workforce contribute to its prominence in the global HIL market, facilitating the development and deployment of sophisticated solutions tailored to diverse industry needs.

Furthermore, several new launches of Hardware in the Loop technology in Europe demonstrate the region's commitment to advancing testing and validation solutions across various industries. For instance, in February 2024, NORDEX SE introduced a new power hardware-in-the-loop (PHIL) test bench, developed by R&D Test Systems, for grid compliance testing of power electric drivetrains. This test bench enables NORDEX SE to simulate various grid conditions and faults in a controlled environment, improving the efficiency and repeatability of testing processes compared to traditional field-testing methods.

The UK hardware in the loop market is driven by increasing demand for advanced testing and validation solutions, particularly within the automotive and aerospace industries. This expansion is fueled by the UK's focus on innovation, stringent regulatory standards, and the need to develop cutting-edge technologies to maintain competitiveness in global markets. Additionally, the UK's strong engineering expertise and research capabilities contribute to its prominence in the global HIL market, facilitating the development and deployment of sophisticated solutions tailored to industry needs.

Key Hardware In The Loop Company Insights

Some of the key companies operating in hardware in the loop market include dSpace GmbH, National Instruments Corp., among others.

-

dSPACE GmbH provides simulation and validation solutions for the development of networked, autonomous, and electrically powered vehicles. Its comprehensive suite of solutions is widely adopted by automotive manufacturers and their suppliers for testing software and hardware components well in advance of vehicle launch. The company also offers expertise in aerospace and industrial automation.

-

National Instruments Corp. provides test, measurement, and control solutions for engineers and scientists. The company offers its solutions and services across various industries, including automotive, aerospace, and electronics. The company's products and services help customers accelerate productivity, innovation, and discovery through advanced technologies such as software-defined instrumentation and modular hardware platforms.

Cognata and Typhoon HIL are some of the emerging market companies in the target market.

-

Cognata provides simulation solutions based on digital twins, catering to AI-driven training, validation, and testing needs for ADAS technologies and Autonomous Vehicles across various sectors. The company's platform also offers advanced off-road simulation for defense applications and photorealistic digital twins for smart city planning, enabled by AI and accurate sensor simulation technologies.

-

Typhoon HIL provides hardware-in-the-loop solutions, serving various industries, including power electronics, microgrids, and e-mobility. The company's platform has revolutionized control software and hardware validation and testing through embedded, real-time HIL technology driven by proprietary numerical algorithms and application-specific processors.

Key Hardware In The Loop Companies:

The following are the leading companies in the hardware in the loop market. These companies collectively hold the largest market share and dictate industry trends.

- dSPACE GmbH

- NATIONAL INSTRUMENTS CORP

- Vector Informatik GmbH

- Cognata

- Siemens

- MicroNova AG

- Opal-RT Technologies

- LHP Engineering Solutions

- IPG Automotive GmbH

- Typhoon HIL

- Speedgoat GmbH

- Eontronix

- Wineman Technology

- Modeling Tech

- Robert Bosch GmbH

Recent Developments

-

In January 2024, dSPACE GmbH and Spirent announced a partnership to enhance real-time positioning scenarios for Autonomous Driving Hardware-in-the-Loop test systems. The partnership aims to provide developers with a turnkey solution by integrating dSPACE's AD-HIL with Spirent's high-fidelity GNSS simulator. This collaboration allowed for comprehensive validation of autonomous driving applications, leveraging real satellite signals to improve safety and precision in vehicle development.

-

In January 2024, Cognata announced its partnership with Microsoft to integrate its high-precision AI simulation technology into Microsoft's Software-Defined Vehicle (SDV) development toolchain. This collaboration aims to enable OEMs to accelerate the validation and integration of automated driving features by leveraging Cognata's simulation capabilities, including Hardware in the Loop testing, within Microsoft's SDV Cloud Infrastructure.

-

In October 2022, National Instruments Corp introduced a unified test system architecture for advanced driver-assistance systems (ADAS) and autonomous driving (AD), enabling seamless iteration between data replay and hardware in the loop testing. This innovative approach aimed to enhance test efficiency by aggregating real-world road test data or simulation scenarios to validate ADAS electronic control units (ECUs), ultimately reducing capital equipment costs, improving test coverage and efficiency, and shortening time to market. National Instruments Corp's collaboration with leaders in autonomous vehicle testing technology, such as ZF Mobility Solutions and Konrad Technologies, further strengthened its position in providing comprehensive and efficient test solutions for the automotive industry.

Hardware In The Loop Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 735.7 million

Revenue forecast in 2030

USD 1.38 billion

Growth rate

CAGR of 11.1% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Mexico; Brazil; KSA; UAE; South Africa

Key companies profiled

Siemens; Typhoon HIL; Speedgoat GmbH; Cognata; dSPACE GmbH; Opal-RT Technologies; Eontronix; MicroNova AG; Modeling Tech; Vector Informatik GmbH; Wineman Technology; LHP Engineering Solutions; National Instruments Corp; IPG Automotive GmbH; Robert Bosch GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hardware In The Loop Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global hardware in the loop market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Open Loop HIL

-

Closed Loop HIL

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace & Defense

-

Electronics and Semiconductor

-

Industrial Equipment

-

Research and Education

-

Energy and Power

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hardware in the loop market size was estimated at USD 665.4 million in 2023 and is expected to reach USD 735.7 million in 2024.

b. The global hardware in the loop market is expected to grow at a compound annual growth rate of 11.1% from 2024 to 2030 to reach USD 1.38 billion by 2030.

b. The closed loop segment claimed the largest market share of 55.4% in 2023 in the hardware in the loop market, driven by its higher accuracy, versatile applications across industries like automotive and aerospace, and enhanced validation capabilities for complex systems and scenarios.

b. Prominent players in the Hardware in the Loop Market Siemens, Typhoon HIL, Speedgoat GmbH, Cognata, dSPACE GmbH, Opal-RT Technologies, Eontronix, MicroNova AG, Modeling Tech, Vector Informatik GmbH, Wineman Technology, LHP Engineering Solutions, National Instruments Corp, IPG Automotive GmbH, and Robert Bosch GmbH.

b. The Hardware in the Loop market is driven by factors such as increasing demand for realistic testing environments, growing adoption of electric vehicles, advancements in simulation technology, cost and time savings realized by the implementation of HIL technology, and the increasing adoption of automation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.