- Home

- »

- Healthcare IT

- »

-

Healthcare Information System Market, Industry Report 2030GVR Report cover

![Healthcare Information System Market Size, Share, & Trends Report]()

Healthcare Information System Market (2025 - 2030) Size, Share, & Trends Analysis Report By Application, By Deployment (Web-based, On-premises, Cloud-based), By Component, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-549-6

- Number of Report Pages: 151

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Information System Market Summary

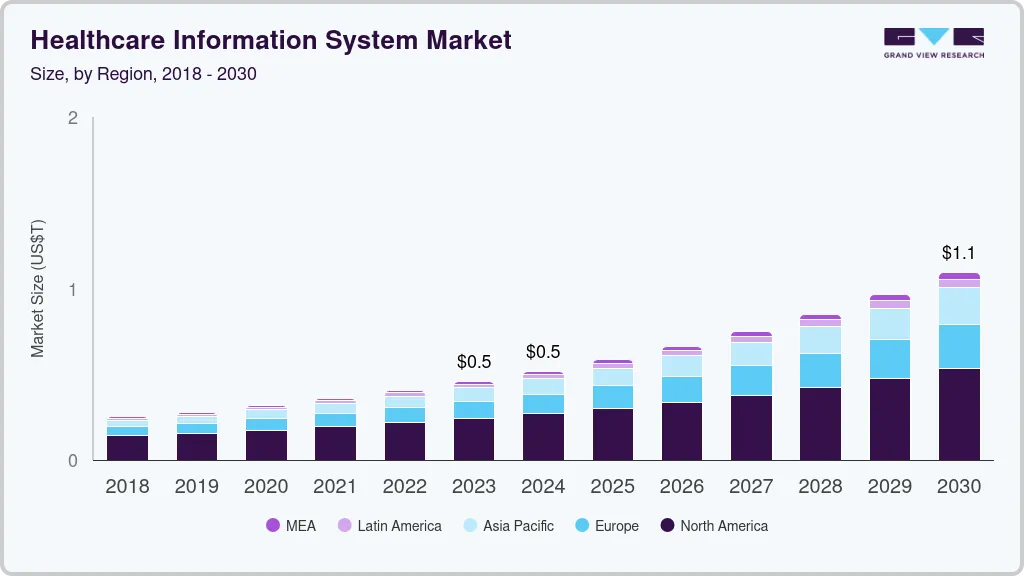

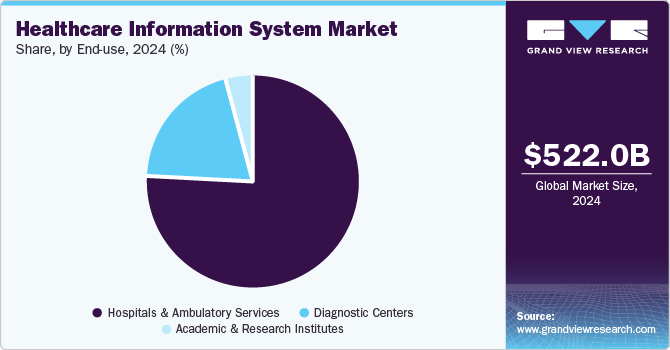

The global healthcare information system market size was estimated at USD 522.01 billion in 2024 and is projected to reach USD 1,117.59 billion by 2030, growing at a CAGR of 13.59% from 2025 to 2030. Implementing Healthcare Information Systems (HIS), such as population health management, can significantly advance disease prevention and management, resulting in substantial financial savings.

Key Market Trends & Insights

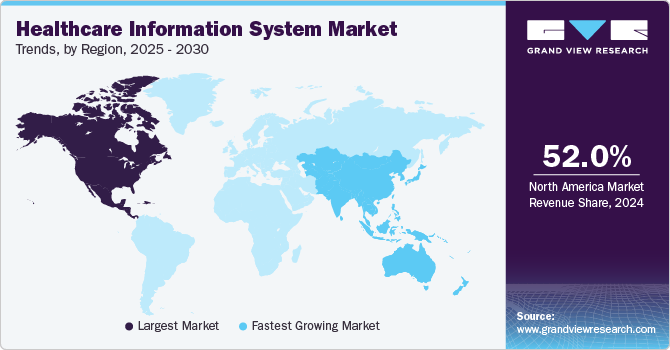

- North America healthcare information system market held the largest revenue share above 52% in 2024.

- Germany healthcare information system market held largest share in the Europe region in 2024.

- By application, the revenue cycle management (RCM) segment dominated the market with a revenue share above 65% in 2024.

- By deployment, the web-based segment dominated the market with a revenue share above 43% in 2024.

- By component, the services segment dominated the market with a revenue share above 47% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 522.01 Billion

- 2030 Projected Market Size: USD 1,117.59 Billion

- CAGR (2025-2030): 13.59%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing demand for remote patient monitoring for improved out-of-hospital care is a primary factor driving the market's growth. Moreover, increasing usage of smartphones, technologically advanced infrastructure, and an increase in a number of initiatives and investments supporting eHealth and digital health are driving the market's growth over the forecast period.

Smartphones have become integral to medical care, with applications like telemedicine, remote disease management, and Health Management Information Systems (HMIS) gaining prominence. Health apps facilitate effective communication between patients and care providers remotely, while the use of mobile devices among physicians is also on the rise. The 2022 Nursing Informatics Workforce Survey by Healthcare Information and Management Systems Society (HIMSS) revealed that nurse informaticists frequently work with EMR/EHR (58%) & clinical documentation systems (53%) and are increasingly using system integration (31%), mobile Tech (28%), and medical device integration (24%). Consequently, the growing significance of mobile devices and mHealth for improving health outcomes and patient care is positively impacting the market.

Technological advancements including IoT, big data, and AI, significantly propel market growth. According to the NVIDIA Corporation article published in March 2024, AI platforms like the NVIDIA Blackwell platform, co-engineered with leading cloud service providers, have revolutionized healthcare IT infrastructure. They provide dedicated access to advanced computing resources, accelerating medical research, improving services, and enhancing operational efficiency.

Buyers evaluate HIS software and services based on technical considerations, cost of ownership, and ease of use, features, functionality, & familiarity. Technical factors take precedence in the selection process, while understanding the total cost of ownership is essential for assessing long-term investment value. Usability plays a crucial role in employee productivity and adoption rates, influencing overall efficiency. Buyers also prioritize features and compatibility with existing systems to ensure seamless integration & enhanced performance. For instance, the implementation of EMRs in hospitals, such as in the case of the AOUI in Verona, Italy, has shown significant improvements in patient care and efficiency by providing a repository for all internal information, allowing patients to track & share their health history with professionals.

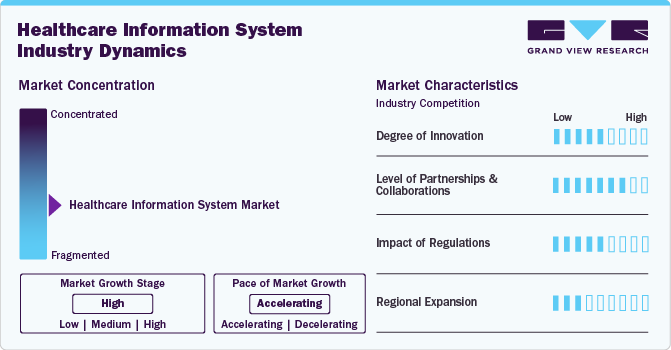

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations activities, impact of regulations, service substitutes, and geographic expansion. The HIS industry is fragmented, with many small players entering the market and offering new products. The level of partnerships & collaborations activities, the impact of regulations, and the regional expansion of the market is medium.

Degree of Innovationin the HIS market is moderate. eHealth initiatives encompass the development of current IT infrastructure and the promotion of patient engagement, as well as patient-physician coordination tools. Globally, there is a growing number of initiatives aimed at implementing eHealth.

Partnerships and collaborations in the market are high, exposing the industry's differentiation of the values of working together to tackle challenges and capitalize on opportunities. This is particularly in demand to address issues like interoperability, data security, and the integration of emerging technologies. For instance, in September 2023, Mayo Clinic and GE Healthcare have entered into a strategic collaboration to drive innovation in medical imaging and theranostics.

Regulations play a crucial role in the market by establishing standards for data security, interoperability, and patient privacy. For instance, legislation such as HIPAA mandates stringent protocols to protect sensitive health data, constraining providers to adopt advanced information systems that adhere to these regulatory frameworks.

The impact of regional expansion in market is high due to increasing demand for digital health solutions globally. As companies expand into new regions, they are entering untapped industry and fostering innovation and collaboration across borders. This expansion is facilitating greater access to care services, improving patient outcomes, and enhancing operational efficiencies for healthcare providers globally.

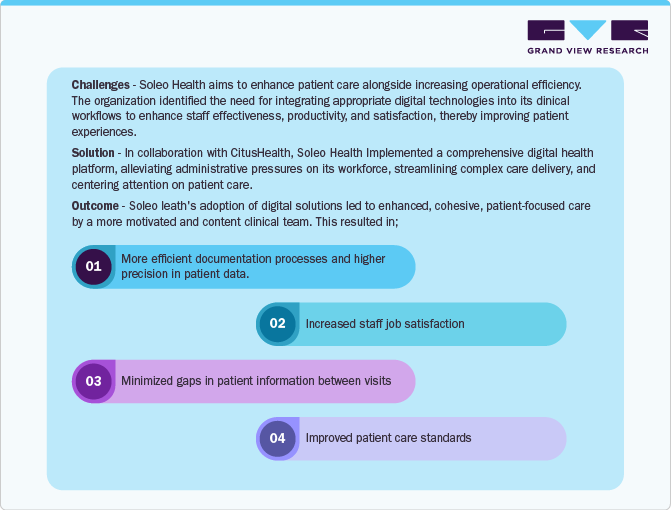

Case Study:Soleo health boosts patient care and staff efficiency with digital integration

Soleo Health partnered with CitusHealth to integrate a digital health platform to enhance patient care and operational efficiency. The solution streamlined complex care delivery and reduced administrative burdens, enabling the clinical team to focus more on patients. In addition, staff satisfaction increased due to more efficient workflows and reduced stress.

Application Insights

The Revenue Cycle Management (RCM) segment dominated the market with a revenue share above 65% in 2024. The healthcare industry is rapidly moving toward digitalization, creating demand for advanced revenue cycle management solutions. The growth in medical facilities is expected to be driven by the increasing demand for workflow optimization with the adoption of synchronized management software systems. The industry is constantly evolving with regular technological advancements, and as a result, several payers & providers are rapidly adopting these advancements. For instance, in November 2023, the Healthcare Financial Management Association (HFMA) partnered with FinThrive, Inc. to launch a five-stage RCM Technology Adoption Model (RCMTAM). This model helps health systems assess current RCM technology maturity and build best-practice plans using industry benchmarks.

Hospital information system segment is expected to grow at the fastest CAGR over the forecast period. The increasing adoption of information systems in hospitals to improve operational efficiency, the growing awareness regarding advanced medical services, and the subsequent need for reducing costs are some of the key factors expected to boost the market over the forecast period. Electronic Health Records (EHRs), Electronic Medical Records (EMRs), patient engagement solutions, and Population Health Management (PHM) are key information system types. The growing use of EHRs for patient-centric care is significantly boosting the market. For instance, in April 2023, Microsoft extended its strategic partnership with Epic to integrate & develop generative AI into healthcare through the combination of the scale of Microsoft’s Azure OpenAI Service and Epic’s advanced EHR software.

Deployment Insights

The web-based segment dominated the market with a revenue share above 43% in 2024. Web-based HIS offer unparalleled accessibility, facilitating seamless communication and data sharing among medical personnels, patients, & stakeholders. Using web-based systems significantly reduces operational hassles encountered due to processing large volumes of data. However, the capability of web-based deployments to support software & systems depends on the availability of the required technical needs and operational aspects of the systems. With the increasing demand for interoperability, mobility, and data security, web-based solutions continue to lead innovation in the market, promising efficiency, scalability, & cost-effectiveness for care facilities globally.

The Cloud-based segment is expected to grow at the fastest CAGR during the forecast period. Cloud-based technology enables hosting applications, software & systems, and services remotely and can be freely accessed or used through the internet. The utilization of cloud-based technology has increased due to various security breaches in on-premises and web-based deployment. For instance, the demand for cloud-based solutions is rising, leading to partnerships & collaborations, acquisitions, and mergers to offer cloud-based solutions. This trend is transforming the HIS market, improving efficiency and care management. For instance, in April 2023, Workday, Inc., a provider of cloud-based enterprise management solutions, formed a strategic partnership with Alight, Inc. to offer HR and payroll professionals a simplified & integrated payroll solution on a global scale.

Component Insights

The services segment dominated the market with a revenue share above 47% in 2024. The emergence of digital health and connected care services has widened the scope for healthcare IT-related services. Moreover, the development of a range of platforms for monitoring, diagnosis, and wellness & prevention of diseases is a key factor boosting the market. For instance, in December 2022, the UK’s Ministry of Defense signed a contract with Atos IT Services to support its Cortisone program in Defense Medical Services. The contract is a 3-year deal with an option of extension by another year. The organization will continue to work as a technical services partner for the medical information system.

The Hardware segment held the second largest share owing to hardware components are crucial in enabling the effective delivery and management of services. The major driving factor for hardware in this market is the demand for robust & reliable infrastructure to support the increasing volume and complexity of healthcare data. Medical devices, servers, storage systems, networking equipment, and other hardware components form the backbone of HIS, facilitating the storage, processing, & transmission of patient information, diagnostic data, and medical records.

End Use Insights

The hospitals & ambulatory services segment dominated the market with a revenue share above 75% in 2024. The increase in the adoption of HIS for improving clinical, financial, & administrative efficiency and the rising need for improving HIS are some of the key factors expected to drive growth. The shift in trend from volume-based care to value-based care is leading to an increase in the demand for HIS. In addition, information systems in ambulatory centers are crucial for optimizing revenue operations and maximizing financial performance. Several companies specialize in providing various information system services, such as Revenue Cycle Management (RCM) services tailored to the unique needs of ambulatory centers.

The diagnostic centers segment is expected to grow at the fastest CAGR during the forecast period. The rising geriatric population, the growing prevalence of chronic diseases globally, and the increasing adoption of healthcare IT services in diagnostic facilities are key factors driving the market. In addition, the introduction of laboratory information systems, the rising demand for automated services, and the growing need for integrating health-related data of individuals for efficient care delivery are other factors expected to fuel the market.

Regional Insights

North America healthcare information system market held the largest revenue share above 52% in 2024. A major factor expected to contribute to its growth is the availability of infrastructure with high digital literacy and policies that support the adoption of Electronic Health Records (EHRs). Furthermore, the development of support for adopting Healthcare Information Technology (HCIT) by healthcare providers and payers is expected to boost market growth. According to Elation article published in October 2023, approximately 9 of 10 U.S.-based physicians have implemented EHR. Thus, high adoption plays a crucial role in boosting market growth. Furthermore, the high disposable incomes, supportive government regulations for healthcare IT, and a large geriatric population in the U.S. & Canada are expected to drive the market over the forecast period.

U.S. Healthcare Information System Market Trends

The U.S. healthcare information system market has witnessed an upsurge in adopting diverse IT services and solutions in the healthcare sector. Technologically advanced products make hospital workflows and administration more efficient. The U.S. government has continued to acknowledge the importance of digital health and healthcare innovation as essential components of a successful healthcare infrastructure. For instance, in October 2023, the ONC Public Health Information and Technology Workforce Development Program allocated USD 75 million to promote diversity in the health IT sector.

Europe Healthcare Information System Market Trends

The presence of developed economies, such as Germany, the UK, France, Spain, & Italy, is expected to fuel the market in Europe during the forecast period. The need for integrated health systems is rising due to the rapidly growing geriatric population and subsequent increase in chronic diseases. Increase in number of initiatives supporting eHealth is expected to drive the regional market over the forecast period. In addition, EU policymakers are promoting various digital health programs, which are expected to boost market growth during the forecast period.

Germany healthcare information system market held largest share in the Europe region in 2024. Germany is one of the key markets for healthcare IT in Europe. Increase in the significance of IT due to efficient utilization of resources, improvement in workflow & delivery of services, and enhanced patient centricity are significant contributing factors to the growing adoption of these technologies in hospitals. High utilization of EHRs to access patient information for treatment and reduce multiple investigations & treatment time is expected to drive the market in Germany.

UK healthcare information system market is expected to witness fastest growth over the forecast period. An increasing number of initiatives, including developing integrated care systems for digital health and eHealth is expected to drive the UK market. The UK government is encouraging the adoption of digital health initiatives by the NHS. For instance, in March 2024, government’s announcement regarding investing USD 4.3 million (EUR 4.2 million) in the digitalization of healthcare services is expected to offer lucrative growth opportunities for market players.

Asia Pacific Healthcare Information System Market Trends

Asia Pacific healthcare information system market is expected to witness the fastest growth over the forecast period. There is a high demand for healthcare IT services due to an increase in government spending on healthcare. In addition, the need for healthcare IT systems has been growing as they enable the effective management of hospitals' financial, clinical, and administrative aspects. Various hospitals in Japan, Malaysia, South Korea, and Australia have adopted these systems for better patient care and satisfaction.

Japan healthcare information system market held the largest share in 2024, owing to factors such as the rapid adoption of new technologies and the growing popularity of at-home care & regular monitoring services are likely to propel the healthcare IT market in Japan. Robot for Interactive Body Assistance (RIBA), an IT-enabled robot for geriatric patients, is an example of Japan adopting digital solutions for patient monitoring. The introduction of technologically advanced mobile devices & wearable devices is boosting the market.

Indian healthcare information system market is driven by the growing geriatric population, the increasing burden of chronic diseases, and government initiatives supporting the country’s eHealth scenario. One such notable initiative is the development of the Integrated Health Information Platform (IHIP). IHIP is being implemented to create standard-compliant EHRs and their integration & interoperability through a centralized platform.

Latin America Healthcare Information System Market Trends

The market in Latin America is anticipated to grow significantly due to demand for advanced healthcare is increasing amid a rapidly aging population and rising prevalence of chronic diseases.

Brazil healthcare information system market held the largest share in 2024, owing to some of the major factors driving Brazil’s healthcare IT industry are rising per capita income, increasing government medical & healthcare spending, improving access to private healthcare facilities, and fast-growing healthcare R&D.

Middle East & Africa Healthcare Information System Market Trends

Middle East & Africa region is anticipated to witness significant growth due to the steady development of healthcare facilities in emerging economies and increased healthcare expenditure. Some of the key countries in the region, such as Saudi Arabia and the UAE, have exhibited significant growth & major changes in healthcare facilities.

South Africa healthcare information system market is in the nascent stage, increase in the adoption of IT in healthcare is expected to boost the market. The eHealth strategy in public health sector in South Africa is expected to drive the adoption of HIS. It aims to facilitate the smooth functioning of the national health information system through a patient-centric approach.

Key Healthcare Information System Company Insights

The market is highly fragmented, with the presence of many country-level players. With the growing aging population and the need for mobile health, a few smaller competitors are entering the industry. Some of the emerging companies are Skyflow, Inc, KareXpert, Inc., and Napier Healthcare Solutions Pte. Ltd.

Key Healthcare Information System Companies:

The following are the leading companies in the healthcare information system market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle (Cerner)

- GE Healthcare

- Veradigm LLC (formerly known as Allscripts)

- Epic Systems Corporation

- eClinicalWorks

- Greenway Health, LLC

- NextGen Healthcare, Inc.

- Medical Information Technology, Inc. (Meditech)

- TruBridge (CPSI)

- AdvancedMD, Inc.

- CureMD Healthcare

- McKesson Corporation

- IQVIA

- Optum, Inc. (subsidiary of UnitedHealth Group)

- Medecision

- Cegedim Healthcare Solutions

- Agfa-Gevaert Group.

- Hewlett Packard Enterprise Development LP

- Carestream Health.

- Novarad Corporation

- CompuGroup Medical

- Ada Health GmbH

- SWORD Health

- Infor.

- EnlivenHealth (Omnicell)

- Experian Information Solutions, Inc

- Belong.Life

- PatientBond (acquired by Upfront in August 2022)

- Inovalon

- Digital Pharmacist

- Keycentrix, LLC

- Cassian Solutions (CassianRx)

- Equipo Health Inc.

- WellSky

- ResMed

- Koninklijke Philips N.V.

- Klara Technologies, Inc.

- Solutionreach, Inc.

- MEDHOST

- Health Catalyst

- AiCure

- Medadvisor Solutions

- Innovaccer, Inc.

- EmpiRx Health, LLC.

- IBM

- Huma

- AllazoHealth

- Nuance Communications, Inc. (Microsoft)

- Aiva, Inc.

Recent Developments

-

In April 2024, GE Healthcare expanded its collaboration with Elekta, a pioneer in precision radiation oncology, to enhance radiation therapy solutions. This collaboration will incorporate advanced medical imaging management solutions from GE Healthcare's MIM Software.

-

In February 2024, Oracle Identity Governance integration was launched for Oracle Health EHR, previously known as Cerner Millennium. This integration intends to empower healthcare institutions to oversee user access to EHR, synchronize data, and bolster security & operational effectiveness. The connector facilitates automated data exchange, streamlines provisioning processes, and meets regulatory standards.

-

In November 2023, Thoma Bravo, a prominent software investment firm, finalized the acquisition of NXGN Management, LLC., Inc. for USD 1.8 billion, which marks a significant step in NextGen's journey as a leading provider of cloud-based healthcare technology solutions.

-

In April 2023, Epic is embraced generative AI's role in healthcare by expanding its collaboration with Microsoft. It is integrating OpenAI services, like GPT-4, into Epic's EHR. Pilot programs for these services have already commenced at select health systems, including UC San Diego Health, UW Health, and Stanford Health Care.

Healthcare Information System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 590.97 billion

Revenue forecast in 2030

USD 1,117.59 billion

Growth rate

CAGR of 13.59% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deployment, component, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Sweden, Denmark, Russia, Netherlands, Switzerland, Belgium, Ireland, Austria, Japan, China, India, Australia, South Korea, Thailand, Singapore, Malaysia, Indonesia, Philippines, New Zealand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait, Morocco

Key companies profiled

Oracle (Cerner); GE Healthcare; Veradigm LLC (formerly known as Allscripts); Epic Systems Corporation; eClinicalWorks; Greenway Health; LLC; NextGen Healthcare, Inc.; Medical Information Technology Inc. (Meditech); TruBridge (CPSI); AdvancedMD, Inc.; CureMD Healthcare; McKesson Corporation; IQVIA; Optum, Inc. (subsidiary of UnitedHealth Group); Medecision; Cegedim Healthcare Solutions; Agfa-Gevaert Group.; Hewlett Packard Enterprise Development LP; Carestream Health.; Novarad Corporation; CompuGroup Medical; Ada Health GmbH; SWORD Health; Infor.; EnlivenHealth (Omnicell); Experian Information Solutions, Inc; Belong.Life; PatientBond (acquired by Upfront in August 2022); Inovalon; Digital Pharmacist; Keycentrix, LLC; Cassian Solutions (CassianRx); Equipo Health Inc.; WellSky; ResMed; Koninklijke Philips N.V.; Klara Technologies Inc.; Solutionreach, Inc.; MEDHOST; Health Catalyst; AiCure; Medadvisor Solutions; Innovaccer, Inc.; EmpiRx Health LLC.; IBM; Huma; AllazoHealth; Nuance Communications Inc. (Microsoft); Aiva Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Information System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare information system market report based on application, deployment, component, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Information System

-

Electronic Health Record

-

Electronic Medical Record

-

Real-time Healthcare

-

Patient Engagement Solution

-

Population Health Management

-

-

Pharmacy Automation Systems

-

Medication Dispensing System

-

Packaging & Labeling System

-

Storage & Retrieval System

-

Automated Medication Compounding System

-

Tabletop Tablet Counters

-

-

Laboratory Informatics

-

Revenue Cycle Management

-

Medical Imaging Information System

-

Radiology Information Systems

-

Monitoring Analysis Software

-

Picture Archiving and Communication Systems

-

-

Patient Administration System

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

On-premises

-

Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software & Systems

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Ambulatory Services

-

Diagnostic Centers

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

Russia

-

Netherlands

-

Switzerland

-

Belgium

-

Ireland

-

Austria

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Singapore

-

Malaysia

-

Indonesia

-

Philippines

-

New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Morocco

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the healthcare information system market growth include increasing adoption of technologically advanced infrastructure in hospitals, diagnostic centers, clinical laboratories, growing awareness regarding e-prescriptions among practitioners and patients.

b. The global healthcare information system market size was estimated at USD 522.01 billion in 2024 and is expected to reach USD 590.97 billion in 2025.

b. The global healthcare information system market is expected to grow at a compound annual growth rate of 13.59% from 2025 to 2030 to reach USD 1,117.59 billion by 2030.

b. Revenue Cycle Management (RCM) dominated the healthcare information system market with more than 65% share in 2024. This is mainly due to the increasing need for reducing medical billing errors, & reducing reimbursements in healthcare.

b. Some key players operating in the healthcare information system market include Oracle (Cerner), GE Healthcare,Veradigm LLC (formerly known as Allscripts), Epic Systems Corporation, eClinicalWorks, Greenway Health, LLC, NextGen Healthcare, Inc., Medical Information Technology, Inc. (Meditech), TruBridge (CPSI), AdvancedMD, Inc., CureMD Healthcare, McKesson Corporation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.