- Home

- »

- Next Generation Technologies

- »

-

Heavy-duty Automotive Aftermarket Industry Report, 2033GVR Report cover

![Heavy-duty Automotive Aftermarket Industry Size, Share & Trends Report]()

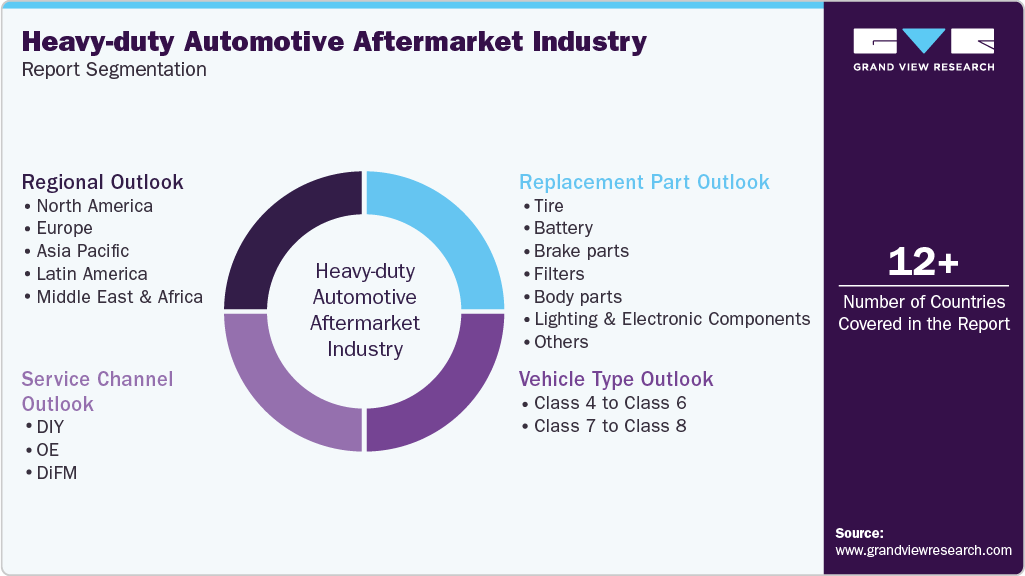

Heavy-duty Automotive Aftermarket Industry Size, Share & Trends Analysis Report By Replacement Part (Tire, Battery, Brake Parts, Filters, Body Parts, Lighting & Electronic Components, Wheels), By Vehicle Type, By Service Channel, By Region, And Segment Forecasts, 2025 - 2033

- Report ID: GVR-2-68038-566-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Heavy-duty Automotive Aftermarket Industry Summary

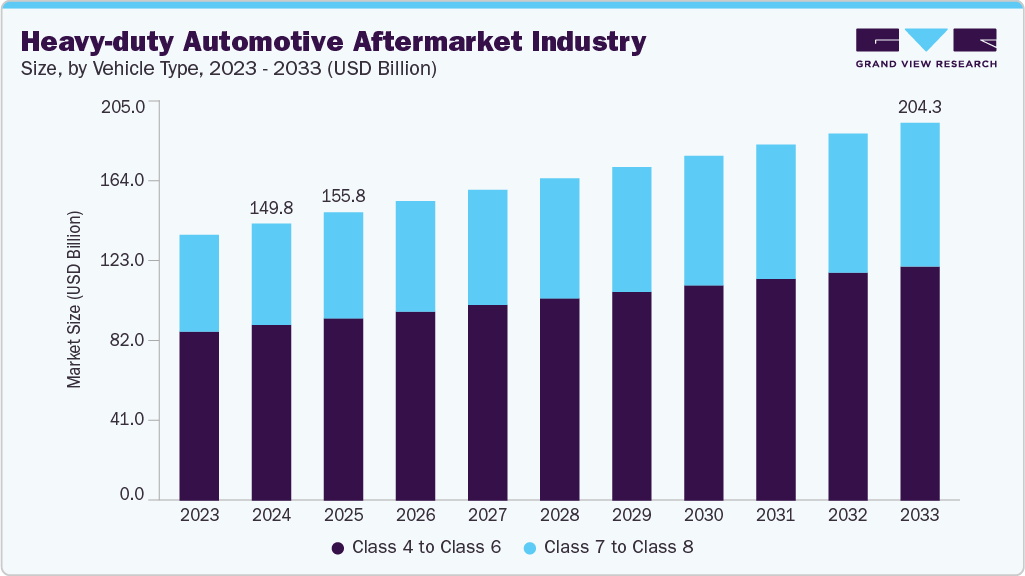

The global heavy-duty automotive aftermarket industry size was valued at USD 149.75 billion in 2024 and is projected to reach USD 204.26 billion by 2033, growing at a CAGR of 3.4% from 2025 to 2033. Rising technological advancements, such as the development of connected and autonomous trucks, advances in diagnostic tools, data analytics, and telematics, have become increasingly important in the market.

Key Market Trends & Insights

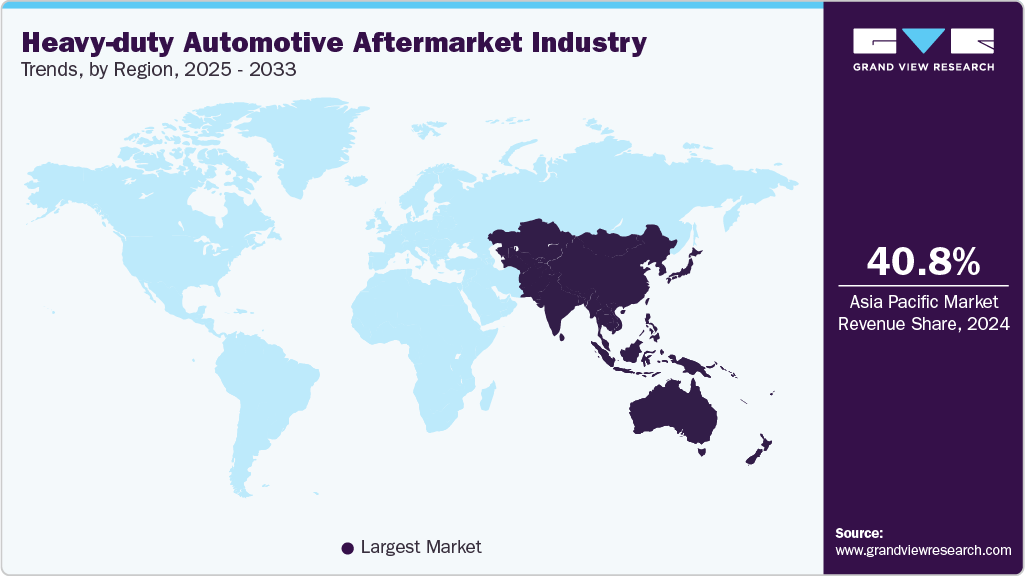

- Asia Pacific dominated the global heavy-duty automotive aftermarket with the largest revenue share of 40.8% in 2024.

- The heavy-duty automotive aftermarket in China led the Asia Pacific market and held the largest revenue share in 2024.

- By replacement part, the turbocharger segment is predicted to foresee significant growth in the forecast period.

- By vehicle type, the class 7 to class 8 segment accounted for the largest market revenue share in 2024.

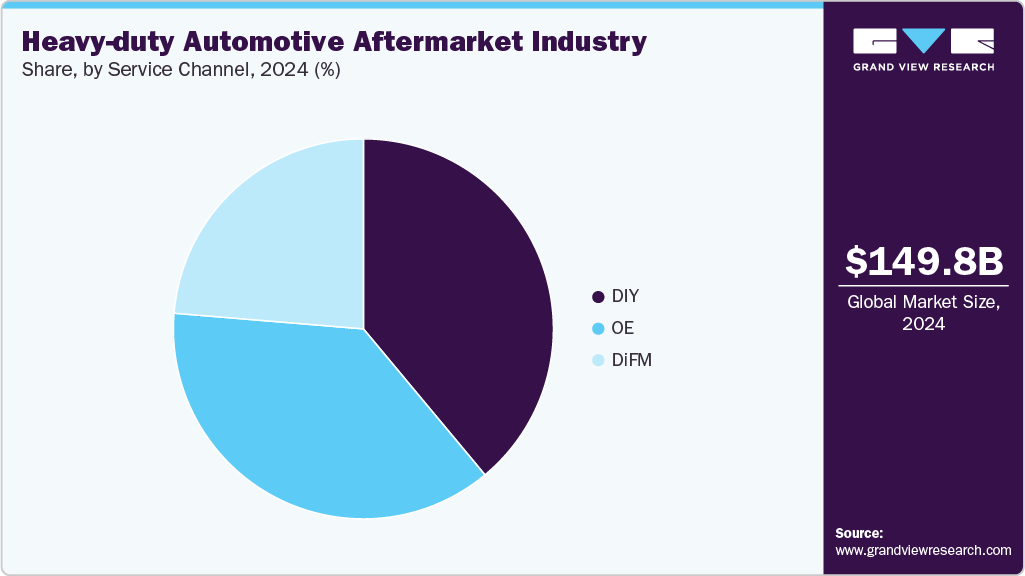

- By service channel, the DiFM segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 149.75 Billion

- 2033 Projected Market Size: USD 204.26 Billion

- CAGR (2025-2033): 3.4%

- Asia Pacific: Largest Market in 2024

Better vehicle monitoring, predictive maintenance, and cost-effective repairs are expected to boost demand over the forecast period. The increasing adoption of electric and hybrid heavy-duty vehicles is creating a new segment in the aftermarket. Electric and hybrid vehicles have different powertrains and components compared to traditional internal combustion engine (ICE) vehicles. This shift in technology creates a demand for a new range of aftermarket products, such as batteries, electric motors, inverters, and charging infrastructure. Moreover, the growth of electric vehicles (EVs) necessitates the development of charging infrastructure, including charging stations, cables, and connectors. The aftermarket plays a role in providing these products and installing charging stations for commercial and fleet customers.Additionally, digitalization and e-commerce are playing a significant role in driving the growth of the heavy-duty automotive aftermarket. Digitalization has led to the emergence of online marketplaces and e-commerce platforms specializing in heavy-duty automotive parts. Fleet operators, repair shops, and individual vehicle owners can conveniently browse catalogs, compare prices, and order parts online. Moreover, e-commerce platforms provide access to a vast array of aftermarket parts and products from various suppliers and manufacturers. Customers can explore a broader selection of products than they might find at traditional brick-and-mortar stores.

Government incentives, subsidies, and regulations related to vehicle maintenance and emissions control can influence the aftermarket. Programs aimed at reducing pollution or promoting cleaner transportation can drive demand for specific products and services. Furthermore, Startups and technology companies are entering the heavy-duty automotive aftermarket with innovative solutions, such as predictive maintenance platforms and digital marketplace platforms.

Replacement Part Insights

The other segment led the market and accounted for 46.9% of the global revenue in 2024. The rising trends of remanufacturing mechanical and electrical components are expected to drive the market demand for heavy-duty automotive aftermarket components, as remanufactured parts assist in minimizing expenses and support the continuity of older vehicles. Moreover, the retrofitting of components and parts reduced the emissions of an older heavy-duty vehicle, enhancing the life of that vehicle and thus directly driving the market demand for heavy-duty automotive aftermarket products.

The turbocharger segment is predicted to foresee significant growth in the forecast period. Turbochargers enable engine downsizing, where a smaller-displacement engine is equipped with a turbocharger to deliver the power output of a larger engine. This reduces fuel consumption and emissions while maintaining performance. Furthermore, the segment is crucial for enhancing the fuel efficiency of heavy-duty vehicles. As fuel costs remain a significant operational expense for fleet operators, there's a growing focus on adopting turbochargers to reduce fuel consumption.

Vehicle Type Insights

The class 7 to class 8 segment accounted for the largest market revenue share in 2024. Stricter emissions regulations are driving the demand for aftermarket emissions control technologies in Class 7 to Class 8 vehicles. This includes diesel particulate filters (DPFs), selective catalytic reduction (SCR) systems, and exhaust gas recirculation (EGR) components. Moreover, the integration of telematics and fleet management systems is growing in this segment. Fleet operators are using these technologies for vehicle tracking, maintenance scheduling, and route optimization, leading to increased demand for related aftermarket products and services.

The class 4 to class 6 segment is predicted to foresee significant growth in the forecast period. The installation of safety and driver assistance systems such as backup cameras, collision avoidance, and lane departure warning systems is growing in this segment. The aftermarket offers retrofit options for existing vehicles. Moreover, to reduce operating costs, medium-duty vehicle owners are looking for efficiency improvements. Aftermarket products like aerodynamic kits, tire management systems, and engine tuning can deliver fuel savings. Moreover, the integration of telematics and predictive maintenance solutions is reshaping parts replacement cycles and service intervals. As fleet operators prioritize cost efficiency and minimize downtime, the demand for high-quality replacement components, remanufactured parts, and digital service platforms continues to strengthen within this segment.

Service Channel Insights

The DiFM segment held the highest market share in 2024. The "Do it For Me" (DiFM) segment is characterized by services and maintenance performed by professional technicians or service providers on behalf of vehicle owners or fleet operators. This segment is essential for those who prefer to outsource vehicle maintenance and repairs rather than doing it themselves. DiFM providers often offer fleet management services that include maintenance scheduling, cost tracking, and compliance management. These services help fleet operators optimize vehicle performance and reduce operational costs. Additionally, fleet downtime costs are prompting operators to outsource repairs to ensure faster turnaround and quality assurance. This trend is further supported by digital service management platforms that enhance scheduling, transparency, and parts availability, strengthening the professional repair ecosystem in the heavy-duty segment.

The DIY segment is predicted to foresee significant growth in the forecast period. The Do-It-Yourself (DIY) segment refers to vehicle owners or enthusiasts who perform maintenance, repairs, and customization on their own vehicles without relying on professional mechanics or service providers. While the heavy-duty automotive sector traditionally has a strong professional service component. The availability of online resources, including repair manuals, instructional videos, and automotive forums, has empowered DIYers with the knowledge and confidence to tackle more complex projects. The availability of online diagnostic tools, e-commerce platforms for spare parts, and video-based learning has strengthened this movement. However, the complexity of modern heavy-duty vehicles and the need for specialized equipment still limit full-scale DIY adoption. Overall, the DIY trend is fostering greater consumer awareness and demand for user-friendly components, driving manufacturers to develop more modular and easily serviceable products.

Regional Insights

The heavy-duty automotive aftermarket industry in Asia Pacific held the highest revenue share of 40.8% in 2024, as the market is driven by the rapid urbanization and infrastructure development, which has led to an increased demand for heavy-duty vehicles such as trucks, buses, and construction equipment in the region. This growth in infrastructure projects has driven the demand for aftermarket parts and services. Moreover, the rise of e-commerce and the growth of logistics and transportation companies in the region have driven the demand for heavy-duty vehicles to transport goods. As these fleets expand, there is a growing need for aftermarket parts and maintenance services.

North America Heavy-duty Automotive Aftermarket Industry Trends

North America heavy-duty automotive aftermarket industry held a significant revenue share in 2024 and is driven by aging vehicle fleets, regulatory mandates, and increasing fleet maintenance needs. Rising demand for replacement parts, especially tires, turbochargers, and emission control components, is fueling aftermarket revenue, with Class 7-8 trucks contributing the largest share. Growing emphasis on fuel efficiency, emission compliance, and predictive maintenance is accelerating the adoption of telematics and IoT-based diagnostic tools. However, challenges such as skilled labor shortages, price competition, and counterfeit parts continue to restrain market growth.

U.S. Heavy-duty Automotive Aftermarket Industry Trends

The heavy-duty automotive aftermarket industry in the U.S. is driven by tires, which remain the largest replacement part segment in terms of revenue, while turbochargers are among the fastest-growing sub-segments, driven by demands for better fuel efficiency and emissions compliance. A large and aging fleet of commercial vehicles encourages reliance on aftermarket maintenance versus fleet replacement, especially under tighter emissions and fuel-economy regulations.

Europe Heavy-duty Automotive Aftermarket Industry Trends

The heavy-duty automotive aftermarket industry in Europe is experiencing steady growth driven by the aging vehicle fleet, increased vehicle parc, and the rising adoption of digital service platforms. Demand for advanced diagnostic tools and telematics-based maintenance is strengthening as fleets seek to minimize downtime and enhance operational efficiency. Sustainability trends, including the shift toward remanufacturing and eco-friendly parts, are also shaping market dynamics. Additionally, strong regulatory frameworks and the expansion of e-commerce channels are supporting consistent aftermarket growth across major European economies.

Key Heavy-duty Automotive Aftermarket Company Insights

Key players operating in the heavy-duty automotive aftermarket industry are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some key companies in the industry are 3M Company, ATC Technology Corp, Continental AG, Denso Corporation, Detroit Diesel Corporation, and more.

-

3M India, with nearly 100 years of global automotive industry experience, offers innovative solutions tailored for the industry. Their product portfolio includes ultra-strong abrasives, advanced materials for lightweighting, and durable adhesives that enhance vehicle repair, maintenance, and manufacturing efficiency. 3M’s technologies support improved fuel economy, faster and higher-quality painting processes, and durable, safe, and environmentally responsible transportation solutions. Their offerings help automotive professionals push limits while ensuring reliability, cost-effectiveness, and performance in demanding heavy-duty applications.

-

Continental, a global technology company, offers a comprehensive range of solutions for the heavy-duty automotive aftermarket. Their offerings include high-performance tires, advanced vehicle electronics, and robust safety systems designed to enhance durability, reliability, and efficiency in heavy-duty vehicles. Continental’s innovations also support sustainable and safe mobility solutions tailored for demanding industrial and commercial transportation needs. The company’s strong global presence and technological expertise position it as a key partner in the heavy-duty automotive aftermarket sector.

Key Heavy-duty Automotive Aftermarket Companies:

The following are the leading companies in the heavy-duty automotive aftermarket industry. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- ATC Technology Corp

- Continental AG

- Denso Corporation

- Detroit Diesel Corporation

- Dorian Drake International Inc.

- Dorman Products

- Federal-Mogul LLC

- Instrument Sales & Service, Inc.

- Remy International Inc.

- UCI International Inc.

Recent Developments

-

In August 2025, DENSO expanded its PowerEdge aftermarket product line to include high-performance NOx sensors for medium- and heavy-duty vehicles. These sensors, covering nearly 40 models from Chrysler/RAM/Stellantis, Cummins, Daimler Truck, and Ford, play a vital role in monitoring nitrogen oxide levels to ensure compliance with federal emissions standards. Manufactured in the U.S. to original equipment (OE) specifications, PowerEdge NOx sensors offer reliable engine performance, durability, and a one-year warranty. By integrating these sensors, fleet owners can meet emissions regulations without compromising on quality or value, reinforcing PowerEdge as a trusted brand for heavy-duty vehicle aftertreatment needs.

-

In September 2024, Continental is significantly expanding its aftermarket product range in original equipment quality, introducing new product groups including sensors for driver assistance systems, chassis and steering components, and high-pressure fuel pumps. The company is also launching the ATE New Original line of brake discs and pads tailored for electric vehicles and future Euro 7 emissions standards. Workshops will benefit from expanded coverage in engine management parts, water pumps, and belt drive kits, along with new digital services like Remote Support for high-quality repairs. This expansion reflects Continental's commitment to meeting the increasing technical demands of modern vehicles and supporting workshops through a diversified, reliable portfolio by mid-2025.

Heavy-duty Automotive Aftermarket Industry Report Scope

Report Attribute

Details

Market size in 2025

USD 155.78 billion

Revenue forecast in 2033

USD 204.26 billion

Growth rate

CAGR of 3.4% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Replacement part, vehicle type, service channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Europe; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

3M Company; ATC Technology Corp; Continental AG; Denso Corporation; Detroit Diesel Corporation; Dorian Drake International Inc.; Dorman Products; Federal-Mogul LLC; Instrument Sales & Service, Inc.; Remy International Inc.; UCI International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heavy-duty Automotive Aftermarket Industry Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global heavy-duty automotive aftermarket industry report based on replacement part, vehicle type, service channel, and region:

-

Replacement Part Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tire

-

Battery

-

Brake parts

-

Filters

-

Body parts

-

Lighting & Electronic components

-

Wheels

-

Exhaust components

-

Turbochargers

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Class 4 to Class 6

-

Class 7 to Class 8

-

-

Service Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

DIY

-

OE

-

DiFM

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global heavy-duty automotive aftermarket industry size was estimated at USD 149.75 billion in 2024 and is expected to reach USD 155.78 billion in 2025.

b. The global heavy-duty automotive aftermarket industry is expected to grow at a compound annual growth rate of 3.4% from 2025 to 2033 to reach USD 204.26 billion by 2033.

b. Asia Pacific dominated the heavy-duty automotive aftermarket industry with a share of 40.8% in 2024. This is attributed to the rapid urbanization and infrastructure development, which have led to an increased demand for heavy-duty vehicles, such as trucks, buses, and construction equipment, in the region.

b. Some key players operating in the heavy-duty automotive aftermarket industry include 3M Company; ATC Technology Corp, Continental AG; Denso Corporation; Detroit Diesel Corporation; Dorian Drake International Inc.; Dorman Products; Federal-Mogul LLC; Instrument Sales & Service, Inc.; Remy International Inc.; and UCI International Inc.

b. The heavy-duty automotive aftermarket is rapidly changing with innovative technologies such as connected vehicles and hybrid vehicles being introduced in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.