- Home

- »

- Advanced Interior Materials

- »

-

High-pressure Die Casting Equipment Market Report, 2030GVR Report cover

![High-pressure Die Casting Equipment Market Size, Share & Trends Report]()

High-pressure Die Casting Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Machine Type (Hot Chamber, Cold Chamber), By Application, By Category (Semi-automatic, Automatic), By Capacity, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-446-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

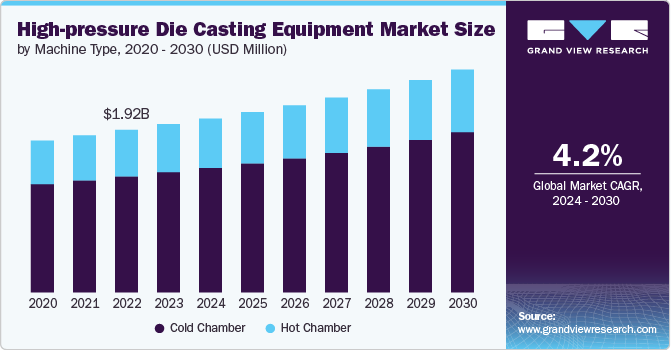

The global high-pressure die casting equipment market size was estimated at USD 1.98 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The rising demand for high-pressure die casting equipment is largely driven by the automotive, aerospace, and heavy machinery industries' continuous search for lightweight, high-strength components. This method allows for the production of complex metal parts with excellent surface finish and dimensional accuracy, which is essential in these competitive market. High-pressure die casting equipment is becoming increasingly sought after not only for its efficiency and productivity but also for its ability to utilize a wide range of metals, including aluminum, zinc, and magnesium alloys, offering versatility to manufacturers.

Significant investments by leading automotive manufacturers such as General Motors, Ford, and Tesla in developing lightweight and durable components for electric vehicles highlight the critical role of high-pressure die casting equipment. For instance, Tesla's ambitious production of the large-scale aluminum frame for its Model Y using high-pressure die casting is a testament to the technology's impact on manufacturing efficiency and material waste reduction. Moreover, in the aviation sector, companies like Boeing and Airbus are leveraging this technology to fabricate intricate parts for aircraft, ensuring both the resilience and performance of these components while adhering to stringent safety standards. These examples underscore the transformative potential of high-pressure die casting in meeting modern manufacturing challenges across industries.

Drivers, Opportunities & Restraints

The drivers of the market are predominantly rooted in the escalating demand for lightweight materials across various industries, including automotive, aerospace, and consumer electronics. As these sectors continually seek ways to enhance fuel efficiency, reduce emissions, and improve product performance, the quest for advanced manufacturing processes like high-pressure die casting has intensified. This method offers unrivaled speed in the production of complex, thin-walled components while maintaining material strength and integrity, making it an invaluable asset in modern manufacturing. Further fueling the market's expansion are the ongoing innovations in die casting technologies, which are geared toward improving precision, reducing cycle times, and extending the life of die casting molds.

However, the market faces several restraints, chief among them being the high initial investment required for deploying high-pressure die casting equipment. The cost associated with purchasing and maintaining these machines can be prohibitive for small and medium-sized enterprises, potentially stifling market growth. Additionally, the process's reliance on non-ferrous metals such as aluminum, magnesium, and zinc, whose prices can be volatile, adds a layer of financial uncertainty for manufacturers. Environmental regulations related to emissions and waste from die casting processes also pose challenges, demanding the adoption of greener practices and technologies which could escalate operational costs.

Despite these challenges, the high-pressure die casting equipment market is presented with numerous opportunities for growth and innovation. The increasing adoption of electric vehicles (EVs) and the push for renewable energy infrastructure are expected to create a surge in demand for die-cast components. Additionally, advancements in automation and smart technologies hold the promise of making high-pressure die casting more efficient, sustainable, and adaptable to complex designs. The integration of Industry 4.0 principles into die casting operations opens the door to predictive maintenance, real-time monitoring, and enhanced quality control, presenting a clear pathway for overcoming existing market restraints and capitalizing on emerging opportunities.

Machine Type Insights

“The demand for cold chamber machine type segment is expected to grow at a significant CAGR of 4.3% from 2024 to 2030 in terms of revenue”

The cold chamber machine type segment led the market and accounted for 71.5% of the global revenue share in 2023. Cold chamber die casting is used for metals with higher melting points, such as aluminum and its alloys, which would otherwise damage the pumping mechanism in a hot chamber machine. Cold chamber die casting is indispensable for industries such as automotive and aerospace, where the demand for durable, high-precision parts is paramount. Despite the differences between these two processes, both play critical roles in modern manufacturing, each offering unique benefits that cater to the specific needs of different metals and applications.

Hot chamber high-pressure die casting equipment is particularly well-suited for metals with low melting points, such as zinc, magnesium, and some low melting point alloys of aluminum. In this process, the melting pot is integrated into the machine itself, allowing for faster and more efficient production cycles due to the proximity of the molten metal to the die cavity.

Application Insights

“The demand for electronics application segment is expected to grow at a significant CAGR of 4.5% from 2024 to 2030 in terms of revenue”

The automotive application segment led the market and accounted for 41.7% of the global revenue share in 2023. The demand for high-pressure die casting equipment has significantly intensified within the automotive and aerospace industries, primarily driven by the relentless pursuit of efficiency and precision in manufacturing processes. The automotive industry, in particular, seeks to leverage this equipment to produce complex parts with high precision and excellent surface finish, such as engine blocks, transmission cases, and structural components. This method not only facilitates the production of lightweight components that enhance fuel efficiency but also ensures consistency in quality and strength, aligning with the industry's stringent safety and performance standards.

Moreover, the aerospace industry adopts high-pressure die casting equipment to manufacture components that demand high strength-to-weight ratios and durability. The need for parts that can withstand extreme conditions while minimizing weight has put a premium on the precision and reliability offered by high-pressure die casting techniques. This technology supports the production of intricately designed parts like turbine blades, gearbox components, and structural elements for aircraft, contributing to advancements in aerospace technology and materials science.

Capacity Insights

“The demand for 1,001 to 4,000 tons capacity segment is expected to grow at a significant CAGR of 4.6% from 2024 to 2030 in terms of revenue”

The 1,001 to 4,000 tons capacity segment led the market and accounted for 24.1% of the global revenue share in 2023. In the automotive, aerospace, and electronics industries, where precision, durability, and strength-to-weight ratios are paramount, there is a significant demand for high-capacity die casting machines. These machines, typically rated between 1,001 to 4,000 tons of clamping force, are sought after for their ability to produce large, intricate components like engine blocks, chassis parts, and housing for electronics with high efficiency and repeatability. The preference for high-capacity machines in these sectors aligns with trends toward lightweight and complexities in product design, necessitating equipment that can handle large volumes of metal with precise control over the casting process.

Conversely, the market for lower-capacity high-pressure die casting equipment, typically those with a clamping force of between 6,001 to 10,000 tons, remains robust, driven by demands from smaller-scale manufacturers and specialized industries that require smaller, detailed parts with high precision. These machines are favored for their lower initial investment, flexibility, and suitability for a wide range of applications, including consumer goods, medical equipment, and intricate automotive components like connectors and sensors.

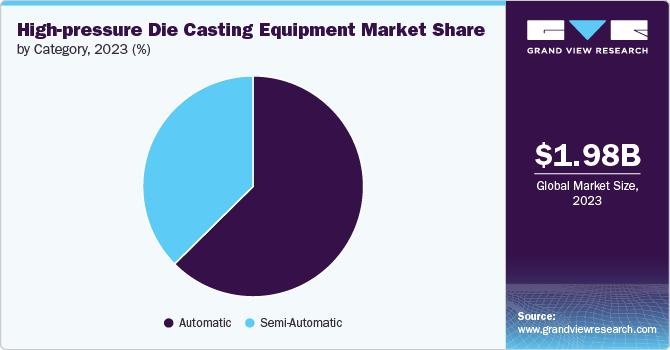

Category Insights

“The demand for automatic category segment is expected to grow at a significant CAGR of 4.3% from 2024 to 2030 in terms of revenue”

The automatic category segment accounted for 62.6% of the global revenue share in 2023. These systems are designed for fully automated operation, from the closing and locking of the mold to the injection of the molten metal, and finally, to the ejection of the finished part. They are equipped with advanced control systems that can precisely manage the casting parameters, significantly reducing the margin of error and enhancing the consistency and quality of the produced parts.

Semi-automatic high-pressure die casting equipment has become a key asset for manufacturers looking for a balance between automation and manual control. These systems allow for a degree of automation in the die casting process, particularly in the injection phase, while requiring manual intervention for tasks such as die setup, extraction of the finished parts, and the inspection process. This blend of automation and hands-on operation makes semi-automatic equipment particularly suitable for production environments where flexibility and adaptability are crucial. Manufacturers can benefit from the increased control over the casting process, which can result in higher quality parts with fewer defects.

Regional Insights

North America high-pressure die-casting equipment market is characterized by its focus on innovation and sustainability. With major economies like the United States and Canada at its core, the demand is substantially driven by the automotive industry's shift toward lightweight and energy-efficient vehicles. The region has steadily adopted aluminum parts to replace traditional steel, necessitating advanced high-pressure die-casting equipment for precision manufacturing. Aerospace and defense are other key sectors contributing to the market's growth, as both require high-strength, lightweight components. Furthermore, the push toward renewable energy and the need for high-quality components for wind turbines and solar panels have opened new avenues for the die-casting equipment industry in North America.

Asia Pacific High-pressure Die Casting Equipment Market Trends

“India to witness the fastest market growth with 5.1% CAGR”

The high-pressure die casting equipment market in Asia Pacific, excluding India, is experiencing significant growth due to the booming automotive, electronics, and construction sectors, especially in countries like China, Japan, and South Korea. This region is known for its vast production capabilities and is a global leader in electronics manufacturing, where high-pressure die-casting plays a critical role in creating intricate metal components. Economic growth has led to an increase in consumer goods demand, further driving the need for die-casting equipment. The Asia Pacific is also seeing a rise in infrastructure projects requiring durable metal products, thus spiking the demand for high-pressure die-casting solutions. Environmental regulations pushing for lighter and more energy-efficient products have additionally spurred innovations and investments in the sector.

India high-pressure die casting equipment market is driven by the rapidly growing automotive and electrical industries. With the country positioning itself as a global hub for auto manufacturing, demand for high-pressure die-casting equipment, used extensively in producing metal parts with complex geometries, has surged. Moreover, government initiatives aimed at boosting manufacturing through schemes like "Make in India" have encouraged both domestic and foreign investments in the sector. This, in turn, has fostered the growth of ancillary industries, including die-casting, further propelling the demand for sophisticated high-pressure die-casting equipment. The emphasis on upgrading to lighter and more fuel-efficient vehicles also contributes to the increased adoption of aluminum parts, benefitting the die-casting equipment market.

Europe High-Pressure Die Casting Equipment Market Trends

The high-pressure die casting equipment market in Europe is growing largely due to its well-established automotive sector, particularly in countries like Germany, Italy, and France. Europe has been at the forefront of adopting stringent environmental regulations, which has led to a significant shift toward electric vehicles (EVs). This transition necessitates high-pressure die-casting equipment for manufacturing lightweight, high-strength EV parts, thus driving the market. Additionally, Europe's focus on recycling and sustainable manufacturing practices has encouraged advancements in die-casting technology, making processes more energy-efficient and reducing waste. The aerospace and industrial machinery sectors in Europe also contribute to the steady demand for precise and durable die-casted components, further cementing the region's position in the global market.

Key High-Pressure Die Casting Equipment Company Insights

Some of the key players operating in the market include Buhler Group and UBE Corporation, among others.

-

The Bühler Group is a global leader in the supply of industrial processing technologies, primarily focusing on producing machinery and plants for the food and feed industry, as well as for the processing of other raw materials. Founded in 1860 in Uzwil, Switzerland, Bühler prides itself on its commitment to sustainability and innovation, aiming to reduce the environmental impact of its manufacturing processes. The company's vast array of products includes technology for grinding grains, making pasta, chocolate production, and coffee processing, among others. Bühler strongly emphasizes research and development, dedicating a significant portion of its resources to advancing technologies that enhance efficiency and reduce energy consumption. This dedication has made Bühler a trusted partner for thousands of companies worldwide, striving to make industrial processes more sustainable and efficient.

-

UBE Corporation, originally founded as Okinoyama Coal Mine in 1897, has transformed into a diversified multinational corporation with a strong presence in chemicals, construction materials, and machinery. Headquartered in Tokyo, Japan, UBE operates in a multitude of sectors, producing products ranging from nylon resins, fine chemicals, pharmaceuticals, to cement and building materials. What sets UBE apart is its dedication to sustainable practices and innovation, particularly evident in its advancements in environmental technologies and the development of materials that contribute to energy conservation. The company also invests in research and development of new technologies in carbon fibers and batteries, reflecting its commitment to addressing global challenges through innovation. With a network spanning across Asia, Europe, and the Americas, UBE Corporation is deeply integrated into the global industrial landscape, focusing on creating value-added products and solutions that cater to a changing world.

TOYO Machinery & Metal Co., Ltd. and HAITIAN GROUP are some of the emerging market participants in the high-pressure die casting equipments market.

-

TOYO Machinery & Metal Co., Ltd. is a prominent Japanese manufacturer specializing in the production and sale of plastic injection molding machines and die-casting machines. Founded in 1948 and headquartered in Akashi, Japan, TOYO has built a strong reputation for its high precision, energy-efficient, and innovative machinery that serves a wide range of industries, including automotive, electronics, and packaging. The company's focus on research and development has led to the creation of advanced technologies such as the "Plastar Greenergy," highlighting its commitment to environmentally friendly manufacturing solutions. With a global footprint, TOYO continues to expand its market presence, offering comprehensive support and services to customers worldwide, thereby reinforcing its position as a leading provider of injection molding and die-casting solutions.

-

HAITIAN GROUP, headquartered in Ningbo, China, is a leading player in the global plastics processing industry, known for its manufacturing of plastic injection molding machines. Since its establishment in 1966, Haitian has grown significantly, becoming the world’s largest manufacturer of injection molding machines by volume. The company operates under the principle of "Technology for the Many, not the Few," focusing on providing efficient, reliable, and cost-effective solutions to its diverse clientele. HAITIAN GROUP's product portfolio is vast, covering a wide range of applications in various sectors, including automotive, consumer goods, and electronic information. The group emphasizes innovation and sustainability, investing heavily in research and development to offer high-precision, energy-saving, and environmentally friendly machinery. With a network of sales and service centers spanning across the globe, HAITIAN GROUP has solidified its position as a key player in fostering the growth and evolution of the plastics industry internationally.

Key High-pressure Die Casting Equipment Companies:

The following are the leading companies in the high-pressure die casting equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Hmt International Limited

- Buhler Group

- TOYO MACHINERY & METAL CO., LTD.

- Norican Group

- Shibaura Machine

- UBE Corporation

- TECHNOLOGY BASE CORPORATION

- Idra Group

- Nantong Hengming Machinary Co., Ltd.

- Lanson

- HAITIAN GROUP

- Dynacast

- Norican Group

Recent Developments

- In October 2023, SA-Foundry sp. z o.o. finalized the creation of a state-of-the-art facility designed to produce premium aluminum alloy castings through the High-Pressure Die Casting (HPDC) method for a new client. This newly established HPDC facility is customized to meet the client's specific needs, enabling them to enhance their output of superior aluminum alloy castings.

High-pressure Die Casting Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.04 billion

Revenue forecast in 2030

USD 2.62 billion

Growth Rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Machine type, application, capacity, category, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Hmt International Limited, Buhler Group, TOYO MACHINERY & METAL CO., LTD., Norican Group, Shibaura Machine, UBE Corporation, TECHNOLOGY BASE CORPORATION, Idra Group, Nantong Hengming Machinary Co., Ltd., Lanson, HAITIAN GROUP, Dynacast, Norican Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-pressure Die Casting Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high-pressure die casting equipment market report on the basis of machine type, application, category, capacity and region:

-

Machine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hot Chamber

-

Cold Chamber

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Electronics

-

Others

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-Automatic

-

Automatic

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 1,000 tons

-

1,001 to 4,000 tons

-

4,001 to 6,000 tons

-

6,001 to 10,000 tons

-

Above 10,000 tons

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global high-pressure die casting equipment market size was estimated at USD 1.98 billion in 2023 and is expected to reach USD 2.04 billion in 2024.

b. The global high-pressure die casting equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 2.62 billion by 2030

b. The automatic category segment accounted for 62.6% of the global high-pressure die casting equipment market revenue share in 2023. These are equipped with advanced control systems that can precisely manage the casting parameters, significantly reducing the margin of error and enhancing the consistency and quality of the produced parts.

b. Some of the key players operating in the high-pressure die casting equipment market include Hmt International Limited, Buhler Group, TOYO MACHINERY & METAL CO., LTD., Norican Group, Shibaura Machine, UBE Corporation, TECHNOLOGY BASE CORPORATION, Idra Group, Nantong Hengming Machinary Co., Ltd., Lanson, HAITIAN GROUP, Dynacast, Norican Group

b. The rising demand for high-pressure die casting equipment is largely driven by the automotive, aerospace, and heavy machinery industries' continuous search for lightweight, high-strength components. This method allows for the production of complex metal parts with excellent surface finish and dimensional accuracy, which is essential in these competitive market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.