- Home

- »

- Catalysts & Enzymes

- »

-

Homogeneous Catalyst Market Size & Share Report, 2030GVR Report cover

![Homogeneous Catalyst Market Size, Share & Trends Report]()

Homogeneous Catalyst Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Metal Based, Chemical Compound, Others), By Application (Environmental, Polymer), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-115-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Homogeneous Catalyst Market Summary

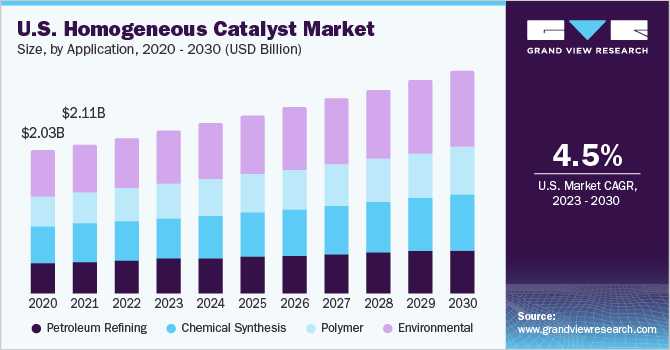

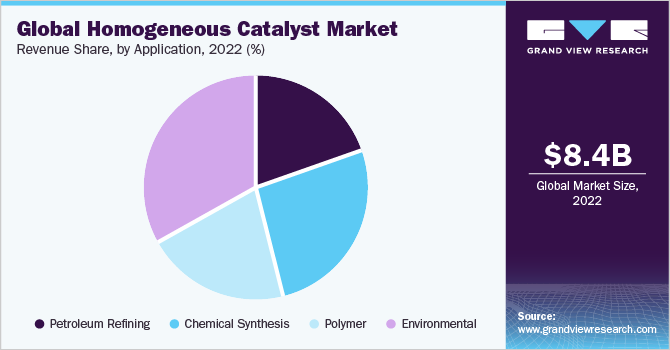

The global homogeneous catalyst market size was valued at USD 8.42 billion in 2022 and is projected to reach USD 12.37 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. This is attributed to the advancing use of the product in variety of chemical reactions across different end use industries for yield improvement, optimization, cost reduction, and energy conservation.

Key Market Trends & Insights

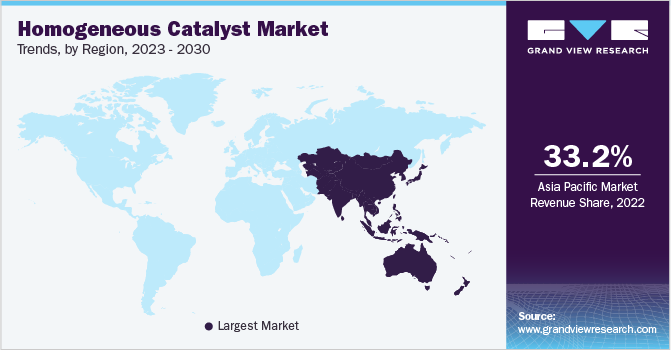

- Asia Pacific dominated the market with a revenue share of 33.2% in 2022.

- North America is another region anticipated to witness growth over the forecast period.

- Based on type, the metal-based type segment dominated the homogeneous catalyst industry with a revenue share of over 53% in 2022.

- In terms of application, the environmental application segment dominated the market with a revenue share of 33.3% in 2022.

- Based on application, chemical synthesis is another segment anticipated to witness growth over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 8.42 billion

- 2030 Projected Market Size: USD 12.37 billion

- CAGR (2023-2030): 4.9%

- Asia Pacific: Largest market in 2022

Their ability to provide better performance in industrial and organic reactions as compared to their heterogeneous alternatives is another factor anticipated to drive the demand for the product over the forecast period. However, these catalytic reactions create huge amounts of toxic waste, causing environmental hazards. This has led to increase in production of biodegradable homogeneous catalysts such as methane sulfonic acid (MSA) to cater to the demand. Homogeneous catalysts are compounds that are used to accelerate chemical reactions by reducing the activation energy required to initiate a reaction. They are majorly used for the esterification of carboxylic acids, which is likely to create a stable demand for the product. In addition, the growing popularity of organometallic compounds for the production of polyethylene and polypropylene is further expected to fuel their demand in the near future.

Enzymes and biocatalysts, which are some popular types of homogeneous catalysts, are being increasingly deployed in the food & beverage and pharmaceutical industries on account of their longer shelf life and eco-friendly nature. Thus, all these factors are anticipated to contribute to the product demand over the forecast period.

The U.S. is a major consumer of the product in North America with revenue share of 80.5% in 2022. This growth is attributed to the expanding end-use industries, including chemical, refinery, and petrochemical. According to the American Chemistry Council, the chemical trade in the U.S. witnessed a growth of around 22.0%, accounting to USD 342.0 billion in 2022. Moreover, the growing gasoline demand in the U.S. is anticipated to contribute to the significance of hydrocracking and FCC (Fluid Catalytic Cracking) activities intended for transforming heavy crude oil to light cuts, thereafter, influencing the overall catalyst market on a positive note.

Type Insights

The metal-based type segment dominated the homogeneous catalyst industry with a revenue share of over 53% in 2022. This is attributable to their ability to be tuned and optimized for specific reactions. Metal-based homogeneous catalysts contain metal complexes as the active catalytic species. The most commonly used metals are transition metals such as iron, nickel, cobalt, copper, ruthenium, rhodium, palladium, and platinum. These metals are chosen for their chemical and physical properties, including redox potential, oxidation state, coordination geometry, and reactivity.

They are often used in organic and chemical synthesis reactions. They catalyze various reactions including hydrogenation, oxidation, isomerization, and various industrial processes such as petroleum refining, polymerization, and fine chemicals production. The metal complexes can be designed and tailored to modify the reaction rate, selectivity, and other process parameters depending on the desired product.

Chemical compound is another segment anticipated to witness growth over the forecast period. One important group of homogeneous catalysts are chemical compound catalysts. They are usually strong acidic compounds such as sulfuric acid, hydrochloric acid, or Lewis acids such as aluminum chloride and boron trifluoride. These catalysts are used extensively in the petrochemical industry for processes such as alkylations, polymerizations, and isomerizations. It operates by donating a proton to the reactant molecule, thereby activating it for subsequent reactions.

Application Insight

The environmental application segment dominated the market with a revenue share of 33.3% in 2022. This growth is attributed to the fact that they help to facilitate chemical reactions that are essential for reducing environmental pollution including industrial and municipal waste treatment and vehicle emission control systems and enhancing sustainability. They help curb pollution and negate many adverse environmental impacts including clean burning of fuels. They are used in catalytic converters, a component of the automobile exhaust system that changes the harmful pollutants in the exhaust gases into less harmful compounds before they are released into the atmosphere leading to better air quality and a healthier environment.

Chemical synthesis is another segment anticipated to witness growth over the forecast period. Homogeneous catalysts are widely used in chemical synthesis to accelerate chemical reactions, increase yields, and enable the production of chemically and economically challenging products. Their use in chemical synthesis can reduce production costs, minimize waste, and promote sustainable chemical synthesis. They are often used in hydrogenation reactions to add hydrogen to organic molecules. This is important in the production of fats, oils, and other organic compounds. Homogeneous catalysts such as transition metal complexes, which can harbor atomic hydrogen, are used to selectively hydrogenate complex molecules to produce the desired products.

In the petroleum refining industry, homogeneous catalysts are used to accelerate the reactions that transform crude oil and other raw materials into useful products such as gasoline, diesel, jet fuel, and lubricants. Their ability to increase reaction rates, reduce energy consumption, and improve product quality has made them essential components in the petroleum refining process such as hydrotreating, alkylation, and catalytic reforming.

In hydrotreating process it is used to remove sulfur and nitrogen compounds in crude oil or hydrocarbon feedstocks. The catalysts facilitate the reaction that transforms sulfurous and nitrogenous compounds into hydrogen sulfide (H2S) and ammonia (NH3) respectively, resulting in cleaner, environmentally friendly fuels. Whereas, in alkylation process it is used to produce high octane gasoline. They catalyze the reaction between isobutane and olefins such as propylene or butene, producing branched-chain hydrocarbons that improve fuel quality. Thus, the wide application of the product is anticipated to drive its demand over the forecast period.

Regional Insights

Asia Pacific dominated the market with a revenue share of 33.2% in 2022. This is attributable to the increasing number of industrial activities in the region. As countries like China and India continue to expand their chemical, pharmaceutical, and petrochemical industries, there is a greater need for catalysts that can help accelerate chemical reactions and improve process efficiency. Homogeneous catalysts are known to provide better performance in industrial and raw material reactions compared to heterogeneous catalysts. Thus, driving the product demand in the region.

North America is another region anticipated to witness growth over the forecast period. The demand for the product in the region is expected to witness significant growth owing to the robust growth of chemical & polymer industry in the region. The presence of major refining companies in the region including Baytown Refinery and Baton Rouge Refinery is expected to further spur the demand over the forecast period.

The region has key petroleum refining manufacturing countries including the U.S. petroleum refining is expected to be a key application segment for the product in North America. Increased oil exploration off the Mexican coasts has resulted in increased product demand in petroleum refining in the past few years and this trend is expected to continue over the forecast period. Moreover, the shale boom in the U.S. has resulted in revival of the refining industry making it internationally competitive, which in turn is expected to drive demand over the period.

Key Companies & Market Share Insights

The market is competitive in nature. Key players penetrating the regions are involved in broadening their product portfolio and global presence. These manufacturing companies undertake various expansions and mergers to meet the rising demand for the product in new geographical markets.

Players are entering into mergers and expansions to establish their position in the market. For instance, in January 2023, Evonik, has consolidated its resources and integrated its alkoxides business with its catalysts business line. As a result, the catalysts business line now boasts an expanded array of homogeneous catalysts alongside its already-extensive range of heterogeneous catalysts. This move is expected to augment the business line's market position, which is identified as one of Evonik's growth areas. Some of the prominent players in the global homogeneous catalyst market include:

-

BASF SE

-

Evonik Industries AG

-

LyondellBasell Industries Holdings B.V.

-

W. R. Grace & Co.-Conn.

-

Johnson Matthey

-

Axens

-

Zeolyst International

-

Clariant

-

Umicore

-

Synthesis with Catalysts Pvt. Ltd

-

Heraeus Holding

Homogeneous Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.83 billion

Revenue forecast in 2030

USD 12.37 billion

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

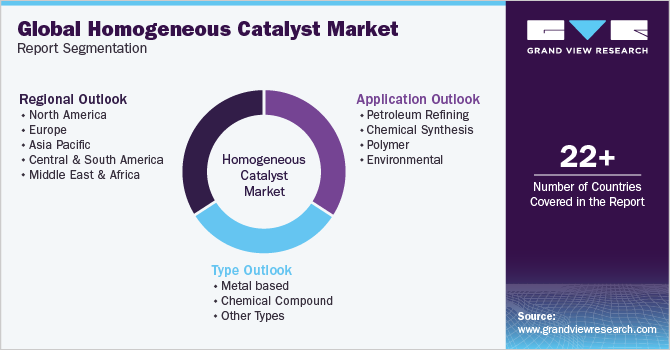

Segments covered

Type, Application, Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Netherlands; China; India; Japan; South Korea; Malaysia, Indonesia, Australia; Brazil; Saudi Arabia; South Africa

Key companies profiled

BASF SE, Evonik Industries AG, LyondellBasell Industries Holdings B.V., W. R. Grace & Co.-Conn., Johnson Matthey, Axens, Zeolyst International, Clariant, Umicore, Synthesis with Catalysts Pvt. Ltd, Heraeus Holding

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Homogeneous Catalyst Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global homogeneous catalyst market report on the basis of product, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Metal based

-

Chemical Compound

-

Other Types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Petroleum Refining

-

Chemical Synthesis

-

Polymer

-

Environmental

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global homogeneous catalyst market size was estimated at USD 8.42 billion in 2022 and is expected to reach USD 8.83 billion in 2023.

b. The global homogeneous catalyst market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 12.37 billion by 2030.

b. Asia Pacific dominated the market with a revenue share of 33.2% in 2022. This is attributable to the increasing number of industrial activities in the region. As countries like China and India continue to expand their chemical, pharmaceutical, and petrochemical industries, there is a greater need for catalysts that can help accelerate chemical reactions and improve process efficiency.

b. Some key players operating in the homogeneous catalyst market include BASF SE, Evonik Industries AG, LyondellBasell Industries Holdings B.V., W. R. Grace & Co.-Conn., Johnson Matthey, Axens, Zeolyst International, Clariant, Umicore, Synthesis with Catalysts Pvt. Ltd, Heraeus Holding

b. Key factors that are driving the market growth include advancing use of the product in variety of end-use industries for yield improvement, optimization, cost reduction, and energy conservation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.