- Home

- »

- Plastics, Polymers & Resins

- »

-

Honeycomb Packaging Market Size, Industry Report, 2033GVR Report cover

![Honeycomb Packaging Market Size, Share & Trends Report]()

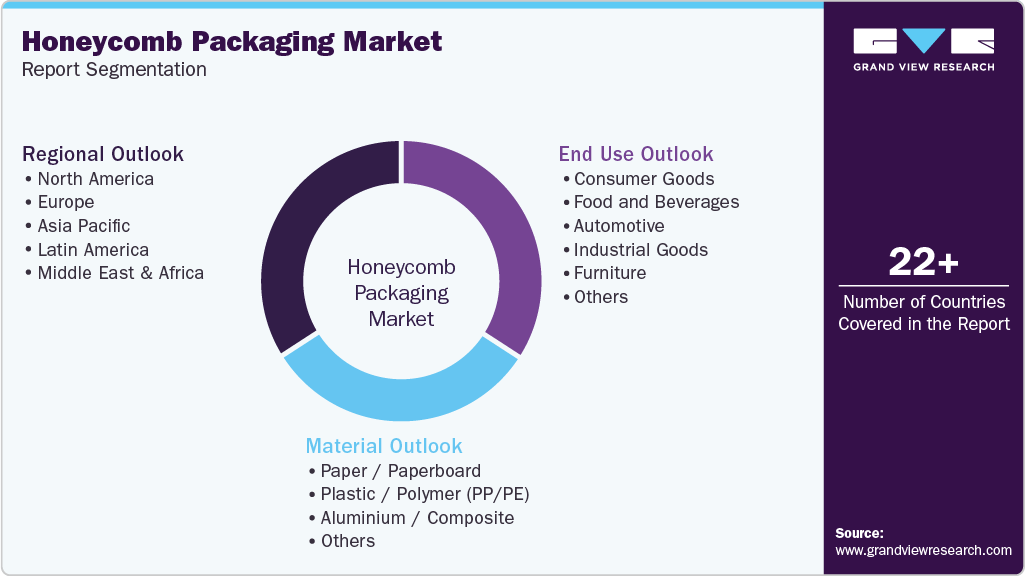

Honeycomb Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Paper / Paperboard, Plastic / Polymer (PP/PE), Aluminium / Composite), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-830-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Honeycomb Packaging Market Summary

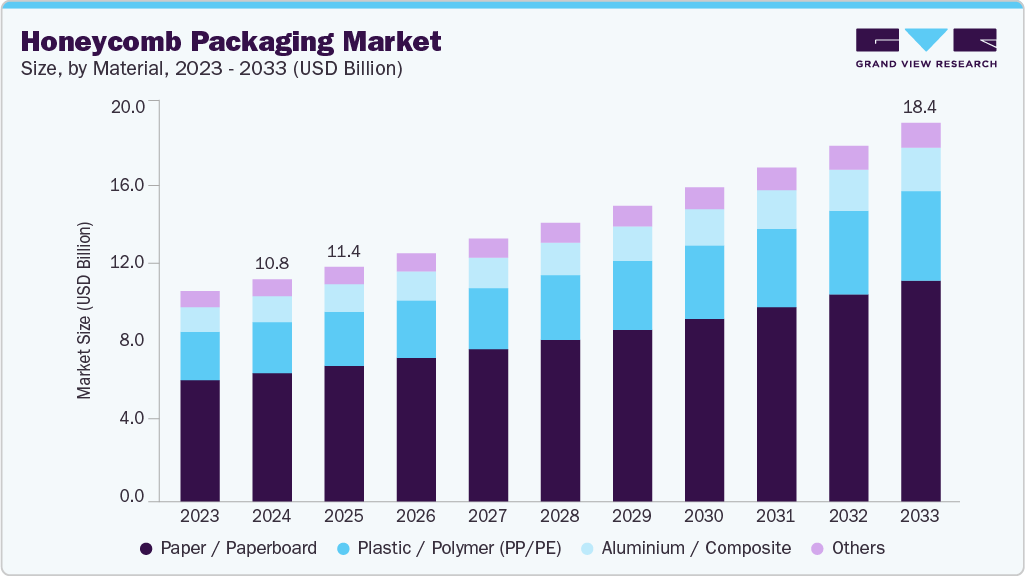

The global honeycomb packaging market size was valued at USD 10.80 billion in 2024 and is expected to reach USD 18.43 billion by 2033, expanding at a CAGR of 6.2% from 2025 to 2033. Rising demand for sustainable, lightweight, and recyclable packaging solutions across e-commerce, automotive, and industrial sectors is driving the honeycomb packaging market.

Key Market Trends & Insights

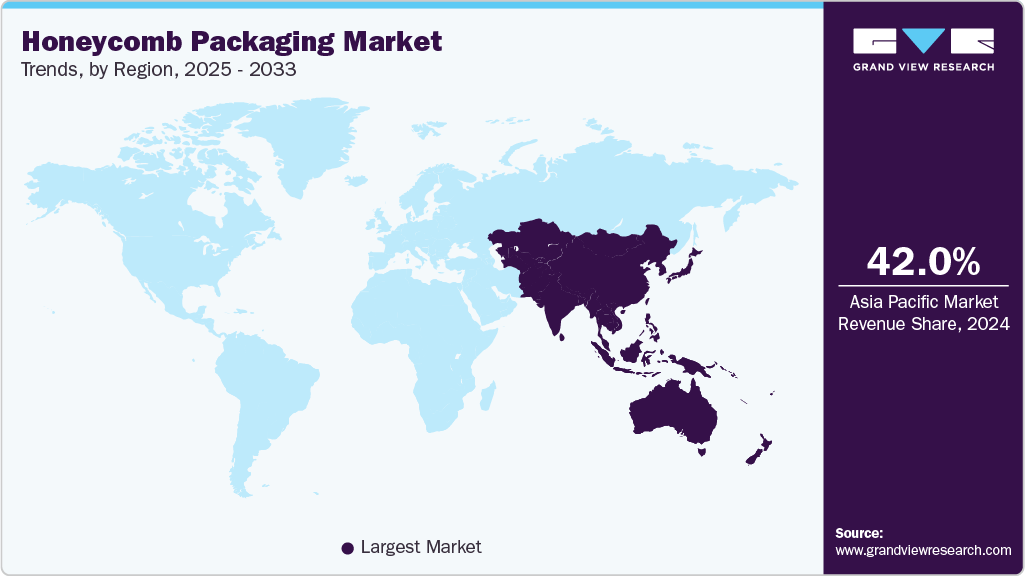

- Asia Pacific dominated the honeycomb packaging market with the largest revenue share of over 42.0% in 2024.

- The honeycomb packaging market in U.S. is expected to grow at a substantial CAGR of 6.4% from 2025 to 2033.

- By material, the plastic / polymer (PP/PE) segment is expected to grow at a considerable CAGR of 6.5% from 2025 to 2033 in terms of revenue.

- By end use, the consumer goods segment is expected to grow at a considerable CAGR of 6.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 10.80 Billion

- 2033 Projected Market Size: USD 18.43 Billion

- CAGR (2025-2033): 6.2%

- Asia Pacific: Largest market in 2024

Additionally, its superior cushioning and load-bearing properties reduce transportation damage and logistics costs, supporting market growth. Honeycomb packaging is made from recyclable kraft paper and offers a strong alternative to plastic-based cushioning materials such as EPS foam and bubble wrap. As environmental regulations tighten, particularly in North America and Europe, manufacturers across industries are actively shifting toward biodegradable solutions. For example, global companies in e-commerce and furniture packaging are adopting honeycomb boards and paper wraps to meet sustainability commitments and reduce carbon emissions. This shift not only enhances brand perception but also supports circular economy initiatives.

Rising applications across high-impact industries are boosting adoption of honeycomb packaging. The automotive, electronics, aerospace, and heavy goods sectors require protective packaging that can withstand compression, shock, and vibration during transport. Honeycomb structures provide high strength-to-weight ratio, making them ideal for packaging sensitive components such as vehicle parts, large glass sheets, and industrial machinery. Moreover, the growing global industrial logistics sector is accelerating demand for secondary and tertiary packaging solutions that ensure product safety while optimizing transportation efficiency.

Growth of e-commerce and the need for cost-effective protective packaging further propel market expansion. Online retail drives higher parcel shipping volumes, increasing the need for lightweight yet durable material to reduce freight costs. Honeycomb packaging is cost-efficient due to low raw material cost and provides customization flexibility for various product shapes and sizes. Companies are increasingly implementing honeycomb pallets, edge protectors, and mailer inserts to reduce damage rates in last-mile delivery. Additionally, the rise of furniture e-commerce players such as IKEA and Wayfair has expanded the usage of honeycomb cores in both protective packaging and as lightweight structural components in ready-to-assemble products.

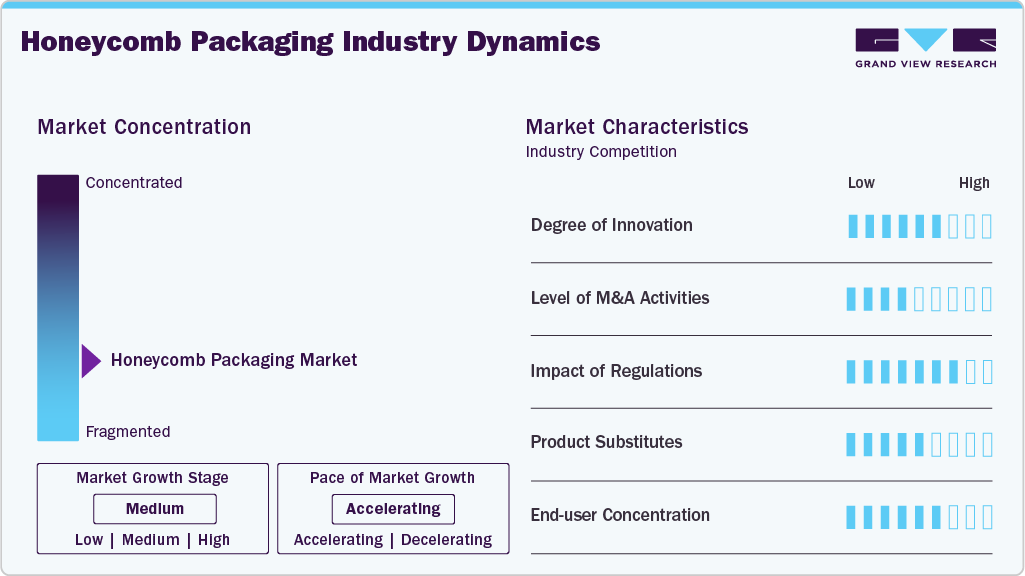

Market Concentration & Characteristics

The honeycomb packaging industry is shaped by its strong focus on sustainability and material optimization. As global demand increases for environmentally responsible packaging, honeycomb solutions offer a recyclable and biodegradable alternative to plastics and foam-based cushioning. The manufacturing process is cost-efficient due to the use of widely available kraft paper and carton board, supporting circular economy practices and helping end users comply with environmental regulations and corporate sustainability targets.

The market is moderately fragmented with a mix of global suppliers and regional manufacturers providing tailored solutions. Supply chain reliability, design expertise, and localized service are competitive differentiators as end users seek speed, cost efficiency, and reduced product damage during logistics. Continuous innovation, including automated production technologies and improved digital design tools, is enhancing product performance and operational productivity. The industry is highly solution-driven, with vendors working closely with clients to develop packaging systems that meet specific load-bearing, vibration resistance and shipping requirements.

Material Insights

The paper / paperboard segment recorded the largest market revenue share of over 57.0% in 2024.Paper and paperboard are the most widely used materials for honeycomb packaging due to their lightweight structure, environmental compatibility, and superior cushioning properties. They are typically manufactured using kraft paper or recycled fibers, making them economical and sustainable. These materials are extensively used for protective packaging, edge protectors, pallets, and filler structures across industries such as furniture, automotive, appliances, and e-commerce.

The plastic / polymer (PP/PE) segment is expected to grow at the fastest CAGR of 6.5% during the forecast period. PP and PE-based honeycomb structures are used in applications requiring enhanced moisture resistance, durability, and reusability. These plastic honeycomb sheets demonstrate high tensile strength, chemical resistance, and stability across temperature variations, making them suitable for automotive trunk liners, industrial reusable packaging, aviation interiors, and sports equipment.

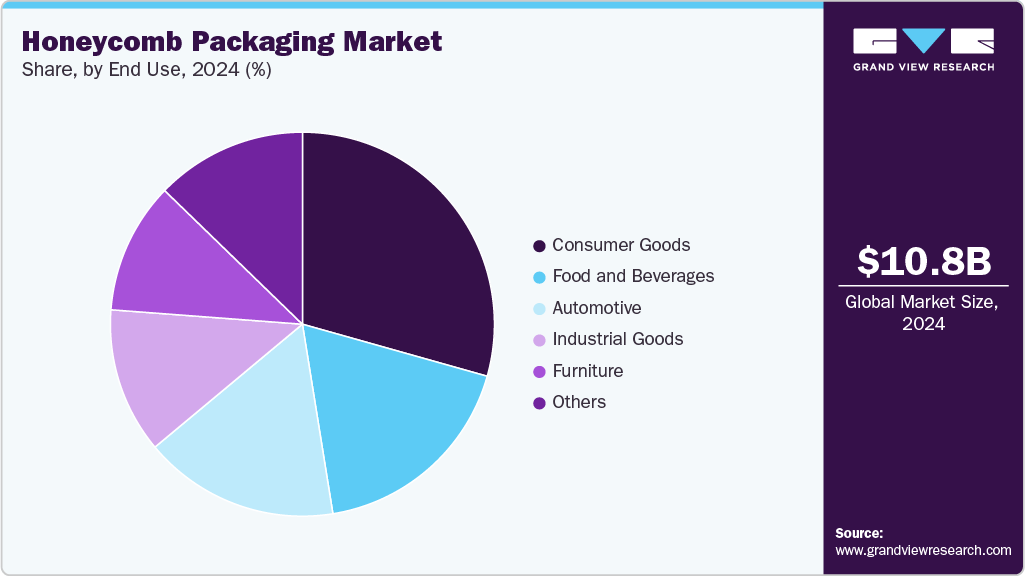

End Use Insights

The consumer goods segment recorded the largest market share of over 29.0% in 2024 and is projected to grow at the fastest CAGR of 6.5% during the forecast period.Consumer goods manufacturers increasingly adopt honeycomb packaging due to its lightweight structure, cushioning performance, and cost efficiency. It is widely used for packaging electronics, small appliances, ceramics, cosmetics, and personal care products where impact resistance and surface protection are critical. Honeycomb boards and wraps provide sustainable solutions by replacing expanded foam and rigid plastics in retail and e-commerce shipments.

Honeycomb packaging is used in bulk food handling, protective transport of beverage bottles, and secondary packaging for processed foods. Pallet skirts, separators, and dividers made from honeycomb boards prevent breakage and ensure stability during warehousing and distribution. In beverage logistics, honeycomb trays effectively protect glass bottles and can replace molded pulp or corrugated partitions. The growing cold-chain supply network also benefits from moisture-resistant and high-strength honeycomb inserts. Rising consumption of packaged food & beverages, increasing grocery e-commerce, and regulatory pressure to reduce single-use plastics are pushing manufacturers to adopt sustainable protective packaging.

Region Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 42.0% in 2024 and is witnessing strong growth as it expected to grow at the fastest CAGR of 6.5% during the forecast period. The region dominates the market due to rapid industrial expansion and increasing demand for sustainable packaging solutions. Growth in e-commerce, consumer goods, and electronics manufacturing fuels strong consumption of protective packaging in China, India, South Korea, and Southeast Asia. The region’s competitive manufacturing base and cost-effective paper production support large-scale honeycomb core output at lower prices. Additionally, government initiatives promoting reduction of plastics and increased recycling are propelling adoption of paper-based honeycomb structures.

China Honeycomb Packaging Market Trends

China is the largest producer and consumer of honeycomb packaging in Asia, supported by abundant paper supply, economies of scale in paper processing, and low-cost manufacturing capabilities. Growth in exports of electronics, furniture, and consumer goods drives high-volume usage of protective honeycomb inserts, corner boards, and pallets for safe shipment.

North America Honeycomb Packaging Market Trends

North America is driven by high emphasis on product protection and logistics cost optimization in retail, automotive, and industrial equipment supply chains. Adoption of lightweight and fully recyclable honeycomb solutions has grown significantly with rising e-commerce parcel volume. Manufacturers in the region are investing in automated production technology to provide customized, performance-driven honeycomb structures for specialized industries such as aerospace and electronics. Sustainability is a key factor contributing to expansion in the region. U.S.-based customers increasingly prefer packaging formats that reduce foam and plastic usage while complying with corporate sustainability goals.

The U.S. honeycomb packaging market drives the North America market based on strong industrial logistics networks and high-performance functional packaging requirements. Major end users like automotive, aerospace, industrial machinery, and household goods rely on honeycomb because of its exceptional compression resistance and lightweight transport benefits. The country also has a mature supply chain with major corporate customers willing to adopt premium sustainable solutions.

Europe Honeycomb Packaging Market Trends

Europe leads in regulatory enforcement focused on circular economy requirements and packaging waste reduction. Strong policy support in the European Union accelerates the shift from traditional cushioning to paper-based engineered packaging. Additionally, Europe has a strong industrial base across automotive manufacturing, machinery exports, and high-end furniture production, all of which require durable protective packaging solutions. Major manufacturers such as DS Smith and Smurfit Kappa drive innovation with lightweight paper honeycomb systems tailored for heavy-duty transport. Design-driven sustainability initiatives in Germany, the Nordics, and Benelux further strengthen regional leadership.

Key Honeycomb Packaging Company Insights

The competitive environment of the honeycomb packaging market is moderately fragmented, with a mix of global packaging leaders and regional specialists competing through cost efficiency, product customization, and sustainability performance. Companies differentiate by enhancing structural strength, expanding automated production capabilities, and offering tailored solutions for high-volume industries such as furniture, automotive, and industrial logistics.

Strategic partnerships, regional capacity expansions, and selective mergers support efforts to improve market presence and supply chain reach. Competitive pressure is heightened by substitute materials such as corrugated boards and foam, pushing suppliers to focus on innovation, lightweighting, cost optimization, and environmental compliance to secure long-term demand.

-

In September 2024, DS Smith announced a significant investment of USD 19.57 million in its packaging facility located in Korinthos, Greece. This investment aims to drive sustainable packaging innovation and increase the facility's production capacity by 30%.

-

In July 2023, Orora, an Australia-based packaging group, signed a partnership to become the exclusive North American distributor of a patented honeycomb fiber-protective packaging system developed by Flexi‑Hex. This shows increasing focus on distribution alliances in North America for sustainable honeycomb solutions.

Key Honeycomb Packaging Companies:

The following are the leading companies in the honeycomb packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Smurfit Westrock

- Signode Industrial Group LLC

- Packaging Corporation of America

- DS Smith

- Axxor

- Ficus Pax Pvt. Ltd.

- BENZ Packaging

- Coastal Container

- Sonoco Products Company

- Cascades Inc.

- Rebul

Global Honeycomb Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.41 billion

Revenue forecast in 2033

USD 18.43 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Smurfit Westrock; Signode Industrial Group LLC; Packaging Corporation of America; DS Smith; Axxor; Ficus Pax Pvt. Ltd.; BENZ Packaging; Coastal Container; Sonoco Products Company; Cascades Inc.; Rebul

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Honeycomb Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global honeycomb packaging market report based on material, end use, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Paper / Paperboard

-

Plastic / Polymer (PP/PE)

-

Aluminium / Composite

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Goods

-

Food and Beverages

-

Automotive

-

Industrial Goods

-

Furniture

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global honeycomb packaging market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach around USD 18.43 billion by 2033.

b. The global honeycomb packaging market was estimated at around USD 10.80 billion in the year 2024 and is expected to reach around USD 11.41 billion in 2025.

b. The consumer goods segment dominated the end-use segment of the honeycomb packaging market due to the growing demand for lightweight, cost-efficient, and highly protective packaging solutions that ensure product safety during high-volume e-commerce and retail distribution.

b. The key players in the honeycomb packaging market include Smurfit Westrock; Signode Industrial Group LLC; Packaging Corporation of America; DS Smith; Axxor; Ficus Pax Pvt. Ltd.; BENZ Packaging; Coastal Container; Sonoco Products Company; Cascades Inc.; and Rebul.

b. Rising demand for sustainable, lightweight, and recyclable packaging solutions across e-commerce, automotive, and industrial sectors is driving the honeycomb packaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.