- Home

- »

- Automotive & Transportation

- »

-

Hydraulics Market Size And Share, Industry Report, 2033GVR Report cover

![Hydraulics Market Size, Share & Trends Report]()

Hydraulics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Mobile Hydraulics, Industrial Hydraulics), By Component (Cylinders, Motors, Pumps, Accumulators, Control Valves), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-746-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydraulics Market Summary

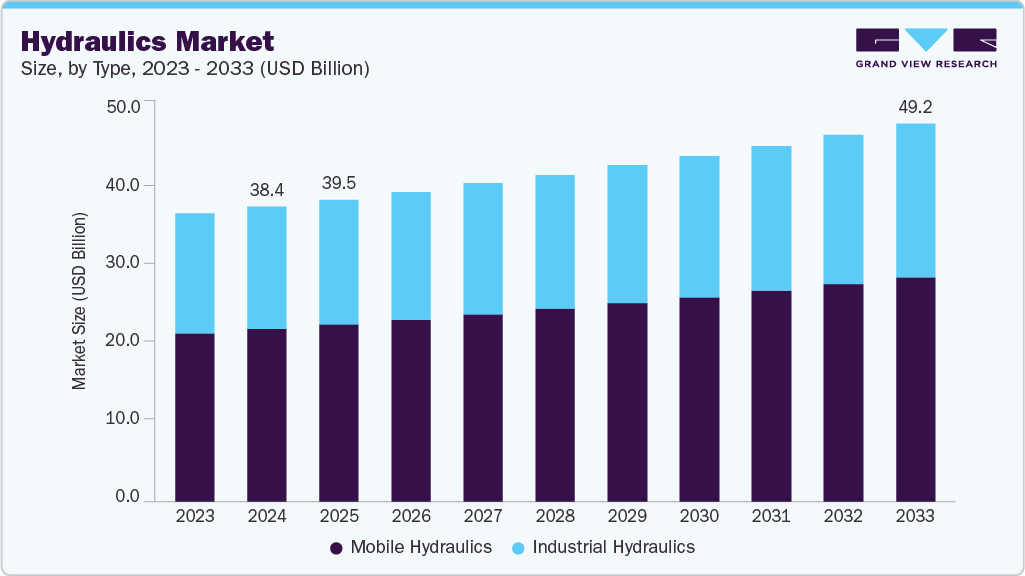

The global hydraulics market size was estimated at USD 38.39 billion in 2024 and is projected to reach USD 49.23 billion by 2033, growing at a CAGR of 2.8% from 2025 to 2033. The market growth is primarily driven by the increasing deployment of hydraulic systems in industrial automation and construction equipment, rising investments in infrastructure development across emerging economies, growing demand for energy-efficient and low-maintenance hydraulic solutions, ongoing advancements in hydraulic components such as pumps, valves, and actuators, and the integration of electro-hydraulic systems for enhanced precision and control in manufacturing and mobile applications.

Key Market Trends & Insights

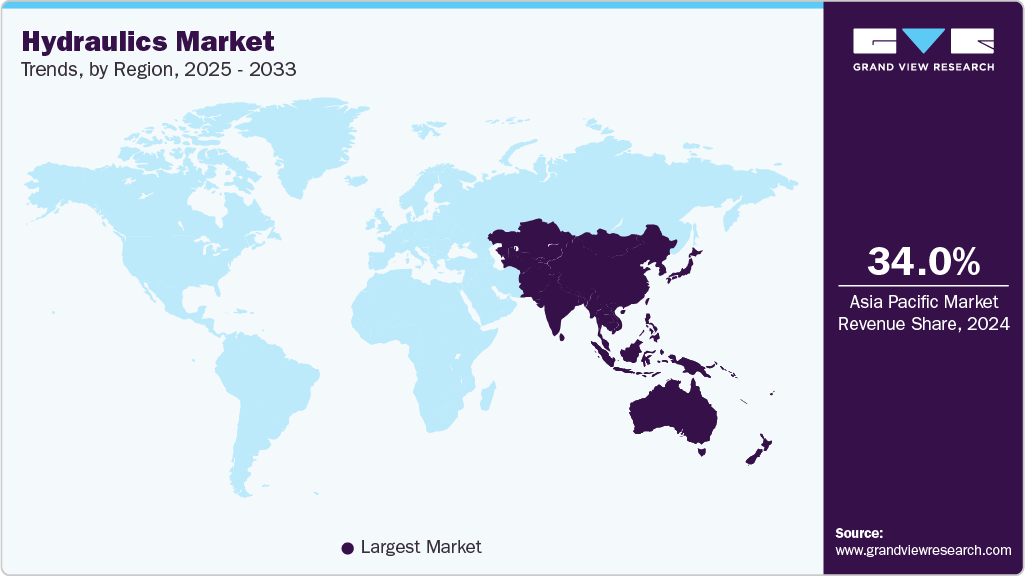

- Asia Pacific dominated the global hydraulics market with the largest revenue share of over 34% in 2024.

- The hydraulics market in China led the Asia Pacific market and held the largest revenue share in 2024.

- By type, the mobile hydraulics segment led the market and held the largest revenue share of over 58% in 2024.

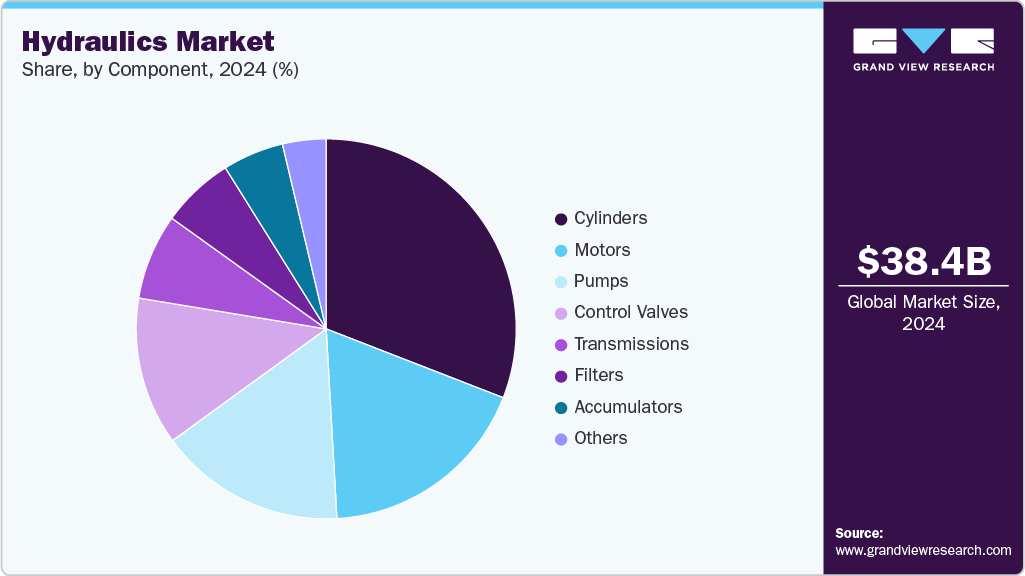

- By component, the cylinders segment led the market and held the largest revenue share of over 30% in 2024.

- By end-use, the construction segment dominates the market and holds the largest revenue share of over 39% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.39 Billion

- 2033 Projected Market Size: USD 49.23 Billion

- CAGR (2025-2033): 2.8%

- Asia Pacific: Largest market in 2024

The market growth is primarily driven by the increasing demand for energy-efficient hydraulic systems across industries such as construction, agriculture, and manufacturing. The growing adoption of automation and smart technologies in industrial machinery is fueling demand for an advanced, responsive hydraulic industry. The integration of IoT and predictive maintenance technologies are significantly enhancing system reliability and minimizing downtime, making hydraulic solutions more appealing for critical operations. The shift toward electrification in mobile equipment and hybrid systems also drives innovation in hydraulic design. The emphasis on sustainability and compliance with environmental regulations is pushing manufacturers to develop eco-friendly, low-leakage, and recyclable hydraulic products, which is expected to drive the hydraulics industry expansion.The rising demand for automation and precision in industrial operations is significantly fueling the growth of the hydraulics market. Industries such as manufacturing, construction, and agriculture are increasingly adopting hydraulic systems to enhance operational efficiency, reduce human intervention, and achieve consistent performance. As factories and equipment become smarter and more automated, hydraulics offer robust solutions for precise movement control and high-power density applications. This shift toward automation is expanding the customer base and driving continuous innovation in hydraulic systems and components.

In addition, the increasing emphasis on energy-efficient and eco-friendly solutions is becoming a major growth driver for the hydraulics market. Traditional hydraulic systems are often criticized for energy loss and fluid leakage; however, advancements such as electro-hydraulic systems and load-sensing technologies are addressing these challenges. Growing regulatory pressures and sustainability targets are driving industries to invest in hydraulic solutions that consume less energy and reduce environmental impact. These developments are enhancing the market's appeal and driving adoption across sectors.

Furthermore, the integration of IoT and smart sensor technologies is revolutionizing the capabilities of hydraulic systems. These advanced technologies enable real-time monitoring, predictive maintenance, and adaptive control, transforming conventional hydraulics into intelligent systems. By reducing downtime, optimizing performance, and extending equipment life, smart hydraulics are becoming indispensable in high-performance industrial settings. As these technologies become more accessible, they are accelerating the modernization of legacy hydraulic infrastructure, thereby boosting market growth.

Moreover, increasing collaboration between OEMs (Original Equipment Manufacturers) and hydraulic solution providers is enhancing the development of specialized hydraulic systems. These partnerships lead to custom-engineered products, tailored control algorithms, and innovative materials that meet specific application requirements in sectors such as aerospace, defense, mining, and offshore drilling. The synergy between equipment manufacturers and hydraulic technology developers is accelerating product innovation and expanding adoption, thereby fueling growth in the global hydraulics market.

Type Insights

The mobile hydraulics segment dominated the market with a market share of over 58% in 2024, owing to the extensive deployment of hydraulic systems in off-road and heavy-duty mobile machinery such as construction equipment, agricultural tractors, and mining vehicles. The dominance is further driven by the increasing demand for fuel-efficient, compact, and high-torque hydraulic components that can operate reliably in rugged and remote environments. The rapid pace of infrastructure development and mechanization in emerging markets, along with government investments in smart farming and construction, reinforces the segment’s leadership in the hydraulics industry.

The industrial hydraulics segment is expected to witness a significant CAGR of over 2.6% from 2025 to 2033. This growth is attributed to the rising automation of manufacturing processes and the demand for high-performance hydraulic systems in precision-intensive industries. The segment is further driven by the growing integration of Industry 4.0 practices, including smart sensors and real-time monitoring systems, which enhance operational efficiency and predictive maintenance. The affordability and scalability of modular hydraulic components are also encouraging widespread adoption across small and medium-sized enterprises. Innovations in energy-efficient hydraulic systems and the increasing use of electro-hydraulic solutions in factory settings are contributing to the segment’s rapid expansion.

Component Insights

The cylinders segment accounted for the largest market share in 2024, owing to the consistent rise in demand for high-performance and durable actuation systems across construction and material handling industries. As infrastructure development and mechanized farming practices accelerate globally, OEMs and equipment manufacturers are increasingly adopting hydraulic cylinders for their superior force output and compact design. The growing adoption of electro-hydraulic systems, which combine electronic controls with hydraulic actuators, is further enhancing precision and energy efficiency in off-road and industrial machinery. The trend toward automation in heavy equipment is driving the integration of smart cylinders equipped with position sensors and feedback control, reinforcing their dominance in the hydraulic industry.

The transmissions segment is expected to witness the fastest CAGR from 2025 to 2033. This growth is driven by the increasing adoption of automated and precision-based hydraulic systems across industries. As equipment becomes more compact and powerful, there's a rising demand for high-efficiency hydraulic transmissions that can handle variable loads with minimal energy loss. The shift toward electrified and hybrid machinery in response to sustainability goals is creating new opportunities for advanced hydraulic transmissions, which offer smoother power delivery and better fuel efficiency, accelerating investment in this high-growth component category.

End-use Insights

The construction segment accounted for the largest market share in 2024, owing to the rising adoption of advanced hydraulic systems in heavy machinery and infrastructure development projects worldwide. Hydraulics enable these machines to deliver greater power density, precise control, and energy efficiency, making them essential in modern construction workflows. These technological advancements, combined with the rising demand for automation and productivity on construction sites, are fueling the dominance of the construction segment in the hydraulics industry.

The marine segment is expected to witness the fastest CAGR from 2025 to 2033, driven by the growing need for advanced hydraulic systems in offshore support vessels, submarines, dredgers, and autonomous surface crafts. The demand for precise and reliable motion control in challenging deep-sea environments is pushing maritime operators toward high-performance hydraulic technologies. Rising investments in naval modernization, offshore energy projects, and maritime safety regulations are further propelling the shift toward next-generation hydraulic market.

Regional Insights

Asia Pacific dominated the global hydraulics market with the largest revenue share of over 34% in 2024, driven by rapid industrialization, expanding infrastructure development, and increasing investment in the construction and manufacturing sectors. Government-led initiatives such are boosting demand for advanced hydraulic machinery. The rise in smart city projects and automation in agriculture and mining is further propelling the adoption of hydraulic market in the Asia Pacific region.

Hydraulics market in Japan is gaining traction, driven by the country's advanced manufacturing sector, infrastructure, and strong focus on automation and robotics. Japan being a global leader in precision engineering and industrial automation, has a high demand for efficient and compact hydraulic systems. Government initiatives promoting smart factories and infrastructure renewal are further propelling the adoption of energy-efficient and intelligent hydraulic technologies. The country's emphasis on disaster-resilient construction is supporting the growth of the hydraulics market.

The China hydraulics market is witnessing robust growth, driven by the country’s rapid industrialization and infrastructure development. The expansion of sectors such as construction, automotive, and heavy machinery is fueling demand for advanced hydraulic systems that offer efficiency and precision. With continuous investments in high-tech equipment and localized manufacturing capabilities, China is emerging as a key growth engine for the global hydraulics market.

North America Hydraulics Market Trends

The North America hydraulics market accounted for the significant market share of over 30% in 2024, primarily driven by the region’s strong presence of industrial automation, a well-established manufacturing base, and ongoing infrastructure modernization. The expansion of shale oil and gas exploration in North America is driving the need for durable and high-performance hydraulic equipment in drilling rigs and hydraulic fracturing operations. The focus on sensor-based predictive maintenance is encouraging industries to upgrade their existing hydraulic infrastructure with intelligent and environmentally sustainable solutions, thereby accelerating market growth in the region.

U.S. Hydraulics Market Trends

The U.S. hydraulics market is expected to grow at a CAGR of over 2% from 2025 to 2033, driven by the country’s robust industrial base, advanced manufacturing infrastructure, and increasing investments in automation technologies. The rising adoption of hydraulic equipment in sectors such as construction, aerospace, defense, and agriculture is fueling market demand. Supportive government initiatives aimed at revitalizing domestic manufacturing and infrastructure development are further propelling the growth of the hydraulics industry across the U.S.

Europe Hydraulics Market Trends

The Europe hydraulics market is expected to grow at a CAGR of over 2% from 2025 to 2033. In Europe, the hydraulics market is driven by the region’s strong focus on energy efficiency and sustainable manufacturing practices. The European Union’s stringent environmental regulations and initiatives such as the Green Deal are prompting industries to adopt next-generation hydraulic systems with lower emissions and higher efficiency. Rising investments in infrastructure development, especially in Eastern and Central Europe. The presence of leading OEMs and a well-established engineering ecosystem further supports innovation and growth in the regional hydraulics market.

Hydraulics market in the UK is expected to grow at a significant rate during the forecast period. The market is benefiting from a robust manufacturing base and strong engineering heritage. Increased investments in infrastructure projects, renewable energy, and smart factories drive demand for efficient, high-performance hydraulic systems. The presence of skilled workforce in fluid power engineering is fostering innovation and adoption of next-generation hydraulic solution across sectors such as aerospace, defense, and construction.

The Germany hydraulics market is driven by the country's strong industrial base, advanced manufacturing capabilities, and growing focus on automation and energy efficiency. With its leadership in engineering and machinery exports, Germany is heavily investing in modern hydraulic systems to support sectors such as automotive, construction, and renewable energy. In addition, government initiatives promoting Industry 4.0 and sustainable technologies are accelerating the adoption of smart and eco-efficient hydraulic industry across German industries.

Key Hydraulics Company Insights

Some of the key players operating in the market include Bosch Rexroth AG and PARKER HANNIFIN CORP among others.

-

Bosch Rexroth AG is a leading global provider of drive and control technologies, recognized for its comprehensive range of hydraulic components and systems. The company offers high-performance solutions including hydraulic pumps, motors, valves, cylinders, and integrated systems used across industrial automation, mobile equipment, and manufacturing sectors. Known for its focus on energy efficiency and digital connectivity, Bosch Rexroth integrates smart technologies such as IoT and Industry 4.0 into its hydraulic offerings to enable predictive maintenance and optimized performance. Its strong R&D capabilities and global service network make it a foundational player in driving innovation within the hydraulics industry.

-

Parker Hannifin Corporation is a prominent manufacturer of motion and control technologies, including a robust line of hydraulic products for industrial and mobile applications. Its hydraulics division supplies a diverse portfolio of valves, pumps, cylinders, motors, and filtration systems tailored for use in agriculture, construction, aerospace, and manufacturing industries. Parker’s advanced hydraulic solutions emphasize durability, efficiency, and system integration, often incorporating smart controls and diagnostics. With a vast global footprint Parker Hannifin plays a critical role in shaping the evolution of modern hydraulic industry.

Wipro Infrastructure Engineering and LHY Powertrain GmbH & Co. KG. are some of the emerging market participants in the hydraulics market.

-

Wipro Infrastructure Engineering is an emerging global player in the hydraulics market, specializing in the design and manufacture of precision-engineered hydraulic cylinders and actuators. With strong engineering capabilities and a growing global footprint including manufacturing facilities in India, Europe, and China Wipro is leveraging advanced automation and smart manufacturing practices to deliver high-performance hydraulic solutions. Its focus on innovation, reliability, and customer-centric customization is positioning it as a fast-scaling player in the global hydraulics landscape.

-

LHY Powertrain GmbH & Co. KG is a dynamic German company developing innovative hydraulic and powertrain solutions tailored for modern off-highway and industrial applications. Combining mechanical engineering excellence with a sustainability-driven approach, LHY focuses on hybrid and energy-efficient hydraulic systems designed to meet the needs of electrified and compact machinery. Though relatively young, the company is gaining recognition for its flexible development processes, advanced R&D, and strategic collaborations within Europe. Its focus on next-generation, smart hydraulic technologies marks LHY as a promising emerging player in the evolving hydraulics market.

Key Hydraulics Companies:

The following are the leading companies in the hydraulics market. These companies collectively hold the largest market share and dictate industry trends.

- Bosch Rexroth AG

- PARKER HANNIFIN CORP

- Eaton.

- Danfoss

- KYB Corporation.

- YUKEN KOGYO CO., LTD.

- Kawasaki Heavy Industries, Ltd.

- HYDAC International GmbH.

- LHY Powertrain GmbH & Co. KG.

- Wipro Infrastructure Engineering

Recent Developments

-

In June 2025, Parker Hannifin Corp announced significant advancements in its hydraulics portfolio, unveiling high-efficiency, low-emission solutions tailored for modern mobile machinery. Key highlights included the launch of the NX8xHM electro-hydraulic pump for 48 V systems and integrated electrification platforms that enhance digital control and energy optimization. The company introduced a new Hydraulic Actuator Division under its Cylinder Central platform, alongside a hybrid actuator sizing tool and a telescopic dump cylinder stocking initiative. These developments are designed to streamline system integration, boost performance, and support sustainability efforts, thereby enhancing productivity and innovation in the hydraulics industry.

-

In February 2025, Eaton introduced a new Bezares dump pump and a variable-flow load-sensing pump as part of its expanded mobile hydraulics product line. Designed for high-efficiency performance, the dump pump supports pressures up to 3,200 psi and features selectable rotation and compact PTO mounting. By addressing key performance demands in mobile machinery, Eaton’s new offerings significantly improve energy efficiency and reliability in the hydraulics market.

-

In February 2025, Bosch Rexroth AG unveiled a comprehensive suite of electrified and digital hydraulic solutions aimed at transforming the hydraulics market. The launch featured the scalable BODAS ecosystem with Collision Avoidance System hardware and software, modular eLION electrification kits including the EML1 inverter and motors. These innovations are designed to enhance safety, energy efficiency, and system integration across industrial and mobile hydraulic applications.

Hydraulics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.35 billion

Revenue forecast in 2033

USD 49.23 billion

Growth rate

CAGR of 2.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

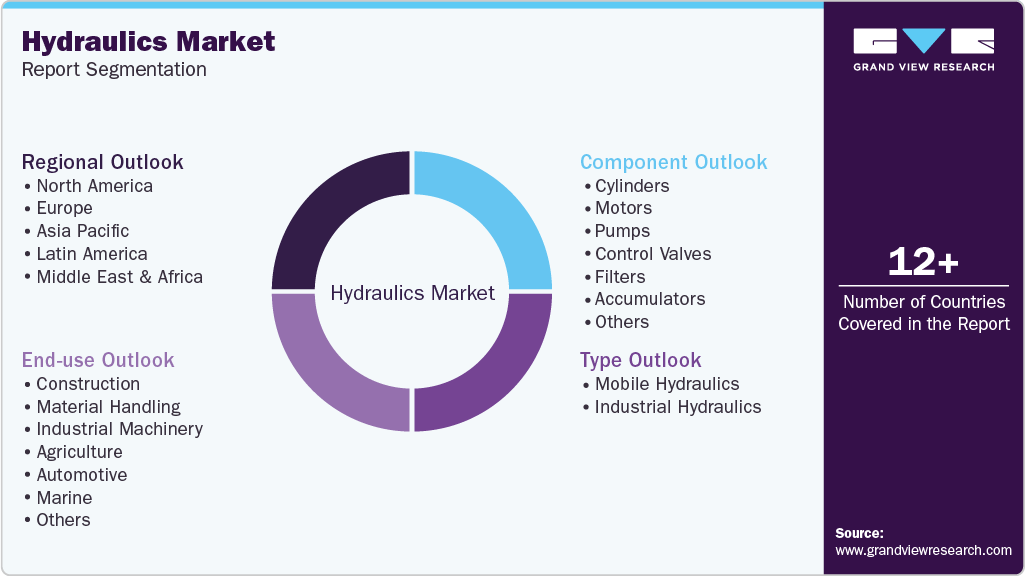

Segments covered

Type, component, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Bosch Rexroth AG; PARKER HANNIFIN CORP; Eaton; Danfoss; KYB Corporation; YUKEN KOGYO CO. LTD.; Kawasaki Heavy Industries, Ltd.; HYDAC International GmbH.; LHY Powertrain GmbH & Co. KG.; Wipro Infrastructure Engineering

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Hydraulics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the hydraulicsmarket report based on type, component, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Mobile Hydraulics

-

Industrial Hydraulics

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Cylinders

-

Motors

-

Pumps

-

Control Valves

-

Filters

-

Accumulators

-

Transmissions

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction

-

Material Handling

-

Industrial Machinery

-

Agriculture

-

Automotive

-

Marine

-

Oil and Gas

-

Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydraulics market size was estimated at USD 38.39 billion in 2024 and is expected to reach USD 39.35 billion in 2025.

b. The global hydraulics market is expected to grow at a compound annual growth rate of 2.8% from 2025 to 2033 to reach USD 49.23 billion by 2033.

b. The mobile hydraulics segment dominated the market with a market share of over 58% in 2024, owing to the extensive deployment of hydraulic systems in off-road and heavy-duty mobile machinery such as construction equipment, agricultural tractors, and mining vehicles.

b. Key players operating in the smart building market include Bosch Rexroth AG, PARKER HANNIFIN CORP, Eaton, Danfoss, KYB Corporation, YUKEN KOGYO CO., LTD., Kawasaki Heavy Industries, Ltd., HYDAC International GmbH., LHY Powertrain GmbH & Co. KG., Wipro Infrastructure Engineering

b. The increasing deployment of hydraulic systems, rising investments in infrastructure development, growing demand for energy-efficient and low-maintenance hydraulic solutions, and ongoing advancements in hydraulic components are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.