- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Hydrolyzed Vegetable Proteins Market Size Report, 2030GVR Report cover

![Hydrolyzed Vegetable Proteins Market Size, Share & Trends Report]()

Hydrolyzed Vegetable Proteins Market (2023 - 2030) Size, Share & Trends Analysis Report By Function (Emulsifying Agent, Flavoring Agent), By Source (Soy, Pea), By Application (Beverages, Meat Substitutes), And Segment Forecasts

- Report ID: GVR-4-68040-049-7

- Number of Report Pages: 240

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global hydrolyzed vegetable proteins market size was valued at USD 1.50 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. The factors, such as the increasing demand for processed & convenience foods and meat analogs, due to the growing popularity of vegetarian and vegan diets and rising awareness about the health benefits of plant-based proteins are projected to augment market growth over the forecast period. In addition, the strong cleansing properties of Hydrolyzed Vegetable Protein (HVP), along with the presence of mineral salts and riboflavin in it, are contributing to the growth of the industry.

HVP is often used as a cost-effective alternative to other protein sources, which has helped drive its adoption in the food industry. It is commonly used as a flavor enhancer and food additive in processed foods, such as soups, sauces, and snack foods. It is often used as a substitute for meat-based flavors in vegetarian and vegan products due to its ability to provide umami flavor. The hydrolysis process used to create HVP can lead to the development of bitter flavors and aftertaste due to the release of free amino acids and peptides, which have a bitter taste. To reduce the bitterness, some manufacturers may use additional processing steps to remove or mask the bitter taste.

HVP is also used as a source of protein in some dietary supplements and protein powders. The rising consumption of protein hydrolysate products among athletes and sports enthusiasts is expected to foster market growth during the forecast period. Protein hydrolysates, including HVP, are increasingly being used in sports nutrition products due to their ability to provide a high-quality source of protein that is easily digestible and absorbed by the body. HVP is particularly attractive for athletes and sports enthusiasts who follow vegetarian or vegan diets, as it provides a plant-based protein source that can help support muscle recovery and growth.

The use of hydrolysate vegetable protein in infant formula is expected to positively impact market growth, as it enhances amino acid absorption and provides an optimum nutrient value of protein. Hydrolysate protein reduces the size of amino acids, making them more easily digestible and absorbable for infants. This has resulted in an increased demand for hydrolysate protein for infant nourishment in developed countries, such as the U.S., Canada, Germany, and the U.K. As more parents turn to infant formula for their babies’ nutrition, the market growth is expected to continue to grow during the forecast period.

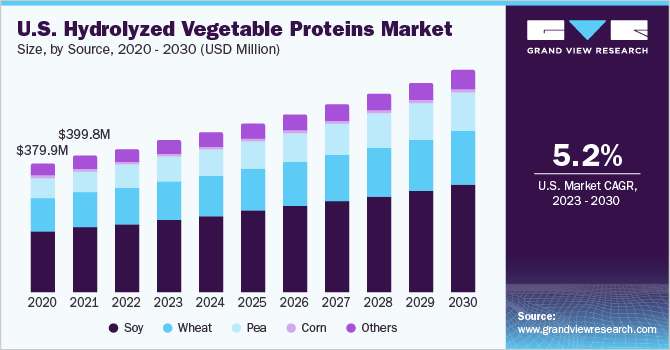

Source Insights

Based on sources, the industry is segmented into soy, wheat, corn, peas, and others. In 2022, the soy segment dominated the market with a revenue share of over 48.60% owing to the cost-effectiveness and the wide availability of soy crops. The demand for HVP made from soy is driven by its availability, health benefits, popularity in vegetarian and vegan diets, cost-effectiveness, and flavor-enhancing properties. Soy is a good source of protein and soy HVP is a relatively healthy alternative to animal-based flavorings as it is low in fat, calories, and cholesterol. Soy HVP is less expensive than animal-based flavorings, making it a cost-effective option for food manufacturers. Furthermore, it has a strong umami flavor, which enhances the taste of various food products and helps mask off flavors or bitter tastes in processed foods.

The pea HVP segment is expected to register a significant CAGR from 2023 to 2030. Pea protein hydrolysate is a popular protein supplement among athletes, bodybuilders, and health-conscious individuals due to its high protein content and potential health benefits, including improved muscle growth, reduced muscle soreness, and lower blood pressure. Its benefits make it an attractive option for individuals looking to enhance their overall health and athletic performance. It is commonly used in sports medicine as it allows for improved absorption of amino acids compared to intact proteins, resulting in optimal nutrient delivery to muscles. In addition to its health benefits, it is free from common allergens, such as dairy, soy, and gluten, making it a safe choice for people with food allergies or sensitivities.

Application Insights

Based on applications, the market is segmented into bakery & confectionary, processed food products, meat substitutes, beverages, and others. In 2022, the processed food products segment dominated the industry with a revenue share of over 41.01% owing to the growing application of HVP in processed food products. HVP is a functional ingredient that is widely used in the food industry because of its ability to enhance flavor and texture, as well as its cost-effectiveness and ease of use. HVP is commonly used as an emulsifying agent, a flavor enhancer, and a texture modifier in processed foods.

The rising demand for processed foods due to their convenience, longer shelf life, and changing consumer lifestyles is expected to increase the demand for HVP as an ingredient in these products. The meat substitutes segment is expected to register the fastest CAGR from 2023 to 2030. HVP is often used as an ingredient in meat substitutes, such as veggie burgers or meatless meatballs, to provide a meaty flavor and texture. It can also be used as a seasoning or flavor enhancer in a variety of vegetarian and vegan dishes. One advantage of using HVP as a meat substitute is that it is typically less expensive than traditional meat, making it an affordable option for those on a budget. In addition, it is a plant-based ingredient, making it a suitable option for vegetarians and vegans.

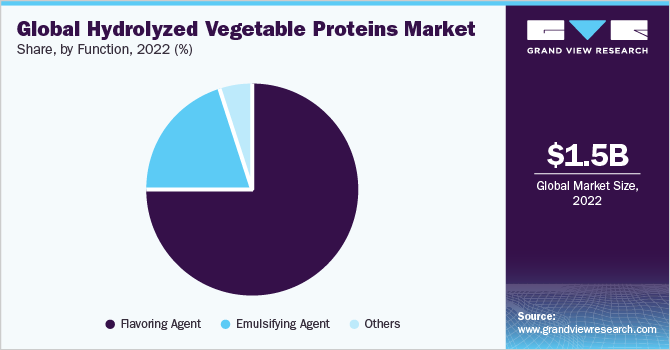

Function Insights

Based on functions, the market is segmented into flavoring agent, emulsifying agent, and others. The flavoring agent segment dominated the market with the highest revenue share of 74.81% in 2022 and is expected to retain its dominance during the forecast period. HVP is a common flavoring agent in the food industry as it provides a savory or umami flavor that enhances the taste of food products. Umami is often referred to as the fifth taste, alongside sweet, sour, salty, and bitter. The food industry’s need to create more flavorful and appealing products that can compete with traditional meat-based products has led to the increasing demand for HVP as a flavoring agent.

HVP is often used in soups, sauces, snacks, and ready-to-eat meals, among other products. The growing demand for plant-based and vegetarian food products is also contributing to the increased use of HVP as a flavoring agent in the food industry. The emulsifying agent segment is expected to register a significant CAGR from 2023 to 2030. The ingredient is used as an emulsifying agent due to its ability to help blend and stabilize different components in a food product that would otherwise separate. HVP can also help improve the texture, appearance, and overall quality of food products by preventing fat bloom, improving viscosity, and reducing water activity.

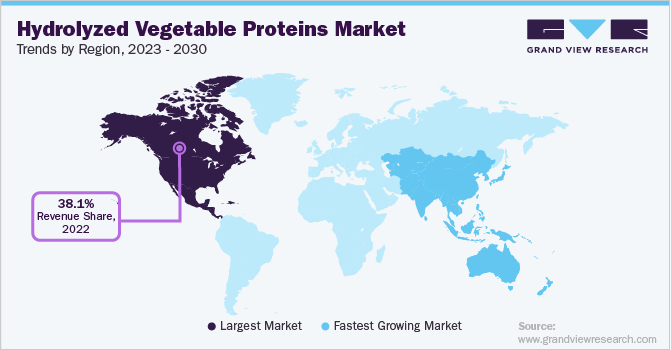

Regional Insights

In terms of revenue, North America dominated the industry with a revenue share of 38.07% in 2022 owing to the large and established food and beverage industry, which creates a significant demand for HVP as a flavor enhancer and functional ingredient. In addition, increasing demand for processed and convenience foods in the region has further fueled the growth of the market. Furthermore, the region has a well-developed healthcare industry that utilizes HVP in medical nutrition products.

Moreover, the region has a high prevalence of various health conditions, such as obesity and diabetes, which have led to an increased demand for healthier food options, including products containing HVP. The Asia Pacific region is expected to register a lucrative CAGR from 2023 to 2030 owing to the rising demand for natural and plant-based food ingredients, as well as increasing awareness about the health benefits of protein. The region is also the largest producer of plant-based protein sources, such as soybean and wheat, which further drives the market growth.

Key Companies & Market Share Insights

The global industry is expected to witness moderate competition owing to the presence of numerous players. Owing to changing consumer trends, companies are expanding their product portfolios to gain a competitive edge in the market. Companies are engaged in R&D activities related to products that are used in the manufacturing of HVPs. They are also expanding their product lines through mergers and acquisitions to meet the growing product demand from various application industries.

For instance, in February 2020, Kerry Group announced its acquisition of Pevesa Biotech, a Spanish company that specializes in organic and non-allergenic plant protein ingredients for general, infant, and clinical nutrition. The acquisition was part of Kerry’s strategy to expand its position in the HVP market and provide customers with non-allergenic as well as organic plant protein ingredients. Some of the prominent players in the global hydrolyzed vegetable proteins market include:

-

Ajinomoto Co., Inc.

-

Kerry Group Plc.

-

Aipu Food Industry

-

Titan Biotech

-

Cargill Inc.

-

Roquette Frères

-

DSM

-

Tate & Lyle

-

ADM

-

Griffith Foods

-

MGP

Hydrolyzed Vegetable Proteins Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.58 billion

Revenue forecast in 2030

USD 2.30 billion

Growth rate

CAGR of 5.48% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in metric tons, revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, function, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Ajinomoto Co., Inc.; Kerry Group Plc.; Aipu Food Industry; Titan Biotech; Cargill Inc.; Roquette Frères; DSM; Tate & Lyle; ADM; Griffith Foods; MGP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrolyzed Vegetable Proteins Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global hydrolyzed vegetable proteins market report based on source, function, application, and region:

-

Source Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Soy

-

Wheat

-

Corn

-

Pea

-

Others

-

-

Function Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Flavoring Agent

-

Emulsifying Agent

-

Others

-

-

Application Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Bakery & Confectionary

-

Processed Food Products

-

Meat Substitutes

-

Beverages

-

Others

-

-

Regional Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydrolyzed vegetable proteins market size was estimated at USD 1.50 billion in 2022 and is expected to reach USD 1.58 billion in 2023.

b. The hydrolyzed vegetable proteins market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 2.30 billion by 2030.

b. North America region dominated the hydrolyzed vegetable proteins market with a revenue share of 38.07% in the year 2022 owing to the large and established food and beverage industry, which creates a significant demand for HVP as a flavor enhancer and functional ingredient. Additionally, the increasing demand for processed and convenience foods in the region has further fueled the growth of the market.

b. Some of the key market players in the hydrolyzed vegetable proteins market are Ajinomoto Co., Inc.; Kerry Group Plc.; Aipu Food Industry; Titan Biotech; Cargill Incorporated; Roquette Frères; DSM; Tate & Lyle; ADM; Griffith Foods; MGP, among others.

b. Key factors that are driving the hydrolyzed vegetable proteins market growth include such as the increasing demand for processed foods and convenience foods, the increasing demand for meat analogs due to the growing trend towards vegetarian and vegan diets, and the rising awareness of the health benefits of plant-based proteins. Additionally, hydrolyzed vegetable protein (HVP) is often used as a cost-effective alternative to other protein sources, which has helped to drive its adoption in the food industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.