- Home

- »

- Renewable Chemicals

- »

-

Hydroxyethyl Cellulose Market Size Report, 2022-2030GVR Report cover

![Hydroxyethyl Cellulose Market Size, Share & Trends Report]()

Hydroxyethyl Cellulose Market (2022 - 2030) Size, Share & Trends Analysis Report By Application (Building Materials, Waterborne Paints & Coatings, Oil Fields, Food), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-918-8

- Number of Report Pages: 106

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydroxyethyl Cellulose Market Summary

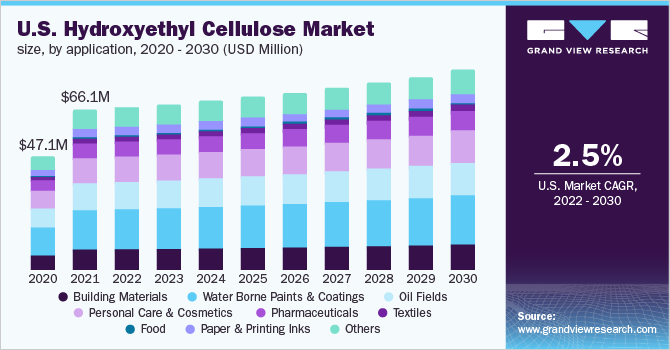

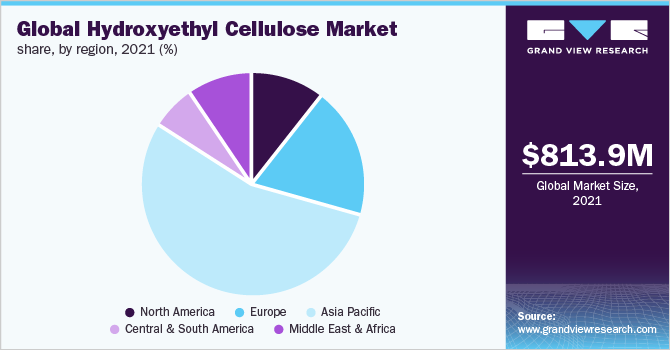

The global hydroxyethyl cellulose market size was valued at USD 813.9 million in 2021 and is projected to reach USD 1.2 billion by 2030, growing at a CAGR of 4.5% from 2022 to 2030. Growing utilization of hydroxyethyl cellulose in several end-use industries such as construction, paints and coatings, textile, food, pharmaceuticals, paper and printing inks, personal care and cosmetics, and oilfields is estimated to drive the market in the near future.

Key Market Trends & Insights

- Asia Pacific dominated the market for hydroxyethyl cellulose and accounted for the largest revenue share of 54.6% in 2021.

- Europe has accounted for the second-largest revenue share of the hydroxyethyl cellulose market.

- By application, the water borne paints and coatings application segment dominated the market and accounted for the largest revenue share of 25.4% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 813.9 Million

- 2030 Projected Market Size: USD 1.2 Billion

- CAGR (2022-2030): 4.5%

- Asia Pacific: Largest market in 2021

The market is highly competitive in nature, owing to the presence of a large number of players who try to gain a competitive edge over others with their product quality, superior distribution networks, and various other strategies. These companies contribute a high market share accounting for nearly 70-75%.

Top manufacturers have defined different grades of products such as pharmaceutical, application, and industrial-grade, which provide a competitive edge in the market for hydroxyethyl cellulose. Demand for hydroxyethyl cellulose is anticipated to be driven by the expanding construction and infrastructure industry and increasing oil and gas exploration activities. Similarly, the demand for building materials is expected to witness increasing consumption owing to the expanding construction industry. Similarly, consumption of water-borne paints and coatings is anticipated to increase owing to their growing consumption in architectural coatings over the forecasted period.

The regulatory framework for water borne coating is governed by the Technische Anleitung (TA), Luft environment protection act, US Environment Protection Agency, and REACH. These regulatory bodies specify the chemical and physical risks associated with the use of raw materials in the manufacturing of water borne coatings and paints and general requirements for labeling, storage, and the use of these raw materials. Rising health and environmental concerns arising from the use of hazardous textile chemicals have led to the increasing adoption of sustainable alternatives such as hydroxyethyl cellulose in the textile industry. Also, increasing awareness pertaining to the use of organic and sustainable alternatives in personal care and cosmetics products is likely to propel the product demand globally.

Application Insights

The water borne paints and coatings application segment dominated the market for hydroxyethyl cellulose and accounted for the largest revenue share of 25.4% in 2021. Its high share is attributable to the increasing usage of the product in architectural coatings intended for on-site application to interior and exterior surfaces of commercial, residential, and institutional buildings. The product provides thickness to paints and helps eliminate sagging, which is one of the most important characteristics required.

Stringent government regulations regarding VOC emissions, especially in Europe and North America, are projected to augment the growth of the water-borne coatings and paints segment. The rising trend in the automotive industry to use water borne coatings and paints in all repair work is further anticipated to propel the demand for hydroxyethyl cellulose over the coming years. The future growth of water borne paints and coatings, both in terms of volume and revenue, is highly dependent on the awareness among consumers regarding the safety of the products and the government regulations associated with them.

The oilfields segment accounted for the second-largest revenue share of 15.5% in the market for hydroxyethyl cellulose in 2021. This is attributed to the wide usage of HEC due to its properties such as thickening, lubrication suspension, and others. Hydroxyethyl cellulose is very effective in large hole drilling and spudding technologies. Using HEC with drilling fluid significantly reduces the hydrodynamic friction, which results in reduced pump pressure. It is also useful in reducing the chances of oil well leakage.

Regional Insights

Asia Pacific dominated the market for hydroxyethyl cellulose and accounted for the largest revenue share of 54.6% in 2021. This is attributed to the growing consumption, owing to its increasing use in building material applications along with consumer preference for sustainable products. Asia Pacific is a highly import-dependent region. Although there are several market players with smaller capacities, the region is still not self-sufficient for the demand. Due to the rising demand-supply gap, market players are looking forward to expanding their production capacities across the region.

Increasing construction and infrastructure spending, particularly in countries like China, India, and Japan, is expected to drive the region’s market. Also, increasing population coupled with rising per-capita middle-class disposable income levels is expected to have a positive impact on the demand in the market for hydroxyethyl cellulose. The emergence of new industries due to low labor costs, availability of a large labor force, and government tax initiatives are expected to drive the market further. In the food industry, factors such as plastic packaging management, sugar reduction, reformulation, availability of locally sourced ingredients, use of plant-based proteins, and the rise of social commerce are anticipated to drive the market.

Europe has accounted for the second-largest revenue share of the hydroxyethyl cellulose market. This is due to the presence of large food manufacturing units in the region that drive the market for hydroxyethyl cellulose. Europe is the home of major economies like Germany, France, and the U.K., with a continuously increasing number of manufacturers and suppliers of food products and beverages, cosmetics, construction, and chemical products. Awareness regarding wellness and health has swayed consumer preference towards organic products. Thus, increasing consumer demand for organic dietary supplements, pharmaceutical formulations, and growing awareness about harmful chemicals and ingredients is also anticipated to fuel the demand over the forecasted period.

Key Companies & Market Share Insights

The competition in the market for hydroxyethyl cellulose is highly dependent on the grade of products, the number of sellers/manufacturers, and geographical location. The products manufacturers are engaged in continuous R&D activities, capacity expansion, mergers and acquisitions, and other strategies to gain a competitive advantage over others. In March 2021, Ashland Global Holdings Inc. announced plans to expand its Natrosol Hydroxyethyl Cellulose (HEC) production capacity in Nanjing, China. This expansion is in line with the company’s growth strategy and commitment to investing in the region.

Manufacturers are focusing intensely on improving their product portfolios by forming strategic Joint Ventures (JV) with some prominent companies. In recent years, major players have made significant investments in innovation to assist corporations in developing new products, addressing the rising demand, and increasing their revenue. Many companies have diversified their supply sources to secure a steady supply of raw materials. Major firms have vertically integrated the manufacturing processes that enable them to procure raw materials at a comparatively lower cost. Some of the prominent players in the hydroxyethyl cellulose market include:

-

Ashland

-

Dow Chemicals

-

Shin-Etsu Chemicals Co., Ltd.

-

AkzoNobel N.V.

-

Daicel Corporation

-

Lotte fine Chemicals

-

Chemcolloids Ltd.

-

Zhejiang Haishen New Materials Limited

-

Yil-Long Chemical Group

-

Wuxi Sanyou New Material Technology Co., Ltd.

Hydroxyethyl Cellulose Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 843.1 million

Revenue forecast in 2030

USD 1.2 billion

Growth Rate

CAGR of 4.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Ashland, Dow Chemicals; Shin-Etsu Chemicals Co., Ltd.; AkzoNobel N.V.; Daicel Corporation; Lotte fine Chemicals; Chemcolloids Ltd.; Zhejiang Hashem New Materials Limited; Yil-Long Chemical Group; Wuxi Sanyou New Material Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hydroxyethyl cellulose market report on the basis of application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Building Materials

-

Waterborne Paints & Coatings

-

Oil Fields

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Textiles

-

Food

-

Paper & Printing Inks

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydroxyethyl cellulose market size was valued at USD 813.9 million in 2021 and is expected to reach USD 843.1 million in 2022

b. The global hydroxyethyl cellulose market is anticipated to grow at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030 and reach USD 1.2 billion by 2030.

b. Water-borne paints & coatings applications dominated the HEC market with a revenue share of 25.4% in 2021. Its high share is attributable to increasing usage of the product in architectural coatings intended for on-site application to interior and exterior surfaces of commercial, residential, and institutional buildings.

b. Some prominent players in the global HEC market include Ashland, Dow Chemicals, Shin-Etsu Chemicals Co., Ltd, AkzoNobel N.V., Daicel Corporation, Lotte fine Chemicals, Chemcolloids Ltd., Zhejiang Hashem New Materials Limited, Yil-Long Chemical Group, Wuxi Sanyou New Material Technology Co., Ltd.

b. The growth is majorly driven by rising demand for cellulose products in water-borne architectural paints, & coatings, textile, personal care & cosmetics, and other industrial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.