- Home

- »

- Next Generation Technologies

- »

-

Immersive Technology Market Size And Share Report, 2030GVR Report cover

![Immersive Technology Market Size, Share & Trends Report]()

Immersive Technology Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software/Platform, Services) By Technology Type, By Application, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-188-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Immersive Technology Market Summary

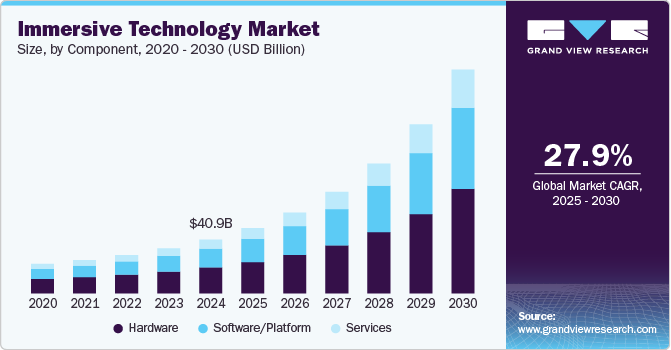

The global immersive technology market size was estimated at USD 40.88 billion in 2024 and is projected to reach USD 169.88 billion by 2030, growing at a CAGR of 27.9% from 2025 to 2030. The market is primarily driven by the growing technological advancements in augmented and virtual reality (AR & VR), the increasing demand for enhanced user experiences in entertainment and gaming, and the growing investments in VR and AR technologies.

Key Market Trends & Insights

- North America immersive technology market dominated the market with the largest revenue share of 41.8% in 2024.

- The immersive technology market in the U.S. accounted for the largest market share in North America in 2024.

- Based on component, the hardware segment led the market with the largest revenue share of 48.2% in 2024.

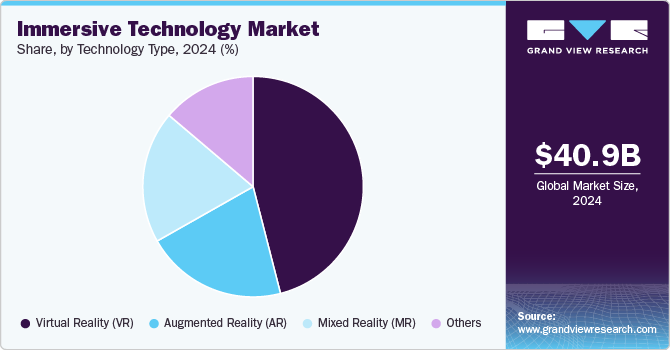

- Based on technology type, the virtual reality segment led the market with the largest revenue share of 46.0% in 2024.

- Based on application, the training & learning segment led the market with the largest revenue share of 40.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 40.88 Billion

- 2030 Projected Market Size: USD 169.88 Billion

- CAGR (2025-2030): 27.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, the rise of social VR platforms that allow users to interact with one another in virtual environments is expected to further fuel the market growth in the coming years. The widespread adoption of smartphones, coupled with their improved processing power, facilitates the delivery of immersive applications. This trend is particularly evident in sectors such as media and entertainment, and education, where mobile devices serve as platforms for immersive experiences. Businesses across industries are leveraging immersive technologies for training, collaboration, and process optimization. In sectors such as manufacturing, immersive technology is being used for simulations, remote assistance, and real-time data visualization, improving efficiency and reducing operational costs. The technology's ability to create realistic environments for training in high-risk industries such as aerospace and healthcare is also a major driver further boosting the market growth.

In addition, immersive technologies are increasingly being applied in e-commerce, allowing consumers to engage in virtual shopping experiences further transforming e-commerce industry by offering consumers immersive, personalized shopping experiences that blend the best of both online and in-store retail models. These immersive experiences help brands differentiate themselves in an increasingly crowded digital marketplace and strengthen customer relationships. This trend is expected to grow as more retailers adopt AR and VR technologies to enhance customer engagement and improve the overall shopping experience, thereby boosting the market expansion.

The healthcare industry's adoption of immersive technologies is driving market growth by utilizing AR and VR for medical training, patient care, and surgical simulations. These technologies allow medical professionals to practice complex procedures in realistic, risk-free environments, improving skills and patient outcomes. In addition, VR is being used in therapeutic applications, such as pain management, mental health treatments, and rehabilitation, providing innovative care solutions. The growing integration of immersive tools into healthcare is expanding the market beyond entertainment, showcasing the versatility of AR and VR in high-stakes, real-world applications, thereby fueling broader adoption across the medical field.

The concept of Metaverse is accelerating immersive technology market growth by creating demand for virtual social interactions, collaborative workspaces, and immersive consumer experiences. Companies are leveraging AR, VR, and MR technologies to build interactive virtual environments where users can socialize, work, shop, and engage with brands in more immersive ways. Businesses are exploring virtual storefronts, digital events, and collaborative workspaces in the Metaverse, driving the adoption of immersive tools such as VR headsets and AR glasses. This shift is opening new revenue streams and business models, such as virtual economies and digital assets, further fueling the expansion of immersive technologies across industries.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 48.2% in 2024, owing to the essential role that hardware components such as sensors, HMD, and jammers play in detecting and neutralizing unauthorized drones. As drone-related security incidents increase globally, governments and military organizations are investing heavily in robust hardware solutions to enhance their defense capabilities. The continuous advancements in the hardware industry further bolster this segment, making it a critical aspect of Immersive Technology systems.

The software/platform segment is expected to witness at the fastest CAGR from 2025 to 2030, driven by rapid technological advancements and the increasing integration of artificial intelligence and machine learning into Immersive Technology software applications. As organizations seek to enhance their drone threat mitigation strategies, the demand for sophisticated software solutions that can analyze and respond to drone activities in real-time is expected to rise significantly in the coming years.

Technology Type Insights

Based on technology type, the virtual reality segment led the market with the largest revenue share of 46.0% in 2024. This growth can be attributed to its widespread adoption across various industries, such as gaming, entertainment, healthcare, and education. The immersive experiences offered by VR technology have proven effective in enhancing user engagement and providing realistic simulations for training and entertainment purposes. As companies are increasingly investing in VR solutions to meet consumer demand for interactive content, the segment's dominance is expected to continue, driven by advancements in hardware and software that improve accessibility and user experience.

The mixed reality segment is expected to register at the fastest CAGR from 2025 to 2030, fueled by the technology's unique ability to blend digital content with the real world, allowing for more interactive and engaging experiences. Industries such as gaming, education, and healthcare are increasingly recognizing the potential of MR for training and simulations, leading to greater investments in MR applications.

Application Insights

Based on application, the training & learning segment led the market with the largest revenue share of 40.1% in 2024, owing to its ability to provide engaging, interactive, and realistic learning experiences. Immersive technologies such as virtual reality (VR) and augmented reality (AR) allow learners to practice skills in safe, controlled environments, making them particularly effective for complex training scenarios such as medical procedures and pilot training. This hands-on approach not only enhances retention but also reduces the risk of errors during real-life applications. As industries increasingly recognize the benefits of immersive training solutions, investments in this segment have surged, further solidifying the segmental growth.

The emergency services segment is expected to register at the fastest CAGR from 2025 to 2030, driven by the need for realistic simulation training in high-pressure situations. Immersive technology enables emergency responders to practice their skills in lifelike scenarios, improving their preparedness for real-world emergencies. For instance, recent innovations such as ambulance simulators allow trainees to experience emergency situations without the associated risks. As more organizations adopt these technologies to enhance training effectiveness and operational readiness, the emergency services segment is poised for significant growth in the coming years.

Industry Insights

Based on industry, the gaming segment led the market with the largest revenue share of 31.7% in 2024, driven by the transformative impact of immersive technologies, particularly Virtual Reality (VR) and Augmented Reality (AR), which enhance user engagement by creating realistic and interactive gaming environments. In addition, the increasing popularity of flagship VR titles, the growth of eSports, and advancements in standalone VR headsets have made these technologies more accessible, allowing casual and family-oriented games to thrive alongside hardcore gaming titles. This trend is expected to drive the market growth in the coming years.

The healthcare segment is projected to grow at the fastest CAGR from 2025 to 2030,fueled by the increasing adoption of immersive technologies like VR and AR. These innovations are reshaping the way healthcare is delivered, offering transformative solutions that improve patient care, enhance medical training, and enable remote consultations. With immersive simulations providing more effective surgical training and patient education, the potential for improved outcomes and reduced learning curves for medical professionals is becoming a key driver.

Regional Insights

North America immersive technology market dominated the market with the largest revenue share of 41.8% in 2024, driven by advancements in hardware capabilities, such as high-resolution displays and powerful graphics processing units (GPUs). The region’s strong investment in research and development, particularly in sectors such as gaming, healthcare, and education, has also fostered innovation. In addition, the increasing adoption of augmented reality (AR) and virtual reality (VR) applications across various industries is enhancing user engagement and experience.

U.S. Immersive Technology Market Trends

The immersive technology market in the U.S. accounted for the largest market share in North America in 2024.The growing demand for remote collaboration tools in the U.S., especially post-pandemic, is driving the market growth. U.S. companies are increasingly utilizing VR and AR to facilitate virtual meetings and training sessions, thereby improving productivity and reducing travel costs, which is expected to drive market growth in the coming years.

Europe Immersive Technology Market Trends

The immersive technology market in Europe was identified as a lucrative region in 2024.In Europe, regulatory support for digital transformation initiatives is a key driver of the immersive technology market. Governments are promoting smart city projects that integrate AR solutions for urban planning and tourism enhancement. The focus on sustainability also encourages the use of immersive technologies for environmental monitoring and education about climate change impacts.

The UK immersive technology market is expected to grow at a rapid CAGR during the forecast period. The UK has seen a surge in startups focusing on immersive technologies owing to favorable funding environments from both private investors and government grants. This entrepreneurial ecosystem fosters innovation in sectors like retail, where AR applications enhance customer experiences through virtual try-ons and interactive shopping environments.

The immersive technology market in Germany held a substantial market share in 2024. Germany’s manufacturing sector is leveraging immersive technologies for training purposes through VR simulations that replicate real-world scenarios without risks associated with physical training environments. This trend not only enhances workforce skills but also improves safety standards within industrial settings.

Asia Pacific Immersive Technology Market Trends

The immersive technology market in the Asia Pacific region is expected to grow at the fastest CAGR of 28.26% from 2025 to 2030. In Asia-Pacific, rapid urbanization coupled with increasing smartphone penetration drives the adoption of mobile AR applications among consumers. The region’s tech-savvy population is eager to engage with immersive content across social media platforms, leading to significant growth opportunities for developers creating AR experiences tailored to the local market.

The Japan immersive technology market is expected to grow at a rapid CAGR during the forecast period, owing to Japan’s cultural affinity towards gaming and anime. The country’s unique blend of traditional arts with cutting-edge technology creates fertile ground for innovative VR experiences that resonate with both local consumers and international audiences seeking authentic cultural interactions.

The immersive technology market in China held a substantial market share in 2024. China’s robust investment in 5G infrastructure significantly boosts the immersive technology landscape by enabling faster data transmission rates essential for seamless VR/AR experiences. The government’s strategic initiatives aimed at becoming a global leader in AI technologies further support the integration of immersive solutions across various sectors, including education, healthcare, and entertainment, thereby driving the regional growth.

Key Immersive Technology Company Insights

Some of the key players operating in the market include Microsoft Corporation, Google LLC, and IBM Corporation.

-

Microsoft Corporation, a multinational technology company, is renowned for its software products, including the Windows operating system and Microsoft Office suite. In recent years, the company has significantly invested in immersive technologies such as augmented reality (AR) and virtual reality (VR), particularly through its HoloLens device, which combines mixed reality with enterprise applications. Microsoft’s Azure cloud platform also supports various immersive technology solutions, enabling developers to create innovative applications that leverage AI and machine learning.

-

Google LLC, a subsidiary of Alphabet Inc., is an American multinational technology company that has diversified into various areas, including advertising technologies, consumer electronics, and cloud computing. In the realm of immersive technology, the company has developed products such as Google Cardboard and the Daydream VR platform to promote virtual reality experiences. In addition, the company has been investing heavily in AR through initiatives such as ARCore, which allows developers to build augmented reality experiences on Android devices.

Barco NV and EON Reality are some of the emerging participants in the global market.

-

Barco NV is a global technology company specializing in visualization and collaboration. The company focuses on developing innovative products that enhance user experiences across various sectors, including entertainment, enterprise, and education. Barco NV’s immersive technology offerings include high-resolution projectors, LED displays, and advanced software solutions designed to create engaging environments for users.

-

EON Reality is U.S. based provider of augmented reality (AR) and virtual reality (VR) solutions aimed at enhancing learning and training experiences across industries. The company specializes in creating interactive 3D content and platforms that enable users to engage with complex information intuitively. EON Reality’s focus on educational applications has led to partnerships with various institutions worldwide to implement AR/VR technologies into their curricula.

Key Immersive Technology Companies:

The following are the leading companies in the immersive technology market. These companies collectively hold the largest market share and dictate industry trends.

- Barco NV

- EON Reality

- Google LLC (Alphabet Inc.)

- HTC Corporation

- IBM Corporation

- Magic Leap, Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Ultraleap Limited (Leap Motion, Inc.)

Recent Developments

-

In August 2024, ANZ Bank, in partnership with Microsoft Corporation, launched Australia's first AI Immersion Centre at its Melbourne headquarters, aimed at accelerating the adoption of generative AI within the bank.

-

In May 2024, Magic Leap, Inc. announced a strategic partnership with Google LLC aimed at advancing augmented reality (AR) technologies. This collaboration was aimed at leveraging Magic Leap, Inc.'s expertise in optics and AR with Google LLC's technological platforms to develop innovative AR solutions and experiences.

-

In February 2024, Ultraleap Limited and EmdoorVR announced a partnership to create a new mixed reality (MR) headset reference design that integrates Ultraleap's advanced hand-tracking technology. This design utilizes shared camera systems for simultaneous hand tracking and SLAM (Simultaneous Localization and Mapping), significantly reducing integration costs for original equipment manufacturers (OEMs).

Immersive Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 49.67 billion

Revenue forecast in 2030

USD 169.88 billion

Growth rate

CAGR of 27.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology type, application, industry, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; UAE

Key companies profiled

Barco NV; EON Reality; Google LLC (Alphabet Inc.); HTC Corporation; IBM Corporation; Magic Leap, Inc.; Meta Platforms, Inc.; Microsoft Corporation; Samsung Electronics Co., Ltd.; Sony Corporation; Ultraleap Limited (Leap Motion, Inc.)

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immersive Technology Market Report Segmentation:

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global immersive technology market report based on component, technology type, application, industry, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

HMD

-

GTD

-

PDW

-

-

Software/Platform

-

Services

-

Professional Services

-

Managed Services

-

-

-

Technology Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Virtual Reality (VR)

-

Augmented Reality (AR)

-

Mixed Reality (MR)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Training & Learning

-

Emergency Services

-

Product Development

-

Sales & Marketing

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Manufacturing

-

Automotive

-

Education

-

Media & Entertainment

-

Gaming

-

Healthcare

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global immersive technology market size was estimated at USD 40.88 billion in 2024 and is expected to reach USD 49.67 billion in 2025.

b. The global immersive technology market is expected to grow at a compound annual growth rate of 27.9% from 2025 to 2030 to reach USD 169.88 billion by 2030.

b. North America dominated the immersive technology market with a share of over 41.8% in 2024. This is attributable to the increased adoption in various industries such as gaming, healthcare, education, and enterprise.

b. Some key players operating in the immersive technology market include Barco NV, Eon Reality, Google LLC (Alphabet Inc.), HTC Corporation, IBM Corporation, Magic Leap, Meta, Microsoft Corporation, Samsung Electronics Co., Ltd., Sony Corporation, Ultraleap Limited (Leap Motion, Inc.).

b. Key factors that are driving the immersive technology market growth include the rising investment in immersive technology, increasing adoption of AR/VR technologies in the healthcare domain for training and education, and the emergence of the Metaverse and Web 3.0.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.