- Home

- »

- Medical Devices

- »

-

In Vivo CRO Market Size And Share, Industry Report, 2030GVR Report cover

![In Vivo CRO Market Size, Share & Trends Report]()

In Vivo CRO Market (2025 - 2030) Size, Share & Trends Analysis Report By Model Type (Rodent Based, Non-Rodent Based), By Modality (Small Molecule, Large Molecule), By Indication, By GLP Type, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-011-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

In Vivo CRO Market Summary

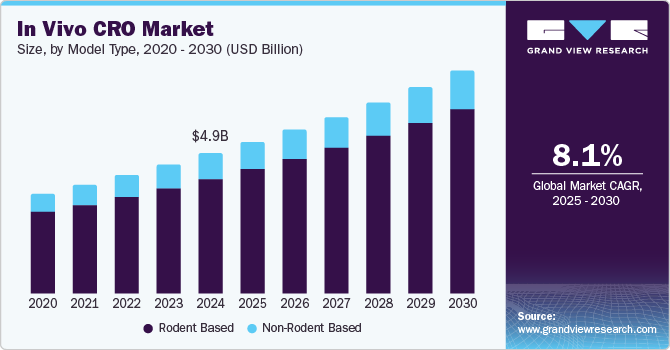

The global in vivo CRO market size was valued at USD 4.98 billion in 2024 and is projected to reach USD 7.96 billion by 2030, growing at a CAGR of 8.13% from 2025 to 2030. The increasing burden of cancer patients, growing in vivo pharmacology studies, and the emerging number of pharma and biotechnology companies focusing on researching and developing novel therapeutics are expected to drive market growth.

Key Market Trends & Insights

- North America held the largest market share of 50.00% in 2024.

- The U.S. in vivo CRO market held the largest share in 2024.

- By model type, the rodents segment gained a largest market share of 81.95% in 2024.

- By modality, the small molecules segment held the largest share in 2024.

- By indication, the oncology segment dominated the global in vivo CRO market and accounted for a revenue share of 29.02% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.98 Billion

- 2030 Projected Market Size: USD 7.96 Billion

- CAGR (2025-2030): 8.13%

- North America: Largest market in 2024

In addition, in vivo CROs are specifically backed by the rising number of CROs, research and development activities, and preclinical studies, which have led to a rise in market growth. Additionally, investments in in vivo gene-modified cell therapies will boost market growth. For instance, in March 2024, Asgard Therapeutics raised USD 33 million in a Series A round, including participation from three pharmaceutical companies. The company innovates medicines that genetically modify genes inside the body, such as in vivo cell therapies are one way to bypass the complex, drawn-out process of making “ex vivo” treatments, in which a patient’s cells are manipulated in a lab and reinfused.

The COVID-19 pandemic has negatively impacted the clinical trials and in vivo CRO industries. However, the effect of the pandemic was comparatively moderate across the in vivo CRO market, as several contract research organizations continuously focused on the R&D of COVID-19 treatment therapeutics, thereby providing in vivo preclinical services for the same. Besides, the integrity of over clinical trials registered remained vulnerable as the coronavirus outbreak spreads worldwide. However, post-pandemic, there was a growing demand for novel technologies and an increasing need for patient-friendly drugs, which has led to improvement in the pipeline of pharmaceuticals due to stringent regulations by regulatory agencies such as the FDA and EMA, pharmaceutical & biopharmaceutical companies outsourcing their medical affairs to streamline the regulatory process. Thus, this is expected to impact market growth in the coming years positively.

Also, the rising complexity concerning new drug development has fueled the in vivo CRO market’s growth. Manufacturing high-quality and safe drugs for patient care is a major concern for drug manufacturers. Moreover, the regulations related to drugs and biologics are vast and a rapidly growing field, complicated by legal technicalities. The complexity of the drug development process has considerably grown in the last few years. Pharmaceutical and biotechnology companies are outsourcing their complex in vivo activities to CROs and focusing on business development.

Additionally, the rising demand for advanced products, such as rare disease therapies and anti-cancer medicines, is one of the major factors supporting the growth of the in vivo CRO market. For instance, Organizations such as the European Society of Medical Oncology (ESMO) and Latin American Society of Clinical Oncology (SLACOM) engage in collaborative work with the Peruvian Cooperative Oncology Group. These favorable initiatives are anticipated to generate lucrative revenue over the forecast period. Likewise, in November 2023, AstraZeneca announced a collaboration & investment agreement with Cellectis to boost the development of next-generation therapeutics in oncology, immunology, and rare diseases.

Furthermore, a growing pipeline of cell and gene therapies is expected to increase market growth opportunities. Advancements in manufacturing, including improved accuracy, manufacturing, and control regulations, have led to tremendous growth in the past few years. According to the American Society of Gene + Cell Therapy (ASGCT), in Q4 2022, the gene therapy pipeline had grown by 6%, and in 2022, five gene therapies were approved for hemophilia. Besides, rare diseases and oncology remain the most commonly targeted indications by gene therapies across the pipeline and in the clinics. In addition, the RNA pipeline had grown throughout 2022, increasing by 17%. Furthermore, across the globe, 24 gene therapies, 21 RNA therapies, and 60 non-genetically modified cell therapies were approved for clinical use in 2022. This is expected to increase the demand in-vivo CRO market, contributing to market profits.

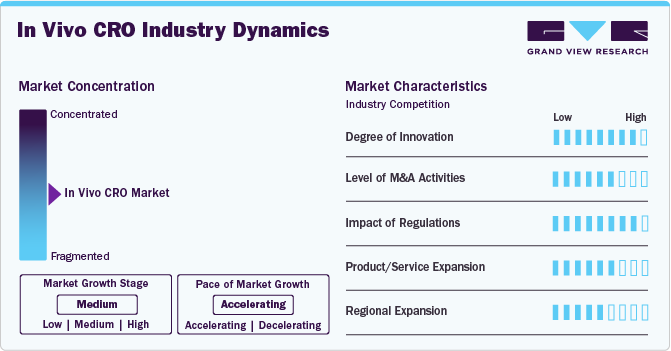

Market Concentration & Characteristics

The market growth stage is medium, and market growth is expected to accelerate over the estimated period. The in vivo CRO sector is characterized by a high degree of innovation owing to the rising need for drug discovery, increasing chronic diseases, and rapid technological advancements. The market is also driven by the rising incidence of cancers and increased demand for innovative products, including CRISPR gene editing and advanced imaging systems. In addition, the need for increased efficiency in preclinical studies has led to the incorporation of automation, data analytics, and artificial intelligence.

The market is also characterized by the leading players' moderate merger and acquisition (M&A) activity. These activities enable companies to expand service offerings, achieve operational efficiency, strengthen market presence, and gain access to new markets. It benefits the companies by enhancing their expertise, achieving cost savings, and competing more effectively in the competitive landscape of preclinical research services.

The market is also subject to increasing regulatory scrutiny. Regulations profoundly impact the market, influencing ethical standards, animal welfare considerations, and the overall conduct of preclinical research. Stringent compliance with regulatory requirements, including Good Laboratory Practice (GLP) guidelines, is crucial for the credibility and acceptance of in vivo study outcomes. The dynamic regulatory landscape also drives innovation within the market, encouraging CROs to adapt to evolving standards, such as increased emphasis on transparency and reproducibility, to maintain compliance and competitiveness.

The market is characterized by accelerating product/service expansion. CROs respond to client needs by diversifying their portfolios with advanced in vivo models, specialized assays, and innovative technologies. The purpose of personalized medicine and the outsourcing trend in the pharmaceutical industry further drive the need for comprehensive, one-stop-shop solutions.

It is driven by the global need for drug development, increased outsourcing, and the desire to offer localized services. CROs are establishing a presence in key regions to serve diverse patient populations, understand local regulatory requirements, and enhance collaboration with pharmaceutical and biotech clients. In addition, this expansion strategy allows CROs to enter emerging markets, capitalize on regional strengths, and provide comprehensive preclinical research solutions globally.

In the market, companies focus on innovation to launch efficient drugs. Besides, a rising number of drug formulations is anticipated to create opportunities for a contract research organization to offer innovative drug form production with quality and quantity for various therapeutic areas. These factors are expected to increase the drug development outsourcing rate, thereby simultaneously supporting the in vivo CRO market growth over the forecast period.

Regulations in pharmaceutical formulation and regulatory compliance allow companies to provide various drugs, invest in advanced technologies, and offer competitive pricing, enhancing their market competitiveness and profitability.

Various market players, such as Taconic Biosciences, Charles River Laboratories, and Crown Bioscience, among others, are involved in merger and acquisition activities. Besides, emerging markets increasingly invest in CRO and new drug innovation, offering products in various price ranges. Through M&A activity, these entities can expand their geographic reach, strengthen their market position, and gain a significant market share.

CROs' continued offering and expansion of manufacturing capacity, as well as the rising number of local players and established market players manufacturing innovator drugs, are expected to improve the demand for the Invivo CRO market. Therefore, the market for Invivo products is expected to witness abundant demand for CRO services.

The expansion of the market in the region can be attributed to the presence of technologically advanced contract research organizations (CROs) and the increasing focus on new, innovative invivo therapy. Furthermore, the presence of pharmaceutical companies and a surge in operational efficiency and therapeutic expertise in the region are propelling the market growth.

Model Type Insights

On the basis of model type segment, the market is segmented into rodent based, and non-rodent based. Rodents based category is further sub-segmented to rat models, mice models, and others. In 2024, the rodents segment gained a largest market share of 81.95% owing to its use as models in medical research due to their similarities to humans in behavior, biology, and genetics. They are extensively used in medical trials and studies, making them the most prevalent species in such research. According to the Foundation for Biomedical Research (FBR), rodents account for around 95% of all laboratory animals. Also, rodents born without immune systems, such as Severe Combined Immune Deficiency (SCID) mice, can be models for malignant and normal human tissue research. Moreover, according to the Koshland Science Museum, rats share approximately 90% of their genes with humans. Thereby, increased adoption of rodents-based models across in-vivo studies has fueled the demand for outsourced in vivo services, thus contributing to the market growth.

On the other hand, the non-rodent segment is expected to witness growth at a CAGR of 7.10% over the forecast period. Non-rodent is mostly used animal models for research and offers several advantages, such as genetic homology to humans, metabolism, body weight, sequential sampling, life span, and organ structure. However, breeding, housing, and handling non-rodent animals can be challenging. Such factors are anticipated to drive the market.

Modality Insights

On the basis of modality segment, the market is segmented into small molecules, and large molecules. In 2024, the small molecules segment held the largest share in the in vivo CRO market. The small molecules are studied across small molecule APIs, Highly Potent Active Pharmaceutical Ingredients (HPAPI), etc. The number of small molecule drug candidates is far more extensive than large molecules. Furthermore, these molecules support in preclinical & clinical development of drug candidates with extensive academic research for novel targets. Likewise, growing FDA approvals for small molecules is anticipated to drive the market. For instance, according to Labiotech UG had mentioned that FDA has increased the small-molecule drug approvals by more than 50% with 34 new approvals in 2023 as compared to 2021 & 2022. These drugs further represent 62% of the total FDA drug approval in 2023 as they continue to be crucial in healthcare advancement.

Additionally, large molecules are anticipated to grow as the fastest-growing segment during the forecast period. The segment further sub-segmented to Cell & Gene Therapy (CAR T-cell therapies, CAR-NK cell therapy, TCR-T cell therapy, Other (Includes- TCR-NK, CAR-M, and TAC-T), RNA Therapy, Others. In vivo CROs play a crucial role in the investigation of large molecules in preclinical and clinical trials. These organizations have special skills and expertise in handling and testing large molecules in appropriate animal models. Safety and toxicity studies, Pharmacokinetic (PK) studies, Efficacy studies, and Immunogenicity studies are some of the common services offered by CROs. For instance, in June 2023, Janssen entered into collaboration with China’s Legend Biotech for CAR-T cell therapy candidate. A six-year partnership between the pharmaceutical giant and the Chinese biotech shows that their CAR-T cell therapy for multiple myeloma is highly effective. Therefore, these factors favor the growth of the segment.

Indication Insights

On the basis of indication segment, the market is segmented into autoimmune/inflammation conditions, pain management, oncology, CNS conditions, diabetes, obesity, and others. The oncology segment dominated the global in vivo CRO market and accounted for a revenue share of 29.02% in 2024. In oncology, mouse models are considered an ideal model for human cancer research across in vivo studies due to the relatively similar physiological and genomic characteristics of tumors in humans and mice. Mice have several similar molecular, cellular, and anatomical characteristics to humans. These characteristics are known to have critical functions & properties in cancer. Mice genes, particularly RNI-like genes, exhibit more than 80% similarity to their human counterparts, enabling researchers to use mice as experimentally tractable models to investigate treatment responses and basic mechanisms of cancer development. The most widely used and affordable traditional models for tumor studies are immunodeficient and immunocompetent mice models with xenografted and syngeneic tumors transplanted orthotopically or subcutaneously. Hence, the aforementioned factors contribute to the largest share of the segment during the analysis period.

The CNS conditions segment is expected to register the fastest growth of 9.35% over the forecast period. Epilepsy, Parkinson’s disease (PD), Huntington’s disease (HD), stroke, and Traumatic Brain Injury (TBI), among others, are some of the major CNS disorders. In vivo CROs play a key role in CNS research by offering specialized services and understanding for carrying out preclinical investigations in animal models. Furthermore, at present, several pipeline of CNS drugs are available in the market. However, the discovery & development of new drugs possess efficacy & tolerability is still a major concern.

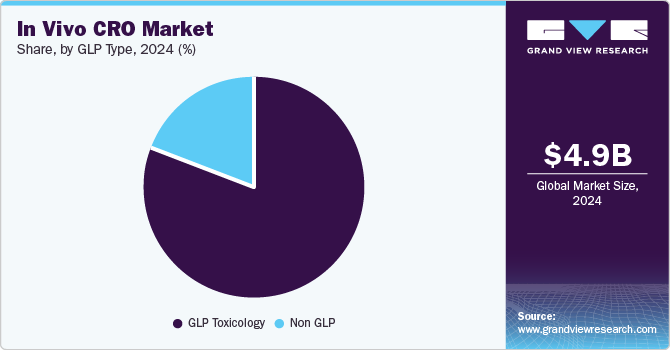

GLP Type Insights

On the basis of GLP type segment, the market is segmented into non GLP, and GLP toxicology. The GLP toxicology segment dominated the market with the largest revenue share in 2024. Clinical studies such as safety pharmacology, genotoxicity, & repeated dose toxicity are mandatory for safe exposure to humans and must be performed as per the GLP standards. These studies are required to be conducted before the IND application. After IND approval, other GLP experiments to evaluate chronic toxicity, developmental & reproductive toxicity, genotoxicity, and carcinogenicity must be carried out during the clinical phase of development. For the evaluation of safety studies, compliance with GLP standards is mandatory.

Increasing clinical trials for oncology studies are expected to boost market growth. For instance, in January 2023, Qualigen Therapeutics initiated the GLP toxicology studies of its QN-302, an oncology program. The research would be carried out by WuXi AppTec. GLP toxicology tests are a crucial part of QN-302's investigational new drug (IND) filing package, which was anticipated to happen in the first half of 2023. After the IND is approved by the U.S. FDA, human clinical trials will be conducted. Hence, the growing number of clinical research for novel therapeutics is one of the major factors contributing to the segment’s growth.

On the other hand, non-GLP segment is projected to grow at a CAGR of 7.31% during the forecast period. Non-GLP toxicology studies are conducted and carried out to the same high standards but need not to adhere to all GLP guidelines. These toxicological studies are carried out in accordance with high standards of quality that ensure the validity and accuracy of the study data required to assess test object or item. Additionally, the drug development process involves clinical and nonclinical studies. These nonclinical studies are conducted using different protocols, including animal studies, which mostly comply with GLP regulations. Thereby, non-GLP toxicology is expected to witness growth at stable growth rate over the estimated time period.

Regional Insights

North America's market held the largest market share of 50.00% in 2024. This can be attributed to the presence of technologically advanced Contract Research Organizations (CROs) and the increasing number of grants provided by government organizations, such as the National Institute of Health (NIH), to foster research activities. The region's CRO has established a good reputation and demonstrated exceptional performance, making them attractive for research investments during the forecast period. Moreover, extensive drug development activities, several pharmaceutical & biotech companies, and a surge in clinical trials in the region are some factors boosting the market.

U.S. In vivo CRO Market Trends

The U.S. in vivo CRO market held the largest share in 2024. The country's robust pharmaceutical and biotechnology industry continuously focuses on drug discovery and development. This emphasis has improved the demand for in vivo CRO services, as these organizations play a crucial role in conducting preclinical and clinical research.

Europe In vivo CRO Market Trends

The in vivo CRO market in Europe is expected to grow significantly due to an increasing big pharmaceutical outsourcing expenditure. Moreover, the focus on rare diseases with unmet needs, the expiry of biological patents, and the arrival of new biosimilars are expected to contribute to the increasing demand for in vivo CRO in this region.

The In vivo CRO market in Germany held the largest share in 2024, owing to numerous German companies specializing in providing contracts exclusively to pharmaceutical and biotechnology companies worldwide. In addition, the pharmaceutical & biotechnology industry in Germany is considered one of the world's largest industries globally, which is expected to drive market growth.

The in vivo CRO market in the UK is anticipated to grow over the forecast period. This growth is primarily due to the development of the pre-clinical services market in the country. Outsourced preclinical services are expected to grow rapidly due to pharmaceutical companies' increasing demand for improved test outcomes at lower costs.

Asia Pacific In vivo CRO Market Trends

Asia Pacific In vivo CRO market is expected to grow at a CAGR of 8.77% during the estimated period. This growth can be attributed to several factors, including the cost-effectiveness of CROs across India & China, economic development, and advanced healthcare infrastructure. Besides, increasing partnerships and investments by CROs and the growing percentage of outsourcing in vivo services to emerging economies are some factors expected to propel growth during the forecast period.

The in vivo CRO market in Japan held the largest share in 2024 due to increasing harmonization between CROs and pharmaceutical and biotech companies and the implementation of faster regulatory processes, which drive in vivo CRO market growth.

The in vivo CRO market in China is expected to grow over the forecast period due to the growing demand for services. This demand can be underpinned by low operational costs, investments to improve technology, R&D capacity building, and adherence to global R&D standards and guidelines to meet international requirements. This support from the government enhances the credibility and reliability of in vivo CRO services in China.

The in vivo CRO market in India is anticipated to witness growth at the fastest CAGR over the forecast period owing to the availability of experts, low operational cost, and recognition of intellectual property rights & international guidelines.

Key In Vivo CRO Company Insights

Key players operating across the globe are adopting notable strategic initiatives, such as new mergers and acquisitions, and partnerships, to increase their market share. For instance, in January 2023, Evotec SE and Janssen Biotech announced a partnership agreement to innovate targeted immune-based therapies for treating oncology patients. In November 2023, Charles River Laboratories mentioned the partnership with Aitia for drug development and in vivo oncology research. Such strategies are anticipated to drive the market.

Key In Vivo CRO Companies:

The following are the leading companies in the in vivo CRO market. These companies collectively hold the largest market share and dictate industry trends.

- IQVIA Inc

- Crown Bioscience

- Taconic Biosciences, Inc.

- PsychoGenics Inc.

- Evotec

- Janvier Labs

- Biocytogen

- GemPharmatech

- Charles River Laboratories

- Icon Plc

- Labcorp Drug Development

- Parexel International Corporation

- SMO Clinical Research (I) Pvt Ltd

Recent Developments

-

In October 2023, ETAP-Lab announced the acquisition of SYNCROSOME. SYNCROSOME is a CRO that offers preclinical in vivo pharmacology services focusing on cardiovascular pathologies. The acquisition represents a step toward implementing ETAP-Lab's strategy and strengthening its position as a leading preclinical CRO.

-

In March 2023, Biocytogen Boston Corp announced a licensing agreement with Janssen Biotech, Inc. that granted Janssen Biotech, Inc. the rights to use the RenLite platform.

-

In January 2023, Qualigen Therapeutics started GLP toxicology studies for its oncology program, QN-302. These studies are likely to be carried out by WuXi AppTec. GLP toxicology tests are a crucial part of QN-302's investigational new drug (IND) filing package, which was anticipated to happen in the first half of 2023. Further, the Human clinical trials will be conducted after the U.S. FDA approves the IND.

In vivo CRO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.38 billion

Revenue forecast in 2030

USD 7.96 billion

Growth rate

CAGR of 8.13% from 2025 to 2030

Historical Year

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Model Type, modality, indication, glp type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

IQVIA Inc., Crown Bioscience, Taconic Biosciences, Inc., PsychoGenics Inc., Evotec, Janvier Labs, Biocytogen Boston Corp, GemPharmatech, Charles River Laboratories, Icon Plc, Labcorp Drug Development, Parexel International Corporation, SMO Clinical Research (I) Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In Vivo CRO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in vivo CRO market report based on model type, modality, indication, GLP type and region:

-

Model Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rodent based

-

Rat Models

-

Mice Models

-

Others

-

-

Non-Rodent based

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecules

-

Large Molecules

-

Cell & Gene Therapy

-

CAR T-cell therapies

-

CAR-NK cell therapy

-

TCR-T cell therapy

-

Other (Includes- TCR-NK, CARM, and TAC-T)

-

-

RNA Therapy

-

Others

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Blood cancer

-

Solid tumor

-

Syngeneic model

-

Patient derived xenograft

-

Xenograft

-

-

Others

-

-

CNS Conditions

-

Epilepsy

-

Parkinson's disease

-

Huntington's disease

-

Stroke

-

Muscular Dystrophy

-

Alzheimer’s Disease

-

Traumatic brain injury

-

Amyotrophic lateral sclerosis (ALS)

-

Spinal Muscular Atrophy

-

Muscle regeneration

-

Other Neurodevelopment Disorders

-

-

Diabetes

-

Obesity

-

Pain management

-

Chronic pain

-

Acute pain

-

-

Autoimmune/inflammation conditions

-

Rheumatoid Arthritis

-

Multiple Sclerosis

-

Osteoarthritis

-

Irritable Bowel Syndrome

-

Others

-

-

Others

-

-

GLP Type Outlook (Revenue, USD Million, 2018 - 2030)

-

GLP Toxicology

-

Non GLP

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global in vivo CRO market size was estimated at USD 4.98 billion in 2024 and is expected to reach USD 5.38 billion in 2025.

b. The global in vivo CRO market is expected to grow at a compound annual growth rate of 8.13% from 2025 to 2030 to reach USD 7.96 billion by 2030

b. Some of the key market players include Pharmaceutical Product Development, LLC (PPD); Quintiles; ICON Plc; Parexel International; American Preclinical Services, LLC; Covance Inc.; Theorem Clinical research; WuXi AppTec, Inc.; inVentiv Health; Evotec (US), Inc.; and Charles River Laboratories.

b. .Key factors that are driving the market growth include rising demand for advanced products, and changing regulatory landscape.

b. North America dominated the in vivo CRO market with a share of 50.0% in 2024. This can be attributed to the presence of technologically advanced Contract Research Organizations (CROs) and the increasing number of grants provided by government organizations to foster research activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.