- Home

- »

- Paints, Coatings & Printing Inks

- »

-

India Anhydrous Hydrogen Fluoride Market Size Report, 2030GVR Report cover

![India Anhydrous Hydrogen Fluoride Market Size, Share & Trends Report]()

India Anhydrous Hydrogen Fluoride Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Fluoropolymers, Fluorogases, Pesticides), And Segment Forecasts

- Report ID: GVR-4-68040-106-5

- Number of Report Pages: 50

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

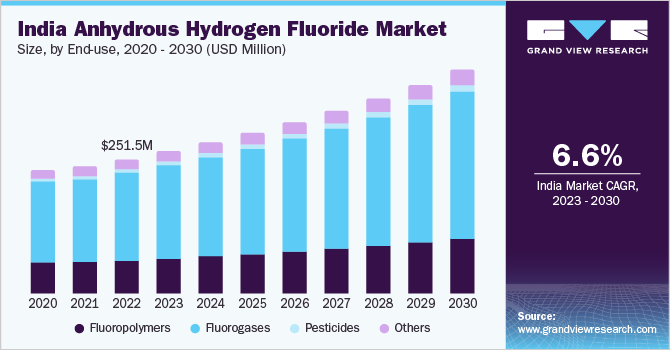

The India anhydrous hydrogen fluoride market size was estimated at USD 251.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. This growth can be attributed to the growing chemicals industry along with the rising demand for consumer goods and automobiles in India. Anhydrous hydrogen fluoride (AHF) is witnessing a surged demand from the chemicals industry in India as it is a primary building block for producing several fluorine-containing chemicals. This compound is used for manufacturing fluorochemicals, fluoropolymers, surfactants, etc. which are used in automobiles, household utensils, etc.

According to the India Brand Equity Foundation (IBEF), the chemicals industry in the country was valued at USD 178 billion in 2019 and is projected to contribute USD 383 billion to the GDP of the country by 2030. An investment of USD 107.38 billion is estimated in this industry in India by 2025. The Government of India has been actively encouraging both, domestic and foreign investments in this industry by providing various incentives and offering required support to attract investors boosting the anhydrous hydrogen fluoride industry in the country.

Anhydrous hydrogen fluoride (AHF) is an essential raw material used during the manufacturing and processing of aluminum. This metal is widely used for the development of automobiles. Aluminum is also increasingly utilized in electric vehicles. This acts as a driver for increasing the consumption of AHF in India during the forecast period. AHF is also used for producing specialty coatings that provide corrosion resistance, durability, and aesthetic appeal to automotive parts. Coatings made from anhydrous hydrogen fluoride-derived materials, including fluorocarbon coatings, are used on car bodies, wheels, and other components to enhance their performance and appearance.

The increasing use of fluorochemicals, produced by anhydrous hydrofluoric acid, for manufacturing hydrochlorofluorocarbons, chlorofluorocarbons, and hydrofluorocarbons used in refrigerators, result in the depletion of the ozone layer. This further contributes to global warming. Hence, the usage of CFCs is banned in several countries, including India. This has further resulted in an increase in demand for anhydrous hydrogen fluoride (AHF) in the market as an effective alternative to CFCs.

End-use Insights

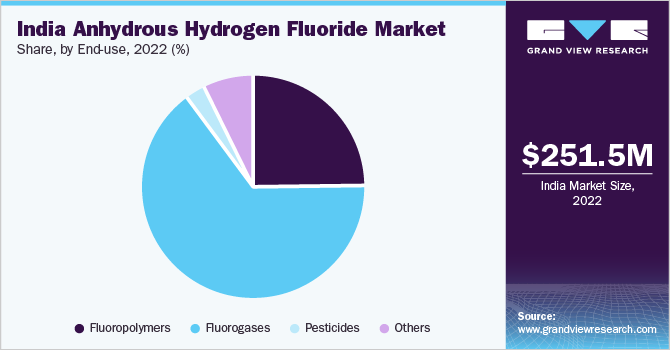

The Fluorogases segment dominated the India AHF market, with the highest revenue share of 65.0% in 2022. This is attributable to its use in increasing urbanization and infrastructure development, changing lifestyles, and rising income levels, which are further rising the demand for refrigerators and air conditioners in India.

According to the India Brand Equity Foundation report published in December 2022, the market size of refrigerators is anticipated to reach 27.5 million units and air conditioners are expected to reach 19.5 million units by 2025. In addition, hydrofluorocarbons are used to produce polyurethane foams. These foams are used in building insulation, furniture such as sofas & mattresses, packaging to protect delicate items during transportation, and automotive interiors. With an increase in demand for HFCs to manufacture polyurethane foams, the demand for anhydrous hydrogen fluoride is expected to increase over the forecast period.

Fluorogases are a group of synthetic gases that contain fluorine atoms. They are characterized by their high chemical inertness, low toxicity, and non-flammability. Hydrofluorocarbons are examples of fluoro gases used in refrigeration and air-conditioning. Moreover, anhydrous hydrogen fluoride is used to synthesize hydrofluorocarbons. When the hydrocarbon reacts with anhydrous hydrogen fluoride, the fluoride atom gets introduced into the hydrocarbon structure, forming the hydrofluorocarbons. HFCs are used to replace the ozone-depleting chlorofluorocarbons and hydrochlorofluorocarbons in refrigeration and air conditioning applications.

Fluorinated ethylene propylene, polytetrafluoroethylene, and polyvinylidene fluoride are examples of fluoropolymers that are used in the chemical processing industries, electronics, automotive and medical devices. Anhydrous hydrogen fluoride is used as a polymerization catalyst as well as a key raw material in the preparation of fluoropolymers. It is mainly used to introduce fluorine atoms into the polymer, which enhances the ability of fluoropolymers to sustain thermal stresses and resistance to acids and solvents.

Fluoropolymers are used in the automobile industry to manufacture fuel lines, O-rings, onboard diagnostic sensors (ODS), gaskets, and seals. Increasing production of vehicles and favorable government initiatives for the automotive sector is expected to drive the demand for fluoropolymers in India.

Key Companies & Market Share Insights

The India anhydrous hydrogen fluoride market is consolidated, with few players accounting for a large market share. The major players operating in the anhydrous hydrogen fluoride market include Solvay, Honeywell International Inc, Linde plc, Lanxess, and Arkema. India has a notable capacity for producing AHF that allows it to meet the demand for this compound within the country, as well as export it. Numerous prominent chemical companies based in India manufacture AHF using advanced processes and technologies.

For instance, in September 2022, Gujarat Fluorochemicals Limited announced an investment worth USD 304.28 Million to expand its fluoropolymer and battery chemical production capacity. The company also announced plans to enhance its AHF manufacturing capacity from 120tpd to 220tpd. Some prominent players in the India anhydrous hydrogen fluoride market include:

-

Honeywell International Inc.

-

Solvay

-

Linde plc

-

Arkema

-

Lanxess

-

Navin Fluorine International Limited

-

Gujarat Fluorochemicals Limited

India Anhydrous Hydrogen Fluoride Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 417.9 million

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use

Regional scope

India

Key companies profiled

Honeywell International Inc.; Solvay; Linde pl; Arkema; Lanxess; Navin Fluorine International Limited; Gujarat Fluorochemicals Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Anhydrous Hydrogen Fluoride Market Report Segmentation

This report forecasts revenue & volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India anhydrous hydrogen fluoride market report based on end-use:

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fluoropolymers

-

Fluorogases

-

Pesticides

-

Others

-

Frequently Asked Questions About This Report

b. The India anhydrous hydrogen fluoride market size was estimated at USD 251.5 million in 2022 and is expected to reach USD 261.1 million in 2022.

b. The India anhydrous hydrogen fluoride market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 417.9 million by 2030.

b. Fluorogases dominated the Indian anhydrous hydrogen fluoride market with a share of 65.0% in 2022. This is attributable to increasing urbanization and infrastructure development, changing lifestyles, and rising income levels, which are further rising the demand for refrigerators and air conditioners in India.

b. Some key players operating in the India anhydrous hydrogen fluoride market include THoneywell International Inc., Solvay, Linde pl, , Arkema, Lanxess, Navin Fluorine International Limited, Gujarat Fluorochemicals Limited.

b. Key factors that are driving the market growth include the growing chemicals industry along with rising demand for consumer goods and automobiles in India.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.